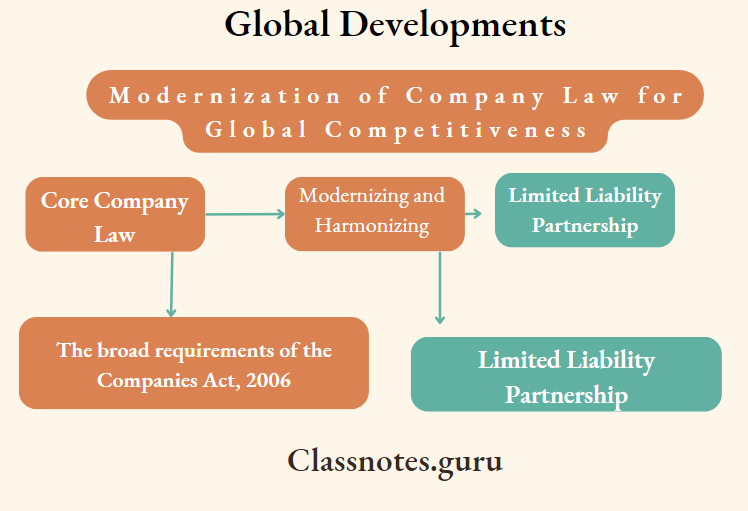

Global Developments

Modernization of Company Law for Global Competitiveness

It is increasingly being recognized that the framework for the regulation of corporate entities must facilitate companies to operate in a national and global context, encourage good corporate governance, and enable the protection of interests of investors, employees, and creditors as well as boost the economy as a whole.

In the competitive and technology-driven business environment, while corporates require greater autonomy of operation and opportunity for self-regulation with optimum compliance costs, there also is a need to bring about transparency through better disclosures and greater responsibility on the part of corporates and management for improved compliance.

Core Company Law

In recognition of the fact that the primary purpose of any law is to facilitate the public and bearing in mind the current international style of legal drafting, an ideal law for the corporate sector should be clear, concise, and comprehensible. The law should be a “core company law” i.e. regulating the “entity” (irrespective of its corporate structure and size) rather than its “activity” and providing the basic principles governing all aspects of the operation of corporate entities within a single, comprehensive framework.

Modernizing and Harmonizing

It is in this context that countries across the world are modernizing and harmonizing their company law with global standards.

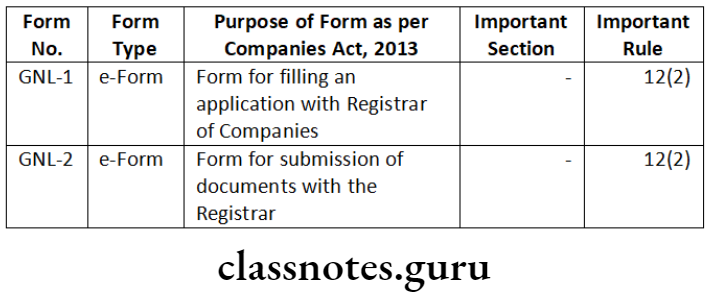

List of Important Forms

Global Developments in Companies Act Descriptive Questions

Question 1. Mention the provisions of the Singapore Companies Act relating to the formation of companies.

“The provisions of the Hong Kong Companies Ordinance relating to the formation of an incorporated company are broadly similar to the provisions of the Companies Act, 2013”. Comment.

Answer:

- Formation of Companies under the provisions of the Singapore Companies Act. Any person may, whether alone or together with another person, subscribe his name or their names to a memorandum and comply with the requirements as to registration form an incorporated company.

A company may be :- a company limited by share

- a company limited by guarantee on unlimited company.

Provisions :

A company must have at least one members – the first consideration is to decide on the right business entity that will meet the business needs.

The most common three business entities available in Singapore are:

- Sole proprietorship

- Limited Liability Partnership

- Private Limited Company.

Sole Proprietorship: The following requirements are given below:

- Minimum one owner

- A Singapore registered office-address.

- For foreign individual and companies only one manager who must be a Singapore resident.

Following documents are needed for registration of a sole proprietorship

- Proposed sole proprietorship name

- Copies of NRIC

- Brief description of business activities

- Registered office address for the sole proprietorship.

Limited Liability Partnership: A LLP gives owner the flexibility of operating as a partnership while having a separate legal entity like a private limited company. Singapore citizens, residents, and employment pass holders can register a LLP.

Private Limited Company: The private limited company is the most popular business entity in Singapore. It has a separate legal entity from its shareholders and directors, who have limited liability for the debt and losses of the company. It usually has the words Pvt. Ltd. as parts of its name.

Answer:

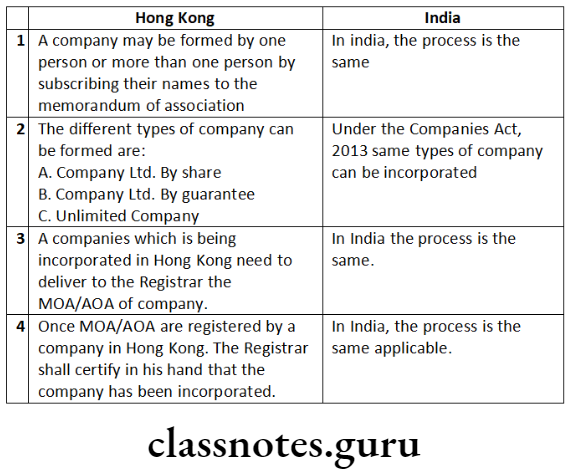

The statements that the provisions of Hong Kong Companies Ordinance relating to the formation of an incorporated company are broadly similar to the provisions of the Companies Act, 2013, appear to be correct for the following reasons.

Similarities are given below:

Company Law Global Developments

Question 2. State the broad requirements of the Companies Act, 2006 of United Kingdom as regards ‘Directors’ Remuneration Report’.

Answer:

Requirement for audited accounts (Section 475 of the UK Companies Act, 2006)

A company’s financial statements for a financial year must be audited in accordance with this part unless the company-

- is exempt from audit under Section 477 (small companies) or Section 480 (dormant companies), or

- is exempt from the requirements of this Part under Section 482 (nonprofit making companies subject to public sector audit)

A company is not entitled to any such exemption unless its balance sheet contains a statement by the directors to that effect.

A company is not entitled to exemption under any of the provisions mentioned in sub-Section (1) (a) unless its balance sheet contains a statement by the directors to the effect that –

- the members have not required the company to obtain an audit of its accounts for the year in question in accordance with Section 476, and

- the directors acknowledge their responsibilities for complying with the requirements of this Act with respect to accounting records and the preparation of accounts.

Question 3. Explain the salient features of the Australian Corporations Act, 2001 relating to appointment of auditors.

Answer:

The following may be appointed as auditor of a company for the purposes of the Australian Corporations Act, 2001: (a) an individual; (b) a firm; (c) a company.

- In case of Proprietary company, the directors may appoint an auditor for the company.

- The company may have more than one auditor. The appointment of a firm as auditor of a company is taken to be an appointment of all persons who, at the date of the appointment, are (a) members of the firm; and (b) registered company auditors. This is so whether or not those persons are resident in Australia.

- The directors of a public company must appoint an auditor of the company within one month after the day on which a company is registered as a company unless the company at a general meeting has appointed an auditor.

- A public company must appoint an auditor of the company at its first AGM and appoint an auditor of the company to fill any vacancy in the office of auditor at each subsequent AGM. Space to write important points for revision

Question 4. What are the special features of the Corporations Act, 2001 of Australia, which are distinct and different from the provisions of the Companies Act, 2013 in India.

Answer:

Corporations Act, 2001 and the Corporate Regulations, 2001 framed under the Corporations Act, 2001 govern the functioning of the companies in Australia. Following are the special and distinct features of the corporate laws in Australia as compared to the Indian Companies Act, 2013:

- The Australian Corporations Act imposes duties on directors and officers of incorporated bodies. Breach of statutory duties draws penalties under the Act which range up to $ 2,20,000. Defaulting Officers or directors may also be required to pay compensation or to account for profits. In some cases, directors may also be disqualified from office.

- It distinguishes proprietary company and public company. A public company must have at least 3 directors out of whom at least 2 directors must ordinarily reside in Australia.

- Australian Securities and Investment Commission (ASIC) controls and regulates the affairs of companies. A person who is not disqualified from managing corporations may only be appointed as director of a company if the appointment is made with permission granted by Australian Securities and Investments Commission under the leave granted by the Tribunal.

- A person who is the only director and only shareholder of a proprietary company can exercise all the powers of the company.

- A company secretary’s obligations may continue even after the company has been deregistered.

- The company secretary must notify ASIC about changes:-

- to the identities, names and addresses of the company’s directors and company secretaries; and

- to the register of members; and

- to any ultimate holding company;

Companies Act Questions And Answers

Question 5. The concept of treasury shares in United Kingdom is same as buy-back of shares in India. Examine.

Answer:

Section 124 read with Chapter 6 of U.K Companies Act, 2006 deals with treasury shares. Treasury shares are purchased by the company out of the distributable profits of the company and the company is allowed to hold such shares. The aggregate nominal value of shares held as treasury shares must not exceed 10 percent of nominal value of issued share capital.

In India, the Section 68 of Companies Act, 2013, provides that the buy back of its own shares but does not allow a company to hold shares. Bought back shares are to be cancelled within seven days, thus in India, bought back shares cannot be held as treasury stock. In India buy back of shares cannot exceed 25% of total paid up capital in any financial year.

Question 6. What types of companies can be formed in Singapore as per the Singapore Companies Act?

Answer:

According to Singapore Companies Act, 1967 any person may, whether alone or together with another person, by subscribing his name or their names to a constitution and complying with the requirements as to registration, form an incorporated company.

A company may be –

- a company limited by shares;

- a company limited by guarantee; or

- an unlimited company.

No company, association or partnership consisting of more than 20 persons can be formed for the purpose of carrying on any business that has for its object the acquisition of gain by the company, association or partnership, or by the individual members thereof, except it is registered as a company under the Singapore Companies Act, or is formed in pursuance of some other written law in Singapore or letters patent.

Question 7. Comment on the following:

In the United Kingdom, the name of the company may be entered in its register of members as a member in certain cases. (5 marks)

Answer:

Under Section 724 of the U.K. Companies Act, 2006 deals with the Treasury Shares, a limited company can make a purchase of its own shares out of distributable profits. The company may

- hold shares (or any of them) or

- deal with any of them, at any time,

As per section 727 or 729 of the U.K. Companies Act, 2006 w.r.t. disposal and cancellation of treasury shares.

Therefore, when such Treasury Shares are held by the company, then the name of the company must be entered in the register of members as the member holding those shares.

Cs Company Law Notes

Question 8. What are the requirements to form a proprietary company under the Australian Corporations Act, 2001?

Answer:

A proprietary company is a company that is registered as, or converts to, a proprietary company under the Australian Corporations Act, 2001.

A proprietary company limited by shares must have at least one shareholder and must have at least one director. That director must ordinarily reside in Australia.

A proprietary company must:

- be limited by shares or be an unlimited company with a share capital;

- have no more than 50 non-employee shareholders; and

- not do anything that would require disclosure to investors under Chapter 6D of the Act (except in limited circumstances).

Question 9. Highlight the aspects of corporate governance in the USA as per SOX Act.

Answer:

Sarbanes-Oxley Act, 2002:

- The rules and enforcement policies outlined in the Sarbanes-Oxley Act of 2002 amended or supplemented existing laws dealing with security regulation, including the Securities Exchange Act of 1934 and other laws enforced by the Securities and Exchange Commission (SEC).

- The new law set out reforms and additions in four principal areas:

- Corporate responsibility.

- Increased criminal punishment

- Accounting regulation

- New protections

Company Law Mcq With Answers

Major Provisions of the Sarbanes-Oxley (SOX) Act of 2002:

- The Sarbanes-Oxley Act of 2002 is a complex and lengthy piece of legislation. Three of its key provisions are commonly referred to by their section numbers: Section 302, Section 404, and Section 802.

- Because of the Sarbanes-Oxley Act of 2002, corporate officers who knowingly certify false financial statements can go to prison.

- Section 302 of the SOX Act of 2002 mandates that senior corporate officers personally certify in writing that the company’s financial statements “comply with SEC disclosure requirements and fairly present in all material aspects the operations and financial condition of the issuer.” Officers who sign off on financial statements that they know to be inaccurate are subject to criminal penalties, including prison terms.

- Section 404 of the SOX Act of 2002 requires that management and auditors establish internal controls and reporting methods to ensure the adequacy of those controls. Some critics of the law have complained that the requirements in Section 404 can hurt publicly traded companies because it’s often expensive to establish and maintain the necessary internal controls.

- Section 802 of the SOX Act of 2002 contains the three rules that affect record keeping. The first deals with the destruction and falsification of records. The second strictly defines the retention period for storing records. The third rule outlines the specific business records that companies need to store, which includes electronic communications.

- Besides the financial side of a business, such as audits, accuracy, and controls, the SOX Act of 2002 also outlines requirements for information technology (IT) departments regarding electronic records. The act does not specify a set of business practices in this regard but instead defines which company records need to be kept on file and for how long. The standards outlined in the SOX Act of 2002 do not specify how a business should store its records, just that it’s the company’s IT department’s responsibility to store them.

- The Sarbanes-Oxley Act (SOX) is the primary federal law governing corporate governance and accountability across multiple aspects of corporate business practice.

- SOX specifically regulates markets, brokers, dealers, accounting and auditing, on-going government and shareholder disclosure by reporting companies, insider trading, anti-fraud, proxy regulation and so forth. SOX established a new regulatory body, increased the authority of existing regulators, as well as imposed regulations beyond those of the self-regulating, industry organizations.

- The primary objectives of SOX are to promote:

- Fairness to Shareholders – SOX requires or promotes governance provisions that protect shareholder rights and allow shareholders to exercise those rights through governance procedures, such as shareholder meetings.

- Fairness to Stakeholders – SOX requires or promotes governance provisions that take into consideration the interests of employees, suppliers, buyers, and the local community.

- Heightened Director and Board Responsibilities – SOX places specific requirements on the composition of boards of Directors, including skill and independence requirements. Notably, in an effort to promote Director independence in decision making, SOX requires corporations to employee committees for special purposes.

Example: SOX requires boards appoint an audit committee where all members are independent of corporate operations (not officers of the corporation) with at least one financial expert as a member of the committee.

- Director and Officer Ethics – SOX imposes additional obligations on corporations to establish and maintain ethical standards for officer and Director conduct and decision-making. Example: SOX prohibits the corporation from making personal loans to corporate executives or their families.

- Disclosure and Accountability – SOX places requirements on boards to increase transparency in corporate governance practices. This includes implementing procedures for ensuring accurate accounting practices and public disclosure mechanisms.

Note: SOX requires internal review procedures and independence of external auditors that report directly to the corporation’s independent audit committee.