Chapter 5 Charges

Charge

- A charge is a security given for securing loans or debentures by way of a mortgage on the assets of the company. As mentioned earlier, the power of the company to borrow includes the power to give security also.

- A charge may be created either through the act of parties or by operation of law.

- A charge created by operation of law does not require registration. But a charge croated by act of parties requires registration.

- The charge may be in perpetuity.

- A charge only gives a right to receive payment out of a particular property.

- A charge is good against subsequent transferees with notice.

- In case of charge, no personal liability is created. But where a charge is the result of a contract, there may be a personal remedy.

- There is no such transfer of interest in the case of a charge.

Two Kinds of Charges

There are two kinds of charges, fixed or specific charge and floating charge.

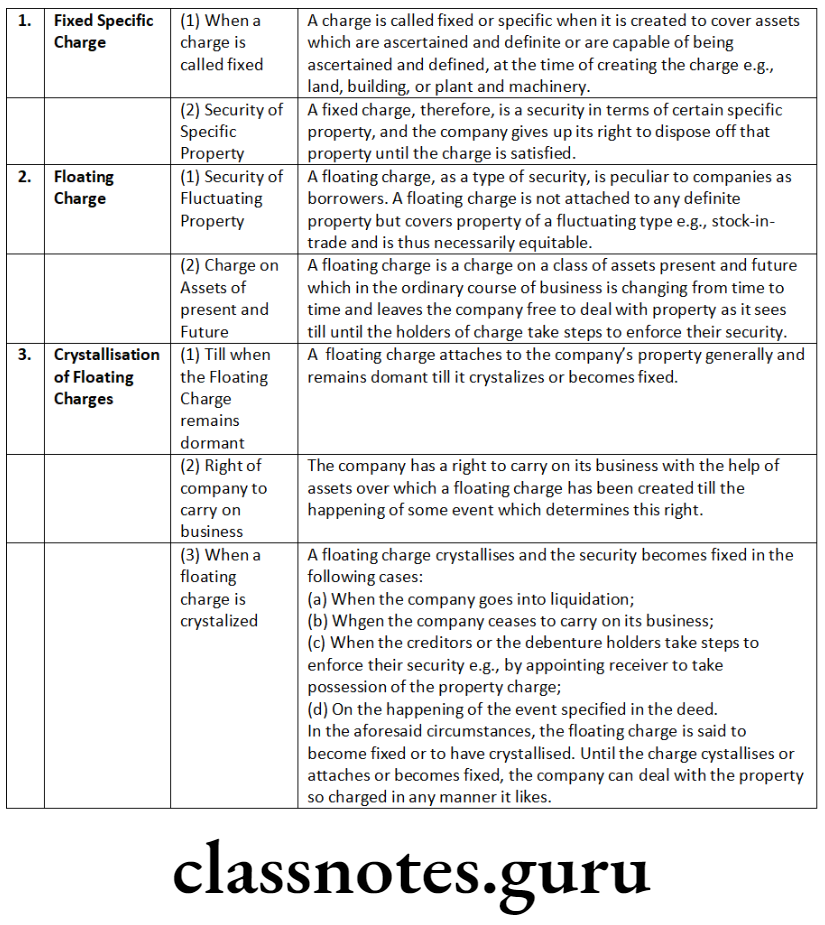

Fixed Charge

A charge is called fixed or specific when it is created to cover assets which are ascertained and definite or are capable of being ascertained and defined, at the time of creating the charge e.g., land, building, or plant and machinery. A fixed charge, therefore, is a security in terms of certain specific property, and the company gives up its right to dispose off that property until the charge is satisfied.

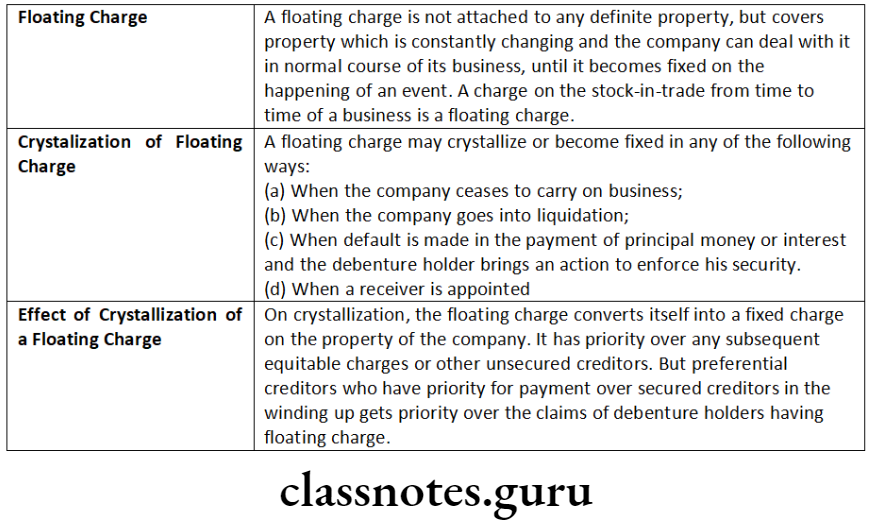

Floating Charge

A floating charge, as a type of security, is peculiar to companies as borrowers. A floating charge is not attached to any definite property but covers property of a fluctuating type e.g., stock-in-trade and is thus necessarily equitable.

A floating charge is a charge on a class of assets present and future which in the ordinary course of business is changing from time to time and leaves the company free to deal with the property as it sees fit until the holders of charge take steps to enforce their security.

Crystallisation of Floating Charge

A floating charge attaches to the company’s property generally and remains dormant till it crystallizes or becomes fixed. The company has a right to carry on its business with the help of assets over which a floating charge has been created till the happening of some event which determines this right. A floating charge crystallises and the security becomes fixed in the following cases:

- when the company goes into liquidation;

- when the company ceases to carry on its business;

- when the creditors or the debenture holders take steps to enforce their security e.g. by appointing receiver to take possession of the property charged;

- on the happening of the event specified in the deed.

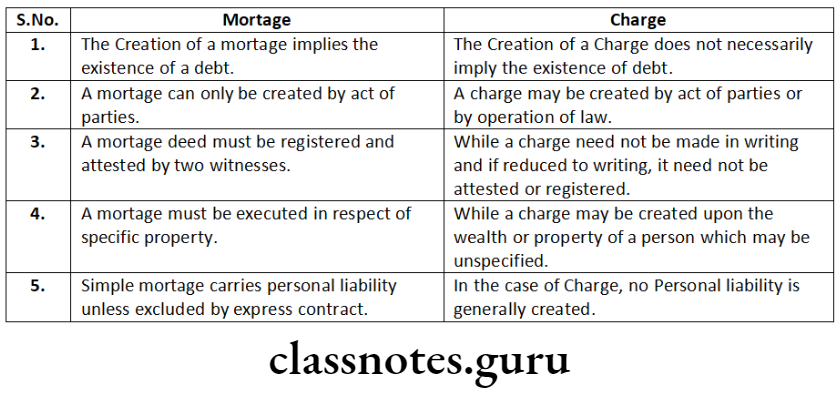

Mortgage

- A mortgage is the transfer of an interest in specific immoveable property for the purpose of securing the payment of money advanced or to be advanced by way of loan, an existing or future debt or the performance of an agreement which may give rise to pecuniary liability.

- A mortgage is created by the act of the parties.

- A mortgage requires registration under the Transfer of Property Act, 1882.

- A mortgage is for a fixed term.

- A mortgage is a transfer of an interest in specific immovable property.

- A mortgage is good against subsequent transferees.

- A simple mortgage carries personal liability unless excluded by express contract.

- A mortgage is a transfer of an interest in a specific immovable property.

Cs Executive Company Law Notes

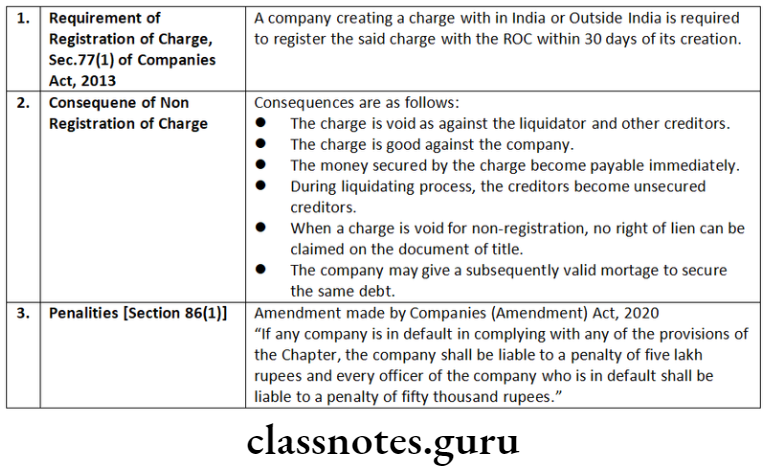

Registration of Charges- Section 77(1)

Any charge created

- within or outside India,

- on its property or assets or any of its undertakings,

- whether tangible or otherwise, and situated in or outside India Shall be registered.

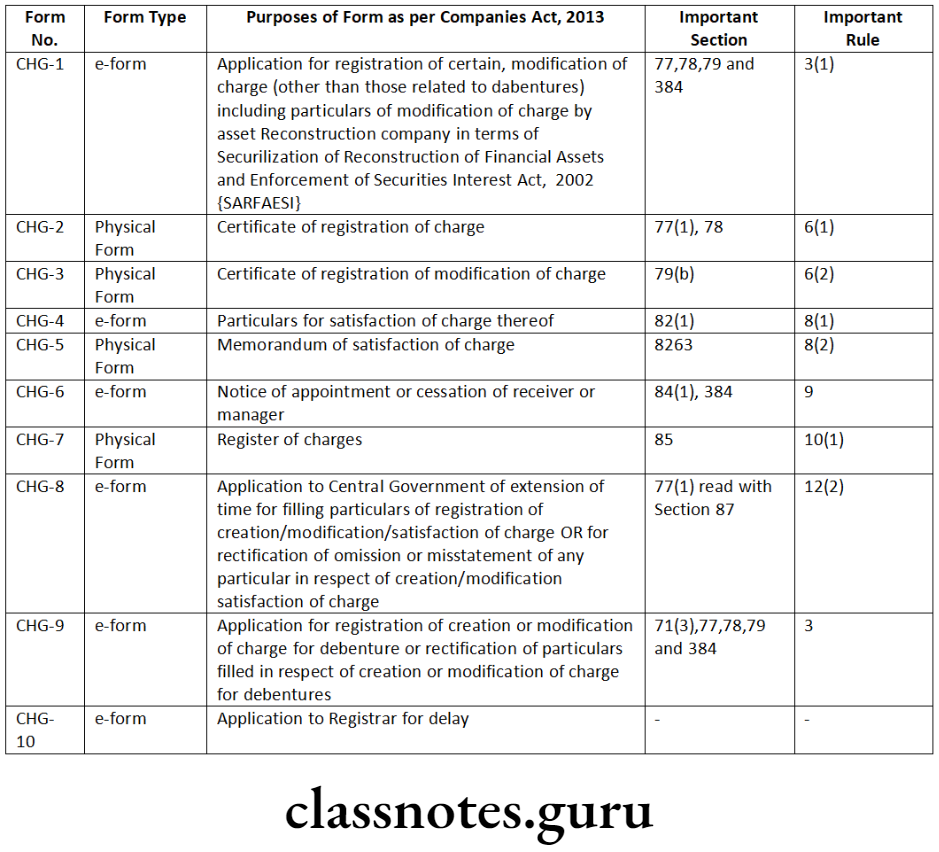

- Particulars of charges that is being filed with Registrar of Companies is to be signed by the company creating the charge and the charge holder in Form No. CHG-1 (for other than Debentures) or Form CHG-9 (for debentures) as the case may be.

- The Charge has to be registered within 30 days of its creation.

As per Companies (Amendment), Act, 2019

Time limit for filing charge created on or after 2.11.2018 reduced The charge should be filed within 30 days from its creation. In case of charges created on or after 2.11.2018, RoC can allow extension upto 30 days (total 60 days from date of creation of charge, on payment of prescribed additional fees.

RoC can allow further extension of 60 days on after payment of such ad valorem fees as may be prescribed – first and second proviso to Section 77(1) of Companies Act, 2013 amended vide the Companies (Amendment) Act, 2019.

There is no provision to grant further extension for registration of charges. Section 87 of Companies Act, 2013 has been amended w.e.f. 2.11.2018 to provide that Central Government cannot order rectification of register of charges in such cases.

Provision in respect of charges created before 2.11.2018 Registrar can allow filing of particulars of such registration within 300 days of such creation, on payment of additional fee as prescribed.

He can grant further extension upto 6 months on payment of additional fees as may be prescribed – first and second proviso to Section 77(1) of Companies Act, 2013 amended vide the Companies (Amendment) Act, 2019.

Registrar can condone delay upto 300 days on being satisfied that company had sufficient cause for not filing particulars and instrument of charge within 30 days, on payment of additional fee – Rule 4 of Companies (Registration of Charges) Rules, 2014.

If the charge is not filed within 300 days of creation, further extension could be granted by Central Government under section 87 of Companies Act, 2013 second proviso to Section 77(1) of Companies Act, 2013 as existing upto 2.11.2018 [powers delegated to Regional Director]. Now, such extension cannot be granted.

Punishment for not filing charges or giving false information Amendment made by Companies (Amendment) Act, 2020 “(1) If any company is in default in complying with any of the provisions of this Chapter, the company shall be liable to a penalty of five lakh rupees and every officer of the company who is in default shall be liable to a penalty of fifty thousand rupees.”.

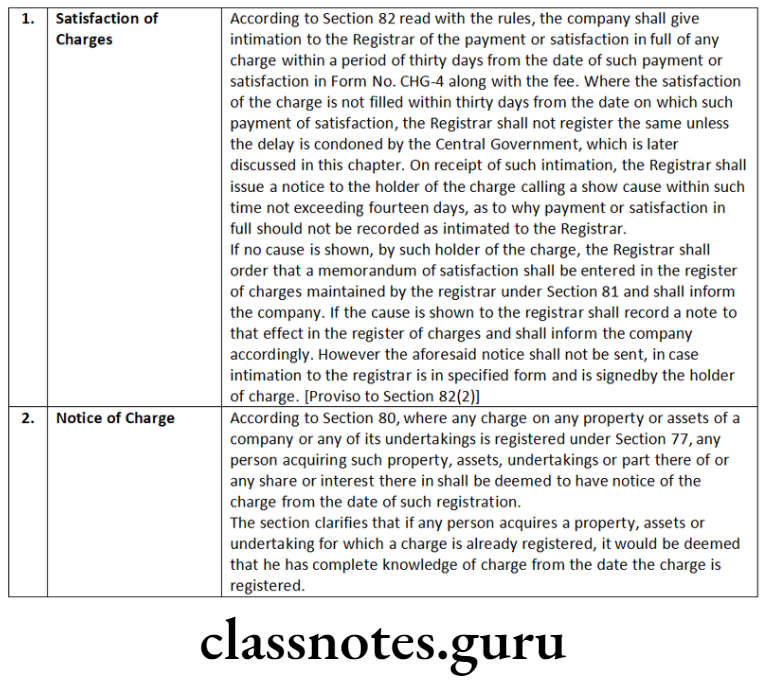

Satisfaction of Charges

According to Section 82 read with the rules, the company shall give intimation to the Registrar of the payment or satisfaction in full of any charge within thirty days from the date of such payment or satisfaction in Form No. CHG-4 along with the fee.

The Registrar may, on an application by the company or the charge holder, allow such intimation of payment or satisfaction to be made within a period of three hundred days of such payment or satisfaction on payment of such additional fees as may be prescribed.

Notice of Charge

According to Section 80, where any charge on any property or assets of a company or any of its undertakings is registered under Section 77, any person acquiring such property, assets, undertakings or part thereof or any share or interest therein shall be deemed to have notice of the charge from the date of such registration.

The section clarifies that if any person acquires a property, assets or undertaking for which a charge is already registered, it would be deemed that he has complete knowledge of the charge from the date the charge is registered.

Consequences of Non-registration of Charge

According to Section 77 of the Companies Act, 2013, all types of charges created by a company are to be registered by the ROC, where they are non-compliant and are not filed with the Registrar of Companies for registration, it shall be void as against the liquidator and any other creditor of the company.

Particulars of Charges

The following particulars in respect of each charge are required to be filed with the Registrar:

- Date and description of instrument creating charge;

- The total amount secured by the charge;

- Date of the resolution authorising the creation of the charge; (in case of issue of secured debentures only);

- General description of the property charged;

- List of the terms and conditions of the loan; and

- Name and address of the charge holder.

Central Government can Order Rectification of Register of Charges Only When Delay was in Respect of Filing of Satisfaction of Charge or Mistake Made in Filing Charges

The Central Government can order the rectification of register on any of the | following grounds:

The Central Government on being satisfied that:

- the omission to give intimation to the Registrar of the payment or satisfaction of a charge, within the time required under this Chapter,

- the omission or misstatement of any particulars with respect to any such charge or modification or with respect to any memorandum of satisfaction or other entry made in pursuance of section 82 or 83, was accidental or due to inadvertence or some other sufficient cause or it is not of a nature to prejudice the position of creditors or shareholders of the company, it may, on the application of the company or any person interested and on such terms and conditions as the Central Government deems just and expedient, direct that the time for the giving of intimation of payment or satisfaction shall be extended or, as the case may require, that the omission or misstatement shall be rectified Section 87 of Companies Act, 2013 amended vide the Companies (Amendment) Act, 2019.

- Central Government cannot order rectification of register of charges if there was delay in filing of the original charge itself, beyond the specified period or extended period as allowable under section 77 of Companies Act, 2013.

- Application for rectification can be made by company or any person interested. Thus, secured creditor (Bank or FI) can make application if the charge or its modification was not filed in time, as the secured creditor is certainly interested in registration/modification of charge. Powers to order rectification of register of charges have been delegated to Regional Director vide Notification F No. 1/6/2014 – CL. V dated 21.5.2014.

List of Important Forms

Charges In Company Law

Short Notes

Question 1. Write a note on the following:

Consequences of non-registration of charge

Answer:

Question 2. Distinguish Between

Distinguish between the following:

‘Mortgage’ and ‘charge’.

Answer:

Question 3. Distinguish between the following:

‘Notice of a charge’ and ‘satisfaction of a charge’.

Answer:

Descriptive Questions

Question 1. What is meant by ‘floating charge’ and how it would be crystallised?

Answer:

Cs Executive Chapter 5 Charges

Question 2. Explain clearly the meaning of the terms ‘fixed charge’ and ‘floating charge’. State the circumstances under which a ‘floating charge’ automatically becomes ‘fixed’.

Answer:

Question 3. Explain whether a Floating charge attached to the company’s property generally remains dormant till it crystallizes or becomes fixed.

Answer:

A floating charge attached to the company’s property generally remains dormant till it crystallizes or becomes fixed. The company has a right to carry on its business with the help of assets over which a floating charge has been created till the happening of some event which determines this right.

Crystallization is the process by which a floating charge converts into a fixed charge. A floating charge crystallises and the security becomes fixed in the following cases:

- when the company goes into liquidation;

- when the company ceases to carry on its business;

- when the creditors or the debenture holders take steps to enforce their security e.g. by appointing receiver to take possession of the property charged;

- on the happening of the event specified in the deed.

In the aforesaid circumstances, the floating charge is said to become. fixed or to have been crystallised. Until the charge crystallises or attaches or becomes fixed, the company can deal with the property so charged in any manner it likes. Once crystallized, the security cannot be sold, and the lender may take possession of it.

Question 4. Comment on the following:

An unregistered charge shall be void against the liquidator and other creditors of the company.

Answer:

- Under Section 77 of the Companies Act, 2013, all types of charges created by a company are to be registered with the Registrar of Companies, where they are non-compliant and are not filed with the Registrar for registration, the charge shall be void as against the liquidator and any other creditor of the company.

- In the case of ONGC Ltd v. Official Liquidators of Ambica Mills Co Ltd (2006), the ONGC had not been able to point out whether the so called charge, on the basis of which it was claiming preference as a secured creditor, was registered or not.

- It was held that in the light of this failure, ONGC could not be treated as a secured creditor.

- This does not, however, mean that the charge is altogether void and the debt is not recoverable. So long as the company does not go into liquidation, the charge is good and may be enforced.

- Void against the liquidator means that the liquidator, on winding up of the company, can ignore the charge for the purpose of ascertaining the priority of payment and can treat the concerned creditor as an unsecured creditor. The property will be treated as free of charge i.e. the creditor cannot sell the property to recover its dues.

- Void against any other creditors of the company means that if any subsequent charge is created on the same property and the earlier charge is not registered, the earlier charge would have no consequence and the latter charge if registered would enjoy priority over the earlier charge.

- Hence, non-filing of particulars of a charge as required under Section 77 of the Companies Act, 2013 does not invalidate the charge against the company as a going concern.

- It is void only against the liquidator and the creditors at the time of liquidation. The company itself cannot have a cause of action arising out of non-registration.

Question 5. Comment on the following:

An encumbrance may be created by a charge, pledge or a mortgage.

Answer:

An encumbrance means a restriction imposed on the owner’s right over his property. All the three words (charge, mortgage and pledge) used above impose a restriction on the right of the owner over his own property.

- Charge: As per Clause 16 of Section 2 of the Companies Act, 2013, charge means an interest or lien created on the property or assets of a company or any of its undertakings or both as security and includes a mortgage.

- A charge is called fixed or specific when it is created to cover assets which are ascertained and definite or are capable of being ascertained and defined, at the time of creating the charge whereas a floating charge is not attached to any definite property but covers property of a fluctuating type such as stock in trade.

- On the contrary, in case of a fixed or a floating charge the possession of the assets remains with the borrower. The ownership of the property also remains with the borrower.

- In case of fixed charge he has no right to sell or transfer the asset except with the consent of the charge holder.

- In case of a floating charge the borrower can treat his floating assets as if they have not been charged.

- He loses this right only when he commits a default and the charge holder decides to take action for recovery of the money due. In the above case we say the floating charge crystallizes.

- Mortgage: A mortgage is the transfer of an interest in specific immoveable property for the purpose of securing the payment of money advanced or to be advanced by way of loan, an existing or future debt or performance of an agreement which may give rise to pecuniary liability.

- Pledge: In a pledge the borrower loses possession of the goods pledged as a security for repayment of a debt or performance of an obligation. The pledgor remains the owner of the property. He is entitled to get back

- Although, in all these cases if the borrower commits a default in payment of the principal and interest thereof the lender gets a right to sell the property and recover the amount due to him.

- Hence, an encumbrance may be created by a charge, pledge or a mortgage.

Types Of Charges In Company Law

Question 6. As a Company Secretary, explain the procedure of satisfaction of charge.

Answer:

- Under Section 82 of the Companies Act, 2013 read with Rule 8 of the Companies (Registration of Charges) Rules, 2014, the company shall give intimation to the ROC of the payment or satisfaction in full of any charge within a period of 30 days from the date of such payment or satisfaction in Form No.CHG-4 along with the prescribed fees.

- The Registrar may, on an application by the company or the charge holder, allow such intimation of payment or satisfaction to be made within a period of three hundred days of such payment or satisfaction on payment of such additional fees as specified.

- On receipt of intimation of satisfaction of charge, the Registrar of Companies (ROC) shall issue a notice to the holder of the charge calling upon him to show cause within such time not exceeding 14 days, as may be specified in such notice, as to why payment or satisfaction in full should not be recorded as intimated to the Registrar of Companies. (ROC).

- If no cause is shown, by such holder of the charge, the RoC shall order that a memorandum of satisfaction shall be entered in the register of charges maintained by the RoC under Section 81 of the Companies Act and shall inform the company.

- Although, if the cause is shown to the Registrar, he shall record a note to that effect in the register of charges and shall inform the company accordingly.

- Further, Proviso to Section 82(2) of the Companies Act, 2013 states that the aforesaid notice shall not be required to be sent, in case intimation to the Registrar of Companies (ROC) in this regard is in the specified form along with the Letter of the charge holder stating that the amount has been satisfied, which is a compulsory attachment in all cases of CHG-4 and is signed by the holder of charge.

- Where the Registrar of Companies (ROC) enters a memorandum of satisfaction of charge in full, he shall issue a certificate of registration of satisfaction of charge in Form No.CHG-5. Space to write important points for revision-

Practical Questions

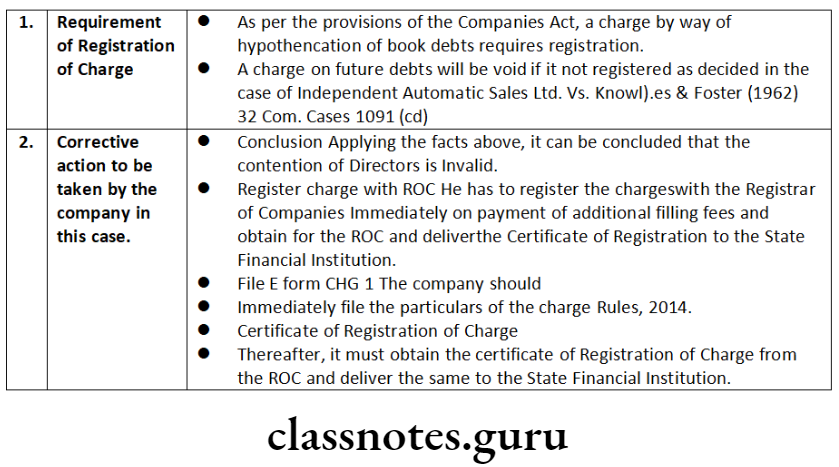

Question 1. Rose Ltd. raised a loan from a State financial institution by creating hypothecation of book debts and also future debts of the company. Incidentally, the charge was not registered with the Registrar of Companies concerned.

State financial institution demanded a certificate of registration of charge for the amount of loan so granted by it. The directors of the company replied to the State financial institution that the charge need not be registered for hypothecation of book debts. Is the action of the directors valid? Give reasons.

Answer:

Company Law Charges Explained

Question 2. XYZ Limited has office building in London. The company has been granted a term loan of 15 crore from a Bank. The company wants to mortgage office building of London. Examining the provisions of the Companies Act, 2013, answer the following:

- Whether the company can mortgage the above office building?

- Whether a charge can be created for property situated outside India?

Answer:

Question 3. The authorised share capital of Shine Ltd. is 50 lakh. The paid-up capital of the company is 20 lakh. The Board of Directors at its 100th meeting held in the residence of Managing Director of the company resolved to create charge on uncalled share capital of 30 lakh. With reference to the provisions of the Companies Act, 2013 ascertain if the resolution is valid.

Answer:

- A loan taken by a company may be secured by a charge on uncalled capital; A company does not have implied power of charging its uncalled share capital and a company may charge its uncalled capital if its articles or memorandum authorise it to charge it.

- The memorandum may give an express power to charge uncalled capital, or the power may be so wide that it can be inferred by implication. In Newton v. Debenture holders of Anglo-Australian Investment Co., (1895) A.C. 224, the memorandum authorised the company to borrow “upon any security of the company”.

- It was held that the power was wide enough to include a charge on uncalled capital.

- In present case the company may take a loan secured by charge on uncalled capital only if the article or memorandum of the company so permits.

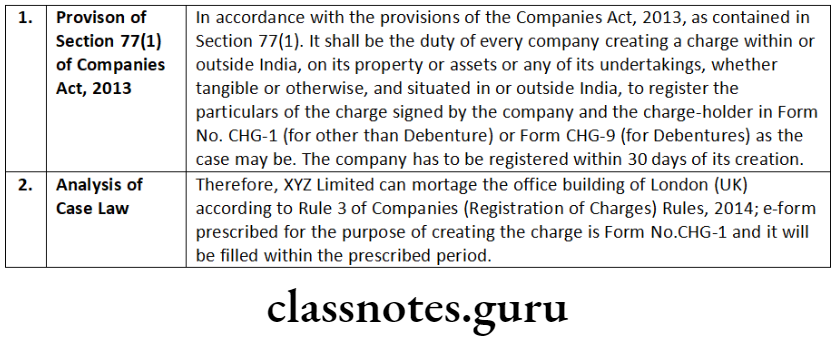

Question 4. XYZ Limited has an office building in London. The Company has been granted a term loan of 15 crore from a Bank. The Company wants to mortgage office building of London. Examining the provisions of the Companies Act, 2013, answer the following:

- Whether the company can mortgage the above office building?

- Whether a charge can be created for property situated outside India?

Answer:

Registration of Charges:

As per Section 77(1) of the Companies Act, 2013 and read with Rule 3 of the Companies (Registration of Charges) Rules, 2014, it shall be the duty of every company creating a charge within or outside India, on its property or assets or any of its undertakings, whether tangible or otherwise, and situated in or outside India, to register the particulars of the charge signed by the company and the charge-holder together with the instruments, if any, creating or modifying such charge in Form No.

CHG-1 (for other than Debenture) or Form No. CHG-9 (For Debentures) as the case may be, and is need to be filed with the Registrar of Companies (ROC) within a period of 30 days of the date of creation or modification of charge along with the specified fees.

- In the above provisions, XYZ Limited can mortgage the office building situated in London (UK).

- In the above provisions, a charge can be created for property situated outside India. The e-form prescribed for the purpose of Registration of the charge is Form No. CHG-1 and it will be filled within the prescribed period.

Short Notes

Question 1. Write short note on Particulars of Charge.

Answer:

The following particulars in respect of each charge are required to be filed with the Registrar:

- date and description of instrument creating charge;

- total amount secured by the charge;

- date of the resolution authorising the creation of the charge; (in case of issue of secured debentures only);

- general description of the property charged;

- list of the terms and conditions of the loan; and

- name and address of the charge holder.

Distinguish Between

Cs Executive Company Law Notes

Question 2. What is the difference between Charge and Pledge?

Answer:

According to the generally accepted definition, a ‘pledge’ is a bailment of personal property as security for some debt or engagement, redeemable on certain terms, and with an implied power of sale on default. It consists of a delivery of goods by a debtor to his creditor as security for a debt or other obligation, to be held until the debt is repaid along with interest or other obligation of the debtor is discharged, and then to be delivered back to the pledger, the title not being changed during the continuance of the pledge.

Unlike a pledge, a ‘charge’ is not a transfer of property of one to another. It is a right created in favour of one, referred to as “the lender” in the immovable property of another, referred to as “the borrower”, as security for repayment of the loan and payment of interest on the terms and conditions contained in the loan documents evidencing charge.

Both a pledge and a charge are the result of voluntary act of parties. Both create security but the nature of the security is different. -Space to write important points for revision-

Descriptive Questions

Question 3. State the procedure to be adopted by the company for satisfaction of a registered charge.

Answer:

Satisfaction of Charges

According to Section 82 read with the rules, the company shall give intimation to the Registrar of the payment or satisfaction in full of any charge within a period of thirty days from the date of such payment or satisfaction in Form No. CHG-4 along with the fee.

The Registrar may, on an application by the company or the charge holder, allow such intimation of payment or satisfaction to be made within a period of three hundred days of such payment or satisfaction on payment of such additional fees as may be prescribed.

On receipt of such intimation, the Registrar shall issue a notice to the holder of the charge calling a show cause within such time not exceeding fourteen days, as to why payment or satisfaction in full should not be recorded as intimated to the Registrar.

If no cause is shown, by such holder of the charge, the Registrar shall order that a memorandum of satisfaction shall be entered in the register of charges maintained by the registrar under section 81 and shall inform the company. If the cause is shown to the Registrar shall record a note to that effect in the register of charges and shall inform the company accordingly.

However the aforesaid notice shall not be sent, in case intimation to the registrar is in specified form and is signed by the holder of charge. [Proviso to Section 82(2)]

Question 4. State the procedure to be followed by a for company for registration of charge.

Answer:

If a company has passed special resolutions under Section 180(2) authorising its Board of directors to borrow funds for the requirements of the company and under Section 180(1)(a), authorising its Board of directors to create charge on the assets and properties of the company to provide security for repayment of the borrowings in favour of the financial institutions/banks or lenders and in exercise of that authority has signed the loan documents and now proposes to have the charge, created it should follow the procedure detailed below:

- Where the special resolution as required under Section 180 is passed, Form MGT-14 of the Companies (Management and Administration) Rules, 2014 is to be filed with the Registrar.

- According to Section 77, every company creating any charge created within or outside India on property or assets or any of the company’s undertakings whether tangible or otherwise, situated in or outside India shall have to be registered. For the purpose of creating/ modifying a charge file particulars of the charge with the concerned Registrar of Companies within thirty days of creating the Form No. CHG-1 (for other than Debentures) or Form No. CHG-9 (for debentures including rectification), as the case may be.

- Attach the following documents with e-Form No. CHG-9/CHG-1:

- A certified true copy of every instrument evidencing any creation or modification of charge;

- In case of joint charge and consortium finance, particulars of other charge holders;

- Instrument(s) evidencing creation or modification of charge in case of acquisition of property which is already subject to charge together with the instrument evidencing such acquisitions.

- Payment of fees can be made online in accordance with Annexure ‘B’ of. Companies (Registration offices and fees) Rules, 2014. Electronic payments through internet can be made either by credit card or by internet banking facility.

- If the particulars of charge cannot be filed within thirty days due to unavoidable reasons, then it may be filed within three hundred days of such creation after payment of such additional fee as prescribed under Annexure ‘B’ of Companies (Registration offices and fees) Rules, 2014.

- Such application for delay to the Registrar shall be made in Form No. CHG-1 and supported by a declaration from the company signed by its secretary or director that such belated filing shall not adversely affect rights of any other intervening creditors of the company.

- Where a charge is registered Registrar will issue a certificate of registration of such charge in Form No. CHG-2. Where the particulars of modification of charge are registered the Registrar shall issue a certificate of modification of charge in Form No. CHG-3.

- A company shall within a period of thirty days from the date of the payment or satisfaction in full of any charge registered, give intimation of the same to the Registrar in Form No. CHG-4 along with the fee as prescribed under Annexure ‘B’ of Companies (Registration Offices and Fees) Rules, 2014.

- Where the Registrar enters a memorandum of satisfaction of charge in full, obtain a certificate of registration of satisfaction of charge in Form No. CHG-5.

- Incorporate changes in relation to creation, modification and satisfaction of charge in the register of charges maintained by the company in Form No. CHG.7 and enter therein particulars of all the charges registered with the Registrar on any of the property, assets or undertaking of the company and the particulars of any property acquired subject to a charge as well as particulars of any modification of a charge and satisfaction of charge. Such register is to be kept at the registered office of the company.

- All the entries in the register shall be authenticated by a director or the secretary of the company or any other person authorised by the Board for the purpose.

- The register of charges shall be preserved permanently and the instrument creating a charge or modification thereon shall be preserved for a period of eight years from the date of satisfaction of charge by .he company.

- Where the satisfaction of the charge is not filed with the Registrar within thirty days from the date on such payment of satisfaction, an application for condonation of delay shall be filed with the Central Government in Form No. CHG-8 along with the fee as prescribed under Annexure ‘B’ of Companies (Registration Offices and Fees) Rules, 2014.

- Where the instrument creating or modifying a charge is not filed with the Registrar within a period of three hundred days from the date of its creation (including acquisition of a property subject to a charge) or modification an application for condonation of delay shall be filed with the Central Government in Form No. CHG-8 along with the fee as prescribed under Annexure ‘B’ of Companies (Registration Offices and Fees) Rules, 2014.

- The order passed by the Central Government shall be required to be filed with the Registrar in Form No. INC.28 along with the fee as per the conditions stipulated in the said order.

- For all other matters other than condonation of delay, application shall be made to the Central Government in Form No. CHG-8 along with the fee.

Charges In Company Law

Question 5. Draft resolution for creating a charge on the company’s assets and properties.

Answer:

Resolution under Section 180(1)(a) for creating charge on company’s assets and properties

- To consider and, if thought fit, to pass with or without modification(s), the following as Special Resolution;

- “Resolved that consent of the Company be and is hereby accorded in terms of Section 180(1) (a) and other applicable provisions, if any, of the Companies Act, 2013 or any modification or re-enactment thereof, to mortgaging and/or charging by the Board of directors of the Company by way of equitable and/or legal mortgage on such immovable and movable properties of the Company, both present and future, together with power to takeover the assets of the Company in certain events, to or in favour of Industrial Development Bank of India (IDBI).

- The Industrial Finance Corporation of India Ltd. (IFCI) by way of first pari passu Charge to secure the Rupee Term Loans of 1000.00 lacs and 880.00 lacs respectively granted to the Company together with interest at the agreed rate(s), liquidated damages, front end fees, premia on pre payment, costs, charges, expenses and all other moneys payable by the Company under the Loan Agreements, Deeds of Hypothecation and other documents executed/to be executed by the Company in respect of the Term Loans of IDBI and IFCI.

- Resolved further that the Board of directors be and is hereby authorised and shall always be deemed to have been authorised to finalise with IDBI and IFCI the documents for creating the aforesaid mortgage and/ or charge and to do all acts, deeds and things as may be necessary for giving effect to the above resolution.”

- To consider and, if thought fit, to pass with or without modification(s), the following as Special Resolution;

- “Resolved that consent of the Company be and is hereby accorded in terms of Section 180(1)(a) and other applicable provisions, if any, of the Companies Act, 2013 or any modification or re-enactment thereof, to mortgaging and/or charging by the Board of directors of the Company by way of equitable and/or legal mortgage on such immovable and movable properties of the Company, both present and future, in favour of State Bank of India.

- New Delhi the Company’s Bankers by way of Second Charge to secure the various fund based/non-fund based credit facilities granted/to be granted to the Company and the interest at the agreed rate, costs, charges, expenses and all other moneys payable by the Company under the Deed(s) of Hypothecation and other documents executed/to be executed by the Company in respect of credit facilities of State Bank of India, in such form and manner as may be acceptable to State Bank of India.

- Resolved further that the Board of directors be and is hereby authorised and shall always be deemed to have been authorised to finalise with State Bank of India the documents for creating the aforesaid mortgage and/or charge and to do all acts, deeds and things as may be necessary for giving effect to the above resolution.”