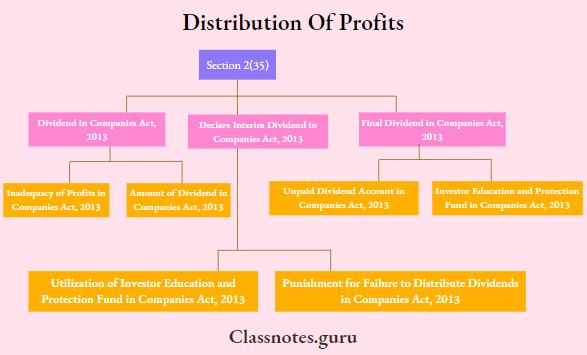

Distribution Of Profits

Section 2(35)

Under section 2(35) of the Companies Act, 2013, ‘dividend’ includes any interim dividend.

Dividend in Companies Act, 2013

The dividend is the share of the company’s profit distributed among the members.

Declare Interim Dividend in Companies Act, 2013

The Board may declare an interim dividend during any financial year out of the surplus in the Profit and Loss Account at any time between two AGMs of the company.

Final Dividend in Companies Act, 2013

Final Dividend means a Dividend which was declared at the Annual General Meeting of the company.

Inadequacy of Profits in Companies Act, 2013

In case of inadequacy of profits, the company can declare the dividend under Rule 3 of Companies (Declaration and Payment of Dividend) Rules 2014.

Amount of Dividend in Companies Act, 2013

The amount of the dividend shall be deposited in a scheduled bank in a separate account within 5 days from the date of declaration.

Unpaid Dividend Account in Companies Act, 2013

Where the dividend is not paid or claimed within 30 days, the company shall, within 7 days transfer the amount to the Unpaid Dividend Account which shall be opened in a scheduled bank.

Investor Education and Protection Fund in Companies Act, 2013

The amount remaining unpaid along with interest accrued thereon for 7 years shall be transferred to the Investor Education and Protection Fund.

Utilization of Investor Education and Protection Fund in Companies Act, 2013

Section 125 (3) provides the Fund shall be utilized for

- The refund in respect of unclaimed dividends, matured deposits, matured debentures, the application money due for refund, and interest thereon;

- Promotion of investors’ education, awareness, and protection;

- Reimbursement of legal expenses incurred in pursuing class action suits under sections 37 and 245 by members, debenture-holders, or depositors as may be sanctioned by the Tribunal.

Distribution Of Profits Under Companies Act

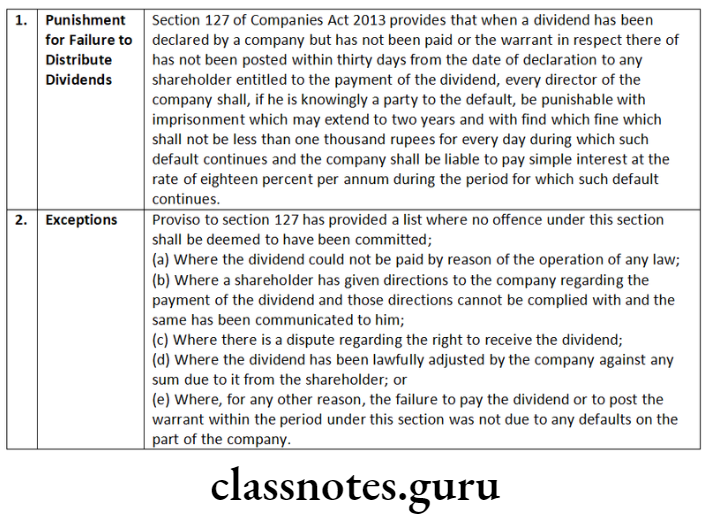

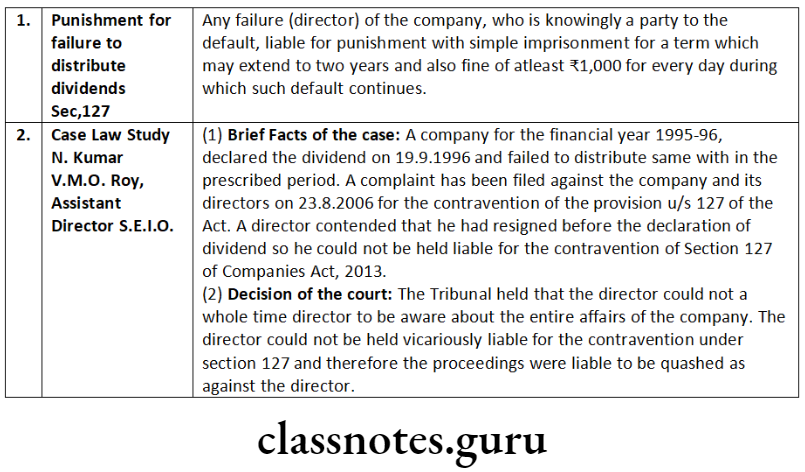

Punishment for Failure to Distribute Dividends in Companies Act, 2013

Section 127 of the Companies Act, 2013 provides that when a dividend has been declared by a company but has not been paid or the warrant in respect thereof has not been posted within thirty days from the date of declaration to any shareholder entitled to the payment of the dividend, every director of the company shall, if he is knowingly a party to the default, be punishable with imprisonment which may extend to two years and with fine which shall not be less than one thousand rupees for every day during which such default continues and the company shall be liable to pay simple interest at the rate of eighteen percent. per annum during the period for which such default continues.

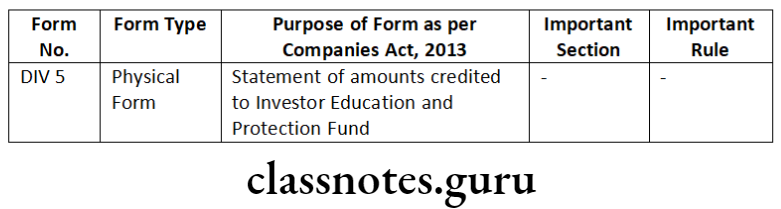

List of Important Forms in Companies Act, 2013

Distribution Of Profits Short Notes

Question 1. Write a note on the following:

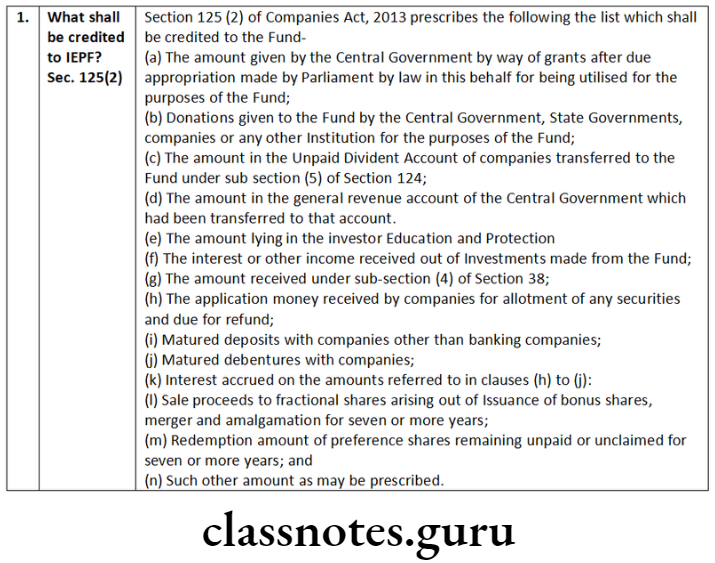

Investor Education and Protection Fund (IEPF) in Companies Act, 2013

Answer:

Question 2. Write a note on the following: Punishment for failure to distribute dividends and exceptions in the Companies Act, 2013

Answer:

Distribution Of Profits Distinguish Between

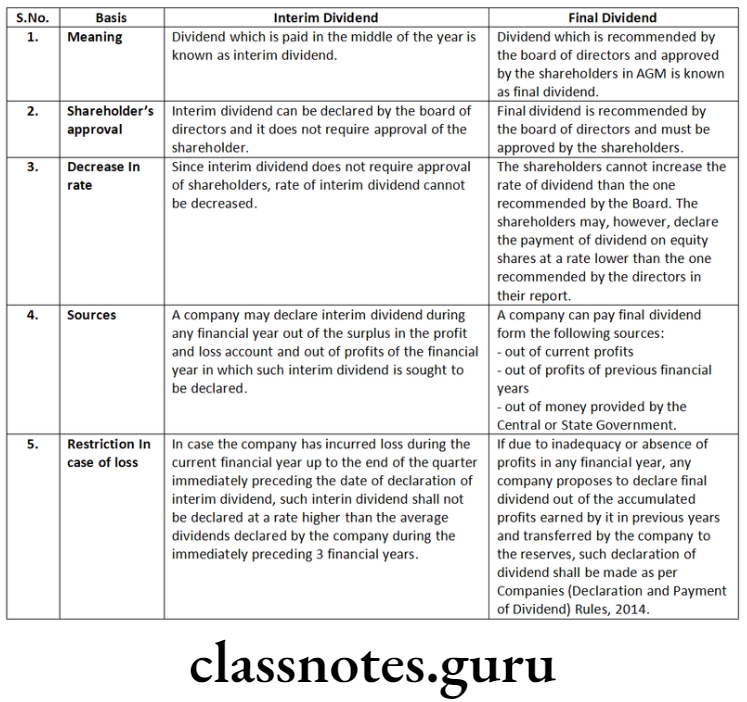

Question 3. Distinguish between the following:

‘Interim dividend’ and ‘final dividend’ in Companies Act, 2013

Answer:

Dividend Distribution Policy In India

Distribution Of Profits Descriptive Questions

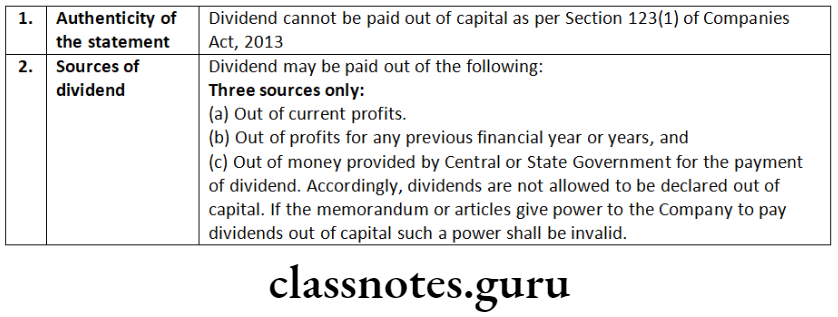

Question 1. Comment on the following:

Dividends can be paid out of capital only if the articles of association of a company authorize such payment.

Answer:

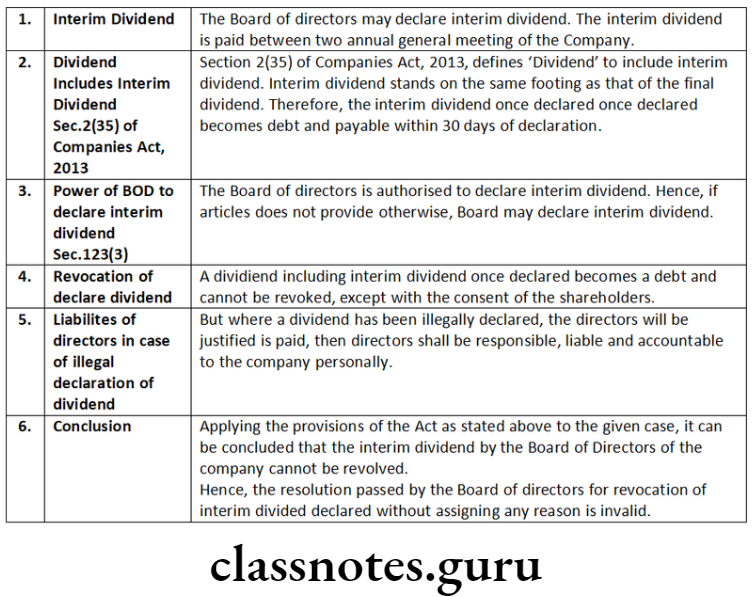

Question 2. The Board of Directors of a company in a meeting held on 30th April 2013 declared an interim dividend. In another meeting held on 18th May 2013, the Board revoked the interim dividend declared without assigning any reason. Advise the company in the matter.

Answer:

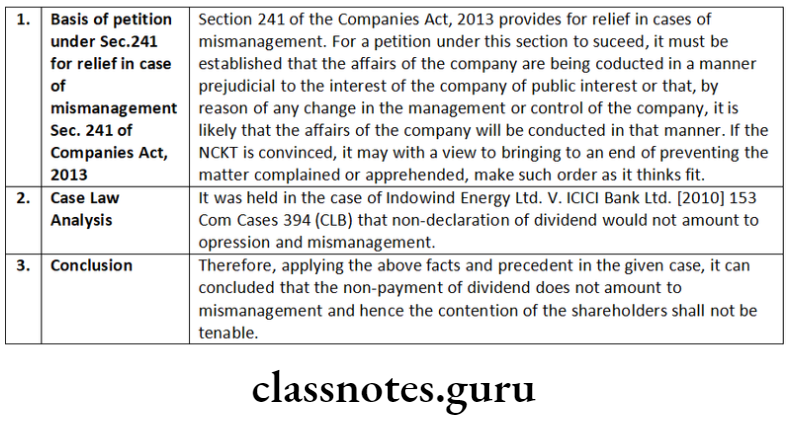

Question 3. Due to the inadequacy of profits, the Board of Directors of Rise Ltd. decided not to recommend any dividend for the financial year ending 31st March 2015.

Certain shareholders of the company complained to the NCLT regarding mismanagement of the affairs of the company, since the Board of the company did not recommend any dividend. Explaining the provisions of the Companies Act, 2013, examine whether the contention of the shareholders is tenable.

Answer:

Question 4. Referring to the provisions of the Companies Act, 2013 advise a public company that declared a dividend on 30th September 2018 as to the procedures to be followed in this regard for payment of dividend. Whether any intervening holidays in October 2018 shall be taken into account in calculating the time limit?

Answer:

- Section 123(4) of the Companies Act, 2013 provides that the amount of the dividend, including interim dividend shall be deposited in a scheduled bank in a separate account within five days from the date of declaration of the dividend.

- However, in the case of a Government Company sub Section 4 of Section 123 shall not apply in which the entire paid-up share capital is held by the Central Government, or by any State Government or Governments by the Central Government and one or more State Governments or by one or more Government Company.

- Inferring from Section 124(1) dividend must be paid to any shareholder entitled to the payment of the dividend, within 30 days from the date of declaration of dividend.

- Secretarial Standard-3(SS-3) hereby clarifies that the Dividend shall be deposited in a separate bank account within five days from the date of declaration and shall be paid within 30 days of declaration. The intervening holidays, if any, falling during ‘such a period shall be included.

- Therefore in the given illustration, the dividend shall be deposited into a separate bank account of a scheduled bank on or before 05.10.2018 and the same must be paid to the registered shareholder or his order or his banker on or before 30.10.2018.

Cs Company Law Profit Distribution Questions

Question 5. Manish, a shareholder of a company has not claimed his dividends from the company for the last 10 years due to different reasons. He wants to know whether he will be able to recover the dividends declared by the company for all these years. Explain to him, the relevant legal provisions.

Answer:

- According to Section 124 of the Companies Act, 2013 dividends must be paid within 30 days from the date of declaration and if any amount remains unpaid or unclaimed then the company is required to transfer the unpaid dividend to a special account, known as Unpaid Dividend Account opened by the company in any scheduled bank within seven days from the date of expiry of thirty days.

- If any money transferred to this account remains unpaid or unclaimed for seven years from the date of transfer to such account it shall be transferred by the company to the Investor Education and Protection Fund established under Section 125 (1) of the Companies Act, 2013 maintained and administered by the Central Government.

- In the present case, the amount of the dividend for the first 3 years must have been transferred to the Investor Education and Protection Fund. The amount for the remaining period must be in the Unpaid Dividend Account of the Company.

- According, to Section 125 of the Companies Act, 2013 read with Rule 7 of the IEPF(Accounting, Audit, Transfer and Refund) Rules, 2016, the person whose amounts have been transferred to Investor Education and Protection Fund, shall be entitled to get a refund out of the fund in respect of such claims by submitting an online application in Form IEPF-5.

- Manish should approach the company for the amount of dividends for the last 7 years.

Question 6. Comment on the following:

Dealing with dividends is the prerogative of the Board of Directors. However, there are certain parameters included in the dividend distribution policy of a company. Answer:

Regulation 43A of the SEBI (LODR) Regulations, 2015 provides for the formulation of policy for dividend distribution which broadly specifies the external and internal factors including parameters that may be considered while declaring dividends and the circumstances under which the shareholders of the company may or may not expect a dividend. The dividend distribution policy shall include the following parameters:

- the circumstances under which the shareholders of the listed entities may or may not expect dividends;

- the financial parameters that shall be considered while declaring dividends;

- internal and external factors that shall be considered for the declaration of dividend;

- policy as to how the retained earnings shall be utilized; and

- parameters that shall be adopted about various classes of shares.

Hence, the top 500 listed entities based on market capitalization (calculated as of March 31 of every financial year) are required to formulate a dividend distribution policy which shall be disclosed in their annual reports and as well as on their websites.

The listed entities other than the top five hundred listed entities based on market capitalization may also disclose their dividend distribution policies voluntarily in their annual reports and on their website.

Distribution Of Profits Practical Questions

Question 1. A company for the financial year 2011-12 declared a dividend on 19th September 2012 but failed to distribute the same within the prescribed period. A case was filed against a director in this regard. The director has contended that he had resigned before the declaration of the dividend. Decide the fate of the director in light of the relevant provisions of the Companies Act, 2013.

Answer:

Question 2. In Evergreen Ltd., the Board of Directors declared an interim dividend but could not distribute the dividend due to objections of the audit committee that the accounts considered by the Board were false; and true financial results were inflated by not incorporating outstanding liabilities and over-valuation of inventories.

A shareholder filed a suit for non-payment of dividends. One of the directors contended that he never attended the Board meeting where the issue relating to the payment of the interim dividend was declared based on false accounts. Discuss the validity of the contention of the director.

Answer:

The contention of the absentee director is correct and he is not liable for the payment of dividends on false accounts declared in a meeting where the director to become liable was absent. The facts of the case are similar to the case law of Nagendra Prabhu v. the Popular Bank ZLR (1961) 1 Ker 340.

Company Profits And Dividends Rules

Question 3. Rise Ltd., a company with diversified interests, has constituted an Investor Education and Protection Fund as required under the provisions of the Companies Act, 2013. The company has so far not deposited any amount to the fund. The President (Finance) has asked you, the Company Secretary, to submit a note on amounts payable to the credit of the fund and the period within which the amount shall be paid. Prepare the said note.

Answer:

Rise Limited

The President (Finance) Date ________

Sir,

Sub: Details on the amount payable to the Investor Education and Protection Fund constituted under the Companies Act, 2013.

According to Section 125(1) of the Companies Act, 2013, the Central Government shall establish a Fund to be called the Investor Education and Protection Fund. Therefore, the company is not required to constitute such a fund.

According to Section 125(2) of the Companies Act, 2013 the following amounts shall be credited to the Fund established by the Government by the company:

- the amount is given by the Central Government by way of grants after due appropriation made by Parliament by law on this behalf for being utilized for the Fund;

- donations given to the Fund by the Central Government, State Governments, Companies, or any other institution for the Fund;

- the amount in the Unpaid Dividend Account of companies transferred to the Fund under sub-section (5) of Section 124;

- the amount lying in the Investor Education and Protection Fund.

- the interest or other income received out of investments made from the Fund;

- the amount received under sub-section (4) of Section 38;

- the application money received by companies for allotment of any securities and due for refund;

- matured deposits with companies other than banking companies;

- matured debentures with companies;

- interest accrued on the amounts referred to in clauses (h) to (i);

- sale proceeds of fractional shares arising out of issuance of bonus shares, merger, and amalgamation for seven or more years;

- redemption amount of preference shares remaining unpaid or unclaimed for seven or more years; and

- such other amount as may be prescribed:

Provided that no such amount referred to in clauses (h) to (j) shall form part of the Fund unless such amount has remained unclaimed and unpaid for seven years from the date it became due for payment.

This is for your information and record, please.

Best Regards

Company Secretary

Question 4. The Board of Directors of AVB Limited wants to declare a dividend. 15 lakhs out of capital profits for the year ended 31st March 2017, without making provisions for depreciation. Referring to the provisions of the Companies Act, 2013, you being the Secretary of the Company advise the board whether it can go ahead with its proposal.

Answer:

- By the provisions of the Companies Act, 2013, as contained in the third proviso to Section 123(1), no dividend shall be declared or paid by a company from its reserves other than free reserves. As per Section 2(43) of the Companies Act, 2013, “free reserves” means such reserves which, as per the latest audited balance sheet of a company, are available for distribution as dividends.

- Further according to Section 123(2), for declaration of dividend by a company as per Section 123(1) (a), depreciation shall be provided by the provisions of Schedule II.

- Therefore, in the given case, AVB Limited can neither declare dividends from capital profit nor it can declare dividends without making provision for depreciation.

Question 5. The Board of Directors of American Express Ltd. declared an interim dividend third time during the financial year 2015-16. After the declaration, the Board of Directors decided to revoke the third interim dividend as they noticed that the company’s financial position did not permit payment of such an interim dividend. The Board of Directors seeks your advice in this matter. Please advise the Board as a company secretary. Would your advice be different in case it was a regular dividend instead of an interim dividend?

Answer:

- The Board of Directors may declare an interim dividend and the amount of the dividend including the interim dividend shall be deposited in a separate bank account within 5 days from the date of declaration of such dividend.

- A dividend when declared becomes debt and a shareholder is entitled to sue for recovery of the same after the expiry of the 30 days prescribed under Section 127.

- Section 2(35) defines ‘Dividend’ to include interim dividend. Therefore, the interim dividend once declared cannot be revoked except with the consent of the shareholders.

- Based on the aforesaid facts, the Board of Directors of American Express Limited cannot revoke the interim dividend and should pay the same.

- No, Regular dividends also cannot be revoked even by the shareholders. It’s a statutory debt against the company once it is declared.

Retained Earnings Vs Distributed Profits

Question 6. The Board of Directors of Peculiar Ltd. proposes to recommend a final dividend of 25 each to all the equity shareholders of the company. The company seeks your opinion on the following:

- The company wants to deposit the dividend amount to a cooperative bank.

- The company is a defaulter in the repayment of deposits and proposes to repay all deposits after the payment of the dividend within 10 days.

- Dividends will be declared out of the capital reserves of the company.

- The company wants to pay such dividends through the cash counter by way of a cash voucher.

Answer:

Peculiar Ltd. has to follow the below procedure for recommending the final dividend:

- Referring to Section 123(4) of the Companies Act, 2013, the amount of the dividend has to be deposited in a scheduled bank. The company should first ensure that said Co-operative bank is a scheduled bank from the list of scheduled banks available on the RBI website, and then it may deposit the dividend amount in the scheduled Co-operative Bank.

- Referring to Section 123(6) of the Companies Act, 2013 a company that fails to comply with the provisions relating to acceptance and repayment of deposits shall not, so long as such failure continues, declare any dividend on its equity shares. Hence Peculiar Ltd. cannot declare dividends till the failure persists.

- Referring to the third proviso to Section 123(1), no dividend shall be declared or paid by a company from its reserves other than free reserves.

Free reserves, as per Section 2(43), means such reserves which, as per the latest audited balance sheet of a company, are available for distribution as dividends: Provided that:- Any amount representing unrealized gains, notional gains, or revaluation of assets, whether shown as a reserve or otherwise, or

- Any change in the carrying amount of an asset or of a liability recognized in equity, including surplus in profit and loss account on measurement of the asset or the liability at fair value, shall not be treated as free reserves;

- Hence dividends cannot be declared out of the capital reserves of the company.

- Referring to Section 123(5) dividends shall not be payable in cash. Hence company’s proposal to pay dividends through the cash counter by way of a cash voucher is not permitted under law.

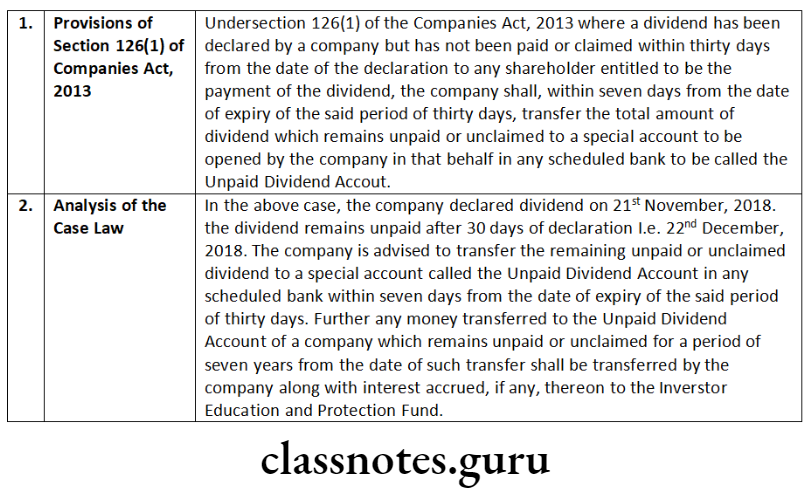

Question 7. A company declared a dividend on 21st November 2018. It reported on 22nd December 2018 that it could not pay dividends to 46 members as they have not been traceable for the last three years. Advise the company about unpaid dividends under the provisions of the Companies Act, 2013.

Answer:

Distribution Of Profits Under Companies Act

Question 8. While adopting accounts for the year, the Board of Directors of Prima Ltd. decided to consider the interim dividend @ 12% as the final dividend and did not consider the transfer of profit to reserves. Explain whether the decisions of the Board were justified by referring to relevant provisions.

Answer:

- Section 123 of the Companies Act, 2013 provides that for the provisions relating to the declaration of dividends.

- Since an interim dividend is also a dividend, companies should provide for depreciation under Section 123 of the Companies Act, 2013. before the declaration of the interim dividend.

- However, the first proviso to Section 123(1) of the Companies Act, 2013 provides that a company may, before the declaration of any dividend in any financial year, transfer such percentage of its profits for that financial year as it considers appropriate to the reserves of the company irrespective of the size of declared dividend i.e. company is not compulsory required to transfer the profit to reserves, and it is only an option made available to the company to transfer such percentage of profit to reserves.

- In the above case, the Board has decided to pay an interim dividend of @12% of the paid-up capital. Assuming the company has complied with the depreciation requirement and other applicable provisions, the interim or final dividend can be declared without transferring such percentage of its profits as it may consider appropriate to the reserve of the company.

- Hence, it may be end that Prima Ltd. is under no contravention of law by not transferring i.e. the company is free to transfer any amount of its profit to the reserves, without any compulsion or restriction before the declaration of any dividend.

- Section 123(3) of the Companies Act, 2013 states that the Board of Directors of a company may declare an interim dividend during any financial year or at any time during the period from the closure of the financial year till the holding of the annual general meeting out of the surplus in the profit and loss account or out of profits of the financial year for which such interim dividend is sought to be declared or out of profits generated in the financial year till the quarter preceding the date of declaration of the interim dividend.

- The amount of dividend including interim dividend should be deposited in a separate bank account within five days from the declaration of such dividend for compliance with Section 123(4) of the Companies Act, 2013.

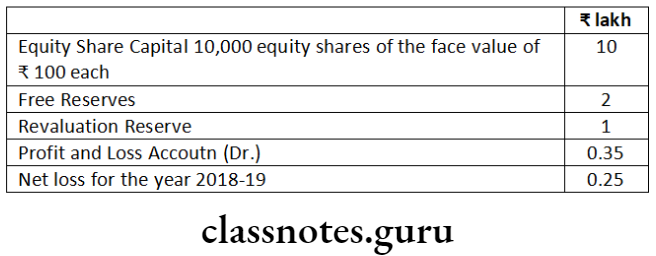

Question 9. The following summarized information is available in respect of a company for the year ended 31st March 2019:

The company has paid dividends to the equity shareholders @ 8%, 10%, and 12% during the immediately preceding three financial years. Advise the Board of Directors on the maximum amount they can pay this year by way of dividends.

Answer:

As per Section 123 (1) of the Companies Act, 2013, a company can distribute dividends out of profits of the current year or from profits of previous financial years.

In the event of inadequacy or absence of profits in any financial year, if the company wants to propose a declaration of dividend, it can pay it out of accumulated profits earned by it in previous years and transferred by the company to the free reserves, according to the conditions prescribed under Rule 3 of the Companies (Declaration and Payment of Dividend) Rules, 2014.

In the above case, the net loss for the year 2018-19 is 25000. According to Rule 3 of the Companies (Declaration and Payment of Dividend) Rules, 2014 the following conditions must be fulfilled:

- The rate of dividend cannot exceed the average of the rates at which the dividend was declared in the three years immediately preceding that year i.e. (8%+10% +12%) / 3 = 10%, so in this case, the amount of dividend should not exceed 1 Lakh.

- The total amount to be drawn from such accumulated profits shall not exceed one-tenth of the sum of its paid-up share capital and free reserves as appearing in the latest audited financial statement. Thus the company can draw only upto 1.2 lakh.

- The balance of reserves after such withdrawal shall not fall below 15% of its paid-up capital as appearing in the latest audited balance sheet. Accordingly, the maximum that may be withdrawn cannot exceed 50000.

- However, the amount so withdrawn must be used to set off losses of the current year i.e. ₹ 25000.

Hence, the maximum amount in this instant case that can be paid by way of dividend is ₹ 25000.

Question 10. Examine the validity of the following:

- XYZ Ltd. wants to declare the dividend out of the current year’s profit without adjusting the previous year’s carry-forward losses and depreciation.

- The Board of Directors of XYZ Ltd. wants to declare an interim dividend after the end of the financial year.

Answer:

Declaration of Dividend:

- Section 123(1) of the Companies Act, 2013 states that the dividend shall be declared or paid by a company for any financial year out of the profits of the company for that year arrived at after providing for depreciation or out of the profits of the company for any previous financial year or years arrived at after providing for depreciation and remaining undistributed, or out of both.

Proviso to this section provides that a company shall not declare dividends unless carried over previous losses and depreciation not provided in the previous year or years are set off against profits of the company for the current year.

Hence, XYZ Ltd has to set off the previous year’s carry-forward loss and depreciation from the current year’s profit before the declaration of the dividend. - As per section 123(3), the board of directors of a company may declare an interim dividend during any financial year or at any time during the period from the closure of the financial year till the holding of the annual general meeting out of surplus in the profit and loss account or out of profits of the financial year for which such interim dividend is sought to be declared or out of profits generated in the financial year till quarter preceding the date of declaration of the interim dividend.

Dividend Distribution Policy In India

Short Notes

Question 1. Write a short note on Punishment for failure to distribute dividends.

Answer:

Section 127 of the Companies Act, 2013 provides that when a dividend has been declared by a company but has not been paid or the warrant in respect thereof has not been posted within thirty days from the date of declaration to any shareholder entitled to the payment of the dividend, every director of the company shall, if he is knowingly a party to the default, be punishable with imprisonment which may extend to two years and with fine which shall not be less than one thousand rupees for every day during which such default continues and the company shall be liable to pay simple interest at the rate of eighteen percent. per annum during the period for which such default continues.

Distribution Of Profits Descriptive Questions

Question 2. State the procedure for the transfer of unpaid or unclaimed dividends to the Investor Education and Protection Fund.

Answer:

Any money transferred to the Unpaid Dividend Account of a company in pursuance of Section 124 which remains unpaid or unclaimed for seven years from the date of such transfer shall be transferred by the company along with interest accrued if any, thereon to the Investor Education and Protection Fund and the company shall send a statement in the prescribed form of the details of such transfer to the Investor Education and Protection Fund Authority and it shall issue a receipt to the company as evidence of such transfer.

- Every company shall within ninety days after holding the Annual General Meeting or the date on which it should have been held as per the provisions of section 96 of the Act and every year thereafter till completion of the seven years, identify the unclaimed dividend, as on the date of holding of Annual General Meeting or the date on which it should have been held as per the provisions of section 96 of the Act, separately furnish and upload on its website and also on website of Authority or any other website as may be specified by the Government, a statement or information through Form No. IEPF-2, separately for each year, contains the following information, namely:

- the names and last known addresses of the persons entitled to receive the sum;

- the nature of the amount;

- the amount to which each person is entitled;

- the due date for transfer into the Invest or Education and Protection Fund; and

- such other information as may be considered relevant for the purposes.

- The amount of unclaimed or unpaid dividend required to be credited by the companies to the Fund shall be remitted into the specified branches of Punjab National Bank, which is the accredited Bank of the Pay and Accounts Office, Ministry of Corporate Affairs, and other authorized banks engaged by the MCA-21 system, within thirty days of such amounts becoming due to be credited to the Fund.

- The amount shall be tendered by the companies along with challan (in triplicate) to the specified Bank Branches of Punjab National Bank and other authorized banks under the MCA-21 system who will return two copies of the challan, duly stamped in token of having received the amount, to the Company. The third copy of the challan will be forwarded along with the daily credit scroll by the receiving branch to its Focal Point Branch of the Bank for onward transmission to the Pay and Accounts Office, Ministry of Corporate Affairs.

- Every company shall file with the concerned Authority one copy of the challan referred to in point (3) indicating the deposit of the amount to the Fund and shall fill in the full particulars of the amount tendered, including the head of the account to which it has been credited.

- The company shall, along with the copy of the challan as required under point(4), furnish a Statement in Form No. IEPF 1 contains details of such transfer to the Authority within thirty days of submission of challan.

- The amount may also be remitted by Electronic Fund Transfer in such manner, as may be specified by the Central Government.

- On receipt of the statement, the Authority shall enter the details of such receipt in a Register maintained physically or electronically by it in respect of each company every year, and reconcile the amount so remitted and collected, with the concerned designated bank every month.

- Each designated bank shall furnish an abstract of such receipts during the month to the Authority within seven days after the close of every month.

- The company shall maintain a record consisting of the name, last known address, amount, folio number or client ID, certificate number, beneficiary details, etc. of the persons in respect of whom unpaid or unclaimed amount has remained unpaid or unclaimed for seven years and has been transferred to the Fund and the Authority shall have the powers to inspect such records. Space to write important points for revision

Company Profits And Dividends Rules

Question 3. Enumerate the procedure for declaration of dividend out of Reserve.

Answer:

- Give notice to all the directors of the company for holding a Board meeting. In the meeting, decide to declare dividends out of the company’s reserves because of inadequacy or absence of profits and also fix the date, time, and place of the Annual General Meeting. Authorize the Company Secretary or any competent person if the company does not have a company secretary to issue the notice of the AGM on behalf of the Board of Directors of the company to all the members, directors, and auditors of the company and other persons entitled to receive the same.

- Ensure that the Companies (Declaration and Payment of Dividend), Rules, 2014 are complied with.

- While calculating the profits of the previous years, take only the net profit after tax.

- Ensure that while computing the amount of profits, the amount transferred from the Development Rebate Reserve is included and all items of capital reserves including reserves created by revaluation of assets are excluded.

- In the case of listed companies, inform the Stock Exchange with which the shares of the company are listed within 30 minutes of the closure of the Board meeting about the decision to recommend the declaration of dividend out of the Company’s Reserves. [Regulation 30 of SEBI (LODR) Regulations, 2015].

- Issue notices in writing at least 21 days before the date of the Annual General Meeting hold the meeting and pass the necessary resolution.

- In the case of listed companies, forward copies of the notice and a copy of the proceeding of the general meeting to the Stock Exchange.

- Open a separate bank account for making dividend payments and credit. the said bank account with the total amount of dividend payable within five days of declaration of dividend.

- Issue dividend warrants within 30 days from the date of declaration of dividend. The rest of the procedural steps are the same as in the case of payment of the final dividend.