Members And Shareholders

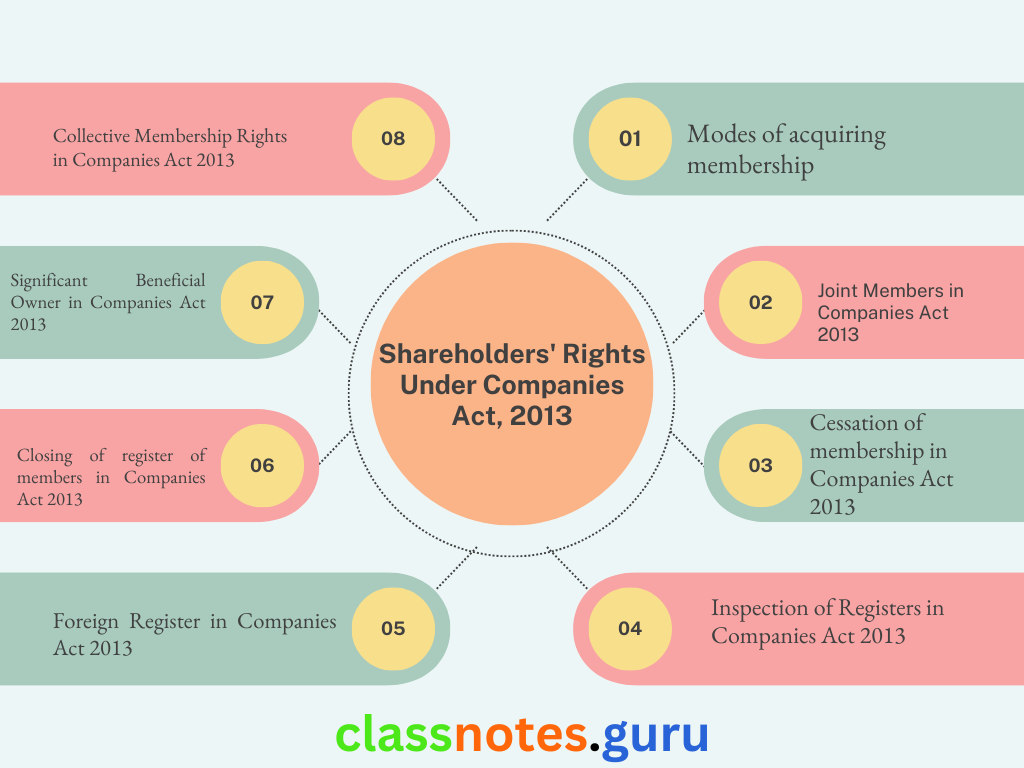

Modes of acquiring membership

Section 2(55) of the Companies Act, 2013 provides the modes by which a person may acquire membership of a Company.

- by subscribing to the Memorandum,

- by agreeing in writing to become a member,

- by holding equity share capital of a Company as beneficial owner in the records of the depository.

Shareholders’ Rights Companies Act 2013

Joint Members in Companies Act 2013

If more than one person apply for shares in a company and shares are allotted to them, each one of such applicant becomes a member. Unless the Articles of the company otherwise provide, joint members can insist on having their names registered in any order they may require.

They may also have their holding split into several joint holdings with their names in different orders so that all of them may have a right to vote as first named holding in one or the other joint holdings.

Cessation of membership in Companies Act 2013

A person ceases to be a member of a company when his name is removed from its register of members, which may occur in any of the following situations:

- He transfers his shares to another person;

- His shares are forfeited;

- His shares are sold by the company to enforce a lien;

- He dies; (his estate, however, remains liable for calls);

- He is adjudged insolvent and the Official Assignee disclaims his shares;

- His redeemable preference shares are redeemed;

- The company is wound up:

Inspection of Registers in Companies Act 2013

According to Section 94(2) read with Rule 14 of Companies (Management and Administration) Rules, 2014 the registers and their indices, except when they are closed under the provisions of this Act, and the copies of all the returns shall be open for inspection by any member, debenture-holder, other security holder or beneficial owner, during business hours without payment of any fees and by any other person on payment of such fees as may be specified in the articles of association of the company but not exceeding 50 for each inspection.

Foreign Register in Companies Act 2013

Section 88(4) of the Companies Act, 2013 empowers companies to keep foreign registers of members or debenture-holders, other security holders or beneficial owners residing outside India. It states:

“A company may, if so authorised by its articles, keep in any country outside India, in such manner as may be prescribed, a part of the register referred to in sub-section (1), called “foreign register” containing the names and particulars of the members, debentureholders, other security holders or beneficial owners residing outside India.”

Closing of register of members in Companies Act 2013

A company may close the register of members or the register of debentureholders or the register of other se curity holders for any period or periods not exceeding in the aggregate forty-five days in each year, but not exceeding thirty days at any one time, subject to giving of previous notice of at least 7 days or such lesser period as may be specified by Securities and Exchange Board for listed companies.

Significant Beneficial Owner in Companies Act 2013

Section 90 of the Act provides that every individual, who acting alone or together, or through one or more persons or trust, including a trust and persons resident outside India, holds beneficial interests, of not less than twenty-five per cent. or such other percentage as may be prescribed, in shares of a company or the right to exercise, or the actual exercising of significant influence or control as defined in clause (27) of Section 2, over the company (herein referred to as “significant beneficial owner”), shall make a declaration to the company, specifying the nature of his interest and other particulars, in such manner and within such period of acquisition of the beneficial interest or rights and any change thereof, as may be prescribed.

Collective Membership Rights in Companies Act 2013

Members of a company have certain rights which can be exercised by members collectively by means of democratic process, i.e. by majority of members usually unless otherwise prescribed.

- This involves the principle of submission by all members to the will of the majority, provided that the will is exercised in accordance with the law and the Memorandum and Articles of Association of the company.

- Thus, the shareholders in majority determine the policy of the company and exercise control over the management of the company.

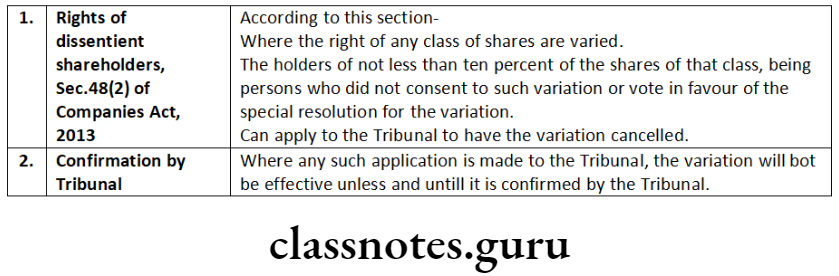

Dissenting members in Companies Act 2013

Rights attached to the shares of any class can be varied with the consent in writing of the holders of not less than three-fourths of the issued shares of that class or with the sanction of a special resolution passed at a separate meeting of the holders of the issued shares of the class.

Variation of Share-holder’s Rights in Companies Act 2013

Section 48 (1) of the Companies Act, 2013 lays down that where a share capital of the company is divided into different classes of shares, the rights attached to the shares of any class can be varied with the consent in writing of the holders of not less than three-fourths of the issued shares of that class or with the sanction of a special resolution passed at a separate meeting of the holders of the issued shares of that class. Further, the variation of rights of shareholders can be effected only:

- if provision with respect to such variation is contained in the Memorandum or Articles of association of the company; or

- in the absence of any such provision in a Memorandum or Articles of association of the company, if such a variation is not prohibited by the terms of issue of the shares of that class.

Shareholders’ Democracy in Companies Act 2013

The concept of shareholders’ democracy in the present day corporate world denotes the shareholders’ supremacy in the governance of the business and affairs of corporate sector either directly or through their elected representatives.

- Under the Companies Act the powers have been divided between two segments: one is the Board of Directors and the other is of shareholders.

- The directors exercise their powers through meetings of Board of directors and shareholders exercise their powers through General Meetings.

- Although constitutionally all the acts relating to the company can be performed in General Meetings but most of the powers in regard thereto are delegated to the Board of directors by virtue of the constitutional documents of the company viz. the Memorandum of Association and Articles of Association.

Shareholder’s Agreement in Companies Act 2013

Shareholders’ agreements (SHA) are quite common in business. In India shareholder’s agreement have gained popularity and currency only lately with bloom in newer forms of businesses. There are numerous situations where such agreements are entered into family companies, JV companies, venture capital investments, private equity investments, strategic alliances, and so on.

Shareholders’ agreement is a contractual arrangement between the shareholders of a company describing how the company should be operated and the defining inter-se shareholders’ rights and obligations. shareholders’ agreement. SHAS are the result of mutual understanding among the shareholders of a company to which, the company generally becomes a consenting party. Such agreements are specifically drafted to provide specific rights, impose definite restrictions over and above those provided by the Companies Act.

Veto Power or Rights in Companies Act 2013

- A right is inherent. Shareholders rights refer to rights enshrined in the constitutional document of the company or as provided by the law. A power has its genesis under the provisions of law.

- As per the provisions of the Companies Act, 2013 there are some resemblance where the management can take decisions on their own, by virtue of law.

- However, there are some instances where the consent of the shareholders is mandatory to approve any decision or transaction which is said to be as the veto power or veto right of shareholders of the company.

- For instance in case of related-party transactions, promoters, who are majority shareholders, cannot vote in special resolutions in cases of related-party transactions.

Veto Power and Casting Vote in Companies Act 2013

Veto power is different than casting vote of Chairman. Casting vote is applicable on in case of equality of votes in favour and against.

- In case of equality the Chairman may give vote either in favour or against the resolution and it can be carried accordingly.

- Veto power has not been defined in Companies Act.

- However, dictionary meaning of veto power is: “to refuse to admit or approve; specifically: to refuse assent to (a legislative bill) so as to prevent enactment or cause reconsideration.”

Assignment of Shares in a Company in Companies Act 2013

Section 44 of the Companies Act, 2013 defines the nature of property in the shares of a company. It lays down: “The shares or debentures or other interest of any member in a company shall be movable property, transferable in the manner provided by the articles of the company.”

Companies Act 2013 Short Notes

Question 1. Write a note on the following:

Rights of dissentient shareholders.

Answer:

Companies Act 2013 Descriptive Questions

Question 1. Comment on the following:

A Limited Liability Partnership can become member in a company incorporated under the provisions of the Companies Act, 2013.

Answer:

- Subject to the Memorandum and Articles, any sui juris (a person who is competent to contract on its own behalf) except the company itself, can become a member of a company.

- Yes, Limited Liability Partnership, being an incorporated body and separate legal entity, under the statute, can become a member of a company.

Question 2. A member of an incorporated company becomes insolvent. He claimed right to vote and receive dividend from the company. Referring to the provisions of the Companies Act, 2013 discuss whether his claim is valid.

Answer:

- An insolvent may be a member of a company as long as he is on the register of members. He is entitled to vote, but he loses all beneficial interest in the shares and company will pay dividend on his shares to the Official Assignee or Receiver [Morgan v. Gray, (1953)].

- Hence, his claim is invalid and his dividend shall be paid to official assignee.

Rights Of Shareholders In Company Law

Question 3. Every shareholder of a company is known as member while every member may not be known as shareholder.

Answer:

- A company is composed of, members though it has its own separate legal entity. The members of the company are the persons who constitute the company as a corporate entity.

- In the case of a company limited by shares, the shareholders are the members.

- The terms “members” and “shareholders” are usually used interchangeably being synonymous, as there can be no membership except through the medium of shareholding.

- Thus, generally speaking every shareholder is a member and every member is a shareholder.

- However, there may be exceptions to this statement, e.g., a person may be a holder of share(s) by transfer but will not become its member until the transfer is registered in the books of the company in his favor and his name is entered in the register of members.

- Similarly, a member who has transferred his shares, though he does not hold any shares yet he continues to be member of the company until the transfer is registered and his name is removed from the register of members maintained by the company under Section 88 of the Companies Act, 2013.

- A member is a person who has subscribed to the memorandum of association of the company.

- A shareholder is a person who owns the shares of the company.

- The bearer of a share warrant is not a member, but the bearer of a share warrant can be a shareholder.

Question 4. Draft “A specimen of deed of Assignment of shares of a company”.

Answer:

Specimen of Deed of Assignment of Shares of Company:

And the assignee hereby agrees to take the said Equity Shares subject to such conditions.

In Witness Whereof the assignor and the assignee do hereto affix their respective signatures on the day, month and the year stated above. Witness: Assignor :

Question 5. A public limited company has only seven shareholders. Being all the shares paid in full, one such shareholder purchased all the shares of another shareholder in a private settlement between them reducing the no. of shareholders to six. The company continues to carry on its business thereafter. Discuss with reference to the Companies Act, 2013 the implications of this transaction on the functioning of the company

Answer:

- Section 3A of the Companies Act, 2013 provides that if at any time the number of members of a company is reduced, in the case of a public company, below seven or in the case of a private company, below two, and the company carries on business for more than six months while the number of members is so reduced, every person who is a member of the company during the time that it so carries on business after those six months and is cognizant of the fact that it is carrying on business with less than seven members or two members, as the case may be, shall be severally liable for the payment of the whole debts of the company contracted during that time, and may be severally sued there for.

- In view of the above provision, if the company continued to carry on the business with that reduced membership (i.e. 6) beyond six months period, only those members who are cognisant of the fact that it is carrying on business with less than seven members shall be severally liable for the payment of the whole of debts of the company contracted during that time, and may be severally sued therefor.

Question 6. Who is a ‘Significant Beneficial Owner’ under the Companies Act, 2013? Is Significant Beneficial Owner required to file BEN-1 to the reporting company?

Answer:

Pursuant to Section 90 of the Companies Act, 2013 every individual, who acting alone or together, or through one or more persons or trust, including a trust and persons resident outside India holds beneficial interests, of not less than 25% or such other percentage as may be specified, in shares of a company or the right to exercise or the actual exercise of significant influence or control as per as Section 2(27) over the reporting company is a significant beneficial owner.

- Such an individual being the Significant beneficial Owner holding such beneficial interest is required to make a declaration to the reporting company specifying the nature of his interest and other particulars as required.

- From commencement of the Companies (SBO) Amendment Rules, 2019, every SBO in a reporting company, is required to give the requisite declaration of his beneficial ownership in Form No. BEN-1 to the reporting company within 90 days from such commencement.

Examine with reference to the provisions of the Companies Act, 2013 whether any of the following persons can become member of the company engaged in the business of producing steel products?

- Pawnee

- Partnership firm

- Unregistered trade union.

Minority Shareholder Rights India

Companies Act 2013 Practical Questions

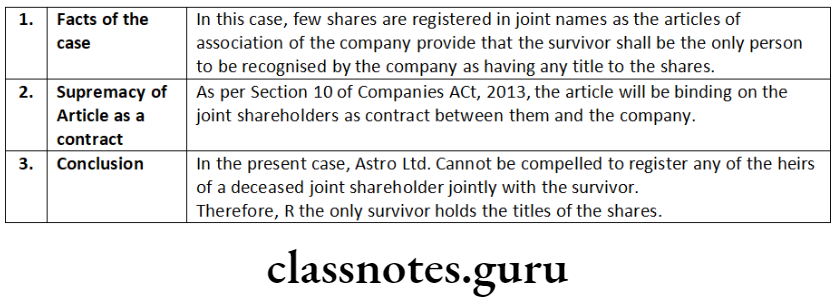

Question 1. 1,000 Shares of Astro Ltd. are registered in the names of three persons P, Q and R jointly. Interestingly, the articles of the company provide that the survivors shall be the only person to be recognised by the company as having any title to the shares of the company. Unfortunately, P and Q died in an air crash. In these circumstances, R, being the survivor claims to be the full owner of the said 1,000 shares. However, the legal heirs of P and Q are also making counter claims. Who will succeed? Explain.

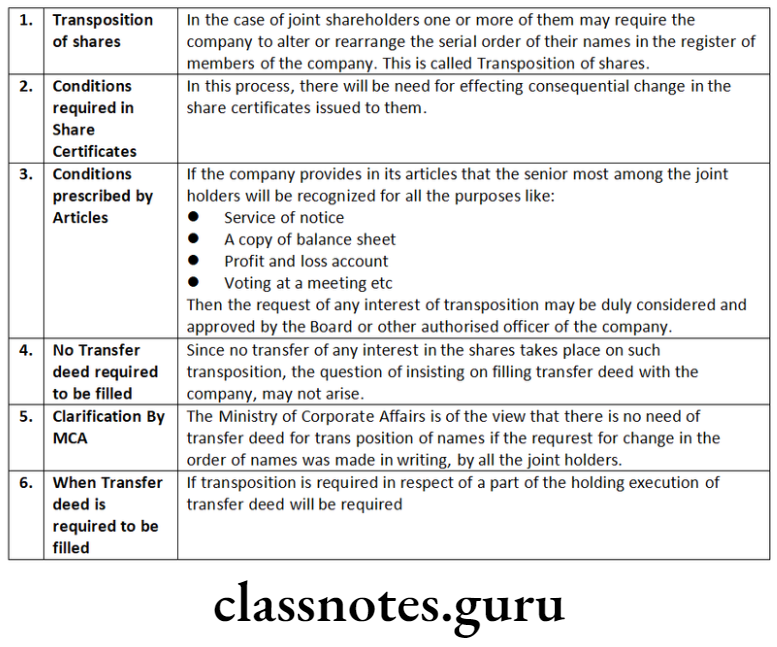

A, B and C are joint holders of shares in Clearhead Ltd. The joint holders now ask the company for altering or rearranging the serial order of their names in the register of members of the company. In reply, the company intends to ask the joint holders to execute a transfer deed for transposition of names in the register of members. Advise the company on the course of action.

Answer:

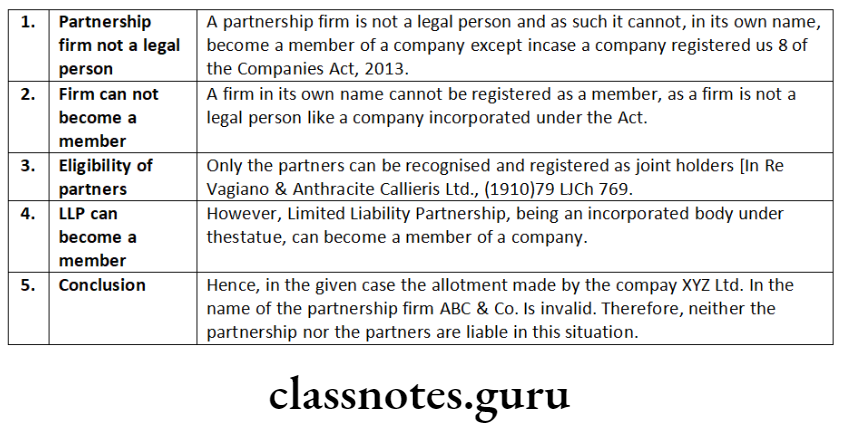

Question 2. ABC & Co., a partnership firm applied for shares in XYZ Ltd. The company allotted the shares required by the partnership firm. In the given context, what is the liability of the partners and the partnership firm?

Answer:

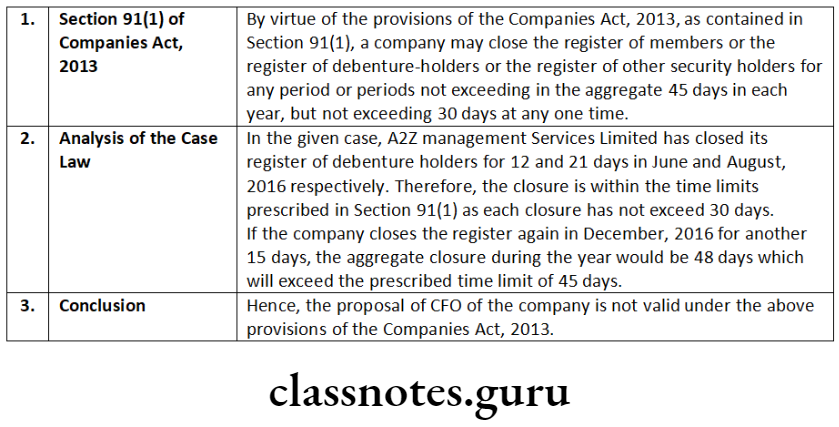

Question 3. A2Z Management Services Limited is a listed company quoted at Bombay Stock Exchange Limited. The company closed its register of debenture holders in June and August 2016 for 12 and 21 days respectively. The Chief Financial Officer (CFO) of the company has informed the Secretary of the company to consider closing the register in December for another 15 days for some strategic reasons. Referring to the provisions of the Companies Act, 2013, examine the validity of the above action of the company.

Answer:

Companies Act 2013 Shareholder Protections

Question 4. Ram Singh is a shareholder of Alexandra India Ltd. The Board of directors of the company are of the view that the conduct of Ram Singh has been detrimental to the interest of the company. Further, the Board also noted that Ram Singh is director in a company which is a competitor company of Alexandra India Ltd. The Articles of Association of Alexandra India Ltd. permit expulsion of members. The Board unanimously decided to expel Ram Singh from the company. Discuss the relevant provisions of Companies Act, 2013 in this regard. If Ram Singh files a case against the Board whether he will win the case?

Answer:

- A controversy has arisen as to whether a public limited company had powers to insert an article in its Articles of Association relating to expulsion of a member by the Board of Directors of the company where the directors were of the view that the activities or conduct of such a member was detrimental to the interests of the company.

- The Department of Company Affairs (now, Ministry of Corporate Affairs) clarified that an article for expulsion of a member is opposed to the fundamental principles of the Company Jurisprudence and is ultra vires the company, the reason being that such a provision will be against the provisions of the Companies Act relating to the rights of a member in a company, the powers of the Central Government as an appellate authority under Section 111 of the Act and the powers of the Court under Sections 107, 395 and 397 of the Companies Act, 1956.

- These sections correspond to Sections 38, 58, 48, 235 and 241 of the Companies Act, 2013 respectively having the same impact as earlier provisions.

- Further, according to Section 6 of the Companies Act, 2013, the Act shall override the Memorandum and Articles of Association and any provisions contained in these documents repugnant to the provisions of the Companies Act, 2013 shall be void.

- Hence, any assumption of the powers by the Board of Directors to expel a member by alteration of Articles of Association shall be illegal and void.

- The Supreme Court in the case of Bajaj Auto Ltd. v. N.K. Firodia [1971] 41 Com Cases 1 has laid down the law as to the conditions on the basis of which directors could refuse a person to be admitted as a member of the company. The principles laid down by the Supreme Court in this case, even though pertain to the refusal by a company to the admission of a person as a member of the company, are applicable even with greater force to a case of expulsion of an existing member.

- As, under Article 141 of the Constitution, the law declared by the Supreme Court is binding on all courts within the territory of India, any provision pertaining to the expulsion of a member by the management of a company which is against the law as laid down by the Supreme Court will be illegal and ultra vires. In the light of the aforesaid position, it is clarified that assumption by the Board of directors of a company of any power to expel a member by amending its articles of association is illegal and void.

- If Ram Singh a files a suit against the company or the directors he will certainly win the case, as expulsion of a member is illegal and void as per the Companies Act 2013.

Question 5. Sumeet, Puneet and Manmeet were subscribers to the Memorandum of Association of a private company for 500 shares, 300 shares and 200 shares respectively. After incorporation, Sumeet and Puneet bought the shares, they had subscribed for, from the company whereas Manmeet bought 200 shares from Sumeet. Will Manmeet be liable to the company for the shares, he has not bought from the company?

Answer:

In the case of a subscriber, no application or allotment is obligatory to become a member. Since, by virtue of his subscribing to the memorandum, he is deemed to have agreed to become a member and he becomes ipso facto member on the incorporation of the company and is liable for the shares he has subscribed.

As per Section 10(2) of the Companies Act, 2013, all monies payable by any member to the company under the Memorandum of Association or Articles of Association of the company shall be debt due from him to the company.

Further, a subscriber to the Memorandum must make payment for his shares, even if the promoters have promised him the shares for services rendered in connection with the promotion of the company.

When the Subscriber subscribes to the Memorandum, he gives an undertaking to the company that he will pay to the company for the shares he has subscribed.

Further, Subscribers has to take these shares directly from the company and not through transfer from other member(s).

In the above case, Manmeet is not absolved from his liability to the company by purchasing the shares from Sumeet. He has a statutory responsibility to buy the shares from the company by making payment to the company.

Voting Rights Of Shareholders In India

Question 6. X applied for 400 shares in XYZ Ltd. and paid $2.50 on the face value of 10 but no allotment was made to him. Subsequently 400 shares were allotted and issued to him without his request and his name was entered in the register of members.

X knew it but took no steps for rectification of the register of members. The company went into liquidation and X was held liable as a contributory. X claims that he is not liable as contributory. Whether his claim is tenable?

Answer:

Registers, etc. to be Evidence:

According to Section 95 of the Companies Act, 2013 states that the register, their indices and copies of annual returns maintained under section 88 and 94 shall be prima facie evidence of any matter directed or authorised to be inserted therein by or under this Act.

A register of members is prima facie evidence of the truth of its contents. Consequently, if a person’s name, to his knowledge, is there in the register of members of a company, he shall be deemed to be a member and onus lies on him to prove that he is not a member.

He must promptly appeal to the Tribunal for rectification of the register under section 59 of the Companies Act, 2013 to take his name off the register, failing which the doctrine of holding out will apply.

In Re. M.F.R.D. Cruz, A.I.R. 1939 Madras 803, the Court held “when a person knows that his name is included in the register of shareholders and he stands by and allow his name to remain, he is holding out to the public that he is a shareholder and thereby he loses his right to have his name removed”.

Local Ltd. is planning to issue its equity shares to persons residing outside India. In this context, Chairman of the company wants to know on the following matters:

- What are the provisions relating to maintaining the foreign register of members?

- Can company discontinue maintaining forsign register of members? If so, when?

- Give your inputs to the Chairman of Local Ltd.

Companies Act 2013 Short Notes

Question 1. Write short on Significant Beneficial Owner.

Answer:

- Section 90 of the Act provides that every individual, who acting alone or together, or through one or more persons or trust, including a trust and persons resident outside India, holds beneficial interests, of not less than twenty-five per cent. or such other percentage as may be prescribed, in shares of a company or the right to exercise, or the actual exercising of significant influence or control as defined in clause (27) of Section 2, over the company (herein referred to as “significant beneficial owner”), shall make a declaration to the company, specifying the nature of his interest and other particulars, in such manner and within such period of acquisition of the beneficial interest or rights and any change thereof, as may be prescribed.

- Further every company shall maintain a register of the interest declared by individuals stated above and changes therein which shall include the name of individual, his date of birth, address, details of ownership in the company and such other details as may be prescribed.

- The register so maintained shall be open to inspection by any member of the company on payment of such fees as may be prescribed.

- Every company shall file a return of significant beneficial owners of the company and changes therein with the Registrar containing names, addresses and other details as may be prescribed within such time, in such form and manner as may be prescribed. -Space to write important points for revision

Voting Rights Of Shareholders In India

Question 2. Write short on the following:

- Shareholders’ Democracy

- Shareholders’ Agreement

Answer:

- Shareholders’ Democracy

- The concept of shareholders’ democracy in the present day corporate world denotes the shareholders’ supremacy in the governance of the business and affairs of corporate sector either directly or through their elected representatives.

- Under the Companies Act the powers have been divided between two segments: one is the Board of Directors and the other is of shareholders.

- The directors exercise their powers through meetings of Board of directors and shareholders exercise their powers through General Meetings.

- Although constitutionally all the acts relating to the company can be performed in General Meetings but most of the powers in regard thereto are delegated to the Board of directors by virtue of the constitutional documents of the company viz. the Memorandum of Association and Articles of Association.

- Proviso to this section restricts the power of the Board of directors to do things which are specifically required to be done by shareholders in the General Meetings under the provisions of Companies Act or Memorandum of Association or the Articles of Association.

- Thus the Companies Act has tried to demarcate the area of control of directors as well as that of shareholders. Basically all the business to be transacted at the meetings of shareholders is by means of an ordinary resolution or a special resolution or by postal ballot.

- Shareholder’s Agreement

- Shareholders’ agreements (SHA) are quite common in business. In India shareholder’s agreement have gained popularity and currency only lately with bloom in newer forms of businesses.

- There are numerous situations where such agreements are entered into-family companies, JV companies, venture capital investments, private equity investments, strategic alliances, and so on.

- Shareholders’ agreement is a contractual arrangement between the shareholders of a company describing how the company should be operated and the defining inter-se shareholders’ rights and obligations. shareholders’ agreement.

- SHAS are the result of mutual understanding among the shareholders of a company to which, the company generally becomes a consenting party.

- Such agreements are specifically drafted to provide specific rights, impose definite restrictions over and above those provided by the Companies Act,

- Enforceability of the Shareholder’s Agreement

- Though the international view is split but to a large extent courts are inclined towards favouring SHA as long as they are not found to be detrimental to the minority stakeholder’s rights.

- In the leading case of Russell v. Northern Bank Development Corporation Ltd [1992] BCC 578; [1992] 1 WLR 588, the House of Lords found that though a’company cannot deprive itself of its power to alter its constitution, the members of the company could agree in a shareholders’ agreement as to how they will exercise their voting rights on a resolution to alter the articles/constitution. The US Courts have largely accepted shareholder agreement.

Companies Act 2013 Distinguish Between

Question 3. Distinguish Between Veto Power and Costing Vote.

Answer:

- Veto power is different than casting vote of Chairman. Casting vote is applicable on in case of equality of votes in favour and against.

- In case of equality the Chairman may give vote either in favour or against the resolution and it can be carried accordingly.

- Veto power has not been defined in Companies Act. However, dictionary meaning of veto power is: “to refuse to admit or approve; specifically: to refuse assent to (a legislative bill) so as to prevent enactment or cause reconsideration.”

- Shareholders Agreement and Articles of Association of a company may provide for certain rights to the minority shareholder who has invested funds in the company.

- Such powers may include power to refuse capital expenditure over certain specified limit.

- In case the representative of the minority group is not in favour of the capital expenditure proposed by the company, he can exercise his right under the Articles which in common terminology is referred to as “veto powers”.

Companies Act 2013 Descriptive Questions

Question 4. What do you understand by Veto Power or Rights.

Answer:

- A right is inherent. Shareholders rights refer to rights enshrined in the constitutional document of the company or as provided by the law. A power has its genesis under the provisions of law.

- As per the provisions of the Companies Act, 2013 there are some resemblance where the management can take decisions own their own, by virtue of law.

- However, there are some instances where the consent of the shareholders is mandatory to approve any decision or transaction which is said to be as the veto power or veto right of shareholders of the company.

- For instance in case of related-party transactions, promoters, who are majority shareholders, cannot vote in special resolutions in cases of related-party transactions.

- As stated under the provisions of Section 188 any related-party transaction that is not done in the ordinary course of business and is not at an arm’s length will need approval of minority shareholders by way of a special resolution.

- The other instance where the law provides veto power to shareholders is in case of class action suits. Section 245 of Companies Act, 2013 provides for class action to be instituted against the company as well as the auditors of the company.

- Under the provisions of sub-section (3) of Section 245, in the case of a company having a share capital, not less than one hundred members of the company or not less than such percentage of the total number of its members as may be prescribed, whichever is less, or any member or members holding not less than such percentage of the issued share capital of the company as may be prescribed, subject to the condition that the applicant or applicants has or have paid all calls and other sums due on his or their shares.