Accounts, Audit And Auditors

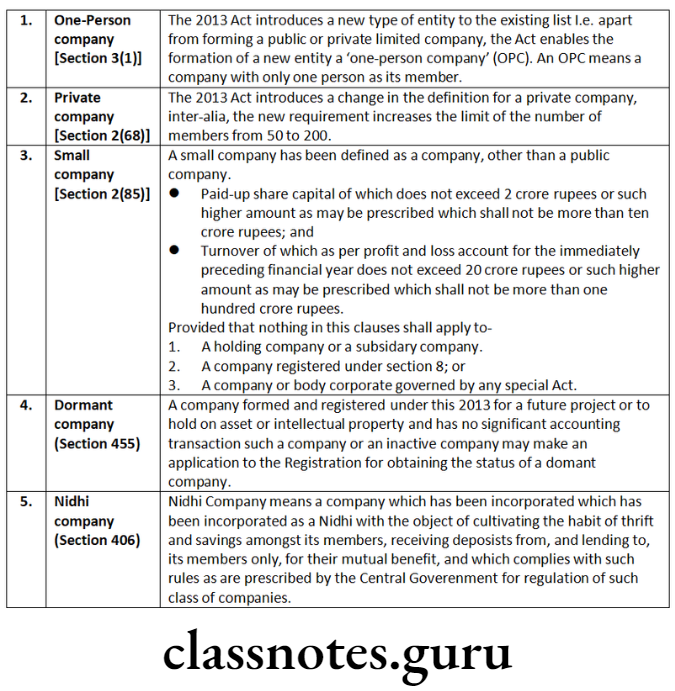

Books of Accounts

Proper books of accounts shall be deemed to have been kept by a company if such books exhibit and explain the transactions and financial position of the business of the company, including books containing sufficiently detailed entries of daily cash receipts and payments.

Kept Book of A/c

Every company is required to keep books of account at its registered office in respect of specified transactions. However, all or any of the books of accounts may be kept at such other place in India as the Board of directors may decide.

Inspection Book of A/c

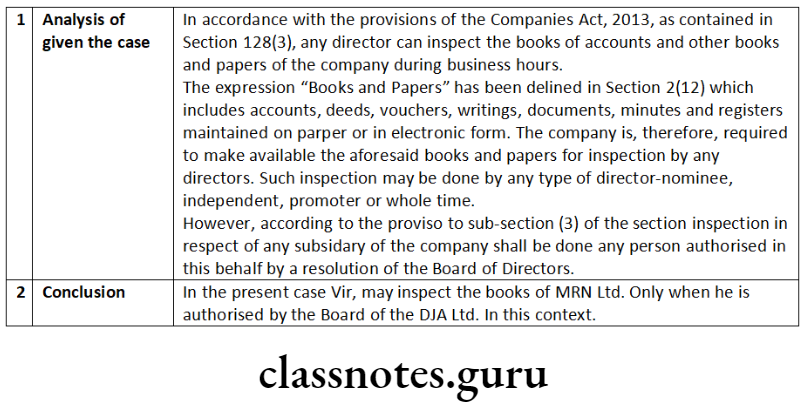

As per the Act, books of account and other books and papers should be available for inspection by any director on working days during business hours.

Persons Responsible to Maintain Books

- Managing Director,

- Whole-Time Director, in charge of finance

- Chief Financial Officer; or

- Any other person of a company charged by the Board with duty of complying with provisions of Section 128.

Financial Statement Section 129

This section provides that the financial statements shall give a true and fair view of the state of affairs of the company or companies in the form as provided for different class or classes in Schedule III and shall comply with accounting standards notified under Section 133 of the Act.

Insurance companies, banking company, companies engaged in generation/supply of electricity or any other class of companies shall make financial statements in the form as has been specified in or under the Act governing such companies.

The financial statement shall be laid in the annual general meeting of that financial year. [Section 129(2)]

Consolidated Financial Statements

The Companies Act, 2013 has made preparation of consolidated accounts mandatory for all companies including unlisted companies and private companies having one or more subsidiaries or associates or joint ventures.

Cs Company Law Question And Answers

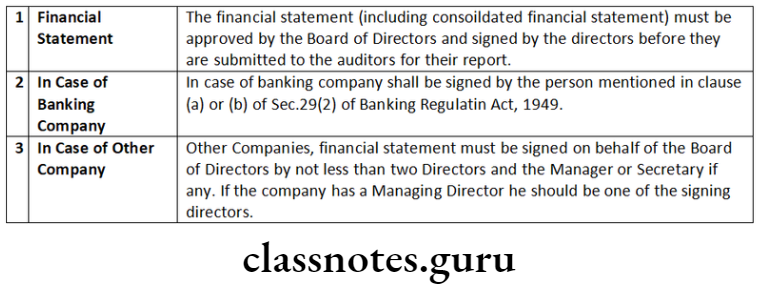

Signature of Financial Statement

The financial statement, including consolidated financial statement, if any, shall be approved by the Board of Directors before they are signed on behalf of the Board by the chairperson of the company where he is authorised by the Board or by two directors out of which one shall be managing director, if any, and the Chief Executive Officer, the Chief Financial Officer and the company secretary of the company, wherever they are appointed, or in the case of One Person Company, only by one director, for submission to the auditor for his report thereon.

The auditors’ report shall be attached to every financial statement. A report by its Board of Directors shall also be attached to statements laid before a company in general meeting.

National Financial Reporting Authority (NFRA)

Through Section 132 of the Companies Act, 2013, the Central Government has introduced a new regulatory authority named as National Authority for Financial Reporting known as National Financial Reporting Authority (NFRA) with wide powers to recommend, enforce and monitor the compliance of accounting and auditing standards.

NFRA shall be responsible for monitoring and enforcing compliance of auditing and accounting standards and for that purpose, oversee the quality of professions associated with ensuring such compliances. The Authority shall investigate professional and other misconducts which may be committed by Chartered Accountancy members and firms.

Accounting Standards

The Act provides that every financial statement of the company shall comply with the accounting standards.

Object of Audit

The main object of audit is to ensure that the statement of accounts of the relevant financial year truly and fairly reflect the state of affairs of the company. Audit also provides a moral check on those who are entrusted with the task of running business and of keeping and maintaining the books of account of the company. An audit of accounts is conducted with two-fold purpose:

- detection and prevention of errors;

- detection and prevention of fraud.

Appointment of Auditors

The Act provides that every company shall, at each annual general meeting appoint an auditor or auditors to hold office from the conclusion of that meeting until the conclusion of next annual general meeting. The Act also provides for methods of appointment of auditors along with their qualifications and disqualifications.

Auditor’s Report

The Act provides that the auditor’s report shall be signed only by the person appointed as an auditor of the company..

Appointment of First Auditor [Section 139(6)]

Appointment of first auditor in case of every company except government company or company owned/ controlled by Central Government/State Government/Central Government and State Government [Section 139(6)]:

- The first auditor of a company, other than a Government company, shall be appointed by the Board within thirty days from the date of registration of the company and if the Board fails to appoint such auditor, it shall inform the members of the company and the members shall make the appointment of first auditor within ninety days of information at an extra ordinary general meeting and such auditor shall hold office till the conclusion of the first annual general meeting.

- Appointment of first auditor shall be made by Comptroller and Auditor-General of India (CAG) within sixty days of registration of the company. If CAG fails to appoint the first auditor within given time then Board of such company shall appoint first auditor within next 30 days. If Board fails to appoint the first auditor within given time then it shall inform to members and members shall make the appointment of first auditor within 60 days of information at an extra ordinary general meeting. The First Auditor shall hold office till the conclusion of first AGM.

Appointment of auditors at AGM (first AGM and subsequent AGM)

Appointment of auditor shall be made by members at First AGM and every subsequent 6th AGM. At the first AGM, every company shall appoint an individual or a firm as an auditor. The auditor so appointed shall hold office from the conclusion of first AGM till the conclusion of 6th AGM.

Rotation of Auditor

In case of an individual as auditor:

- No individual shall be appointed or re-appointed as auditor for more than 1 term of 5 consecutive years.

- An individual auditor, who has completed his term of 5 consecutive years, shall not be eligible for re-appointment as auditor in the same company for 5 years from the date of completion.

In case of a firm as an auditor:

- No audit firm shall be appointed or re-appointed as auditor for more than 2 terms of 5 consecutive years.

- An audit firm which has completed its 2 terms of 5 consecutive years, shall not be eligible for re-appointment as auditor in the same company for 5 years from the completion of such terms.

- If any firm/LLP which has one or more partners who are also partners in the outgoing audit firm/LLP, cannot be appointed as auditors during the 5 year period.

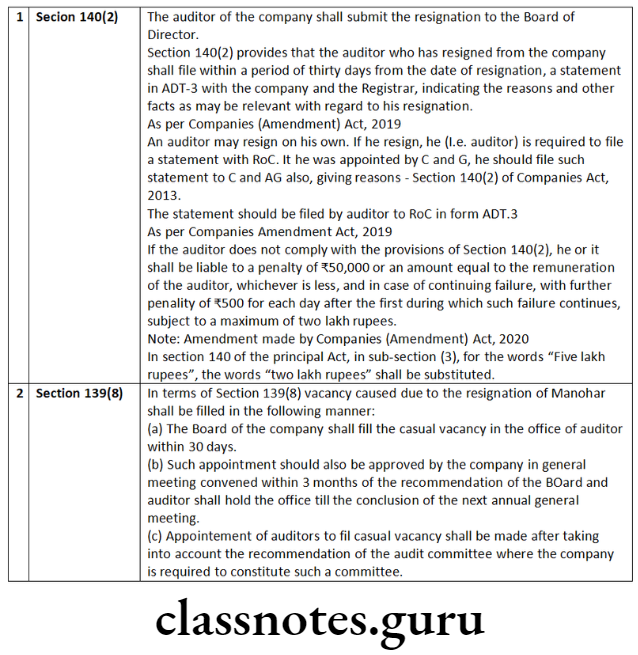

Appointment of an Auditor in Casual Vacancy

Casual vacancy arising by other than resignation: Whereas casual vacancy is arising by other than resignation then vacancy shall be filled by the Board within 30 days.

Casual vacancy arising due to resignation: If casual vacancy is arising due to the resignation of auditor, it shall be filled within 30 days by the Board of Directors, and the appointment made by the Board shall be approved in a general meeting convened within 3 months from the date of recommendation of the Board.

Appointment of auditor in Casual Vacancy in case of Govt. Company

Casual vacancy shall be filled by the CAG within 30 days. If CAG fails to fill the vacancy within given time then BOD shall fill the vacancy within next 30 days.

Auditors not to render certain services

- accounting and book keeping services;

- internal audit;

- design and implementation of any financial information system;

- actuarial services;

- investment advisory services;

- investment banking services;

- rendering of outsourced financial services;

Audit And Auditors Important Questions Cs

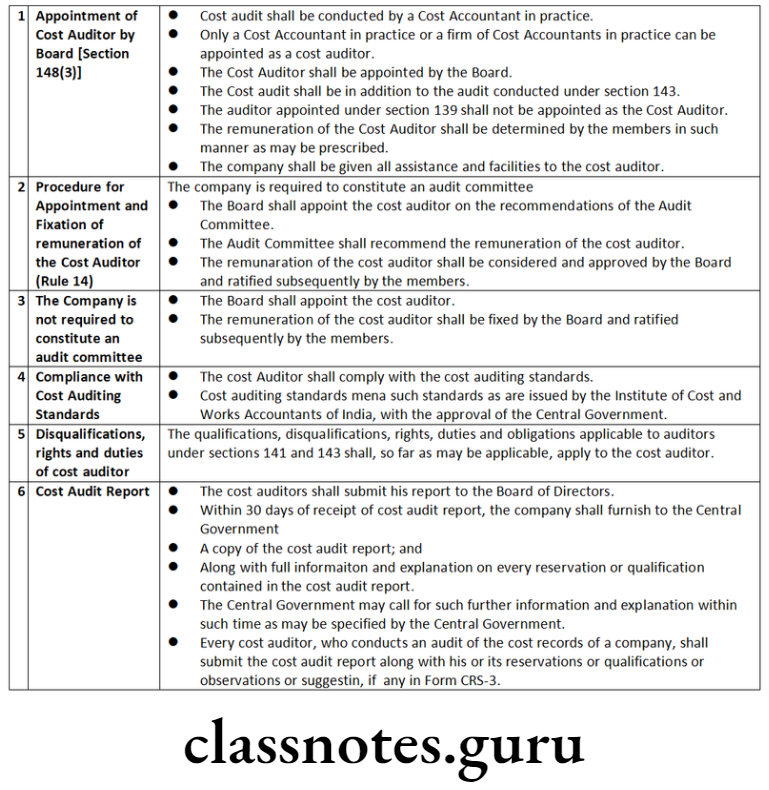

Cost Auditor

- Every company referred to in sub-rule (1) shall inform the cost auditor concerned of his or its appointment as such and file a notice of such appointment with the Central Government within a period of thirty days of the Board Meeting in which such appointment is made or within a period of one hundred and eighty days of the commencement of the financial year, whichever is earlier, through electronic mode, in form CRA-2,

- After the expiry of thirty days, the company shall issue formal letter of appointment to the cost auditor.

- Every cost auditor, who conducts an audit of the cost records of a company, shall submit the cost audit report along with his or its reservations or qualifications or observations or suggestions, if any, in form CRA-3.

- Every cost auditor shall forward his report to the Board of Directors of the company within a period of one hundred and eighty days from the closure of the financial year.

- Every company covered under these rules shall, within a period of thirty days from the date of receipt of a copy of the cost audit report, furnish the Central Government with such report alongwith full information and explanation on every reservation or qualification contained therein, in form CRA-4 along with fees specified in the Companies (Registration Offices and Fees) Rules, 2014.

The company shall disclose full particulars of the cost auditor, along with the due date and actual date of filing of the cost audit report by the cost auditor, in its Annual Report for each relevant financial year.

Branch Audit Section 143 (8) and Rule 12

Branch Auditor: Accounts of branch office can be audited by-

- The company’s auditor; or

- Any other person, qualified to be and appointed as an auditor as per the provisions of the Act as branch auditor; or

- In case of foreign branch, by the company ‘s auditor or by an accountant or a competent person appointed in accordance with the prevailing laws of the foreign country.

The branch auditor shall prepare a report on the accounts of the branch examined by him and the company’s auditor shall deal with such report in his audit report in a manner as he considers necessary.

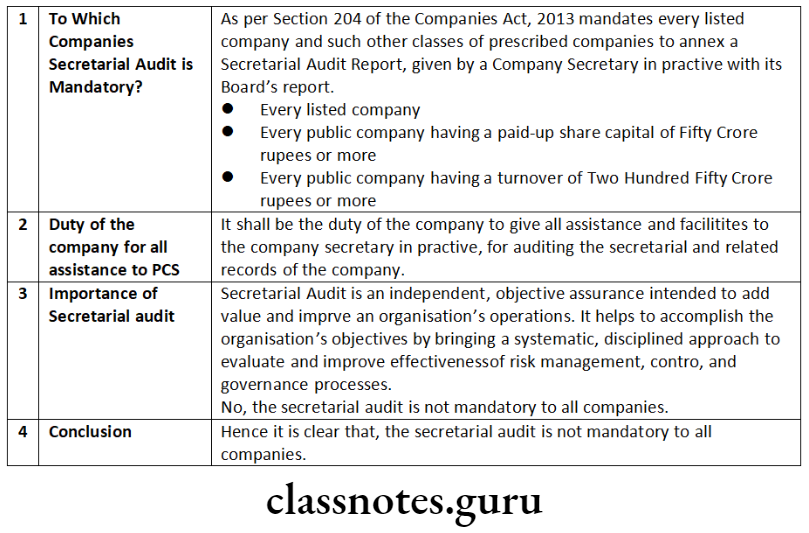

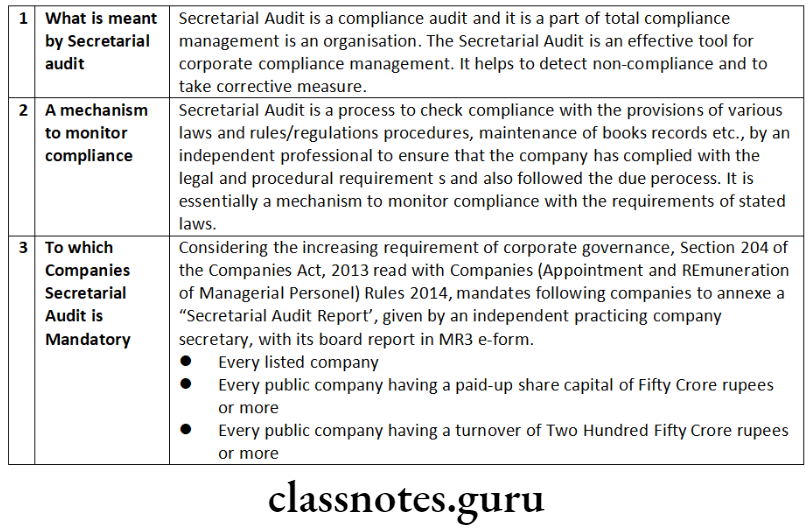

Secretarial Audit

Secretarial Audit is a compliance audit and it is a part of total compliance management in an organisation. The Secretarial Audit is an effective tool for corporate compliance management. It helps to detect non-compliance and to take corrective measures.

Secretarial Audit is an independent, objective assurance intended to add value and improve an organisation’s operations. It helps to accomplish the organisation’s objectives by bringing a systematic, disciplined approach to evaluate and improve effectiveness of risk management, control, and governance processes.

As per rule 9 of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014, the prescribed class of companies is as under:

- every public company having a paid-up share capital of fifty crore rupees or more; or

- every public company having a turnover of two hundred fifty crore rupees or more.

Note: As per Companies (Appointment and Remuneration of Managerial Personnel) Amendment Rules, 2020

- with this insertion in Rule 9(1) of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014, now every company having outstanding loans or borrowing from banks or public financial institutions of one hundred crore rupees or more is also required to annex the Secretarial Audit report with its Boards Report. MCA has also clarified that for the purpose of this rule paid up share capital, turnover, or outstanding loans or borrowings as the case may be, existing on the last date of latest audited financial statement shall be taken into account.

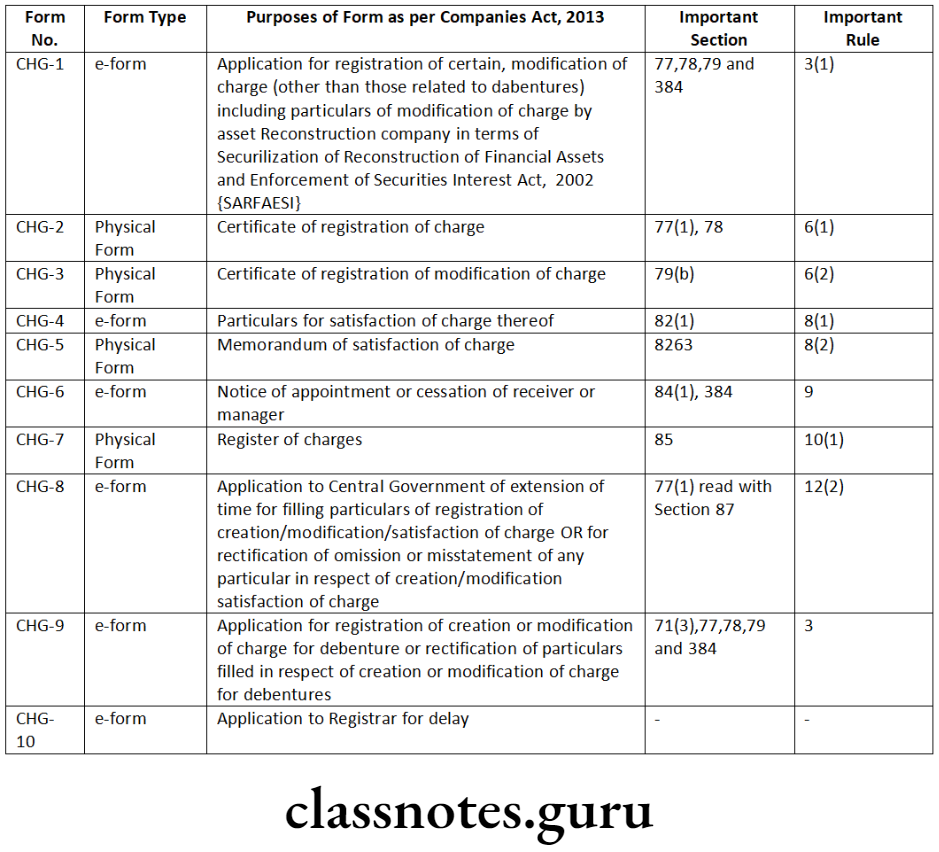

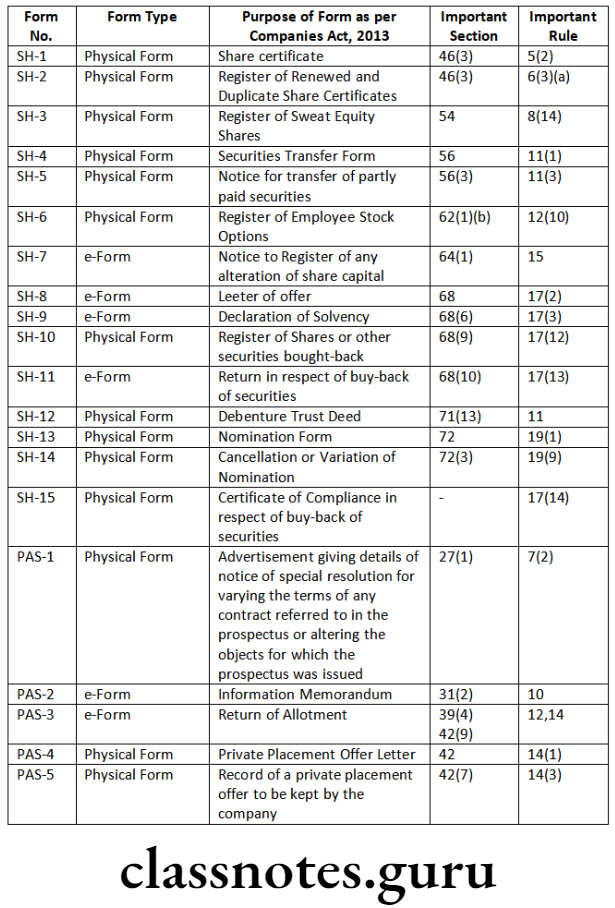

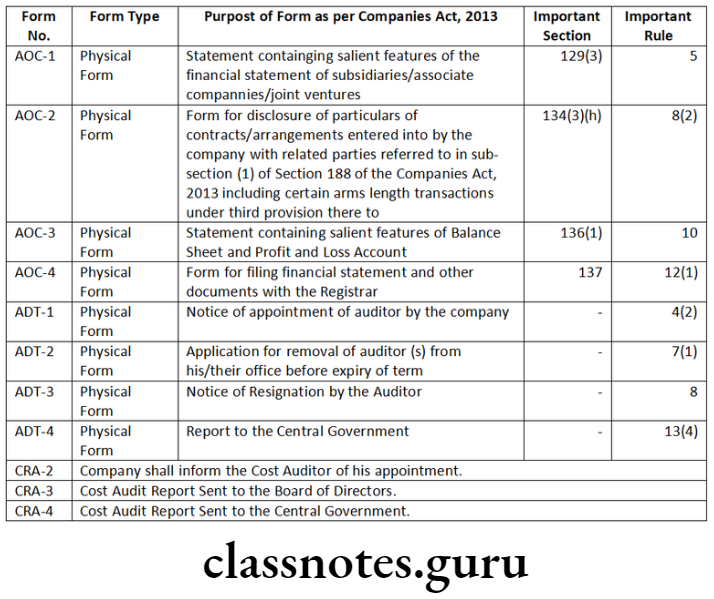

List of Important Forms

Company Accounts Cs Executive

Short Notes

Question 1. Write a short note on ‘appointment of cost auditor’.

Answer:

Question 2. Write a note on the following:

Intangible assets

Answer:

Intangible means “that cannot be touched.”

Some of the assets are such which cannot be touched and do not have physical existence and are called intangible assets.

For example:

- Goodwill

- Brands/trademarks

- Computer software

- Mining rights

- Recipes formulae, models, designs and proto types.

Question 3. Write a note on the following:

Approval and signing of the financial statement.

Answer:

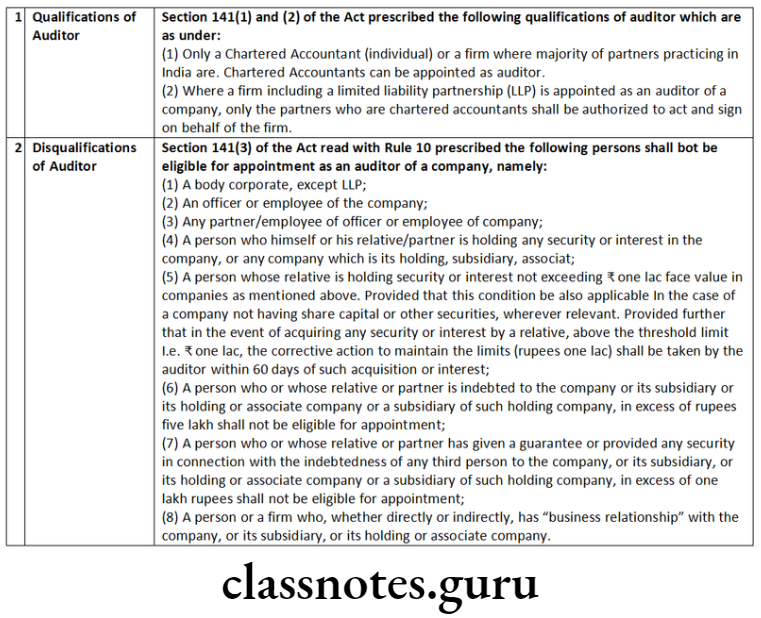

Question 4. Write a note on the following:

Qualifications and disqualifications of auditors.

Answer:

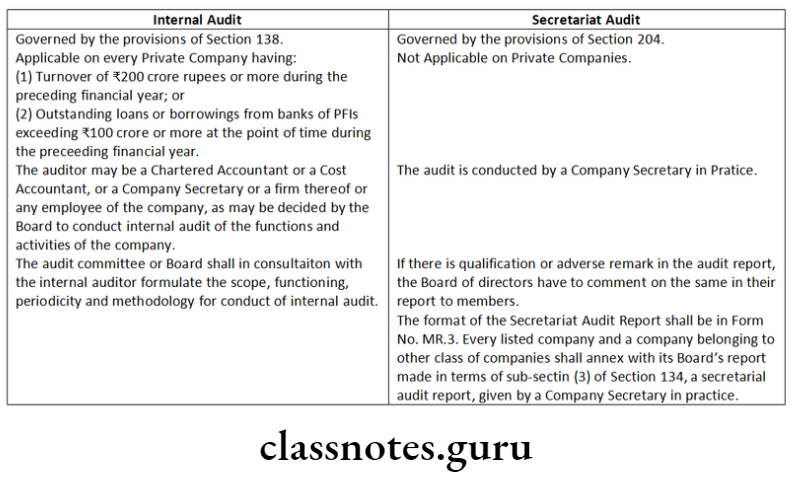

Question 5. Distinguish between the following:

‘Internal Audit’ and ‘Secretarial Audit’.

Answer:

‘Internal Audit’ and ‘Secretarial Audit’

Cs Executive Company Law Previous Year Questions

Descriptive Questions

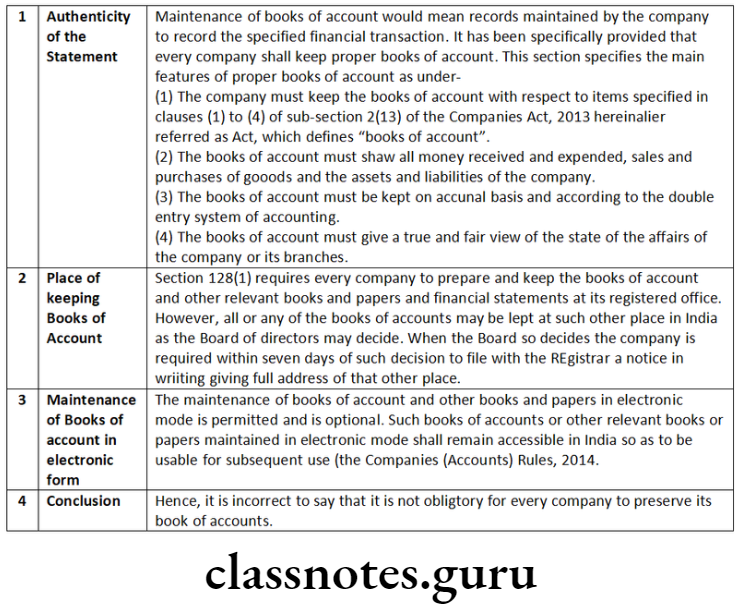

Question 1. Comment on the following:

It is not obligatory for every company to preserve its books of account.

Answer:

Question 2. Comment on the following:

Adoption of accounts is an important business to be transacted only at general meetings.

Answer:

- An important business to be transacted at an annual general meeting is adoption of the accounts including:

- Financial Statement (including consolidated financial statement)

- Director Report and

- Auditor Report

- The financial statements are required to be placed only at an annual general meeting and not at any other general meeting.

- In case, if the financial statements are not ready for laying at the annual general meeting, the company may adjourn the said annual general meeting to a subsequent date. This may be done by adopting an appropriate resolution adjourning the said annual general meeting to a specified date or to a date to be specified later. -Space to write important points for revision

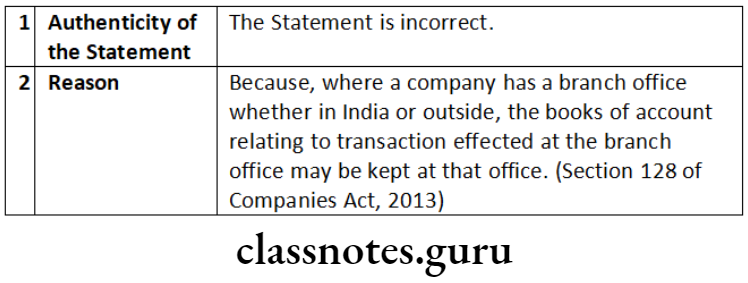

Question 3. Comment on the following:

Where a company has a branch office, whether in India or abroad, the original books of account, records, etc. of the branch office will have to be maintained in the registered office of the company.

Answer:

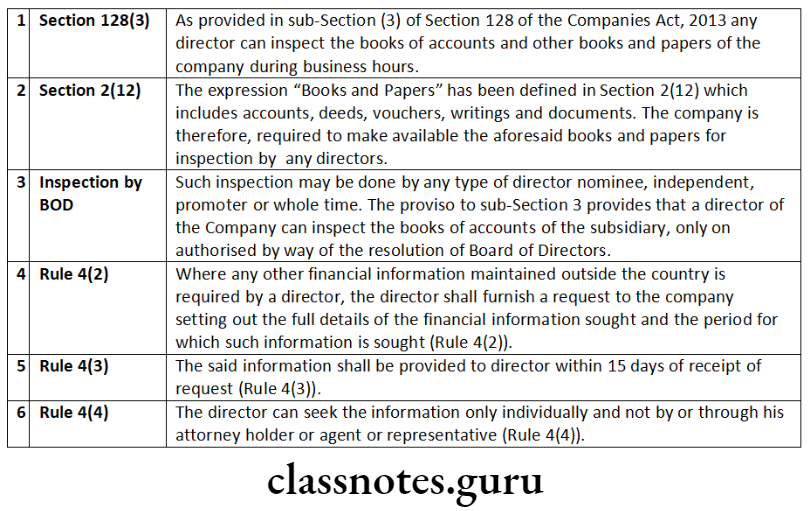

Question 4. Comment on the following:

A director of a company has an absolute right of inspection of the books of account.

Answer:

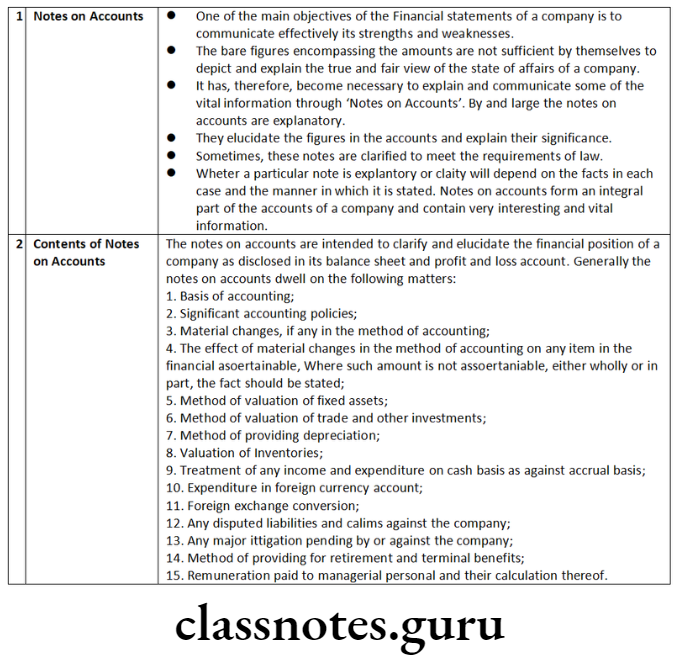

Question 5. Mention the importance of ‘notes on accounts’. Will it convey any meaning to stakeholders?

Answer:

Company Law And Audit Notes For Cs

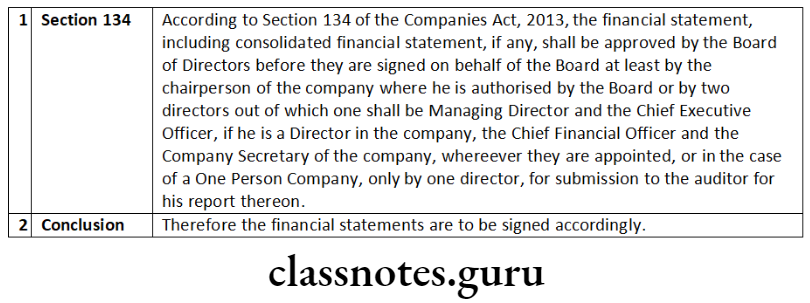

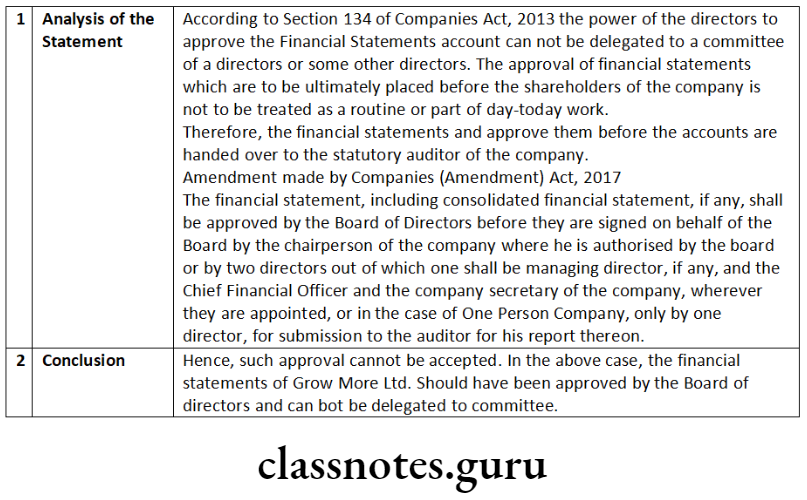

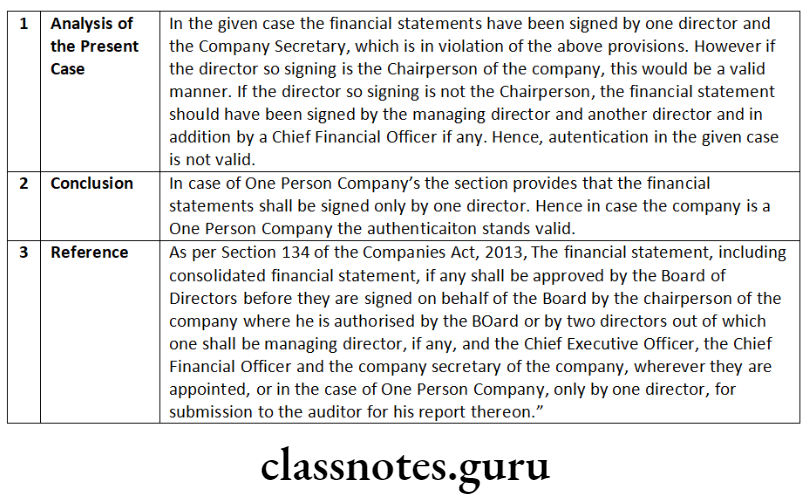

Question 6. “Financial statements shall be signed only by the Chairperson of the company.” Explain.

Answer:

Note:

Amendment made by Companies (Amendment) Act, 2017

Revised Section 134(1)-

“The financial statement, including consolidated financial statement, if any, shall be approved by the Board of Directors before they are signed on behalf of the Board by the chairperson of the company where he is authorised by the Board or by two directors out of which one shall be managing director, if any, and the Chief Executive Officer, the Chief Financial Officer and the company secretary of the company, wherever they are appointed, or in the case of One Person Company, only by one director, for submission to the auditor for his report thereon.”

Revised Section 134(3)(a)-

“(a) the web address, if any, where annual return referred to in sub-section (3) of Section 92 has been placed;”

Revised Section 134(3)(p)-

“(p) in case of a listed company and every other public company having such paid-up share capital as may be prescribed, a statement indicating the manner in which formal annual evaluation of the performance of the Board, its Committees and of individual directors has been made.”

Provison to Revised Section 134(3)-

“Provided that where disclosures referred to in this sub-section have been included in the financial statements, such disclosures shall be referred to instead of being repeated in the Board’s report:

Provided further that where the policy referred to in clause (e) or clause (0) is made available on company’s website, if any, it shall be sufficient compliance of the requirements under such clauses if the salient features of the policy and any change therein are specified in brief in the Board’s report and the web- address is indicated therein at which the complete policy is available.”

Section 134(3A)-

“(3A) The Central Government may prescribe an abridged Board’s report, for the purpose of compliance with this section by a One Person Company or small company.”

Question 7. Explain the provisions of the Companies Act, 2013 relating to ‘secretarial audit’. State whether ‘secretarial audit’ is mandatory for all companies.

Answer:

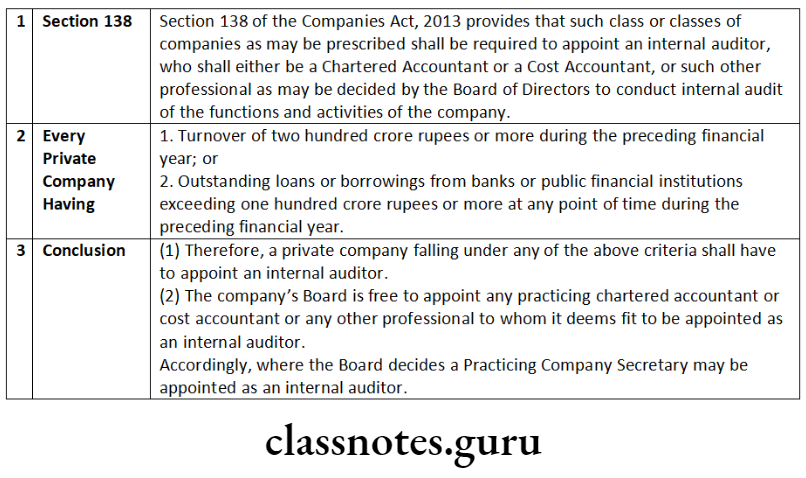

Answer the following by explaining the provisions of the Companies Act, 2013 relating to ‘internal audit’:

- Whether a private company is mandatorily required to appoint an internal auditor?

- Who may be appointed as an internal auditor? Whether a Practicing Company Secretary (PCS) can be appointed as an internal auditor?

Answer:

Company Law And Audit Notes For Cs

Question 8. Explain with reference to the provisions of the Companies Act, 2013, the meaning and importance of ‘secretarial audit’. Which companies are required to get the ‘secretarial audit’ conducted?

Answer:

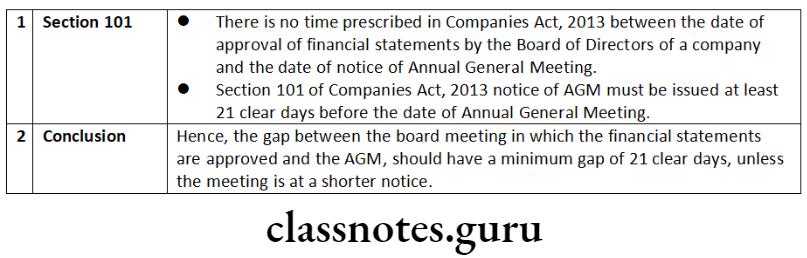

Question 9. Comment on the following:

The time gap between the date of approval of financial statements by the Board of directors of a company and the date of notice of annual general meeting should be 45 days.

Answer:

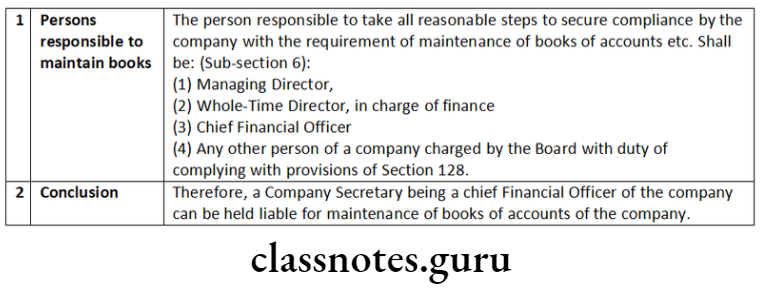

Question 10. Referring to the provisions of the Companies Act, 2013, explain whether the Company Secretary being a Chief Financial Officer of the company can be held liable for maintenance of books of account of the company.

Answer:

Question 11. Comment on the following:

- Consolidation of financial statements is mandatory for all companies including unlisted companies and private companies.

- A statutory auditor of a private limited company is restricted to take up any other assignment in the companies.

Answer:

The Companies Act, 2013 has made preparation of consolidated accounts mandatory for all companies including unlisted companies and private companies having one or more subsidiaries or associates or joint ventures.

In accordance with the provisions of the Companies Act, 2013, as contained in Section 129(3), where a company has one or more subsidiaries or associates or joint ventures, it shall, in addition to its financial statements for the financial year, prepare a consolidated financial statement of the company and of all the subsidiaries or associates or joint ventures in the same form and manner as that of its own which shall also be laid before the annual general meeting of the company along with the laying of its financial statements, a separate statement containing the salient features of the financial statements of its subsidiaries or associate (s) or joint venture (s) in Form AOC -1 (Rule 5).

However, for intermediate holding company, the provisions of Rule 6 of Companies (Accounts) Rules, 2014 inter alia provide certain conditions, compliance of which ensures exemption from consolidation of accounts to such intermediate holding company. These conditions are:-

- intimation to all members for not consolidating the accounts.

- shares being unlisted or not in process of listing on any stock exchanges and filing of consolidated financial statement by the ultimate Indian holding company whose 100% subsidiary is the intermediate holding company.

Amendment made by Companies (Amendment) Act, 2017 Revised Section 129(3)-

“Where a company has one or more subsidiaries or associate companies, it shall, in addition to financial statements provided under sub-section (2), prepare a consolidated financial statement of the company and of all the subsidiaries and associate companies in the same form and manner as that of its own and in accordance with applicable accounting standards, which shall also be laid before the annual general meeting of the company along with the laying of its financial statement under sub-section (2):

Provided that the company shall also attach along with its financial statement, a separate statement containing the salient features of the financial statement of its subsidiary or subsidiaries and associate company or companies in such form as may be prescribed:

Provided further that the Central Government may provide for the consolidation of accounts of companies in such manner as may be prescribed.”

An auditor appointed under this Act shall provide to the company only such other services as are approved by the Board of Directors or the audit committee, as the case may be, (of the company concerned) but which shall not include any of the following services (whether such services are rendered directly or indirectly to the company or its holding company or subsidiary company, namely:

- accounting and book keeping services

- internal audit

- design and implementation of any financial information system

- actuarial services

- investment advisory services

- investment banking service

- rendering of outsourced financial services

- management services and

- any other kind of services as may be prescribed.

Question 12. Comment on the following:

Appointment and rotation of statutory auditor is mandatory for one person company and small company.

Answer:

As per Section 139(1) of the Companies Act, 2013 inter alia provides that every company shall, at the first annual general meeting, appoint an individual or a firm as an auditor who shall hold office from the conclusion of that meeting till the conclusion of its sixth annual general meeting and thereafter till conclusion of every sixth meeting.

The Companies Act, 2013 has introduced the system of rotation of auditors under Section 139. As per Rule 5 of the Companies (Audit and Auditors) Rules, 2014, rotation of auditors is applicable to:

- All listed companies;

- All unlisted public companies having paid up share capital of 10 crore or more;

- All private limited companies having paid up share capital of ₹ 50 crore or more;

- All companies having paid up share capital of below threshold limit mentioned in (a) and (b) above, but having public borrowings from financial institutions, banks or public deposits of 50 crore or more. In view of the above it is clear that appointment is applicable on all the Companies including one person companies and small companies, however, the provisions of rotation of auditors shall not apply to one person companies and small companies.

Cs Company Law Question And Answers

Question 13. Perfect Pvt. Ltd. wishes to appoint its Secretary, Satish, as an internal auditor. Referring to the provisions of the Companies Act, 2013 advise the company.

Answer:

According to Section 138(1) of the Companies Act, 2013 read with the Rule 13 of the Companies (Accounts) Rules, 2014, following persons may be appointed as an internal auditor of the company:

- a Chartered Accountant or;

- a Cost Accountant or;

- such other professional as may be decided by the Board to conduct internal audit of the functions and activities of the Company.

Further, Rule 13 of the Companies (Accounts) Rules, 2014 inter alia provides that the internal auditor may or may not be an employee of the Company. Mr. Satish being the Secretary of Perfect Ltd. may be appointed as an internal auditor of the company only if so decided by the Board to conduct internal audit of the functions and activities of the Company.

Question 14. Who will appoint Secretarial Auditor of the company: Board of Directors or Shareholders? What is the duty of Board of Directors towards secretarial auditor and audit report?

Answer:

- According to Section 204, every listed company and every public company having paid up share capital of fifty crore rupees or more; or public company having a turnover of two hundred fifty crore rupees or more shall attach a Secretarial Audit Report given by Practicing Company Secretary (PCS).

- As per Section 179 of the Companies Act, 2013 read with Rule 8 of the Companies (Meeting of Board and its Powers) Rules, 2014, the Board of Directors, only by means of resolutions passed at meetings of the Board, shall appoint a Secretarial Auditor.

- It shall be the duty of the company to give all assistance and facilities to the Company Secretary in Practice (Secretarial Auditor), for auditing the secretarial and related records of the company. (Section 204(2))

- The Board of Directors, in their report shall explain in full any qualification or observation or other remarks made by the company secretary in practice in his report.

Question 15. Comment on the following:

Chief Financial Officer is responsible to maintain books of account of the company.

Answer:

As per Section 128 of the Companies Act, 2013 provides that to maintenance of Books of accounts by the company. According to sub section. (6) of Section 128 if the Managing Director, the Whole-Time Director in charge of finance, the Chief Financial Officer or any other person of a company charged by the Board with the duty of complying with the provisions of Section 128, fails to comply with the provisions shall be punishable with fine which shall not be less than fifty thousand rupees but which may extend to five lakh rupees.

Accordingly it is the responsibility of the Chief Financial Officer along with Managing Director and whole time director in charge of finance of the company to maintain the Books of Accounts of the company. -Space to write important points for revision

Question 16. Every financial statement of the company must give true and fair view of the state of affairs of the company at the end of the financial year.

Answer:

As per provisions of sub-Sections (1) and (2) of Section 129 of the Companies Act 2013 every financial statement of the company must give true and fair view of the state of affairs of the company at the end of financial year. True and Fair view in respect of financial statement means-

- Financial statements and items contained should comply with accounting standards notified under Section 133;

- Financial statement shall be in form or forms as provided for different ‘class or classes of companies in Schedule III;

- Financial statement shall not be treated as not disclosing a true and fair view of the state of affairs of the company, merely by the reason of the fact that they do not disclose-

- in the case of an insurance company, any matters which are not required to be disclosed by the Insurance Act, 1938, or the Insurance Regulatory and Development Authority Act, 1999;

- in the case of a banking company, any matters which are not required to be disclosed by the Banking Regulation Act, 1949;

- in the case of a company engaged in the generation or supply of electricity, any matters which are not required to be disclosed by the Electricity Act, 2003;

- in the case of a company governed by any other law for the time being in force, any matters which are not required to be disclosed by that law.

Question 17. An application has been made by a shareholder of a company to the National Company Law Tribunal (NCLT) that the company which has been just incorporated has supplied incorrect information in the documents filed for incorporation. Examine what action can be taken by the NCLT if the contention of the shareholder is proved to be true?

Answer:

Under Section 7(7) of the Companies Act, 2013, where a company has got incorporated by furnishing any false or incorrect information or representation or by suppressing any material fact or information in any of the documents or declaration filed or made for incorporating such company or by any fraudulent action, the National Company Law Tribunal may on an application made to it, on being satisfied that the situation so warrants:

- Pass such orders as it may think fit for regulation of the management of the company including changes, if any, in its Memorandum and Articles, in public interest or in the interest of the company and its members and creditors; or

- Direct that the liability of the members shall be unlimited; or

- Direct removal of the name of the company from the register of companies; or

- Pass an order for winding up of the company; or

- Pass any such orders as it deems fit.

Question 18. Books of account have to be kept only at the registered office of the company. As a corporate consultant give your comments in this regard.

Answer:

According to Section 128(1) of the Companies Act, 2013 requires every company to prepare and keep the books of accounts and other relevant books and papers and financial statements for every financial year at its registered office.

Although, all or any of the books of accounts and other relevant papers may be kept at such other place in India as the Board of Directors may decide.

- When the Board of Directors so decides, the company shall, within 7 days of such decision, file with the Registrar of Companies, a notice in writing giving full address of that other place.

- Such intimation is to be made in e-form AOC 5 to the Registrar of Companies.

Therefore, Board of Directors of the company may decide any place, other than the Registered office of the company for keeping the books of accounts.

Question 19. Comment on the following:

National Financial Reporting Authority (NFRA) has wide powers to recommend, enforce and monitor the compliance of accounting and auditing standards.

Answer:

National Financial Reporting Authority (NFRA)

- Through Section 132 of the Companies Act, 2013, the Central Government has introduced a new regulatory authority named as National Authority for Financial Reporting known as National Financial Reporting Authority (NFRA) with wide powers to recommend, enforce and monitor the compliance of accounting and auditing standards.

- NFRA is responsible for monitoring and enforcing compliance of auditing and accounting standards and for that purpose, oversee the quality of professions associated with ensuring such compliances. The Authority has power to investigate professional and other misconducts which may be committed by Chartered Accountancy members and firms. There is also a provision for appellate authority.

- The National Financial Reporting Authority is a quasi-judicial body to regulate matters related to accounting and auditing. With increasing demand of non-financial reporting, it may be referred to as a National level business Reporting Authority to regulate standards of all kind of reporting-financial as well as non-financial, by the companies in future.

- National Financial Reporting Authority shall give its recommendations on accounting standards and auditing standards. It shall only recommend and it is the Central Government who shall prescribe such standards.

- The objectives of National Financial Reporting Authority are as follows:

- Make recommendations on formulation of accounting and auditing policies and standards for adoption by companies, class of companies or their auditors;

- Monitor and enforce the compliance with accounting standards and auditing standards;

- Oversee the quality of service of professionals associated with ensuring compliance with such standards and suggest measures required for improvement in quality of service; and

- Perform such other functions as may be prescribed in relation to aforementioned objectives.

Audit And Auditors Important Questions Cs

Practical Questions

Question 1. The Board of directors of Grow More Ltd., a public company, has duly delegated its power to approve the financial statements of the company for the year 2011-12 to a committee of directors. The said committee considered the financial statements and approved the same before the accounts were handed over to the statutory auditor of the company. Will you accept such approval of financial statements?

Answer:

Question 2. An auditor of a company signed the financial statement including Financial Statement and schedules/notes and furnished the auditors report on the same date on which the reports were signed by the directors on behalf of the Board. One of the directors raised objection stating that the audit can not be completed and certified in a day. Do you agree with the director and if not, why?

Answer:

Question 3. A director of the company along with another director was prosecuted for their failure to file annual return, financial statements and audited balance sheet required to be laid before the AGM. The directors filed petition before the Tribunal to quash the prosecution initiated by the Registrar of Companies. As a Company Secretary in Practice, advise in the matter.

Answer:

- Section 137 requires every company to file the financial statements including consolidated financial statement together with Form AOC-4

- with the Registrar within 30 days from the day on which the annual general meeting held and adopted the financial statements with such fees or additional fee as specified in Companies (Registration Offices and Fees) Rules, 2014.

- If the financial statements are not adopted at the annual general meeting or adjourned annual general meeting, such unadopted financial statements along with the required documents be filed with the Registrar with in thirty days of the date of annual general meeting. The Registrar shall take them in his record as provisional, until the adoption at annual general meeting.

- The One Person Company shall file the copy of financial statements duly adopted by its members within a period of one hundred and eighty days from the closure of financial year.

- The company shall also attach the accounts of subsidiaries incorporated outside India and which have not established their place of business in India with the financial statements.

- The class of companies as may be notified by the Central Government from time to time, shall mandatorily file their financial statement in Extensible Business Reporting Language (XBRL) format and the Central Government may specify the manner of such filing under such notification for such class of companies [Rule 12(2).]

- If annual general meeting has not been held, the financial statement duly signed along with the statement of facts and reasons for not holding the annual general meeting shall be filed with the Registrar within thirty days of the last days before which the annual general meeting should have been held.

- If company fails to comply with the requirement of submission of financial statement before Registrar, the company shall be liable to penalty of one thousand rupees for every day during which failure continues subject to maximum of rupees ten lakh.

- The managing director and CFO if any, and, in the absence of such managing director or CFO, any other director who is charged by the Board with the responsibility of complying with the provisions of this

- section, in the absence of such director, all directors of the company shall be liable to a penalty of 10,000 and in case of continuing failure, with a further penalty of 100 for each day after the first during which such failure continues, subject to a maximum of 50,000. As per Companies (Amendment) Act, 2020.

Question 4. Vir is a director in DJA Ltd. (the company). The company holds 75% shares of MRN Ltd. Vir wants to inspect the books of MRN Ltd. Examining the provisions of the Companies Act, 2013 advise whether Vir, the director of DJA Ltd. can be allowed to inspect the books of MRN Ltd.

Answer:

Question 5. Manohar, the auditor of Belle Ltd. appointed by the company in its last general meeting has resigned from the office of auditor of the company for some personal reasons. Referring to the provisions of the Companies Act, 2013, answer the following:

- Who is the competent authority to accept and approve the resignation?

- State the manner in which the vacancy caused by Manohar’s resignation shall be filled in.

Answer:

Company Accounts Cs Executive

Question 6. Adorable Ltd., incorporated under the Companies Act, 2013 has on its Board, 5 Directors and a Managing Director. The company has also appointed a Company Secretary. The financial statements of the company, viz., balance sheet and statement of profit and loss for the year ended 31st March, 2015, were authenticated under signatures of one director and the Company Secretary.

Referring to the provisions of the Companies Act, 2013, examine the validity of authentication. What shall be your answer in case the company in question is a ‘one person company’?

Answer:

Question 7. The paid-up equity share capital of Strong Foundry Ltd. is 45 lakh. President (Finance) of the company seeks your advice whether it is possible to re-open its books of account and recast the company’s financial statements of the previous year. You being the Secretary of the company, advise the President (Finance) by preparing a note in this regard.

Answer:

Re-opening of Accounts on Tribunals’s Orders: Section 130 provides for provisions relating to re-opening or re- casting of books of accounts of the company. Accordingly,

- A company shall not re-open its books of account and shall not recast its financial statements, unless an application in this regard is made by any one or more of the following:

- the Central Government, or

- the Income-tax authorities, or

- the Securities and Exchange Board of India (SEBI), or

- any other statutory regulatory body or authority or any person concerned, and

- an order in this regard is made by a Tribunal of competent jurisdiction or the Tribunal.

- The re-opening and re-casting of financial statements is permitted only for the following reasons:

- the relevant earlier accounts were prepared in a fraudulent manner; or

- the affairs of the company were mismanaged during the relevant period, casting a doubt on the reliability of financial statements.

- The Tribunal, as the case may be, shall give the notice to:

- the Central Government,

- the Income-tax authorities,

- the Securities and Exchange Board,

- any other statutory regulatory body or authority concerned and shall take into consideration the representations, if any, made by Central Government or the income tax authorities, Securities and Exchange Board or the body or authority concerned before passing any order under this section.

- Director’s report of the year in which such provisions are invoked, should provide for the reasons or circumstances in which. such revisions were warranted.

Further, Section 131 deals with power of Board to make application to tribunal and obtain approval for voluntary revision of financial statements and Board’s Report of any of the preceding three financial years.

Hence, one time revision of financial accounts of the company may be made after, obtaining approval of the tribunal subject to applicability and enforceability of Section 131 of Companies Act, 2013.

This is for information and record please.

Amendment made by Companies (Amendment) Act, 2017 Section 130(3): No order shall be made under sub-section (1) in respect of re-opening of books of account relating to a period earlier than eight financial years immediately preceding the current financial year:

Provided that where a direction has been issued by the Central Government under the proviso to sub-section (5) of Section 128 for keeping of books of account for a period longer than eight years, the books of account may be ordered to be re-opened within such longer period.

Question 8. Peculiar Ltd., an unlisted company, did not prepare its financial statements for the year ended 31st March, 2016 in conformity with some of the mandatory accounting standards. With reference to the provisions of the Companies Act, 2013, state the responsibilities of the directors and statutory auditors of the company in this regard.

Answer:

- In accordance with the provisions of the Companies Act, 2013 as contained in Section 129 read with Section 133 financial statements of a company shall be prepared in compliance with the accounting standards.

- Section 129(5) states that where the financial statements of the company do not comply with accounting standards, such companies shall disclose in its profit and loss account and the balance sheet-

- the deviation from the accounting standards;

- the reasons for such deviation; and

- the financial effects, if any, arising out of such deviation. The Board of Directors is required under Section 134 of the Companies Act, 2013 to include, in Board’s report, a Director’s Responsibility Statement indicating therein that in the preparation of the financial statements, the applicable accounting standards have been followed along with proper explanation relating to material departures.

- As per this provision the directors need to ensure that the financial statements are prepared in accordance with the accounting standards.

- The statutory auditor of the company has a duty to state if, in his opinion, the financial statements are not in compliance comply with accounting standards.

Cs Executive Company Law Previous Year Questions

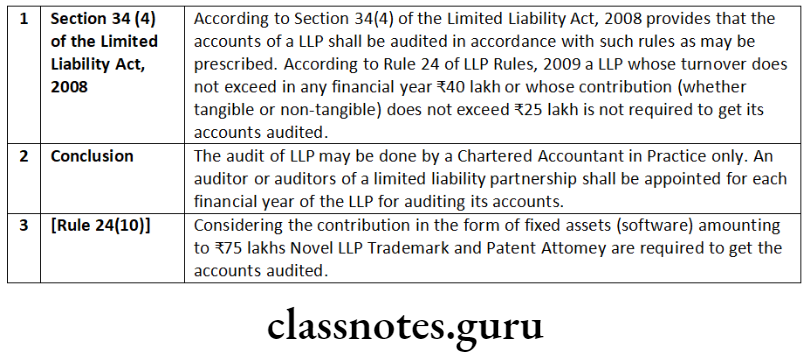

Question 9. Novel LLP, Trademark and Patent Attorneys, have been successfully running their business for the last five years. They have fixed assets in the form of intangibles (software) worth 75 lakh in their balance sheet. Advise as to whether their accounts are to be audited.

Answer:

Question 10. Board of Directors of Anil Limited has decided not to preserve the books of accounts and other related records of accounts, for more than five years immediately preceding the relevant financial year of 2016-17 due to shortage of space in the office premises. Referring to the provisions of the Companies Act, 2013, examine the validity of the Board’s decision.

Mr. X is a director is Greenfield Industries Limited. He is a man of wide knowledge of commercial matters. The company has not filed financial statements with the Registrar of Companies for the years ended 31st March, 2014, 31st March, 2015 and 31st March, 2016. However, it has filed the annual returns for those years in compliance of the provisions of the Companies Act, 2013.

Considering Mr. X’s huge experience, Redfield Industries Limited wants to induct him as a director on its Board. Referring to the provisions of the Companies Act, 2013 examine the validity of such proposition.

Answer:

According to sub-section (5) of Section 128 of the Companies Act, 2013, the books of accounts, together with vouchers relevant to any entry in such books are required to be preserved for a period of not less than eight financial years immediately preceding a financial year. Where the company had been in existence for a period less than eight years, the books of account in respect of all the preceding years together with the vouchers relevant to any entry in such books of account shall be kept in good order.

The provisions of the Income-tax Act, 1961 shall also be complied with in this regard. As per proviso to sub-section (5) of Section128, where an investigation has been ordered in respect of the company under Chapter XIV, the Central Government may direct that the books of account may be kept for such longer period as it may deem fit and give directions to that effect.

The decision taken by the Board of Directors of Anil Limited is not in accordance with the provisions of the law and the company cannot do

Amendment made by Companies (Amendment) Act, 2017 Section 164(2) also provides that no person who is or has been a director of a company which –

- Has not filed financial statements or annual returns for any continuous period of three financial years; or

- Has failed to repay the deposits accepted by it or pay interest thereon or to redeem any debentures on the due date or pay interest due thereon or pay any dividend declared and such failure to pay or redeem continues for one, year or more, shall be eligible to be re-appointed as a director of that company or appointed in other company for a period of five years from the date on which the said company fails to do so.

In the given case, Greenfield Industries Limited has not filed its financial statements for the financial years ended 31st March, 2014, 31st March, 2015 and 31st March, 2016. Therefore, it has not filed such statements for a continuous period of 3 financial years. However, it has filed annual return for those 3 financial years. Non-filing of any one of financial statements or annual returns for a continuous period of 3 financial years will disqualify such director from being appointed as a director in any other company.

Applying the above provisions of Section 164(2)(a), in the given case, Mr. X, a director of Greenfield Industries Limited cannot be appointed as a director in Redfield Industries Limited till the expiry of five years.

Question 11. CIF Technosystems Private Limited is proposed to be incorporated in Bhubaneshwar, Orissa under the Companies Act, 2013. The company will be a holding company of CIF Holding Private Limited, already incorporated in Brazil under the Company Law of Brazil. The company in Brazil follows financial year 1st January to 31st December of a calendar year. Referring to the provisions of the Companies Act, 2013, state whether the financial year of CIF Technosystem can also be 1st January to 31st December, in order to make it easier to prepare consolidated financial statements.

Answer:

Section 2(41) of the Companies Act, 2013 has defined the term “financial year”. It states that financial year in relation to any company or body corporate, means the period ending on the 31st day of March every year.

The financial year of every company registered under the Companies Act in India has to be from April of a calendar year to March of the next calendar year.

However, proviso to Section 2(41) reads that on an application made by a company or body corporate, which is a holding company or a subsidiary or Associated company of a company incorporated outside India and is required to follow a different financial year for consolidation of its accounts outside India, the Central Government may, if it is satisfied, allow any period as its financial year.

As per Companies (Amendment) Act, 2019

Where a company or body corporate, which is a holding company or a subsidiary or associate company of a company incorporated outside India and is required to follow a different financial year for consolidation of its accounts outside India, the Central Government may, on an application made by that company or body corporate in such form and manner as may be prescribed, allow any period as its financial year, whether or not that period is a year-first proviso to Section 2(41) of Companies Act, 2013 as amended vide the Companies (Amendment) Act, 2019.

Earlier, the powers were with NCLT. Applications pending with NCLT as on 2.11.2018 will continue to be dealt by NCLT-second proviso to Section 2(41) of Companies Act, 2013 as inserted vide the Companies (Amendment) Act, 2019.

Provision as existing upto 2.11.2018- On an application made by a company or body corporate, which is a holding company or a subsidiary or associate company of a company incorporated outside India and is required to follow a different financial year for consolidation of its accounts outside India, the NCLT may, if it is satisfied, allow any period as its financial year, whether or not that period is a year [first proviso to Section 2(41) of Companies Act, 2013 as existing upto 2.11.2018]. [The words in italics were added w.e.f. 9.2.2018].

On the basis of position of law here in above, CIF Technosystems Private Limited proposed to be incorporated under the Companies Act, 2013 has to have its financial year to end on 31st March every calendar year.

However, as it is a holding company of CIF Private Limited, a company in Brazil incorporated outside India, and that company follows its financial year 1st January to 31st December of a calendar year, the Indian company CIF Technosystems Private Limited can apply to Tribunal to allow its financial year to be aligned to end on 31st December for ease of consolidation of financial statement. The Tribunal will decide on the basis of merit in application.

Question 12. XYZ Ltd. has 6 directors on its Board of Directors. Out of 6 directors, 5 are foreigners and they reside in America. The company wants to convene its Board meeting in Mumbai but all the 5 directors are pre- occupied and are not in a position to travel to India. Advice the company regarding conduct of such a Board meeting as per provisions of the Companies Act, 2013 and relevant Rules. Will the same Rules or provisions be applicable in case the company wants to approve annual financial statements in the Board meeting.

Answer:

The directors of the company may participate in a meeting of Board/Committee of directors under the Companies Act, 2013 through video conferencing or other audio visual mean. “Video conferencing or other audio visual means” means audio-visual electronic communication facility employed which enables all the persons participating in a meeting to communicate concurrently with each other without an intermediary and tc participate effectively in the meeting.

A director participating in a meeting through use of video conferencing shal be counted for the purpose of quorum. The minutes shall also disclose the particulars of the directors who attend the meeting through electronic mode. Therefore, to convene Board meeting, the director present in India shall ac as Chairman and shall be physically present in Mumbai.

According to Rule 4 of the following matters shall not be dealt with in any meeting held through video conferencing or other audio visual means:

- the approval of the annual financial statements;

- the approval of the Board’s report;

- the approval of the prospectus;

- the Audit Committee Meetings for 2 consideration of financial statement including consolidated financial statement if any, to be approved by the board under sub-section (1) of Section 134 of the Act; and

- the approval of the matter relating to amalgamation, merger, demerger, acquisition and takeover.

Therefore, Annual financial statements cannot be approved in a meeting conducted through video conferencing.

Amendment made by Companies (Amendment) Act, 2017

Second Proviso to Section 173(2)-

“Provided further that where there is quorum in a meeting through physical presence of directors, any other director -may participate through video conferencing or other audio visual means in such meeting on any matter specified under the first proviso.”

Company Law And Audit Notes For Cs

Question 13. Ram is a chartered accountant in practice. His proprietory concern has been appointed as the statutory auditor of a private limited company. Subsequently, it came to light that Mrs. Ram has been holding less than 1% shares of that private limited company. Examine the legal validity of the appointment of statutory auditor.

Answer:

Pursuant to Section 141, a person who himself, or his relative or partner is holding any security of or interest in the company or its subsidiary, or of its holding or associate company or a subsidiary of such holding company is not eligible for appointment of auditor of the company.

Provided that the relative may hold security or interest in the company of face value not exceeding 1,000 or such sum as may be prescribed.

As per Rule 10 of the Companies (Audit and Auditors) Rules, 2014, a relative of an auditor may hold securities in the company of face value not exceeding * 1 lakh.

In accordance with provisions stated above, Mrs. Ram may hold shares of the value not exceeding 1 lakh to render Mr. Ram eligible for appointment as the auditor.

Since the question is silent on the value of the 1% shares of the company, the conclusion regarding the appointment of Ram may be drawn as under: If the holdings of Mrs. Ram exceed 1 lakh based on aforesaid provision of law Mr. Ram cannot be appointed as auditor.

However, if Mrs. Ram holding is less than 1 lakh Mr. Ram can be appointed as auditor.

Question 14. Ram is a practising Chartered Accountant and partner of two audit firms namely PYMG and YE. In the immediately preceding financial year, PYMG has completed its two terms of five consecutive years in Gayatri Pvt. Ltd. having paid-up share capital of 60 crore. Now Gayatri Pvt. Ltd. is considering appointing YE firm as its statutory auditors. Can Gayatri Pvt. Ltd. appoint YE firm as its auditors?

What will be your answer in the following cases?

- If appointing company is a one person company;

- If appointing company is a small company.

Answer:

Under section 139 of the Companies Act, 2013 read with Rule 5 of Companies (Audit and Auditors) Rules, 2014, the following companies are required to appoint and rotate auditors:

- All listed companies;

- All unlisted public companies having paid up share capital of rupees ten crore or more;

- All private limited companies having paid up share capital of rupees fifty crore or more;

- All companies having paid up share capital of below threshold limit mentioned in (a) and (b) above, but having public borrowings from financial institutions, banks or public deposits of rupees fifty crores or more.

- An individual auditor who has completed his term as auditor for more than one term of five consecutive years and an audit firm who has completed the term as auditor for more than two terms of five consecutive years shall not be re-appointed as an auditor of the company.

- It is further provided that as on the date of appointment no audit firm having a common partner or partners to the other audit firm, whose tenure has expired in a company immediately preceding the financial year, shall be appointed as auditor of the same company for a period of five years.

Accordingly in the above case, the company is required to appoint and rotate the auditors on completion of the tenure. Thus Gayatri Ltd. cannot appoint YE audit firm as auditor of the company.

- In case the appointee company is a One Person Company, rotation of auditor does not apply and hence the appointing company can appoint YE audit firm as auditor.

- In case the appointee company is a Small Company, rotation of auditor does not apply and therefore the appointing company can appoint YE audit firm as auditor.

Question 15. Vijay is an auditor of XYZ Ltd. a listed public company having paid-up share capital of 10 crore. Advise him as to whether he can render the following services, keeping in mind, the relevant provisions of Companies Act, 2013?

- Vijay wants to conduct internal audit of XYZ Ltd. He also wishes to provide actuarial services to XYZ Ltd.

- Vijay wishes to “design and implement one financial system” and offer management services to ABC Ltd. the holding company of XYZ Ltd.

- What will be your answer in the above two cases if services are provided to PQR Ltd. a subsidiary company of XYZ Ltd.?

Answer:

Section 144 of the Companies Act, 2013 provides that an auditor shall provide to the company only such other services as are approved by the Board of Directors/ the audit committee, but which shall not include any of the following services (whether such services are rendered directly or indirectly to the company or its holding company or subsidiary company, namely:

- accounting and book keeping services;

- internal audit;

- design and implementation of any financial information system;

- actuarial services;

- investment advisory services;

- investment banking services:

- rendering of outsourced financial services;

- management services; and

- any other kind of services as may be prescribed.

Therefore based on the above mentioned provisions advice to Vijay will be as under:

- Vijay cannot conduct internal audit of XYZ Ltd or carry out actuarial services to XYZ Ltd.

- Vijay cannot provide management services or implementation of financial system to ABC Ltd as such services to the holding company is also not allowed.

- Providing (i) and (ii) services above to PQR Ltd the subsidiary company of XYZ Ltd is also not allowed. Space to write important points for revision-

Question 16. Reels India Ltd. is a wholly owned subsidiary of Wheels India Ltd. The auditor of Wheels India Ltd. has intimated the Board of directors that the company will not be required to prepare consolidated financial statements if provisions of section 129, Companies Act, 2013 are complied with. As a company secretary give your comments in this regard.

Answer:

The consolidation of financial statements of the company shall be made in accordance with the provisions of Schedule III of the Act and the applicable accounting standards:

In case of a company covered under of Section 129(3) of the Companies Act, 2013 which is not required to prepare consolidated financial statements under the Accounting Standards, it shall be sufficient if the company complies with provisions on consolidated financial statements provided in Schedule III of the Act.

The contention of the Auditor is justifiable as Section 129 (3) of Companies Act, 2013 provides for not preparing the consolidated financial statement if conditions are fulfilled. Which according to second proviso to Rule 6 are as under:

Provided further that nothing in this rule shall apply in respect of preparation of consolidated financial statements by a company if it meets the following conditions:-

- It is a wholly-owned subsidiary, or is a partially-owned subsidiary of another company and all its other members, including those not otherwise entitled to vote, having been intimated in writing and for which the proof of delivery of such intimation is available with the company, do not object to the company not presenting consolidated financial statements;

- It is a company whose securities are not listed or are not in the process of listing on any stock exchange, whether in India or outside India; and

- Its ultimate or any intermediate holding company files consolidated financial statements with the Registrar which are in compliance with the applicable Accounting Standards.

Cs Company Law Question And Answers

Question 17. ABC & Associates is an audit firm with partners A, B and C. The firm’s tenure as statutory auditor in M Ltd. has expired under Companies Act, 2013. M Ltd. is a listed company. XY & Co. another audit firm is appointed as auditor of M Ltd. for the subsequent year. B joins XY & Co. as partner, 4 months after it was appointed as statutory auditor of M Ltd. Comment with reference to the provisions of the Companies Act, 2013.

Answer:

According to Section 139(2) of the Companies Act, 2013 provides that as on date of appointment of Auditors, no audit firm having a common partner or partners to the other audit firm whose tenure has expired in a company immediately preceding the financial year shall be appointed as auditor of the same company for a period of 5 years.

Now M Ltd is a listed entity and therefore rotational provisions are applicable. B is a partner in ABC & associates whose tenure as statutory auditor in M Ltd. has expired. He joined XY & Co. as partner 4 months after XY & Co. was appointed as statutory auditor of M Ltd..

It may be noted that there should not be a common partner in firms as on date of appointment. In the above case, B has joined XY & Co. after 4 months of its appointment as statutory auditor of M Ltd. Thus, XY &Co. can continue as statutory auditor of M Ltd for the remaining term after B joined them as Partner.

Question 18. In the course of business of the company, RST Logistics Ltd. received 2 lakh on 31st March, 2015 as advance towards consideration for providing future services in the form of warranty as per their agreement with Apurva. The period for providing such services in terms of common business practice is 3 years.

The amount is still lying as advance and while auditing the books of accounts for the year ended 31st March, 2019, the statutory auditor had commented about contravention of the provisions of the Companies Act, 2013 in its preliminary findings to the Vice-President (Finance). Advise the Vice-President (Finance) if the comments of the auditor are justified in terms of provisions of the Companies Act, 2013.

Answer:

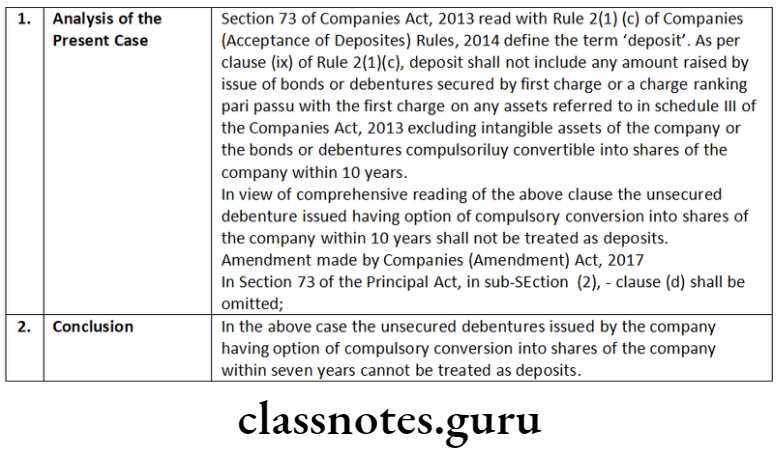

According to Rule 2(1) (xii) (e) of the Companies (Acceptance of Deposits) Rules, 2014. The term ‘deposit’ does not include any advance towards consideration for providing future services in the form of a warranty or maintenance contract as per written agreement or arrangement, if the period for providing such services does not exceed the period prevalent as per common business practice or five years, from the date of acceptance of such service whichever is less.

In the instant case, the amount of 2 lakhs received on March 31, 2015 as advance towards consideration for providing future services in the form of a warranty, is still lying with the company until March 31, 2019 and the period prevalent as per common business practice, for providing such service is 3 years, which has expired.

Accordingly, this amount has come within the ambit of the term ‘deposit’. Hence, the comments of the auditor are justified and the Vice-President (Finance) is advised to immediately refund the advance amount along with the due interest thereon to Apurva.

Question 19. Comment on the following:

Debapriya was appointed as alternate director of Julien in Amal Housing Finance Ltd. The company was served a demand notice by Goods & Service Tax department for 25 lakh for violation of certain provisions of GST law. Due to cash crunch the CEO approached Debapriya for a help of 12 lakh. Debapriya borrowed 7.50 lakh from his sister’s husband and gave to the company. The company recorded the same in its books of account.

Answer:

As per rule 2(1)(c) of the Companies (Acceptance of Deposits) Rules 2014, provides that any amount received from a person who, at the time of receipt of the amount, was a director of the company shall not be regarded as deposit, if the director from whom money is received, furnishes to the company at the time of giving the money, a declaration in writing that the amount is not being given out of funds acquired by him by borrowing or accepting loans or deposits from others.

Although, proviso to Section. 73(1) read with Rule 1(3)(iii) of the Companies (Acceptance of Deposits) Rules 2014 excludes a housing finance company registered with National Housing Bank established under the National Housing Bank Act, 1987 from the provisions of Section 73 to 76A of the Companies Act, 2013 and the Companies (Acceptance of Deposits) Rules, 2014.

Therefore, the transaction of accepting money from the director recorded by Amal Housing Finance Ltd. in its book of account is not considered as non-compliance of the provisions of the Companies Act.

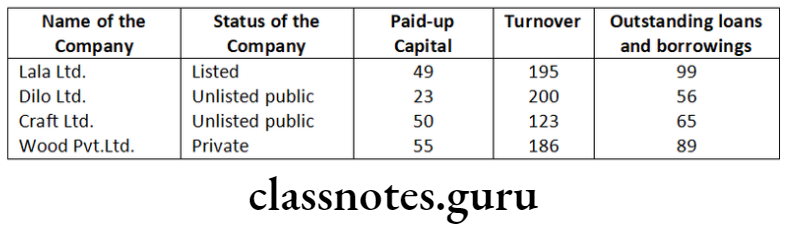

Question 20. Advise whether the internal auditor is required to be appointed in the following scenarios:

Can the following persons be appointed as internal auditor?

- President (HR)

- DGM (Finance)

Answer:

According to Section 138 of the Companies Act, 2013 read with Rule 13 of the Companies(Accounts) Rules, 2014, lay down the following class of companies which is required to appoint an internal auditor namely:

- Every listed company;

- Every unlisted public company having:

- paid up share capital of 50 crore or more during the previous financial year; or

- turnover of 200 crore or more during the previous financial year; or

- Outstanding loans or borrowings from banks or public financial institutions exceeding 100 crore or more at any point of time during the previous financial year; or

- Outstanding deposits of 25 crore or more at any point of time during the previous financial year; and

- Every private company having-

- Turnover of 200 crore or more during the previous financial year;

or - Outstanding loans or borrowings from banks or public financial institutions exceeding 100 crore or more at any point of time during the previous financial year.

- Turnover of 200 crore or more during the previous financial year;

Accordingly, in the above case, solution is as under:

An internal auditor, shall either be a chartered accountant or a cost accountant, or such other professional as may be decided by the Board to conduct internal audit of the functions and activities of the company. The internal auditor may or may not be an employee of the company. Therefore, if President (HR) and DGM (Finance) satisfying the above criteria, can be appointed as internal Auditor.

Audit And Auditors Important Questions Cs

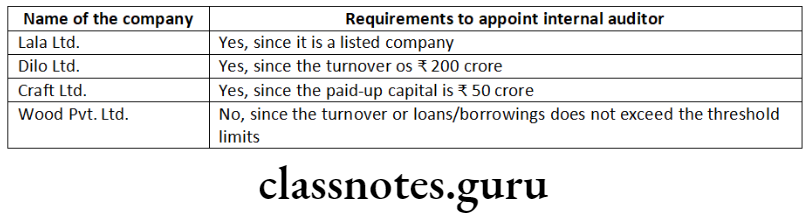

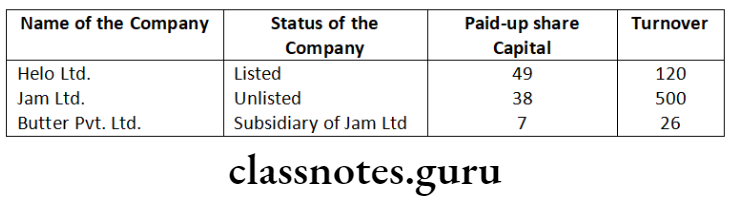

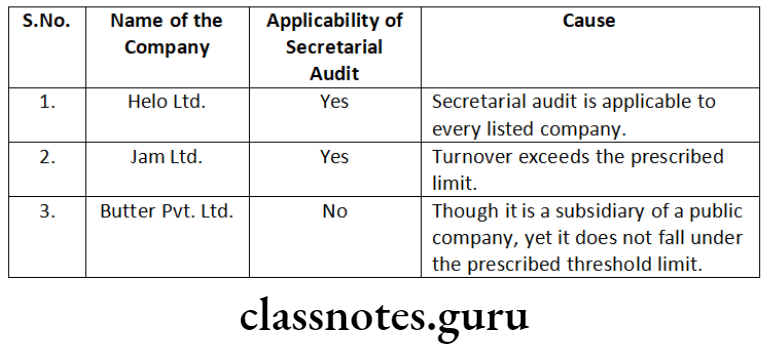

Question 21. Chief Financial Officer (CFO) of a conglomerate is of the view that secretarial audit is mandatory for all the companies. He has approached you to determine whether secretarial audit is applicable in case of the following companies:

Answer:

Considering the increasing significance of Corporate Governance, Section 204 of the Companies Act, 2013 directive every listed company and such other class of prescribed companies to annex a Secretarial Audit Report, given by a Company Secretary in practice in Form MR-3 with its Board’s report.

As per rule 9 of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014, the lay down class of companies is as under:

- every public company having a paid-up share capital of 50 Crore or more; or

- every public company having a turnover of ₹250 crore or more; or

- every company having outstanding loans or borrowings from banks or public financial institutions of 100 crore or more.

Secretarial Audit is also applicable to a private company which is a subsidiary of a public company, and which falls under the prescribed class of companies as indicated above.

Question 22. In light of the given case, applicability is specified in the table below:

Answer the following with regard to appointment of auditor:

- X, a practising chartered accountant holds shares in ABC Ltd. The nominal value of shares is 50,000. Whether ABC Ltd. can appoint him as auditor?

- A, a practising chartered accountant has business relationship with XYZ Hotels Ltd. The hotel used to provide services to A frequently on the same price as charged from other customers. Whether XYZ Hotels Ltd appoint A as its auditor?

- X, a chartered accountant is working as a General Manager Accounts with ABC Ltd. Could X be appointed as auditor in ABC Ltd?

Answer:

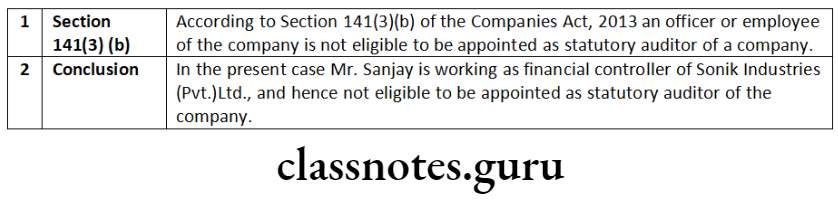

- According to Section 141(3) of the Companies Act, 2013 provides that a person shall not be eligible for appointment as an auditor of a company when he himself or his relative or partner is holding any security of or interest in the company or its subsidiary, or of its holding or associate company or a subsidiary of such holding company. In the above problem Mr. X, a practicing Chartered Accountant holding shares in ABC Ltd cannot be appointed as Auditor of that company.

- Section 141(3) of the Companies Act, 2013 read with Rule 10 of the Companies (Audit and Auditors) Rules, 2014 provides that a person shall not be eligible for appointment as an auditor of a company when he has business relationship with the company, or its subsidiary, or its holding or associate company or subsidiary of such holding company or associate company.

- The term business relationship shall be construed as any transaction entered into for a commercial purpose except –

- commercial transactions which are in the nature of professional services permitted to be rendered by an auditor or audit firm under the Act and the Chartered Accountant Act, 1949 and the rules or the regulations made under those Act;

- commercial transactions which are in the ordinary course of business of the company at arm’s length price like sale of products or services to the auditors, as customer, in the ordinary course of business, by companies engaged in the business of telecommunications, airlines, hospitals, hotels and such other similar businesses.

As the transaction is at the arm length price so Mr. A can be appointed as an auditor of XYZ Hotels Ltd.

- As per section 141(3) of the Companies Act, 2013 provides that an officer or employee of the company is not eligible for appointment as an auditor of a company.

In the above case Mr. X, is working as a General Manager Accounts with ABC Ltd. so he cannot be appointed as Auditor of that company. Space to write important points for revision-

Short Notes

Question 1. Write short note on the following:

- National Finance Reporting Authority

- Consolidated Financial Statement

Answer:

National Financial Reporting Authority (NFRA)

Through Section 132 of the Companies Act, 2013, the Central Government has introduced a new regulatory authority named as National Authority for Financial Reporting known as National Financial Reporting Authority (NFRA) with wide powers to recommend, enforce and monitor the compliance of accounting and auditing standards.

NFRA shall be responsible for monitoring and enforcing compliance of auditing and accounting standards and for that purpose, oversee the quality of professions associated with ensuring such compliances. The Authority shall investigate professional and other misconducts which may be committed by Chartered Accountancy members and firms. T

he National Financial Reporting Authority shall be a quasijudicial body to regulate matters related to accounting and. auditing. With increasing demand of non-financial reporting, it may be referred to as a National level business Reporting Authority to regulate standards of all kind of reporting-financial as well as non-financial, by the companies in future.

National Financial Reporting Authority shall give its recommendations on accounting standards and auditing standards. It shall only recommend and it is the Central Government who shall prescribe such standards.

Objective

The objectives of National Financial Reporting Authority inter alia shall be as follows:

- Make recommendations on formulation of accounting and auditing policies and standards for adoption by companies, class of companies or their auditors;

- Monitor and enforce the compliance with accounting standards, monitor and enforce the compliance with auditing standards;

- Oversee the quality of service of professionals associated with ensuring compliance with such standards and suggest measures required for improvement in quality of service, and

- Perform such other functions as may be prescribed in relation to aforementioned objectives.

Consolidated Financial Statements

The Companies Act 2013 has made preparation of consolidated accounts mandatory for all companies including unlisted companies and private companies having one or more subsidiaries or associates or joint ventures.

According to sub Section 3 of the Section 129 of the Companies Act, 2013, where a company has one or more subsidiaries or associates companies, it shall, in addition to its financial statements for the financial year, prepare a consolidated financial statement of the company and of all the subsidiaries and associates companies in the same form and manner as that of its own which shall also be laid before the annual general meeting of the company along with the laying of its financial statement under sub Section 2.

The company shall also attach along with its financial statement, a separate statement containing the salient features of the Financial Statement of its subsidiary/ies or associate/s or joint venture/s in Form AOC-1 (Rule 5).

Manner of Consolidation of Accounts

The consolidation of financial statements of the company shall be made in accordance with the provisions of Schedule III of the Act and the applicable accounting standards:

Provided that in case of a company covered under sub-Section (3) of Section 129 which is not required to prepare consolidated financial statements under the Accounting Standards, it shall be sufficient if the company complies with provisions on consolidated financial statements provided in Schedule III of the Act.

Question 2. Write short note on Secretarial Audit.

Answer:

Secretarial Audit:

Secretarial Audit is a compliance audit and it is a part of total compliance management in an organisation. The Secretarial Audit is an effective tool for corporate compliance management. It helps to detect non-compliance and to take corrective measures.

Secretarial Audit is an independent, objective assurance intended to add value and improve an organisation’s operations. It helps to accomplish the organisation’s objectives by bringing a systematic, disciplined approach to evaluate and improve effectiveness of risk management, control, and governance processes.

As per Rule 9 of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014, the prescribed class of companies is as under:

- every public company having a paid-up share capital of fifty crore rupees or more; or

- every public company having a turnover of two hundred fifty crore rupees or more.

As per Companies (Appointment and Remuneration of Managerial Personnel) Amendment Rule, 2020

- with this insertion in Rule 9(1) of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014, now every company having outstanding loans or borrowing from banks or public financial institutions of one hundred crore rupees or more is also required to annex the Secretarial Audit report with its Boards Report.

- MCA has also clarified that for the purpose of this rule paid up share capital, turnover, or outstanding loans or borrowings as the case may be, existing on the last date of latest audited financial statement shall be taken into account.

It shall be the duty of the company to give all assistance and facilities to the company secretary in practice for auditing the secretarial and related records of the company.

Secretarial Audit is also applicable to a private company which is a subsidiary of a public company, and which falls under the prescribed class of companies as indicated above.

Descriptive Questions

Question 3. What is the procedure of report fraud.

Answer:

Reporting of Frauds by Auditor-Section 143(12) to 143 (15) and Rule 13 Section 143(12) and Rule 13 provides that If an auditor of a company, in the course of the performance of his duties as statutory auditor, has reason to believe that an offence of fraud, which involves or is expected to involve individually an amount of rupees one crore or above, is being or has been committed against the company by its officers or employees, the auditor shall report the matter to Central Government.

- The auditor shall report the matter to the Central Government as under:-

- the auditor shall report the matter to the Board or the Audit Committee, immediately but not later than two days of his knowledge of the fraud, seeking their reply or observations within forty-five days;

- on receipt of such reply or observations, the auditor shall forward his report and the reply or observations of the Board or the Audit Committee along with his comments (on such reply or observations of the Board or the Audit Committee) to the Central Government within fifteen days from the date of receipt of such reply or observations;

- in case the auditor fails to get any reply or observations from the Board or the Audit Committee within forty-five days, he shall forward. his report to the Central Government along with a note containing the details of his report that was earlier forwarded to the Board or the Audit Committee for which he has not received any reply or observations;

- The report shall be sent to the Secretary, Ministry of Corporate Affairs in a sealed cover by Registered Post with Acknowledgement Due or by Speed Post followed by an e-mail in confirmation of the same.

- The report shall be on the letter-head of the auditor containing postal address, e-mail address and contact telephone number or mobile number and be signed by the auditor with his seal and shall indicate his Membership Number.

- The report shall be in the Form ADT-4.

- In case of a fraud involving lesser than the amount specified above, the auditor shall report the matter to Audit Committee or to the Board immediately but not later than two days of his knowledge of the fraud and he shall report the matter specifying the following:

- Nature of Fraud with description;

- Approximate amount involved; and

- Parties involved.

- The fraud reported to the Audit Committee or the Board during the year shall be disclosed in the Board’s Report specifying the following-

- Nature of Fraud with description;

- Approximate Amount involved;

- Parties involved, if remedial action not taken; and

- Remedial actions taken.

- The provision of this rule shall also apply, mutatis mutandis, to a Cost Auditor and a Secretarial Auditor during the performance of his duties under Section 148 and 204 respectively.

Note: The following details of each of the fraud reported to the Audit Committee or the Board under sub-rule (3) during the year shall be disclosed in the Board’s Report:- Nature of Fraud with description;

- Approximate Amount involved;

- Parities involved, if remedial action not taken; and

- Remedial action taken.

Question 4. ABC Ltd. wants to appoint FMC and Associates as its internal auditor. What are the conditions of such appointment?

Answer:

Internal Audit:

Classes of companies requiring Internal Audit

The following class of companies shall be required to appoint an internal auditor or a firm of internal auditors:-

- Every listed company;