Debt Capital

Borrowing

All companies are given the power to borrow by their articles which fix the maximum limit of borrowings.

Power to borrow

The power to borrow monies and to issue debentures (whether in or outside India) can only be exercised by the Directors at a duly convened meeting.

Ultra vires borrowings

Where the company borrows without the authority conferred on it by the Articles or beyond the amount set out in the Articles, it is an ultra vires borrowing and hence void.

Ultra vires borrowings cannot even be ratified by a resolution passed by the company in a general meeting. In case of ultra vires borrowings the lender has the following remedies: (a) Injunction and Recovery, (b) Subrogation, (c) Suit against Directors.

Debenture

A debenture is a document given by a company under its seal as evidence of a debt to the holder usually arising out of a loan and most commonly secured by a charge.

Amendment made by Companies (Amendment) Act, 2017

In Section 2 in clause (30), the following proviso shall be inserted, namely: “Provided that-

- the instruments referred to in Chapter III-D of the Reserve Bank of India Act, 1934; and

- such other instrument, as may be prescribed by the Central Government in consultation with Reserve Bank of India, issued by a company, shall not be treated as debenture.”

Kinds of debentures

Debentures may be of different kinds, viz. redeemable debentures, registered and bearer debentures, secured and unsecured or naked debentures, and convertible debentures.

Debenture stock

A debenture stock is a borrowed capital consolidated into one mass for the sake of convenience.

Debenture Redemption Reserve

Section 71(4) of the Act requires every company to create a debenture redemption reserve account to which an adequate amount shall be credited out of its profits available for payment of dividends until such debentures are redeemed and shall utilize the same exclusively for the redemption of a particular set or series of debentures only.

Appointment of Debenture Trustees

Section 71(5) read with Rule 18(2) of aforesaid rules, provide that a company before making an issue of a prospectus or an offer or inviting the public or members to more than 500 persons, shall appoint one or more debenture trustees. The names of the debenture trustees shall be stated in the letter of offer inviting subscription for debentures and also in all the subsequent notices or other communications sent to the debenture holders. Before the appointment of a debenture trustee or trustees, written consent shall be obtained from such debenture trustee.

Duties of Debenture Trustees

Section 71(6) read with Rule 18(3) of aforesaid rules provides that a debenture trustee shall take steps to protect the interests of the debenture holders and redress their grievances.

It shall be the duty of every debenture trustee to

- satisfy himself that the letter of offer does not contain any matter which is inconsistent with the terms of the issue of debentures or with the trust deed;

- satisfy himself that the covenants in the trust deed are not prejudicial to the interest of the debenture holders;

- call for periodical status or performance reports from the company;

- inform the debenture holders immediately of any breach of the terms of the issue of debentures or covenants of the trust deed;

- ensure the implementation of the conditions regarding the creation of security for the debentures, if any, and debenture redemption reserve;

Debenture trust deed

A debenture trust deed is a document created by the company, whereby debenture trustees are appointed to protect the interest of Debenture holders before they are offered for public subscription.

Company

The company may accept deposits from its members by passing a resolution in a general meeting and subject to conditions as may be prescribed in the Rules including Credit rating, Deposit insurance,, etc.

Cs Executive Company Law Notes

Eligible company

Eligible company public company may accept deposits, if it has a net worth of not less than 100 crores or a turnover of not less than 500 crore and has obtained the prior consent of the company in a general meeting using a special resolution and also filed the said resolution with the Registrar of Companies and where applicable, with the Reserve Bank of India before making any invitation to the Public for acceptance of Deposits.

Deposit trustees

No company under sub-section (2) of section 73 or any eligible company shall issue a circular or advertisement inviting secured deposits unless the company has appointed one or more deposit trustees to create security for the deposits.

Deposit insurance

Amendment made by companies (Amendment) Act, 2017 Contract providing for deposit insurance at least thirty days before the issue of circular or advertisement.

In Section 73 of the principal Act, in sub-Section (2),-clause (d) shall be omitted;

Foreign investment

Repatriation Capital flows from a foreign country to the country of origin. This usually refers to returning returns on foreign investment in the case of a corporation or transferring foreign earnings home in the case of an individual.

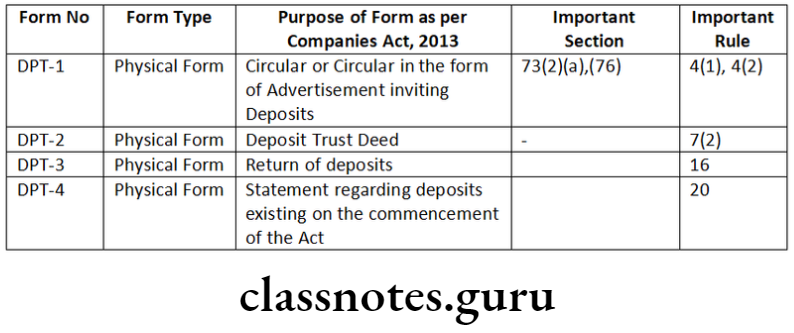

List of Important Forms

Debt Capital Distinguish Between

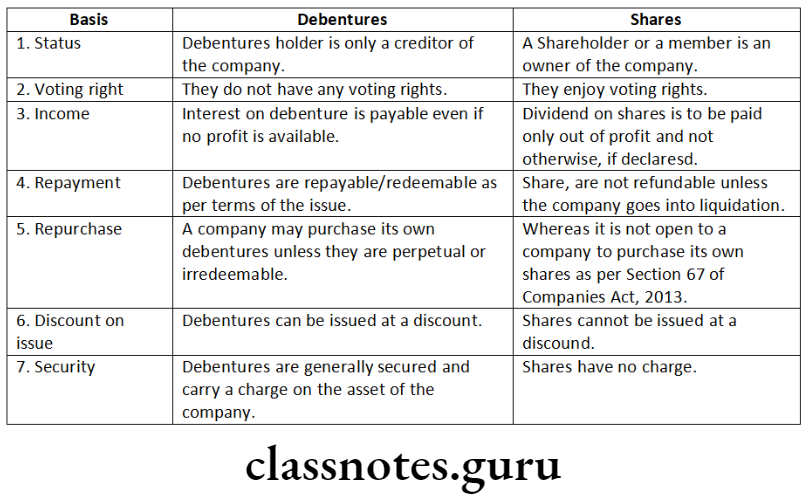

Question 1. Distinguish between the following:

‘Debentures’ and ‘shares’.

Answer:

Debt Capital Descriptive Questions

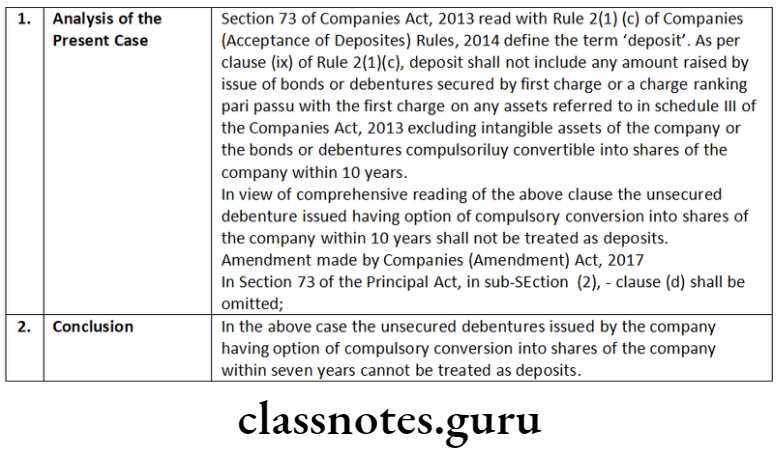

Question 1. Comment on the following:

Issue of unsecured debentures by a company to another company, where the debentures have an option for compulsory conversion into equity shares within seven years, cannot be termed as deposits.

Answer:

Cs Executive Company Law Chapter 4 Summary

Question 2. Define the term ‘deposits’ and list the receipts of money that are not considered deposits.

Answer:

As per Section 2(31) of the Companies Act, 2013 “deposit” includes any receipt of money by way of deposit or loan or in any other form by a company, but does not include such categories of amount as may be prescribed in consultation with the Reserve Bank of India.

“Deposit” includes any receipt of money by way of deposit or loan or in any other form, by a company, but does not include:

- Any amount received from the Central Government or a State Government, any amount received from any other source whose repayment is guaranteed by the Central Government or a State Government any amount received from a local authority, or any amount received from a statutory authority constituted under an Act of Parliament or a State Legislature;

- Any amount received from foreign governments, foreign or international banks, multilateral financial institutions (including, but not limited to, International Finance Corporation, Asian Development Bank, Commonwealth Development Corporation, and International Bank for Industrial and Financial Reconstruction), foreign governments development financial institutions, foreign export credit agencies, foreign collaborators, foreign bodies corporate and foreign citizens, foreign authorities or persons resident outside India subject to the provisions of Foreign Exchange Management Act, 1999 and rules and regulations made there under;

- Any amount received as a loan or facility from any banking company or the State Bank of India or any of its subsidiary banks or from a banking institution notified by the Central Government under Section 51 of the Banking Regulation Act, 1949, or a corresponding new bank as defined in clause (d) of Section 2 of the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1970, or in clause (b) of Section (2) of the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1980 or from a co-operative bank as defined in clause (b-ii) of Section 2 of the Reserve Bank of India Act, 1934;

- Any amount received as a loan or financial assistance from Public Financial Institutions notified by the Central Government on this behalf in consultation with the Reserve Bank of India, or any regional financial institutions or Insurance Companies or Scheduled Banks as defined in the Reserve Bank of India Act, 1934;

- Any amount received against the issue of commercial paper or any other instruments issued by the guidelines or notification issued by the Reserve Bank of India;

- Any amount received by a company from any other company; (vii) any amount received and held under an offer made by the provisions of the Act towards a subscription to any securities, including share application money or advance towards allotment of securities pending allotment, so long as such amount is appropriated only against the amount due on allotment of the securities applied for.

- Any amount received from a person who, at the time of the receipt of the amount, was a director of the company. The director from whom money is received, furnishes to the company at the time of giving the money, a declaration in writing to the effect that the amount is not being given out of funds acquired by him by borrowing or accepting loans or deposits from others;

- Any amount raised by the issue of bonds or debentures secured by a first charge or a charge ranking pari passu with the first charge on any assets referred to in Schedule III of the Act excluding intangible assets of the company or bonds or debentures compulsorily convertible into shares of the company within ten years. If such bonds or debentures are secured by the charge of any assets referred to in Schedule Ill of the Act excluding intangible assets, the amount of such bonds or debentures shall not exceed the market value of such assets as assessed by a registered valuer;

- Any amount received from an employee not exceeding his annual salary, under a contract of employment with the company like non-interest-bearing security deposit;

- Any non-interest-bearing amount received or held in trust;

- Any amount received in the course of or for the business of the company:

- As an advance for the supply of goods or provision of services provided that such advance is appropriated against the supply of goods or provision of services within a period of three hundred and sixty-five days from acceptance of such advance. In case of any advance which is the subject matter of any legal proceedings before any Court of law, the said time limit of three hundred and sixty-five days shall not apply.

- As advance, accounted for in any manner whatsoever, received in connection with consideration for an immovable property under an agreement or arrangement, provided that such advance is adjusted against the property, by the terms of agreement or arrangement.

- As a security deposit for the performance of the contract for the supply of goods or provision of services.

- As advance received under long-term projects for supply of capital goods except those covered under item (b) above. if the amount received under (a), (b) and (d) above becomes refundable (with or without interest) because the company accepting the money does not have the necessary permission or approval to deal in the goods properties, or services for which the money is taken, the amount received shall be deemed to be a Deposit under these rules.

- Any amount brought in by the promoters of the company by way of an unsecured loan in pursuance of the stipulation of any lending financial institution or a bank subject to fulfillment of the following conditions:

- The loan is brought in pursuance of the stipulation imposed by the lending institutions on the promoters to contribute such finance; and

- The loan is provided by the promoters themselves by their relatives or by both and

- The exemption under this sub-clause shall be available only till the loans of financial institutions or banks are repaid and not thereafter.

- Any amount accepted by a Nidhi Company by the rules made under Section 406 of the Act.

Cs Company Law Important Questions

Question 3. Comment on the following:

A private company incorporated under the Companies Act, 2013 may issue debentures to any number of persons and can accept deposits from the public.

Answer:

- According to the definition of a private company under Section 2(68), a private limited company may not make an invitation to the public to subscribe to any securities of the company. However, under Section 42 read with Section 2(68), it may issue such security to any person (number of persons not exceeding 200).

- In terms of provisions of Section 73(2) read with Exemption Notification dated 5th June 2015, a private company may accept from its members monies not exceeding one hundred percent of the aggregate of the paid-up share capital and free reserves, subject to the passing of a resolution in general meeting and subject to such rules as may be prescribed in consultation with the Reserve Bank of India, accept deposits from its members on such terms and conditions, as may be agreed upon between the company and its members, subject to the fulfillment of certain conditions, as provided under the Act. -Space to write important points for revision

Question 4. Comment on the following:

A private limited company can accept deposits from its members under the provisions of the Companies Act, 2013.

Answer:

A private limited company can accept deposits from its members by Section 73 of the Companies Act, 2013 and the rules made thereunder. Moreover, the Government has exempted the private companies vide notification dated 13th June 2017, from applicability of Section 73(1)(a) to (e).

Accordingly, a private company may accept deposits from its members:

- not exceeding one hundred percent of the aggregate of the paid-up share capital, free reserves, and securities premium account; or

- is a start-up, for five years from the date of its incorporation; or

- if it full all of the following conditions, namely:

- is not an associate or a subsidiary company of any other company;

- if the borrowings of such a company from banks or financial institutions or any body corporate is less than twice its paid-up share capital or fifty crore rupees, whichever is lower; and

- such a company has not defaulted in the repayment of such borrowings subsisting at the time of accepting deposits under this section:

Provided that the company referred to in clause (A), (B), or (C) shall file the details of monies accepted to the Registrar in such manner as may be specified.

Question 5. Comment on the following:

A public company may issue secured irredeemable debentures.

Answer:

- A Debenture, in which no time is fixed for the company to pay back the money, is an irredeemable debenture.

- As per Rule 18(1)(a) Companies (Share Capital and Debentures) Rules, 2014 an issue of secured debenture may be made for a period of redemption not exceeding ten years from the date of issue. In the case of certain companies such redemption period may exceed ten years but not exceed thirty years.

- After the commencement of the Companies Act, 2013, no company either public or private can issue perpetual or irredeemable debentures.

A private company and a banking company can freely accept deposits.

Answer:

Rule 1(3) of the Companies (Acceptance of Deposits) Rule, 2014 made under Sections 73 and 76 of the Companies Act, 2013 provides that the Companies (Acceptance of Deposits) Rule, 2014 shall apply to a company other than

- a banking company;

- a non-banking financial company as defined in the Reserve Bank of India Act, 1934 registered with the Reserve Bank of India;

- a housing finance company registered with the National Housing Bank established under the National Housing Bank Act, 1987; and

- a company specified by the Central Government under the proviso to sub-Section (1) of Section 73 of the Act.

Accordingly, the Companies (Acceptance of Deposits) Rules 2014 does not apply to banking companies. Hence, a banking company can freely accept deposits.

A private company is allowed to accept deposits from its members subject to fulfillment of conditions provided under Section 73(2)(a) to (e) of the Companies Act, 2013.

However, the Ministry of Corporate Affairs vide the notification dated 13th June 2017 provides that Section 73(2)(a) to (e) shall not apply to the following classes of private companies.

- which accepts from its member’s monies not exceeding one hundred percent of the aggregate of the paid-up share capital, free reserves, and securities premium account; or

- which is a start-up, for five years from the date of its incorporation; or

- which fulfills all of the following conditions, namely:-

- which is not an associate or a subsidiary company of any other company;

- if the borrowings of such a company from banks or financial institutions or anybody corporate is less than twice its paid-up share capital or fifty crore rupees, whichever is lower; and

- such a company has not defaulted in the repayment of such borrowings subsisting at the time of accepting deposits under this section:

The company referred to in clauses (A), (B), or (C) shall file the details of monies accepted to the Registrar in Form DPT-3.

Company Law Cs Executive Study Material

Question 6. Concerning the provisions of the Companies Act, 2013 and the rules framed there under, state the disqualifications for a Debenture Trustee. Explain whether the following persons can be appointed as Debenture Trustees.

- A relative of the whole-time director of the company.

- A shareholder who has no beneficial interest.

Answer:

Section 71 of the Companies Act 2013, read along with rule 18(2) of the Companies (Share Capital and Debentures) Rules, 2014 provides that a person shall not be appointed as a debenture trustee if he

- beneficially holds shares in the company;

- is a promoter, director, or key managerial personnel or any other officer or an employee of the company or its holding, subsidiary, or associated company;

- is beneficially entitled to money which is to be paid by the company otherwise than as remuneration payable to the debenture trustee;

- is indebted to the company, or its subsidiary its holding or associated company, or a subsidiary of such holding company;

- has furnished any guarantee in respect of the principal debts secured by the debentures or interest thereon;

- has any pecuniary relationship with the company amounting to two percent or more of its gross turnover or total income or fifty lakh rupees or such higher amount as may be prescribed, whichever is lower, during the two immediately preceding financial years or the current financial year;

- is relative to any promoter or any person who is employed by the company as a director or key managerial personnel.

Accordingly, the explanations to the questions would be as under:

- A relative of the whole-time director of the company (KMP) cannot be appointed as a debenture trustee.

- A shareholder who has no beneficial interest can be appointed as a debenture trustee.

Question 7. What are the disqualifications for debenture trustees?

Answer:

Rule 18 of the Companies (Share Capital & Debentures) Rules, 2014, provides that the disqualifications for debenture trustees are as under:

- Beneficially holds shares in the company;

- Is a promoter, director or key managerial personnel or any other officer or an employee of the company or its holding, subsidiary, or associate company;

- Is beneficially entitled to money which is to be paid by the company otherwise than as remuneration payable to the debenture trustee;

- Is indebted to the company, or its subsidiary its holding or associate company, or a subsidiary of such holding company;

- Has furnished any guarantee in respect of the principal debts secured by the debentures or interest thereon;

- Has any pecuniary relationship with the company amounting to 2% or more of its gross turnover or total income or fifty lakh rupees or such higher amount as may be prescribed, whichever is lower, during the two immediately preceding financial years or the current financial year;

- Is relative of any promoter or any person who is in the employment by the company, as a director, or as a key managerial personnel. Space to write important points for revision-

Question 8. Comment on the following:

A private limited company incorporated under the Companies Act, 2013, may issue debentures to any number of persons and can accept deposits from the public.

Answer:

Definition of Private Company and Securities:

A private company has been defined under Section 2(68) of the Companies Act, 2013, as a private limited company that is prohibited from making an invitation to the public to subscribe to any securities of the company.

‘Securities’ has been defined under Section 2(81) of the Companies Act, 2013 to mean the securities as defined in Section 2(h) of the Securities Contracts (Regulation) Act, 1956. As per Section 2(h) of the Securities Contracts (Regulation) Act, 1956, “Securities” include debentures, debenture stock, or other marketable securities of a like nature.

However, under Section 42 of the Companies Act, 2013, a Private Company may issue such securities on a private placement basis only to a selected group of persons who have been identified by the Board of Directors, and whose number shall not exceed 200 (two hundred) in the aggregate in a financial year excluding the qualified institutional buyers (IB) and employees of the company being offered securities under a scheme of employees stock options subject to prescribed conditions.

Further, as per Sections 73 and 76 of the Companies Act, 2013, only the. following may invite, accept, or renew public deposits from the public:

- a banking company

- non-banking financial company (NBFC) as defined in the Reserve Bank of India Act, 1934

- to such other company as the Central Government may, after consultation with the Reserve Bank of India (RBI), specify on this behalf,

- Public company (Eligible Company) having a Net worth not less than * 100 Crores or a Turnover not less than 500 Crores and which has obtained the prior consent of the company in a general meeting using a resolution and also filed the said resolution with the Registrar of Companies (ROC) before making any invitation to the Public for acceptance of deposits.

So, a Private Company cannot accept deposits from the public. -Space to write important points for revision

Debt Capital Practical Questions

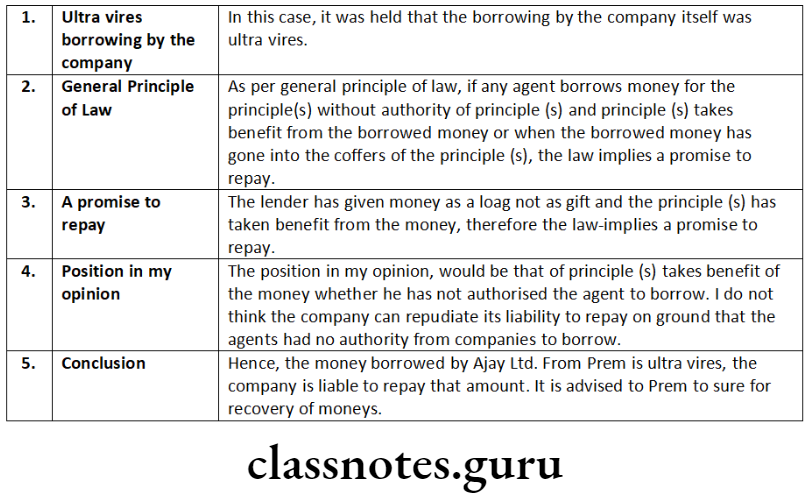

Question 1. Ajay Ltd. borrowed 100 crore from Prem, without the authority conferred on it by the articles of association. Later, the money borrowed by Ajay Ltd. was used by its Board of directors to pay off lawful debts of the company. In this scenario, Prem, the lender seeks your advice for the recovery of his money. Advise him.

Answer:

Cs Executive Company Law Chapter Wise Notes

Question 2. The balance sheet of Duck Ltd. shows a paid-up capital of 5 crore and free reserves of 2 crore. Due to the heavy financial requirements of the company, it plans to apply for a loan of 8 crore with XYZ Bank Ltd. Advise the company on the formalities required to be fulfilled. Also advise on the alternative course of action, if any.

Answer:

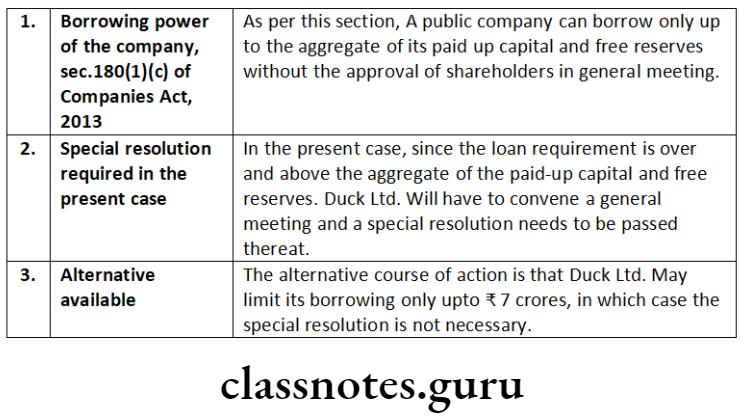

Question 3. Sun-beam Ltd. failed to pay interest on repayment of deposits. One depositor approached the consumer forum with the request to issue an order against the company for payment of interest on deposits. The company contended that the consumer forum was not a proper authority to issue such directions. Advise the company suitably.

Answer:

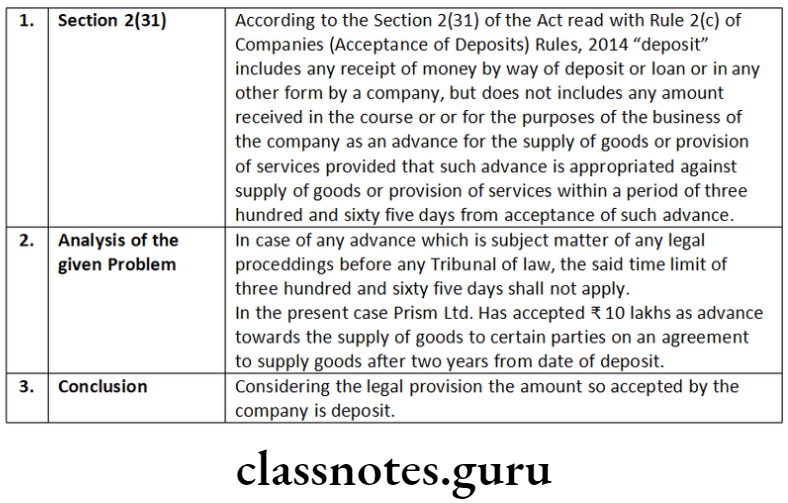

Question 4. Prism Ltd. has accepted 10 lakh as an advance towards the supply of goods to certain parties. As per the agreement, the company will supply the goods after two years from the date of deposit. Later on, internal auditors qualified their report on the ground that the company had violated the provisions of the Companies Act, 2013.

Directors explained that this is required to complete the order. Examining the relevant provisions of the Companies Act, 2013 state whether the explanation given by the directors is justified.

Answer:

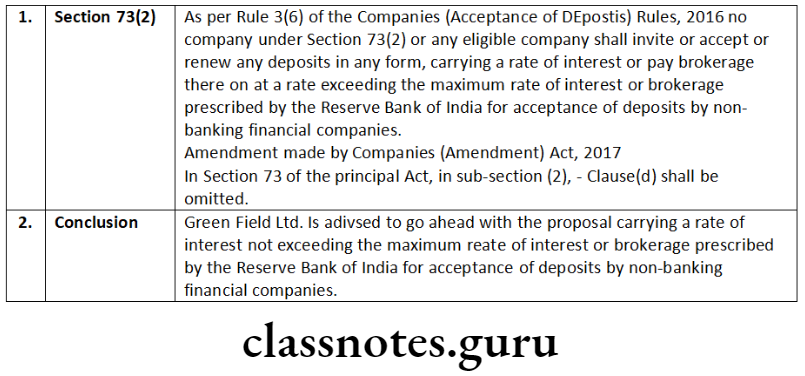

Question 5. The Board of Directors of Green Field Ltd. decides to accept deposits from the public at a compound interest rate of 12% per annum. Examining the provisions of the Companies Act, 2013, advise whether the Board can go ahead with its proposal.

Answer:

Cs Executive Company Law Previous Year Questions

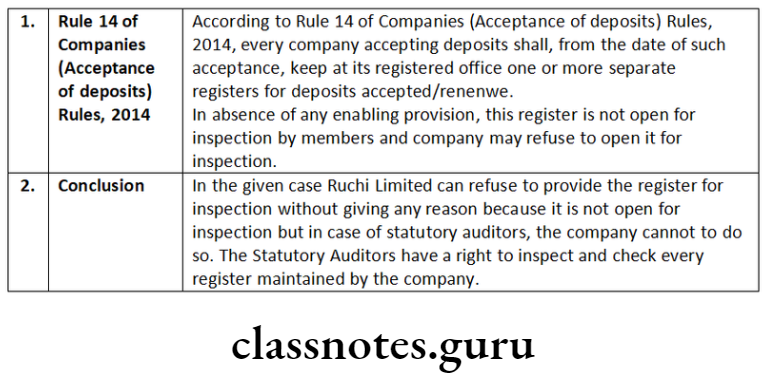

Question 6. Suresh, a member of Ruchi Ltd., wants to inspect the register of deposits maintained by the company as required under the provisions of the Companies Act, 2013. The company refused to provide the register for inspection without assigning any reason. Referring to the provisions of the Act, examine the validity of the company’s refusal. What shall be your answer if the same Register is demanded by the statutory auditors of the company for inspection and audit?

Answer:

Question 7. A company has taken a term loan from a financial institution and is regularly paying the loan installments and interest. The financial institution proposes to convert 20% of the loan into equity shares of the company as per the terms of the agreement. Advise the company, whether the financial institution can enforce such a convertibility clause. Also, examine the validity of such a clause.

Answer:

Section 62(3) states the provisions of Section 62 shall not apply to the increase of the subscribed capital of the company caused by the exercise of an option as a term attached to the debentures issued or loan raised by the companies to convert such debentures/loan into the shares in the company. Further, the terms of the issue of such debentures or loans containing such an option should have been approved before the issue of such debentures or raising of loans by a special resolution passed by the company in the General Meeting.

Thus, in the given case, if the raising of a loan is already approved by the shareholders by special resolution, then the financial institution can enforce the convertibility.

Question 8. KAJ Ltd., a company incorporated under the Companies Act, 2013 wants to go for the issue of secured debentures. Referring to relevant provisions and Rules, state the conditions to be satisfied before the company goes for such issue of debentures. Will your answer be different in case such an issue of debentures is by a Government company where the Central Government has given a guarantee?

Answer:

Section 71(2) states that no company shall issue any debentures carrying any voting rights. Secured Debentures to comply with terms and conditions prescribed Section 71(3) states that Secured Debentures may be issued by a company subject to such terms and conditions as may be prescribed. Rule 18(1) of Companies (Share Capital and Debentures) Rules, 2014, prescribes the following conditions;

The company shall not issue secured debentures, unless it complies with the following conditions, namely:

- An issue of secured debentures may be made, provided the date of its redemption shall not exceed ten years from the date of issue. A company engaged in the setting up of infrastructure projects may issue secured debentures for a period exceeding ten years but not exceeding thirty years;

- such an issue of debentures shall be secured by the creation of a charge, on the properties or assets of the company, having a value that is sufficient for the due repayment of the amount of debentures and interest thereon;

- the company shall appoint a debenture trustee before the issue of prospectus or letter of offer for subscription of its debentures and not later than sixty days after the allotment of the debentures, execute a debenture trust deed to protect the interest of the debenture holders; and

- the security for the debentures by way of a charge or mortgage shall be treated in favor of the debenture trustee on-

- any specific movable property of the company (not being like the pledge); or

- any specific immovable property wherever situated, or any interest therein.

In the case of a non-banking financial company, the charge or mortgage may be created on any movable property. Further in case of any issue of debentures by a Government company that is fully secured by the guarantee given by the Central Government or one or more State Governments or by both, there is no requirement for the creation of a charge under this sub-rule.

In case of any loan taken by a subsidiary company from any bank or financial institution, the charge or mortgage may also be created on the properties or assets of the holding company.

Cs Executive Company Law Notes

Question 9. Fun and Frolic Ltd. has received 5 lakh from its Promoters as unsecured Joan in pursuance of the stipulation of credit facilities from the Bank. Can the company accept the unsecured loan? What would be your answer if the company has repaid in full its amount of credit facilities and after such repayment, the company continues this unsecured loan? Referring to the provisions of the Companies Act, 2013 advise the company.

Answer:

According to Rule 2 of the Companies (Acceptance of Deposit) Rules, 2014 any amount brought in by the promoters of the company by way of an unsecured loan in pursuance of the stipulation of any lending financial institution or a bank, shall not be treated as deposit, subject to fulfillment of the following conditions, namely:

- the loan is brought in pursuance of the stipulation imposed by the lending institutions on the promoters to contribute such finance;

- the loan is provided by the promoters themselves by their relatives or by both; and

- the exemption under this sub-clause shall be available only till the loans of financial institution or bank are repaid and not thereafter;

Accordingly, in the case of Fun and Frolic Ltd., 5 Lakhs may be accepted from the Promoters, as the same is in pursuance of the stipulation of credit from the bank. Once the credit facilities are paid in entirety and the company continues to retain the unsecured loan, it shall be treated as a deposit under the Companies Act, 2013.

Question 10. IOL, a manufacturing company, issued partly convertible debentures with 36 crores a few years back. The convertible option is only for 50% of the issue and debentures are redeemable in the current financial year. What is the quantum of Debenture Redemption Reserve (DDR) required to be created by the company now and how much should be deposited or invested by the company?

Answer:

- Section 71(4) of the Companies Act, 2013, read with Rule 18(7) of the Companies (Share Capital & Debentures) Rules, 2014 provides for the creation of a Debenture Redemption Reserve (DRR) out of the profits of the company available for payment of dividend. The amount credited to such account shall not be utilized by the company except for the redemption of debentures.

- The provisions for the creation of DRR for manufacturing companies are 25% of the value of outstanding debentures issued through the public issue as per present SEBI (Issue and Listing of Debt Securities) Regulations, 2008, and also 25% DRR is required in the case of privately placed debentures by listed companies. For unlisted companies issuing debentures on a private placement basis, the DRR will be 25% of the value of outstanding debentures.

- Every company required to create a Debenture Redemption Reserve shall on or before the 30th day of April in each year, be required to invest or deposit a sum that shall not be less than 15% of the amount of debentures maturing during the current financial year ending 31st March of next year.

- In case of partly convertible debentures, a Debenture Redemption Reserve shall be created in respect of non- convertible portion of the debenture issue by this rule.

- Since, only 50% of the debentures are convertible, for the non-convertible part the DRR is required to be created. Thus, only 3 crores worth of debentures DRR is required. Hence, 25% of 3 crores is 75 lakhs to be created as DRR and 45 Lakhs (15%) deposited in the invested bank account or securities, etc. during the current financial year.

Question 11. Arup entered into a transaction with Brilliant Merchandise Ltd. for a contract worth 51 lakh. The Articles of Association of the company stipulate that a contract above 25 lakh should be approved by a meeting of the Board of Directors.

Anjaan, Deputy General Manager (Commercial) produces a forged document which shows a resolution approving the contract having been passed in a Board Meeting. Later, the forgery is discovered. Arup pleads that his contract with the company is protected by the Doctrine of Indoor Management. Will Arup succeed?

Answer:

The doctrine of Constructive Notice protects a company from outsiders. The doctrine provides that an outsider must read the Memorandum and Articles of the Company and satisfy himself that the contract he is seeking to enter into with the company is within its powers.

As far as internal procedures are concerned, an outsider is entitled to presume that everything has been done according to the procedures laid down and there is no irregularity. An outsider cannot find out what is going on inside the doors as the doors of management are closed. This is called the doctrine of Indoor Management [also known as the rule in Royal British Bank v. Turquand (1856) CI & B 327].

However, in certain exceptional situations, the doctrine of indoor management is not applicable and one of them is when a person relies on a forged document. Nothing can validate forgery. A company cannot be held liable for forgery committed by its officers. This has been established in the case Ruben v. Great Fingall Consolidated case [1906] 1 AC 439.

In the above case, Arup has relied on a forged document. Therefore he will not be protected and he will not succeed in his pleading.

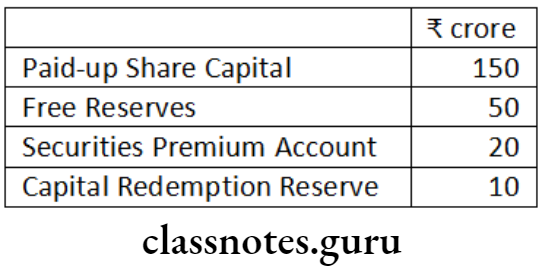

Question 12. The following information as per the latest balance sheet figures as of 31 March 2019 is made available to you:

The company has not accepted any deposits as of now. The Board of Directors wants to know what is the maximum amount it can accept by way of deposits from (1) members and (2) the public. Advise them.

Answer:

As per Rule 3(4) of the Companies (Acceptance of Deposits) Rules, 2014, no eligible company can accept or renew-

- any deposit from its members, if the amount of such deposit together with the number of deposits outstanding as on the date of acceptance or renewal of such deposits from members exceeds 10% of the aggregate of the paid-up share capital, free reserves, and securities premium account of the company.

- any other deposit, if the amount of such deposit together with the amount of such other deposits, other than the deposit referred to in clause (a), outstanding on the date of acceptance or renewal exceeds 25% of the aggregate of the paid-up share capital, free reserves and securities premium account of the company.

In the above case, as the net worth of the company exceeds 100 crore, the company is assumed to be an eligible company. Further, the aggregate of the paid-up share capital, free reserves, and securities premium account is 220 crores and the company has not accepted any deposits as of now. Accordingly, from the members, the eligible company can accept upto 10% of 220 crores i.e. 22 crores. From the public, it can accept upto 25% of 220 crores i.e. 55 crores.

Cs Executive Company Law Chapter 4 Summary

Question 13. ABC Products Ltd. has taken a term loan of * 5 crores from the bank and has given the properties situated in the Maldives as prime security of the loan. Can the company give the properties situated outside India for security of loan? Referring to the provisions of the Companies Act, 2013, discuss.

Answer:

The Companies Act, 2013 does not limit a company to give any property situated in India or outside India. An inference can be drawn from Section 77(1) of the Companies Act, 2013, which permits the registration of charges created on a property situated in or outside India.

Section 77(1) of the Companies Act, 2013, provides that it shall be the duty of every company creating a charge within or outside India, on its property or assets or any of its undertakings, whether tangible or otherwise, and situated in or outside India, to register the particulars of the charge signed by the company and the charge-holder together with the instruments, if any, creating/modifying such charge in Form CHG-1/CHG-9, as the case may be, and is required to be filed with the Registrar of Companies (ROC) within 30 days of the date of creation or modification of charge along with the specified fees.

Hence, ABC Products Ltd. can give the properties situated in the Maldives for the security of a term loan.

Debt Capital Short Notes

Question 1. Write a short note on the following:

- Ultra virus borrowing

- Intra virus borrowing

- Debenture stock

Answer:

- Where a company borrows without the authority conferred on it by the articles or beyond the amount set out in the Articles, it is an ultra vires borrowing. Any act which is ultra vires the company is void. In such a case the contract is void and the lender cannot sue the company for the return of the loan. The securities given for such ultra-vires borrowing are also void and inoperative.

- Ultra vires borrowings cannot even be ratified by a resolution passed by the company in a general meeting. However, equity assists the lender where the common law fails to do so. If the lender has parted with his money to the company under an ultra vires borrowing, and is, therefore, unable to sue for its return or enforce any security granted to him, he nevertheless has, in equity, the following remedies:

- Injunction and Recovery: Under the equitable doctrine of restitution he can obtain an injunction provided he can trace and identify the money lent, and any property which the company has bought with it. Even if the monies advanced by the lender cannot be traced, the lender can claim repayment if it can be proved that the company has benefited thereby.

- Subrogation: Where the money of an ultra vires borrowing has been used to pay off lawful debts of the company, he would be subrogated to the position of the creditor paid off and to that extent would have the right to recover his loan from the company. Subrogation is allowed for the simple reason that when a lawful debt has been paid off with an ultra vires loan, the total indebtedness of the company remains the same. By subrogating the ultra vires lender, the Court can protect him from loss, while the debt burden of the company is in no way increased.

- Suit against Directors: In the case of ultra vires borrowing, the lender may be able to sue the directors for breach of warranty of authority, especially if the directors deliberately misrepresented their authority.

- A distinction should always be made between a company’s borrowing powers and the authority of the directors to borrow. Where the directors borrowed money beyond their authority and the borrowing is not ultra vires the company, such borrowing is called Intra vires borrowing but outside the Scope of Agents’ Authority.

- The company will be liable to such borrowing if the borrowing is within the directors’ ostensible authority and the lender acted in good faith or if the transaction was ratified by the company.

- Where the borrowing is intra vires the company but outside the authority of the directors e.g. where the articles provide that the directors shall have the power only up to 100 lacs and prior approval of the shareholders would be required to borrow beyond 100 lacs; any borrowing beyond 100 lacs without shareholders approval i.e. intra vires borrowing by the company but outside the authority of directors can be ratified by the company and become binding on the company.

- The company would be liable, particularly if the money has been used for the benefit of the company.

- Here the legal position is quite clear. The company has the power or capacity to borrow, but the authority of the directors is restricted either by the articles of the company or by the statute, and they have exceeded it.

- A company, instead of issuing debentures, each in respect of a separate and distinct debt, may raise one aggregate loan fund or composite stock known as ‘debenture stock’.

- Accordingly, a debenture stock is a borrowed capital consolidated into one mass for the sake of convenience.

- Instead of each lender having a separate bond or mortgage, he has a certificate entitling him to a certain sum being a portion of one large loan.

- It is generally secured by a trust deed. As in the case of shares, a person may subscribe for, or transfer any amount even a fraction amount.

- Debenture stock is the indebtedness itself, and the debenture stock certificate furnishes evidence of the title or interest of the holder in the indebtedness.

- A debenture is a document that furnishes evidence of the debt. Debenture stock must be fully paid, while debenture may or may not be fully paid.

Cs Company Law Important Questions

Debt Capital Descriptive Questions

Question 2. Is it compulsory to maintain a Debenture Redemption Reserve Account? If yes, how?

Answer:

Section 71(4) read Rule 18(7) of aforesaid rules provides that when debentures are issued by a company, the company shall create a debenture redemption reserve account (DRR) out of the profits of the company available for payment of dividends. The amount credited to such account shall not be utilized by the company except for the redemption of debentures.

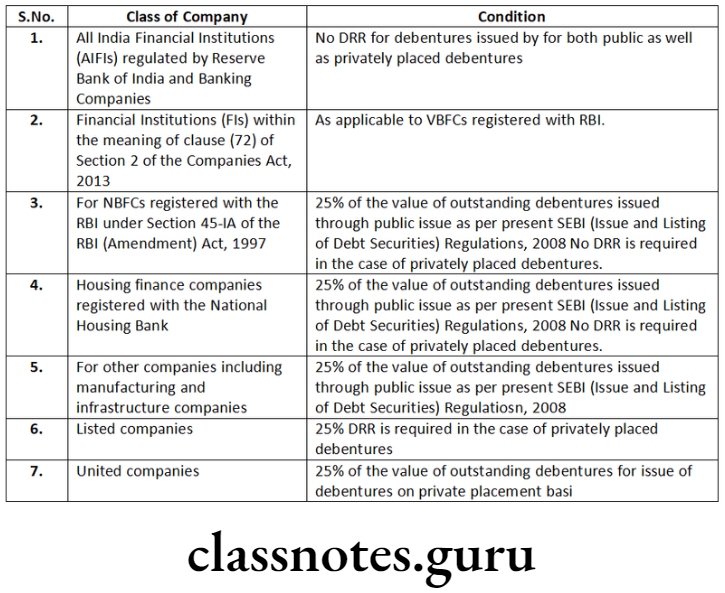

Quantum of Debenture Redemption Reserve

DRR is not required to be created for the convertible part of partly convertible debentures. The provisions for creation of DRR for various classes of companies are as follows:

Every company required to create DRR is required to invest or deposit at least 15% of the debentures maturing during the current financial year ending 31st March of next year.

The company may choose any of the below-given methods:

- in deposits with any scheduled bank, free from any charge or lien;

- in unencumbered securities of the Central Government or of any State Government;

- in unencumbered securities mentioned in sub-clauses (a) to (d) and (ee) of Section 20 of the Indian Trusts Act, 1882;

- in unencumbered bonds issued by any other company which is notified under sub-clause (f) of Section 20 of the Indian Trusts Act, 1882;

- the amount invested or deposited as above shall not be used for any purpose other than for redemption of debentures maturing during the year referred above: The amount remaining invested or deposited, as the case may be, shall not at any time fall below fifteen percent of the amount of the debentures maturing during the year ending on the 31s day of March of that year;

Question 3. What are the duties of debenture trustees?

Answer:

It shall be the duty of every debenture trustee to

- satisfy himself that the letter of offer does not contain any matter which is inconsistent with the terms of the issue of debentures or with the trust deed;

- satisfy himself that the covenants in the trust deed are not prejudicial to the interest of the debenture holders;

- call for periodical status or performance reports from the company;

- communicate promptly to the debenture holders defaults, if any, about payment of interest or redemption of debentures and action taken by the trustee therefor;

- appoint a nominee director on the Board of the company in the event of-

- two consecutive defaults in payment of interest to the debenture holders; or

- default in the creation of security for debentures; or

- default in the redemption of debentures.

- ensure that the company does not commit any breach of the terms of issue of debentures or covenants of the trust deed and take such reasonable steps as may be necessary to remedy any such breach;

- inform the debenture holders immediately of any breach of the terms of the issue of debentures or covenants of the trust deed;

- ensure the implementation of the conditions regarding the creation of security for the debentures, if any, and debenture redemption reserve;

- ensure that the assets of the company issuing debentures and of the guarantors, if any, are sufficient to discharge the interest and principal amount at all times and that such assets are free from any other encumbrances except those which are specifically agreed to by the debenture holders;

- do such acts as are necessary in the event the security becomes enforceable;

- call for reports on the utilization of funds raised by the issue of debentures;

- take steps to convene a meeting of the holders of debentures as and when such meeting is required to be held;

- ensure that the debentures have been converted or redeemed by the terms of the issue of debentures; -Space to write important points for revision

Company Law Cs Executive Study Material

Question 4. What is the procedure for accepting deposits from numbers?

Answer:

The procedure to accept deposits from members can be summarized as under:-

- The companies intending to invite deposits from its members shall convene a Board meeting to consider and Approve the business to propose and accept deposits from members and decide the day, date, time, and place of the general meeting.

- Issue notice of general meeting to the members of the company.

- Hold the general meeting and pass a resolution for acceptance of deposits.

- Comply with the Rules prescribed in consultation with RBI and terms and conditions mutually agreed by the company and deposit holders either for acceptance or for repayment of deposits.

- Issue circular to the members of the company including therein a statement showing the financial position of the company, the credit rating obtained, the total number of depositors, and the amount due towards depositors in respect of any previous deposits and such other particulars as may be prescribed. These details indicate the soundness of the company or a warning about the risks involved. The circular shall be published at least once in the English language in a leading English newspaper and vernacular language in a vernacular newspaper having wide circulation in the State in which the registered office of the company is situated.

- File the copy of the aforesaid circular in Form DPT-1 along with such statement with the Registrar within thirty days before the date of issue of circular.

- In case, a company does not secure the deposits or secures such deposits partially, then, the deposits shall be termed “unsecured deposits” and shall be so quoted in every circular, form, advertisement, or any document related to invitation or acceptance of deposits.

- A company inviting secured deposits shall provide for security by way of a charge on its assets for the due repayment of the amount of deposit and interest thereon. The company shall submit Form CHG-1 with the Registrar for assets other than intangible assets. Secured deposits including interest thereon can in no case exceed the market value of the charged assets assessed by the registered valuer.

- After the expiry of 30 days of filing Form DPT-1, the circular in Form DPT-1 along with the application form is sent to all members by registered post with acknowledgement due/speed post/electronic mail.

- Collect duly signed application forms along with money from the members.

- Issue receipts of deposits within 21 days of the receipts of money/realization of cheque.

- Maintain a register of deposits at its registered office which shall contain the details as prescribed under Rule 14 Companies (Acceptance of Deposits) Rules, 2014 from the date of such acceptance.

- Pay interest as per the rate proposed on agreed terms.

- Deposit such sum which shall not be less than twenty percent of the amount of its deposits maturing during the financial year and the financial year following and keep it in a separate bank account called a deposit repayment reserve account.

- Certification that the Company has not committed any default in the repayment of deposits accepted either before or after the commencement of this Act or payment of interest on such deposits and where a default had occurred, the company made good the default and a period of five years had elapsed since the date of making good the default

- Submit the return of deposits in Form DPT-3 on or before 30th June each year for information as of 31st March of the respective year.