Corporate Social Responsibility

Meaning of CSR

Corporate Social Responsibility is an important business strategy because, to some extent a consumer wants to buy products from companies he trusts, a supplier wants to form business partnership with companies he can rely on, an employee want to work for a company he respects, other concerns want to establish business contacts with companies seeking feasible solutions and innovations in areas of common concern.

CSR Applicability

As per Section 135 of the Companies Act, 2013, the CSR provision is applicable to companies which fulfills any of the following criteria during the immediately preceding financial year:

- Companies having net worth of rupees five hundred crore or more, or

- Companies having turnover of rupees one thousand crore or more or

- Companies having a net profit of rupees five crore or more

Functions of CSR Committee

- To formulate and recommend to the Board, a CSR Policy which would indicate the activities to be undertaken in areas or subject, specified in Schedule VII of the Act.

- To recommend the amount of the expenditure to be incurred on the activities undertaken in pursuance of the CSR policy.

- To institute a transparent monitoring mechanism for implementation of the CSR projects or programs or activities undertaken by the company.

- To monitor the CSR policy of the company time to time.

List of CSR Activities

- eradicating hunger, poverty and malnutrition, promoting health care including preventive health care and sanitation including contribution to the Swach Bharat Kosh set-up by the Central Government for the promotion of sanitation and making available safe drinking water.

- promoting education, including special education and employment enhancing vocation skills especially among children, women, elderly and the differently abled and livelihood enhancement projects.

- promoting gender equality, empowering women, setting up homes and hostels for women and orphans; setting up old age homes, day care centres and such other facilities for senior citizens and measures for reducing inequalities faced by socially and economically backward groups;

- protection of national heritage, art and culture including restoration of buildings and sites of historical importance and works of art; setting up public libraries; promotion and development of traditional arts and handicrafts;

- measures for the benefit of armed forces veteran, war widows and their dependents;

- training to promote rural sports, nationally recognized sports, para Olympic sports and Olympic sports;

- rural development projects.

CSR Expenditure

- The Board of every company shall ensure that the company spends, in every financial year, at least two per cent of the average net profits of the company made during the three immediately preceding financial years, in pursuance of its Corporate Social Responsibility Policy. This amount will be CSR expenditure.

- If the company fails to spend such amount, the Board shall, in its report specify the reasons for riot spending the amount.

- The company shall give preference to the local area and areas around it where it operates, for spending the amount earmarked for Corporate Social Responsibility activities.

- Expenditure incurred on specified activities that are carried out in India only will qualify as CSR expenditure. Such expenditure includes contribution to the corpus or on projects or programs relating to CSR activities.

- Any surplus arising out of CSR activities will not be considered as business profit for the spending company.

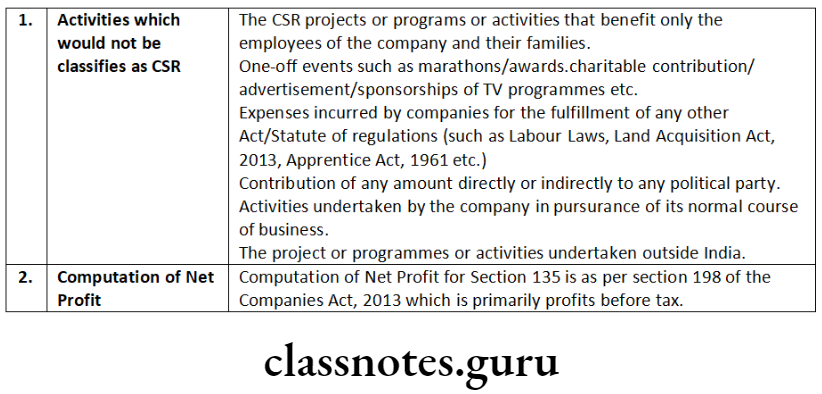

Computation of Net Profit

“Net profit” as per explanation of Section 135(5) means that net profit shall not include such sums as may be prescribed, and shall be calculated in accordance with the provisions of Section 198. The net worth, turnover and net profits are to be computed in terms of Section 198 of the 2013 Act as per the profit and loss statement prepared by the company in terms of Section 381 (1) (a) and Section 198 of the 2013 Act.

Every company will have to report its standalone net profit during a financial year for the purpose of determining whether or not it triggers the threshold criteria as prescribed under Section 135(1) of the Companies Act.

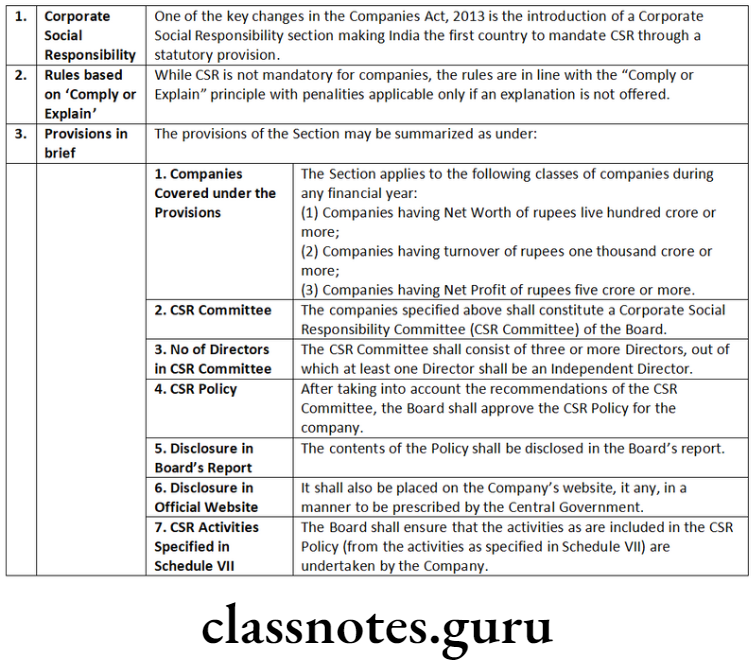

Corporate Social Responsibility In Company Law

Corporate Social Responsibility Disclosure Requirements

It is mandatory for companies to disclose in Board’s Report, an annual report on CSR. The report of the Board of Directors attached to the financial statements of the Company would also need to include an annual report on the CSR activities of the company in the format prescribed containing following particulars –

- A brief outline of the company’s CSR policy, including overview of projects or programs proposed to be undertaken and a reference to the web-link to the CSR policy and projects or programs.

- The Composition of the CSR Committee.

- Average net profit of the company for last three financial years

- Prescribed CSR Expenditure

- Details of CSR spent during the financial year.

- In case the company has failed to spend the two per cent of the average net profit of the last three financial years or any part thereof, the company shall provide the reasons for not spending the amount in its Board report.

Corporate Social Responsibility Descriptive Questions

Question 1. The Companies Act, 2013 has introduced several provisions which would change the way Indian corporates do business and one such provision is spending on corporate social responsibility (CSR) activities which has assumed considerable importance. Discuss the provisions governing CSR as provided in the Companies Act, 2013 and rules made thereunder.

Answer:

The provisions of Corporate Social Responsibility are dealt under Section 135 read with the Companies (Corporate Social Responsibility Policy) Rules, 2014 and clarifications issued by the Ministry from time to time. Some of the important provisions are as under:

- As per Section 135 of the Companies Act, 2013, every company having net worth of 500 crores or more, or turnover of 1,000 crores or more or a net profit of 5 crores or more during the immediately preceding financial year shall constitute a Corporate Social Responsibility Committee of the Board consisting of three or more directors out of which at least one director shall be an independent director. There need not be any independent director on the CSR Committee if the Company is unlisted Public Company or a Private Company.

- In case of Private Company CSR Committee can be formed with two members.

- CSR Committee shall formulate and recommend Corporate Social Responsibility Policy which shall indicate the activity or activities to be undertaken by the company as specified in Schedule VII and also recommend the amount of expenditure to be incurred on CSR activities. The Board of every company shall ensure that the company spends in every financial year at least 2% of the average net profit of the company made during the three immediately preceding financial years in pursuance of its CSR policy.

- Net Profit of a company for the purposes of Section 135 of the Companies Act, 2013 does not include the profit arising from any overseas branch of the company and the dividends received from other companies in India which are complying with Section 135 of the Companies Act, 2013.

- The company shall give preference to local areas where it operates, for spending amount earmarked for CSR activities.

- The CSR activities shall be undertaken by the company, as per its stated CSR Policy, as projects or programs or activities (either new or ongoing), excluding activities undertaken in pursuance of its normal course of business.

- The Board of a company may decide to undertake its CSR activities approved by the CSR committee, through a registered trust or a registered society or a company established by the company or its holding or subsidiary or associate company under section 8 of the Act or otherwise.

- The CSR projects or programs or activities undertaken in India only shall amount to CSR expenditure.

- The CSR projects or programs or activities that benefit only the employees of the company and their families shall not be considered as CSR activities in accordance with Section 135 of the Act.

- Contribution of any amount directly or indirectly to any political party under section 182 of the Act, shall not be considered as CSR activity.

- The CSR Policy of the company is required to be displayed on Company’s website.

- The term CSR is not defined under the Act but Schedule VII of the Companies Act, 2013 requires that the CSR policy created by the CSR Committee must involve atleast one of the focus areas as mentioned in that schedule.

- The CSR activities should be according to the stated CSR policy, as projects or programs or activities (either new or ongoing). The CSR activities may be decided by the Board to be undertaken through a registered trust or a registered society or a company established by the company or its holding or subsidiary or associate company, provided that:

- if such trust, society or company is not established by the company or its holding or subsidiary or associate company, it shall have an established track record of three years in undertaking similar programs or projects;

- the company has specified the project or programs to be undertaken through these entities, the modalities of utilization of funds on such projects and programs and the monitoring and reporting mechanism.

- A company may also collaborate with other company but the reports of such projects shall be separately made as per the rules.

- CSR projects or programs or activities undertaken in India shall amount to CSR expenditure.

- CSR projects that benefits only the families of the employees shall not be considered as CSR activities.

- Companies can either conduct CSR activities by mobilizing their own personnel or through institutions having a track record of at least three years but such expenditure must exceed 5% of total CSR expenditure in one financial year.

- Contribution made to the any political party shall not be considered as CSR activity.

CSR Under Companies Act 2013

Question 2. Referring to the provisions of the Companies Act, 2013 relating to ‘corporate social responsibility’ (CSR), answer the following:

- Which activities would not qualify as CSR?

- Whether the average net profit criteria for CSR is before tax or after tax?

Answer:

Question 3. Any expenditure incurred for the benefit of the society will be considered as expenditure in pursuance of corporate social responsibility policy. Comment with reference to the provisions of the Companies Act, 2013.

Answer:

As per Section 135 of Companies Act, 2013 provides that a company falling under specified criteria shall put in place a Corporate Social Responsibility Policy specify the activities to be undertaken by the company in areas or subject, specified in Schedule VII of Companies Act, 2013.

It is further provided that the Board of Directors of every company shall make sure that the activities as are included in Corporate Social Responsibility Policy of the company are accept by the company.

The expenditure incurred for the benefit of society shall be considered as expenditure in pursuance to Section 135 of Companies Act, 2013, only if the same falls under Corporate Social Responsibility Policy of the Company.

Logical Solutions Ltd., a listed company, is having a Corporate Social Responsibility (CSR) committee constituted with the following members:

Rohan-Whole-time director and Chairman of CSR committee and Board

Sohan-Non-executive director

Mohan-Independent director

Question 4. Can company constitute a Nomination and Remuneration committee consisting of same three members of CSR committee with same composition? Discuss.

Answer:

Under section 178 of Companies Act, 2013, the Board of Directors of every listed public company shall constitute the Nomination and Remuneration Committee consisting of three or more non-executive directors out of which not less than one-half shall be independent director.

The Chairperson of the company (whether executive or non-executive) may be appointed as a member of the Nomination and Remuneration Committee but shall not chair such Committee.

In the above case the CSR Committee cannot serve as Nomination and Remuneration committee as the composition is different.

Question 5. Explain whether the Corporate Social Responsibility (CSR) Committee is entrusted with any specific functions under the Companies Act, 2013?

Answer:

Section 135 (3) of the Companies Act, 2013 read with Rules made thereunder provides that the following functions shall be carried out by a Corporate Social Responsibility (CSR) Committee:

- To formulate and recommend to the Board. a CSR Policy which would indicate the activities to be undertaken in areas or subject, specified in Schedule VII of the Act.

- To recommend the amount of the expenditure to be incurred on the activities undertaken in pursuance of the CSR policy.

- To institute a transparent monitoring mechanism for implementation of the CSR projects or programs or activities undertaken by the company.

- To monitor the CSR policy of the company time to time.

Corporate Social Responsibility Questions And Answers

Question 6. DEF Traders Ltd. is incorporated as a small company. State with reference to the relevant legal provisions whether it is required to set up a Corporate Social Responsibility Committee?

Answer:

According to Section 135 of the Companies Act, 2013, only the following companies are required to constitute a Corporate Social Responsibility Committee which in the immediately preceding financial year have:

- Net worth of 500 crore or more; or

- Turnover of 1000 crore or more; or

- Net profit of 5 crore or more

A small company is defined in section 2(85) of the Companies Act, 2013 to mean a company, other than a public company whose:

- Paid up share capital does not exceed 50 Lakh or such higher amount as may be prescribed which shall not be more than 10 crore and

- Turnover of which as per profit and loss account for the immediately preceding financial year does not exceed 2 crore or such higher amount as may be prescribed which shall not be more than 100 crore

As DEF Traders Ltd. is incorporated as small company, it does not meet the criteria specified in section 135 of the Companies Act, 2013 and would, therefore not be required to constitute a Corporate Social Responsibility Committee.

Corporate Social Responsibility Practical Questions

Question 1. Brave Ltd. is listed at Bombay Stock Exchange and has a net worth of over 600 crore. The company has constituted a corporate social responsibility (CSR) committee with Jay and Vijay as its members. Both Jay and Vijay are directors of the company, Jay being an independent director.

Explaining the provisions of the Companies Act, 2013 relating to ‘corporate social responsibility’, examine whether the company has complied with the provisions of the Act in this regard.

Answer:

Note: Since the company in question has a net worth of 600 crore which is more than the required sum of 500 crore, the company has to comply with the provisions of the Companies Act, 2013, presently, company has only two directors, accordingly there is a need to reconstitute the CSR Committee of Brave Ltd.

Amendment made by Companies (Amendment) Act, 2017 Revised Section 135(1)-

“Every company having net worth of rupees five hundred crore or more, or turnover of rupees one thousand crore or more or a net profit of rupees five crore or more during the immediately preceding financial year shall constitute a Corporate Social Responsibility Committee of the Board consisting of three or more directors, out of which at least one director shall be an independent director.

Provided that where a company is not required to appoint an independent director under sub-section (4) of Section 149, it shall have in its Corporate Social Responsibility Committee two or more directors.”

Revised Section 135(3)(a)-

“(a) formulate and recommend to the Board, a Corporate Social Responsibility Policy which shall indicate the activities to be undertaken by the company in areas or subject, specified in Schedule VII.”

Revised Explanation to Section 135(5)

“For the purposes of this section “net profit” shall not include such sums as may be prescribed, and shall be calculated in accordance with the provisions of Section 198.”

Cs Company Law Csr Questions

Question 2. Corporate Social Responsibility (CSR) provisions are applicable to Microskill Ltd. The company finalised the project under its CSR initiatives which require funds beyond the mandated 2% of average net profit of the company for last three financial years. Will such excess expense, when incurred, be counted in subsequent financial years as a part of CSR expenditure? Advise.

Answer:

In terms of Section 135(5) of the Companies Act, 2013, the Board of every company to which Section 135 is applicable shall ensure that the company spends in every financial year, at least 2% of the average net profits or where the company has not completed the period of three financial years since its incorporation, during such immediately preceding financial years, in pursuance of its Corporate Social Responsibility Policy.

Provided that the company shall give preference to the local area and areas around it where it operates, for spending the amount earmarked for Corporate Social Responsibility activities.

Provided further that if the company fails to spend such amount, the Board shall, in its report made under clause (o) of sub-section (3) of section 134, is required to specify the reasons for not spending the amount and, unless the unspent amount relates to any ongoing project referred to in section 135(6), transfer such unspent amount to a Fund specified in Schedule VII, within a period of six months of the expiry of the financial year.

There is no provision for carry forward or excess expenditure to the next year(s). The words used in the section are ‘at least’. Therefore, any expenditure over 2% could be considered as “voluntary higher spending”.

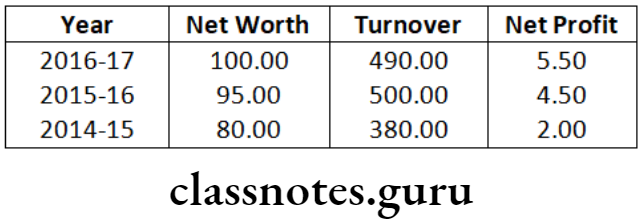

Fortune Ltd. had below financial details during the last three financial years:

Question 3. Discuss the compliance requirements for the Company on Corporate Social Responsibility. Whether Company requires to spend amount on CSR Activities, and what are the consequences if the Company fails to spend any amount?

Answer:

Section 135(1) of the Companies Act, 2013 provides that every company having net worth of rupees five hundred crore or more, or turnover of rupees one thousand crore or more or a net profit of rupees five crore or more during the immediately preceding financial year shall constitute a Corporate Social Responsibility Committee of the Board consisting of three or more directors, out of which at least one director shall be an independent director.

Section 135(3) requires that the Committee shall formulate and recommend to the Board, a CSR Policy which shall indicate the activities to be undertaken by the company as specified in Schedule VII. The Committee shall further recommend the amount of expenditure to be incurred on CSR activities and monitor the Policy from time to time.

As per Section 135(5) of the Act, the Board shall ensure that the company spends, in every financial year, at least 2% of the average net profits of the company made during the three immediately preceding financial years, in pursuance of its CSR Policy.

In Section 135 of the principal Act,

- in sub-section (5),-

- after the words “three immediately preceding financial years,”, the words “or where the company has not completed the period of three financial years since its incorporation, during such immediately preceding financial years,” shall be inserted;

- in the second proviso, after the words “reasons for not spending the amount” occurring at the end, the words, brackets, figure and letters “and, unless the unspent amount relates to any ongoing project referred to in sub-section (6), transfer such unspent amount to a Fund specified in Schedule VII, within a period of six months of the expiry of the financial year”.

Amendment made by Companies (Amendment) Act, 2020

in sub-section (5), after the second proviso, the following proviso shall be inserted, namely:-

“Provided also that if the company spends an amount in excess of the requirements provided under this sub-section, such company may set off such excess amount against the requirement to spend under this sub-section for such number of succeeding financial years and in such manner, as may be prescribed.”;

As Per Companies (Amendment) Act, 2019:

After sub-Section (5), the following sub-Sections shall be inserted, namely:

- “Any amount remaining unspent under sub-Section (5), pursuant to any ongoing project, fulfilling such conditions as may be prescribed, undertaken by a company in persuance of its Corporate Social Responsibility Policy, shall be transferred by the company within a period of thirty days from the end of the financial year to a special account to be opened by the company in that behalf for that financial year in any scheduled bank to be called the Unspent Corporate Social Responsibility.

- Account, and such amount shall be spent by the company in pursuance of its obligation towards the Corporate Social Responsibility Policy within a period of three financial years from the date of such transfer, failing which, the company shall transfer the same to a Fund specified in Schedule VII, within a period of thirty days from the date of completion of the third financial year.

- If a company contravenes the provisions of sub-Section (5) or sub- Section (6), the company shall be punishable with fine which shall not be less than fifty thousand rupees but which may extend to twenty-five lakh rupees and every officer of such company who is in default shall be punishable with imprisonment for a term which may extend to three years or with fine which shall not be less than fifty thousand rupees but which may extend to five lakh rupees, or with both.

- The Central Government may give such general or special directions to a company or class of companies as it considers necessary to ensure compliance of provisions of this Section and such company or class of companies shall comply with such directions.”

- Accordingly, Fortune Ltd. whose net profits during the current year exceeds rupees five crore is required to comply with the requirements of Section 135 and form a CSR Committee as explained above and spend an amount of rupees eight lakh (being 2% of the average net profits of rupees four crore).

- However, the company shall seek to give preference to the local area and areas around it where it operates for spending the aforesaid amount. However, if Fortune Ltd. fails to spend such amount, the Board shall, in its report made u/s 134(3)(0), specify the reasons for not spending the amount. Space to write important points for revision

CSR Policy Requirements In India

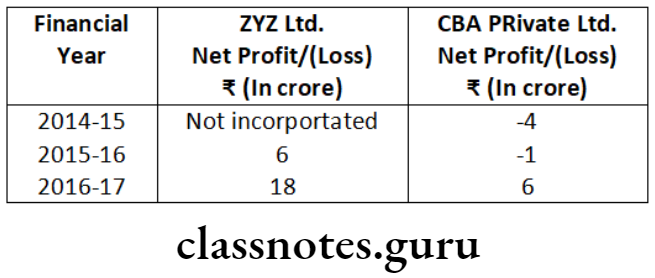

Question 4. From the following information in respect of two companies viz. ZYX Limited and CBA Private Limited, compute the amount the companies are required to spend on account of Corporate Social Responsibility (CSR):

Answer:

Section 135(1) read with Section 135(5) of the Companies Act; 2013 provides that every company having net worth of rupees 500 crore or more, or turnover of rupees 1,000 crore or more or a net profit or rupees 5 crore or more during any financial year shall ensure that the company spends, in every financial year, at least 2% of the average net profits of the company made during the three immediately, preceding financial years.

As Per Companies (Amendment) Act, 2019:

After sub-Section (5), the following sub-Sections shall be inserted, namely:

- “Any amount remaining unspent under sub-Section (5), pursuant to any ongoing project, fulfilling such conditions as may be prescribed, undertaken by a company in persuance of its Corporate Social Responsibility Policy, shall be transferred by the company within a period of thirty days from the end of the financial year to a special account to be opened by the company in that behalf for that financial year in any scheduled bank to be called the Unspent Corporate Social Responsibility.

- Account, and such amount shall be spent by the company in pursuance of its obligation towards the Corporate Social Responsibility Policy within a period of three financial years from the date of such transfer, failing which, the company shall transfer from the date of completion of the third financial year. the same to a Fund specified in Schedule VII, within a period of thirty days

- The Central Government may give such general or special directions to a company or class of companies as it considers necessary to ensure compliance of provisions of this Section and such company or class of companies shall comply with such directions.”

- Where the amount to be spent by a company under sub-section (5) does not exceed fifty lakh rupees, the requirement under sub-section (1) for constitution of the Corporate Social Responsibility Committee shall not be applicable and the functions of such Committee provided under this section shall, in such cases, be discharged by the Board of Directors of such company.”

- In the given case, in case of ZYX Limited, the net profit for financial year 2016-17 is 18 crore. The average net profit for preceding 3 financial years is (0+6+18) crore/3=24 crore/3=8 crore. It is to be noted that though the company was not incorporated in the financial year 2014-15, yet that year is to be considered for calculation of average net profit. Accordingly, the company has to spend 2% of 8 crore, i.e., 0.16 crore towards CSR activities.

- In case of CBA Private Limited, the net profit for financial year 2016-17 is 6 crore. The average net profit for preceding 3 financial year is * [(-4)+ (-1)+6] crore/3=1 crore/3 33.33 lakh. It is to be observed that though the company suffered losses in 2 years 2014-15 and 2015-16, yet those 2 years are to be considered for calculation of average net profit. Accordingly, the company has to spend 2% of 33.33 lakh, i.e., 0.67 lakh towards CSR activities.

Corporate Social Responsibility Case Studies

Question 5. RS Ltd. has incurred 5 lakh for the fulfillment of Labour Law, Land Acquisition Act and Food Safety and Standards Act in the month of May, 2018. The company has accounted for this 5 lakh as Corporate Social Responsibility (CSR) expenditure. Explaining the provisions of the Companies Act, 2013 discuss whether the company has rightly accounted for the amount in CSR.

Answer:

According to the Provisions of Section 135 of the Companies Act, 2013 and rules and clarifications thereunder, expenses incurred by companies for the fulfillment of any Act/Statute of regulations (such as Labour Laws, Land Acquisition Act etc.) would not count as CSR expenditure under the Companies Act, 2013.

In accordance with the aforementioned clarification, expenditure of * 5 lacs relating to fulfillment of requirement under Labour Law, Land Acquisition Act and Food Safety and Standard Act by RS Ltd., will not be treated as CSR expenditure.

Question 6. XYZ Ltd. is carrying out a project under its CSR initiatives. Some of its employees are working in this project. The company want to monetize and account it under the head of ‘CSR expenditure’? Advice the company.

Answer:

As per the MCA General Circular No. 01/2016 dated 12th January, 2016, the contribution and involvement of employees in CSR activities of the company will no doubt generate interest/pride in CSR work and promote transformation from Corporate Social Responsibility as an obligation, to Socially Responsible Corporate in all aspects of their functioning. Therefore, should be encouraged to involve their employees in CSR activities. Although, monetization of such services of employees would not be counted towards CSR expenditure.