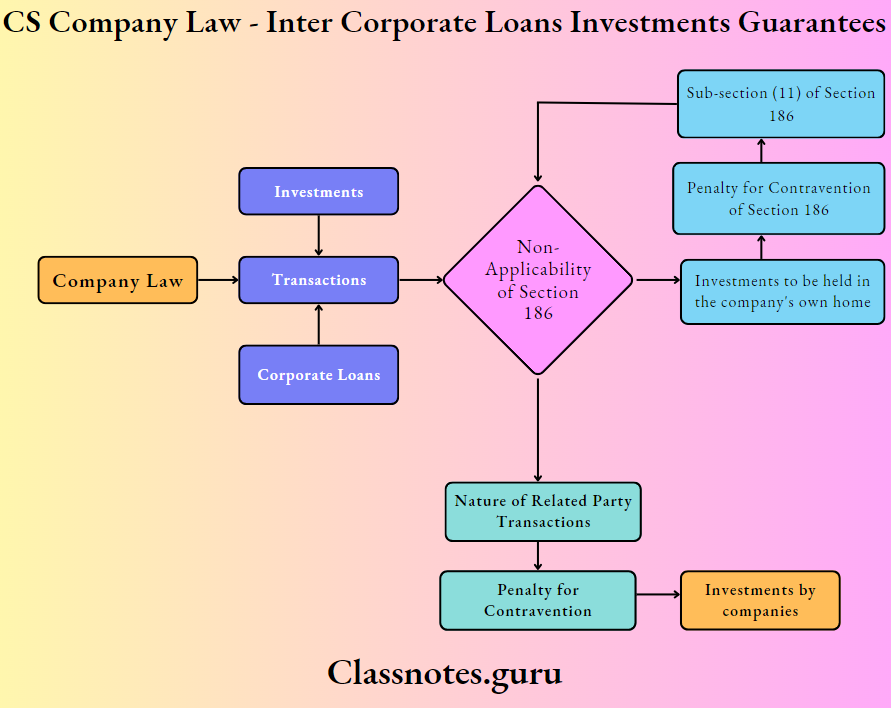

An Overview Of Inter Corporate Loans, Investments, Guarantees And Security, Related Party Transactions

Investments

Investments have been used in a limited sense in the lesson to mean the investing of money in shares, stock, debentures, or other securities.

Loans and Investments by Companies (Section 186)

A company shall unless otherwise prescribed, invest in not more than two layers of investment companies. [Sub-section (1) of section 186]

However, the aforesaid provisions shall not affect-

- A company from acquiring any other company incorporated in a country outside India if such other company has investment subsidiaries beyond two layers as per the laws of such country;

- a subsidiary company from having any investment subsidiary for meeting the requirements under any law or under any rule or regulation framed under any law for the time being in force. [Proviso to sub-section (1) of Section 186]

Limits for Loans, Guarantees, Security and Investment – Section 186(2)

No Company shall, directly or indirectly:

- Give any loan to any person or other body corporate;

- Give any guarantee, or provide security, in connection with a loan to any other body corporate or person; and

- Acquire, by way of subscription, purchase, or otherwise the securities of any other body corporate;

exceeding 60% of its paid-up share capital, free reserves, and securities premium account or 100% of its free reserves and securities premium account, whichever is more unless the same is previously authorized by a special resolution passed in a general meeting.

Non-Applicability of Section 186

Sub-section (11) of Section 186 provides that nothing contained in this section, except sub-section (1), shall apply-

- To any loan made, any guarantee given any security provided, or any investment made by a banking company, an insurance company, a housing finance company in the ordinary course of its business, or a company established with the object of and engaged in the business of financing industrial enterprises, or of providing infrastructural facilities;

- To any investment-

- made by an investment company;

- made in shares allotted in pursuance of clause (a) of sub-section (1) of Section 62 or in shares allotted in pursuance of rights issues made by a body corporate;

- made, in respect of investment or lending activities, by a non-banking financial company registered under Chapter 3-B of the Reserve Bank of India Act, 1934 and whose principal business is the acquisition of securities.

Inter Corporate Loans And Investments Cs

Penalty for Contravention of Section 186

If a company contravenes the provisions of this section, the company shall be punishable with a fine which shall not be less than twenty-five thousand rupees but which may extend to five lakh rupees and every officer of the company who is in default shall be punishable with imprisonment for a term which may extend to two years and with fine which shall not be less than twenty-five thousand rupees but which may extend to one lakh rupees.

Investments to be held in the company’s own home

As per the Act, all investments made or held by a company in any property, security, or other asset shall be made and held by it in its name. This requirement is confined to only those investments which are made by it on its behalf and not on behalf of someone else. However, in certain circumstances, the Act exempts the companies from complying with the above provisions.

Investment not held in the company’s own home

When any shares or securities in which a company has made investments are not held by it in its name as a beneficial owner when such investments are held in the name of a depository according to permissible conditions given in the Act, the company shall forthwith enter in a register maintained by it for the purpose, particulars as specified in the Act.

Related Party Transactions

According to Section 2(76) of the Companies Act, 2013, “related party”, concerning a company, means-

- A director or his relative;

- A key managerial personnel or his relative;

- A firm, in which a director, manager or his relative is a partner;

- A private company in which a director or manager or his relative is a member or director;

- A public company in which a director or manager is a director and holds along with his relatives, more than two percent (2%) of its paid-up share capital;

- Anybody corporate whose Board of Directors, managing director, or manager is accustomed to act by the advice, directions, or instructions of a director or manager;

- Any person on whose advice, directions, or instructions a director or manager is accustomed to act:

- Provided that nothing in sub-clauses (6) and (7) shall apply to the advice, directions, or instructions given in a professional capacity;

- Anybody corporate which is-

- a holding, subsidiary, or an associate company of such company;

- a subsidiary of a holding company to which it is also a subsidiary; or

- an investing company or the venturer of the company.

Nature of Related Party Transactions

The scope of dealing with Related Party Transactions has been widened in the Companies Act, 2013. Section 188 (1) of the Act provides that except with the consent of the Board of Directors given by a resolution at a meeting of the Board and subject to such conditions as prescribed under Rule 15 of the Companies (Meetings of Board and its Powers) Rules, 2014, no company shall enter into any contract or arrangement with a related party with respect to-

- Sale, purchase, or supply of any goods or materials;

- Selling or otherwise disposing of, or buying, property of any kind;

- Leasing of property of any kind;

- Availing or rendering of any services;

- Appointment of any agent for the purchase or sale of goods, materials, services, or property;

- Such related party’s appointment to any office or place of profit in the company, its subsidiary company, or associate company; and

- Underwriting the subscription of any securities or derivatives thereof, of the company:

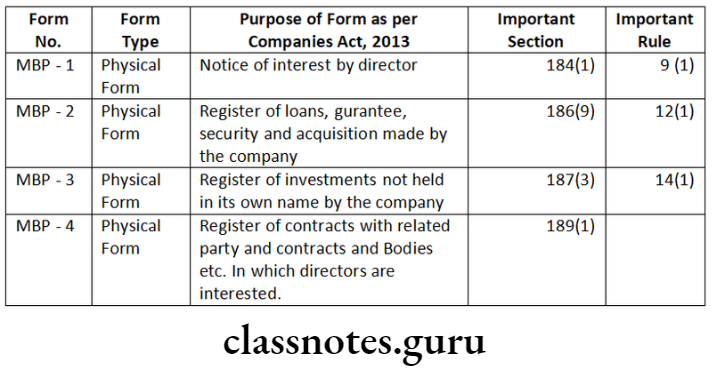

List of Important Forms

Inter Corporate Loans Under Companies Act 2013

Distinguish Between

Question 1. Distinguish between the following:

- ‘Free Reserves’ and ‘Net Worth’ under the provisions of the Companies Act,

- ‘Related Party’ and ‘Relative’ as defined and applied under the Companies Act, 2013.

Answer:

Free Reserves

As per Section 2(43) “free reserves” means such reserves which, as per the latest audited balance Sheet of a company, are available for distribution as dividends:

Provided that:

- any amount representing unrealized gains, notional gains or revaluation of assets, whether shown as a reserve or otherwise, or

- any change in the carrying amount of an asset or of a liability recognized in equity, including surplus in profit and loss account on measurement of the asset or the liability at fair value, shall not be treated as free reserves.

Whereas “Net Worth” means the aggregate value of the paid-up share capital and all reserves created out of the profits and securities premium account, after deducting the aggregate value of the accumulated losses, deferred expenditure and miscellaneous expenditure not written off, as per the audited balance sheet, but does not include reserves created out of revaluation of assets, write-back of depreciation and amalgamation.

Amendment made by Companies (Amendment) Act, 2017 account and debit or credit balance of profit and loss account, after deducting the aggregate value of the accumulated losses, deferred expenditure and miscellaneous expenditure not written off, as per the audited balance sheet, but does not include reserves created out of revaluation of assets, write-back of depreciation and amalgamation.

According to Section 2(76) of the Companies Act, 2013, “related party”, about a company, means:

- A director or his relative;

- A key managerial personnel or his relative;

- A firm, in which a director, manager or his relative is a partner;

- A private company in which a director or manager or his relative is a member or director;

- A public company in which a director or manager is a director and holds along with his relatives, more than two percent (2%) of its paid-up share capital;

- Anybody corporate whose Board of Directors, managing director, or manager is accustomed to act per the advice, directions, or instructions of a director or manager;

- Any person on whose advice, directions, or instructions a director or manager is accustomed to act:

- Provided that nothing in sub-clauses (vi) and (vii) shall apply to the advice, directions, or instructions given in a professional capacity;

- Any company which is-

- A holding, subsidiary, or an associate company of such company; or

- A subsidiary of a holding company to which it is also a subsidiary;

- According to Notification No. GSR 464(E), dated 05/06/2015 in the case of Private Companies this subclause shall not apply concerning Section 188.

- Such other person as may be prescribed;

Rule 3 of the Companies (Specification of Definitions Details) Rules, 2014 prescribes, that a director other than an independent director or key managerial personnel of the holding company or his relative about a company, shall be deemed to be a related party.

According to Section 2(77), ‘relative’ concerning any person means anyone who is related to another, if: (i) they are members of a HUF; (ii) they are husband and wife; or (iii) one person is related to the other in such manner as may be prescribed.

According to Rule 4 of the Companies (Specification of Definitions Details) Rules, 2014, a person shall be deemed to be the relative of another, if he or she is related to another in the following manner, namely:

- Father: Provided that the term “Father” includes step-father.

- Mother: Provided that the term “Mother” includes the stepmother.

- Son: Provided that the term “Son” includes the stepson.

- Son’s wife.

- Daughter.

- Daughter’s husband.

- Brother: Provided that the term “Brother” includes the step-brother;

- Sister: Provided that the term “Sister” includes the step-sister. -Space to write important points for revision

Descriptive Questions

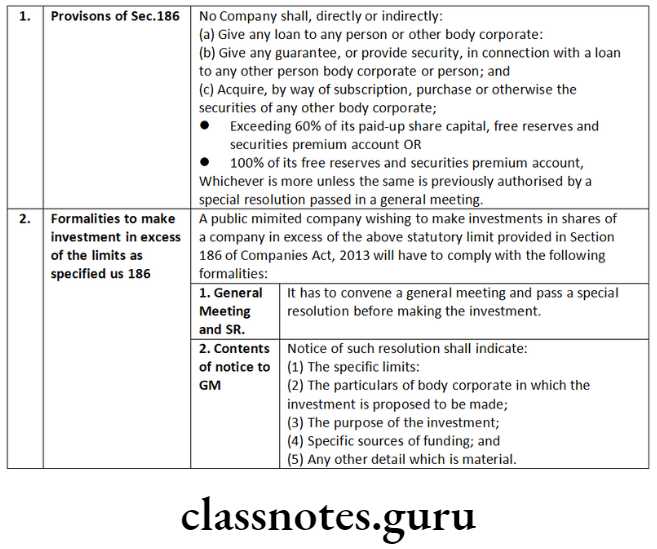

Question 1. Your company, which is a public limited company wishes to make investments in shares of a company. The total investment exceeds the statutory limit stipulated by the Companies Act, 2013. What are the formalities to be complied with in this regard?

Answer:

Inter Corporate Guarantees Rules

Question 2. What transactions are considered as ‘related party transactions’ under the provisions of the Companies Act, 2013? Explain.

Answer:

Provisions of the Companies Act Regarding Related Party Transaction

Meaning of related party. Sec. 2(76) of Companies Act, 2013

Concerning company, the term ‘related party’ means and includes the following:

- a director or his relative,

- KMP or their relative,

- a firm in which a director, manager, or his relative is a partner,

- a private company in which a director or manager is a director or member,

- a public company in which a director or Manager is a director or holds along with his relatives more than 2% of its paid-up share capital.

- a person on whose advice, directions, or instruction (except given in a professional capacity) a director or manager is accustomed to act,

- a holding/ subsidiary or associate company, subsidiary’s subsidiary, and such person as would be prescribed.

Related Party Transaction Sec. 188

The escape of dealing with related party transactions has been given in the Companies Act, 2013, stating that the contracts or arrangements with above mentioned related party which comes to the following shall be covered under the scope of the provision:

- Sale, purchase, or supply of any goods or materials;

- Selling or otherwise disposing of, or buying, property of any kind;

- Leasing of property of any kind;

- Availing or rending of any services;

- Appointment of any agent for the purchase or sale of goods, materials, services, or property;

- Such, related party’s appointment to any office or place of profit in the company, its subsidiary company or associate company; and Underwriting the subscription of any securities or derivatives thereof, of the company.

Ordinary Resolution

- Provided that no contract or arrangement, in the case of a company having a paid-up share capital of not less than such amount, or transactions not exceeding such sums, as may be prescribed, shall be entered into except with the prior approval of the company by an ordinary resolution.

- Provided further that no member of the company shall vote on such ordinary resolution, to approve any contract or arrangement that may be entered into by the company, if such member is a related party. (This proviso is not applicable on private companies)

When Prior Approval of

Company by Ordinary Resolution Required for Related Party Transactions [Rule 15 of Companies (Meeting of Board and its Powers) Rules, 2014]

- Transaction

- Sale, purchase, or supply of any goods or materials, directly or through the appointment of an agent.

- Selling or otherwise disposing of or buying property of any kind, directly or through the appointment of an agent.

- Leasing of property of any kind

- Availing or rendering of any services, directly or through the appointment of an agent

- Is for appointment to any office or place of profit in the company, its subsidiary company, or associate company

- Is for remuneration for underwriting the subscription of any 6. securities or derivatives thereof, of the company

- When Ordinary Resolution is Required

- Exceeding ten percent of the turnover of the company or rupees one hundred crore, whichever is lower.

- Exceeding ten percent of the net worth of the company or rupees one hundred crore, whichever is lower.

- Exceeding ten percent of the net worth of the company or ten percent. of turnover of the company or rupees one hundred crore, whichever is lower

- Exceeding ten percent. of the turnover of the company or rupees fifty crore, whichever is lower

- At a monthly remuneration exceeding two and a half lakh rupees

- Exceeding one percent of the net worth.

Question 3. Who is a “related party” as defined in Section 2(76)?

Answer: According to Section 2(76) of the Companies Act 2013, “related party”, about a company, means-

- A director or his relative:

- A key managerial personnel or his relative;

- A firm, in which a director, manager or his relative is a partner;

- A private company in which a director or manager or his relative is a member or director;

- A public company in which a director or manager is a director and holds along with his relatives, more than two percent (2%) of its paid-up share capital;

- Any body corporate whose Board of Directors, managing director, or manager is accustomed to act by the advice, directions, or instructions of a director or manager;

- Any person on whose advice, directions, or instructions a director or manager is accustomed to act: Provided that nothing in sub-clauses (6) and (7) shall apply to the advice, directions, or instructions given in a professional capacity:

- Any body corporate which is

- A holding, subsidiary, or an associate company of such company;

- A subsidiary of a holding company to which it is also a subsidiary; or

- An investing company or the venturer of the company.

Explanation: For this clause, “the investing company or the venturer of a company” means a body corporate whose investment in the company would result in the company becoming an associate company of the body corporate Such other person as may be prescribed.

Question 4. A company passed a special resolution in its general meeting for the grant of a loan to another body corporate more than the limits specified in section 186(2). However, one of the directors contended that prior approval of their financial institution is also required for such lending. Explain whether the contention of the director is acceptable.

Answer:

Section 186(5) of the Companies Act, 2013 provides that no investment shall be made loan guarantee, or security given by the company unless the resolution sanctioning it is passed at a meeting of the Board with the consent of all the directors present at the meeting and the prior approval of the public financial institution (PFI) concerned where any term loan is subsisting, is procured.

Although the prior consent of a Public Financial Institution shall not be needed where the aggregate of loans and investments so far made, the amounts for which guarantee or security so far provided to or in all other bodies corporate, along with the investments, loans, guarantee or security proposed to be made or given does not exceed the limit of 60% of its paid-up share capital, free reserves, and securities premium account or 100% of its free reserves and securities premium account, whichever is higher and there is no default in repayment of loan installments or payment of interest thereon as per the terms and conditions of such loan to the public financial institution.

In the above case, the Company is passing the special resolution under Section 186(2) of the Companies Act, 2013, indicating thereby that the proposed loan together with the loans already given is already more than the limits given under Section 186 (2) of Companies Act, 2013. Therefore the contention of the director is correct as the company aggregate of loans and investments so far made, exceed the limit under Section 186(2) of the Companies Act, 2013.

However, if the aggregate loans/ investments are well within the limits of consent and the company is passing the Special Resolution either in terms of its Article of Association (AOA) or voluntarily only due to some other commercial requirement other than Section 186(2) of Companies Act, 2013, then the prior consent from Financial Institution will not be required.

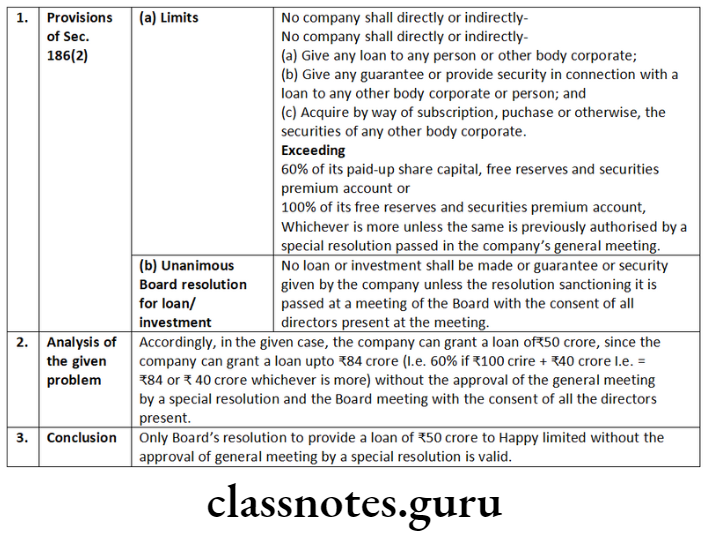

Practical Questions

Question 1. The board of directors of Joy Ltd., by a resolution passed at its meeting, decided to provide a loan of 50 crores to Happy Ltd. The paid-up share capital of Joy Ltd. on the date of resolution was 100 crore and the aggregate balance in the free reserves and securities premium account stood at 40 crore. Examining the provisions of the Companies Act, 2013, decide whether the Board’s resolution to provide a loan of 50 crores to Happy Ltd. is valid.

Answer:

Cs Company Law Investment And Loans Questions

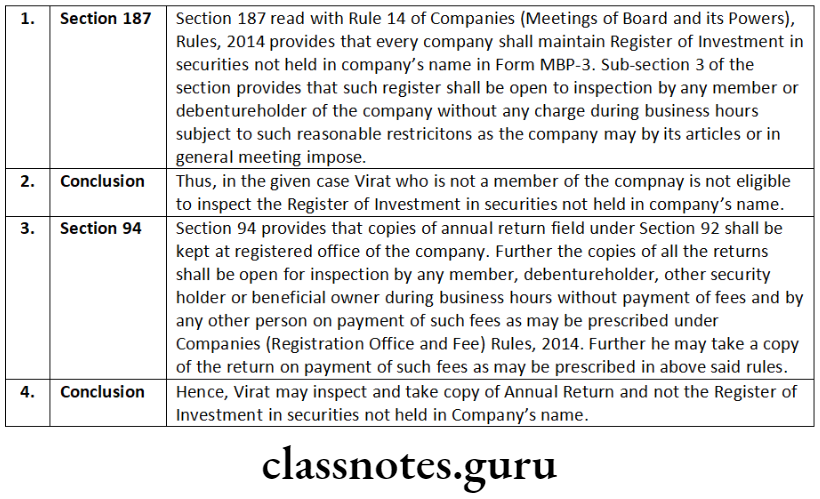

Question 2. Virat, a person of 21 years of age is pursuing MBA (Finance) course at a reputed recognised business school. He is not a shareholder of Grow (Pvt.) Ltd. He wishes to inspect the register of investments in securities not held in company’s name and annual return of Grow (Pvt.) Ltd. He also wants to take copies thereof. Examining the relevant provisions of the Companies Act, 2013, advise Virat whether he would be successful in this regard.

Answer:

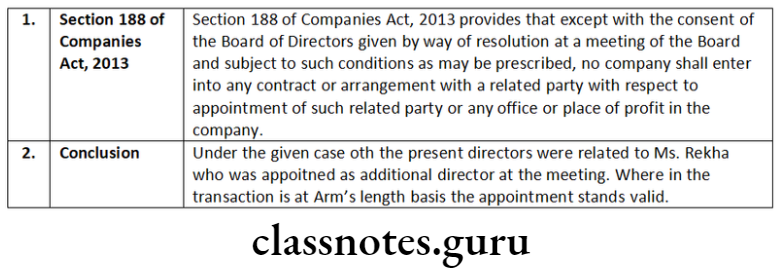

Question 3. Barkha Ltd. has four directors on its Board. A Board meeting was convened which was attended by only two directors, where Rekha was appointed as an additional director. Rekha is related to both the directors. Referring to the provisions of the Companies Act, 2013, examine the validity of the appointment.

Answer:

Question 4. RR Limited has decided to make investments in other companies for ₹ 50 lakhs, which is over 60% of the company’s paid-up share capital, free reserves, and securities premium account. The company has 5 directors. Four directors were present in the Board meeting, three directors have given their consent but one director abstained from voting. The decision of the Board was noted in the minutes of Board meeting and decided to make such an investment by passing of Board resolution with the majority. Referring to the provisions of Companies Act, 2013, examine the validity of the Board’s decision.

Answer:

By the provisions of the Companies Act, 2013, as contained in Section 186 (5), no investment shall be made or loan or guarantee or security given by the company unless the resolution sanctioning it is passed at a meeting of the Board with the consent of all the directors present at the meeting and the prior approval of the public financial institution concerned where any term loan is subsisting, is obtained.

Further, under the provisions of Section 186(2) and 186(3), the loan amount must not exceed 60% of its paid-up capital, free reserves, and securities premium account or 100% of free reserves and securities premium account, whichever is more. In case, the company wishes to exceed the said limit, prior approval, of the company through special resolution would be acquired.

In the given case, in the absence of adequate information, even if we assume that 50 lakh does not exceed 100% of free reserves and securities premium account, RR Limited has not complied with the provisions of Section 186 (5) of the Companies Act, 2013 where consent of all-the directors present is required. The resolution of the Board of Directors, therefore, is not valid and has no legal effect.

Question 5. XYZ Ltd., a company, has a paid-up share capital of * 60 crores and free reserves of 25 crores. It desires to make a loan of 20 crores to M Ltd. The company XYZ Ltd. has already made investments in many other companies including loans to the extent of 35 crores. Can the company go ahead with a loan to M Ltd.? Please advise the company about the procedure to be followed by it.

Answer:

As per Section 186 of the Companies Act, 2013 a company shall make investments up to 60 percent of paid-up share capital and free reserves or 100 percent of free reserves and securities premium account whichever is more.

In this case, the company can make a maximum investment of 60% (60+25) = 51 crores.

Since the company has already invested 35 crores it can further invest 16 crores only.

To invest upto 20 crores they need to take approval of shareholders through a special resolution.

Inter Corporate Loans Limits And Regulations

Question 6. HIJ Engineers Ltd. has a paid-up capital of * 20 lahks, Free Reserves of 3 lakh, and a Securities Premium of 2 lakh. It has granted a loan of 14 lakh to KLM Traders Ltd. The Board of Directors is proposing the following transactions without securing approval of the members:

- Sanctioning a loan of 2 lakh to KLM Cement Ltd. and

- Sanctioning a loan of ₹ 3 lakh to an employee of the company.

Can the Board of Directors sanction the aforesaid loans?

Answer:

According to Section 186 (2) of the Companies Act, 2013 provides that, no company shall directly or indirectly give any loan to any person or other body corporate exceeding 60% of its paid-up share capital, free reserves and securities premium account or 100% of its free reserves and securities premium account, whichever is higher.

As per Section 186(3) of the Companies Act, 2013 states that where the aggregate of the loans and investment so far made, along with the investment or loan, proposed to be made or given by the Board, exceed the limits specified under section 186(2), no investment or loan shall be made unless previously authorised by a special resolution passed in a general meeting.

Therefore, as per section 186(2) of the Companies Act, 2013, the limits for the loan and investment will be the amount whichever is higher of the following:

- 60% of paid up share capital, free reserves and securities premium account 15 lakh or

- 100% of free reserves and securities premium account = 5 lakh In the above case, since the company has already given loans of 14 lakh to KLM Traders Ltd and further proposed to grant loan, of 2 Lakh to KLM Cement Ltd, it will exceed the limit of 15 lakh, therefore prior approval by special resolution in the general meeting will be required to be passed by HIJ. Engineers Ltd. in terms of Section 186(3) of the Companies Act, 2013.

As per Explanation w.r.t. to Section 186(2) of the Companies Act, 2013, the word person, used under this sub-section does not include any individual who is in the employment of the company.

Accordingly, there are no limit imposed on the right of a company to sanction a loan to an employee of the company under Section 186(2) of the Companies Act, 2013, the Board of directors can grant a loan of 3 lakhs to the employee. No need to require any approval from the members.. Space to write important points for revision

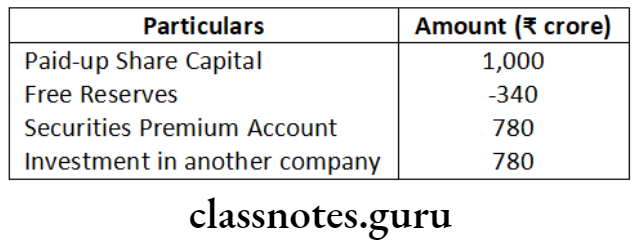

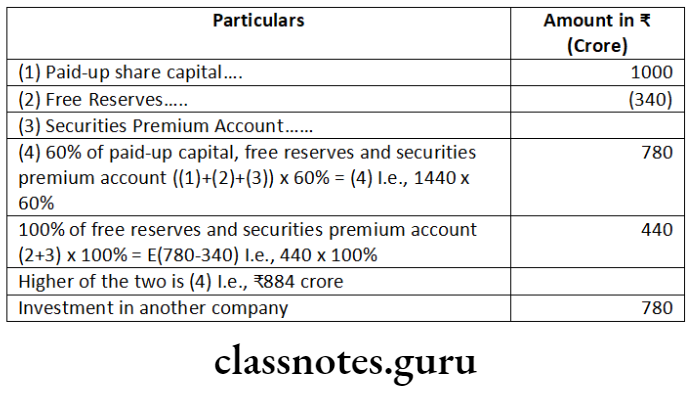

Question 7. Jupiter Ltd. Intends to acquire shares in another company. How much amount can be invested by Jupiter Ltd. without passing special resolution considering the facts mentioned below?

Answer:

As per section 186(2) of the Companies Act, 2013, no company shall, directly or indirectly:

- give any loan to any person or other body corporate;

- give any guarantee or provide security in connection with a loan to any other body corporate or person; and

- acquire by way of subscription, purchase or otherwise, the securities of any other body corporate, exceeding 60% of its paid-up share capital, free reserves and securities premium account or 100% of its free reserves and securities premium account, whichever is higher.

Further, where the aggregate of the loans and investment so far made, the amount for which guarantee or security so far provided to or in all other bodies corporate along with the investment, loan, guarantee or security proposed to be made or given by the Board, exceed the limits specified under Section 186(2) of the Companies Act, 2013, no investment or loan shall be made or guarantee shall be given or security shall be provided unless previously authorised by a special resolution passed in a general meeting.

Hence, a further investment that can be made by Jupiter Ltd. without passing a special resolution will be higher of (iv) or (v) or E reduced by investment already made i.e. (864-78084 Crore)

Inter Corporate Loans And Investments Cs

Question 8. XYZ Ltd. is an investment company whose principal business is the acquisition of shares and debentures of other companies. The following figures were derived from the books of XYZ Ltd.:

Assets:

Investment in shares and debenture ₹ 95 Lakh

Other Assets ₹ 105 Lakh

Total ₹ 200 Lakh

Income:

Income from investment business ₹ 12 Lakh

Other Income ₹ 18 Lakh

Total ₹ 30 Lakh

Whether the company is an investment company as per section 186 and eligible to claim exemption given thereunder?

Answer:

As per explanation to Section 186 (13) of the Companies Act, 2013; the expression “investment company” means a company whose principal business is the acquisition of shares, debentures or other securities and a company will be deemed to be principally engaged in the business of acquisition of shares, debentures or other securities, if its assets in the form of investment in shares, debentures or other securities constitute not less than fifty percent. of its total assets, or if its income derived from investment business constitutes not less than fifty per cent. as a proportion of its gross income.

Conclusion: Since no condition is satisfied, XYZ Limited cannot be categorized as an Investment Company and hence cannot claim exemption given thereunder.

Question 9. The Board of Directors of XYZ Ltd is considering the proposal for making the investment in ABC Ltd. The company has 5 directors on board and in the board meeting 4 directors were present, three of them given consent to the proposal and one director abstained from voting. Comment on the same.

Answer:

Under section 186(5) of the Companies Act, 2013, no investment shall be made or loan or guarantee or security given by the company, unless the resolution sanctioning it is passed at a meeting of the Board of Director with the consent of all the directors present at the meeting and the prior approval of the public financial institution (PFI) concerned where any term loan is subsisting is obtained.

Conclusion:

In the above problem, the Board of Directors of XYZ Ltd. while considering the proposal for making the investment in ABC Ltd. has not complied with the provision of section 186(5) of the Companies Act, 2013, where the consent of all the directors present at the meeting is required.

The resolution of the board of directors therefore is not valid and has no legal effect.

Short Notes

Question 1. Write short note on the following:

- Related Party not to vote on resolution

- Arm’s length transaction

Answer:

Second Proviso to Section 188 (1) of the Act provides that no member of the company shall vote on such resolution, to approve any contract or arrangement which may be entered into by the company, if such member is a related party.

This shall not apply to a company in which ninety per cent. or more members, in number, are relatives of promoters or are related parties.

- Exemption to Private Companies: In case of private companies second proviso shall not apply (Notification No. GSR 464(E) dated5-6-2015).

- Exemption to Government Companies: In case of Government companies above mentioned Second Proviso to the section 188 (1) of the Act shall not apply to –

- a Government company in respect of contracts or arrangements entered into by it with any other Government company or with Central Government or any State Government or any Combination thereof;

- a Government company other than a listed company, in respect of contracts or arrangements other than those referred to in clause (a), in case such company obtains approval of the Ministry or Department of the Central Government which is administratively in charge of the company, or, as the case may be the State Government before entering into such contract or arrangement. (Notification No. GSR 463(E) dated5-6-2015).

- As per the explanation (2) to Section 188(1) of the Act, the expression “arm’s length transaction” means a transaction between two related parties that is conducted as if they were unrelated, so that there is no conflict of interest.

- The phrase ‘on an arm’s length basis’ is in fact ‘at arm’s length’ or ‘an arm’s length relationship’ which means avoiding intimacy or close contact. The phrase ‘at arm’s length’ in relation to dealings between two parties is used to refer to dealings when neither party is controlled by the other.

- Arm’s length is the condition or fact that the parties to a transaction are independent and on an equal footing. Arm’s length transaction is a transaction between unrelated persons or organizations, in which there is no improper influence exercisable by one party over another, and no conflict of interests of or relating to dealings between two parties who are not related or not on close terms and who are presumed to have roughly equal bargaining power; not involving a confidential relationship.

- Parties are said to deal at “arm’s length” when they conduct the business without being subject to the other’s control or overmastering influence. An arm’s length transaction is a transaction between companies or people that do not have close contact or any financial connections and be or deal at arm’s length means without a close relationship with a person or a company.

- The burden to establish that a transaction was at arm’s length would be on the company and there must be sufficient and pertinent material to prove that the terms of the transaction with a related party were purely commercial and the same as in the case of a transaction between the company and a non- related party and there were no extra-commercial considerations.

Inter Corporate Loans Under Companies Act 2013

Descriptive Questions

Question 2. Discuss the role of Audit Committee in Related Party transactions.

Answer:

Section 177(4)(iv) of the Companies Act, 2013 provides that the terms of reference of Audit Committee shall include approval or any subsequent modification of transactions of the company with related parties;

Provided that the Audit Committee may make omnibus approval for related party transactions proposed to be entered into by the company subject to such conditions as may be prescribed;

Thus, it is the responsibility of the audit committee to approve the transactions of the company with related parties.

As per Rule 6A of Companies (Meeting of Board and its Powers) Second Amendment Rules, 2015, the audit committee may make omnibus approval for all related party transactions proposed to be entered into by the company subject to the following conditions, namely –

- The Audit Committee shall, after obtaining approval of the Board of Directors, specify the criteria for making the omnibus approval which shall include the following, namely:

- maximum value of the transactions, in the aggregate, which can be allowed under the omnibus route in a year;

- the maximum value per transaction that can be allowed;

- extent and manner of disclosures to be made to the Audit. Committee at the time of seeking omnibus approval;

- review, at such intervals as the Audit Committee may deem fit, related party transactions entered into by the company pursuant to each of the omnibus approvals made;

- transactions that cannot be subject to the omnibus approval by the Audit Committee.

- The Audit Committee shall consider the following factors while specifying the criteria for making omnibus approval, namely:

- The repetitiveness of the transactions (in the past or future);

- Justification for the need for omnibus approval.

- The Audit Committee shall satisfy itself on the need for omnibus approval for transactions of a repetitive nature and that such approval is in the interest of the company.

- The omnibus approval shall contain or indicate the following:-

- Name of the related parties;

- Nature and duration of the transaction;

- The maximum amount of transactions that can be entered into;

- The indicative base price or current contracted price and the formula for variation in the price, if any; and

- Any other information relevant or important for the Audit Committee to decide on the proposed transaction:

Provided that where the need for related party transaction cannot be foreseen and aforesaid details are not available, the audit committee may make ‘omnibus approval for such transactions subject to their value not exceeding rupees one crore per transaction.

- Omnibus approval shall be valid for a period not exceeding one financial year and shall require fresh approval after the expiry of such financial year.

- Omnibus approval shall not be made for transactions in respect of selling or disposing of the undertaking of the company. Space to write important points for revision

Question 3. Which companies are exempt from the provisions about loans and investments by companies?

Answer:

Non Applicability of Section 186

Exemptions

Sub-section (11) of Section 186 provides that nothing contained in this section, except sub-Section (1), shall apply-

- to any loan made, any guarantee given any security provided or any investment made by a banking company, an insurance company, a housing finance company in the ordinary course of its business, or a company established with the object of and engaged in the business of financing industrial enterprises, or of providing infrastructural facilities;

- to any investment-

- made by an investment company;

- made in shares allotted in pursuance of clause (a) of sub-section (1) of Section 62 or in shares allotted in pursuance of rights issues made by a body corporate;

- made, in respect of investment or lending activities, by a non-banking financial company registered under Chapter III-B of the Reserve Bank of India Act, 1934 and whose principal business is the acquisition of securities.

Exemption from Applicability of Section 186 to Government Company Given the Central Government’s notification dated 5th June 2015 under Section 462 of the Companies Act, 2013, Section 186 shall not apply to:

- a Government company engaged in defense production;

- a Government company, other than a listed company, in case such company obtains approval of the Ministry or Department of the Central Government which is administratively in charge of the company, or, as the case may be, the State Government before making any loan or giving any guarantee or providing any security or making any investment under the section.

Penalty for Contravention of Section 186

If a company contravenes the provisions of this section, the company shall be punishable with a fine which shall not be less than twenty-five thousand rupees but which may extend to five lakh rupees and every officer of the company who is in default shall be punishable with imprisonment for a term which may extend to two years and with fine which shall not be less than twenty-five thousand rupees but which may extend to one lakh rupees.