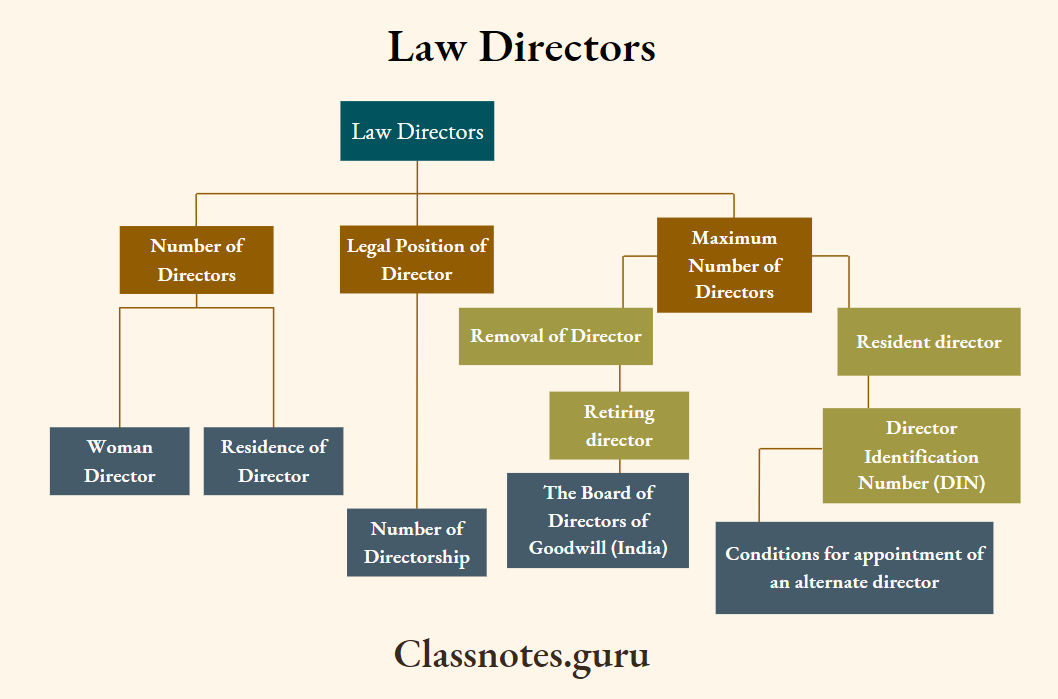

Law Directors

Number of Directors

Every public company shall have at least 3 directors every private company shall have at least 2 directors and every one-person company shall have at least 1 director under Section 149.

Legal Position of Director

Directors are trustees for the company i.e. the directors are persons selected to manage the affairs of the company for the benefit of the shareholders.

Maximum Number of Directors

The maximum number of directors is 15, which can be increased by passing a special Resolution.

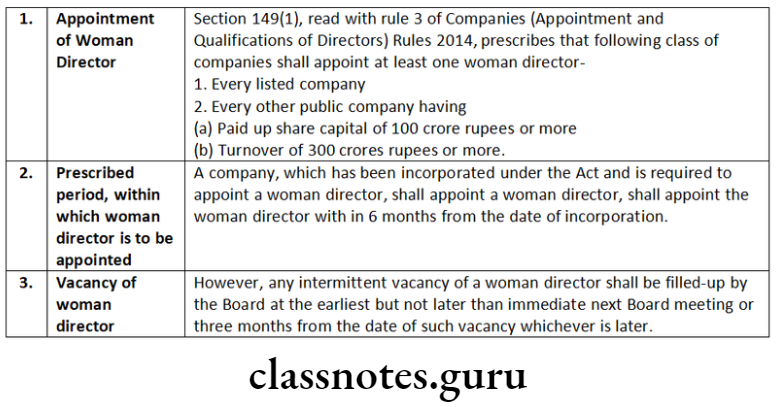

Woman Director

Certain prescribed class or classes of companies is required to have at least one woman director. This is a mandatory provision. Residence of Director

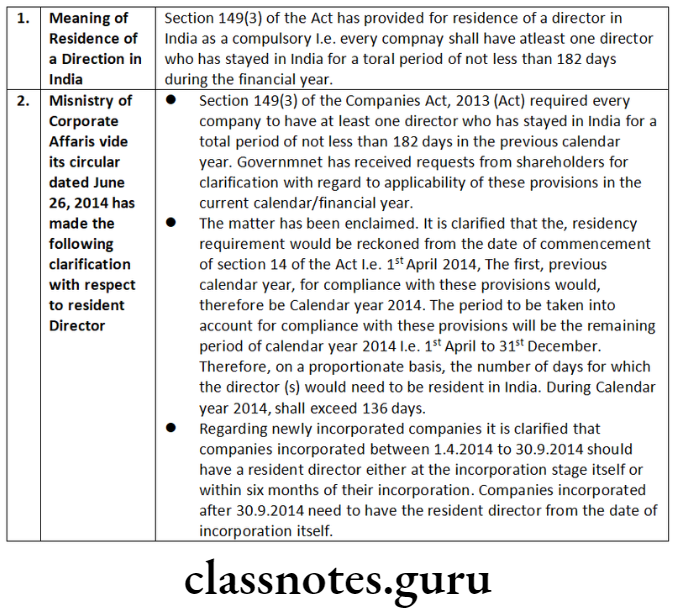

Residence of Director

Every company including one person company shall have at least one director who stays in India for not less than 182 days during the financial year.

Number of Directorship

The maximum limit on the total number of directorships has been fixed at 20 companies and the maximum number of public companies in which a person can be appointed as a director shall be 10.

Removal of Director

A director may be removed from the office by giving a special notice.

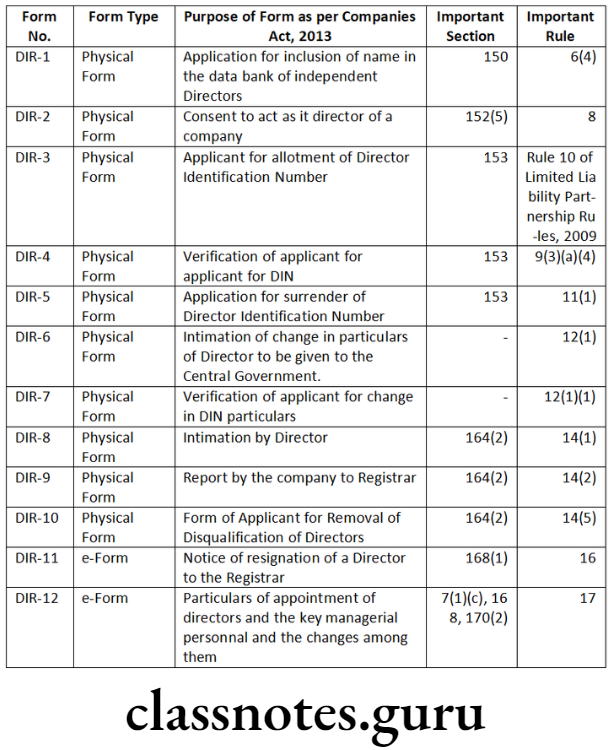

List of Important Forms

Directors Under Companies Act 2013

Short Notes

Question 1. Write a note on the following:

Resident director

Answer:

Distinguish Between

Question 1. Distinguish between the following:

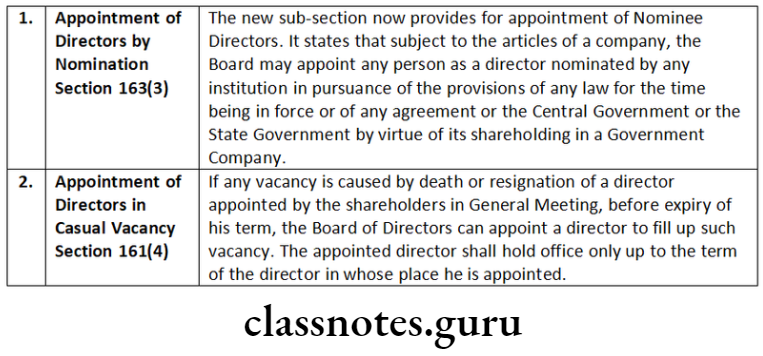

‘Appointment of directors by nomination’ and ‘appointment of directors against casual vacancy’.

Answer:

Descriptive Questions

Question 1. State the provisions of the Companies Act, 2013 relating to loans to directors.

Answer:

Amendment made by Companies (Amendment) Act, 2017 Section 185:

- For Section 185 of the Principal Act, the following section shall be substituted, namely:

“185. (1) No company shall, directly or indirectly, advance any loan, including any loan represented by a book debt to, or give any guarantee or provide any security in connection with any loan taken by,-- any director of the company, or of a company which is its holding company or any partner or relative of any such director; or

- any firm in which any such director or relative is a partner.

- A company may advance any loan including any loan represented by a book debt, or give any guarantee or provide any security in connection with any loan taken by any person in whom any of the directors of the company is interested, subject to the condition that-

- a special resolution is passed by the company in the general meeting: Provided that the explanatory statement to the notice for the relevant general meeting shall disclose the full particulars of the loans given, or guarantee given or security provided and the purpose for which the loan or guarantee or security is proposed to be utilized by the recipient of the loan or guarantee or security and any other relevant fact; and

- the loans are utilized by the borrowing company for its principal business activities.

Explanation. For this sub-section, the expression “any person in whom any of the directors of the company is interested” means-- any private company of which any such director is a director or member;

- any body corporate at a general meeting of which not less than twenty-five percent. of the total voting power may be exercised or controlled by any such director, or by two or more such directors, together; or

- any body corporate, the Board of directors, managing director or manager, whereof is accustomed to act by the directions or instructions of the Board, or of any director or directors, of the lending company.

- Nothing contained in sub-sections (1) and (2) shall apply to

- the giving of any loan to a managing or whole-time director-

- as a part of the conditions of service extended by the company to all its employees; or

- under any scheme approved by the members by a special resolution; or

- a company which in the ordinary course of its business provides loans or gives guarantees or securities for the due repayment of any loan and in respect of such loans an interest is charged at a rate not less than the rate of prevailing yield of one year, three year, five year or ten year Government security closest to the tenor of the loan; or

- any loan made by a holding company to its wholly owned subsidiary company or any guarantee given or security provided by a holding company in respect of any loan made to its wholly owned subsidiary company; or

- any guarantee given or security provided by a holding company in respect of a loan made by any bank or financial institution to its subsidiary company:

Provided that the loans made under clauses (c) and (d) are utilized by the subsidiary company for its principal business activities.

- the giving of any loan to a managing or whole-time director-

- If any loan is advanced or a guarantee or security is given or provided or utilized in contravention of the provisions of this section,-

- the company shall be punishable with a fine which shall not be less than five lakh rupees but which may extend to twenty-five lakh rupees,

- every officer of the company who is in default shall be punishable with imprisonment for a term which may extend to six months or with a fine which shall not be less than five lakh rupees but which may extend to twenty-five lakh rupees; and

- the director or the other person to whom any loan is advanced or guarantee or security is given or provided in connection with any loan taken by him or the other person, shall be punishable with imprisonment which may extend to six months, or with a fine which shall not be less than five lakh rupees but which may extend to twenty-five lakh rupees, or with both.”

Types Of Directors In Company Law

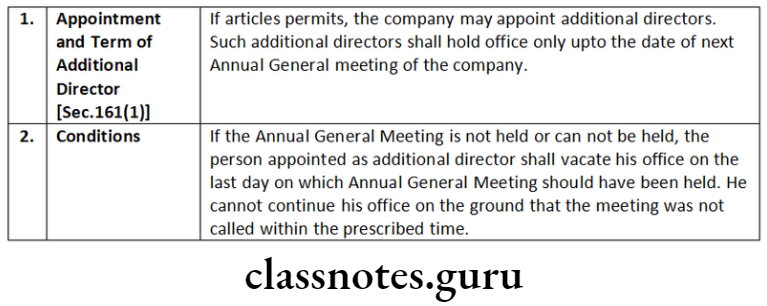

Question 2. The Board of Directors of Zest Ltd. appoints Pavan as a director under Section 161, of the Companies Act, 2013 by passing a resolution by circulation. The appointee now seeks your advice about the tenure of his appointment. Advise him.

Answer:

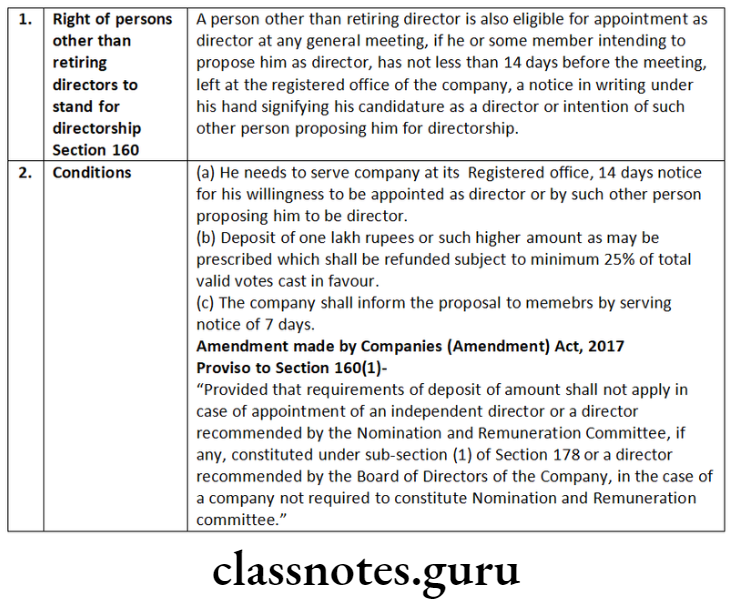

Question 3. A person other than a retiring director is also eligible for appointment as director. Examine.

Answer:

Question 4. Comment on the following:

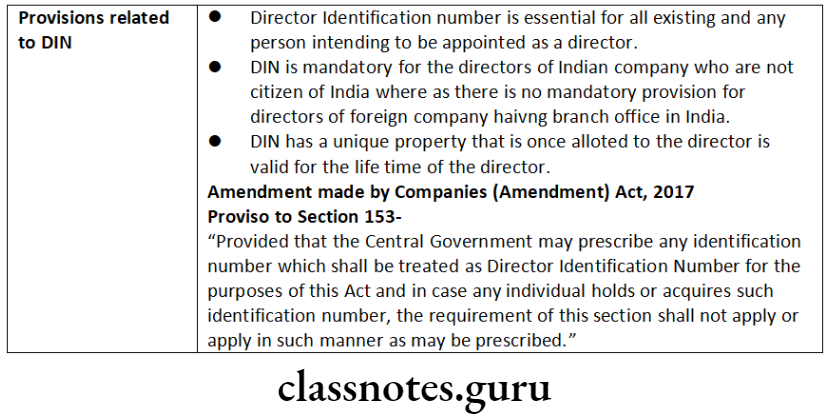

Director Identification Number (DIN) is not mandatory for directors of a foreign company having branch offices in India.

Answer:

Question 5. In what way do the Companies Act, 2013 and the Rules made thereunder regulate the appointment of woman directors in a company? Explain.

Answer:

Question 6. Comment on the following:

Every director of a company must disclose his interest or the nature of his concern in other companies in which he is a director.

Answer:

Disclosure of interest by Director (Section 184)

- Yes, every director of a company must disclose his interest or the nature of his concern in other companies in which he is a director. The Act provides for the disclosure by directors relating their concern or interest in any company or companies or body corporate (including shareholding interest), firms, or other association of individuals by giving a notice in writing in form MBP 1 (Rule 9(1)) at the first meeting of the board after being appointed as director and at the first meeting of the board of every financial year, in addition to this, any change required to be disclosed in next board meeting.

Applicability for Disclosure

- Every director is required to disclose the nature of his concern or interest at the meeting of the board in which the contract or arrangement is discussed and he has not to participate in such meeting.

- The abovementioned interest may be direct or indirect and relate to some contract or arrangement or proposed contract or arrangement entered into or to be entered into with a body corporate in which such director or such director in association with another director holds more than two percent shareholding or is a promoter, manager, Chief Executive Officer of that body corporate or with a firm or other entity in which such director is a partner, owner or member as the case may be.

- If a contract or arrangement entered into by the company without disclosure of interest by the director or with participation by a director who is concerned or interested in any way, directly or indirectly, in the contract or arrangement, shall be voidable at the option of the company.

- Amendment made by Companies (Amendment) Act 2020. If a director of the company contravenes the provisions of sub-section (1) or sub-section (2) of Section 184 of the Companies Act, 2013, such director shall be liable to a penalty of ₹ 1 Lakh.

- Any contract or arrangement entered into or to be entered into between two companies, where any director of any company holds more than two percent of the paid-up capital in another company, the provisions of this section shall not apply. Amended by the Companies Act, 2017 shall apply to any contract or arrangement entered into or to be entered into between two companies or between one or more companies and one or more bodies corporate where any of the directors of the one company or body corporate or two or more of them together holds or hold not more than two percent. of the paid-up share capital in the other company or the body corporate.

Types Of Directors In Company Law

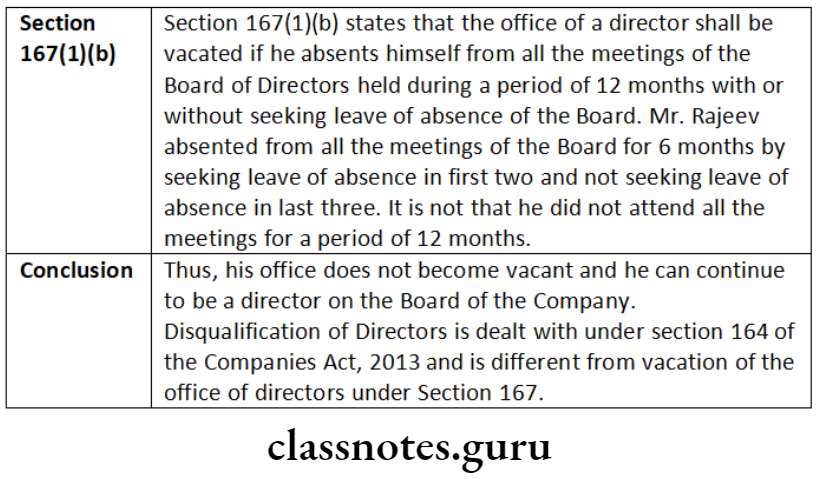

Question 7. Five Board meetings were held in Asha Ltd. during the period from January to June in the calendar year 2016. Rajeev, an additional director, attended none of these meetings. For the first two meetings, he sought a leave of absence from the Board but did not inform the Board for the remaining three meetings. Examining the provisions of the Companies Act, 2013, decide whether he is disqualified to act as a director.

Answer:

Question 8. Mr. Sunil Goyal, a director of XYZ Limited wants to go on a foreign trip. He wants to assign his office to the Vice President of the company. Mr. Sunil Goyal seeks your advice on whether he can do so. Referring to the provisions of the Companies Act, 2013 advise him in the matter.

Answer:

By the provisions of the Companies Act, 2013, as contained in Section 166(6), a director of a company shall not assign his office. Any assignment so made shall be void. Therefore, Mr. Sunil Goyal, the director of the company who wants to go on a foreign trip cannot assign his office to the Vice President. He is advised accordingly not to assign his office.

However, for quorum and smooth function of the Board, the Alternate director may be appointed under the provisions of Section 161 of the Companies Act, 2013.

Question 9. Examine the validity of the following statements:

- ‘Every listed public company must have an independent woman director.’

- ‘Every listed public company must have a small shareholders’ director.”

Answer:

According to Regulation 17 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, the Board of Directors of the top 500 listed entities shall have at least one independent woman director by April 1, 2019, and the Board of Directors of the top 1000 listed entities shall have at least one independent woman director by April 1, 2020.

The top 500 and 1000 entities shall be determined based on market capitalization, as of the end of the immediate previous financial year.

Thus, every listed public company is not required to appoint an independent woman director, but the listed entities falling under the above bracket must have an independent woman director.

According to Section 151 of the Companies Act, 2013 r/w Rule 7 of the Companies (Appointment and Qualifications of Directors) Rules, 2014, a listed company may have one director elected by small shareholders upon notice by not less than one thousand small shareholders or one-tenth of the total number of such small shareholders, whichever is lower. Although, a listed company may opt to have a director representing small shareholders -suo-motu.

Hence, the appointment of small shareholders by the listed companies is optional.

Question 10. Kailash, a director of a company has sent in his resignation notice stating that he is resigning from the office of director with effect from 10th December 2019. The notice was received by the company on 15th December 2019. State the effective date of resignation Kailash and the date up to which the company is required to inform the Registrar of Companies (ROC). Is Kailash required to intimate his resignation to the ROC mandatorily?

Answer:

According to Section 168(2) of the Companies Act, 2013, the resignation of a director shall take effect from the date on which the notice is received by. the company or the date, if any, specified by the director in the notice, whichever is later. Thus, in the given case, the resignation of Kailash shall take effect from December 15, 2019.

Section 168(1) read with Rule 15 of the Companies (Appointment and Qualifications of Directors) Rules, 2014 stipulates that the company shall within thirty days from the date of receipt of notice of resignation from a director, intimate to the Registrar of Companies (ROC) in Form DIR- 12 along with specified fees and post the information on its website, if any. Consequently, in this case, the company will have to file form DIR-12 by January 14, 2020.

According to Rule 16 of the Companies (Appointment and Qualifications of Directors) Rules, 2014 the resigning director may also forward to the Registrar of Companies, a copy of his resignation along with reasons for the resignation in form DIR-11 along with prescribed fees within 30 days from the date of resignation.

Question 11. Vasu is an independent director in various companies and he seeks your opinion regarding the presence of independent directors in different types of Committees. Advise.

Answer.

Practical Questions

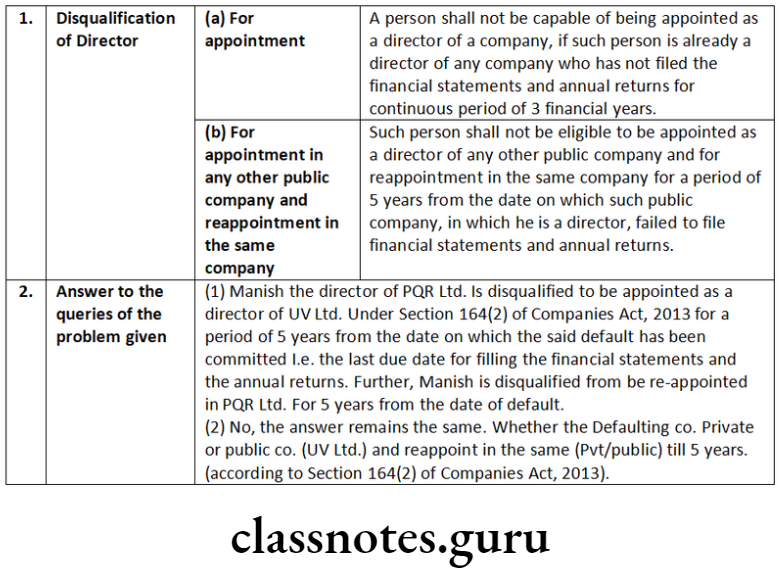

Question 1. Manish, a director of PQR Ltd., defaulted in filing financial statements and annual returns with the Registrar of Companies for a continuous period of three financial years ended 31st March 2012. Based on the provisions of the Companies Act, 2013, validate the following:

- Whether Manish can continue to be a director of PQR Ltd. when he is also a director of UV Ltd.? Also, narrate whether he can be reappointed in PQR Ltd. as well as in UV Ltd.

- If the defaulting company is a private limited company, what would be your answer?

Answer:

Appointment And Removal Of Directors

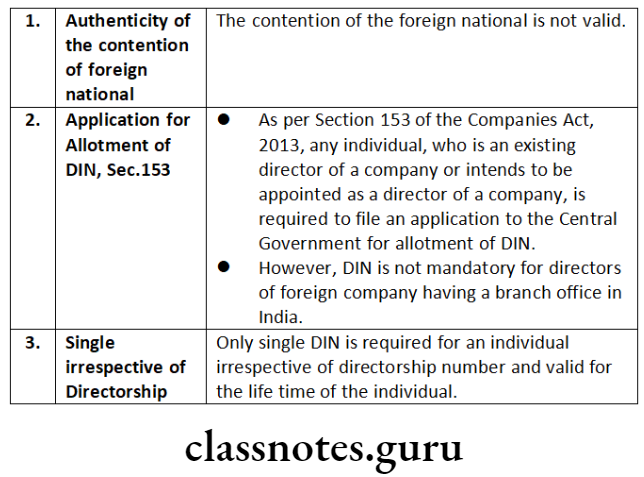

Question 2. Answer the following citing the relevant provisions of law/case law, if any:

A foreign national was intended to be appointed to the Board of an MNC in India. He contends that a director identification number (DIN) is not required for him as he is a foreign national. Whether his contention valid?

Answer:

Question 3. In a public limited company, certain directors who guaranteed the company’s debts retired, and new directors were appointed in their places and they also signed the guarantee bonds. There was no agreement to show that the earlier guarantee had ceased to be operative. repayment.

The retired directors contended that they have already retired The bank who is the beneficiary, exercised its option and demanded that they are not liable to the bank on the strength of the bond. Is the contention valid? Decide the case about the provisions of the Companies Act, 2013.

Answer:

In the case of Bank of Baroda v. Official Liquidator (1992) 73 Com. Cases 688 (MP). It was held that all the directors including the retired directors were liable jointly and severally under the guarantee and hence the contention of the Bank is correct. They have to make good the guarantee amount under the bond to the bank.

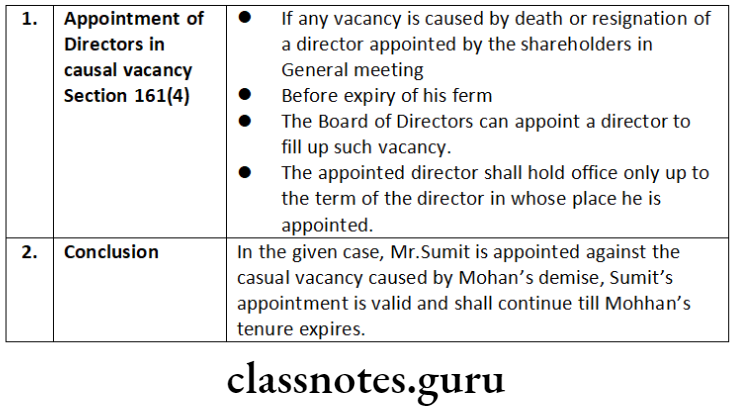

Question 4. In Bright Ltd., the vacancy of a director is caused by the death of Mohan, a director of the company, after three months of his joining the company as director. The Board of the company, therefore, appointed Sumit in his place but did not seek approval from the company in a general meeting. Referring to the provisions of the Companies Act, 2013, examine the validity of Sumit’s appointment.

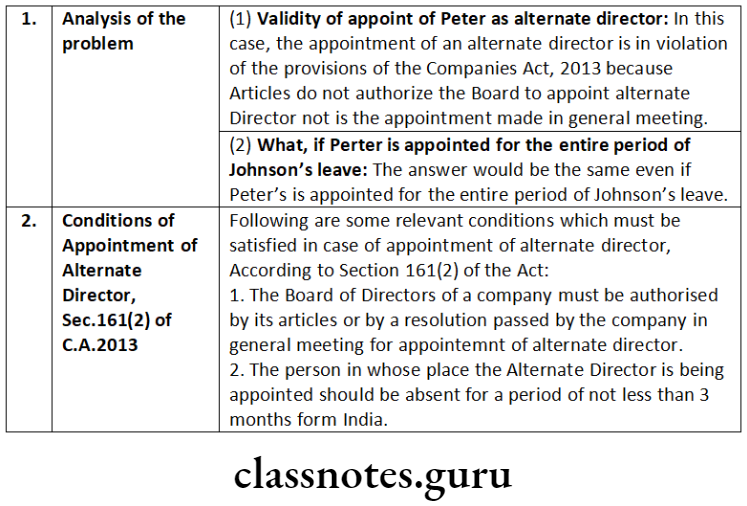

Johnson, a director in Disha Ltd. proceeds on leave for 8 months to France for personal reasons. The Board of Directors at a meeting appoints Peter for two months, as an alternate director. Articles of association of the company do not confer upon the Board of Directors any such power to appoint anyone as alternate director. Referring to the provisions of the Companies Act, 2013, examine the validity of the above appointment. What shall be your answer in case the Board appoints Péter for the entire period of Johnson’s leave?

Answer:

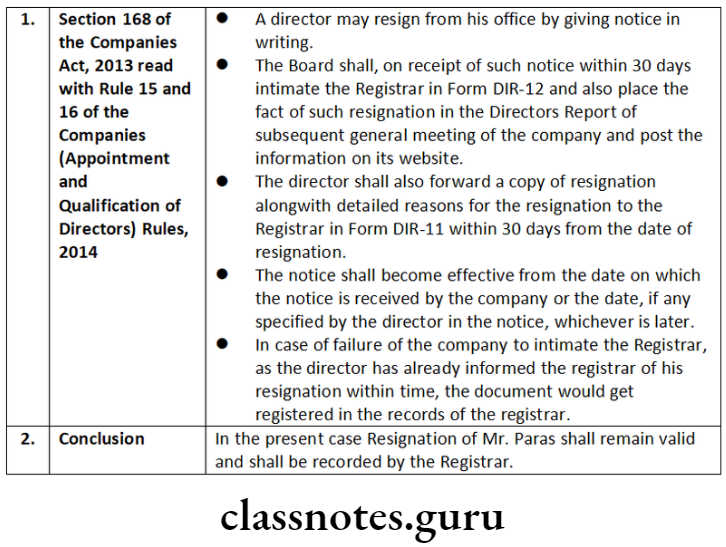

Question 5. Paras, a director of Spike (Pvt.) Ltd. resigns from the office of director. He has forwarded a copy of his resignation to the company and the Registrar of Companies (ROC) in time. The company, however, has not filed a relevant form to the ROC. Explaining the provisions of the Companies Act, 2013 in this regard, decide the status of Paras.

Answer:

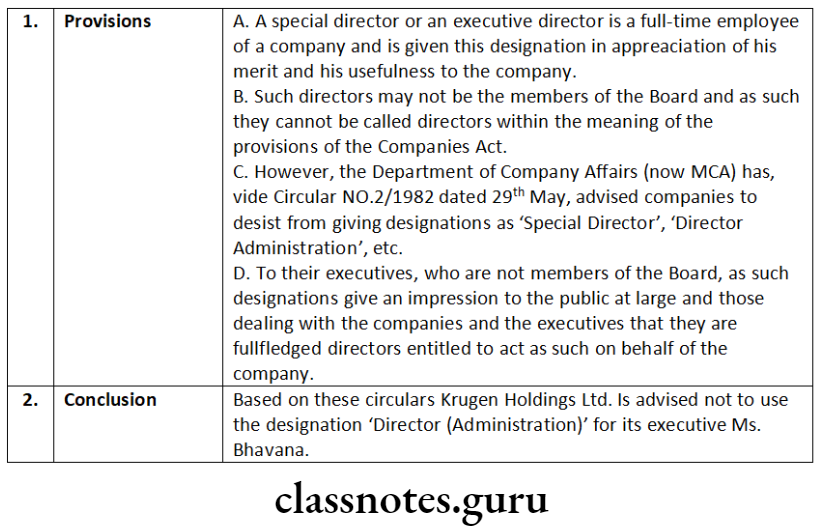

Question 6. Krugen Holdings Ltd. promoted Ms. Bhavna and designated her as the Director (Administration). Examine the validity of such a designation under the provisions of the Companies Act, 2013.

Answer:

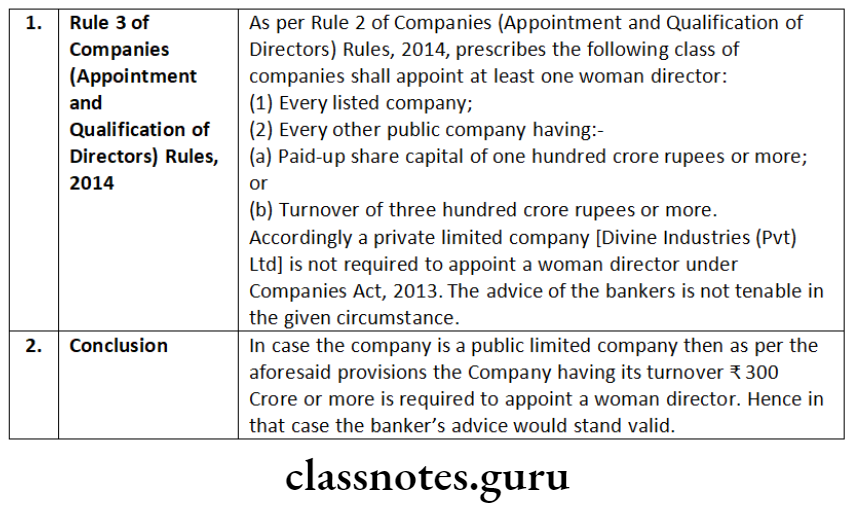

Question 7. Divine Industries (Pvt.) Ltd. has a turnover of * 350 crore during the financial year 2014-15. The bankers of the company have advised the company to compulsorily appoint a women director company as required under the Companies Act, 2013. Referring to the provisions of the Act, examine the validity of the banker’s advice. What would be your answer in case the company in question is a public limited company?

Answer:

Appointment And Removal Of Directors

Question 8. Newly incorporated Abhay Limited has not mentioned the names of the first directors of the company in the Articles of Association. Referring to the provisions of the Companies Act, 2013, advise the Board of Directors regarding the appointment of the first directors of the company. What would be your answer in case the company is a one-person company? Also, state whether provisions of the Act apply to a Private Limited Company.

Answer:

First directors of the companies are generally named in the articles of the company. Regulation 60 of Table F provides that the number of directors and the names of the first directors shall be determined in writing by the subscribers of the memorandum or a majority of them. If they are not so named in the articles of a company, then subscribers to the memorandum who are individuals shall be deemed to be the first directors of the company until the directors are duly appointed.

In the case of a one-person company, an individual being a member shall be duly deemed to be the company’s first director until the director (s) are duly appointed by the members by the provisions of Section 152 of the Companies Act, 2013.

Section 152 (1) of the Act applies to all companies, whether public or private.

Question 9. Mr. Solid, a young professional of 29 years, has stayed in India for 150 days in the previous financial year. He does not hold any shares in Happy Retails Limited, which is a quoted (listed) company. Small shareholders have decided amongst themselves that he is proposed to be appointed as small shareholders director who shall not be liable to retire by rotation and his tenure shall be for five years from the date of joining the office of director. Examining the provisions of the Companies Act, 2013, state whether Mr. Solid can be so appointed as small shareholders’ director.

Answer:

Rule (7) of the Companies (Appointment and Qualification of Directors) Rules, 2014 contains provisions for the appointment and qualification of small shareholder directors. Sub-rule (2) allows a person who is not a shareholder to become a shareholder’s director. Under sub-rule (5), the appointment of a small shareholder’s director shall be subject to the provisions of Section 152 except that-

- such director shall not be liable to retire by rotation,

- such director’s tenure as small shareholders’ director shall not exceed 3 corrective years and,

- on the expiry of the tenure, such director shall not be eligible for re-appointment.

Thus, by sub-rule(2) of Rule 7, Mr. Solid who does not hold any shares in Happy Retails Limited can be proposed to be appointed as a small shareholder director. He shall not be liable to retire by rotation but he cannot be appointed for 5 years. Mr. Solid can be appointed as a small shareholders’ director only for 3 years.

Question 10. The Board of Directors of Goodwill (India) Ltd. wishes to appoint an alternate director on the Company’s Board in the absence of Mr. Prince, a director, who proceeded on leave. Referring to the provisions of the Companies Act, 2013, state the conditions to be satisfied before the Board appoints such a director. What shall be the tenure of such alternate director in case Mr. Prince incurs a disqualification and ceases to be a director?

Answer:

Section 161(2) of the Act empowers the Board if so authorized by its articles or by a resolution passed by the company in a general meeting, to appoint a director (termed as ‘alternate director) to act in the absence of an original director during his absence for not less than three months from India.

The provisions applicable to an alternate director are as follows.

Applicability:

Section 161(2) of the Act applies to all companies, whether public or private.

Conditions for appointment of an alternate director:

- The Board of Directors of a company must be authorized by its articles or by a resolution passed by the company in a general meeting for the appointment of the alternate director.

- The person in whose place the Alternate Director is being appointed should be absent for not less than 3 months from India.

- The person to be appointed as the Alternate Director shall be a person other than the person holding any Alternate directorship for any other Director in the company.

- If it is proposed to appoint an Alternate Director to an Independent Director, it must be ensured that the proposed appointee also satisfies the criteria of Independence as per Section 149(6) of the Act.

Terms of office of an alternate director:

- Not exceeding the term permissible to the original director: An alternate director shall not hold office for a period longer than that permissible to the director in whose place he has been appointed. If the original director ceases to be a director because of death or vacation of office under Section 167, the alternate director shall immediately cease to hold his office.

- On the return of the original director: The alternate director shall vacate his office when the original director in whose place he has been appointed returns to India.

Cs Company Law Directors Questions

Question 11. R Systems Ltd. holds 40% of the paid-up share capital of ATC Aviation Pvt. Ltd. R Systems appointed a representative director in ATC Aviation Pvt. Ltd. to safeguard its interest. The Board of Directors of R Systems Ltd. wishes to know whether the director appointed by them shall be treated as a nominee director. Advise the Board.

Answer:

Explanation to Section 149 of the Companies Act, 2013 provides that a “Nominee Director” means a director

- nominated by any financial institution in pursuance of the provisions of any law for the time being in force, or of any agreement, or

- appointed by any Government, or

- any other person to represent its interests.

Thus, the Director appointed by R Systems Ltd. in ATC Aviation Pvt. Ltd. shall be treated as a “Nominee Director”.

Question 12. Anil, a shareholder holding 9% equity shares of the company, who is not holding any directorship wants to stand for directorship in Pritam Ltd. in its next annual general meeting. State the procedure for the appointment of Anil as per the provisions of the Companies Act, 2013.

Answer:

In the given case, Mr. Anil not a retiring director in the company is desirous of standing for directorship of the Pritam Ltd., in pursuance of Section 160 of the Companies Act, 2013 the following procedure needs to be followed:

- The proposed director or some member intending to propose him as a director, has, not less than fourteen days before the general meeting, left at the registered office of the company, a notice in writing under his hand signifying his candidature as a director or, as the case may be, the intention of such member to propose him as a candidate for that office, along with the deposit of one lakh rupees which shall be refunded to such person or, as the case may be, to the member, if the person proposed gets elected as a director or gets more than twenty-five percent of total valid votes cast either on a show of hands or on the poll on such resolution.

- The company shall, at least seven days before the general meeting, inform its members of the candidature of a person for the office of a director or the intention of a member to propose such person as a candidate for that office:

- By serving individual notices, on the members through electronic mode to such members who have provided their email addresses to the company for communication purposes, and in writing to all other members; and

- By placing notice of such candidature or intention on the website of the company, if any; or

- Publishing the same in vernacular newspaper seven days before the meeting.

- The candidate may obtain a Director Identification Number (DIN) and give his consent in DIR-2.

- If the candidate is elected the company shall file DIR-12. Space to write important points for revision

Question 13. Fashion Ltd. holds a general meeting to pass a special resolution regarding the appointment of Shyamal aged 72 years as Managing Director of the company. Out of the 50 members present in the meeting 25 voted in favour, 15 against and 10 members did not cast their vote. Can the company appoint Shyamal as the Managing Director of the company? Discuss.

Answer:

Under section 196(3) of the Companies Act, 2013, no company shall appoint or continue the employment of any person as managing director, whole-time director, or manager who is below the age of twenty-one years or has attained the age of seventy years. Further appointment of a person who has attained the age of seventy years may be made by passing a special resolution in which case the explanatory statement annexed to the notice for such motion shall indicate the justification for appointing such person.

In the case where no such special resolution is passed but votes cast in favor of the motion exceed the votes, if any, cast against the motion and the Central Government is satisfied, on an application made by the Board that such appointment is most beneficial to the company, the appointment of the person who has attained the age of seventy years may be made.

A person who has attained the age of seventy may be appointed as the managing director of the company after passing a special resolution. In the present case, the special resolution was not passed.

Mr. Shyamal may be appointed as the Managing Director since the votes cast in favor exceed the vote cast against the resolution and Central Government approval may be obtained by the Board of Directors of the Company to appoint him as managing director. If the Central Government is satisfied the approval may be granted.

Question 14. “A” Ltd., a public company wants to appoint Alternate Directors. Examine the validity of acts of the company concerning provisions of the Companies Act, 2013 in the following cases:

- ‘D’ a director was absent for two and a half months. It is proposed to appoint an alternate director.

- ‘E’ a director was absent for 4 months. It is proposed to appoint ‘F’ as an alternate director in the place of ‘E’. ‘F’ is already acting as an alternate director in “A” Ltd. for director ‘G’ who was absent for 5 months.

- Can the said appointment, if permitted, be passed by circular resolution?

Answer:

- Section 161(2) of the Companies Act 2013 empowers the Board if so authorized by its articles or by a resolution passed by the company in a general meeting, to appoint a director (termed as ‘alternate director) to act in the absence of an original director during his absence for not less than three months from India. Since D has been absent only for two and a half months. An alternate director in place of D cannot be appointed.

- Section 161(2) of the Companies Act, 2013 states that in the conditions for the appointment of an Alternate Director, the person to be appointed as the Alternate Director shall be a person other than the person holding any alternate directorship for any other Director in the company or holding directorship in the same company. Therefore since F is acting as an alternate director for another director i.e. “G”, he cannot be appointed again as alternate director for E in the same company.

- There is no specific provision in the Act that provides that the appointment of an Alternate Director shall be made at the meeting of the Board. In the absence of any such prohibition, an alternate director can be appointed by passing a resolution by circulation. Therefore in the given illustration, if permitted the alternate Director can be appointed by circular resolution.

Question 15. ‘T’ Ltd. a listed company has 20 crore paid-up share capital and has nine directors on its Board. Advise T Ltd. on the following matters:

- The number of independent directors it should appoint on its board.

- How many independent directors should be appointed by T Ltd. in case it is an “unlisted public company”?

- Can T Ltd. appoint an independent director for a second consecutive term of 6 years whose first term, as an independent director in T Ltd. was for 4 years?

- Ltd. wants to appoint another independent director for a further period of 2 years. He has already completed 2 consecutive tenures of 4 years each as an independent director in T Ltd.

Answer:

- As per Section 149(4) of the Companies Act 2013, every listed public company is mandatorily required to have at least one-third of the total number of directors as independent directors. T Ltd should appoint 1/3 of its total Directors as Independent Directors and accordingly has to appoint 3 independent directors.

- As per Rule 4 of the Companies (Appointment and Qualification of Directors) Rules. 2014 unlisted public companies having paid-up share capital of 10 crore rupees or more shall have at least two independent. Hence, Two independent directors have to be appointed by T Ltd as it is an unlisted company and its paid-up share capital is more than 10 crores.

- Section 149(10) of the Companies Act, 2013 states that subject to the provisions of Section 152, an independent director can be appointed for a term of up to five consecutive years on the Board. It has been clarified that as such while appointment of an Independent Director for a term of less than 5 years would be permissible, appointment for any term (whether for 5 years or less) is to be treated as a one term under Section 149(10) of the Act. Therefore T Ltd cannot appoint an Independent Director for term of a six years for the second consecutive term.

- Section 149(11) of the Act, no person can hold the office of Independent Director(ID) for more than two consecutive term’s such a person shall have to demit office after two consecutive terms, even if the total number of years of his appointment in such two consecutive terms is less than 10 years. It is clarified by the Ministry that appointment for any term (whether 5 years or less) is to be treated as one term under Section 149(10) of the Companies Act, 2013.

- Further, under Section 149(11) of the Companies Act,2013 no person can hold the office of independent director for more than two consecutive term’s such a person shall have to demit office after two consecutive terms, and he shall be eligible for appointment only after the expiry of the requisite cooling -off period of 3 years. Therefore T Ltd cannot appoint an independent Director who has already completed two consecutive terms for 4 years for another period of two years.

Cs Company Law Directors Questions

Question 16. ‘X’ was appointed as an Additional Director of Precious Ltd. w.e.f. 21st November, 2018 in a casual vacancy caused by the unexpected death of “P” by way of a circular resolution passed by the Board of Directors. Concerning the provisions of the Companies Act, 2013 advise the company on the validity of the appointment of ‘X’ and his continuation as Additional director.

Answer:

Section 161(4) of the Companies Act, 2013 states that if the office of any director appointed by the company in a general meeting is vacated before his term of office expires in the normal course, the resulting casual vacancy may, in default of and subject to any regulations in the articles of the company, be filled by the Board of directors at a meeting of the Board which shall be subsequently approved by members in the immediate next general meeting.

Provided that any person so appointed shall hold office only up to the date up to which the director in whose place he is appointed would have held office if it had not been vacated.

Section 161 does not authorize the Board to appoint an additional director to fill the casual vacancy

- If the appointment of X is made as an additional director, then, such an appointment cannot amount to filling a casual vacancy.

- If X is appointed to fill a casual vacancy, then he shall not be an additional director.

It is thus clear that the appointment of X as an additional director to fill the casual vacancy is not valid. However, X can be treated as an additional director and his office as an additional director will be valid upto the date of the ensuing AGM. In this regard, the text of the resolution dealing with a casual vacancy will be void but will be valid to the extent of the additional directors.

Further X has been appointed to fill the casual vacancy by passing a circular resolution. Since the appointment of a director to fill a casual vacancy requires the passing of the resolution in a board meeting, the appointment of X is in contravention of Section 161, and is, therefore, invalid.

Question 17. Rajesh Gawda is a director of XYZ Pvt. Ltd. having a paid-up share capital of 11 crore. The company has granted a loan of ₹ 2 crore to Rajesh Gawda. The company has a borrowing of 15 crore from HDFC Bank. The company secretary informs the company that the loan to the director violates the provisions of the Companies Act, 2013. Justify the claim of the company secretary.

Answer:

Pursuant to Section 185(1) of the Companies Act, 2013, no company shall, directly or indirectly, advance any loan, including any loan represented by a with any loan taken by,- book debt to, or give any guarantee or provide any security in connection

- Any director of the company, or of a company which is its holding company or any partner or relative of any such director; or

- Any firm in which any such director or relative is a partner.

Further, vide Exemption Notification dated 5th June 2015, Section 185 of the Companies Act, 2013 shall not apply to Private Companies meeting the following conditions:

- In whose share capital no other body corporate has invested any money;

- If the borrowings of such a company from banks or financial institutions or anybody corporation is less than twice its paid-up share capital or fifty Crores rupees, whichever is lower; and

- Such a company has not defaulted in repayment of such borrowings subsisting at the time of making transactions under this section.

Now, considering that the Paid Capital of the Company is 11 Crores and borrowing from HDFC Bank is 15 Crore, it can be seen that the amount of borrowings by the company from Banks (* 15 Crores) is less than twice the amount paid-up capital (i.e. 2 x 11 Cr. =22 Crores). So as per exemption conditions available to private companies borrowing from the bank is less than 2 times of Paid-up Capital of the Company.

To avail exemption, the company needs to fulfill all conditions as provided in the Exemption Notification. Therefore, if all the above conditions are fulfilled, the loan to Rajesh Gowda is exempted under Section 185 and the company is not in violation of the provisions of the Companies Act, 2013 and the claim of CS is not justified.

Question 18. Destinations Ltd. is a listed company with a paid-up share capital of 40 crore, a turnover of 200 crore but a loss of *10 crore for the year ended 31 March 2018. The woman direonor in the Board of the company resigned on 1 October 2018. The last Board meeting was held on 25th September 2018.

The Board is likely to meet next on 15th January 2019. Lalita, aged 30 years, has conveyed her interest to be associated with the company as a woman director. Discuss if any woman director is required to fill the vacancy and if so, when the appointment should be made as per the provisions of the Companies Act, 2013.

Answer:

Second Proviso to section 149 of the Companies Act, 2013 provides that such class or classes of companies as may be prescribed in Rule 3 of Space to write important points for revision- Companies (Appointment and Qualification of Directors) Rules, 2014, provides that the following class of companies shall appoint at least one woman director-

- every listed company;

- every other public company has:-

- paid-up share capital of one hundred crore rupees or more; or

- turn over of three hundred crore rupees or more.

However, any intermittent vacancy of a woman director shall be filled up by the Board at the earliest but not later than the immediate next Board meeting or three months from the date of such vacancy, whichever is later. In the above case, as Destinations Ltd. is a listed company hence, the company is required to appoint a woman director to its board irrespective of paid-up capital, turnover, and loss amounts.

The appointment of Ms. Lalita as woman director is to be made at the before time but not later than the immediate next board meeting i.e. 15th January 2019 or 3 months from the date of cause of vacancy i.e. 1st October 2018; whichever is later, than way the appointment shall be made by 15th January 2019.

Powers And Duties Of Directors In India

Question 19. Rajeev and his wife Surekha are the only two directors of Rajsur Pvt. Ltd. Rajeev went abroad for two months. Before going abroad, he registered a general power of attorney in favour of his son Ranbeer, aged 21 years, to execute all documents on his behalf as an individual, as well as director of Rajsur Pvt. Ltd. Ranbeer, signed a contract on behalf of Rajsur Pvt. Ltd. by exercising his power of attorney. Is this contract binding upon the company?

Answer:

Section 166 (6) of the Companies Act 2013 prohibits the assignment of the office of director to any other person. Any assignment of office made by a director shall be void. Authorizing any person to sign a document as a director amounts to the assignment of the office of director.

Hence, in the instant case, Rajeev cannot assign his office of directorship in Rajsur Pvt. Ltd. to his son Ranbeer by a general power of attorney to sign documents on his behalf as director of the company. Contracts signed by Ranbeer on behalf of the company are void and not binding upon the company.

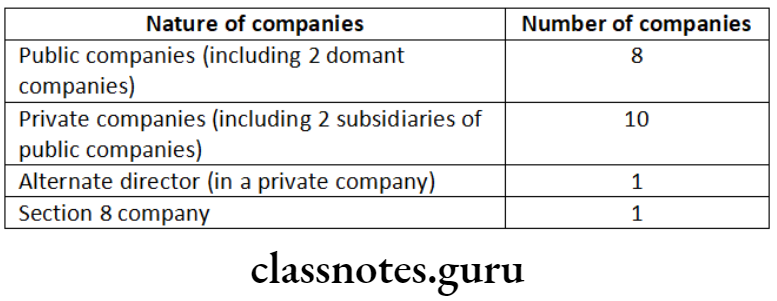

Amit has directorship of the following companies:

Indicate how many more directorships Amit can undertake in public or private companies.

Answer.

As per Section 165(1) of the Companies Act, 2013, no person, can hold office as a director, including any alternate directorship, in more than twenty companies at the same time. For reckoning the limit of directorships in twenty companies, the directorship in a dormant company is excluded.

Further, out of the above twenty companies, the maximum number of Public Companies in which a person can be appointed as a director cannot be more than ten. For reckoning the limit of ten Public Companies, directorship in Private Companies that are either holding or subsidiary companies of a Public Company shall also need to be included.

In the above case, Amit is holding a directorship in:

- 8 Public Companies (including 2 Dormant Companies);

- 10 Private Companies (including 2 subsidiaries of Public Companies);

- Alternate Director (in a Private Company);

- Section 8 Company

Accordingly, in a Public Company presently he is holding 8 directorships, and in a Private Company 9 directorships. Therefore, the total number of directorships he is already holding is 17 (since, directorship in Section 8 Company is excluded, from reckoning the limit of directorship of 20 companies). Hence, Amit can take up directorship in 2 more Public Companies and 1 more Private Company

Question 20. Rohan is a well-known banker and holds directorship in 22 companies as of 30th September 2020. The companies include 10 public companies, 11 private companies (including MNP Pvt. Ltd., a dormant company), and 1 company registered under section 8 of the Companies Act, 2013. Recently, on 20th December 2020, ABC-Ltd. in which Rohan is not a director acquired 100% of shares in MNP Pvt. Ltd. In this context, answer the following:

- Whether the directorships held by Rohan as of 30th September 2020 aalid?

- Can Rohan continue to hold directorship in all 22 companies after the acquisition made by ABC Ltd.?

- The Company Secretary of ABC Ltd. has proposed to restrict several directorships of the directors in ABC Ltd. Whether the proposal given by the Company Secretary is tenable in light of the provisions of the Companies Act, 2013.

Answer:

- As per Section 165 of the Companies Act, 2013, no person shall hold office as a director, including any alternate directorship, in more than 20 companies at the same time.

- Whereas the maximum number of public companies in which a person can be appointed as a director shall not exceed 10.

- For computation, the limit of public companies in which a person can be appointed as director, and directorship in private companies that are either holding or subsidiary companies of a public company shall be included. Further, for reckoning the limit of directorships of 20 companies, the directorship in a dormant company and section 8 companies shall not be included.

- The members of a company may, by special resolution, specify any lesser number of companies in which a director of the company may act as directors.

- In the given case, the holding of directorship of Rohan as of 30th September 2020 is valid as he is holding directorship in 10 public companies and in 11 private companies out of which one company is dormant and one company is registered under section 8 of the Companies Act, 2013. Therefore, the maximum directorship he is holding is in 20 companies.

- Upon MNP Pvt. Ltd. becoming a subsidiary of ABC Ltd. (a public company) directorship in MNP Pvt. Ltd. shall also be included within the limit of 10 public companies.

Accordingly, if Rohan acts as a director in more than 10 public companies, then same will violate Section 165 of the Companies Act, - As per section 165(2) of the Companies Act, 2013 subject to the provisions of Section 165 (1), the members of a company may, by special resolution, specify any lesser number of companies in which a director of the company may act as directors. Therefore, the proposal of the Company Secretary is tenable.

Question 21. Raman is a director of Mega Ltd., a company engaged in the business of selling mineral water. Rohini, wife of Raman, is a partner in M/s. Total is a partnership firm, engaged in the business of selling packaged juices. Raman also holds 100 shares in Zimba Pvt. Ltd., a company engaged in the business of manufacturing bottles.

The board of directors of Mega Ltd. Intends to grant a loan to M/s. Total and Zimba Pvt. Ltd. within the limits specified under the Companies Act, 2013. Examine whether Mega Ltd. can grant the loan. If yes, what are the conditions?

Answer:

Under section 185(1) of the Companies Act, 2013, no company shall, directly or indirectly, advance any loan, including any loan represented by a book debt to, or give any guarantee or provide any security in connection with any. a loan is taken by:

- any director of the company, or of a company which is its holding company or any partner or relative of any such director; or

- any firm in which any such director or relative is a partner.

- Consequently, based on the above provisions of Section 185(1) of the Companies Act, 2013, Megha Ltd. cannot grant a loan to M/s. Total, since it is a partnership firm in which the wife of Raman (Director of the lending company) is a partner.

Section 185(2) of the Companies Act, 2013 prescribes that a

company may advance any loan including any loan represented by a book debt, or give any guarantee or provide any security in connection with any loan taken by any person in whom any of the directors of the company is interested, subject to the condition that-- A special resolution is passed by the company in a general meeting

- the loans are utilized by the borrowing company for its principal business activities.

- Consequently, by complying with the conditions as prescribed above under Section 185(2) of the Companies Act, 2013, Megha Ltd. can grant a loan to Zimba Pvt. Ltd. which Raman is a member holding. 100 shares.

- Consequently, based on the above provisions of Section 185(1) of the Companies Act, 2013, Megha Ltd. cannot grant a loan to M/s. Total, since it is a partnership firm in which the wife of Raman (Director of the lending company) is a partner.

Powers And Duties Of Directors In India

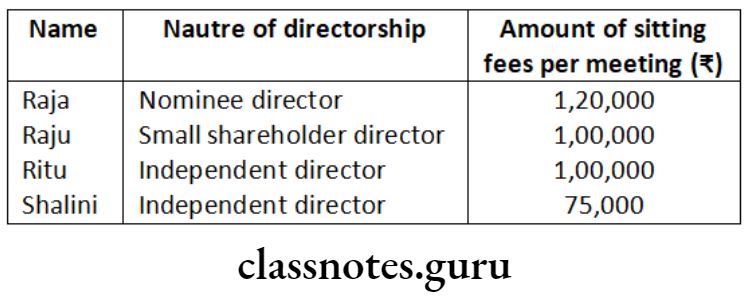

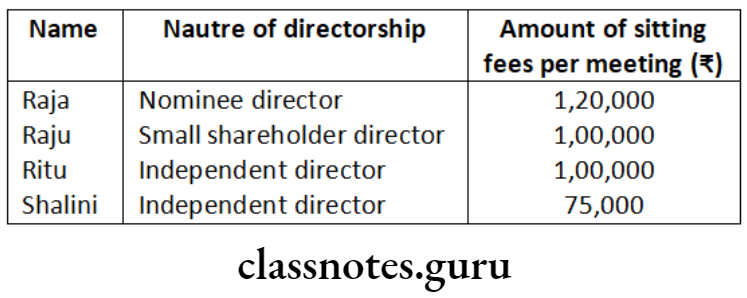

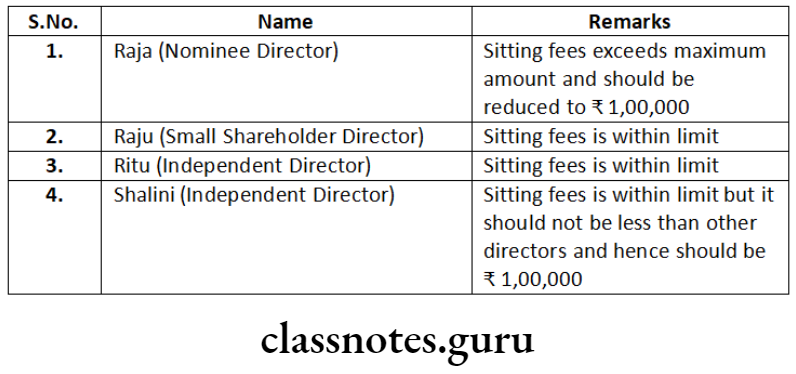

Question 22. In the following scenario, examine whether the amount of sitting fees decided by the Board of directors is by the provisions of the Companies Act, 2013 and the rules made thereunder:

Answer:

Section 197(5) of the Companies Act, 2013 read with Rule 4 of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014 prescribes that a company may pay a sitting fee to a Director for attending meetings of the Board or committees thereof, such sum as may be decided by the Board of Directors, which shall not exceed 1 lakh per meeting of the Board or committees thereof.

Provided that for Independent Directors and Women Directors, the sitting fee shall not be less than the sitting fee payable to other Directors. Based on the above laid down provisions, the following mentioned sitting fees payable is:

Question 23. Dim Dim Ltd. was incorporated on 31st December 2019. An advisor to the company has suggested that since the Articles of Association (AOA) does not contain provisions relating to the appointment of first directors, the company can function without the directors until the AOA is amended.

Do you agree with the suggestion given by the advisor? Can Dim Dim Ltd. appoint a director who has just stayed for 120 days in India during the financial year 2019-20?

Answer:

The first directors of most of the companies are named in their Articles of Association. Regulation 60 of Table F provides that the number of directors and the names of the first directors shall be determined in writing by the subscribers of the memorandum or a majority of them.

, Section 152(1) of the Companies Act, 2013 provides that, where no provision is made in the Articles of Association of a company for the appointment of the first director, the subscribers to the memorandum who are individuals shall be deemed to be the first directors of the company until the directors are duly appointed.

Consequently, in the given case, the advice given by the advisor regarding the first director is not correct.

- Section 149(3) of the Companies Act, 2013 provides that every company shall have at least one director who has stayed in India for a total period of not less than 182 days during the financial year.

- However, in the case of a newly incorporated company, the requirement under this sub-section shall apply proportionately at the end of the financial year in which it is incorporated.

Therefore, Dim Dim Ltd. which was incorporated on December 31, 2019, can appoint a director who has just stayed for 120 days in India during the financial year, 2019-20.

Question 24. Shankar was appointed as a small shareholders’ director on 2nd March 2017. Shankar has submitted a letter to the Board of directors expressing his desire to get re-appointed. In this context, the Board wants your opinion on the following points:

- Whether Shankar can be re-appointed as on 31st March, 2021?

- Whether he is liable to retire by rotation of 31st Marc, 2019?

- Since Shankar is serving as a director in many companies, whether his directorship in the capacity of small shareholders’ director included in the total number of directors as per the provisions of the Companies Act, 2013? Answer to the Board.

Answer:

According to Section 151 read with Rule 7 of the Companies (Appointment and Qualifications of Directors) Rules, 2014, the tenure of small shareholders’ director shall not exceed 3 consecutive years and on the expiry of the tenure, such director shall not be eligible for re-appointment. Further, such a director shall not be liable to retire by rotation. A small shareholders’ director is included in the total limit of directorship of 20 companies as prescribed under section 165 (1) of the Companies Act, 2013.

Based on the above provisions, answers to the questions are as under:

- No, Shankar as small shareholder director cannot be re-appointed as of March 31, 2021.

- No, Shankar is not liable to retire by rotation as of March 31, 2019.

- Yes, Shankar’s directorship will be counted in the overall limit provided under Section 165 (1) of the Companies Act, 2013.

Directors Under Companies Act 2013

Question 25. X proposes his candidature as a director of X Ltd. along with a deposit of 1 Lakh. Later X failed to be appointed as director but received 39% of the total votes. , claimed X Ltd. to refund the deposit but the companyrefusedd to pay as he failed to be elected having obtained only 39% ofthe votes cast. Is the decision of the company valid? Explain when the requirement of deposit of amount is not applicable.

Answer:

Right of persons other than retiring directors to stand for directorship [Section 160]

- A person who is not a retiring director shall be eligible for appointment to the office of a director at any general meeting, if he, or some member intending to propose him as a director, has, not less than fourteen days before the meeting, left at the registered office of the company, a notice in writing under his hand signifying his candidature as a director or, as the case may be, the intention of such member to propose. him as a candidate for that office. Such a person may be a member or a non-member, an additional director or a director to fill a casual vacancy, or an alternate director, or a nominee director.

- Such notice must come along with the deposit of one lakh rupees or such higher amount as may be prescribed which shall be refunded to such person or, as the case may be, to the member, if the person proposed gets elected as a director or gets more than twenty-five percent of total valid votes cast either on a show of hands or on the poll on such resolution. In the case of Nidhi company, instead of Rupees One Lakh, a deposit of Rupees ten thousand is required with the notice.

- Section 160 does not apply to a Government Company where the entire paid-up share capital is held by the Central Government jointly or severally or in the case of a subsidiary of a Government Company in which the entire paid-up capital is held by that Government Company. Further, Section 160 does not apply to Private Companies, Section 8 Companies whose article provides for election of directors by Ballot.

Conclusion: X failed to get appointed as Director in X Ltd, but secured more than 25% of the total votes. Hence, considering the above relevant provisions of the Act, the decision of the Company, X Ltd, is not valid. -Space to write important points for revision

Question 26. X has applied to the Indian Institute of Corporate Affairs (IICA) for the inclusion of his name in the data bank of independent directors. He is working as a director of X Ltd. and Y Ltd, both unlisted public companies having a paid-up share capital of 10 crores for the last 7 years. X says that he is not required to pass the online proficiency self-assessment test as he is the director of two unlisted companies with paid-up share capital of 10 crores in the last 7 years. Explain whether the contention of X is correct.

Answer:

As per Rule 6(4) of the Companies (Appointment and Qualification of Directors) Rules, 2014:

- Every individual whose name is included in the data bank of independent directors of IICA shall pass an online proficiency self-assessment test conducted by the IICA within two years from the date of inclusion of his name in the data bank, failing which, his name shall stand removed from the data bank of the institute.

- Proviso to this sub-rule provides that the individual who has served for not less than three years as of the date of inclusion of his name in the data bank as a director or key managerial personnel in a listed public company or an unlisted public company having a paid-up share capital of 10 crores or more shall not be required to pass the online proficiency self-assessment test.

- It is further provided that for calculation of the period of three years referred to in the first proviso, any period during which an individual was acting as a director or as key managerial personnel in two or more companies or bodies corporate or statutory corporations at the same time shall be counted only once.

Conclusion:

Given the above problem, the contention of the director is valid as the experience of the director is 7 years.

Short Notes

Question 1. Write a short note on the resignation of Directors.

Answer:

According to Section 168-

- A director may resign from its office by giving a notice with the reasons of resignation in writing to the company.

- The Board shall on receipt of such a notice from a director take note of the same.

- The company shall within 30 days from the date of receipt of notice of resignation from a director, intimate the registrar in Form DIR-12 and post the information on its website if any as provided in Rule 15 of the companies (Appointment and Qualification of Directors) Rules, 2014.

- The board shall place the facts of such resignation by the director in the Report of Directors laid in immediately following the general meeting by the company.

- The Director shall within 30 days from his resignation, forward to the registrar a copy of his resignation along with reasons for resignation with reasons provided therein in Form DIR-11 along with the fee provided. In the case of Specified IFSC public and private companies, a director may file Form DIR-11 to the Registrar.

- The resignation shall be effective from the date on which the notice is received by the company or the date specified by the Director in the notice whichever is later.

- When all the Directors resign at the same time under section 167, in such case,e the required number of directors are to be appointed by the promoter or, the Central Government. The Directors so appointed shall hold office till the Directors are appointed by the company in a general meeting.

Descriptive Questions

Question 2. Describe the procedure for the Appointment of directors to be elected by small shareholders.

Answer:

- A listed company has a paid-up capital of five crore rupees or more. and having one thousand or more small shareholders (holding shares of nominal value of 20,000 or less may have a director elected by such small shareholders.

- Small shareholders intending to propose a person as a candidate for the post of small shareholders’ director shall leave a notice of their intention with the company at least fourteen days before the meeting under their signature specifying the name, address, shares held, and folio number of the person whose name is being proposed for the post of director and of the small shareholders who are proposing such person for the office of director.

- If the person being proposed does not hold any shares in the company, the details of shares held and folio number need not be specified in the notice.

- The notice shall be accompanied by a statement of the proposed director stating his DIN, that he is not disqualified and his consent to act as director of the company.

- Such a director shall be considered as an independent director subject to being eligible and giving a declaration of his independence by sub-sections (6) and (7) of Section 149 of the Act.

- The small shareholder director shall be elected through a postal ballot.

- Ensure that the proposed director shall not hold the position of small shareholder director in more than 2 companies at the same time. Provided that the second company in which he has been appointed shall not be in a business which is competing or is in conflict with the business of the first company.

- Such a director shall not be retired by rotation and shall have a tenure of continuous three years.

- After completion of tenure small shareholders director shall not be eligible for reappoint.

- When small shareholders directors cease to beshareholdersrser they cease to be small shareholders directors.

- The company has to file particulars of the director in Form DIR-12 with the Registrar of Companies within thirty days of the appointment after paying the requisite fee electronically.

- Ensure that said Form is digitally signed by the managing director or manager or secretary of the company and also certified by a Company Secretary or Chartered accountant or Cost accountant in Full-time practice by digitally signing it.

- To file Form DIR-12, the following attachments are required:

- Letter of appointment

- Declaration by the first director

- Declaration of the appointee Director, in Form DIR-2;

- Interest in other entities;

- In the case of a listed company, the particulars of the appointment of a director should also be given to the stock exchange if the shares of the company are listed.

- The particulars of the director and other aspects of the director have to be entered by the company in the registers maintained under sections 170 and 189

- After appointment the director concerned has to inform other companies in which he is director about his appointment

Question 3. How can the directors be removed from the office before the expiry of their term?

Answer:

The following procedure is required to be adopted for removal of a director:

- A special notice from a member of the company proposing an ordinary resolution for removing the director is necessary.

- Send forthwith a copy of the special notice to the director proposed to be removed.

- Decide to call a general meeting through the Board resolution.

- Issue notice of the general meeting in writing at least twenty-one clear days before the date of the meeting informing about the special notice and proposing the ordinary resolution for removal.

- In the notice of the meeting, state the facts of the representation made by the director concerned and also send a copy of the representation to every member of the company to whom notice of the meeting is sent (whether before or after the receipt of the representations by the company).

- If the representation is received too late and it cannot be sent to the members, the director concerned may require that the representation be read out at the meeting. The director concerned has also the right of being heard at the meeting.

- However, the National Company Law Tribunal on an application of the company or any other person who claims to be aggrieved, on having satisfied, may dispense with the procedure of sending a copy of representation and reading thereof at the meeting if it is being used to secure needless publicity for defamatory matter.

- In the case of a listed company, send notice of the general meeting to the stock exchange(s) within 24 hours of the occurrence of the event where the company is listed [Refer Regulation 30(6) of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015].

- Hold the general meeting and pass the proposed resolution by ordinary resolution.

- In the case of a listed company, forward a copy of the proceedings of the meeting within 24 hours of the occurrence of the event to the stock exchange(s) where the company is listed.

- Ensure that said Form is digitally signed by the managing director or manager or secretary of the company and also certified by a Company Secretary or Chartered accountant or Cost accountant in Full-time practice by digitally signing it.

- The company has to file particulars of the director in Form DIR-12 with the Registrar of Companies within thirty days of the removal after paying the requisite fee electronically.

- To file Form DIR-12, the following attachments are required:

- Notice of resignation;

- Evidence of Cessation;

- Interest in other entities;

- The particulars of the director and other aspects of the director have accordingly been modified in the registers maintained under sections 170 and 189.

- Give a general public notice in the newspaper regarding the removal of the director if it is so warranted for the protection of the company and the benefit of the general public.

Types Of Directors In Company Law

Question 4. Under what circumstances is a director deemed to have vacated the office of directorship?

Answer:

According to Section 167 of the Companies Act, 2013, the office of a director shall become vacant in case –

- he incurs any of the disqualifications specified in Section 164;

- he absents himself from all the meetings of the Board of Directors held during twelve months with or without seeking leave of absence of the Board;

- he acts in contravention of the provisions of Section 184 relating to entering into contracts or arrangements in which he is directly or indirectly interested;

- he fails to disclose his interest in any contract or arrangement in which he is directly or indirectly interested, in contravention of the provisions of Section 184;

- he becomes disqualified by an order of a court or the Tribunal;

- he is convicted by a court of any offense, whether involving moral turpitude or otherwis, and sentenced in respect thereof to imprisonment for not less than six months. Provided that the office shall not be vacated by the director in case of orders referred to in clauses (e) and (f)-

- for thirty days from the date of conviction or order of disqualification;

- where an appeal or petition is preferred within thirty days as aforesaid against the conviction resulting in sentence or order, until expiry of seven days from the date on which such appeal or petition is disposed of; or

- where any further appeal or petition is preferred against order or sentence within seven days, until such further appeal or petition is disposed of;

- he is removed in pursuance of the provisions of this Act;

- he, having been appointed a director by his holding any office or other employment in the holding, subsidiary, or associate company, ceases to hold such office or other employment in that company.

- has not complied with the provisions of Section 165(1)

Question 5. Enumerate the rights and duties of directors.

Answer:

- Duty to act as per the articles of the company

The director of a company shall act by the articles of the company. - Duty to act in good faith

A director of a company shall act in good faith to promote the objects of the company for the benefit of its members as a whole and in the best interests of the company, its employees, the shareholders, the community, and for the protection of the environment. - Duty to exercise due care

A director of a company shall exercise his duties with due and reasonable care, skill, and diligence and shall exercise independent judgment. - Duty to avoid conflict of interest

A director of a company shall not be involved in a situation in which he may have a direct or indirect interest that conflicts, or possibly may conflict, with the interest of the company. - Duty not to make any undue gain

A director of a company shall not achieve or attempt to achieve any undue gain or advantage either to himself or to his relatives, partners, or associates and if such director is found guilty of making any undue gain, he shall be liable to pay an amount equal to that gain to the company. - Duty not to assign his office

A director of a company shall not assign his office and any assignment so made shall be void.