Chapter 1 Introduction

Company

A company is an association of both natural and artificial persons incorporated under the existing law of a country. A company has a separate legal entity from the persons constituting it.

Characteristics of a company

The main characteristics of a company are corporate personality, limited liability, perpetual succession, separate property, transferability of shares, common seal, capacity to sue and be sued, contractual rights, limitation of action, separate management, termination of existence etc.

Cs Executive Company Law Introduction

Compared to other types of business associations

As compared to other types of business associations, an incorporated company has the advantage of corporate personality, limited liability, perpetual succession, transferable shares, separate property, capacity to sue, flexibility and autonomy.

Disadvantages and inconveniences in incorporation

There are, however, certain disadvantages and inconveniences in incorporation. Some of these disadvantages are formalities and expenses, corporate disclosures, separation of control from ownership, greater social responsibility, greater tax burden in certain cases, cumbersome winding-up procedure.

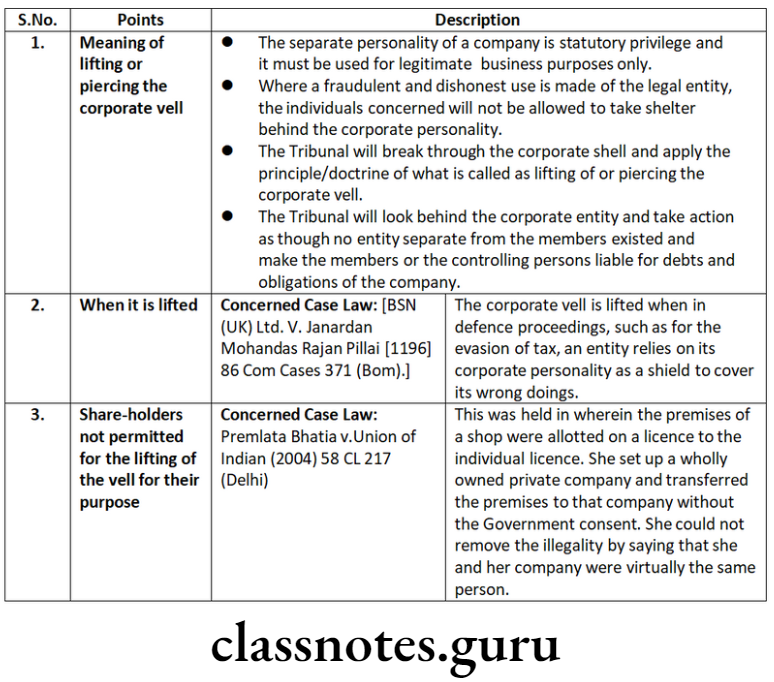

Doctrine of lifting of or piercing the corporate veil

- Sometime veil of corporate personality is used for some dishonest and fraudulent purpose in that case NCLT will look into reality and remove the corporate veil.

- In the following case the Tribunal have lifted the corporate veil.

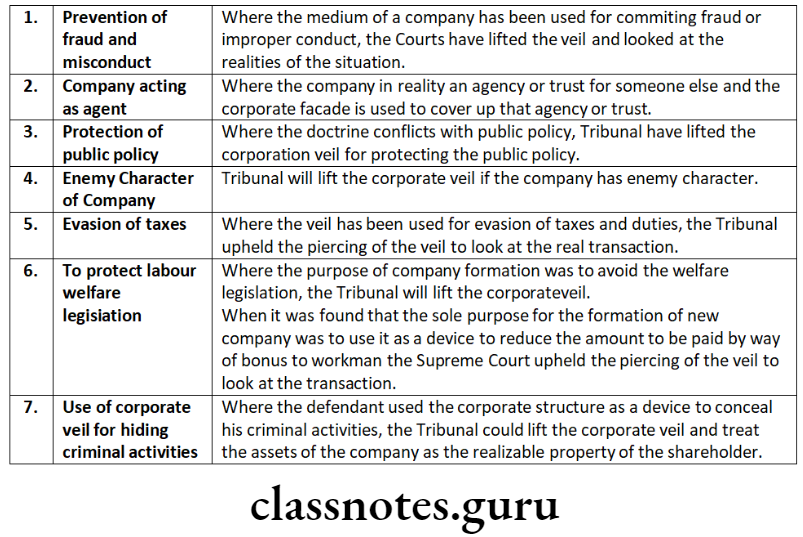

- Prevention of fraud and misconduct [Gilford Motor Co. Vs. Horne [1933] Ch 935]

- The company is in reality an agency or trust for someone else [Re. F G Films Ltd. (1953) 1 All E.R. 615]

- Protection of public policy [Connors Vs. Connors Ltd. (1940) 4 All E.R. 179]

- Enemy character of company [Daimler Co. Ltd. Vs. Continental Tyre and Rubber Co. (1916) 2 A.C. 307]

- To protect labour welfare legislation [Workmen of Associated Rubber Industries Ltd. Vs. Associated Rubber Industries Ltd. A.I.R. 1986 SC 1]

- Use of corporate veil for hiding criminal activities.

- To punish for contempt of Court [Jyoti Limited Vs. Kanwaljit Kavr Bhasin 32] (1987) DLT 198]

- Where a fraudulent and dishonest use is made of the legal entity, the individuals concerned will not be allowed to take shelter behind the corporate personality.

- The NCLT will break through the corporate shell and apply the principle/doctrine of what is called as “lifting of or piercing the corporate veil”.

LLP

It is an alternative corporate business form that gives the benefits of limited liability of a company and the flexibility of a partnership. LLP can continue its existence irrespective of changes in partners.

It is capable of entering into contracts and holding property in its own name. LLP is a separate legal entity, and is liable to the full extent of its assets but liability of the partners is limited to their agreed contribution in the LLP.

Corporation

An organization formed under state law for the purpose of carrying on a business enterprise in such a manner as to make the enterprise distinct from its owners.

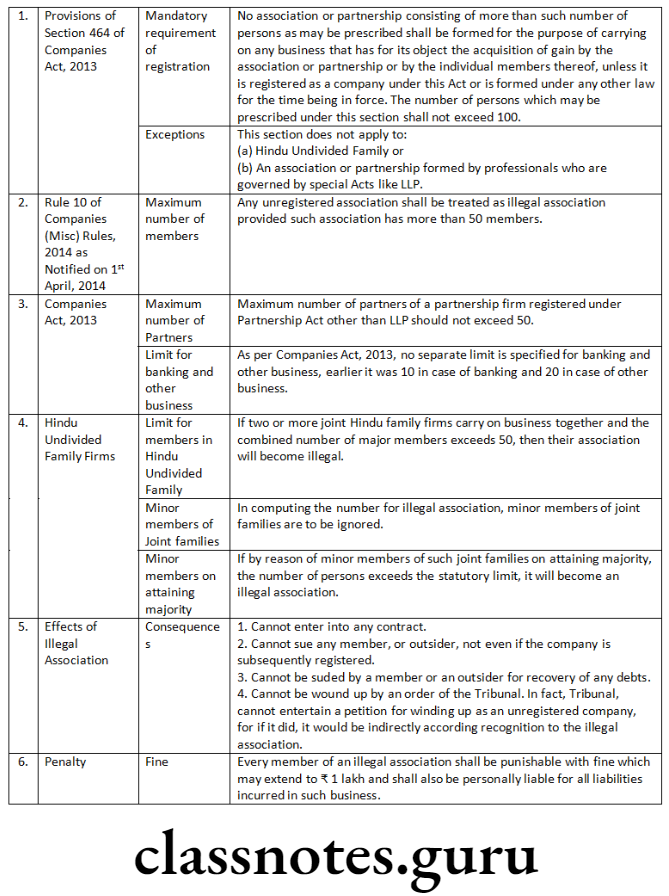

Illegal association

As per Section 464 of Companies Act, no association or partnership consisting of more than such number of persons as may be prescribed shall be formed for the purpose of carrying on any business that has for its object the acquisition of gain by the association or partnership or by the individual members thereof, unless it is registered as a company under this Act or is formed under any other law for the time being in force. The number of persons which may be prescribed under this section shall not exceed 100. Rule 10 of Companies (Miscellaneous) Rules, 2014 prescribes 50 persons in this regard.

Effects of an illegal association: An illegal association:

- Cannot enter into any contract.

- Cannot sue any member, or outsider, not even if the company is subsequently registered.

- Cannot be sued by a member, or an outsider for recovery of any debts.

- Cannot be wound up by an order of the Tribunal. In fact, the Tribunal cannot entertain a petition for winding up as an unregistered company, for if it did, it would be indirectly according recognition to the illegal association. [Raghubar Dayal Vs. Sarafa Chamber A.I.R. 1954 All. 555]

However, an illegal association is liable to be taxed. [Kumara Swamy Chattiar Vs. Income Tax Officer (1957) I.T.R. 457].

Company as a Citizen

The company, though a legal person, is not a citizen under the Citizenship Act, 1955 or under the Constitution of India.

In State Trading Corporation of India Ltd. Vs. CTO AIR 1963 SC 1811, the Supreme Court held that the State Trading Corporation though a legal person, was not a citizen and can act only through natural persons.

Introduction To Company Law Cs Executive

Nationality & Residence

Though it is established through judicial decisions that a company cannot be a citizen, yet it has nationality, domicile and residence.

In Gasque Vs. Inland Revenue Commissioners (1940) 2 K.B. 88, it was held that a limited company is capable of having a domicile and its domicile is the place of its registration and that domicile clings to it throughout its existence.

Short Notes

Question 1. Write a note on the following: (5) Illegal association.

Answer:

Illegal Association:

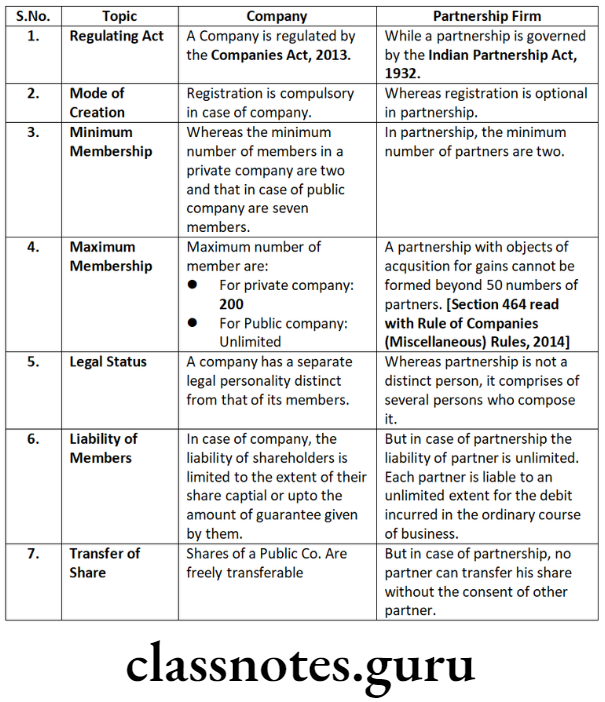

Distinguish Between

Question 1. Distinguish between the following:

(a) ‘Company’ and ‘partnership firm’.

Answer:

Question 2. Distinguish between the following:

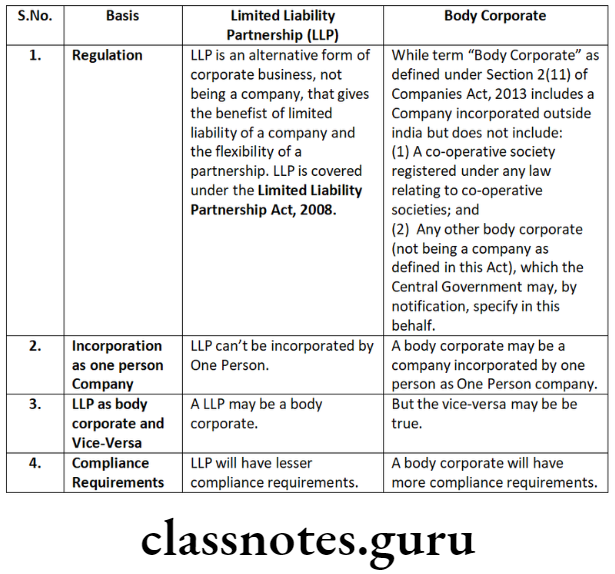

(c) ‘Limited liability Partnership’ and ‘body corporate’.

Answer:

Limited Liability Partnership (LLP) and Body Corporate

Question 3. Distinguish between the following:

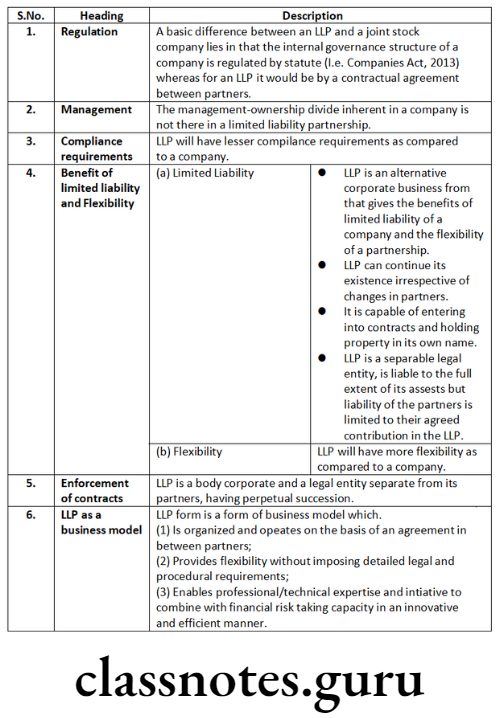

(a) ‘Company’ and ‘limited liability partnership’.

Answer:

Descriptive Questions

Question 1. Comment on the following:

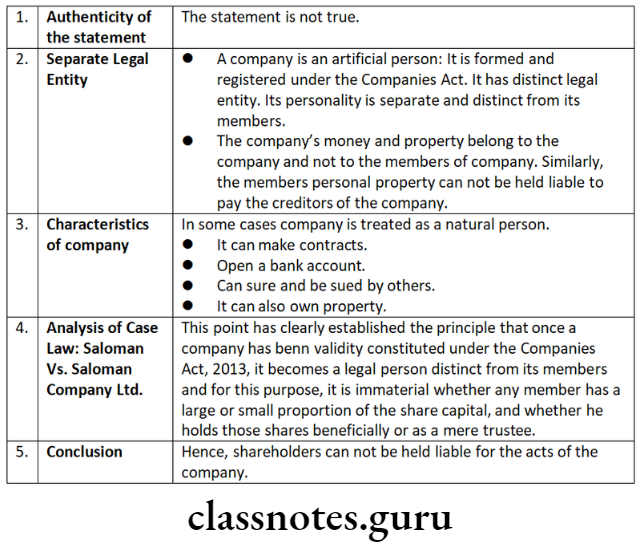

(2) A shareholder who holds 99% of the share capital of a company can be held liable for the acts of the company.

Answer:

Cs Company Law Chapter 1 Summary

Question 2. Comment on the following:

(b) A shareholder is held personally liable for the acts of the company, if he holds virtually the entire share capital of the company.

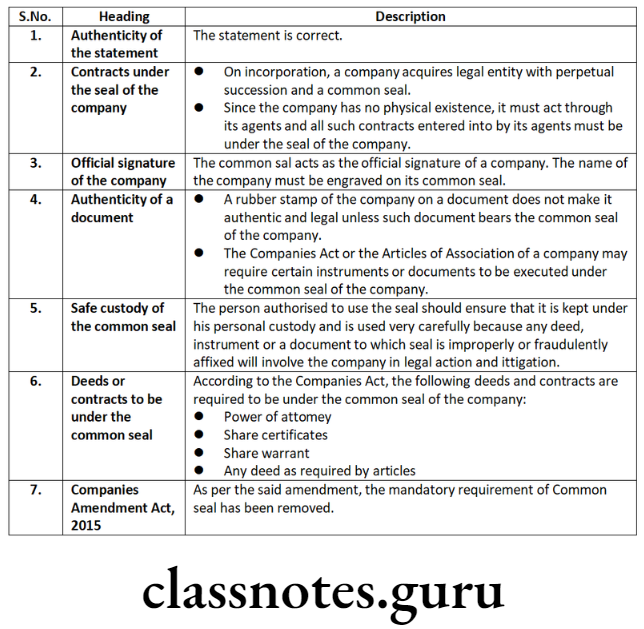

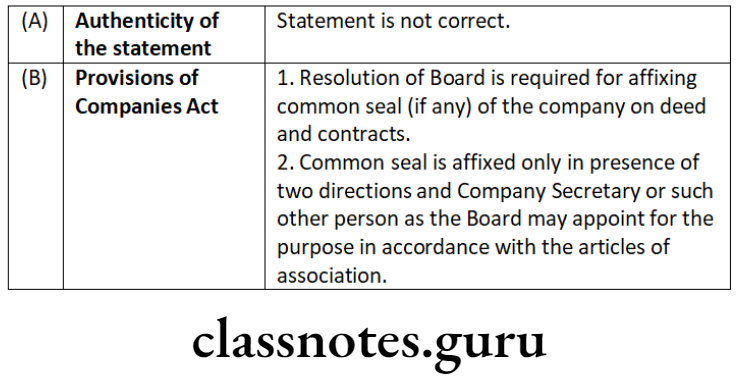

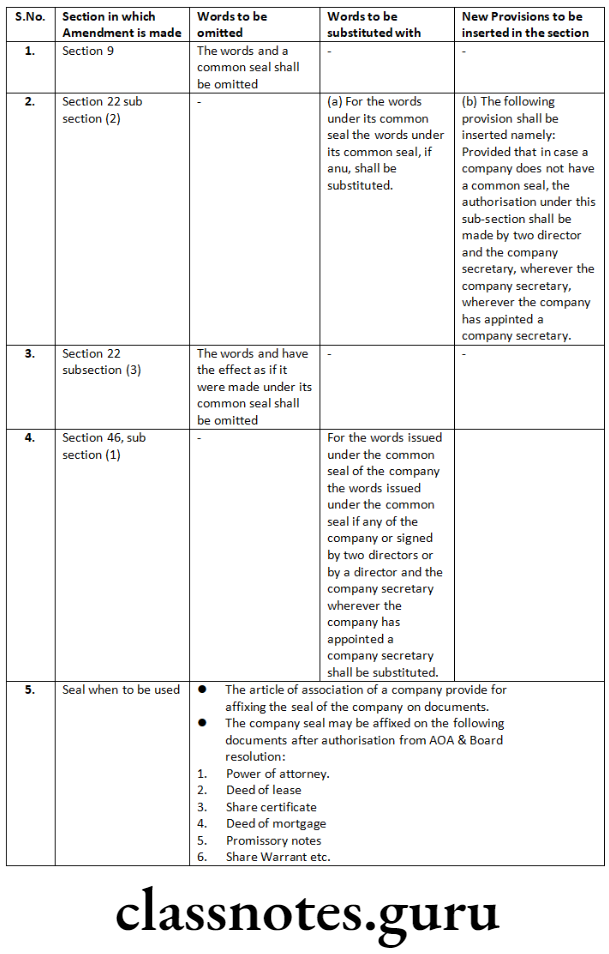

(d) Common seal acts as the official signature of a company.

Answer:

Question 3. Comment on the following:

(b) Common seal can be used by any employee of the company irrespective of his designation.

Answer:

Amendment Made by Companies (Amendment) Act, 2015

Question 4. Answer the following citing the relevant provisions of law/case law, if any:

“Separate personality of a company is a special privilege. In case of dishonest or fraudulent use of this privilege, corporate veil can be lifted”. Discuss.

Answer:

Doctrine of lifting of or piercing the corporate veil:

In the following cases the Tribunal have lifted the corporate veil.

Company Law Cs Executive Study Material

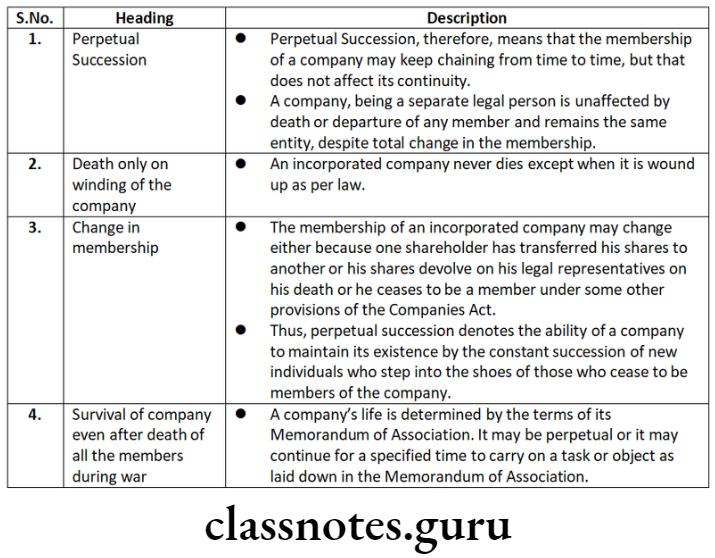

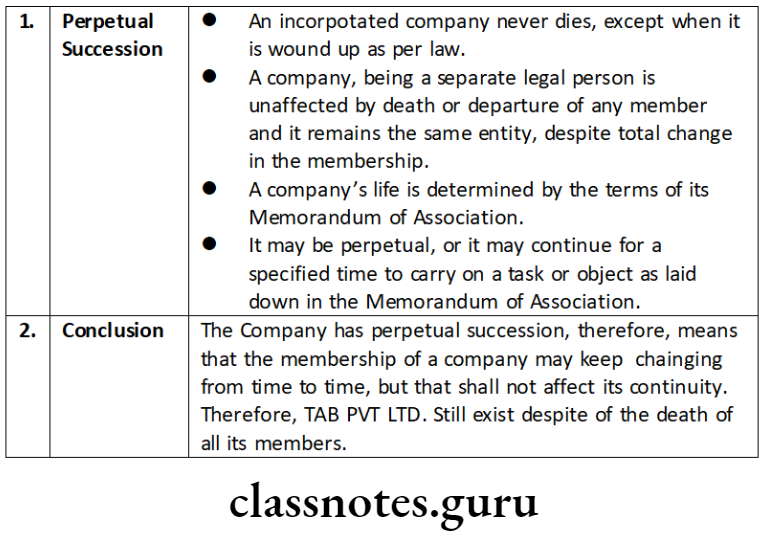

Question 5. In an annual general meeting of Amar (Pvt.) Ltd., all the shareholders were killed in a bomb blast. State, whether the company is still in existence. If so, how?

Answer:

Question 6. Comment on the following:

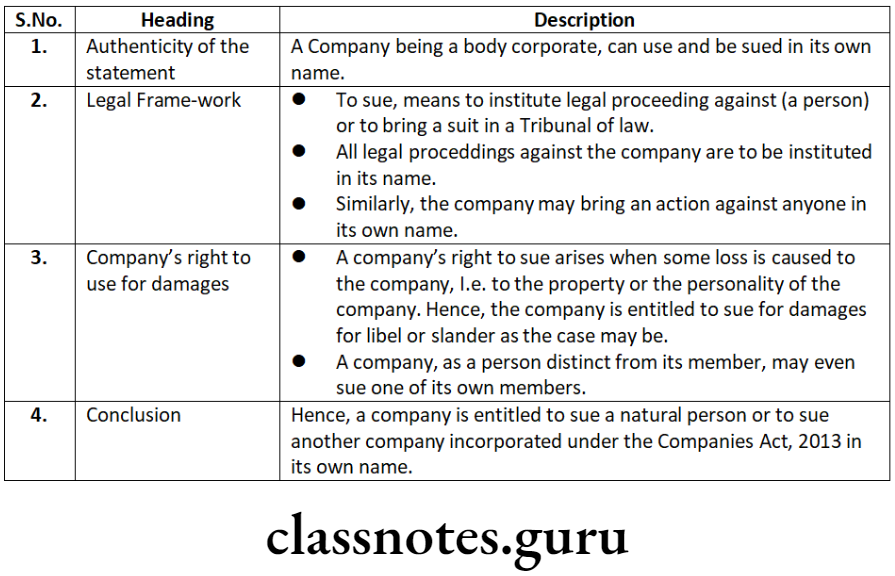

(a) A company incorporated under the Companies Act, 2013, being an artificial person, is not entitled to sue a natural person or to sue another company incorporated under the same Act.

(d) A company incorporated under the Companies Act, 2013 never dies except when it is wound-up as per the law.

Answer:

However in case of merger, the transferor company is dissolved without winding up.

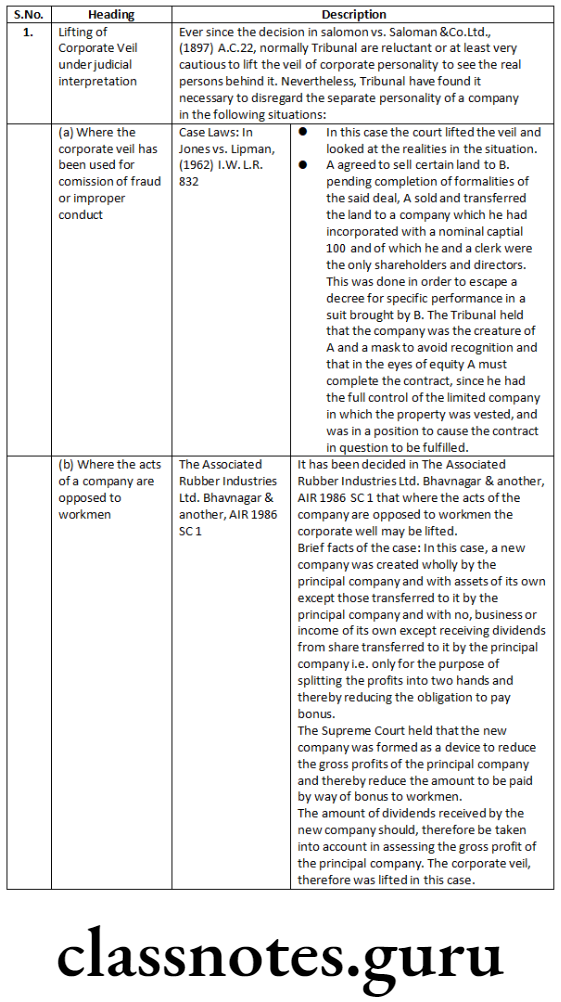

Question 7. Explain clearly the meaning of ‘lifting of corporate veil’ in relation to a company incorporated under the Companies Act, 2013. Examining the judicial decisions, state whether ‘corporate veil’ can be lifted in the following cases:

Where the corporate veil has been used for improper conduct; and

Where the acts of a company are opposed to workmen?

Answer:

Cs Executive Company Law Notes Pdf

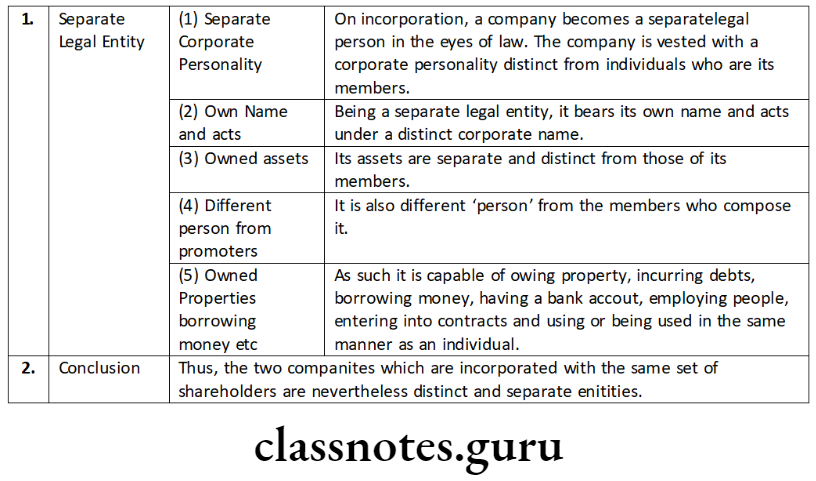

Question 8. Comment on the following:

Three companies incorporated with the same set of shareholders are treated as same companies under the Companies Act, 2013.

Answer:

Question 9. One of the subscribers to Memorandum of Association of a company under process of incorporation is a foreign national residing outside India. State the provisions of Companies Act, 2013 regarding authentication of his signature and address. Will the requirement of business visa be applicable to his case if he is a person of Indian origin or overseas citizen of India?

Answer:

Where subscriber to the memorandum is a foreign national residing outside India:

- in a country in any part of the Commonwealth, his signatures and address on the memorandum and articles of association and proof of identity shall be notarized by a Notary (Public) in that part of the Commonwealth.

- in a country which is a party to the Hague Apostille Convention, 1961, his signatures and address on the memorandum and articles of association and proof of identity shall be notarized before the Notary (Public) of the country of his origin and be duly apostillised in accordance with the said Hague Convention.

- in a country outside the Commonwealth and which is not a party to the Hague Apostille Convention, 1961, his signatures and address on the memorandum and articles of association and proof of identity, shall be notarized before the Notary (Public) of such country and the certificate of the Notary (Public) shall be authenticated by a Diplomatic or Consular Officer empowered in this behalf under Section 3 of the Diplomatic and Consular Officers (Oaths and Fees) Act, 1948 (40 of 1948) or, where there is no such officer by any of the officials mentioned in Section 6 of the Commissioners of Oaths Act, 1889 (52 and 53 Vic.C.10), or in any Act amending the same;

- visited in India and intended to incorporate a company, in such case the incorporation shall be allowed if, he/she is having a valid Business Visa.

Explanation: For the purposes of this clause, it is hereby clarified that, in case of Person is of Indian Origin or Overseas Citizen of India, requirement of business Visa shall not be applicable.

Question 10. Comment on the following:

(a) The Companies Act, 2013 does not provide statutory recognition to the doctrine of lifting of corporate veil. Only judicial interpretations disregard the concept of separate personality.

Answer:

It is not correct to State that the Companies Act, 2013 does not provide statutory recognition to the doctrine of lifting of corporate veil and only judicial interpretation disregard the concept of separate personality.

The Companies Act, 2013 itself contains various provisions in Sections 7(7), 251(1) and 339 which lift the corporate veil to reach the real forces of action. Section 7(7) of Companies Act, 2013 deals with punishment for incorporation of company by furnishing incorrect information; Section 251(1) of Companies Act, 2013 provides that liability for making fraudulent application for removal of name of company from the register of companies and Section 339 of Companies Act, 2013 deals with liability for fraudulent conduct of business during the course of winding up.

Ever behind the decision in Salomon v. Salomon & Co. Ltd., generally Courts are reluctant or at least very cautious to lift the veil of corporate personality to see the real persons behind it. Nevertheless, Courts have found it necessary to disregard the separate personality of a company in the different situations:

- Fraud or Improper conduct: Where the corporate veil has been used for commission of fraud or improper conduct. In this case, Courts have lifted the veil and looked at the realities of the situation. (Case Law:Jones vs. Lipman)

- Company acting as an agent: Where a corporate facade is really only an agency instrumentality.(Case Law: R.G. Films Ltd.)

- Conflict with Public Policy: Where the conduct conflicts with public policy, Courts lifted the corporate veil for protecting the public policy. (Case Law: Connors Bros. v. Connors)

- Enemy Character: A company will be regarded as having enemy character, if the persons having de facto control of its affairs are resident in an enemy country or, wherever they may be, are acting under instructions from or on behalf of the enemy. (Case Law: Daimler Co. Ltd. v. Continental Tyre & Rubber Co.)

- Evasion of taxes: Where it was found that the sole purpose for which the company was formed was to evade taxes the Court will ignore the concept of separate entity and make the individuals concerned liable to pay the taxes which they would have paid but for the formation of the company.(Case Law: Sir Dinshaw Maneckjee Petit, Vodafone case)

- Avoidance of welfare legislation: Avoidance of welfare legislation is as common as avoidance of taxation and the approach in considering problems arising out of such avoidance has necessarily to be the same and, therefore, where it was found that the sole purpose for the formation of the new company was to use it as a device to reduce the amount to be paid by way of bonus to workmen, the Supreme Court upheid the piercing of the veil to look at the real transaction. (Case Law: The Workmen Employed in Associated Rubber Industries Limited)

- Unjust and inequitable: Where it is found that a company has abused its corporate personality for an unjust and inequitable purpose, the Court would not hesitate to lift the corporate veil. Space to write important points for revision

Cs Company Law Important Topics

Question 11. Comment on the following:

The privilege of Limited Liability for Business Debts is one of the principal advantage of doing business under the corporate form of organization with some exceptions.

Answer:

“The privilege of limited liability for business debts is one of the principal advantages of doing business under the corporate form of organisation.” The company, being a separate person, is the owner of its assets and bound by its liabilities. The liability of a member as shareholder, extends to the contribution to the capital of the company up to the nominal value of the shares held and not paid by him. Members, even as a whole, are neither the owners of the company’s undertakings, nor liable for its debts.

Exceptions to the principle of limited liability:

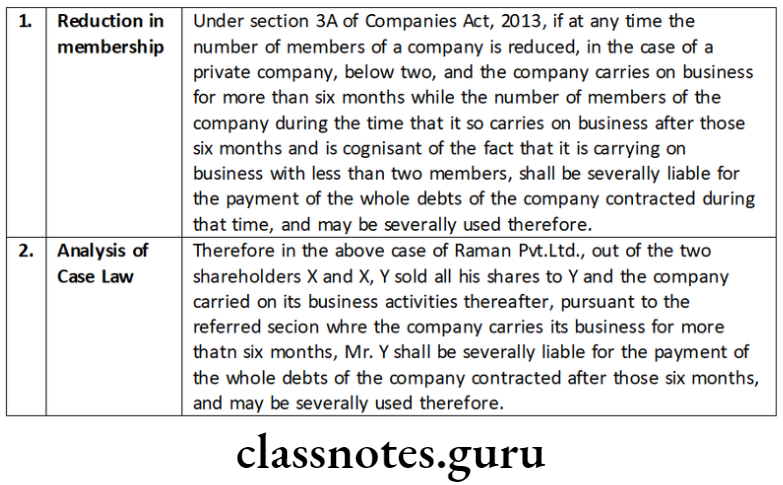

- Members are severally liable in certain cases- If at any time the number of members of a company is reduced, in the case of a public company, below seven, in the case of a private company, below two, and the company carries on business for more than six months while the number of members is so reduced, every person who is a member of the company during the time that it so carries on business after those six months and is cognizant of the fact that it is carrying on business with less than seven members or two members, as the case may be, shall be severally liable for the payment of the whole debts of the company contracted during that time, and may be severally sued therefor. [Section 3A]

- Where a company has been got incorporated by furnishing any false or incorrect information or representation or by suppressing any material fact or information in any of the documents or declaration filed or made for incorporating such company or by any fraudulent action, the Tribunal may, on an application made to it, on being satisfied that the situation so warrants, direct that liability of the members of such company shall be unlimited. [Section 7(7)(b)]

- Further under section 339(1), where in the course of winding up it appears that any business of the company has been carried on with an intent to defraud creditors of the company or any other persons or for any fraudulent purpose, the Tribunal may declare the persons who were knowingly parties to the carrying on of the business in the manner aforesaid as personally liable, without limitation of liability, for all or any of the debts/liabilities of the company. [Section 339]

- Under Section 35(3), where it is proved that a prospectus has been issued with intent to defraud the applicants for the securities of a company or any other person or for any fraudulent purpose, every person who was a director at the time of issue of the prospectus or has been named as a director in the prospectus or every person who has authorized the issue of prospectus or every promoter or a person referred to as an expert in the prospectus shall be personally responsible, without any limitation of liability, for all or any of the losses or damages that may have been incurred by any person who subscribed to the securities on the basis of such prospectus

- As per section 75(1), where a company fails to repay the deposit or part thereof or any interest thereon referred to in section 74 within the time specified or such further time as may be allowed by the Tribunal and it is proved that the deposits had been accepted with intent to defraud the depositors or for any fraudulent purpose, every officer of the company who was responsible for the acceptance of such deposit shall, without prejudice to other liabilities, also be personally responsible, without any limitation of liability, for all or any of the losses or damages that may have been incurred by the depositors.

- Section 224(5) states that where the report made by an inspector states that fraud has taken place in a company and due to such fraud any director, key managerial personnel, other officer of the company or any other person or entity, has taken undue advantage or benefit, whether in the form of any asset, property or cash or in any other manner, the Central Government may file an application before the Tribunal for appropriate orders with regard to disgorgement of such asset, property, or cash, and also for holding such director, key managerial personnel, officer or other person liable personally without any limitation of liability. Space to write important points for revision-

Practical Questions

Question 1. Six persons are the only members of Tab (Pvt.) Ltd. All of them went to USA on a pleasure trip by aeroplane. On the way, the plane crashed and all the six members died. Does Tab (Pvt.) Ltd. still exist? Decide.

Answer:

Question 2. Comment on the following:

Raman Pvt. Ltd. has only two shareholders, X and Y. All shares were fully paid-up X sold all his shares to Y and the company carries on its business activities thereafter.

Answer:

Cs Executive Company Law Introduction

Short Notes

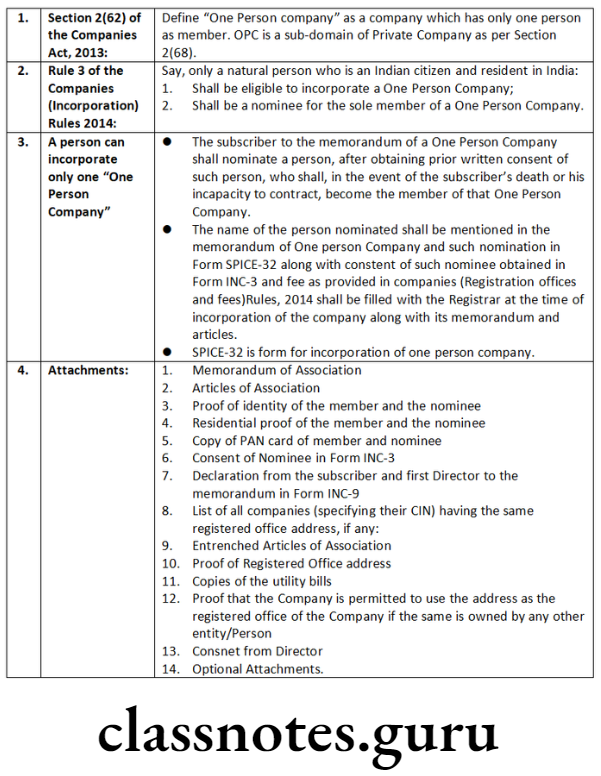

Question 1. Write short note on one person company.

Answer.

Distinguish Between

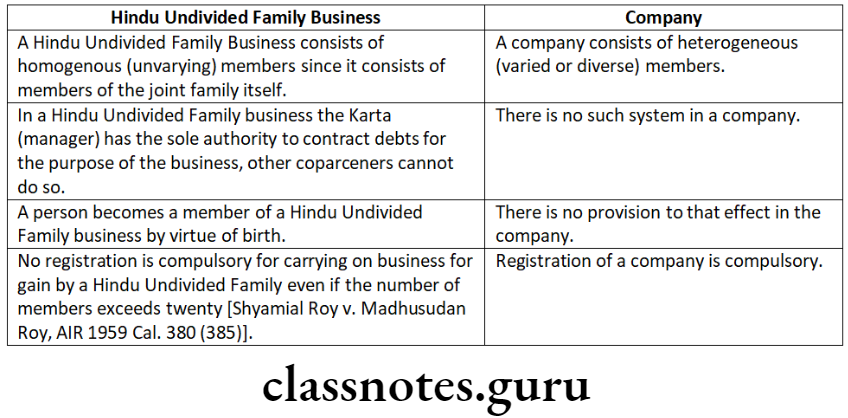

Question 2. Distinguish between Hindu Undivided Family and company.

Answer.

Introduction To Company Law Cs Executive

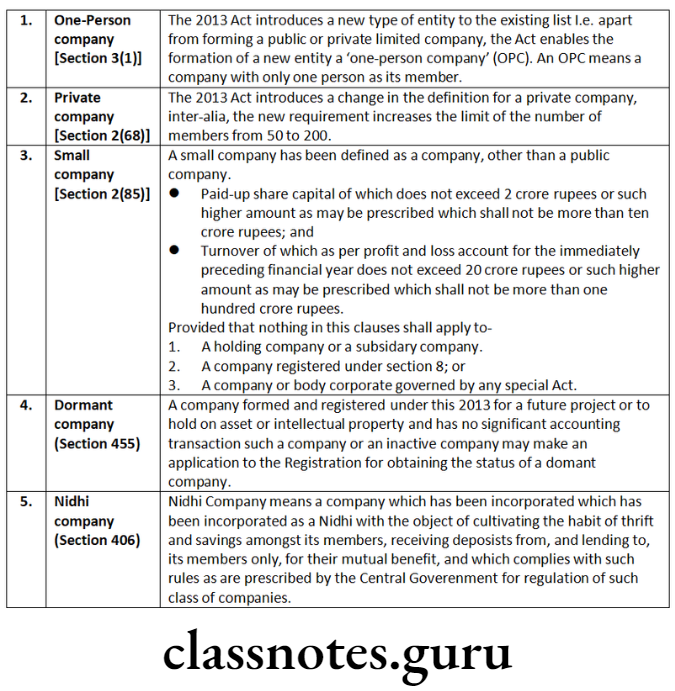

Question 3. Discuss the new concepts relates to types of companies under companies Act, 2013.

Answer.