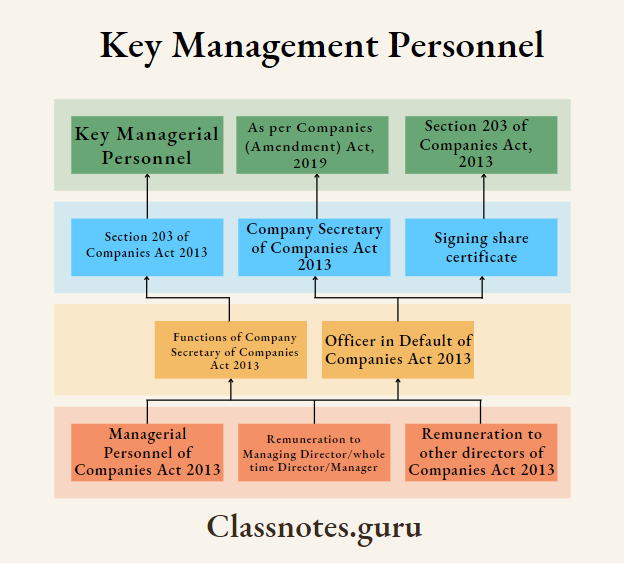

Key Management Personnel

Key Managerial Personnel

- Under section 2(51) a Key Managerial Personnel is define as the Chief Executive Officer or Managing Director or the manager or, a Company Secretary or the whole time director and the Chief Financial Officer in relation to a company.

Amendment made by Companies (Amendment) Act, 2017 Revised Section 2(51)-

“Key managerial personnel” in relation to a company, means-

- the Chief Executive Officer or the managing director or the manager;

- the company secretary;

- the whole-time director;

- the Chief Financial Officer;

- such other officer, not more than one level below the directors who is in whole-time employment, designated as key managerial personnel by the Board; and

- such other officer as may be prescribed;”

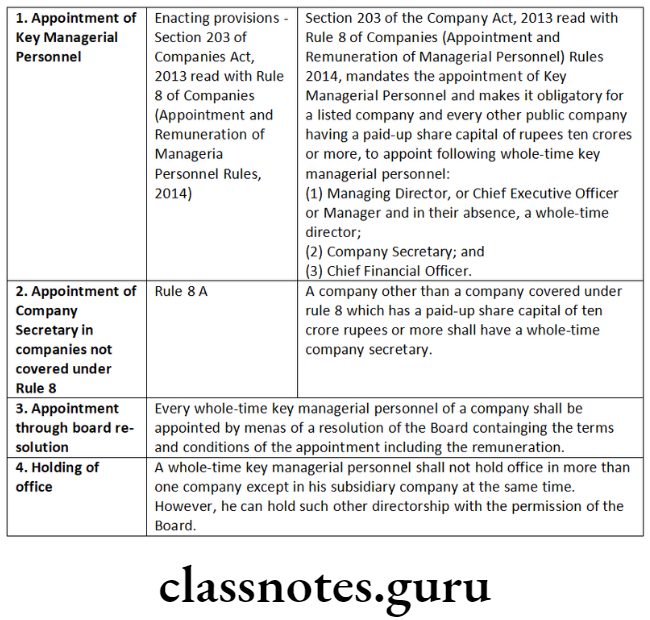

- Every listed Company and every other public company having a paid up share capital of 10 crore or more is compulsorily required to have whole time key managerial personnel.

- The whole time key managerial personnel is to be appointed by the Board and shall not hold office in more than one company however he is permitted to hold such other office with the permission of Board of the company.

Penalty for not appointing Key Managerial Personnel when Mandatory

Every director or the key managerial personnel who is in default shall be punishable with a fine which may extend to 50,000 and a further fine which may be extended to 1,000 for every day during which the default continues.

As per Companies (Amendment) Act, 2019

Section 203 of Companies Act, 2013 make provisions for mandatory appointment of certain Key Managerial personnel like MD or CEO, Company Secretary and CFO.

If any company makes any default in complying with the provisions of Section 203, such company shall be liable to a penalty of five lakh rupees and every director and key managerial personnel of the company who is in default shall be liable to a penalty of fifty thousand rupees and where the default is a continuing one, with a further penalty of one thousand rupees for each day after the first during which such default continues but not exceeding five lakh rupees – Section 203(5) of Companies Act, 2013 amended vide the Companies (Amendment) Act, 2019.

Till 2.11.2018, the section provided for fine which could be imposed only by Court. Now, penalty can be imposed by RoC or RD who is authorized for this purpose.

Even earlier, the offense was compoundable. However, procedure of compounding had to be complied with. Now, directly penalty can be imposed after issuing Show Cause Notice.

Section 203 of Companies Act 2013

The Company Secretary has been covered under the same section of KMP i.e. Section 203.

- Rule 8A of Companies (Appointment and Remuneration of Managerial Personnel) Amendment Rule, 2020, Appointment of Company Secretaries in companies not covered under Rule 8A. A company other than a company covered under Rule 8 which has a paid up share capital of 10 crore or more shall have a whole time company secretary.

Company Secretary of Companies Act 2013

Section 2(24) of the Companies Act, 2013 defines “company secretary” or “secretary” means a company secretary as defined in clause (c) of sub-section (1) of Section 2 of the Company Secretaries Act, 1980 who is appointed by a company to perform the functions of a company secretary under this Act.

According to clause (c) of Sub-section (1) of Section 2 of the Company Secretaries Act, 1980, a company secretary means a person who is a member of the Institute of Company Secretaries of India. Therefore, ‘Company Secretary’ means a person who is a member of the Institute of Company Secretaries of India (ICSI) and who is appointed by a company to perform the functions of a company secretary. The functions of company secretary have been detailed in Section 205 of the Act.

Key Management Personnel In Company Law

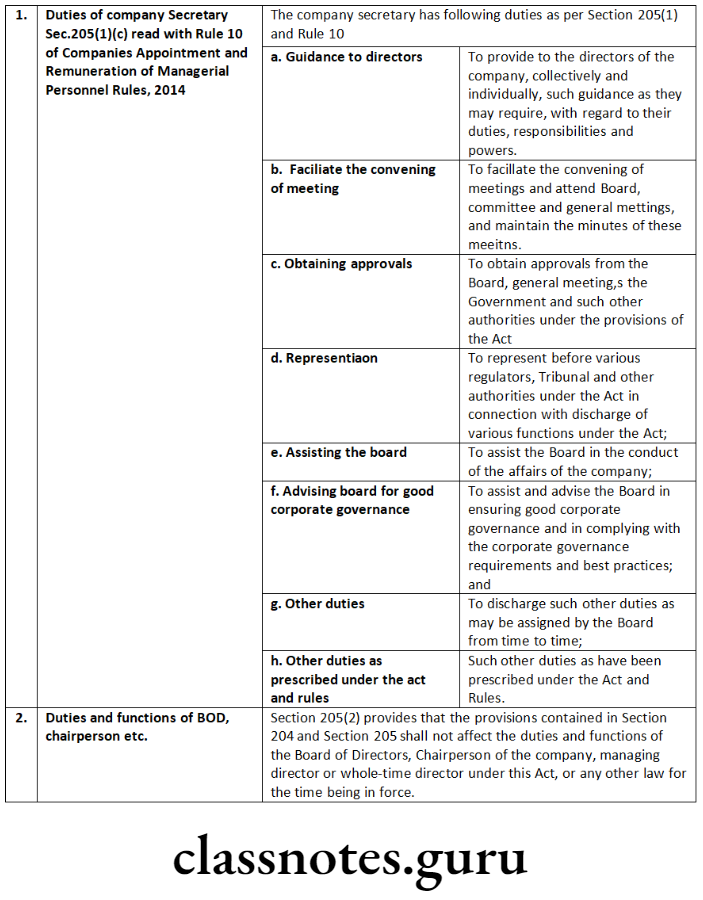

Statutory Duties and Liabilities of a Company Secretary of Companies Act 2013

- Declaration regarding compliance with requirement of registration

- Authentication of documents, proceedings and contracts

- Signing share certificate

- Signing annual return

- Signing of financial statements

- Appear before NCLT

- Secretary as Compliance Officer of listed company

- Demat shares

- Additional duties

- Nodal Officer

Functions of Company Secretary of Companies Act 2013

According to Section 205 the functions of the company secretary shall include,-

- to report to the Board about compliance with the provisions of this Act, the rules made thereunder and other laws applicable to the company;

- to ensure that the company complies with the applicable secretarial standards;

- to discharge such other duties as may be prescribed.

Officer in Default of Companies Act 2013

As per Section 2(60), “officer who is in default”, for the purpose of any provision in this Act which enacts that an officer of the company who is in default shall be liable to any penalty or punishment by way of imprisonment, fine or otherwise, means any of the following officers of a company, namely:

- whole-time director;

- key managérial personnel;

- where there is no key managerial personnel, such director or directors as specified by the Board in this behalf and who has or have given his or their consent in writing to the Board to such specification, or all the directors, if no director is so specified;

- any person who, under the immediate authority of the Board or any key managerial personnel, is charged with any responsibility including maintenance, filing or distribution of accounts or records, authorises, actively participates in, knowingly permits, or knowingly fails to take active steps to prevent, any default;

- in respect of the issue or transfer of any shares of a company, the share transfer agents, registrars and merchant bankers to the issue or transfer.

Managerial Personnel of Companies Act 2013

Overall managerial remuneration of Companies Act 2013

Section 197 of the Companies Act, 2013 prescribed the maximum ceiling for payment of managerial remuneration by a public company to its managing director whole-time director and manager which shall not exceed 11% of the net profit of the company in that financial year computed in accordance with Section 198 except that the remuneration of the directors shall not be deducted from the gross profits.

Remuneration to Managing Director/whole time Director/Manager

The remuneration payable to any one managing director or whole- time director or manager shall not exceed 5% of the net profits of the company and if there are more than one such director remuneration shall not exceed 10% of the net profits to all such directors.

Remuneration to other directors of Companies Act 2013

Except with the approval of the company in general meeting, the remuneration payable to directors who are neither managing directors nor whole-time directors shall not exceed,-

1% of the net profits of the company, if there is a managing or whole-time director or manager;

3% of the net profits in any other case.

Remuneration by a company having no profit or inadequate profit of Companies Act 2013

If, in any financial year, a company has no profits or its profits are inadequate, the company shall not pay to its directors, including managing or whole time director or manager, any remuneration exclusive of any fees payable to directors except in accordance with the provisions of Schedule V and if it is not able to comply with Schedule V, with the previous approval of the Central Government.

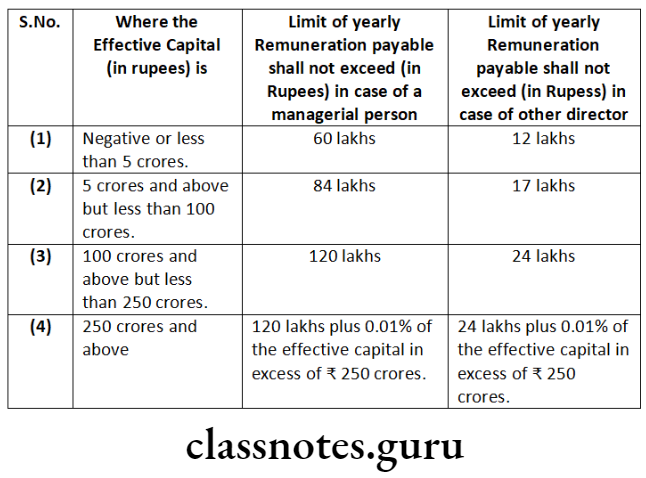

Managerial Remuneration under Schedule V (Part II)

Section 1: Remuneration by Companies ha:ing Profits

A company having profits in a financial year may pay remuneration to its managerial persons or persons or other director or directors in accordance with Section 197.

Section 2: Where in any financial year during the currency of tenure of a managerial person, or other director a company has no profits or its profits are inadequate it may without Central Government approval, pay remuneration to the managerial person or other directors not exceeding the limits under (A) and (B) given below:

Provided that the above limits shall be doubled if the resolution passed by the shareholders is a special resolution.

Explanation-

It is hereby clarified that for a period less than one year, the limits shall be pro-rated.

In case of a managerial person or other director who is functioning in a professional capacity, no approval of Central Government is required, if such managerial person or other director is not having any interest in the capital of the company or its holding company or any of its subsidiaries directly or indirectly or through any other statutory structures and not having any direct or indirect interest or related to the directors or promoters of the company or its holding company or any of its subsidiaries at any time during the last two years before or on or after the date of appointment and possesses graduate level qualification with expertise and specialised knowledge in the field in which the company operates:

Provided that any employee, of a company holding shares of the company not exceeding 0.5% of its paid up share capital under any scheme formulated for allotment of shares to such employees including Employees Stock Option Plan or by way of qualification shall be deemed to be a person not having any interest in the capital of the company.

Cs Company Law Questions And Answers

Amendment made by Companies (Amendment) Act, 2017 Revised First Proviso to Section 197(1)-

“Provided that the company in general meeting may, with the approval of the Central Government, authorize the payment of remuneration exceeding eleven percent. of the net profits of the company, subject to the provisions of Schedule V:”

Revised Second Proviso to Section 197(1) of Companies Act 2013

“Provided further that, except with the approval of the company in general meeting by a special resolution,-

- the remuneration payable to any one managing director; or whole-time director or manager shall not exceed five per cent. of the net profits of the company and if there is more than one such director remuneration shall not exceed ten per cent. of the net profits to all such directors and manager taken together;

- the remuneration payable to directors who are neither managing directors nor whole-time directors shall not exceed,-

- one per cent. of the net profits of the company, if there is a managing or whole-time director or manager;

- three per cent, of the net profits in any other case.

Third Proviso to Section 197(1) of Companies Act 2013

“Provided also that, where the company has defaulted in payment of dues to any bank or public financial institution or non-convertible debenture holders or any other secured creditor, the prior approval of the bank or public financial institution concerned or the non-convertible debenture holders or other secured creditor, as the case may be, shall be obtained by the company before obtaining the approval in the general meeting.”

Compensation For Loss of Office of Managing or Whole-Time Director or Manager (Section 202)

Section 202 provides that a company may make payment to a managing or whole-time director or manager, but not to any other director, by way of compensation for loss of office, or as consideration for retirement from office or in connection with such loss or retirement.

However, No payment shall be made in the following cases:

- where the director resigns from his office as a result of the reconstruction/amalgamation of the company and is appointed as the managing or whole-time director, manager or other officer of the reconstructed company/of resulting company from the amalgamation;

- where the director resigns from his office otherwise than on the reconstruction/ amalgamation of the company;

- where the office of the director is vacated due to disqualification;

- where the company is being wound up due to the negligence or default of the director;

- where the director has instigated, or has taken part directly or indirectly in bringing about, the termination of his office.

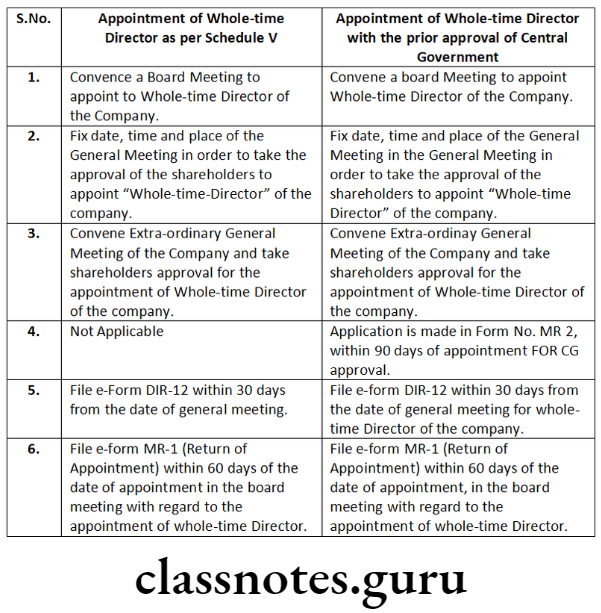

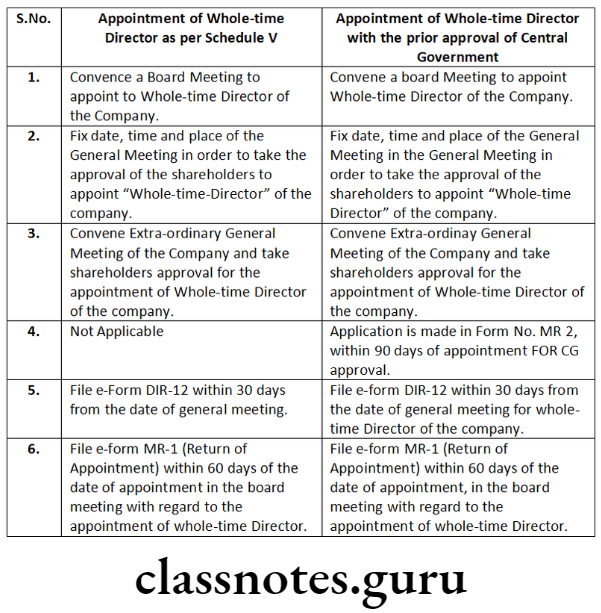

Steps for the Appointment of Whole-time Director

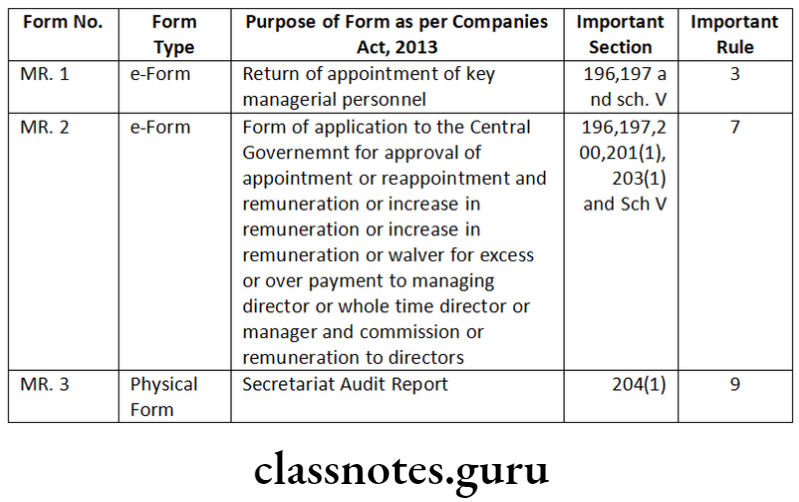

List of Important Forms of Companies Act 2013

Key Managerial Personnel Under Companies Act

Key Management Personnel Short Notes

Question 1. Write a note on the following:

Statutory duties of a Company Secretary under the Companies Act, 2013.

Answer:

Key Management Personnel Distinguish Between

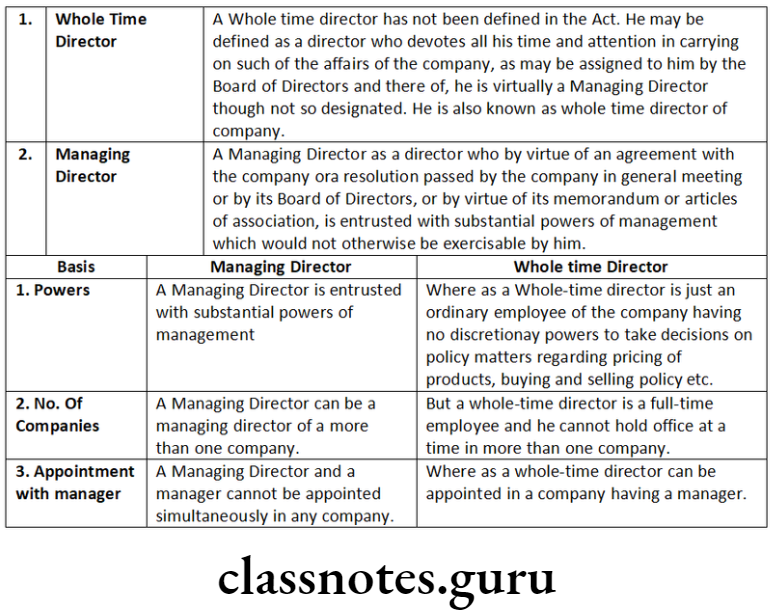

Question 1. Distinguish between the following:

‘Managing director’ and ‘whole-time director’.

Answer:

Question 2. Distinguish between the following:

‘Key-managerial personnel’ and ‘Managing Director’.

Answer:

‘Key-managerial personnel’ and ‘Managing Director’

Key-Managerial Personnel

As per Section 2(51) of the Companies Act, 2013, “key managerial personnel”, in relation to a company, means-

- the Chief Executive Officer or the managing director or the manager;

- the Company Secretary;

- the whole-time director;

- the Chief Financial Officer; and

- such other officer as may be prescribed.

Amendment made by Companies (Amendment) Act, 2017 Revised Section 2(51)-

“Key managerial personnel” in relation to a company, means-

- the Chief Executive Officer or the managing director or the manager;

- the company secretary;

- the whole-time director;

- the Chief Financial Officer;

- such other officer, not more than one level below the directors who is in whole-time employment, designated as key managerial personnel by the Board; and

- such other officer as may be prescribed;”

‘Key managerial personnel’ (KMP) is a broader term and it includes managing director and other specified officers of a company. For being designated as KMP vesting of substantial power is not necessary. For example, a CFO or a Company Secretary may or may not have substantial power of management; still they may be designated as KMP.

Managing Director

According to Section 2(54) of the Companies Act, 2013, “managing director” means a director who, by virtue of the articles of a company or an agreement with the company or a resolution passed in its general meeting, or by its Board of Directors, is entrusted with of the affairs of the company and substantial powers of management position of managing director, by includes a director occupying the whatever name called.

A Managing Director (MD) can be KMP but it is not mandatory that a KMP shall be MD.

The Managing Director must have substantial power of management.

Question 3. Distinguish between the following:

Chief Executive Officer and Managing Director.

Answer:

Section 2(18) of the Companies Act, 2013, has defined “Chief Executive Officer’ so as to mean an officer of a company, who has been designated as such by it.

Section 2(54) of the Companies Act, 2013, “Managing Director” means a director who, by virtue of the articles of a company or an agreement with the company or a resolution passed in its general meeting, or by its Board of Directors, is entrusted with substantial powers of management of the affairs. of the company and includes a director occupying the position of managing director, by whatever name called.

Key Management Personnel Descriptive Questions

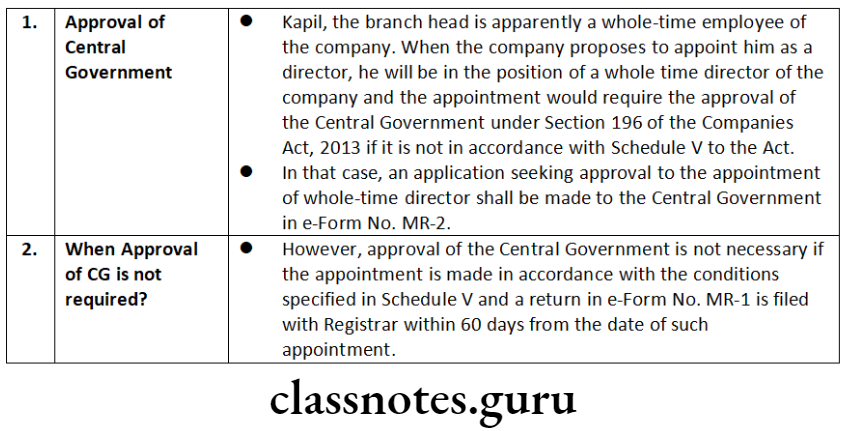

Question 1. Kapil is branch head of a limited company. The company proposes to elevate Kapil to the Board. Enumerate the steps involved in such a proposal.

Answer:

Cs Executive Company Law Important Questions

Steps for the Appointment of Whole-time Director

Question 2. Explain the meaning of the term ‘key managerial personnel’ in relation to a company as introduced by the Companies Act, 2013 and also state the manner in which they are appointed.

Answer:

Question 3. If a company has appointed a Company Secretary then his signature is mandatory on the share certificate issued by the company. Analyse with reference to the provisions of the Companies Act, 2013.

Answer:

Under Section 46(3) of the Companies Act, 2013 a share certificate, issued under the common seal, if any, of the company or signed by two directors or by a director and the Company Secretary, wherever the company has appointed a Company Secretary, specifying the shares held by any person, is the prima facie evidence of the title of the person to such shares.

Therefore, where the company has appointed a Company secretary then his signature is compulsory on the share certificate issued by the company.

Question 4. Jackson is a prospective candidate for the post of Managing Director of Tirubuvani Sugars Ltd. Unfortunately, his proposed appointment could not satisfy the conditions of Schedule V of the Companies Act, 2013. Discuss if any other option is available with the company to appoint him as the Managing Director of the company.

Answer:

- Pursuant to Section 196 and Section 201 of the Companies Act, 2013 in case the provisions of Schedule V of the Companies Act, 2013 are not satisfied by company, w.r.t. appointment of a Managing Director, the terms and conditions of such appointment and remuneration payable be approved by the Board of Directors (BOD) at a meeting which shall be subject to approval by a resolution at the next general meeting of the company and by the Central Government.

- Further an application seeking approval to the appointment of a managing director as aforesaid shall be made to the Central Government, in E-Form No. MR:2, within a period of 90 days from the date of such appointment.

- Section 201 of the Companies Act, 2013, before such application is made to the Central Government, there shall be issued by or on behalf of the company a general notice to the members indicating nature of application proposed to be made.

- The general notice shall be published in at least once in a newspaper in the main language of the district in which, registered office of the Company is situated and at least once in English in an English newspaper circulating in that district.

- The copies of the notices, together with a certificate by the company as to the due publication therefore, shall be attached to the application.

- Hence, Tirubuvani Sugars Limited will file an application seeking approval to the appointment of Jackson as Managing Director to the Central Government in e-Form No. MR-2.

Question 5. Logic Ltd. wants to remove Radhika, Company Secretary of the Company. Explain the procedure.

Answer:

A Company Secretary can be removed or dismissed like any other employees of the organization. Since he/she is appointed by Board, the Board of Directors of a company has absolute discretion to remove a Company Secretary or to terminate his/her services at any time for any reason or without any reason. Although, principles of natural justice like show cause notice, hearing, reasoned order etc. must be followed.

A Company Secretary can be removed in accordance with the terms of. appointment and the Board can record the same. The procedure for removal of Company Secretary is given below:

- Convene a Board Meeting after giving notice to all the Directors of the company as per section 173 of the Companies Act, 2013, place the matter of removal of the Company Secretary and pass a resolution to the effect. The resolution shall state the effective date of termination of the Company Secretary.

- The Company shall thereafter serve a notice of termination to the Company Secretary. The period of notice shall be governed by the employment letter or in its absence the termination policy of the Company.

- The Company Secretary shall cease to be in office from the date of expiry of notice.

- Company is required to file e-Form DIR-12 within 30 days of cessation with the Registrar of Companies together with requisite filing fees along with evidence of Cessation. Inform the stock exchange, if the company is listed.

- Make entries in the Register maintained for recording the particulars of Company Secretaries under section 170 of the Companies Act, 2013.

- Issue a general public notice, if it is so warranted, according to size and nature of the company.

Hence, Logic Ltd. has to follow above procedures to remove Radhika, Company Secretary of the company.

Company Law Mcq With Answers

Key Management Personnel Practical Questions

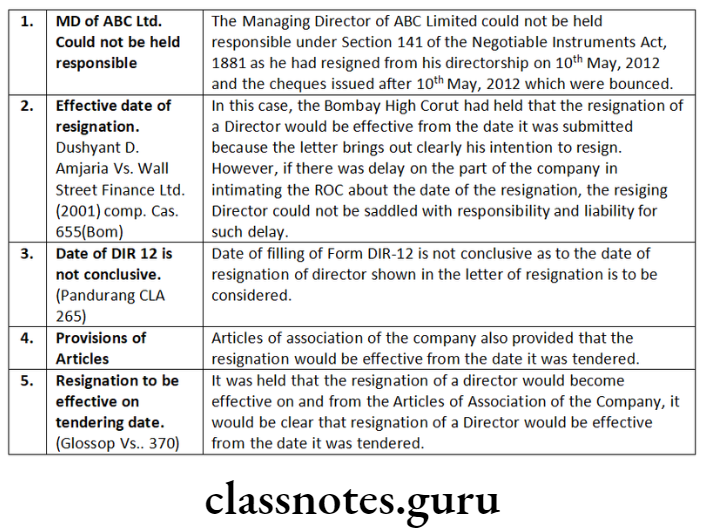

Question 1. Pawan, the Managing Director of ABC Ltd., resigned on 10th May, 2012. The company has filed e-form No. DIR-12 with the Registrar of Companies mentioning the date of resignation as 5th July, 2013.

The company issued various cheques to its investors in repayment of the deposits after 10th May, 2012 and the said cheques were dishonoured. The investors filed complaints against the company and Pawan, the former Managing Director of the company. Discuss and advise whether Pawan shall be liable or not.

Answer:

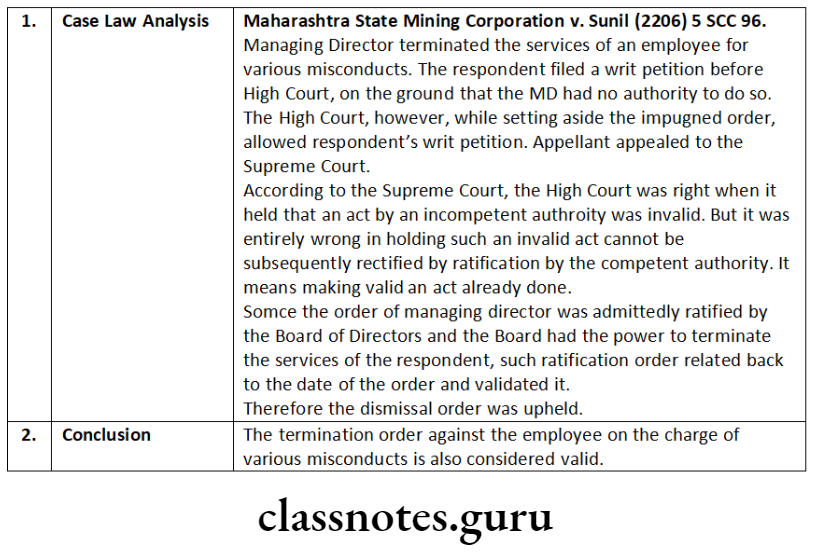

Question 2. In a limited company, the Managing Director terminated an employee on the charge of various misconducts. The aggrieved employee filed a writ petition before the High Court challenging the dismissal contending that the Managing Director had no power to do so and the proper authority was the Board of Directors.

During the pendency of writ, the Board of Directors passed a resolution ratifying the action of the Managing Director. The High Court while setting aside the Managing Director’s dismissal order, allowed the writ petition. Managing Director appealed to the Supreme Court. Decide the case having regard to the judicial pronouncements in the matter.

Answer:

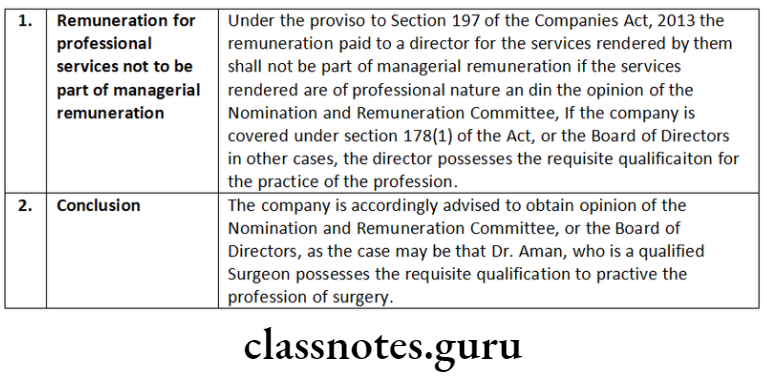

Question 3. Heal Ltd. owns a chain of hospitals in Mumbai. Dr. Aman, a practicing surgeon, has been appointed by the company as its non- executive ordinary director and wants to pay him fees on case-to-case basis for surgeries performed by him on patients at hospital. Advise the company, whether payment of such fees to him would amount to payment of managerial remuneration to a director under the Companies Act, 2013.

Answer:

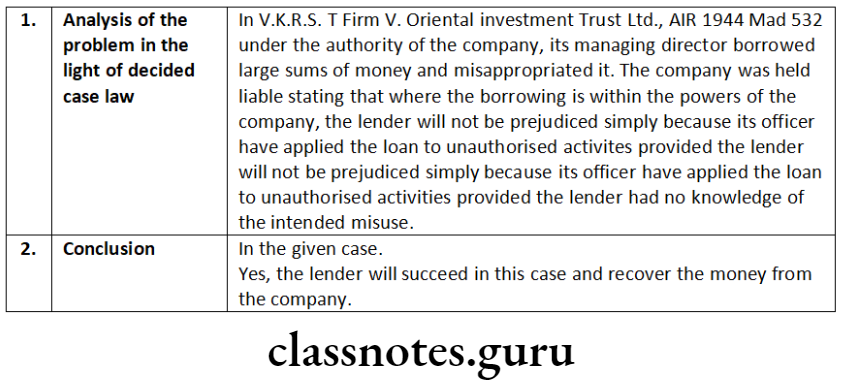

Question 4. Alok, the Managing Director of Yellow Ltd., borrowed a large sum of money and misappropriated the same. Later, when -the lender demanded his money, the company refused to repay, contending that the money borrowed by Managing Director was misappropriated by him and the company is not liable for repayment. Decide, giving reasons, whether the lerder would succeed in recovering the money from the company.

Answer:

Key Management Personnel In Company Law

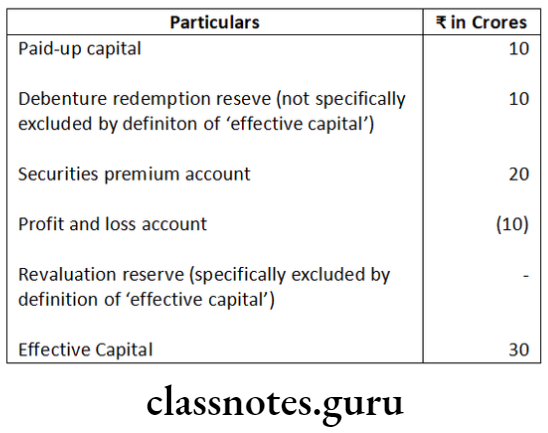

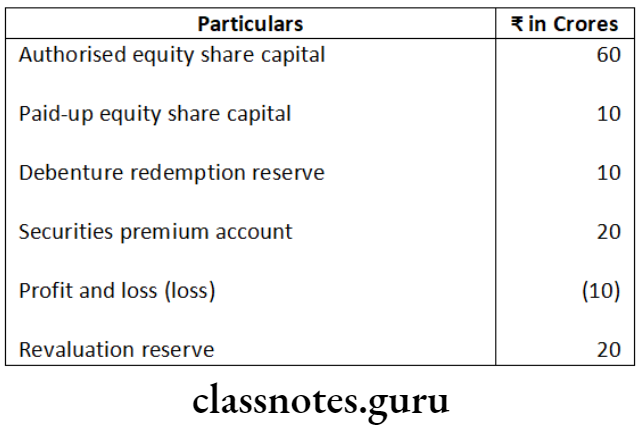

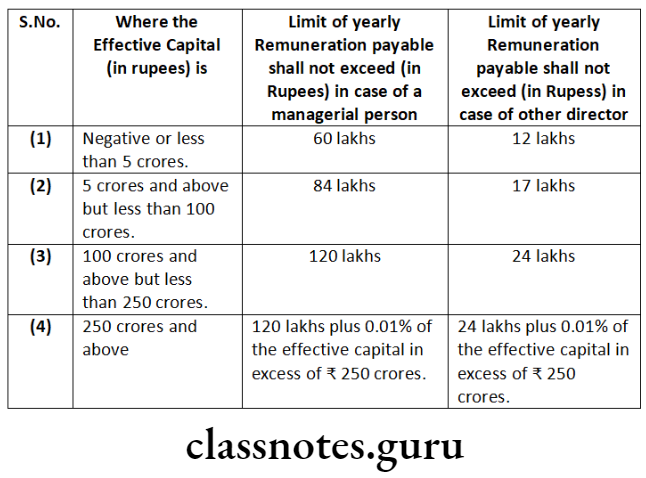

Question 5. Ms. Jyoti is the Managing Director of Wise (India) Ltd., incorporated under the Companies Act, 2013. Board of Directors of the company presents the following financial data extracted from the company’s financial statements as at 31st March, 2015:

Due to losses in the financial year 2014-15, the company is not in a position to pay any remuneration to Ms. Jyoti, Managing Director of the company. As per the agreement of service between Ms. Jyoti and the company, in case of losses or inadequacy of profits in any financial year, she is to be paid remuneration on the basis of ‘effective capital’ of the company. Based on the provisions of the Companies Act, 2013, decide the maximum remuneration payable to Ms. Jyoti for the financial year 2014-15 without the approval of the Central Government.

Answer:

“Effective Capital” means the aggregate of the paid-up share capital (excluding share application money or advances against shares); amount, if any for the time being standing to the credit of share premium account; reserves and surplus (excluding revaluation reserve); long-term loans and deposits repayable after one year (excluding working capital loans, overdrafts, interest due on loans unless funded, bank guarantee, etc.,

And other short-term arrangements) as reduced by the aggregate of any investments (except in case of investment by an investment company whose principal business is acquisition of shares, stock, debentures or other securities), accumulated losses and preliminary expenses not written off.

Computation of effective capital for managerial remuneration:

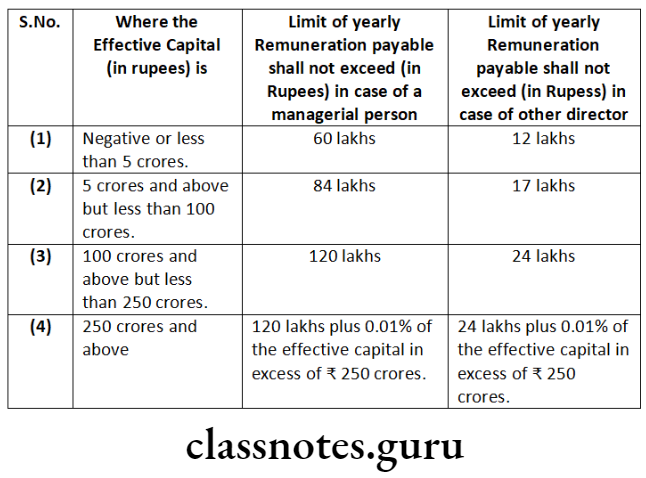

Remuneration payable by companies having no profit or inadequate profit without Central Government approval [Section II of the Part II of the Schedule V]: Where in any financial year during the currency of tenure of a managerial person, or other director a company has no profits or its profits are inadequate, it may, without Central Government approval, pay remuneration to the managerial person or other director not exceeding the limits given below:

Remuneration based on effective capital:

Provided that the above limits shall be doubled if the resolution passed by the shareholders is a special resolution.

The above limits shall be doubled if the resolution passed by the shareholders is a special resolution.

If a period less than one year, the limits shall be pro-rated. Considering the above provisions, Ms. Jyoti, Managing Director of Wise (India) Ltd. can be remunerated in following ways without approval of Central Government:

- As company’s effective capital’ is between ” 5 Crores to 100 Crores”; Ms. Jyoti can be paid annual remuneration of 84 Lakhs i.e. monthly * 7 Lakhs.

- If company pass special resolution, remuneration can be doubled i.e. *1 Crore 68 lakhs annum i.e. 14.00 Lakhs per month can be paid.

Amendment made by Companies (Amendment) Act, 2017 Revised First Proviso to Section 197(1)-

“Provided that the company in general meeting may, with the approval of the Central Government, authorise the payment of remuneration exceeding eleven per cent. of the net profits of the company, subject to the provisions of Schedule V:”

Revised Second Proviso to Section 197(1)-

“Provided further that, except with the approval of the company in general meeting by a special resolution,-

- the remuneration payable to any one managing director; or whole-time director or manager shall not exceed five percent. of the net profits of the company and if there is more than one such director remuneration shall not exceed ten per cent. of the net profits to all such directors and manager taken together;

- the remuneration payable to directors who are neither managing directors nor whole-time directors shall not exceed,-

- one per cent. of the net profits of the company, if there is a managing or whole-time director or manager;

- three per cent. of the net profits in any other case.

Third Proviso to Section 197(1)-

“Provided also that, where the company has defaulted in payment of dues to any bank or public financial institution or non-convertible debenture holders or any other secured creditor, the prior approval of the bank or public financial institution concerned or the non-convertible debenture holders or other secured creditor, as the case may be, shall be obtained by the company before obtaining the approval in the general meeting.”

Important:

As per Companies (Amendment) Act 2019.

Penalty for contravention of Section 197 in respect of managerial remuneration

Section 197 makes provisions in respect of managerial remuneration. If any person makes any default in complying with the provisions of Section 197, he shall be liable to a penalty of one lakh rupees and where any default has been made by a company, the company shall be liable to a penalty of five lakh rupees – Section 197(15) of Companies Act, 2013 amended vide the Companies (Amendment) Act, 2019.

Till 2.11.2018, the section provided for fine which could be imposed only by Court. Now, penalty can be imposed by RoC or RD who is authorized for this purpose.

Even earlier, the offense was compoundable. However, procedure of compounding had to be complied with. Now, directly penalty can be imposed after issuing Show Cause Notice.

Cs Company Law Questions And Answers

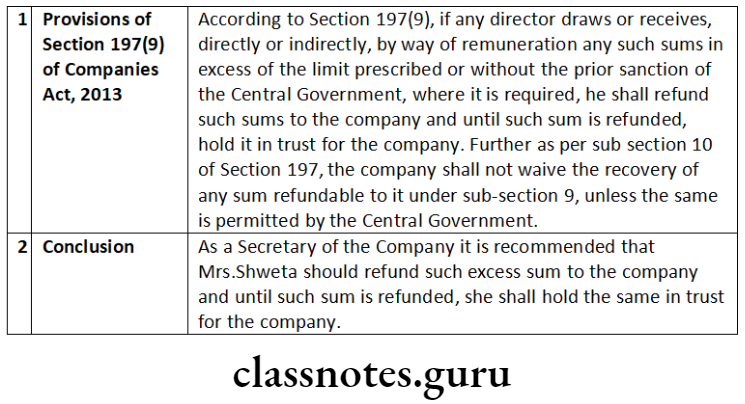

Question 6. It has been found that Mrs. Shweta director of a company, has drawn remuneration in excess of the prescribed limits. The Chief Financial Officer of the company has sought your advice in the matter. As the Secretary of the company, advise the Chief Financial Officer, the course of action that may be taken in this regard.

Answer:

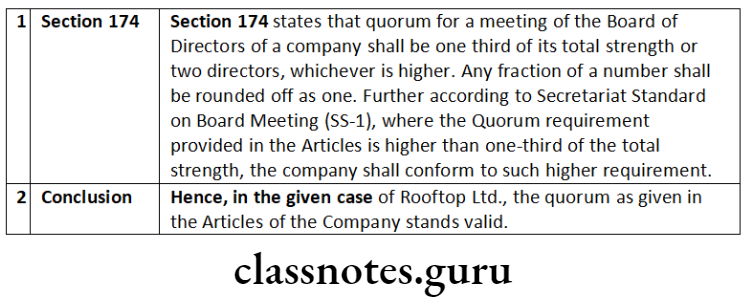

Question 7. Out of 9 directors in Rooftop Ltd., 5 are Indian nationals, 3 are foreign residents and one is a person of Indian origin. The articles of the company stipulate that quorum for a Board meeting shall be 5 directors of which at least one director shall be a foreign resident. Referring to the provisions of the Companies Act, 2013, examine the validity of the above provision in the articles.

Board of directors of KM Ltd. proposes to transfer 11.33% of the net profits of the company for the financial year 2015-16 to general reserves. Examining the provisions of the Companies Act, 2013, advise the Board whether it can go ahead with its proposal.

Answer:

A company may, before the declaration of any dividend in any financial year, transfer such percentage of its profits for that financial year as it may consider appropriate to the reserve of the company.

Hence, Board of Directors of KM Ltd. may transfer 11.33% of the net profit to general reserves.

Question 8. Mr. Atul Rastogi, the Managing Director of ABC Limited has resigned from the Managing Directorship of the company. He, however, wants to continue as a director in the company. Referring to the provisions of the Companies Act, 2013, state whether Mr. Atul can continue as a director in the company.

Answer:

Yes. According to the provisions of the Companies Act, 2013, Mr. Atul Rastogi can continue as a director of the company in the given case.

In G. Subba Rao. v. Rasmi Die-Casting Ltd. [1998] 93 Com. Cases 797, the Andhra Pradesh High Court held that from the definition of ‘managing director’ as per Section 2 (26) [Corresponds to Section 2(54) of the Companies Act, 2013], it is clear that the managing director has to act under the superintendence, control and direction of the Board of directors. Moreover, powers of routine administrative nature like the power to affix common seal, to draw and endorse any negotiable instrument do not fall within the substantial powers conferred upon the managing director.

What is to be seen is whether the managing director making any representation for and on behalf of a company had in fact, ‘actual authority’ either in terms of the provisions of the constitution of that company or by virtue of the delegation by the Board of directors.

A managing director must hold and continue to hold the office of director. A managing director is first a director and then a managing director with certain additional powers [Shanta Shamsher Jung Bahadur v. Kamani Brothers P. Ltd. (1959) 29 Com Cases 501 (Bom.)].

A managing director is an ordinary director entrusted with special powers. If a company wants to appoint a person as managing director, who is not a director of the company, he has first to be appointed as an additional director in accordance with the provisions of Section 161 of the Companies Act, 2013 of the Act. Space to write important points for revision

Key Managerial Personnel Under Companies Act

Question 9. Mrs. Beautiful, aged 40 years, is the Managing Director of Beauty Care Products Limited. She has received contribution to superannuation fund and leave encashment during her tenure with the company during the financial year ending 31st March, 2017. The Manager (Accounts) of the company is not very confident, if these perquisites are to be included in the computation of ceiling on remuneration specified in the Companies Act, 2013. Referring to the provisions of the Act, advise the Manager (Accounts).

Answer:

The matter given in the question needs to be solved in the light of the provisions as contained in Section IV of Part II to Schedule V of the Companies Act, 2013. A managerial person or other director shall be eligible for the following perquisites which shall not be included in the computation of the ceiling on remuneration specified in Section 2 and 3:

- contribution to provident fund, superannuation fund or annuity fund to the extent these either singly or put together are not taxable under the Income-Tax Act, 1961;

- gratuity payable at a rate not exceeding half a month’s salary for each completed year of service; and

- encashment of leave at the end of the tenure.

Therefore, applying the provisions as stated above, contribution to superannuation fund received by Mrs. Beautiful, Managing Director shall not be included in the computation of managerial remuneration ceiling. But she has received leave encashment during the tenure of her service and not at the end of her tenure and thus it should be included in the calculation of ceiling of managerial remuneration under the provisions of the Companies Act, 2013.

The Manager (Accounts) is accordingly advised.

Question 10. Sand Ltd. wants to appoint River as Managing Director of the company for a period of three years with effect from 1st August, 2018. River has given a written statement to the company that he has paid rupees one thousand to the prescribed authorities for a conviction of an offence under the Conservation of Foreign Exchange and Prevention of Smuggling Activities Act, 1974 on 30th June, 2018. State whether River can be appointed as Managing Director of the company under the Companies Act, 2013.

Answer.

According to Schedule V of the Companies Act, 2013, no person shall be eligible for appointment as a managing or whole-time director or a manager of a company, if he has been detained for any period under the Conservation of Foreign Exchange and Prevention of Smuggling Activities Act, 1974.

In the present case Mr. River has only paid fine of 1,000 to the prescribed authorities for a conviction of an offence under the Conservation of Foreign Exchange and Prevention of Smuggling Activities Act, 1974. Since it is only conviction and he was not detained, he can be appointed as Managing Director of the company.

Question 11. On 4th September, 2018 Varun was appointed as Managing Director of Astha Ltd. by the Board of directors subject to the approval of the members at the next general meeting. On 10th September, 2018 Varun in the capacity of managing director executed an agreement with Shabeer to purchase some machines.

On 3rd October, 2018 members in the general meeting did not approve the appointment of Varun. Later on company refuses to accept delivery of machines from Shabeer on the ground that agreement was executed by Varun whose appointment is not approved by the members. Is refusal of company valid on the said ground? Examine.

Answer:

According to Section 196(5) of Companies Act, 2013 where an appointment of a managing director, whole-time director or manager is not approved by the company at a general meeting, any act done by him before such approval shall not be deemed to be invalid.

In accordance with above express provision in the given case the contention of refusing to accept delivery of goods on the grounds that the appointment of managing director was not approved at the general meeting and agreement was signed prior to general meeting and after appointment by the Board does not stand valid.

Question 12. SRM Ltd. has paid 15 lakh as an insurance premium on behalf of its Company Secretary and Managing Director for indemnifying any of them against any liability in respect of any negligence, default, misfeasance, breach of duty or breach of trust for which they may be guilty in relation to the company. Can the company pay such insurance premium? Discuss referring to the provisions of the Companies Act, 2013.

Answer:

Under section 197(13) of Companies Act, 2013, where any insurance is taken by a company on behalf of its managing director, whole-time director, manager, Chief Executive Officer, Chief Financial Officer or Company Secretary for indemnifying any of them against any liability in respect of any negligence, default, misfeasance, breach of duty or breach of trust for which they may be guilty in relation to the company, the premium paid on such insurance shall not be treated as part of the remuneration payable to any such personnel.

Further it has been provided that if such person is proved to be guilty, the premium paid on such insurance shall be treated as part of the remuneration. In accordance with above express provision in the given case the company can pay the insurance premium of 15.00 lakhs for company secretary and managing director for indemnifying any of them against any liability in respect of any negligence, default, misfeasance, breach of duty or breach of trust for which they may be guilty in relation to the company, and such shall not be treated as remuneration.

Question 13. ‘S’ is a member of Institute of a Company Secretaries of India. He has defaulted in payment of annual subscription and his name is removed from the Register of Members by ICSI on 31 December, 2018.

- Can he be appointed as “Company Secretary” by ‘M’ Ltd. with a paid up share capital of 10 crore on 1 January, 2019?

- If M Ltd. has paid up share capital of 2 crore and it has appointed ‘S’ as a company secretary on part time basis, is it valid? (4 marks)

Answer:

Section 2(24) of the Companies Act, 2013 defines “company secretary” or “secretary” means a company secretary as defined in clause (c) of sub Section (1) of Section 2 of the Company Secretaries Act, 1980 who is appointed by a company to perform the functions of a company secretary under this Act.

According to clause (c) of Sub-section (1) of section 2 of the Company Secretaries Act, 1980, a company secretary means a person who is a member of the Institute of Company Secretaries of India. Therefore, ‘Company Secretary means a person who is a member of the Institute of Company Secretaries of India (ICSI) and who is appointed by a company to perform the function of a company secretary. The functions of company secretary have been detailed in Section 205 of the Companies Act, 2013.

- No, S cannot be appointed as a company secretary as his name is removed from the register of members by ICSI on 31.12.2018 itself.

- There is no mandatory requirement to appoint company secretary for a company having paid up share capital of less than five crore rupees. No, S cannot be appointed as a company secretary of M Ltd. even if the paid up capital of the company is 2 crores as his name is removed from the register of members by ICSI. Therefore, appointment of S as Company Secretary is not valid.

Cs Executive Company Law Important Questions

Question 14. ABC Corporation Ltd. has no managerial person acting in professional capacity. During the current financial year the company sustained a loss. How can the company remunerate their non-professional managerial personnel in such a situation?

Answer:

The ABC Corporation Ltd. can remunerate their non-professional managerial personnel according to the following provisions of Section 197 of the Companies Act, 2013 read with Schedule V of the Act, which provides as under:

- If in any financial year, a company has no profits or its profits are inadequate, the company shall not pay by way of remuneration any sum exclusive of sitting fees to its directors including any managing or whole- time director or manager except in accordance with the provisions of Schedule 5.

- In cases where Schedule V is applicable on grounds of no profits or inadequate profits, any provision relating to the remuneration of any director which purports to increase or has the effect of increasing the amount thereof, whether the provision be contained in Company’s memorandum or articles, or in an agreement entered into by it, or in any. resolution passed by the company in general meeting or its Board, shall not have any effect unless such increase is in accordance with the conditions specified in that schedule.

Provided that the remuneration in excess of above limits may be paid if the resolution passed by the shareholders is a special resolution.

Question 15. Owing to the resignation of Prashant, Managing Director of Beauty Herbals Ltd. on 15th October, 2019, the company appointed one of its Senior Deputy General Manager Kristina Kelly, aged 26 years and a Canadian citizen as its Managing Director with effect from 1st November, 2019 at a meeting of the Board of Directors held on 31st October, 2019.

Kristina Kelly came to India for the first time for the purpose of taking up employment in India on 1st January, 2018. She got appointed in the Company on 1st April, 2018. From 1st December, 2018 she was sent for a training program for 6 months and she returned to India on 1st June, 2019. Advise the management of the company whether her appointment by the Board of Directors is valid and if any further compliances are required to validate her appointment.

Answer:

The Foreign national can also be appointed as a Managing Director of a company subject to the compliance of conditions prescribed under Section 196 along with Part I of Schedule V of the Companies Act, 2013.

As per Part I (e) of Schedule V of the Companies Act, 2013, the person is required to be a resident of India to be appointed as a Managing Director of the company.

As per Explanation I to the above schedule, resident in India includes a person who has been staying in India for a continuous period of not less than 12 months immediately preceding the date of his appointment as a managerial person and who has come to stay in India, –

- for taking up employment in India; or

- for carrying on a business or vacation in India.

In the given case, Kristina Kelly who is a Canadian citizen, appointed as Managing Director of the company w.e.f. November 01, 2019 has not stayed in India for a continuous period of 12 months immediately preceding the date of her appointment.

Consequently, her appointment as Managing Director by the Board of Directors of the Company is not valid as it is not in compliance with Part I of Schedule V of the Companies Act, 2013.

Therefore, to validate her appointment, the company is required to file an application in e-Form MR-2 within a period of 90 days from the date of such appointment to the Central Government seeking the approval for such appointment as provided in Section 196 read with Rule 7 of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014.

Question 16. Board of director of Yes No Ltd. proposes to appoint Arjun as managing director. Arjun has recently celebrated his 71st birthday. Arjun has spent his entire career in power sector and will be a strategic fit for Yes No Ltd. Company Secretary of the company suggests that Arjun can only be appointed through special resolution. Do you agree with the Company Secretary?

Answer:

According to Section 196(3) of the Companies Act, 2013, no company shall appoint or continue the employment of any person as managing director, whole-time director or manager who is below the age of 21 years or has attained the age of 70 years.

- Although, appointment of a person who has attained the age of 70 years may be made by passing a special resolution in which case the explanatory statement annexed to the notice for such motion shall indicate the justification for appointing such person.

- Where no such special resolution is passed but votes cast in favour of the motion exceed the votes, if any, cast against the motion and the Central Government is satisfied, on an application made by the Board, that such appointment is most beneficial to the company, the appointment of the person who has attained the age of seventy years may be made..

Consequently, in the above case, appointment of Mr. Arjun in Yes No Ltd. can also be made by an application made by the Board of Directors to the Central Government. Hence, advice of Company Secretary is not correct.

Question 17. X has been appointed as the Managing Director of XYZ Limited. The company does not have any other whole time directors. The terms and conditions of his appointment are as under:

- Remuneration amounting to 5% of the net profits of the company.

- A fees of 1,00,000 per annum towards actuarial services, even though X does not hold any professional qualification in actuarial science.

- Sitting fees of 50,000 for every meeting of the Board or the Committee thereof attended by X.

The Company had defaulted in the repayment of interest and principal on term loans borrowed from banks, which default is still subsisting. Suggest, whether the above remuneration is in line with the provisions of the Companies Act, if not also explain the remedial action required from the Company.

Answer:

Chapter 8 of the Companies Act, 2013 read with Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014 deal with the legal and procedural aspects of appointment of key managerial personnel including managing director, whole-time director or manager, managerial remuneration, secretarial audit etc.

- 10 has been appointed as the Managing Director of XYZ Ltd. The Company does not have any other Whole Time Director. In this case, remuneration to X, amounting to 5% of Net Profits of the Company, is absolutely as per provisions of the Act and perfectly valid.

- In case of a managerial person or other director who is functioning in a professional capacity: If a managerial personnel or other director is functioning in professional capacity, remuneration as per item (A) may be paid, if the following conditions is satisfied:

- They are not having any interest in the capital of the company or its holding company or any of its subsidiaries directly or indirectly or through any other statutory structures

- not having any, direct or indirect interest or related to the directors or promoters of the company or its holding company or any of its subsidiaries at any time during the last two years before or on or after the date of appointment; and

- possesses graduate level qualification with expertise and specialized knowledge in the field in which the company operates. Hence, fees paid to X amounting to 1 lakh p.a. towards actuarial services is not valid.

- Sitting fee can be paid to Director upto 1 lakh per meeting. Hence, sitting fee of 50000/- for every Board Meeting or meeting of committee thereof, attended by X, is valid.

- The benefits of the limits specified for Managerial Remuneration can be availed if the following further conditions are satisfied.

- Further, considering the above provisions, the fee payable for actuarial services is to be added to Mr. X remuneration as he does not hold any professional qualification to practice actuarial science.

- In the above case, the overall remuneration exceeds the limit of 5% of net profits as provided in the section. Therefore, the company has to get the approval of the shareholders by way of a special resolution in terms of Section 197 of the Act.

- As the company has defaulted in payment of interest and principal on term loans to the banks, the company should also take a prior approval of the banks for paying the above remuneration to Mr. X before passing the special resolution by shareholders.

Question 18. XYZ Ltd wants to pay sitting fees to its women directors, less than the sitting fees payable to other directors of the Company. And want to appoint X as its Managing Director of the company for a term exceeding five years at a time. Advise the company on the above proposals.

Answer:

As per Rule 4 of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014:

A company may pay a sitting fees to a director for attending meetings of the Board or committees thereof, such sum as may be decided by the Board of directors thereof which shall not exceed one lakh rupees per meeting of the Board or committee thereof.

Although, for Independent Directors and Women Directors, the sitting fees shall not be less than the sitting fee payable to other directors.

Thus, XYZ Ltd. cannot pay sitting fees to its women directors less than the sitting fees payable to other directors of the company.

Conclusion:

As per Section 196 of the Companies Act, 2013 a company shall not appoint or reappoint any person as its managing director for a term exceeding five years at a time.

Thus, Mr. X cannot be appointed as Managing Director of the company for a term exceeding five years at a time.

Question 19. X, a finance expert having experience of 30 years. XYZ Ltd. wants to appoint him as a Chief Financial Officer at a salary which is more than that of director of the company. State whether the limits on managerial remuneration under section 197 of the Companies Act, 2013 and Schedule -V apply to X.

Answer:

Remuneration of Director:

According to Section 197 of the Companies Act, 2013 contains certain limits with respect to remuneration of Directors including managing director and whole time director and manager. However, these limits do not apply to other key managerial personnel i.e. the Chief Executive Officer, the Chief Financial Officer and the Company Secretary.

As per, Schedule V contains certain limits with respect to remuneration of managing director, whole time director and manager. However, these limits also do not apply to other key managerial personnel, i.e. the Chief Executive Officer, the Chief Financial Officer and the Company Secretary.

Conclusion:

So, the limits on managerial remuneration as contained in section 197 of the Companies Act, 2013 and Schedule V shall not apply to Mr. X.

Key Management Personnel Descriptive Questions

Question 1. Describe the compensation for loss of office of managing or Whole Time Director or Manager.

Answer:

Section 202 provides that a company may make payment to a managing or whole-time director or manager, but not to any other director, by way of compensation for loss of office, or as consideration for retirement from office or in connection with such loss or retirement.

However, No payment shall be made in the following cases:

- where the director resigns from his office as a result of the reconstruction/amalgamation of the company and is appointed as the managing or whole-time director, manager or other officer of the reconstructed company/of resulting company from the amalgamation;

- where the director resigns from his office otherwise than on the reconstruction/ amalgamation of the company;

- where the office of the director is vacated due to disqualification;

- where the company is being wound up due to the negligence or default of the director;

- where the director has been guilty of fraud or breach of trust or gross negligence or mismanagement of the conduct of the affairs of the company or any subsidiary company or holding company; and

- where the director has instigated, or has taken part directly or indirectly in bringing about, the termination of his office.

Question 2. Enumerate the statutory duties and liabilities of a company secretary.

Answer:

- Declaration regarding compliance with requirement of registration: In terms of Section 7(1)(b) of the Companies Act, 2013, a company gets incorporated by submitting memorandum and articles duly signed along with a declaration in a prescribed form that all requirements of Act and rules have been complied with in respect of registration of company. Such declaration in prescribed form can be signed by an Advocate, a chartered accountant, cost accountant or company secretary in practice who is engaged in the formation of the company and by a person named in the articles as a director, manager or secretary of the company.

- Authentication of documents, proceedings and contracts: Authentication is more than simply attestation. Authentication is attestation made by proper officer by which he certifies that a record is in due form of law and that the person who certifies is the officer appointed to do so. A document or proceeding requiring authentication by a company or contract made by or on behalf of a company may be signed by any key managerial personnel or an officer of the company duly authorized by the Board in this behalf.

- Signing share certificate:

Share certificates of the company should be signed by two directors (out of which one should be Managing Director or whole time director, if appointed) and Secretary or other person authorized by Board. - Signing annual return:

Annual return to be filed with Registrar of Companies has to be signed by a director and Company Secretary. If Company does not have Company Secretary, the return can be signed by company secretary in practice. - Signing of financial statements:

The financial statement, including consolidated financial statement is to be signed on behalf of the Board by the chairperson of the company where he is authorised by the Board or by two directors out of which one shall be managing director, if any, and the Chief Executive Officer, the Chief Financial Officer and the company secretary of the company, wherever they are appointed. - Appear before NCLT:

A Company Secretary can appear before National Company Law Tribunal (NCLT) on behalf of the company. [Section 432] - Secretary as Compliance Officer of listed company:

As per clause (1) of Regulation 6 of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, a listed company is required to appoint the company secretary to act as ‘Compliance Officer’, who will be responsible for the following-- ensuring conformity with the regulatory provisions applicable to the listed entity in letter and spirit.

- co-ordination with and reporting to the Board, recognised stock exchange(s) and depositories with respect to compliance with rules, regulations and other directives of these authorities.

- Demat shares

Secretary has to coordinate between depository and stock exchange in case of demat shares. - Additional duties

In addition to statutory duties of company secretary, he is often entrusted with additional duties like looking after legal matters, personnel matters, finance and sometime even general administration. - Nodal Officer

Company secretary has to perform duty of nodal officer under IEPF Rules. He shall verify all applications filed to reclaim shares from IEPF.

Liabilities of Company Secretary

Company Secretary has been defined as ‘Officer in default’ along with Managing Director, Manager and Wholetime Director etc. Thus, he can be punished in respect of offences under Companies Act. He may be held liable as Key Managerial Personnel also under various provisions of the Act.

Company Law Mcq With Answers

Question 3. Enumerate the role and responsibilities of company secretary.

Answer:

A company secretary is an officer of the company responsible for compliance by the company with the provisions of the Companies Act, 2013 and various other corporate, taxation, industrial and economic laws applicable to companies in general.

Under the Companies Act, the role of a secretary is three-fold, viz., as a statutory officer, as a co-ordinator and as an administrative officer if so authorized. Similarly, the responsibility of company secretaries extends not only to a company, but also to its shareholders, depositors, creditors, employees, consumers, society and government.

The role of a company secretary may conveniently be studied from three different angles:

- as a statutory officer,

- as a co-ordinator,

- as an administrative officer..

Statutory Officer:

The company secretary is an officer responsible for compliance with numerous legal requirements under different Acts including the Companies Act, 2013 as applicable to companies. The responsibilities of company secretary has also increased as he has been included in the definition of Key Managerial Personnel as defined in Section 2(51) of the Act, who are also liable to punishment by way of imprisonment, fine or otherwise for violation of the provisions of the Companies Act which hold the “officers in default” under Section 2(60).

Co-ordinator:

On dealing with the Board functions, Peter Ferdinand Drucker say – “But there are real functions which only a Board of directors can discharge”. The Board cannot function without proper coordination amongst various department of the company and communication of their proposals and project which deserve consideration of the board.

This is evidenced by the various conditions imposed in the loan agreements entered into between the financial institutions and the assisted companies. Company managements look to the company secretary for implementation of the conditions in the loan agreements.

The financial institutions stipulate that in the case of companies assisted by them financially, compliance certificate as per their format duly certified by the company secretary should be furnished periodically at the Board meetings.

Furnishing of the certificate requires skill of coordination between the company secretary and the functional heads and the factory manager.