Special Courts, Tribunals Under Companies Act

Tribunal

It is an administrative body established for the purpose of discharging quasi-judicial duties. It is neither a Court nor an executive body.

Delegation of powers

The Tribunal or the Appellate Tribunal may direct any of its officers or employees or any other person to inquire into any matter connected with any proceeding. They may also specify such conditions as they think fit. This can be done by a general or special order.

Right to legal representation

A party to any case or proceeding or appeal before the Tribunal or the Appellate Tribunal may either appear in person or authorize one or more chartered accountants or company secretaries or cost accountants or legal practitioners or any other person to present his case before the Tribunal or the Appellate Tribunal.

Special courts

Section 435 of the Companies Act gives the Central Government the power to establish or designate as many Special Courts as may be necessary. This is done for the purpose of providing speedy trial of offences under this Act. The establishment of such special courts is done by passing a notification and publishing it I the Official Gazette.

Learn and Read More CS Executive JIGL Question and Answers

Lodging of caveat

A caveat is a specific limitation, stipulation or condition.

Any person may lodge a caveat, which is to be filed in triplicate. It can be filed in case of any appeal or petition or application that may be instituted before this Tribunal by paying the prescribed fee after forwarding a copy by registered post or serving the same on the expected petitioner or appellant.

In cases of emergencies, the Tribunal may pass interim orders too.

The validity of a caveat is for a period of ninety days from the date of its filing.

Benches of tribunal

A bench is a forum comprised of the judges of a court. Generally There shall be constituted such number of Benches of the Tribunal, as are specified by the Central Government.

The Principal Bench of the Tribunal shall be at New Delhi which shall be presided over by the President of the Tribunal.

Generally, the powers of the Tribunal are exercisable by Benches consisting of two Members out of whom one is a Judicial Member and the other shall be a Technical Member:

Interlocutory applications

An interlocutory application is an application usually filed for some urgent relief or to bring certain new facts to the knowledge of the court.

It has been defined in the Civil Rules of Practice, Section 2(j) as, “Application to the court in any suit, appeal or proceedings already instituted in such court, other than a proceeding for the execution of a decree or order.”

it can be for stay, directions, condonation of delay, exemption from production of copy of order appealed against or extension of time etc. It shall be in prescribed form and accompanied by an affidavit supporting the application.

Descriptive Questions

Question 1: Explain provisions for contempt and caveat under Companies Act, 2013.

Answer:

Provisions for contempt and caveat under Companies Act, 2013

According to Section 425 of the Companies Act, 2013, the National Company Law Tribunal and the National Company Law Appellate Tribunal shall have the same jurisdiction, powers and authority in respect of contempt of themselves as the High Court has and may exercise, for this purpose, the powers under the provisions of the Contempt of Courts Act, 1971, which shall have the effect subject to modifications that (a) the reference therein to

a High Court shall be construed as including a reference to the Tribunal and the Appellate Tribunal; and (b) the reference to Advocate-General in section 15 of the said Act shall be construed as a reference to such Law Officers as the Central Government may, specify in this behalf.

Rule 25 of the National Company Law Tribunal Rules, 2016 provides that any person may lodge a caveat in triplicate in any appeal or petition or application that may be instituted before this National Company Law Tribunal by paying the prescribed fee after forwarding a copy by registered post or serving the same on the expected petitioner or appellant and

The caveat shall be in the form prescribed and contain such details and particulars or orders or directions, details of authority against whose orders or directions the appeal or petition or application is being instituted by the expected appellant or petitioner or applicant with full address for service on other side.

So that the appeal or petition or application could be served before the appeal or petition or interim application is taken up. The caveat shall remain valid for a period of ninety days from the date of its filing.

Question 2: Explain the powers of Special Courts for offences triable by it under Special Courts, Tribunal under Companies and other legislations.

Answer:

The powers of Special Courts for offences triable by it under Special Courts, Tribunal under Companies and other legislations

According to Section 436(1) of the Companies Act, 2013, notwithstanding anything contained in the Code of Criminal Procedure, 1973,-

all offences specified under Section 435(1) shall be triable only by the Special Court established for the area in which the registered office of the company in relation to which the offence is committed or where there are more Special Courts than one for such area, by such one of them as may be specified in this behalf by the High Court concerned;

where a person accused of, or suspected of the commission of, an offence under this Act is forwarded to a Magistrate under Section 167(2) or Section 167(2A) of the Code of Criminal

Procedure, 1973, such Magistrate may authorise the detention of such person in such custody as he thinks fit for a period not exceeding fifteen days in the whole where

such Magistrate is a Judicial Magistrate and seven days in the whole where such Magistrate is an Executive Magistrate.

Where such Magistrate considers that the detention of such person upon or before the expiry of the period of detention is unnecessary, he shall order such person to be forwarded to the Special Court having jurisdiction.

the Special Court may exercise, in relation to the person forwarded to it ( under clause (b), the same power which a Magistrate having jurisdiction to try a case may exercise under section 167 of the Code of Criminal Procedure, 1973 in relation to an accused person who has been forwarded to him under that section; and

a Special Court may, upon perusal of the police report of the facts constituting an offence under this Act or upon a complaint in that behalf. no take cognizance of that offence without the accused being committed to it for trial.

Section 436 (2) of the Act provides that when trying an offence under this Act, a Special Court may also try an offence other than an offence under this Act with which the accused may, under the Code of Criminal Procedure, 1973 be charged at the same trial.

As per Section 436 (3) of the Act, notwithstanding anything contained in the Code of Criminal Procedure, 1973, the Special Court may, if it thinks fit, try in a summary way any offence under this Act which is punishable with imprisonment for a term not exceeding three years.

With the new amendments, the Central Government may establish or designate as many Special Courts as may be necessary, by notification. This is to ensure speedy trials of offences under this Act.

This does not include the cases as presented by section 452., i.e. the new provision exempts the offences under section 452-Punishment for wrongful withholding of property out of the jurisdiction of Special Courts.

Question 3: Discuss in brief the provisions for filing an appeal before the National Company Law Appellate Tribunal (NCLAT) under the Companies Act, 2013.

Answer:

The provisions for filing an appeal before the National Company Law Appellate Tribunal (NCLAT) under the Companies Act, 2013

Section 421 of the Companies Act, 2013 deals with appeal from orders of National Company Law Tribunal and provides as under:

The NCLAT is constituted under Section 410 of the Companies Act, 2013. It has been given the powers to hear appeals against any direction, decision or order covered under Section 53A of the Competition Act, 2002.

Moreover, existing restrictions on the appointment of judicial and technical members in the Appellate Tribunal, as put in force by the Central Government, have henceforth been eliminated.

Any person aggrieved by an order of the National Company Law Tribunal may prefer an appeal to the National Company Law Appellate Tribunal.

No appeal shall lie to the National Company Law Appellate Tribunal from an order made by the National Company Law Tribunal with the consent of parties.

Every appeal shall be filed within a period of forty-five days from the date 1 on which a copy of the order of the National Company Law Tribunal is made available to the person aggrieved and shall be in such form, and accompanied by such fees, as may be prescribed:

Provided that the National Company Law Appellate Tribunal may entertain an appeal after the expiry of the said period of forty-five days from the date aforesaid, but within a further period not exceeding forty-five days, if it is satisfied that the appellant was prevented by sufficient cause from filing the appeal within that period.

On the receipt of an appeal, the National Company Law Appellate Tribunal shall, after giving the parties to the appeal a reasonable opportunity of being heard, pass such orders thereon as it thinks fit, confirming, modifying or setting aside the order appealed against.

The National Company Law Appellate Tribunal shall send a copy of every order made by it to the National Company Law Tribunal and the parties to appeal.

Question 4: Explain the rights of a party to appear before the National Company Law Tribunal.

Answer:

Rights of a party to appear before the National Company Law Tribunal are as under:

- Every party may appear before a Tribunal in person or through an authorised representative, duly authorised in writing in this behalf.

- The authorised representative shall make an appearance through the filing of Vakalatnama or Memorandum of Appearance in specified Form representing the respective parties to the proceedings.

- The Central Government, the Regional Director or the Registrar of Companies or Official Liquidator may authorise an officer or an Advocate to represent in the proceedings before the Tribunal.

- The officer authorised by the Central Government or the Regional Director or the Registrar of Companies or the Official Liquidator shall be an officer not below the rank of Junior Time Scale or company prosecutor.

Question 5: Describe the constitution of Special Court established under Section 435 of the Companies Act, 2013.

Answer:

The Central Government may, for the purpose of providing speedy trial of offences under Section 435 of the Companies Act, 2013 by notification, establish or designate as many Special Courts as may be necessary.

A Special Court shall consist of-

a single judge holding office as Session. Judge or Additional Session Judge, in case of offences punishable under this Act with imprisonment of two years or more; and

a Metropolitan Magistrate or a Judicial Magistrate of the First Class, in the case of other offences, who shall be appointed by the Central Government with the concurrence of the Chief Justice of the High Court within whose jurisdiction the judge to be appointed is working.

Question 6: Explain any four rights of a party to appear before the National Company Law Tribunal, under the Companies Act, 2013.

Answer:

Rights of a party to appear before the Tribunal:

The Act provides the following rights to a party regarding the right to appear before the Tribunal:

A party may appear before a Tribunal in person or through an authorized representative, who has been specially authorized in writing for this very purpose.

The authorized representative shall make get his appearance registered by filing a Vakalatnama or a Memorandum of Appearance in Form No. NCLT – 12 representing the respective parties to the proceedings.

The Central Government, the Regional Director or the Registrar of Companies or Official Liquidator may authorize an officer or an Advocate to represent in the proceedings before the Tribunal.

The officer authorized by the Central Government or the Regional Director or the Registrar of Companies or the Official Liquidator shall be an officer not below the rank of Junior Time Scale or company prosecutor.

During any proceedings before the Tribunal, it may call upon the Registrar of Companies to submit information on the affairs of the company on the basis of information available in the MCA21 portal. Reasons for such directions shall be recorded in writing.

Generally it is done for the purpose of its knowledge. Audio or video recording of the Bench proceedings by the parties or their authorised Representatives are not permitted. [Rule 45 of the NCLT Rules]

Question 7: Explain the procedure for lodging of caveat before National Company Law Tribunal and what is the validity period of such caveat?

Answer:

Lodging of Caveat:

A caveat is a specific limitation, stipulation or condition. It can also be defined as a legal warning to the judicial officer to suspend a proceeding until the opposition has been given a fair chance of a hearing or appropriate counter measure. The following important points need to be kept in mind regarding it –

- Any person may lodge a caveat, which is to be filed in triplicate.

- It can be filed in case of any appeal or petition or application that may be instituted before NCLT.

- The prescribed fee has to be paid after forwarding a copy of the caveat by registered post or serving the same on the expected petitioner or appellant.

- In cases of emergencies, the Tribunal may pass interim orders too.

- It can be filed in Form NCLT 3C. 6) The validity of a caveat is for a period of ninety days from the date of its.

Question 8: What is meant by Tribunal? Explain the object of Tribunals.

Answer:

Tribunal:

It is an administrative body established for the purpose of discharging quasi-judicial duties. It is neither a Court nor an executive body. It is a quasi-judicial institution established for a number of functions like adjudicating disputes, for settling rights between parties claiming property or other matter, making and reviewing administrative decisions, etc.

It is an administrative body established for the purpose of discharging quasi-judicial duties. The term is used to refer to any person or body or institution that has been given the power to adjudicate claims or disputes – whether or not it is called a ‘tribunal’.

It has quasi-judicial duties; hence it is neither a Court nor an executive body.

Why make tribunals?

Specialized tribunals have been created in order to lessen the burden on courts. They have been created under various statutes, viz the NCLT under the Companies Act, 2013.

Legal vs. domestic tribunals:

A legal ‘tribunal’ is different from a domestic tribunal. A ‘domestic tribunal’ is an administrative agency that regulates the professional conduct and imposes discipline amongst the members of a particular stream or profession.

It has powers to investigate and to adjudicate. On the other hand, legal tribunals are the quasi-judicial bodies established to adjudicate disputes related to specified matters. These derive their authority from the Statute establishing them.

They are bound by the principles of natural justice and the statutory provisions under which the Tribunal is established. The tribunal/authority may have to determine the rights and liabilities of the parties, hence their function is known as a quasi-judicial function.

Question 9: Briefly discuss the Constitution of National Company Law Tribunal.

Answer:

Constitution of the NCLT: The NCLT and the NCLAT were conceptualized with the enactment of the Companies (Second Amendment) Act, 2002 that amended the Companies Act, 1956.

The Supreme Court finally decided the matter in the case of Union of India v. R. Gandhi, President, Madras Bar Association (2010), upholding the constitutional validity of the Tribunal and the Appellate Tribunal.

Finally, the Central Government notified the Tribunal and Appellate Tribunal under the provisions of the Companies, 2013, which were notified by the Central Government w.e.f. 1th June, 2016.

The new fora, will take over powers from the Company Law Board (CLB), the Board of Industrial and Financial Reconstruction (BIFR) and the High Courts, wherein they dealt with company restructuring matters.

The new Tribunal is meant to be an efficient and effective alternate institutional forum, as it deals with matters in a simpler, speedier and more accessible manner. Section 8 of the Companies Act, 2013 gives the Central Government the authority to constitute a Tribunal to be known as the National Company Law Tribunal consisting of a President and such number of Judicial and Technical members, as the Central Government may deem necessary.

These are to be formed by notification, and the members are also to be appointed by notification, to exercise and discharge such powers and functions as are, or may be, conferred on it by or under this Act or any other law for the time being in force.

The National Company Law Tribunal (NCLT) & the Appellate Tribunal have been constituted by the Central Govt. under section 408 & 410 of the Companies Act, 2013. The NCLT is a quasi-judicial body which resolves matters pertaining to companies in India.

The NCLT has eleven benches, two at New Delhi (one being the principal bench) and one each at Ahmedabad, Allahabad, Bengaluru, Chandigarh, Chennai, Guwahati, Hyderabad, Kolkata and Mumbai.

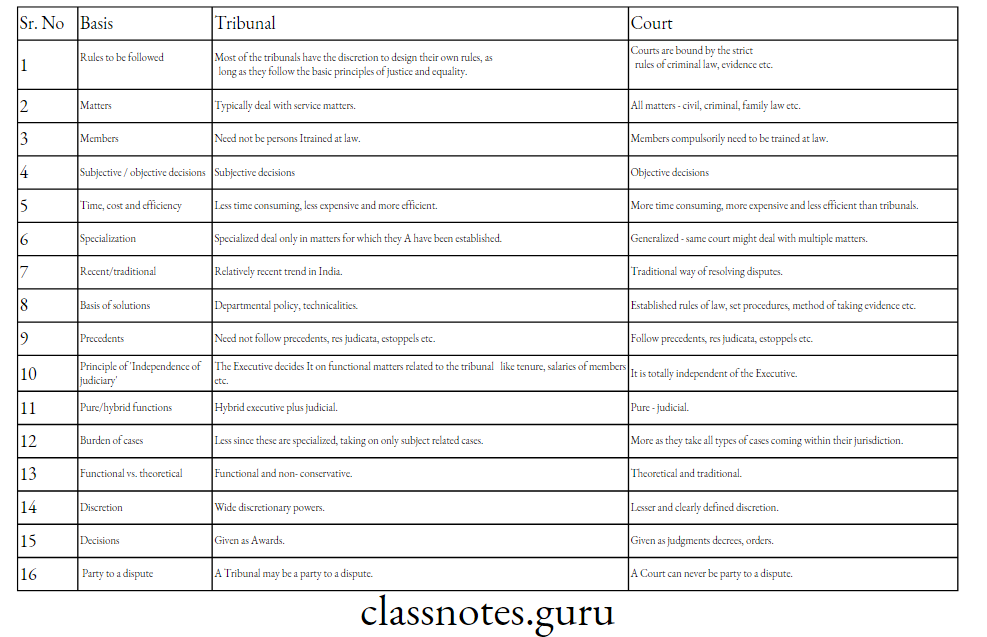

Distinguish Between

Question.1: What is the difference between a court and a tribunal?

Answer:

The difference between a court and a tribunal

Tribunal: A Tribunal is a quasi-judicial institution established for a number of functions like adjudicating disputes, for settling rights between parties claiming property or other matter, making and reviewing administrative decisions, etc.

Court: A court is essentially a judicial body set up by the government for adjudicating disputes between two or more parties. It has a pre-determined formal process for dispute resolution. It deals with civil, criminal and administrative matters. The decisions in a court may be taken by a single judge or a panel of judges or magistrate(s).

Important Differences between Administrative Tribunals and Courts

Special Courts, Tribunals Under Companies Act Descriptive Questions

Question.1: Define a ‘tribunal’. Why are tribunals made?

Answer:

‘Tribunal’

It is an administrative body established for the purpose of discharging quasi-judicial duties. The term is used to refer to any person or body or institution that has been given the power to adjudicate claims or disputes – whether or not it is called a ‘tribunal’.

It has quasi-judicial duties; hence it is neither a Court nor an executive body.

Why make tribunals?

Specialized tribunals have been created in order to lessen the burden on courts. They have been created under various statutes, viz the NCLT under the Companies Act, 2013.

Legal vs. domestic tribunals:

A legal ‘tribunal’ is different from a domestic tribunal. A ‘domestic tribunal’ is an administrative agency that regulates the professional conduct and imposes discipline amongst the members of a particular stream or profession.

It has powers to investigate and to adjudicate. On the other hand, legal tribunals are the quasi-judicial bodies established to adjudicate disputes related to specified matters. These derive their authority from the Statute establishing them.

They are bound by the principles of natural justice and the statutory provisions under which the Tribunal is established. The tribunal/authority may have to determine the rights and liabilities of the parties, hence their function is known as a quasi-judicial function.

Question 2: Explain the setting up of the NCLT and the NCLAT.

Answer:

The setting up of the NCLT and the NCLAT

The NCLT and the NCLAT were conceptualized with the enactment of the Companies (Second Amendment) Act, 2002 that amended the Companies Act, 1956.

The Supreme Court finally decided the matter in the case of Union of India v. R. Gandhi, President, Madras Bar Association (2010), upholding the constitutional validity of the Tribunal and the Appellate Tribunal.

Finally, the Central Government notified the Tribunal and Appellate Tribunal under the provisions of the Companies, 2013, which were notified by the Central Government w.e.f. 1st June, 2016.

The new fora, will take over powers from the Company Law Board (CLB), the Board of Industrial and Financial Reconstruction (BIFR) and the High Courts, wherein they dealt with company restructuring matters.

The new Tribunal is meant to be an efficient and effective alternate institutional forum, as it deals with matters in a simpler, speedier and more accessible manner.

The National Company Law Tribunal (NCLT) & the Appellate Tribunal have been constituted by the Central Govt. under Sections 408 & 410 of the Companies Act, 2013.

The newly inserted Section 418A w.r.t. “Benches of Appellate Tribunal”-provides that the powers of the Appellate Tribunal may be exercised by the Benches thereof, which are to be constituted by the Chairperson of the Tribunal.

The provisions pertaining to the benches are as under-

A Bench of the Appellate Tribunal shall have at least one Judicial Member and one Technical Member.

The Benches of the Appellate Tribunal shall ordinarily sit at New Delhi or such other places as the Central Government may, in consultation with the Chairperson, notify.

The Central Government has the power to notify, after consultation with the Chairperson, the establishment of such number of Benches of the Appellate Tribunal, as it may consider necessary, to hear appeals against any direction, decision or order referred to in section 53A of the Competition Act, 2002 and under section 61 of the Insolvency and

Bankruptcy Code, 2016.

Question.3: What are the powers exercisable by the NCLT and the NCLAT?

Answer:

The powers exercisable by the NCLT and the NCLAT

The Tribunal and the Appellate Tribunal are bound by the rules of natural justice and equity laid down in the Code of Civil Procedure and the other provisions of this Act and of any rules that are made by the Central

Government. The Tribunal and the Appellate Tribunal have the power to establish their own procedures. No civil court has jurisdiction over any matter which the Tribunal or the Appellate Tribunal is empowered to decide.

Some of the important powers that are presently vested with NCLT are as follows:

Class Action:

It is an action brought about by one or more persons representing a particular class. This is under Section 245 that has been introduced in the new Act to provide relief to the investors against the wrongful actions committed by the company management or other people associated with the company.

Such actions can be brought about against any type of companies, whether in the public sector or in the private. Moreover, they can be filed against any company which is incorporated under the Companies Act, 2013 or any previous Companies Act. There is only one exemption – banking companies.

Deregistration of Companies:

The procedural errors at the time of registration can now be corrected; the Tribunal can even cancel the registration of a company or dissolve it. The Tribunal can declare this in certain circumstances when the registration of a company is obtained in an illegal or wrongful manner. It is a remedy that is distinct from winding up and striking off.

Reopening of Accounts and Revision of Financial Statements:

This can be ordered in case of falsification of books of accounts. Sections 130 and 131. provide the instances where financial statements can be revised/reopened. Section 130 is mandatory, where the Tribunal or Court may direct the company to reopen its accounts when certain circumstances are shown.

Section 131 allows company to revise its financial statement but does not permit reopening of accounts. The company can itself approach the Tribunal under Section 131, through its director for revision of its financial statement.

Tribunal Ordered Investigations:

These are under Chapter XIV of the new Act:

- Power to order investigation: On application by 100 members, for an investigation into the affairs of a company.

- Power to investigate into the ownership of the company.

- Power to impose restriction on any securities. (

- Power to freeze assets of the company.

- Power to seek assistance of Chief Metropolitan Magistrate.

- De-registration of Companies.

- Declare the liability of members unlimited.

- De-registration of companies in certain circumstances when there is registration of companies is obtained in an illegal or wrongful manner.

- Remedy of oppression and mismanagement.

- Power to hear grievance of refusal of companies to transfer securities and rectification of register of members.

- Protection of the interest of various stakeholders, especially non-promoter shareholders and depositors.

- Power to provide relief to the investors against a large set of wrongful actions committed by the company management or other consultants and advisors who are associated with the company.

- Aggrieved depositors have the remedy of class actions for seeking redressal for the acts/omissions of the company which hurt their rights as depositors.

- Power to freeze assets of the company. Conversion of public limited company into private limited company.

- If the company cannot or has not held an Annual General Meeting as required under the Companies Act or a required Extraordinary General Meeting, then the Tribunal has powers to call for a General Meetings.

- Power to alter the financial year of a company registered in India.

National Company Law Appellate Tribunal (NCLAT) Appeals from orders of the Tribunal can be raised with the National Company Law Appellate Tribunal (NCLAT). Appeals can be made by any person aggrieved by an order or decision of the NCLT, within a period of 45 days from the date on which a copy of the order or decision of the Tribunal is received by him.

On the receipt of an appeal from an aggrieved person, the Appellate Tribunal would pass such orders as it considers fit, after giving an opportunity of a hearing. They can confirm, modify or set aside the order that is appealed against.

The Appellate Tribunal is required to dispose the appeal within a period of six months from the date of its receipt. The NCLAT is constituted under Section 410 of the Companies Act, 2013.

It has been given the powers to hear appeals against any direction, decision or order covered under Section 53A of the Competition Act, 2002. Moreover, existing restrictions on the appointment of judicial and technical members in the Appellate Tribunal, as put in force by the Central Government, have henceforth been eliminated.

The newly inserted Section 418A w.r.t. “Benches of Appellate

Tribunal”-provides that the powers of the Appellate Tribunal may be exercised by the Benches thereof, which are to be constituted by the Chairperson of the Tribunal. The provisions pertaining to the benches are as under –

A Bench of the Appellate Tribunal shall have at least one Judicial Member and one Technical Member.

The Benches of the Appellate Tribunal shall ordinarily sit at New Delhi or such other places as the Central Government may, in consultation with the Chairperson, notify.

The Central Government has the power to notify, after consultation with the Chairperson, the establishment of such number of Benches of the Appellate Tribunal, as it may consider necessary, to hear appeals against any direction, decision or order referred to in section 53A of the Competition Act, 2002 and under section 61 of the Insolvency and

Bankruptcy Code, 2016.

Question.4: Explain the concept of ‘benches’.

Answer:

Benches of Tribunal

There shall be constituted such number of Benches of the Tribunal, as the Central Government may, by notification, specify. The Principal Bench of the Tribunal shall be at New Delhi which shall be presided over by the President of the Tribunal.

The Benches are to consist of two Members, out of whom one shall be a Judicial Member and the other shall be a Technical Member. It may also have a single Judicial Member for such class of cases or such matters as the President may, by general or special order, specify.

If at any stage of the hearing of any such case or matter, it appears to the Member that the case or matter is of such a nature that it ought to be heard by a Bench consisting of two Members, the case or matter may be transferred by the President, or, as the case may be, referred to him for transfer, to such Bench as the President may deem fit.

The Central Government shall notify and establish such number of benches of the Tribunal as it may consider necessary, to exercise the jurisdiction, powers and authority of the Adjudicating Authority conferred on such Tribunal by or under Part II of the Insolvency and Bankruptcy Code, 2016.

If there is a difference of opinion amongst the members of the tribunal, it shall be decided according to simple majority. If the Members are equally divided, the case shall be referred by the President for hearing.

The newly inserted Section 418A w.r.t. “Benches of Appellate Tribunal”-provides that the powers of the Appellate Tribunal may be exercised by the Benches thereof, which are to be constituted by the Chairperson of the Tribunal.

The provisions pertaining to the benches are as under. A Bench of the Appellate Tribunal shall have at least one Judicial Member and one Technical Member.

The Benches of the Appellate Tribunal shall ordinarily sit at New Delhi or such other places as the Central Government may, in consultation with the Chairperson, notify.

he Central Government has the power to notify, after consultation with the Chairperson, the establishment of such number of Benches of the Appellate Tribunal, as it may consider necessary, to hear appeals against any direction, decision or order referred to in section 53A of the Competition Act, 2002 and under section 61 of the Insolvency and Bankruptcy Code, 2016.

Question.5: Can the NCLT punish a party for contempt?

Answer:

Power to Punish for Contempt

Section 425 of the Act gives the NCLT the power to punish for contempt. In this context, the Tribunal and the Appellate Tribunal shall have the same jurisdiction, powers and authority in respect of contempt of themselves as the High Court has.

To this end, they may exercise the powers under the provisions of the Contempt of Courts Act, 1971. This means that the reference in the Act to a High Court shall be construed as including a reference to the Tribunal and the Appellate Tribunal; and wherever the Advocate-General is referred to, it will be taken as a reference to such Law Officers as the Central Government may, specify in this behalf.

Question.6: Explain the procedure for institution of proceedings before the NCLT.

Answer:

Institution of proceedings, petition, appeals etc. before NCLT Part III of the National Company Law Tribunal Rules, 2016 deals with the institution of proceedings, petitions, appeals etc. before the NCLT.

The procedure of Appeal is as under:

Every appeal or petition or application to be in English. If it is in some other Indian language, it shall be accompanied by a copy translated in English.

The title shall state “Before the National Company Law Tribunal” and Joe shall also specify the Bench to which it is presented.

It will mention the cause title and the provision of law under which it is preferred.

Appeal or petition or application or counter objections shall all be divided 2. 918 into paragraphs and shall be numbered consecutively. Each paragraph shall contain a separate fact or allegation or point.

Full name, parentage, age, description of each party, address and in case a party sues or is being sued in a representative character, whom he represents shall also be specified at the beginning of the appeal or petition or application.

Every petition, application and appeal shall be presented in triplicate by the appellant or applicant or petitioner or respondent, as the case may be, in person or by his duly authorised representative or by an advocate duly appointed in this behalf in the prescribed form with stipulated fee at the filing counter of the relevant bench of the NCLT.

Question.7: Explain the concept of special courts and also the differences between a Special Court and the NCLT.

Answer:

Special Courts

For speedy trial of offences, the Central Government is empowered to establish special courts in consultation with the Chief Justice of the High Court within whose jurisdiction the judge is to be appointed. (Section 435 of the Companies Act, 2013).

They shall be presided over by a single judge. All offences under this Act shall be triable by the Special Court established for the area as may be specified in this behalf by the High

Court concerned. (Section 436)

Such courts can give decisions regarding offences punishable with imprisonment for a term not exceeding three years. It has the discretion to order a regular trial instead of proceeding with the case itself.

Differences between NCLT and Special Court:

Jurisdiction: A Special Court has limited jurisdiction or special jurisdiction, and only covers cases related to bankruptcy, family matters etc., whereas, the NCLT is a quasi-judicial body which resolves matters pertaining to companies in India.

Authority: The Special Court derives power from its constituting authority, like the constitution or a statute. On the other hand the NCLT was established under the Companies Act.

Number of benches: The NCLT has eleven benches, two at New Delhi (one being the principal bench) and one each at Ahmedabad, Allahabad,

Bengaluru, Chandigarh, Chennai, Guwahati, Hyderabad, Kolkata and Mumbai, whereas there is a single Special Court for each matter.

Appeals: Decisions of the NCLT may be appealed to the National Company Law Appellate Tribunal. Appeals against the orders of the Special Court can only be filed to the Supreme Court.

Question.8: What are the details to be set out in the address of the party, for delivery of summons?

Answer:

Particulars to be set out in the address for service of summons

The address for service of summons is provided by the parties at the time of filing of the appeal, petition, application or caveat. It is to include the following details –

- The full and proper name of the road, street, lane and Municipal Division or Ward, Municipal door and other number of the house;

- The name of the town or village;

- The post office, postal district and PIN Code, and

- Any other details that might be deemed essential to locate and identify the addressee such as fax number, mobile number, valid e-mail address, if any, etc.

Question.9: What are the requirements related to the presentation of petition or appeal?

Answer:

Presentation of petition or appeal

The requirements as per the Act are as under –

Every petition, application, caveat, interlocutory application, documents and appeal shall be filed in triplicate by the appellant, applicant, petitioner or respondent..

He can do so in person or through his duly authorized representative or by an advocate duly appointed in this behalf in the prescribed form. It has to be filed with the stipulated fee at the designated filing counter. Non-compliance of this may constitute a valid ground to refuse to give it due recognition.

Every petition or application or appeal is to be accompanied by documents duly certified by the authorized representative or duly verified from the originals by the advocate filing the petition, application or appeal.

The documents filed in the Tribunal shall be accompanied by an index in triplicate containing their details and the amount of fee paid thereon. Required number of copies of the appeal or petition or application shall also be filed for being served to the opposite party as prescribed under these rules.

In case of pending matters, all applications shall be presented after serving copies thereof in advance on the opposite side or his authorized

representative.

The processing fee prescribed by these rules, the required size and number of envelopes and notice forms shall be filled along with memorandum of appeal (MoA).

Question.10: What is the rule regarding production of authorization for and on behalf of an association?

Answer:

Production of authorization for and on behalf of an association

Where an appeal, application, petition or other proceeding is filed or initiated on behalf of an association, the person who signs or verifies the same has to produce along with such application a true copy of the resolution of the association that authorizes such person to do so.

This is for the purpose of verification by the Registry. The Registrar may, at any time, call upon the party to produce such further materials as he deems fit for satisfying himself

about due authorization.

Moreover, the resolution shall set out the list of members for whose benefit or on whose behalf the proceedings are instituted.

Question.11: Comment on the rights of a party to appear before the National Company Law Tribunal.

Answer:

Rights of a party to appear before the Tribunal

The Act provides the following rights to a party regarding the right to appear before the Tribunal – A party may appear before a Tribunal in person or through an authorized

representative, who has been specially authorized in writing for this very purpose.

The authorized representative shall make get his appearance registered by filing a Vakalatnama or a Memorandum of Appearance in Form No. NCLT-12 representing the respective parties to the proceedings.

The Central Government, the Regional Director or the Registrar of Companies or Official Liquidator may authorize an officer or an Advocate to represent in the proceedings before the Tribunal.

The officer authorized by the Central Government or the Regional Director or the Registrar of Companies or the Official Liquidator shall be an officer not below the rank of Junior Time Scale or company prosecutor.

During any proceedings before the Tribunal, it may call upon the Registrar of Companies to submit information on the affairs of the company on the basis of information available in the MCA21 portal.

Reasons for such directions shall be recorded in writing. Generally it is done for the purpose of its knowledge. Audio or video recording of the Bench proceedings by the parties or their authorised Representatives are not permitted.

Question.12: Which types of offences are triable by Special Courts?

Answer:

Offences Triable by Special Courts (Section 436)

These are provided in Section 436, which provides that – Regardless of anything contained in the Code of Criminal Procedure, 1973, All offences specified under sub-section (1) of Section 435 shall be triable only by the Special Court established for the area in which the registered office of the company situated.

Where there are multiple such courts, cases shall be tried by the one specified in this behalf by the concerned High Court.

When an accused or one suspected of the commission of an offence under this Act is referred to a Magistrate under Section 167 (2A) of the Code of Criminal Procedure, 1973, such Magistrate may authorise the detention of such person in such custody as he thinks fit.

Such detention shall be for a period not exceeding fifteen days in toto where such Magistrate is a Judicial Magistrate and seven days in the whole where such Magistrate is an Executive Magistrate.

If the concerned Magistrate feels that the detention of such person upon or before the expiry of the period of detention is unnecessary, he shall refer such person to the Special Court having proper jurisdiction in the matter.

Special Court may exercise the same power which a Magistrate having jurisdiction to try a case may exercise under section 167 of the Code of Criminal Procedure, 1973 in relation to an accused person who has been forwarded to him under that Section.

A Special Court has the right to take cognizance of the offence without the accused being committed to it for trial, upon perusal of the facts presented in the police report or in the complaint made in that behalf.

When trying an offence under this Act, a Special Court may also try an offence other than an offence under this Act with which the accused may be charged under the Code of Criminal Procedure, 1973, at the same trial.

A Special Court may try in a summary way any offence under this Act which is punishable with imprisonment for a term not exceeding three years. In such a case, in the case of any conviction, no sentence of imprisonment for a term exceeding one year shall be passed.

If, at the commencement of, or in the course of a summary trial, the Special Court believes that the nature of the case is such that the sentence of imprisonment for a term exceeding one year may have to be passed or if it is not desirous of trying the case summarily, the Special Court shall, after hearing the parties, record an order to that effect.

In doing so, it may also recall any witnesses who may have been examined and proceed to hear or rehear the case in accordance with the procedure for the regular trial.

Application of Code to Proceedings before Special Court As per Section 438, “the provisions of the Code of Criminal Procedure, 1973 shall apply to the proceedings before a Special Court and for the purposes of the said provisions, the Special Court shall be deemed to be a Court of Session or the court of Metropolitan Magistrate or a Judicial Magistrate of the First Class, as the case may be, and the person conducting a prosecution before a Special Court shall be deemed to be a Public Prosecutor.”