An Overview Of Corporate Re-organisation Merger And Amalgamation Of Companies Chapter At A Glance

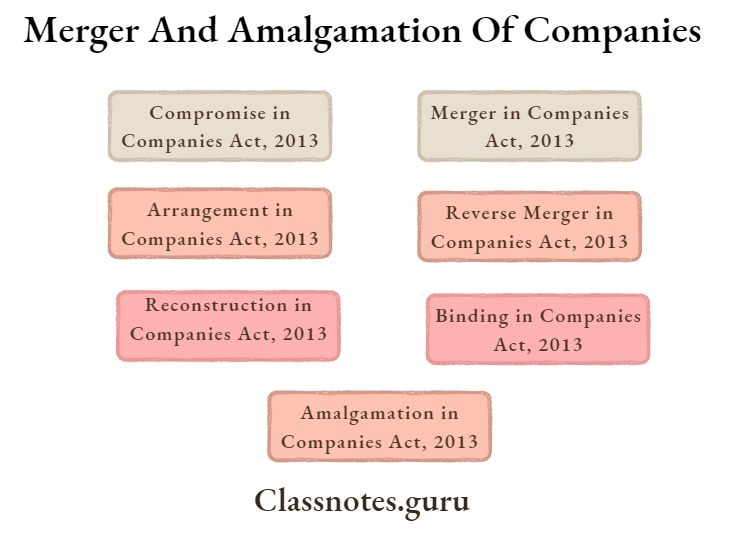

Compromise in Companies Act, 2013

A compromise means settlement or adjustment of claims in dispute by mutual concessions.

Arrangement in Companies Act, 2013

Arrangement includes a reorganization of the share capital of the Company by consolidation of shares of different classes or division of shares into shares of different classes or by both of these methods.

Reconstruction in Companies Act, 2013

Reconstruction’, inter alia, indicates the process that involves

- the transfer of undertakings of an existing company to another company, usually incorporated for the purpose. The old company ceases to exist. However, all the assets might not be passed to the new company;

- the carrying on of substantially the same business by the same persons;

- the rights of the shareholders in the old company are satisfied by their being allotted shares in the new company.

Amalgamation in Companies Act, 2013

Amalgamation is the blending of two or more undertakings (companies) into one undertaking, the shareholders of each blending undertaking becoming substantially the shareholders of the other company that holds blended undertakings.

Merger in Companies Act, 2013

Merger is a form of amalgamation where all the properties and liabilities of the transferor company get merged with the properties and liabilities of the transferee company leaving behind nothing with the transferor company except its name, which also gets removed through the process of law. In reality, companies do not merge; only the assets and liability merge.

Reverse Merger in Companies Act, 2013

Reverse Merger is the opposite of Merger. No clear definition of reverse merger has been given in the Companies Act nor the term has been precisely defined by the Indian Courts. Reverse Merger represents a case where the loss-making company or less profit-earning company extends its embracing arms to the profitable company and, in turn, absorbs it into its fold.

Binding in Companies Act, 2013

The sanctioned scheme would be binding on all the concerned parties. However, in certain circumstances, the Tribunal shall not sanction a scheme of compromise and arrangement.

No Objection Certificate in Companies Act, 2013

In a scheme of compromise or arrangement, the Tribunal is bound to seek a report from the Registrar of Companies as well as a no objection certificate from the Income Tax Authority to ensure that the affairs of the Company have not been conducted in a prejudicial manner.

Explanatory Statement in Companies Act, 2013

An explanatory statement, as provided for in the act, would be attached to every notice calling the meeting.

Supervise the Scheme in Companies Act, 2013

The Tribunal has the power to supervise the implementation of the scheme and to sanction modification of the terms of the scheme. While sanctioning the scheme; the Tribunal also has the power to order winding up.

Merger And Amalgamation In Company Law

Cross Border Mergers in Companies Act, 2013

Section 234(2) states that subject to the provisions of any other law for the time being in force, a foreign company, may with the prior approval of the Reserve Bank of India, merge into a company registered under this Act or vice versa and the terms and conditions of the scheme of merger may provide, among other things, for the payment of consideration to the shareholders of the merging company in cash or Depository Receipts or partly in cash and partly in Depository Receipts, as the case may be, as per the scheme to be drawn up for the purpose.

Merger And Amalgamation Of Companies Descriptive Questions

Question 1. Examining the provisions of the Companies Act, 2013, explain the powers of the Central Government to order the amalgamation of companies in the public interest.

Answer:

Section 237(1) states that when the Central Government is satisfied that it is essential in the public interest that two or more companies should amalgamate, the Central Government may, by order notified in the Official Gazette, provide for the amalgamation of those companies into a single company with such constitution, with such property, powers, rights, interests, authorities, and privileges, and with such liabilities, duties, and obligations, as may be specified in the order.

Question 2. Comment on the following:

The merger of a ‘Subsidiary’ Company into a ‘Holding’ Company.

Answer:

The merger of a ‘Subsidiary’ Company into a ‘Holding’ Company

- As per Section 233 of the Companies Act, 2013, a scheme of merger or amalgamation may be entered into between two or more small companies or between a holding company and its wholly-owned subsidiary company or such other class or classes of companies as may be prescribed, subject to the following, namely:

- a notice of the proposed scheme inviting objections or suggestions, if any, from the Registrar and Official Liquidators where the registered office of the respective companies are situated or persons affected by the scheme within thirty days is issued by the transferor company or companies and the transferee company

- the objections and suggestions received are considered by the companies in their respective general meetings and the scheme is approved by the respective members or class of members at a general meeting holding at least ninety percent. Of the total number of shares

- each of the companies involved in the merger files a declaration of solvency, in the prescribed form, with the Registrar of the place where the registered office of the company is situated and

- the scheme is approved by a majority representing nine-tenths in value of the creditors or class of creditors of respective companies indicated in a meeting convened by the company by giving a notice of twenty-one days along with the scheme to its creditors for the purpose or otherwise approved in writing.

- The transferee company shall file a copy of the scheme so approved in the manner as may be prescribed, by the Central Government, Registrar, and the Official Liquidator where the registered office of the company is situated.

- On the receipt of the scheme, if the Registrar or the Official Liquidator has no objections or suggestions to the scheme, the Central Government shall register the same and issue a confirmation thereof to the companies.

- If the Registrar or Official Liquidator has any objections or suggestions, he may communicate the same in writing to the Central Government within thirty days:

- Provided that if no such communication is made, it shall be presumed that he has no objection to the scheme.

- If the Central Government after receiving the objections or suggestions or for any reason thinks that such a scheme is not in the public interest or the interest of the creditors, it may apply to the Tribunal within sixty days of the receipt of the scheme under sub-Section (2) stating its objections and requesting that the Tribunal may consider the scheme under Section 232.

- On receipt of an application from the Central Government or any person, if the Tribunal, for reasons to be recorded in writing, thinks that the scheme should be considered as per the procedure laid down in Section 232, the Tribunal may direct accordingly or it may confirm the scheme by passing such order as it deems fit:

- Provided that if the Central Government does not have any objection to the scheme or it does not file any application under this section before the Tribunal, it shall be deemed that it has no objection to the scheme.

Types Of Mergers And Amalgamations

Question 3. Serious Ltd. has three factories in Chennai. The company wants to sell one of the factories. Can the company sell its factory? Further, assuming that the company has also borrowed credit facilities from the bank, explain the statutory provisions under the Companies Act, 2013.

Answer:

According to Sub-Section (1)(a) of Section 180 of the Companies Act, 2013, the Board of Directors of a company may sell, lease or otherwise dispose of the whole or substantially the whole of the undertaking of the company or where the company owns more than one undertaking, of the whole or substantially the whole of any of such undertakings only with the consent of the company by a special resolution.

Accordingly, the company may sell any of its factories with the consent of the company by a special resolution.

Where the company has a credit facility on creating a charge on such undertaking, the company, may be required to obtain a no-objection- certificate from the bank as per contractual obligation and shall also modify the charge accordingly.

Question 4. Comment on the following:

The provisions of the Companies Act, 2013 relating to compromises and arrangements are uniformly applicable to all companies.

Answer:

Sections 230 to 240 of the Companies Act, 2013 provide for the Compromise, Arrangements, and Amalgamation of Companies. The said provisions are uniformly applicable to all companies except Section 233 which specifies the simplified procedure for merger or amalgamation of –

- Two or more small companies, or

- Between a holding company and its wholly-owned subsidiary company,

or - Such other classes or classes of companies as may be prescribed.

Section 233 (1) of the Companies Act, 2013 Provides that notwithstanding the provisions of Section 230 and Section 232 of the Companies Act, 2013, a scheme of merger or amalgamation may be entered into between two or more small companies or between a holding company and its wholly-owned subsidiary company or such other class or classes of companies as may be specified, subject to the following, namely:-

- a notice of the proposed scheme inviting objections or suggestions, if any, from the Registrar and Official Liquidators where the registered office of the respective companies are situated or persons affected by the scheme within 30 days is issued by the transferor company or companies and the transferee company;

- the objections and suggestions received are considered by the. companies in their respective general meetings and the scheme is approved by the respective members or class of members at a general meeting holding at least ninety percent of the total number of shares;

- each of the companies involved in the merger files a declaration of solvency, in the prescribed form, with the Registrar of the place where the registered office of the company is situated; and

- the scheme is approved by a majority representing nine-tenths in value of the creditors or class of creditors of respective companies indicated in a meeting convened by the company by giving a notice of twenty-one days along with the scheme to its creditors for the purpose or otherwise approved in writing.

Question 5. The appointed date and Effective date are very important in any merger or amalgamation through a scheme of arrangement. Do you agree?

Answer:

The appointed date and Effective date are two significant dates in any scheme of Merger and Amalgamation.

Mention of an appointed date is compulsory for the schemes falling under Section 232 of the Companies Act, 2013. Schemes involving Merger Amalgamation or division of undertaking are required to fix an appointed date.

In Marshall Sons & Co. India Ltd. vs. ITO, it was held by the Hon’ble Supreme Court that every scheme of amalgamation has to necessarily provide a date with effect from which the amalgamation/transfer shall take place and that such date may precede the date of sanctioning of the scheme by the Court, the date of filing of certified copies of the orders of the Court before the Registrar of Companies, and the date of allotment of shares, etc. Although, would be given effect from the transfer date (appointed date) itself.

- Section 232(6) of the Companies Act, 2013 states that the scheme shall be deemed to be effective from the ‘appointed date’ and not a date after the ‘appointed date’.

- This is an enabling provision to allow the companies to decide and agree upon an ‘appointed date’ from which the scheme shall come into force.

The “Effective date” is the date when the amalgamation/merger is completed in all respects after having gone through the formalities involved, and the transferor company is dissolved by the Registrar of Companies and a certified copy of the order for the scheme of compromise and arrangement is filed with ROC and all other required statutory authorities, if any.

Merger And Amalgamation Of Companies Practical Questions

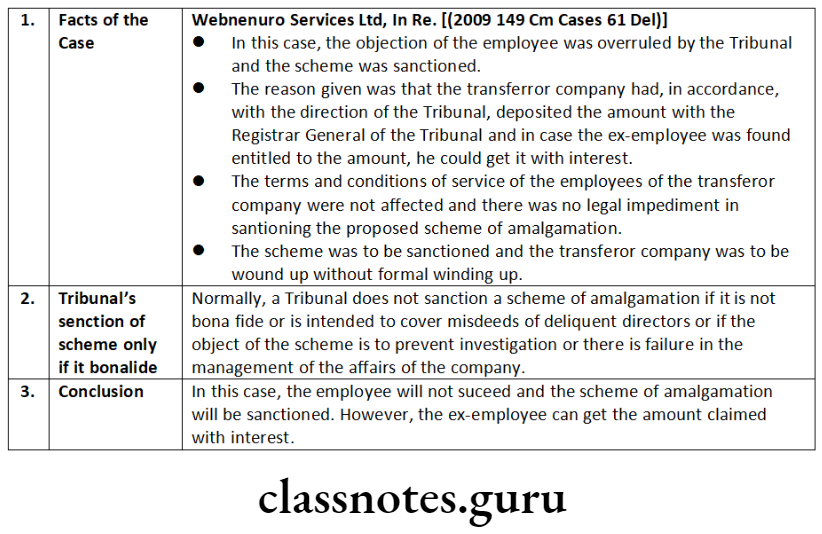

Question 1. A transferor company got approval for a scheme of amalgamation with the transferee company. An amount of 5 lakh was deposited by the transferor company on the direction of the Tribunal for settling the dues of employees. An ex-employee of the transferor company objected to the amalgamation citing that he is also entitled to the claim in the amount deposited. Will he succeed? Give reasons.

Answer:

Companies Act Merger And Amalgamation Process

Question 2. SUP Ltd. is a public company incorporated in India. It wants to propose a scheme of arrangement (merger) with another company in the same line of business in India. Help the company in preparing such a scheme of arrangement first. Secondly, help the company in getting approval from NCLT. Advise how the company should approach NCLT for its approval of the scheme and discuss grounds based on which NCLT will accord its approval.

Answer:

Preparation of Scheme of Amalgamation

The scheme of amalgamation to be prepared by the company should contain the following information:

- Brief details of transferor and transferee companies.

- Appointed date.

- Main terms of transfer of assets and liabilities from the transferor to the transferee.

- Effective date of the scheme.

- The terms of carrying on the business activities by transferor between ‘appointed date’ and ‘effective date’.

- Details of Share Capital of Transferor and Transferee Company.

No Companies or arrangement shall be sanctioned by the Tribunal unless a certificate by the company’s auditor has been filed with the Tribunal to the effect that the accounting treatment, if any, proposed in the scheme of compromise or arrangement conforms with the accounting standards prescribed under Section 133.

Approach the Tribunal

In terms of provisions of Section 232(1), an application is required to be made to the Tribunal for sanctioning a scheme of an arrangement (merger) proposed between a company and another company.

On receiving the application, the Tribunal may order a meeting of the creditors or class of creditors or the members or class of members, as the case may be, to be called, held, and conducted in such manner as the Tribunal may direct and the provisions of sub-sections (3) to (6) of Section 230 shall apply mutatis mutandis.

The company, after receiving such an order must circulate the required documents for members’/creditors’ meetings as stated under the provisions of Section 232(2).

Merger And Amalgamation Of Companies Short Notes

Question 1. Write short notes on the merger of small companies.

Answer:

Accordingly, sub-section (1) of Section 233 states that notwithstanding the provisions of Section 230 and 232, a scheme of merger or amalgamation may be entered into between two or more small companies or between a holding company and its wholly-owned subsidiary company or such other class or classes of companies as may be prescribed, subject to the following, namely:

- a notice of the proposed scheme inviting objections or suggestions, if any, from the Registrar and Official Liquidators where the registered office of the respective companies are situated or persons affected by the scheme within thirty days is issued by the transferor company or companies and the transferee company;

- the objections and suggestions received are considered by the companies in their respective general meetings and the scheme is approved by the respective members or class of members at a general meeting holding at least ninety percent of the total number of shares;

- each of the companies involved in the merger files a declaration of solvency, in the prescribed form, with the Registrar of the place where the registered office of the company is situated; and

- the scheme is approved by a majority representing nine-tenths in value of the creditors or class of creditors of respective companies indicated in a meeting convened by the company by giving a notice of twenty-one days along with the scheme to its creditors for the purpose or otherwise approved in writing.

Merger And Amalgamation Of Companies Descriptive Questions

Question 2. Describe the powers of the Central Government to provide for the amalgamation of companies in the public interest.

Answer:

- If the Central Government is satisfied that it is essential in the public interest that two or more companies should amalgamate, the Central Government may, by order notified in the Official Gazette, provide for the amalgamation of those companies into a single company with such constitution, with such property, powers, rights, interests, authorities, and privileges, and with such liabilities, duties, and obligations, as may be specified in the order.

- The order under sub-section (1) may also provide for the continuation by or against the transferee company of any legal proceedings pending by or against any transferor company and such consequential, incidental, and supplemental provisions as may, in the opinion of the Central Government, be necessary to give effect to the amalgamation.

- Every member or creditor, including a debenture holder, of each of the transferor companies before the amalgamation shall have, as nearly as may be, the same interest in or rights against the transferee company as he had in the company of which he was originally a member or creditor, and in case the interest or rights of such member or creditor in or against the transferee company are less than his interest in or rights against the original company, he shall be entitled to compensation to that extent, which shall be assessed by such authority as may be prescribed and every such assessment shall be published in the Official Gazette, and the compensation so assessed shall be paid to the member or creditor concerned by the transferee company.

- Any person aggrieved by any assessment of compensation made by the prescribed authority under sub-section (3) may, within thirty days from the date of publication of such assessment in the Official Gazette, prefer an appeal to the Tribunal and thereupon the assessment of the compensation shall be made by the Tribunal. No order shall be made under this section unless-

- a copy of the proposed order has been sent in draft to each of the companies concerned;

- the time for preferring an appeal under sub-section (4) has expired, or where any such appeal has been preferred, the appeal has been finally disposed of; and

- the Central Government has considered and made such modifications, if any, in the draft order as it may deem fit in the light of suggestions and objections which may be received by it from any such company within such period as the Central Government may fix in that behalf, not being less than two months from the date on which the copy aforesaid is received by that company, or from any class of shareholders therein, or any creditors or any class of creditors thereof.

The copies of every order made under this section shall, as soon as may be after it has been made, be laid before each House of Parliament.

Cs Company Law Merger Questions

Question 3. Describe the provisions relating to cross-border mergers in Companies Act, 2013.

Answer:

Section 234(2) states that subject to the provisions of any other law for the time being in force, a foreign company, may with the prior approval of the Reserve Bank of India, merge into a company registered under this Act or vice versa and the terms and conditions of the scheme of merger may provide, among other things, for the payment of consideration to the shareholders of the merging company in cash, or Depository Receipts, or partly in cash and partly in Depository Receipts, as the case may be, as per the scheme to be drawn up for the purpose.

For subsection (2), the expression “foreign company” means any company or body corporate incorporated outside India whether having a place of business in India or not.

Section 234(1) states that the provisions of this Chapter unless otherwise provided under any other law for the time being in force, shall apply mutatis mutandis to schemes of mergers and amalgamations between companies registered under this Act and companies incorporated in the jurisdictions of such countries as may be notified from time to time by the Central Government. The Central Government may make rules, in consultation with the Reserve Bank of India, in connection with mergers and amalgamations provided under this section.

Question 4. What are the requirements relating to notice required under Section 230 of the Companies Act, 2013?

Answer:

Section 230(3) states that when a meeting is proposed to be called in pursuance of an order of the Tribunal under sub-section (1), a notice of such meeting shall be sent to all the creditors or class of creditors and all the members or class of members and the debenture-holders of the company, individually at the address registered with the company which shall be accompanied by

- a statement disclosing the details of the compromise or arrangement,

- a copy of the valuation report, if any, and

- explaining their effect on creditors, key managerial personnel, promoters and non-promoter members, and the debenture-holders, and

- the effect of the compromise or arrangement on any material interests of the directors of the company or the debenture trustees, and

- such other matters as may be prescribed;

Such notice and other documents shall also be placed on the website of the company, if any, and in the case of a listed company, these documents shall be sent to the Securities and Exchange Board and stock exchange where the securities of the companies are listed, for placing on their website and shall also be published in newspapers in such manner as may be prescribed. -Space to write important points for revision

An Overview Of Corporate Reorganisation Majority Rule And Minority Rights

Powers

Under the Companies Act, the powers have been divided between two segments; one is the Board of Directors and the other is of shareholders. The directors exercise their powers through meetings of the Board of Directors and shareholders exercise their power through Annual General Meetings/Extra-ordinary General Meetings.

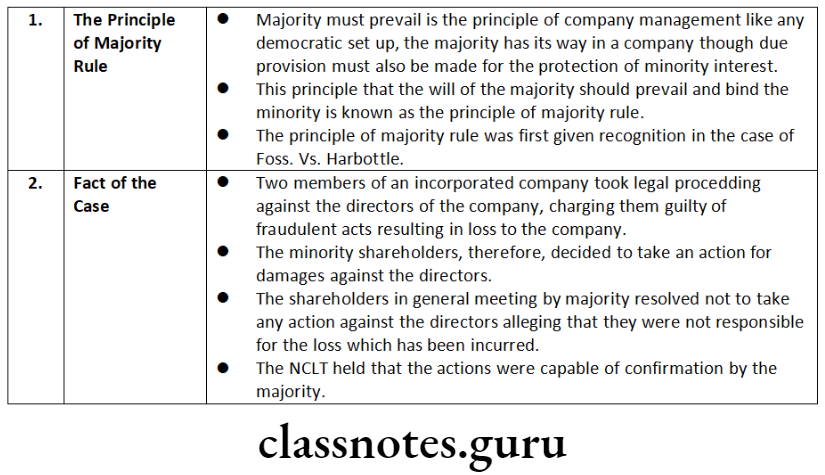

Principle of company law

The general principle of company law is that every member holds equal rights with other members of the company in the same class. The scale of rights of members of the same class must be held evenly for the smooth functioning of the company. In case of difference(s) amongst the members, the issue is decided by a vote of the majority.

Protection for the minority shareholders

Since the majority of the members are in an advantageous position to run the company according to their command, the minority shareholders are often oppressed. The company law provides for adequate protection for the minority shareholders when their rights are trampled by the majority.

Prejudicial to the public interest

Any member of a company who complains that the affairs of the company are being conducted in a manner prejudicial to the public interest or in a manner oppressive to any member(s) (including any one or more of themselves) may make an application to the NCLT by way of petition for relief.

Relief

Relief under the Act will also be available if the affairs of the company are being conducted in a manner prejudicial to the public interest. ‘Public interest’ is a very broad term involving the welfare not only of the individual shareholders but also of the country according to the economic and social policies of the State.

Violation of the Regulations

If there is a persistent violation of the regulations and statutes and an appeal to the general body is not likely to put an end to the matters complained of because those responsible for the violations control the affairs of the company, then it will be just and equitable to wind up the company.

Right to Apply

The following members of a company shall have the right to apply u/s 241, namely:

- In the case of a company having a share capital of not less than 100 members of the company or not less than one-tenth of the total number of members, whichever is less or any member or members holding not less than one-tenth of the issued share capital of the company, subject to the condition that the applicant or applicants have or have paid all calls and other sums due on his or their shares;

- In the case of a company not having a share capital: Not less than one-fifth of the total number of members. However, the Tribunal may, on an application, waive all or any of the above requirements to enable the members to apply u/s 241.

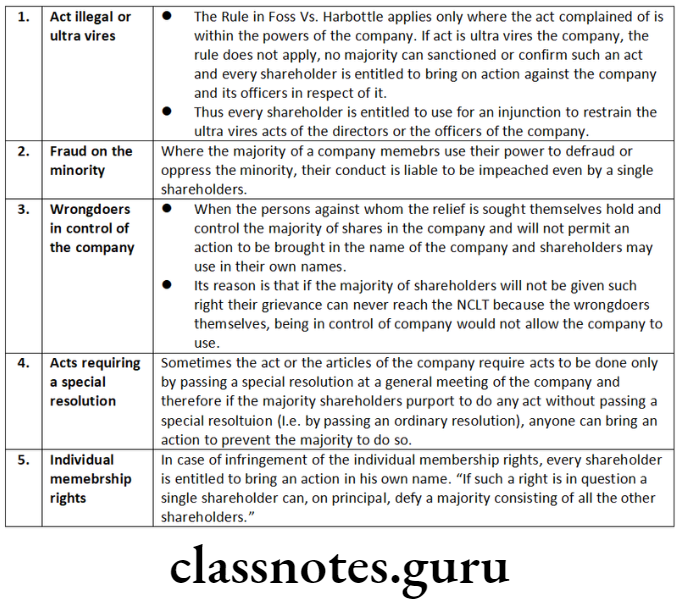

Exceptions to the Rule in Foss v. Harbottle or Protection of Minority Rights and share-holders remedies

- Ultra Vires Act

- Fraud on Minority

- Wrongdoers in Control

- A resolution requiring a Special Majority but is passed by a simple majority

- Personal Actions

- Breach of Duty

- Prevention of Oppression and Mismanagement

Under the Provision of Companies Act, 2013:

The first remedy in the hands of an oppressed minority is to move the NCLT. Section 241 provides that any member of a company who complains that the affairs of the company are being conducted in a manner prejudicial to the public interest or in a manner oppressive to any member(s) (including any one or more of themselves) may make an application to the NCLT by way of petition for relief.

The following requirements must be satisfied to seek relief under Section 241:

- That the affairs of the company are being conducted: (a) in a manner prejudicial to public interest; or (b) oppressive to any members.

- The fact justified the compulsory winding up order because it is just and equitable that the company should be wound up.

- That to wind up the company would unfairly prejudice the petitioners [Ramji Lal Baiswala v. Britain Cable Ltd., (1964) 14 Raj. 135].

On being satisfied with the above requirements, the NCLT may make the necessary orders for ending the matters complained of. The first requirement relates to public interest or oppression. First, we analyze and discover the precise connotation of the word “oppression” with the help of judicial decisions.

Class Action Suits

A class action suit is a lawsuit where a group of people representing a common interest may approach the Tribunal to sue or be sued. It is a procedural instrument that enables one or more plaintiffs to file and prosecute litigation on behalf of a larger group or class having common rights and grievances.

Application of Class Action and Relief

- to restrain the company from committing an ultra act vires the articles or memorandum of the company;

- to restrain the company from committing a breach of any provision of the company’s memorandum or articles;

- to declare a resolution altering the memorandum or articles of the company as void if the resolution was passed by suppression of material facts or obtained by misstatement to the members or depositors;

- to restrain the company and its directors from acting on such a resolution;

- to restrain the company from doing an act which is contrary to the provisions of this Act or any other law for the time being in force;

- to restrain the company from taking action contrary to any resolution passed by the members;

Difference Between Merger And Amalgamation

Corporate Reorganisation Majority Rule And Minority Rights

Distinguish Between

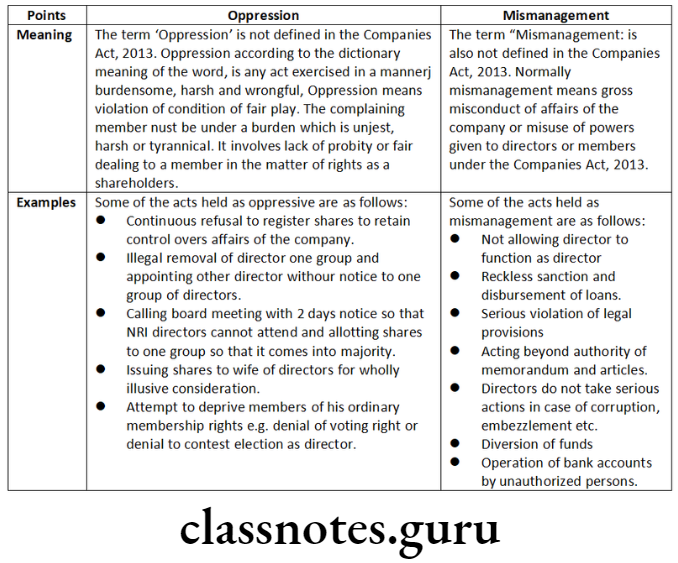

Question 1. Distinguish between the following:

‘Oppression’ and ‘mismanagement’.

Answer:

Question 2. Distinguish between the following:

Oppression and mismanagement application and Class action suits.

Answer:

Oppression and Mismanagement Application:

Section 244 of the Companies Act, 2013 provides that the following members of a company have the right to apply in case of oppression and management referred to under Section 241 to the tribunal:

- in the case of a company having a share capital, not less than one hundred members of the company or not less than one-tenth of the total number of its members, whichever is less, or any member or members holding not less than one-tenth of the issued share capital of the company, subject to the condition that the applicant or applicants have or have paid all calls and other sums due on his or their shares;

- in the case of a company not having a share capital, not less than one-fifth of the total number of its members:

The Tribunal has the power that on an application made to it on this behalf, waive all or any of the above-mentioned requirements to enable the members to apply under Section 241.

Class Action Suits:

Section 245 of the Companies Act, 2013, dea! with Class action suits. It is provided that members, depositors. or any class of them, may, if they think that the management or conduct of the affairs of the company is being conducted in a manner prejudicial to the interests of the company or its members or depositors, apply to the Tribunal on behalf of the members or depositors.

The requisite number of members is as under:

- in the case of a company having a share capital, not less than one hundred members of the company or not less than such percentage of the total number of its members as may be prescribed, whichever is less, or any member or members holding not less than such percentage of the issued share capital of the company as may be prescribed, subject to the condition that the applicant or applicants have or have paid all calls and other sums due on his or their shares;

- in the case of a company not having a share capital, nor less than one-fifth of the total number of its members.

Further, the requisite number of depositors shall not be less than one hundred depositors or not less than such percentage of the total number of depositors as may be prescribed, whichever is less, or any depositor or depositors to whom the company owes such percentage of total deposits of the company as may be prescribed.

Corporate Reorganisation Majority Rule And Minority Rights

Descriptive Questions

Question 1. Comment on the following:

The NCLT law will not interfere with the internal management of companies acting within their powers.

Answer:

Approval Process For Mergers In India

Question 2. Explain the following:

A mere lack of confidence between the majority shareholders and minority shareholders would not be enough to order relief under Section 241.

Answer:

- The scope of Section 241 was very succinctly enunciated by the Supreme Court in Shanti Prasad Jain v. Kalinga Tubes Ltd. where it observed that “It is not enough to show that there is just and equitable cause for winding up of the company though that must be shown as a preliminary to the application under Section 241.

- It must further be shown that the conduct of majority shareholders was oppressive to the minority as members and this requires that events have to be considered not in isolation but as a part of a consecutive story.

- There must be continuous acts on the part of the majority shareholders continuing to the date of the petition, showing that the affairs of the company were being conducted in a manner oppressive to some members. the conduct must be burdensome, harsh, and wrongful.

- Mere lack of confidence between the majority shareholders and the minority shareholders would not be enough unless the lack of confidence springs from the oppression of the minority by the majority in the management of the company’s affairs and such oppression must involve at least an element of lack of probity or fair dealing to a member in the matter of his proprietary rights as a shareholder.”

Question 3. A petition signed by 100 members of a company has been moved to NCLT for prevention of mismanagement. Later on, half of the members (signatories) withdrew their consent after filing the petition. Examine whether the remaining applicants (petitioners/signatories) to the petition would be successful in their complaint to NCLT.

Answer:

- Right to apply under Section 241 [Section 244]

- The following members of a company shall have the right to apply u/s 241, namely:

- In the case of a company having a share capital of not less than 100 members of the company or not less than one-tenth of the total number of members, whichever is less or any member or members holding not less than one-tenth of the issued share capital of the company, subject to the condition that the applicant or applicants have or have paid all calls and other sums due on his or their shares;

- In the case of a company not having a share capital: Not less than one-fifth of the total number of members.

- The following members of a company shall have the right to apply u/s 241, namely:

- Rajahmundry Electric Supply Co. v. A. Nageshwara Rao, AIR 1956 SC 213

- However, the Tribunal may, on an application, waive all or any of the above requirements to enable the members to apply u/s 241. Once the consent has been given by the requisite number of members by signing the application, the application may be made by one or more of them on behalf of and for the benefit of all of them.

- It has been held by the Supreme Court in Rajahmundry Electric Supply Co. v. A. Nageshwara Rao, AIR 1956 SC 213, that if some of the consenting members have, after the presentation of the application, withdraw their consent, it would not affect the right of the applicant to proceed with the application.

- Obtaining consent is a condition precedent to the making of the application and hence consent obtained after the application is ineffective. Makhan Lal Jain Vs. The Amrit Banaspati Co. Ltd., I. L. R. (1954) I All. 131.

- Chandramurthy V. K. L. Kapsi (2005) 48 SCL | 294 CLB

- In L. Chandramurthy V. K. L. Kapsi (2005) 48 SCL 294 CLB, a person who had disposed of his shares was not allowed to apply. Therefore, in the above case, the withdrawal of consent by some of the members shall not affect the success of the remaining applicants.

Question 4. What do you mean by Class Action Suit? Discuss concerning eligibility criteria for class action, the nature of relief, and the effect of the Tribunal’s order.

Answer:

Section 245 of the Companies Act, 2013 makes provision for class action by investors. The term ‘investors’ includes shareholders, deposit holders, and any class of security holders of the company.

Section 245 permits a representative of any class of investors to file a suit before the National Company Law Tribunal for relief.

In terms of Section 245 (1), Such number of members or members, depositor or depositors or any class of them, as the case may be, as is indicated in sub-section (2) of the section may if they think that the management or conduct of the affairs of the company is being conducted in a manner prejudicial to the interests of the company or its members or depositors, apply to the Tribunal on behalf of the members or depositors for seeking all or any of the relief specified. Eligibility criteria for class action

Sub-section (3) (i) of Section 245 of the Companies Act, 2013 provides the requisite number of members provided in Sub-Section (1) shall be as under:

- in the case of a company having a share capital, not less than one hundred members of the company or not less than such percentage of the total number of its members as may be prescribed, whichever is less, or any member or members holding not less than such percentage of the issued share capital of the company as may be prescribed, subject to the condition that the applicant or applicants have or have paid all calls and other sums due on his or their shares;

- in the case of a company not having a share capital, not less than one-fifth of the total number of its members.

The requisite number of depositors provided in sub-section (1) shall not be less than one hundred depositors or not less than such percentage of the total number of depositors as may be prescribed, whichever is less, or any depositor or depositors to whom the company owes such percentage of total deposits of the company as may be prescribed.

Nature of Relief

The order by Tribunal may relate:

- to restrain the company from committing an ultra act vires the articles or memorandum of the company;

- to restrain the company from committing a breach of any provision of the company’s memorandum or articles;

- to declare a resolution altering the memorandum or articles of the company as void if the resolution was passed by suppression of material facts or obtained by misstatement to the members or depositors;

- to restrain the company and its directors from acting on such a resolution;

- to restrain the company from doing an act which is contrary to the provisions of this Act or any other law for the time being in force;

- to restrain the company from taking action contrary to any resolution passed by the members;

- to claim damages or compensation or demand any other suitable action from or against:

- the company or its directors for any fraudulent, unlawful, or wrongful act or omission or conduct or any likely act or omission or conduct on its or their part;

- the auditor including the audit firm of the company for any improper or misleading statement of particulars made in his audit report or for any fraudulent, unlawful, or wrongful act or conduct; or

- any expert advisor consultant or any other person for any incorrect or misleading statement made to the company or for any fraudulent, unlawful, or wrongful act or conduct or any likely act or conduct on his part;

- to seek any other remedy as the Tribunal may deem fit.

Effect

Any order passed by NCLT shall be binding on the company and all its members, depositors, auditors, consultants advisors, or any other person associated with the company. Non-compliance with the order by the company shall be punishable with a fine which shall not be less than 5 Lakhs but which may extend to 25 Lakhs and every officer of the company who is in default shall be punishable with imprisonment for a term upto 3 years and with a fine ranging from 25,000 to 1 lakh.

Merger And Amalgamation In Company Law

Question 5. What do you understand by ‘class action suit’ as introduced by the Companies Act, 2013? Explain the objective behind introducing this provision in the Companies Act and the persons who can initiate such a class action suit.

Answer:

A class action suit is a lawsuit where a group of people representing a common interest may approach the Tribunal to sue or be sued. It is a procedural instrument that enables one or more plaintiffs to file and prosecute litigation on behalf of a larger group or class having common rights and grievances.

The major objective behind the provision of class action suits is to safeguard the interests of the minority shareholders. So, class action suits are expected to play an important role in addressing numerous prejudicial and abusive acts committed by the Board of Directors and other managerial personnel.

Person to initiate Class Action Suit:

- Members:

The requisite number of members provided in sub-section (1) shall be as under:-

- in the case of a company having a share capital, not less than one hundred members of the company or not less than such percentage of the total number of its members as may be prescribed, whichever is less, or any member or members holding not less than such percentage of the issued share capital of the company as may be prescribed, subject to the condition that the applicant or applicants have or have paid all calls and other sums due on his or their shares;

- in the case of a company not having a share capital, not less than one-fifth of the total number of its members.

- Depositors:

- According to Section 245(3)(ii) the requisite number of depositors provided in Section 245(1) shall not be less than one hundred depositors or not less than such percentage of the total number of depositors as may be prescribed, whichever is less, or any depositor or depositors to whom the company owes such percentage of total deposits of the company as may be prescribed. Space to write important points for revision

Question 6. In a scheme of amalgamation, it was proposed that the name of the transferor company shall be deemed to be the name of the transferee company. The Regional Director (RD), of the Ministry of Company Affairs, objected to the because the proposed name is undesirable if it is identical with or too nearly resembling the name of an existing company. Decide if the stand taken by the RD is valid under the Companies Act, 2013. Reference may be made to decided case laws.

Answer:

It has been held in earlier judgment PMP Auto Industries Ltd. that in case of amalgamation Chapter XV of the Companies Act, 2013 is a complete code like a “single window clearance” system, the object of which is to eliminate frequent applications being made to the Court in order effectively to implement a scheme of amalgamation which the Court sanctions in the exercise of its powers.

Further, in this case, Michelin India Private Limited High Court held that a complete code by itself on the subject of arrangement/compromise and reconstruction is comprehensive enough to include a change in the name consequent on the amalgamation or arrangement.

Thus considering the above, in the present case the objection of RD is invalid.

Question 7. “The Companies Act, 2013 attempts to maintain a balance between the rights of majority and minority shareholders.” Discuss.

Answer:

- In India, the Companies Act, 2013 attempts to maintain a balance between the rights of majority and minority shareholders by admitting, the rule of the majority but limiting it at the same time by several well-defined minority rights, thus protecting the minority shareholders as well.

- The rule of Foss V. Harbottle establishes the rule of the majority but it is not absolute but subject to certain exceptions and the minority shareholders are protected by

- the common law; and

- the provisions of the Companies Act, 2013.

- Section 241 to Section 245 of Chapter XVI of the Companies Act, 2013 deals with the provisions relating to the prevention of oppression and mismanagement of a company.

- Oppression and mismanagement of a company mean that the affairs of the company are being conducted in a manner that is oppressive and biased against the minority shareholders or any member or members of the company.

- To prevent the same, there are provisions for the prevention and mismanagement of a company.

Corporate Reorganisation Majority Rule And Minority Rights Practical Questions

Question 1. In a case about oppression and mismanagement, the respondents pleaded that the legal heirs of a deceased member whose name is still on the register of members are not entitled to apply before the Tribunal, as only members of the company can complain about oppression and mismanagement. Thus, legal heirs have no locus standi. Examine this argument in the light of decided cases.

Answer:

According to Section 241 of the Companies Act, 2013 any member of the company may make an application to the Tribunal for relief in cases of oppression or mismanagement under given circumstances. In Worldwide Agencies (P) Ltd. v. Margaret T. Decor (1990), it was decided that the legal representatives of a deceased member whose name is still on the register of members are entitled to file a petition, for relief against oppression or mismanagement.

In the above case, the above-mentioned case is applicable, where the member has died and his name still exists in the register of members, the legal heirs are entitled to maintain the petition.

Question 2. XYZ Ltd. sold a mine, owned by it for 28.20 crore. A minority shareholder brought an action for damages against their directors and against the company itself stating that the real value of the mine was 100.00 crore. Concerning provisions of the Companies Act, 2013 state whether the action for damages is maintainable.

Answer:

In the case of Pavlides v. Jensen (1956) Ch. 565, a minority shareholder brought an action for damages against three directors and against the company it because that they had been negligent in selling a mine owned by the company for £ 82,000, whereas its real value was about £ 10,00,000. It was held that the action was not maintainable.

The judge observed, “It was open to the company, on the resolution of a majority of the shareholders to sell the mine at a price decided by the company in that manner, and it was open to the company by a vote of majority to decide that if the directors by their negligence or error of judgment have sold the company’s mine at an undervalue, proceedings should not be taken against the directors”.

Applying the above interpretation, the action for damages undertaken by the minority shareholders of XYZ Ltd. is not maintainable. Hence an action for damages neither against the company nor against the directors is valid. Space to write important points for revision-

Types Of Mergers And Amalgamations

Corporate Reorganisation Majority Rule And Minority Rights Short Notes

Question 1. Write short notes on Class Action Suits.

Answer:

A class action suit is a lawsuit where a group of people representing a common interest may approach the Tribunal to sue or be sued. It is a procedural instrument that enables one or more plaintiffs to file and prosecute litigation on behalf of a larger group or class having common rights and grievances.

Application of Class Action and Reliefs [Section 245(1)]

Subsection (1) of Section 245 states that such number of members, depositors, or any class of them, as the case may be, may, file an application before the Tribunal for seeking all or any of the following orders, namely:

- to restrain the company from committing an ultra act vires the articles or memorandum of the company;

- to restrain the company from committing a breach of any provision of the company’s memorandum or articles;

- to declare a resolution altering the memorandum or articles of the company as void if the resolution was passed by suppression of material facts or obtained by misstatement to the members or depositors;

- to restrain the company and its directors from acting on such a resolution;

- to restrain the company from doing an act which is contrary to the provisions of this Act or any other law for the time being in force;

- to restrain the company from taking action contrary to any resolution passed by the members;

- to claim damages or compensation or demand any other suitable action from or against-

- the company or its directors for any fraudulent, unlawful, or wrongful act or omission or conduct or any likely act or omission or conduct on its or their part;

- the auditor including the audit firm of the company for any improper or misleading statement of particulars made in his audit report or for any fraudulent, unlawful, or wrongful act or conduct; or

- any expert advisor consultant or any other person for any incorrect or misleading statement made to the company or for any fraudulent, unlawful, or wrongful act or conduct or any likely act or conduct on his part;

- to seek any other remedy as the Tribunal may deem fit.

Question 2. Write short notes on the Effect of Order.

Answer:

Order shall The ordering: Any order passed by the Tribunal shall be binding on the company and all its members, depositors, and auditor including the audit firm expert consultants advisor, or any other person associated with the company. [Section 245(6)]

Punishment for non-compliance: Any company which fails to comply with an order passed by the Tribunal under this section shall be punishable with fine which shall not be less than five lakh rupees but which may extend to twenty-five lakh rupees and every officer of the company who is in default shall be punishable with imprisonment for a term which may extend to three years and with fine which shall not be less than twenty-five thousand rupees but which may extend to one lakh rupees. [Section 245(7)]

Companies Act Merger And Amalgamation Process

An Overview Of Corporate Re-organisation Winding-up

Winding-up of a Company

- Winding-up of a Company is defined as a process by which the life of a Company is brought to an end and its property administered for the benefit of its members and creditors.

- An administrator called the liquidator is appointed and he takes control of the Company, collects its assets, pays debts, and finally distributes any surplus among the members by their rights.

- At the end of winding up, the Company will have no assets or liabilities. When the affairs of a company are completely wound up, the dissolution of the Company takes place.

- On dissolution, the company’s name is struck off from the Register of Companies, and its legal personality as a corporation comes to an end.

Modes of Winding-up

There are two modes of winding up:

Winding up by Tribunal i.e. Compulsory Winding-up, and Voluntary Winding-up;

Compulsory Winding-up

Section 271 of the Companies Act, 2013 provides that a company may, on a petition under Section 272, be wound up by the Tribunal under the following circumstances-

- if the company has, by special resolution, resolved that the company be wound up by the Tribunal;

- if the company has acted against the interests of the sovereignty and integrity of India, the security of the State, friendly relations with foreign States, public order, decency, or morality;

- if on an application made by the Registrar or any other person authorized by the Central Government by notification under this Act, the Tribunal thinks that the affairs of the company have been conducted fraudulently or the company was formed for a fraudulent and unlawful purpose or the persons concerned in the formation or management of its affairs have been guilty of fraud, misfeasance or misconduct in connection therewith and that it is proper that the company be wound up;

- if the company has made a default in filing with the Registrar its financial statements or annual returns for immediately preceding five consecutive financial years; or

- if the Tribunal thinks that it is just and equitable that the company should be wound up.”.

Petition for the Winding up (Section 272 of Companies Act, 2013)

Who may file a Petition for the Winding up?

- the company; or

- any creditor or creditors, including any contingent or prospective creditor or creditors; or

- any contributory or contributories; or

- all or any of the parties specified above in clauses (a), (b), (c) whether together or separately; or

- the Registrar; or

- any person authorized by the Central Government.

- by the Central government or State Govt., in a case falling under clause (c) of Section 271(1).

Voluntary Winding-up

- A corporate person who intends to liquidate itself voluntarily and has not committed any default may initiate voluntary liquidation proceedings under the provisions of this Chapter.

- The voluntary liquidation of a corporate person under sub-section (1) shall meet such conditions (3) and procedural requirements as may be specified by the Board.

- Without prejudice to sub-section (2), voluntary liquidation proceedings of a corporate person registered as a company shall meet the following conditions, namely:

- a declaration from the majority of the directors of the company verified by an affidavit stating that-

- they have made a full inquiry into the affairs of the company and they have formed an opinion that either the company has no debt or that it will be able to pay its debts in full from the proceeds of assets to be sold in the voluntary liquidation; and

- the company is not being liquidated to defraud any person;

- the declaration under sub-clause (a) shall be accompanied by the following documents, namely:

- audited financial statements and records of business operations of the company for the previous two years or for the period since its incorporation, whichever is later;

- a report of the valuation of the assets of the company, if any prepared by a registered valuer;

- within four weeks of a declaration under sub-clause (a), there shall be

- a special resolution of the members of the company in a general meeting.

- a resolution of the members of the company in a general meeting requiring the company to be liquidated voluntarily as a result of the expiry of the period of its duration, if any, fixed by its articles or on the occurrence of any event in respect of which the articles provide that the company shall be dissolved.

- a declaration from the majority of the directors of the company verified by an affidavit stating that-

Registered Valuer

Section 247(1) of the Companies Act, 2013 states that where a valuation is required to be made in respect of any property, stocks, shares, debentures, securities or goodwill, or any other assets or net worth of a company or its liabilities under the provision of the Companies Act, 2013, it shall be valued by a person having such qualifications and experience and registered as a valuer in such manner, on such terms and conditions as may be prescribed and appointed by the audit committee or in its absence by the Board of Directors of that company.

ICSI- RVO

As specified above, Section 247 of the Companies Act, 2013 provides that where a valuation is required to be made in respect of any assets it shall be valued by a person who, having the necessary qualifications and experience, and being a valuer member of a recognized valuer organization, is registered as a valuer with the Authority. Accordingly, to enable the members of the Institute/others to practice as Registered Valuers, the Institute incorporated ICSI-RVO.

ICSI-RVO is a Section 8 company that has been formed with the intent to enroll, register, educate, train, promote, develop, and regulate Registered Valuers Rules while establishing and promoting high standards of practice and professional conduct and to promote good professionalism, ethical conduct and competency of Registered Valuers for ensuring the quality of valuation work.

Difference Between Merger And Amalgamation

Corporate Re-organisation Winding-up Distinguish Between

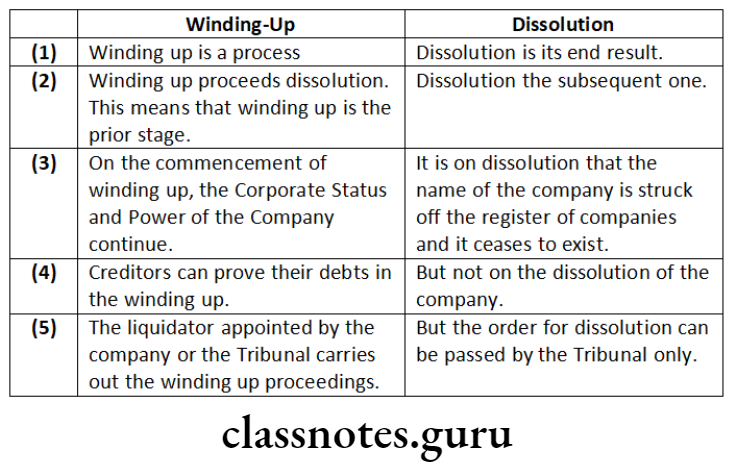

Question 1. Distinguish between the following: (a) ‘Winding-up’ and ‘dissolution’.

Answer:

The terms winding up and dissolution are sometimes erroneously used to mean the same thing. But there is a subtle difference between the two terms.

Corporate Re-organisation Winding-up Descriptive Questions

Question 1. Comment on the following:

Winding-up is only a process while dissolution puts an end to the existence of a company.

Answer:

In the process of winding up the assets of the company are disposed of and the debts of the company are paid off out of the realized assets by a liquidator. If any balance remains in the hands of the liquidator, it is distributed among the members of the company by their rights under the articles.

According to Professor Gower, “winding up of a company is the process whereby its life is ended and its property administered for the benefit of its creditors and members.”

- An administrator, called a liquidator, is appointed and he takes control of the company, collects its assets, pays its debts, and finally distributes any surplus among the members by their rights. At the end of the winding up there will not be type remained any of assets and liabilities in the company, and it will therefore be simply a formal step for it to be dissolved that is for its legal personality as a corporation to be brought to an end.

- In between winding up and dissolution, the legal entity of the company remains and it may be sued in a Tribunal.

- A company that has been dissolved no longer exists as a separate entity capable of holding property or of being sued in a Tribunal of law, but a company in liquidation though the administration of its affairs has passed the liquidator retains its complete existence.

- If the liquidation should be annulled, the company will resume its powers.

- On dissolution, the company’s name is struck off the register of companies, and its legal personality as a corporation comes to an end. Space to write important points for revision

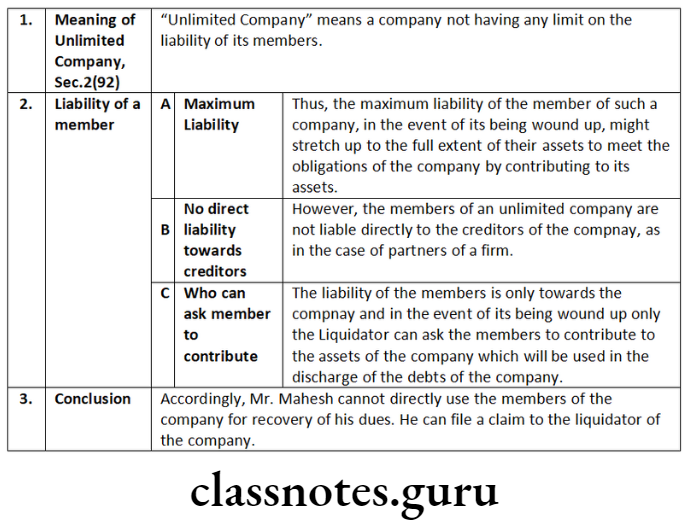

Question 2. Mahesh is a creditor of an unlimited company. The company was wound up. Mahesh, therefore, wants to sue the members of the company to recover the dues. Advise Mahesh regarding the remedy available to him.

Answer.

Question 3. Referring to the provisions of the Companies Act, 2013, state the grounds on which the Registrar of Companies can file a petition for the winding-up of a company.

Answer:

The Registrar shall be entitled to present a petition for winding up under Section 271, except on the grounds specified in clause (a) or clause (e) of that sub-section:

Provided that the Registrar shall obtain the previous sanction of the Central Government for the presentation of a petition:

Provided further that the Central Government shall not accord its sanction unless the company has been given a reasonable opportunity to make representations.

Question 4. The Mumbai Bench of the National Company Law Tribunal has received a petition for the winding up of Presentable Commodities Ltd. Pramod, Manager (Human Resources) of the company wants to know from you, the Secretary of the company, what orders can be passed by the Tribunal in this regard. Advise Pramod, under the relevant provisions of the Companies Act, 2013.

Answer:

According to Section 273(1) of the Companies Act, 2013, the Tribunal may, on receipt of a petition for winding up pass any of the following orders:

- dismiss it, with or without costs;

- make any interim order as it thinks fit;

- appoint a provisional liquidator of the company till the making of a winding-up order;

- make an order for the winding up of the company with or without costs;

or - any other order as it thinks fit.

Difference Between Merger And Amalgamation

Question 5. Can a contributory file a petition for the winding up of the company? Discuss.

Answer:

Section 272(1) of the Companies Act, 2013 provides that subject to the provisions of this section, a petition to the Tribunal for the winding up of a company shall be presented by, inter-alia, any contributory or contributory.

As per Section 272(2) of the Companies Act, 2013, a contributory shall be entitled to present a petition for the winding up of a company, notwithstanding that he may be the holder of fully paid-up shares, or that the company may have no assets at all or may have no surplus assets left for distribution among the shareholders after the satisfaction of its liabilities, and shares in respect of which he is a contributory or some of them were either originally allotted to him or have been held by him, and registered in his name, for at least six months during the eighteen months immediately before the commencement of the winding up or have devolved on him through the death of a former holder.

Question 6. Govt. of West Bengal applied winding up of KTC Ltd. in the Tribunal citing sec. 271 of the Companies Act, 2013 in the interest of the sovereignty and integrity of India which was opposed by the company stating that the state government cannot file a petition for winding up. Is the claim of the company sustainable and why?

Answer:

Section 271(b) of the Companies Act, 2013 provides that a company may, on a petition under section 272, be wound up by the Tribunal if the company has acted against the interests of the sovereignty and integrity of India, the security of the State, friendly relations with foreign States, public order, decency or morality.

Section 272(1) of the Companies Act, 2013 provides that subject to the provisions of this section, a petition to the Tribunal for the winding up of a company shall be presented by

- the company;

- any contributory or contributors;

- all or any of the persons specified in clauses (a) and (b);

- the Registrar;

- any person authorized by the Central Government on that behalf; or

- in a case falling under clause (b) of sub-section (1) of section 271, by the Central Government or a State Government.

Given the above provisions, the claim of the company is not sustainable. -Space to write important points for revision

Corporate Re-organisation Winding-up Practical Questions

Question 1. On 3rd December 2018, the Registrar of Companies applied to the Regional Director for seeking sanction to file a winding up application against a company. On the next day i.e. on 4th December, 2018, the Regional Director granted its sanction. Examine the validity of the Regional Director’s action.

Answer:

Section 272(1) of the Companies Act, 2013, provides that a petition to the Tribunal for the winding up of a company can be presented by the Registrar of Companies. However, the Registrar shall obtain the previous sanction of the Central Government for the presentation of a petition. The section also provides that the Central Government shall not accord its sanction unless the company has been given a reasonable opportunity to make representations. The Power of Central Government in this context has been assigned to Regional Directors.

In the above case, the Regional Director granted its sanction on the very next day of filing the petition without giving a reasonable opportunity to the company to be heard. Here the action of the Regional Director is invalid. – Space to write important points for revision-

Question 2. Amitabh is a director at PQR Overseas Trading Ltd. The company’s name has recently been struck off from the register of companies by the Registrar. He does not hold a directorship in any other company. Therefore, Amitabh applied to the Registrar for cancellation of his DIN. However, the application was rejected by the Registrar. Is the rejection of the application correct in your opinion?

Answer:

Rule 11 of the Companies (Appointment and Qualification of Directors) Rules, 2014 allows cancellation surrender, or deactivation of DIN under the following cases-

- If DIN is found to be duplicated in respect of the same person provided the data related to both the DIN shall be merged with the validly retained number;

- If it is obtained in a wrongful manner or by fraudulent means

- Death of the concerned individual

- A concerned individual has been declared as a person of unsound mind by a competent court

- A concerned individual has been adjudicated an insolvent

- On application made in Form DIR-5 by the DIN holder to surrender DIN along with a declaration that he has never been appointed as a director in any company and said DIN has never been used for filing of any document with any authority.

The issue raised in question is not covered in any of the above conditions. As Amitabh was appointed as a director using his DIN (and presumably filed e-forms using the DIN), such DIN shall not be deactivated and DIR-5 cannot be filled even though the name of the company has been struck off and he does not hold directorship in any other Company. Therefore, the action of the Registrar is correct.

Question 3. Sunita sold her flat to NOP Televisions Ltd. on 1 April 2016. The company appointed Prakash (a registered valuer and also husband of Sunita) on 1st May 2019 to determine the value of the flat purchased from Sunita. Can Prakash validly undertake this assignment? Would your answer differ if the appointment had been made on 1 March 2019?

Answer:

According to Section 247(2)(d) of the Companies Act, 2013, the valuer shall not undertake the valuation of any assets in which he has a direct or indirect interest or becomes so interested at any time during three years before his appointment as a valuer or three years after the valuation of assets was conducted by him.

In the instant case, Prakash had an indirect interest in the property because it was owned by his wife (Sunita). However, he was appointed on May 01, 2019, as valuer of the property, since a period of three years has already elapsed after the sale of the property, Prakash can validly take up the assignment of valuation of the property.

However, if the appointment had been made on March 01, 2019, the period of three years would not have elapsed and he could not have taken up the assignment.

Approval Process For Mergers In India

Corporate Re-organisation Winding-up Short Notes

Question 1. Write short notes on Registration Offices and Fees.

Answer:

Section 403 states that any document, required to be submitted, filed, registered, or recorded, or any fact or information required or authorized to be registered under the Companies Act, 2013, shall be submitted, filed, registered, or recorded within the time specified in the relevant provision on payment of such fee as may be prescribed. The fees are prescribed under the Companies (Registration Offices and Fees) Rules, 2014.

However, in case of failure to submit, file register, or record the above-stated documents, within the period provided in the relevant section, it may, without prejudice to any other legal action or liability under the Companies Act, 2013, be submitted, filed, registered or recorded as the case may be:-

- In case of documents provided under Section 92 or 137 [First proviso to Section 403]

- alter expiry of the period so provided under Section 92 or 137,

- on payment of such additional fee as may be prescribed –

- which shall not be less than one hundred rupees per day, and

- different amounts may be prescribed for different classes of companies.

- In case of any other documents [Second proviso to Section 403]:

- after the expiry of the period so provided under the relevant Section,

- on payment of such additional fees as may be prescribed and different fees may be prescribed for different classes of companies.

Corporate Re-organisation Winding-up Descriptive Question

Question 2. Who shall Conduct the valuation?

Answer:

Section 247(1) of the Companies Act, 2013 states that where a valuation is required to be made in respect of any property, stocks, shares, debentures, securities or goodwill, or any other assets or net worth of a company or its liabilities under the provision of the Companies Act, 2013, it shall be valued by a person having such qualifications and experience and registered as a valuer in such manner, on such terms and conditions as may be prescribed and appointed by the audit committee or in its absence by the Board of Directors of that company.

The valuer appointed under sub-section (1) shall,-

- make an impartial, true, and fair valuation of any assets which may be required to be valued;

- exercise due diligence while performing the functions as a valuer;

- make the valuation by such rules as may be prescribed; and

- not undertake valuation of any assets in which he has a direct or indirect interest or becomes so interested at any time during three years before his appointment as valuer or three years after the valuation of assets was conducted by him.

Question 3. What is ICSI-RVO?

Answer:

As specified above, Section 247 of the Companies Act, 2013 provides that where a valuation is required to be made in respect of any assets it shall be valued by a person who, having the necessary qualifications and experience, and being a valuer member of a recognized valuer organization, is registered as a valuer with the Authority. Accordingly, to enable the members of the Institute/others to practice as Registered Valuers, the Institute incorporated

ICSI-RVO.

ICSI-RVO is a Section 8 company that has been formed with the intent to enroll, register, educate, train, promote, develop, and regulate Registered Valuers Rules while establishing and promoting high standards of practice and professional conduct and promoting good professionalism, ethical conduct and competency of Registered Valuers for ensuring the quality of valuation work.

The IBBI vide Registered Valuers Organisation Recognition No. IBBI/RVO/2018/003 recognized ICSI RVO. as a Registered Valuers Organisation for the Asset Class(es):-

- Land and Building

- Plant and Machinery

- Securities or Financial Assets

Companies Act Merger And Amalgamation Process

Question 4. Who can offer valuation services?

Answer:

For conducting valuations required under the Companies Act, 2013, and the Insolvency and Bankruptcy Code, 2016, a person is to be registered with the IBBI as a registered valuer. To register with IBBI, a person must have the necessary qualifications and experience, haves to be enrolled as a valuer member with a Registered Valuer Organisation (RVO), complete a recognized educational course conducted by the RVO and pass a value,tion examination conducted by IBBI.

IBBI, being the Authority, in pursuance of the first proviso to Rule 5 (1) of the Companies (Registered Valuers and Valuation) Rules, 2017 specified the details of the educational course for the Asset Class of ‘Securities or Financial Assets’. These courses shall be delivered by the RVOS in not less than 50 hours.

A person, who is rendering valuation services under the Companies Act, 2013, may continue to do so without a certificate of registration up to 31st March, 2018, thereafter with effect from 1st April, 2018 for conducting valuations required under the Companies Act, 2013 and the Insolvency and Bankruptcy Code, 2016, a person is to be registered with the IBBI as a registered value.