Transparency And Disclosures

The annual report is a comprehensive report provided by most public companies to disclose their corporate activities over the past year. The report is typically issued to shareholders and other stakeholders who use it to evaluate the firm’s performance including both operating and financial highlights.

Such annual report shall contain the following:

- audited financial statements i.e. balance sheets, profit and loss accounts etc, and Statement on Impact of Audit Qualifications, if applicable;

- consolidated financial statements audited by its statutory auditors;

- cash flow statement presented only under the indirect method as prescribed in Accounting Standard-3 or Indian Accounting Standard 7, as applicable, specified in Section 133 of the Companies Act, 2013

- directors report;

- management discussion and analysis report – either as a part of directors report or addition thereto;

- for the top five hundred listed entities based on market capitalization

Board’s Report in Companies Act, 2013

The Board’s Report is the most important means of communication by the Board of Directors of a company with its shareholders. It is a comprehensive document which serves to inform the shareholders about the performance and various other aspects of the company, its major policies, relevant changes in management, future programmes of expansion, modernization and diversification, capitalization or reserves, etc.

It is mandatory for the Board of Directors of every company to present financial statement to the shareholders along with its report, known as the “Board’s Report” at every annual general meeting.

Disclosure in Board’s Report pursuant to the Companies Act, 2013

- Disclosures under Section 134(3)

- Details of Employees Stock Option Scheme – section 62(1)(b)

- Voluntary revision of Financial Statements or Board’s Report- Section 131(1)

- Resignation of Director – Section 168(1)

- Issue of Equity Shares with differential rights

- Restrictions on purchase by company or giving of loans by it for

- Corporate Social Responsibility – Section 135

- Composition of Audit Committee – Section 177(8)

- Issue of Sweat Equity Shares

- Disclosures pertaining to Consolidated Financial Statements

- Re-Appointments of an Independent Director – Section 149(10)

- Details of Vigil Mechanism – Section 177(10)

- Disclosures pertaining to remuneration of directors and employees – Section 197(12)

- Policy relating to the remuneration for the directors, key managerial personnel and other employees – Section 178(4)

- Remuneration received by MD and WTD from holding or subsidiary companies-Section 197(14)

- Related party transactions – Section 188(2) (xvii) Secretarial Audit Report – Section 204(1)

- Additional Disclosures by Producer Company

Signing of Board’s Report [Section 134(6)]

Transparency And Disclosure In Corporate Governance

Annual Return in Companies Act, 2013

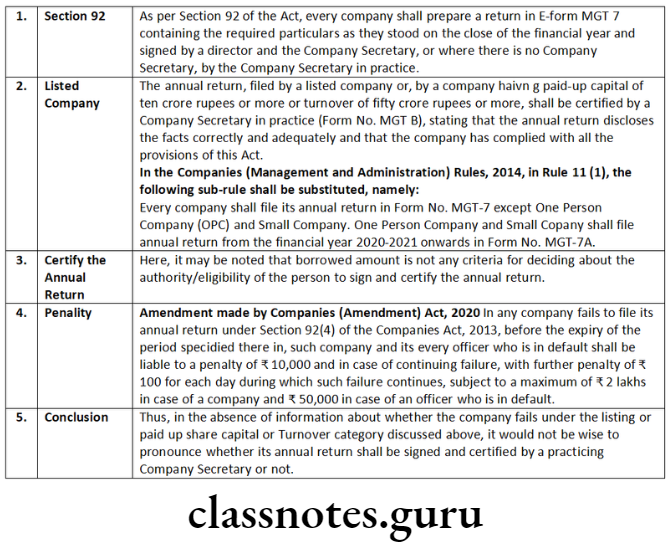

As per Section 92 of the Companies Act, 2013, every company is required to prepare the Annual Return in Form No. MGT-7 containing the particulars as they stood on the close of the financial year. Annual Return is to be filed with the Registrar within 60 days from the date on which Annual General Meeting (AGM) is actually held or from the last day on which AGM should have been held.

- As provided in sub-Section (2) of Section 384, the provisions of Section 92 regarding filing of annual return apply to a foreign company subject to such exceptions, modifications and adoptions as may be provided for in the Rules.

- Rule 7 of the Companies (Registration of Foreign Companies) Rules, 2014 provides that every foreign company shall prepare and file, within a period of sixty days from the last day of its financial year, to the Registrar annual return in Form FC-4 along with fee, containing the particulars as they stood on the close of the financial year.

Signing of Annual Return in Companies Act, 2013

Under section 92(1) of the Act, the Annual Return is required to be signed both by a director and the Company Secretary, or where there is no Company Secretary, by a Company Secretary in Practice.

The Annual Return of One Person Company and Small Company shall be signed by the Company Secretary or where there is no company- secretary, by the director of the company. The Act authorises the Central Government.

Website Disclosures in Companies Act, 2013

Companies Act, 2013 does not mandate companies to have an active website, but SEBI (LODR), 2015 requires all the listed entities shall maintain a functional website containing the following information about the listed entity:

- details of its business;

- financial information including complete copy of the annual report including balance sheet, profit and loss account, directors report etc;

- email address for grievance redressal and other relevant details;

- name of the debenture trustees with full contact details;

- the information, report, notices, call letters, circulars, proceedings, etc. concerning non-convertible redeemable preference shares or non convertible debt securities;

- all information and reports including compliance reports filed by the listed entity;

Transparency And Disclosures Short Notes

Question 1. Write a note on the following:

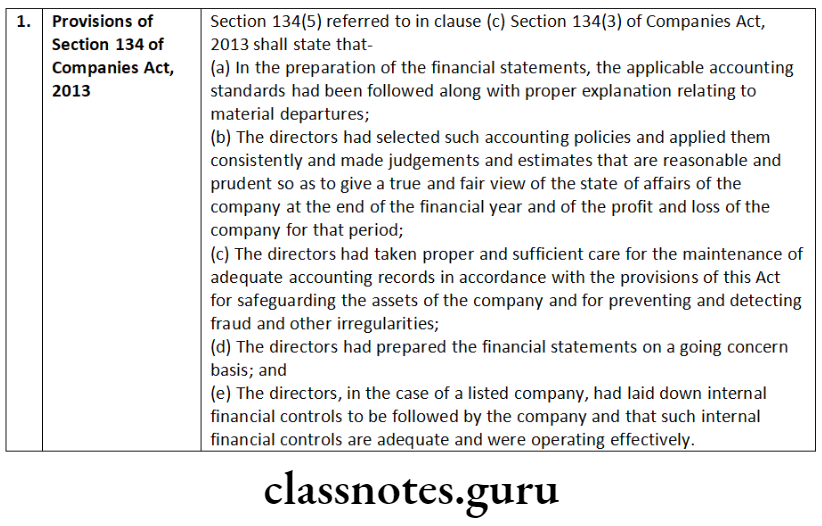

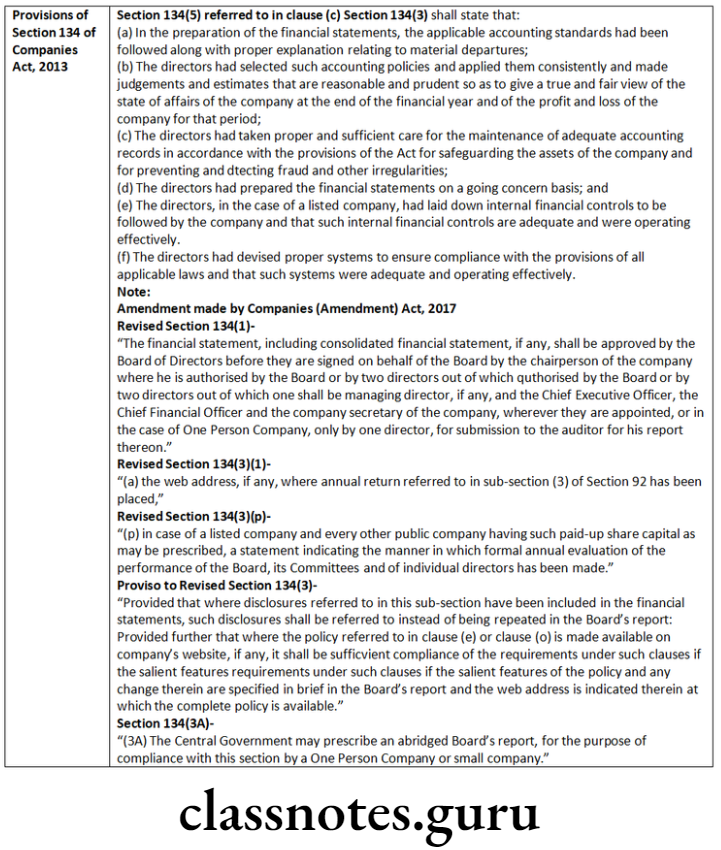

Directors’ responsibility statement in Companies Act, 2013

Answer:

Transparency And Disclosures Descriptive Questions

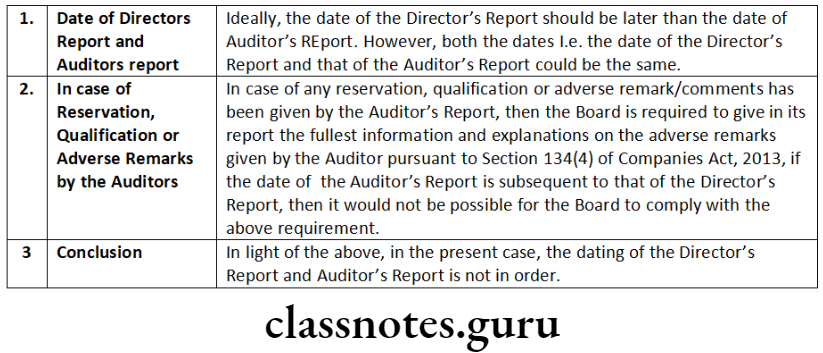

Question 1. The Directors’ Report of Ayush Ltd. for the financial year ended 31st March, 2012 has been dated 15th May, 2012, whereas the Auditors’ Report for the same period is dated 16th May, 2012. Is this in order? Explain.

Answer:

Disclosures Under Companies Act 2013

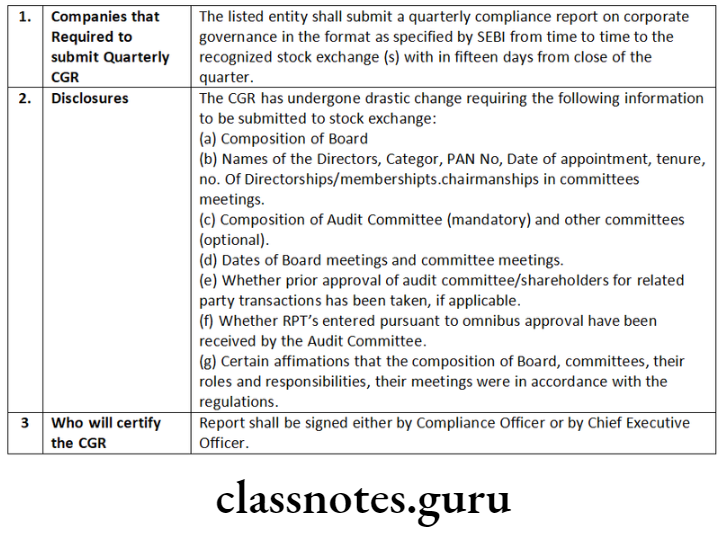

Question 2. Narrate briefly the importance of Corporate Governance Report and also state who can certify such report.

Answer:

Question 3. The Board of directors of Charming Ltd. seek your advice on the matters to be included in the directors’ responsibility statement forming part of the company’s annual report to shareholders. As the Company Secretary of Charming Ltd., advise the Board.

Answer:

Question 4. Comment on the following:

Every company is required to disclose the details of vigil mechanism in the Board Report.

Answer:

According to Section 177(9) of Companies Act, 2013, read with Rule 7 of Companies (Meetings of Board and its Powers) Rules, 2014 the following companies are required to establish a vigil mechanism for their directors and employees to report their genuine concerns or grievances.

- Every listed company;

- The Companies which accept deposits from the public;

- The Companies which have borrowed money from banks and public financial institutions in excess of fifty crore rupees.

Further the sub-section (10) provides that the details of establishment of such mechanism shall be disclosed by the company on its website, if any, and in the Board’s report.

Corporate Transparency And Accountability

Question 5. What are the ‘related party disclosures’ required to be made by listed entities as per SEBI Regulations?

Answer:

According to SEBI (LODR) Regulations, 2015, the Annual Report shall make certain provisions of Related Party Disclosures. Further as per Regulation 27(2) of SEBI (LODR) Regulations, 2015 details of all material transactions with related parties shall be disclosed along with the quarterly compliance report on corporate governance in the format as prescribed by the Board from time to time to the recognised Stock Exchange(s) within fifteen days from end of the quarter.

- The listed entity shall make disclosures in compliance with the Accounting Standard on “Related Party Disclosures”.

- The disclosure requirements shall be given below:-

Disclosures of amounts at the year end and the maximum amount of loans/advances/ investments outstanding during the year, in the books of accounts of:

- Holding Company:-

- Loans and advances in the nature of loans to subsidiaries by name and amount.

- Loans and advances in the nature of loans to associates by name and amount.

- Loans and advances in the nature of loans to firms/companies in which directors are interested by name and amount.

- Subsidiary:-Same disclosures as applicable to the parent company in the accounts of subsidiary company.

- Holding Company:- Investments by the loanee in the shares of parent company and subsidiary company, when the company has made a loan or advance in the nature of loan.

For the purpose of above disclosures directors’ interest shall have the same meaning as given in Section 184 of the Companies Act, 2013. Disclosures of transactions of the listed entity with any person or entity belonging to the promoter/promoter group which holds 10% or more shareholding in the listed entity, in the format specified in the relevant accounting standards for annual results.

Question 6. Comment on the following:

Annual Return is a significant document in relation to the company.

Answer:

Annual Return is an important document in relation to the company Annual Return is an important document for the stakeholders of a company as it provides a very exhaustively information about the different aspects of a company. It is perhaps the most significant document required’ to be filed by every company with the Registrar of Companies.

Apart from the Financial Statements, this is the only document to be mandatory filed with the Registrar of Companies, every year irrespective of any events/happenings in the company.

While the Financial Statements give information on the financial performance of a company, it is the Annual Return which gives substantial disclosure and greater insight into the non-financial matters of the company and the people entrusted with the management of the company.

Under Section 92(1) of the Companies Act, 2013 Annual Return contains the following information:

- its registered office, principal business activities, particulars of its holding, subsidiary and associate companies;

- its shares, debentures and other securities and shareholding pattern;

- its indebtedness [omitted by the Companies (Amendment) Act, 2017)];

- its members and debenture-holders along with changes therein since the close of the previous financial year;

- its promoters, directors, key managerial personnel along with changes therein since the close of the previous financial year;

- meetings of members or a class thereof, Board and its various committees along with attendance details;

- remuneration of directors and key managerial personnel;

- penalty or punishment imposed on the company, its directors or officers and details of compounding of offences and appeals made against such penalty or punishment;

- matters relating to certification of compliances, disclosures as may be prescribed;

- such other matters as may be prescribed.

Cs Company Law Disclosure Requirements

Question 7. Comment on the following:

Every Company is required to comply the disclosure requirements under the Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013 in their Board Report.

Answer:

Under Section 134 read with Rule 8(5) (x) of the Companies (Accounts) Rules, 2014, every company except (Small Companies and One Person Companies) is required to include the following in its Director’s Report:

Statement that the company has complied with provisions relating to the constitution of Internal Complaints Committee under the Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013

Disclosure Requirements under the Sexual Harassment of Women at Workplace (Prevention, Prohibition & Redressal) Act, 2013

- The Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013 is applicable to every workplace, establishment, company or organisation employing 10 or more employees irrespective of its location or nature of industry.

- The said Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal Act,) 2013 provides for constitution of a Committee to be known as the “Internal Complaints Committee”.

- Section 21 of the Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013 mandates that Internal Committee shall prepare an Annual Report

- Section 22 of the said Act provides that the employer shall include in its report the number of cases filed, if any, and their disposal under this Act in the Annual Report.

As Per Rule 14 of Sexual Harassment of Women at Workplace (Prevention, Prohibition & Redressal) Rules, 2013 provides that the annual report which the Complaints Committee is required to prepare under Section 21 of the Sexual Harassment of Women at Workplace (Prevention, Prohibition & Redressal) Act, 2013 shall contain the following details:

- Number of complaints of sexual harassment received in the year;

- Number of complaints disposed off during the year;

- Number of case’s pending for more than 90 days;

- Number of workshops or awareness programme against sexual harassment carried out;

- Nature of action taken by the employer or District Officer.

Question 8. Every company is required to have active website. Comment.

Answer:

The Companies Act, 2013 does not mandate companies to have an active website, but the SEBI (LODR) Regulations, 2015 requires that all listed entities shall maintain a functional website containing the basic information about the listed entity:

As per the provisions of the SEBI (LODR) Regulation, 2015, the listed entity shall disseminate the prescribed informations under a separate section on its website, including:

- details of its business;

- terms and conditions of appointment of independent directors;

- composition of various committees of board of directors;

- code of conduct of board of directors and senior management personnel;

- details of establishment of vigil mechanism/ Whistle Blower policy;

- criteria of making payments to non-executive directors, if the same has not been disclosed in annual report;

- policy on dealing with related party transactions;

- policy for determining ‘material’ subsidiaries;

- details of familiarization programmes imparted to independent directors including the following details:-

- number of programmes attended by independent directors (during the year and on a cumulative basis till date),

- number of hours spent by independent directors in such programmes (during the year and on cumulative basis till date), and

- other relevant details.

- the email address for grievance redressal and other relevant details;

- contact information of the designated officials of the listed entity who are responsible for assisting and handling investor grievances;

- financial information including:

- notice of meeting of the board of directors where financial results shall be discussed;

- financial results, on conclusion of the meeting of the board of directors where the financial results were approved;

- complete copy of the annual report including balance sheet, profit and loss account, directors report, corporate governance report etc.

- shareholding pattern;

- details of agreements entered into with the media companies and/or their associates, etc.;

- the information, report, notices, call letters, circulars, proceedings, etc. concerning non- convertible redeemable preference shares or non-convertible debt securities;

- all information and reports including compliance reports filed by the listed entity;

- information with respect to the following events:

- default by issuer to pay interest on or redemption amount;

- failure to create a charge on the assets;

- revision of rating assigned to the non-convertible debt securities.

It is important that the listed entity ensures the contents of the website are correct and updated at any given point of time.

Types Of Disclosures In Company Law

Question 9. Comment on the following:

Signing of the Board’s Report can be done by any one of the directors and be filed within 60 days of AGM.

Answer:

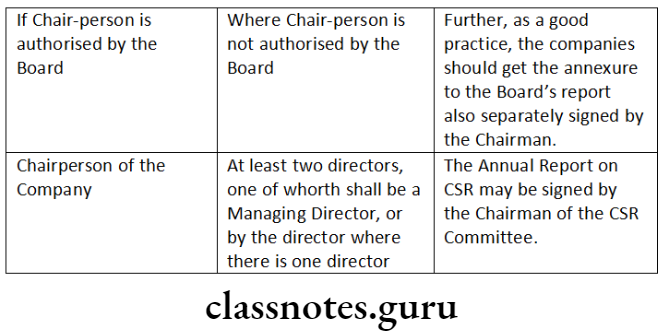

As per Section 134(6) of the Companies Act, 2013, the Board’s report and any annexures thereto, shall be signed by the Chairperson of the company if he is authorised by the Board and where he is not so authorised, shall be signed by at least two directors, one of whom shall be a managing director, or by the director where there is one director.

As per Section 137(1) of the Companies Act, 2013 states that a copy of financial statements, including consolidated financial statement, if any, along with all documents required to be attached to such financial statements under the Companies Act, 2013, duly adopted at the annual general meeting (AGM) or adjourned annual general meeting of the company shall be filed with the Registrar of Companies (ROC) within 30 days of annual general meeting or adjourned annual general meeting along with the prescribed fees.

The Board’s Report has to be attached to the financial statements. Although, where the financial statements are not adopted at annual general meeting (AGM) or adjourned annual general meeting, such unadopted financial statements along with the required documents shall be filed with the Registrar within thirty days of the date of annual general meeting.

In case of a One Person Company (OPC) a copy of the financial statements duly adopted by its member, along with all the documents which are required to be attached to such financial statements, shall be filed within one hundred eighty days from the closure of the financial year.

Transparency And Disclosures Practical Questions

Question 1. Pioneer Fisheries Ltd. has borrowed an amount of * 50 crore from a financial institution. The annual general meeting of the company was held on 1st September, 2015. Examining the provisions of the Companies Act, 2013, state as to who will sign and certify the annual return while filing the same with the Registrar of Companies after the annual general meeting.

Answer:

Question 2. Amendment made by Companies (Amendment) Act, 2017

Revised Section 92(1)-

“Every company shall prepare a return (hereinafter referred to as the annual return) in the prescribed form containing the particulars as they stood on the close of the financial year regarding:

- its registered office, principal business activities, particulars of its holding, subsidiary and associate companies;

- its shares, debentures and other securities and shareholding pattern;

- its members and debenture-holders along with changes therein since the close of the previous financial year;

- its promoters, directors, key managerial personnel along with changes therein since the close of the previous financial year;

- meetings of members or a class thereof, Board and its various committees along with attendance details;

- remuneration of directors and key managerial personnel;

- penalty or punishment imposed on the company. its directors or officers and details of compounding of offences and appeals made against such penalty or punishment;

- matters relating to certification of compliances, disclosures as may be prescribed;

- details, as may be prescribed, in respect of shares held by or on behalf of the Foreign Institutional Investors; and

- such other matters as may be prescribed, and signed by a director and the company secretary. or where there is no company secretary, by a company secretary in practice:

Provided that in relation to One Person Company, small company and such other class or classes of companies as may be prescribed, the annual return shall be signed by the company secretary, or where there is no company secretary, by the director of the company.

Provided further that the Central Government may prescribe abridged form of annual return for One Person Company, small company and such other class or classes of companies as may be prescribed.”

Question 3. Priya, a nominee director on the Board of Aroma Ltd., a listed company, informed the Board of directors during a Board meeting that the next annual report of the company shall contain a ‘Management Discussion and Analysis Report’. You being the Company Secretary have been asked by the Board to prepare the said report. State the matters you would include in the report.

Answer:

A Management Discussion and Analysis Report (MDAR) should form part of the Annual Report to the shareholders. This Management Discussion and Analysis should include discussion on the following matters within the limits set by the company’s competitive position:

- Industry structure and developments.

- Opportunities and Threats.

- Segment-wise or product-wise performance.

- Outlook.

- Risks and concerns.

- Internal control systems and their adequacy.

- Discussion on financial performance with respect to operational performance.

- Material developments in Human Resources/Industrial Relations front, including number of people employed.

Transparency In Financial Reporting

Question 4. Fabulous Ltd. is in the process of finalisation of its annual return. It is a listed company with paid-up capital 1 crore. The company seeks your advice on the following:

- Who will sign the return on behalf of the company?

- What are the requirements of certification of annual return by a practising Company Secretary.

Answer:

- As per Section 92 of the Companies Act, 2013, every company shall prepare its annual return containing the required particulars as they stood on the close of the financial year and shall be signed by a director and the Company Secretary, or where there is no Company Secretary, by a Company Secretary in practice.

- Whereas in case of One Person Company and small company, the annual return shall be signed by the Company Secretary, or where there is no Company Secretary, by the director of the company.

- Every listed company, or a company with paid up share capital of 10 crore or more or a company with turnover of 50 crore or more, shall be required to get a certificate by the Practicing Company Secretary (PCS) stating the facts that the requirements of the Companies Act, 2013 and rules thereto have been complied with and Annual Return discloses the facts correctly and adequately.

Question 5. Phosphate Ltd. has suffered a major loss of * 100 crore in May, 2018 on the dealing of commodity exchange. The annual accounts and Board’s report for the year 2017-18 are under finalization.

The Chief Financial Officer (CFO) of the company does not want to disclose this loss in the Board’s report for year 2017-18 because this loss does not pertain to said financial year. Is the view of CFO correct? The Board of Directors seek your advice in this matter.

Answer:

According to Section 134(3)(k) all material changes and commitments, if any, affecting the financial position of the company which have occurred between the end of the financial year of the company to which the financial statements relate and the date of the report should form part of the Board’s Report.

The Director’s Report shall, therefore, contain material changes pertaining to post-financial statement events impacting the operations and performance of the Company. Thus, in present case view of Chief Financial Officer is incorrect. Loss of 100 Crore incurred during May, 2018, i.e. post financial year, shall be included in the Board’s Report for the year 2017-18. -Space to write important points for revision

Transparency And Disclosures Short Notes

Question 1. Write short note on Certification of Annual Return.

Answer:

Certification of Annual Return:

Certification of Annual Return under sub-section (2) of Section 92 of the Act read with Rule 11(2) of the Companies (Management and Administration) Rules, 2014, the Annual Return of a listed company or of a company having a paid up share capital of 10 Crores or more or turnover of 50 Crores or more shall be certified by a Company Secretary in Practice in the Form No. MGT-8. The certificate shall state that the annual return discloses the facts correctly and adequately and that the company has complied with all the provisions of this Act.

The Companies (Management and Administration) Amendment Rules, 2021:

The MCA has notified the Companies (Management and Administration) Amendment Rules, 2021 to further amend the Companies (Management and Administration) Rules, 2014.

In Section 92 of the Principal Act, for sub-Section (5), the following sub- Section shall be substituted, namely:

Amendment made by Companies (Amendment) Act, 2020

If any company fails to file its annual return under Section 92(4) of the Companies Act, 2013, before the expiry of the period specified therein, such company and its every officer who is in default shall be liable to a penalty of ₹10,000 and in case of continuing failure, with further penalty of ₹100 for each day during which such failure continues, subject to a maximum of 2 lakhs in case of a company and 50,000 in case of an officer who is in default.

Disclosures Under Companies Act 2013

Question 2. Write short note on website disclosure.

Answer:

Website Disclosure:

- details of its business;

- financial information including complete copy of the annual report including balance sheet, profit and loss account, directors report etc;

- contact information of the designated officials of the listed entity who are responsible for assisting and handling investor grievances;

- email address for grievance redressal and other relevant details;

- name of the debenture trustees with full contact details;

- the information, report, notices, call letters, circulars, proceedings, etc concerning non-convertible redeemable preference shares or non convertible debt securities;

- all information and reports including compliance reports filed by the listed entity:

- information with respect to the following events:

- default by issuer to pay interest on or redemption amount;

- failure to create a charge on the assets;

- revision of rating assigned to the non convertible debt securities:

It is important that the listed entity ensures the contents of the website are correct and updated at any given point of time. Space to write important points for revision

Transparency And Disclosures Descriptive Questions

Question 3. What information is required to be disclosed in Annual Report.

Answer:

Annual Report:

The annual report is a comprehensive report provided by most public companies to disclose their corporate activities over the past year. The report is typically issued to shareholders and other stakeholders who use it to evaluate the firm’s performance including both operating and financial highlights.

Such annual report shall contain the following:

- audited financial statements i.e. balance sheets, profit and loss accounts otc, and Statement on Impact of Audit Qualifications, if applicable;

- consolidated financial statements audited by its statutory auditors;

- cash flow statement presented only under the indirect method as prescribed in Accounting Standard-3 or Indian Accounting Standard 7, as applicable, specified in Section 133 of the Companies Act, 2013

- directors report;

- management discussion and analysis report – either as a part of directors report or addition thereto;

- for the top five hundred listed entities based on market capitalization Further it is provided that the annual report shall contain any other disclosures specified in Companies Act, 2013 along with other requirements as specified in Schedule V of above mentioned regulations.

As per SEBI (LODR), the annual report shall contain the following additional disclosures:

- Related Party Disclosure:

- Management Discussion and Analysis:

- Corporate Governance Report

- A brief statement on listed entity’s philosophy on code of governance.

- Board of directors:

- Audit committee

- Nomination and Remuneration Committee:

- Remuneration of Directors:

- Stakeholders’ grievance committee:

- General body meetings:

- Means of communication:

- General shareholder information:

- Declaration signed by the chief executive officer stating that the members of board of directors and senior management personnel have, affirmed compliance with the code of conduct of board of directors and senior management.

- Compliance certificate from either the auditors or practicing company secretaries regarding compliance of conditions of corporate governance shall be annexed with the directors’ report.

- Disclosures with respect to demat suspense account/ unclaimed suspense account

Corporate Transparency And Accountability

Question 4. Describe the contents and signing of Annual Return.

Answer:

Annual Return:

- As per Section 92 of the Companies Act, 2013, every company is required to prepare the Annual Return in Form No. MGT-7 containing the particulars as they stood on the close of the financial year.

- Annual Return is to be filed with the Registrar within 60 days from the date on which Annual General Meeting (AGM) is actually held or from the last day on which AGM should have been held.

- As provided in sub-Section (2) of Section 384, the provisions of Section 92 regarding filing of annual return apply to a foreign company subject to such exceptions, modifications and adoptions as may be provided for in the Rules.

- Rule 7 of the Companies (Registration of Foreign Companies) Rules, 2014 provides that every foreign company shall prepare and file, within a period of sixty days from the last day of its financial year, to the Registrar annual return in Form FC-4 along with fee, containing the particulars as they stood on the close of the financial.year.

Contents of Annual Return

Annual Return shall contain the following particulars in consonance with the Section 92(1) of the Act:

- its registered office, principal business activities, particulars of its holding, subsidiary and associate companies;

- its shares, debentures and other securities and shareholding pattern;

- its members and debenture-holders along with changes therein since the close of the previous financial year;

- its promoters, directors, key managerial personnel along with changes therein since the close of the previous financial year;

- meetings of members or a class thereof, Board and its various committees along with attendance details;

- remuneration of directors and key managerial personnel;

- penalty or punishment imposed on the company, its directors or officers and details of compounding of offences and appeals made against such penalty or punishment;

- matters relating to certification of compliances, disclosures as may be prescribed;

- details, as may be prescribed, in respect of shares held by or on behalf of the Foreign Institutional Investors and such other matters as may be prescribed.

Signing of Annual Return

Under section 92(1) of the Act, the Annual Return is required to be signed both by a director and the Company Secretary, or where there is no Company Secretary, by a Company Secretary in Practice.

The Annual Return of One Person Company and Small Company shall be signed by the Company Secretary or where there is no company secretary, by the director of the company. The Act authorises the Central Government.