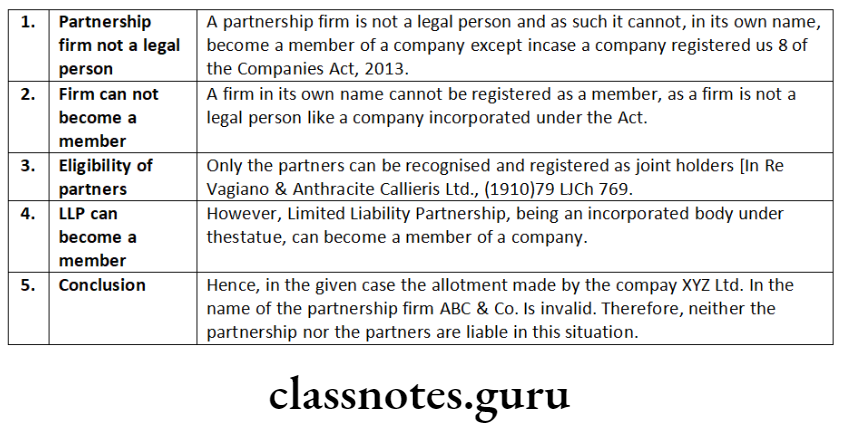

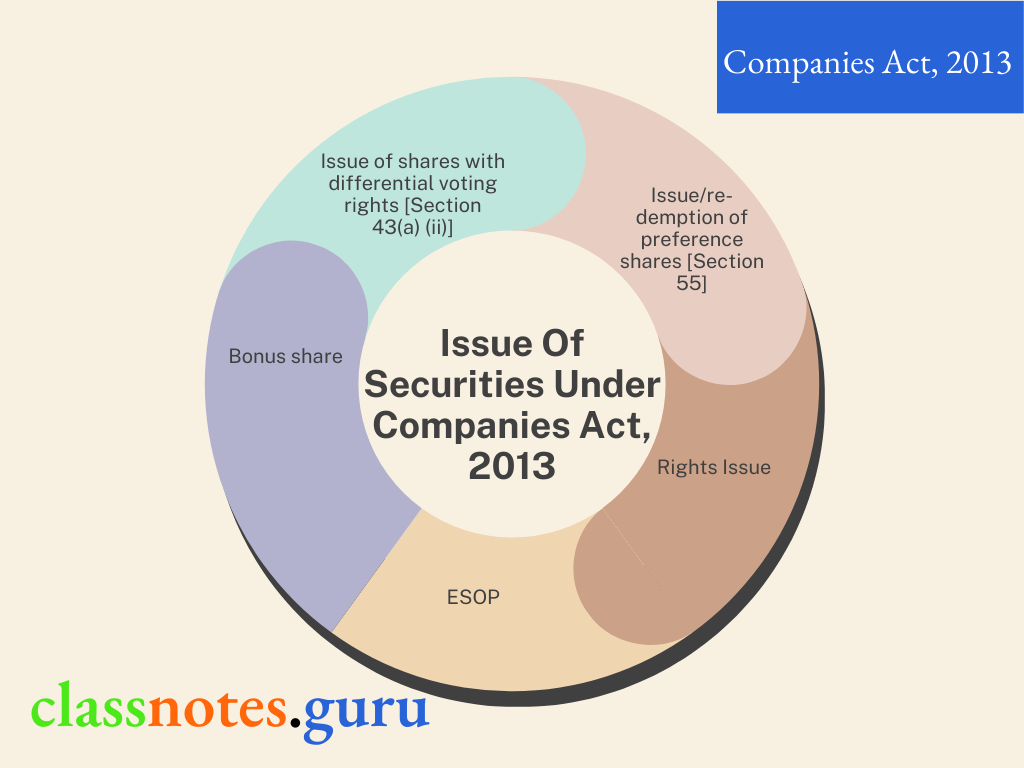

Issue Of Securities

Issue of shares with differential voting rights [Section 43(a) (ii)]

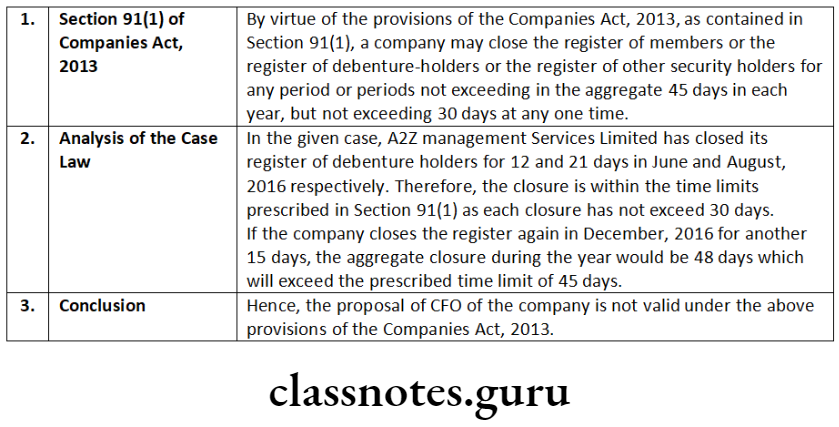

- Articles to authorise the issue.

- Ordinary resolution to be passed and if shares are listed then approval through postal ballot.

- The voting power in respect of shares with differential rights of the company shall not exceed seventy four per cent of total voting power including voting power in respect of equity shares with differential rights issued at any point of time.

- The company not to be penalised under specified legislature in last 3 years.

- No default in filing financial statements in the last 3 years.

- No default in payment of dividend.

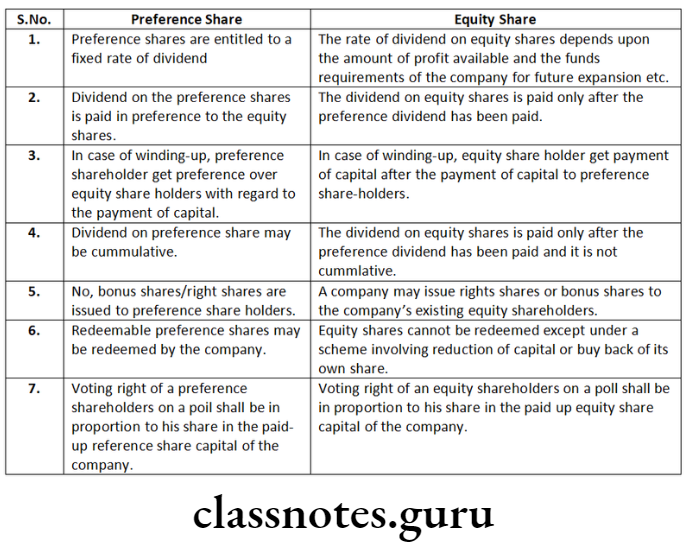

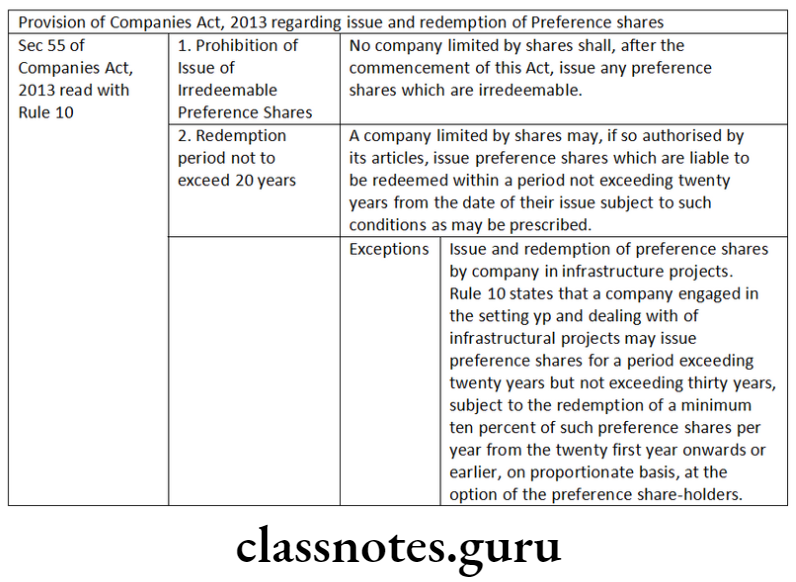

Issue/re-demption of preference shares [Section 55]

- Issue to be authorised by special resolution.

- Explanatory statement to be annexed to the notice of general meeting containing the relevant material facts.

- No company shall issue irredeemable preference shares of redeemable preference shares with the redemption period beyond 20 years.

- Infrastructural companies may issue preference shares for a period exceeding 20 years but not exceeding 30 years.

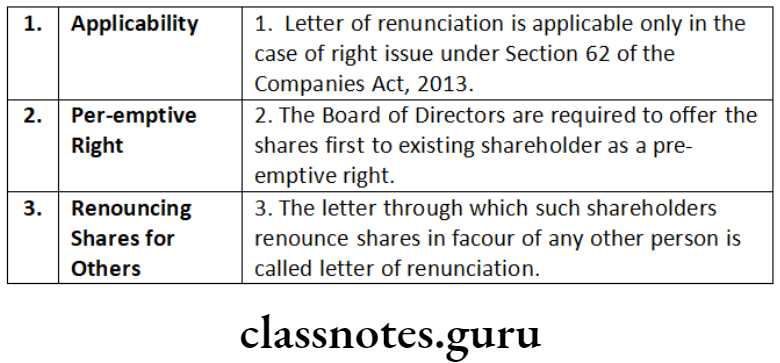

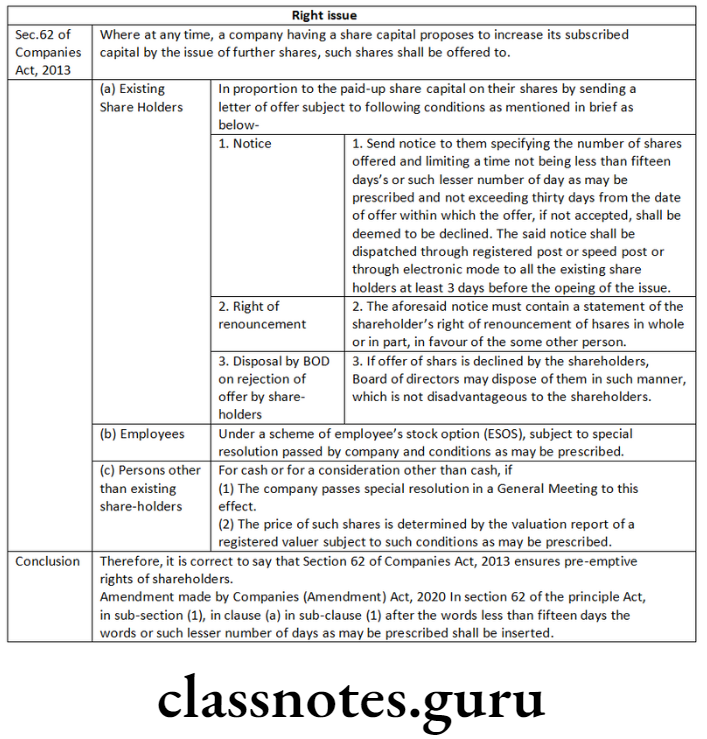

Rights Issue

Rights issue is an issue of capital to be offered to the existing shareholders of the company through a letter of offer.

- Listed companies to inform concerned stock exchanges.

- Company to give notice to equity shareholder giving him 15-30 days to decide.

- Company can issue shares to other than existing share holder for cash or other than cash if a special resolution is obtained.

- Price to be determined by the registered valuer’s report.

- The provisions of Section 62 are applicable to all type of companies.

ESOP

- Pass special resolution.

- Disclosures to be made in explanatory statement.

- Free pricing in conformity with accounting policies.

- Separate resolution to be obtained for granting options to employees of holding/subsidiaries.

- Minimum 1 year period between grant of options and vesting of option.

- Company is free to set lock-in period.

- Option granted shall not be transferable, pledged, hypothecated, mortgaged in any manner.

- Disclosures to be made in board report.

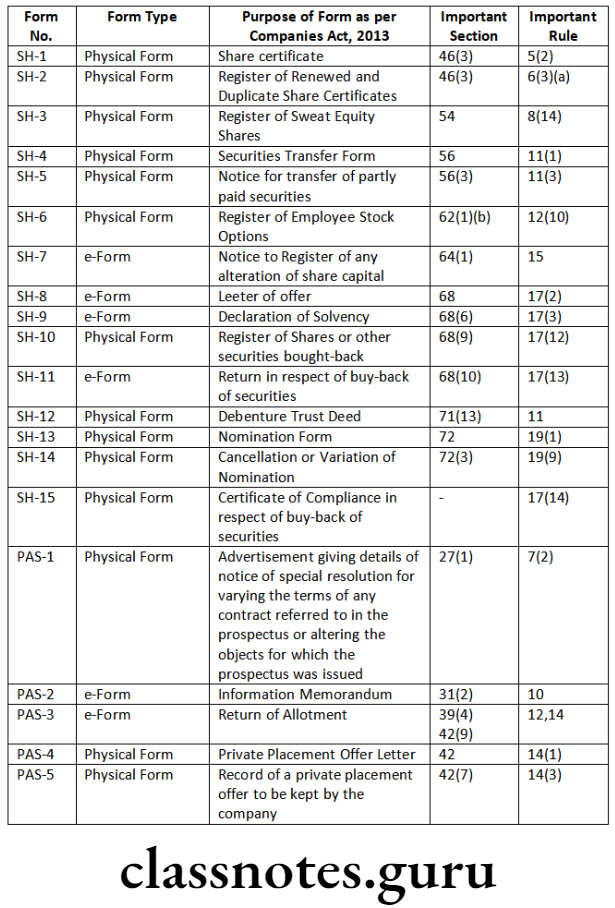

- Register to be maintained in form SH-6.

- Listed companies to comply with SEBI guidelines.

Preferential Issue Rule 13 of the Companies (Share Capital and Debentures) Rules, 2014

- Pass special resolution.

- Listed company shall follow SEBI regulations. Issue to be authorised by the articles.

- Securities to be made fully paid-up on allotment.

- Disclosures to be made in explanatory statement to be annexed to the notice of general meeting.

- Allotment to get completed within 12 months if not completed a fresh resolution is required.

- Price determination by the registered valuer’s report.

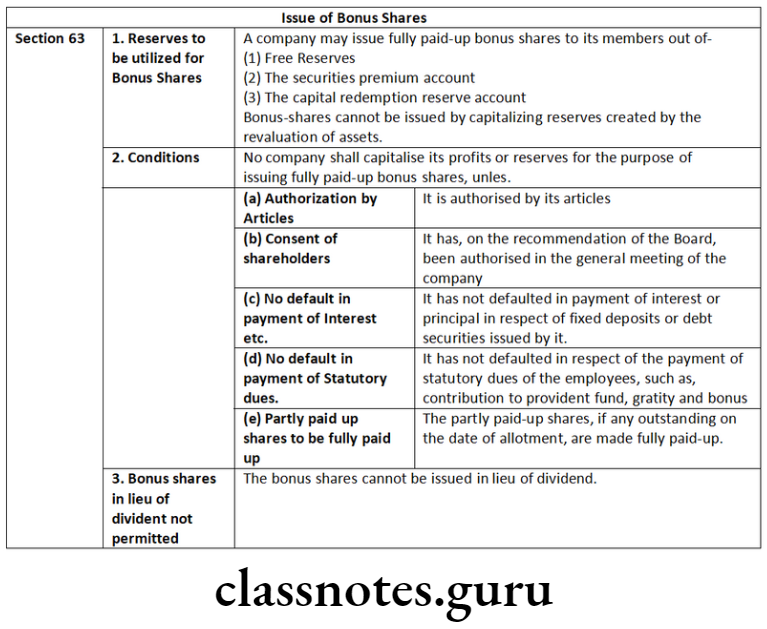

Bonus share

When a company is prosperous and accumulates large distributable profits, it converts these accumulated profits into capital and divides the capital among the existing members in proportion to their entitlements. Members do not have to pay any amount for such shares. A company may, if its Articles provide, capitalize its profits by issuing fully-paid bonus shares.

- Authorised by articles.

- Authorised on recommendation of the board in general meeting.

- No default in payment of interest or principle in respect of debt securities and fixed deposits and in respect of payment to employees.

- Partly paid up shares to be made fully paid up on allotment.

- Listed companies to follow SEBI regulations.

- Once announced by the board about bonus issue no company shall withdraw the same.

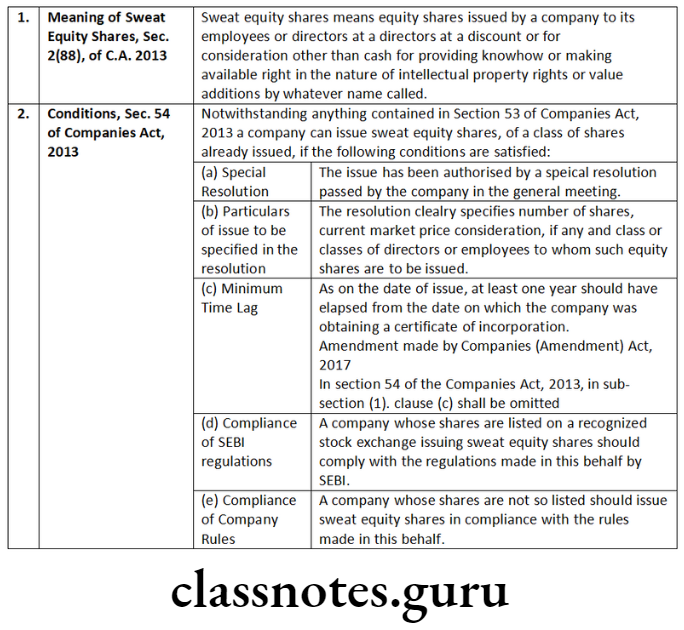

Sweat equity shares

Means equity shares issued by a company to its employees or directors at a discount or for consideration, other than cash for providing know-how or making available rights in the nature of intellectual property rights or value additions, by whatever name called.

- Issue of sweat equity shares to be authorized by special resolution at a general meeting.

- The special resolution authorizing sweat equity shares is not valid if the allotment is made after 12 months of passing the resolution. i.e., the validity of special resolution is 12 months.

- The price of sweat equity shares is to be determined by a registered valuer.

- The company shall maintain a Register of Sweat Equity Shares in Form No. SH 3.

- Issue of sweat equity shares to employees and directors at a discount under Section 54 is outside the scope of Section 53.

Companies (Share Capital and Debentures) Second Amendment Rules, 2018

For the purpose of rules relating to issuance of Sweat equity shares the definition of Employee has been modified through this amendment. Current definition is as under:

“Employee” means-

- a permanent employee of the company who has been working in India or outside India; or

- a director of the company, whether a whole time director or not; or

- an employee or a director as defined in sub-clauses (a) or (b) above of a subsidiary, in India or outside India, or of a holding company of the company;

Issue Of Securities Companies Act 2013

Issue Of Securities Short Notes

Write a note on the following:

Issue of sweat equity shares.

Answer:

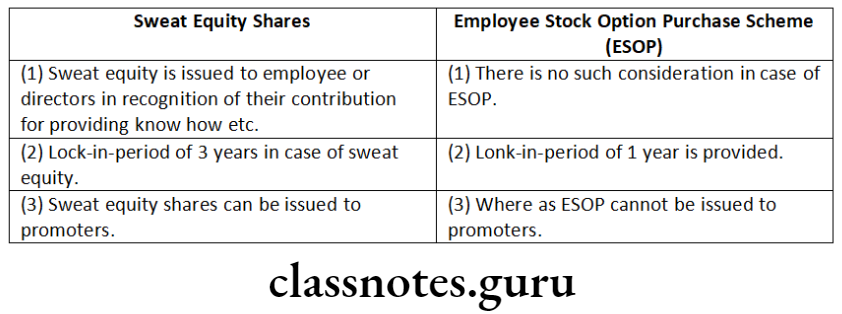

Issue Of Securities Distinguish Between

Distinguish between the following:

‘ESOP’ and ‘sweat equity shares’.

Answer:

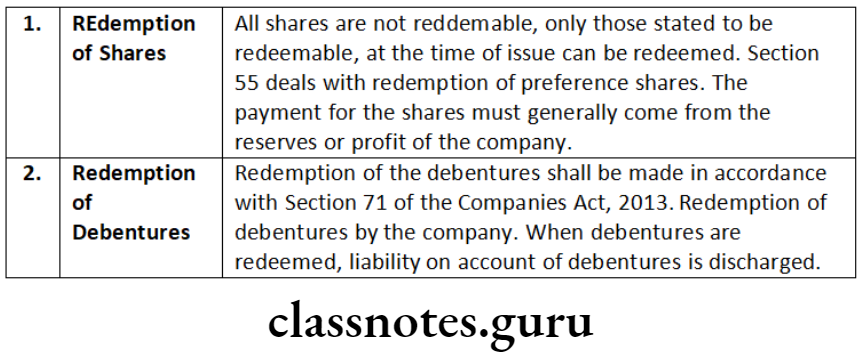

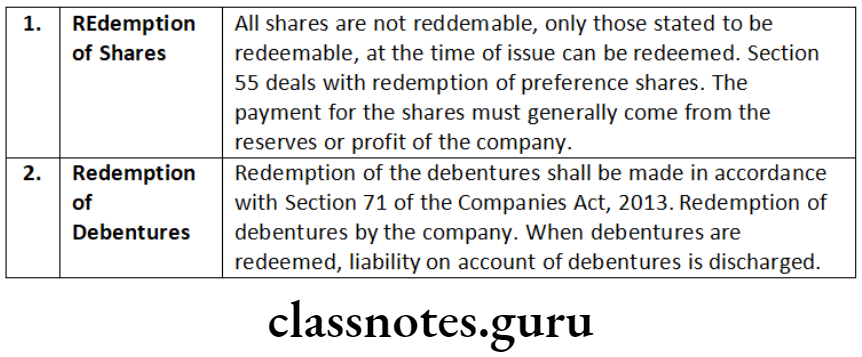

Distinguish between the following:

Redemption of shares and Redemption of debentures.

Answer:

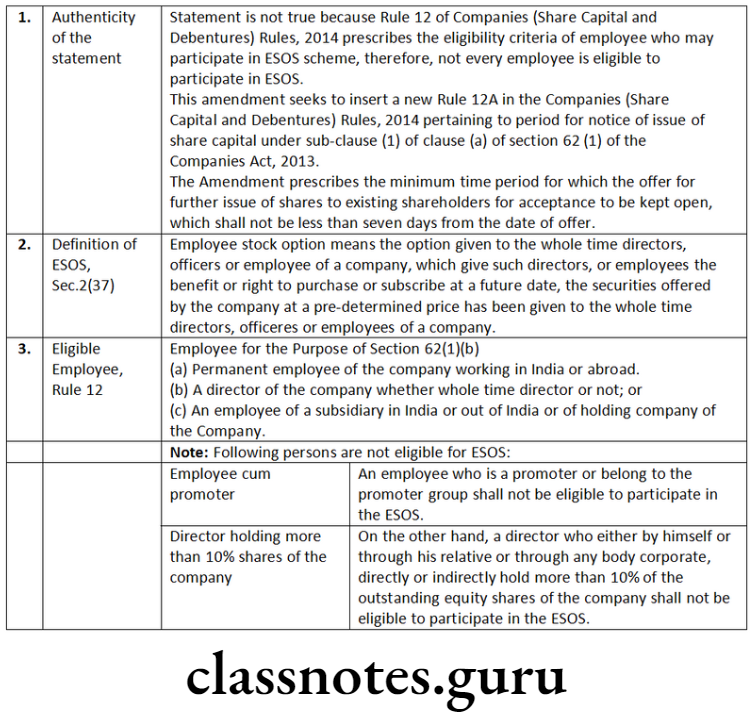

Issue Of Securities Descriptive Questions

Comment on the following:

Every employee of a company shall be eligible to participate in Employee Stock Option Scheme (ESOS).

Answer:

Whether equity shares already issued can be converted into redeemable preference shares? Discuss.

Answer:

Section 62 of Companies Act, 2013 ensures pre- emptive rights of shareholders. Discuss.

Answer:

Comment on the following:

In no circumstances a company can issue redeemable preference shares with a redemption period beyond 20 years.

Answer:

Referring to the provisions of the Companies Act, 2013, state the conditions required to be fulfilled before a company can issue bonus shares to shareholders of the company.

Answer:

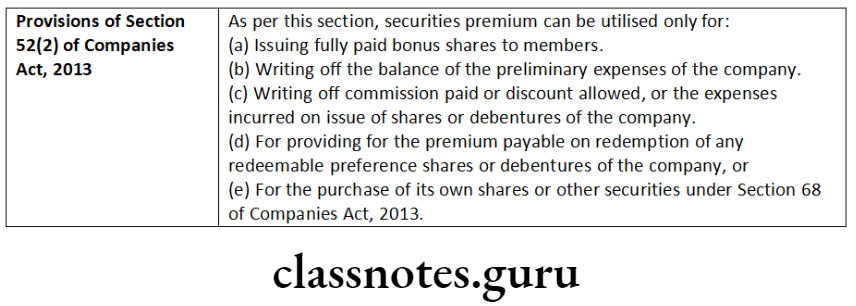

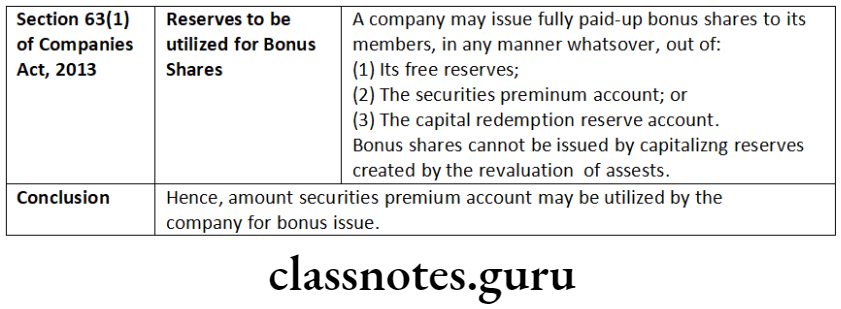

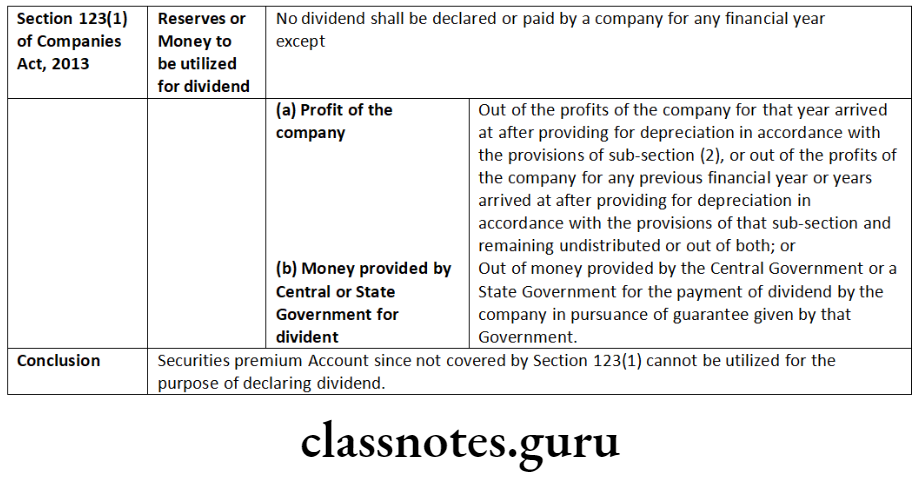

In view of the provisions of the Companies Act, 2013 relating to ‘securities premium’, state whether the amount lying in securities premium account of a company can be used:

For issuance of bonus shares; and

For payment of dividend declared by the company at its general meeting.

Answer:

Companies Act 2013 Securities Issue Process

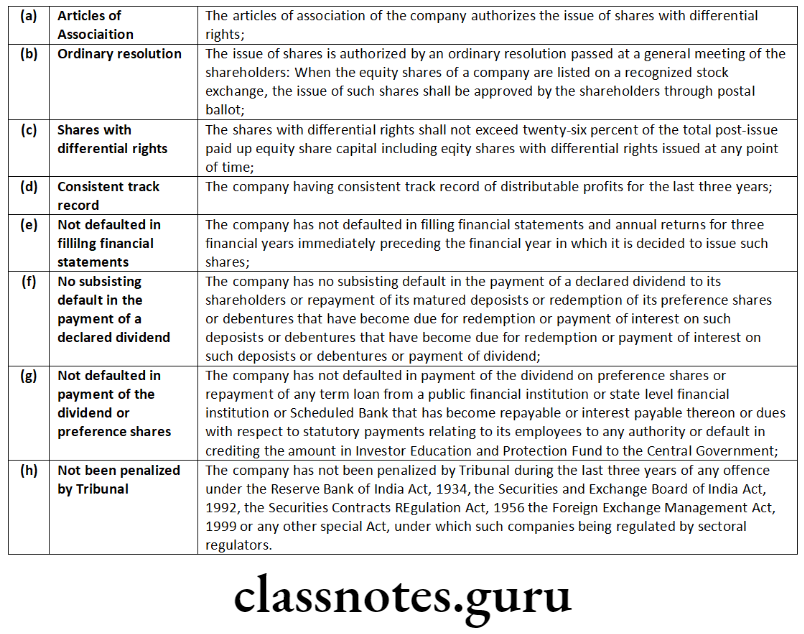

Board of directors of Progressive Ltd. decides to issue equity shares of the company with differential voting rights. Examining the provisions of the Companies Act, 2013, state the conditions to be complied with by the company in this regard.

Answer:

Section 43 enables companies to issue a variety of equity shares with differential rights etc. Rule 4 of Companies (Share Capital and Debentures) Rules, 2014 states the following conditions regarding shares with differential voting rights.

As a Practicing Company Secretary, advise your client company regarding the matters relating to issue of shares with differential rights, to be included in the Board of Directors Report.

Answer:

Pursuant to Rule (4) sub-rule (4) of the Companies (Share Capital and Debentures) Rules, 2014, the Board of Directors shall inter alia, disclosure in the Board Report for the financial year in which the issue of equity shares with differential Rights was completed, the following details, namely:

- total number of shares allotted with differential rights,

- details of the differential rights relating to voting rights and dividend,

- the percentage of the shares with differential rights to the total post issue equity share capital with differential rights issued at any point of time,

- the price at which such shares shall be issued,

- the particulars of promoter, directors, or KMP to whom such shares are issued,

- the change in control, if any in company,

- the diluted EPS pursuant to issue of each class of shares.

- the pre and post issue shareholding pattern.

The Board of Directors of the company are accordingly advised to make disclosures in their report-Director’s Responsibility Statement. – Space to write important points for revision-

Issue Of Securities Practical Questions

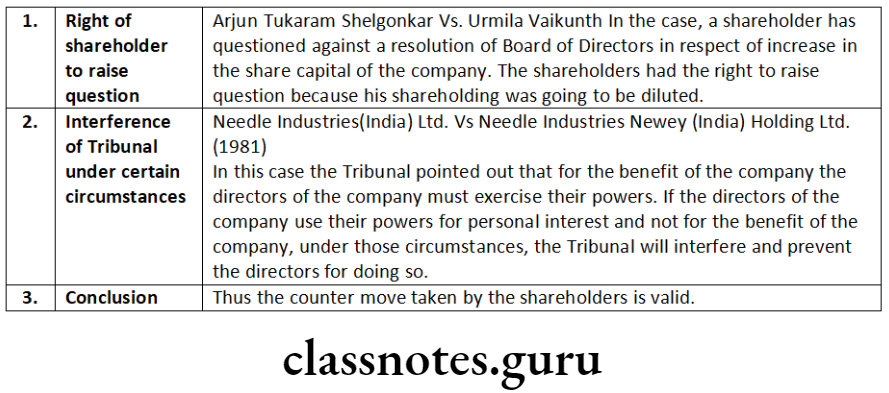

The Board of directors of Nav Avtar Ltd. passed a resolution for issue of rights shares. However, certain shareholders of the company raised an objection as to whether the company needed additional capital. Discuss the validity of the counter-move taken by the shareholders and resolution passed by the Board.

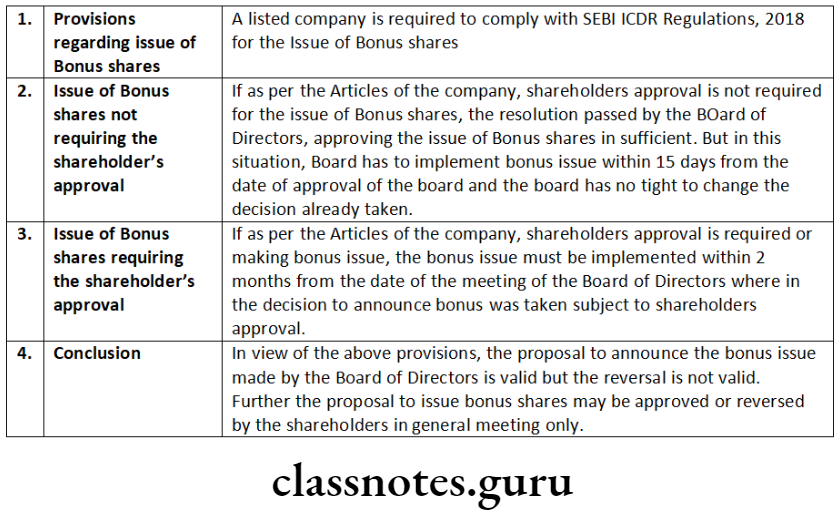

The Board of directors of Aakash Ltd., a listed company, at its meeting held on 1st April, 2011 announced a proposal for issue of bonus shares to all equity shareholders of the company at 1:1 ratio. On 1st May, 2011, the directors at another meeting passed a resolution to reverse the proposal of bonus issue announced on 1st April, 2011. Discuss the validity of the proposal and the reversal.

Answer:

During the financial year 2016-17, the Board of Directors of CARE Automation Services Limited has issued shares to employees under Employees Stock Option Scheme. Ms. Excellent has recently joined the Board of the company and asks you, the Secretary of the company, as to what details are to be disclosed in the Board’s Report for the year ending 31st March, 2017 in this regard. Advise her.

Answer:

Pursuant to Rule 12(9) of the Companies (Share Capital and Debentures)

Rules, 2014 the Board shall disclose following details of ESUP→

- options granted;

- options vested;

- total no. of shares arising as a result of exercise a options;

- options lapsed;

- the exercise price;

- variation of times of offer;

- money realised by exercise of options;

- total options in force;

- employee wise detail enforced regarding ESOS grant to KMP.

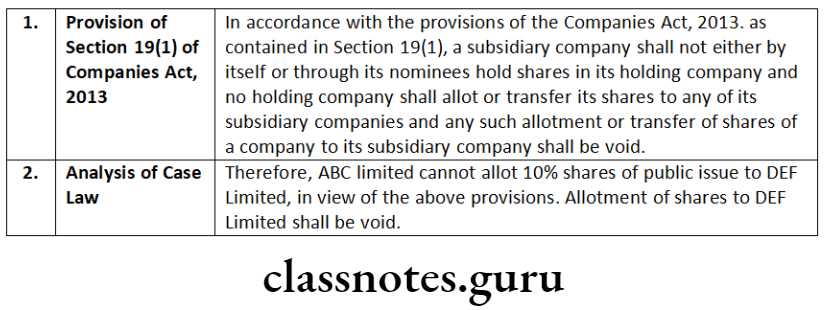

ABC Ltd. holds 75% equity share capital of DEF Ltd. and controls composition of Board of Directors of DEF Ltd. ABC Ltd. goes for public issue for raising further share capital. Board of Directors of ABC Ltd. allót 10% of the issue to DEF Ltd. Referring to the provisions of the Companies Act, 2013 examine the validity of Board’s decision to allot 10% – of issue to DEF Ltd. DEF Ltd. holds certain number of shares as a legal representative of a deceased member of ABC Ltd. and has a right to vote at a general meeting of ABC Ltd. in respect of such shareholdering, will this right be affected by issue of 10% to DEF Ltd. by ABC Ltd.?

Answer:

Note

Further, in the following circumstances, where a subsidiary can hold the shares of its holding company:

- Where the subsidiary company holds such shares as the legal representative of a deceased member of the holding company; or

- Where the subsidiary company holds such shares as a trustee; or

- Where the subsidiary company is a shareholder even before it became a subsidiary company of its holding company.

The subsidiary company, however, as referred above shall have a right to vote at a meeting of the holding company only in respect of the shares held by it as a legal representative or as a trustee.

Private Placement Vs Public Issue

Green Commercial Ltd., an unlisted company, has made a preferential offer of shares for consideration other than cash. A question has been raised by the accounts department as to the valuation of consideration at allotment and the manner of treatment of non-cash consideration in books of account. As a practising company secretary advise the company with reference to the provisions of the Companies Act, 2013.

Answer:

Under Section 62 read with Rule 13(2) of the Companies (Share Capital and Debentures) Rules 2014, where shares or other securities are to be allotted for consideration other than cash, the valuation of such consideration shall be done by a registered valuer who shall submit a valuation report to the company for justification of valuation.

Where the preferential offer of shares is made for a non-cash consideration, such non-cash consideration shall be treated in the following manner in the books of account of the company-

- where the non-cash consideration takes the form of a depreciable or amortizable asset, it shall be carried to the balance sheet of the company in accordance with the accounting standards; or

- where above clause is not applicable, it shall be expensed as provided in the accounting standards.

The Practicing Company Secretary (PCS) can advised the Green Commercial Ltd. accordingly.

The share capital of Raney Ltd. is 30 crore. ‘Russel’ is appointed as the managing director of the company, the company wants to compensate him by issue of shares for supplying technical know-how without any cost. In this context, answer the following:

- Whether the company is allowed to allot such shares?

- Is approval of shareholders required for issuing such shares?

- If found eligible to allot such shares, what will be the quantum (value) of shares that can be allotted?

- Can Russel sell such allotted shares in the market?

- Will the amount that he receives on sale of his shares be considered a part of his remuneration?

Answer:

- Yes, Section 54 of the Companies Act, 2013 permits issue of sweat equity shares to employees or directors in recognition of their contribution for providing know how etc. as mentioned earlier. As the contribution made by employees/directors results in increased profits to the company for a number of years, sweat equity shares provide a new form of adequate return.

- Yes, Rule 8(1) of the Companies (Share capital and Debentures) Rules, 2014 provides that the special resolution shall be passed authorizing the issue of sweat equity shares and shall be valid for making the allotment within a period of not more than twelve months from the date of passing of the special resolution.

- Rule 8(4) of the Companies (Share capital and Debentures) Rules, 2014 provides that the company shall not issue sweat equity shares for more than fifteen percent of the existing paid up equity share capital in a year or shares of the issue value of rupees five crores, whichever is higher, The issuance of sweat equity shares in the company shall not exceed 25%, of the paid up equity capital of the company at any time.

- As the paid-up capital of the company is 30 crores. Hence he can be allotted with 15% of existing equity i.e. (15% of 30 crores up to € 4.5 Crores) value of shares or 5 crores whichever is higher.

- Rule 8(5) of the Companies (Share capital and Debentures) Rules, 2014 says that the sweat equity shares issued to directors or employees shall be locked/non transferrable for a period of three years from the date of allotment and the fact that the share certificates are under lock-in and the period of expiry of lock-in shall be stamped in bold or mentioned in any other prominent manner on the share certificate.

- Yes, Rule 8(10) of the Companies (Share capital and Debentures) Rules, 2014 provides that the amount of sweat equity shares issued shall be treated as part of managerial remuneration for the purposes of Sections 197 and 198 of the Act, if the following conditions are fulfilled namely-

- The sweat equity shares are issued to any director or manager; and

- They are issued for consideration other than cash, which does not take the form of an asset which can be carried to the balance sheet of the company in accordance with the applicable accounting standards.

The Board of Directors of Aakash Ltd., a listed company, in its meeting held on 1st April, 2021 announced a proposal for issue of bonus shares to all equity shareholders of the company in the ratio of 1: 1. On 1st May 2021, the directors at another meeting passed a resolution to reverse the proposal of bonus issue announced on 1st April, 2021. Discuss the validity of the resolutions.

Answer.

A listed company is need to comply with the requirements of the Companies Act, 2013, rules made thereunder and SEBI (ICDR) Regulations, 2018 for issue of bonus shares.

As per section 63(2) of the Companies Act, 2013, no company shall capitalise its profits or reserves for the purpose of issuing fully paid-up bonus shares, unless it has, on the recommendation of the Board of Director been authorised in the general meeting of the company.

Further, as per Rule 14 of the Companies (Share capital and Debentures) Rules, 2014, a company which has once announced the decision of its Board recommending a bonus issue, shall not subsequently withdraw the same.

Also, the SEBI (ICDR) Regulations, 2018 provides that a bonus issue, once announced, shall not be withdrawn.

In view of the above case, the BOD of Aakash Limited once announced the issue of bonus share on 1st April 2021 to all equity shareholders of the company in the ratio of 1:1 cannot subsequently reverse the proposal of such issue in another board meeting. Therefore, the first board resolution proposing the bonus share is valid but second board resolution for reversal ‘is not valid.

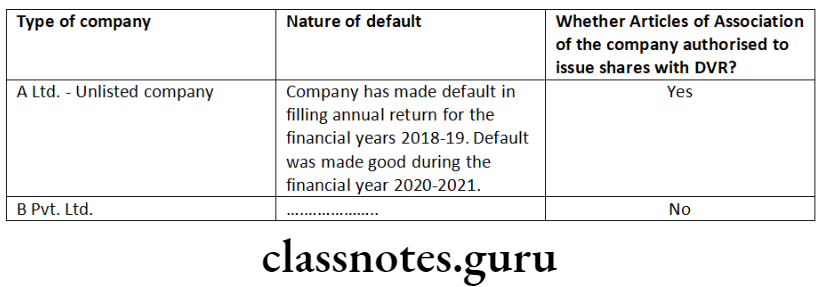

Which of the following companies is eligible to issue shares with Differential Voting Rights (DVRs) during the financial year 2022-23?

Issue Of Securities Short Notes

Question 1. Write short note on preferential offer.

Answer:

The expression ‘Preferential Offer’ means an issue of shares or other securities, by a company to any select person or group of persons on a preferential basis and does not include shares or other securities offered through a public issue, rights issue, employee stock option scheme, employee stock purchase scheme or an issue of sweat equity shares or bonus shares or depository receipts issued in a country outside India or foreign securities.

Issue Of Securities Descriptive Questions

Question 2. Describe the Procedure for Issue of Equity Shares with Differential Voting Rights.

Answer:

Procedure for Issue of Equity Shares with Differential Voting Rights

- Check whether the Articles of Association of the company authorizes issue of equity shares with differential rights and if not, the name and the Articles of Association of the company.

- Hold the Board meeting to issue the notice of general meeting fo issuance of equity share with differential rights.

- Before issuing equity shares with differential rights as to dividend, voting or otherwise, ensure that the conditions of issue are fully satisfied.

- If the company is listed with any of the recognized stock exchange, then within 15 minutes of the closure of the aforesaid Board Meeting intimate to the concerned Stock Exchange about the decision taken at the Board Meeting.

- Pass the ordinary resolution in the general meeting or through Postal Ballot under Section 110 of the Act.

- Once the company makes any allotment, then it shall, within 30 days thereafter, file with the Registrar a return allotment in Form PAS-3, along with the fees as specified in the Companies (Registration Offices and Fees) Rules, 2014.

- The company shall not convert its existing equity share capital with voting rights into equity share capital carrying differential voting rights and vice versa.

- In case of listed company, send copies of the notice and a copy of the proceedings of the general meeting to the stock exchange within 24 hours of the occurrence of event. [Regulation 30 (6) of SEBI (Listing Obligations and Disclosure Requirements), 2015].

- Complete all other proceedings for the issue of certificate of shares with differential voting rights making necessary entries in various registers. In case of a company whose shares are dematerialized form, inform the depositories about the same for credit to the respective accounts.

- Intimate the details of allotment of shares to the Depository immediately on allotment of such shares.

- Maintain the Register of Members under Section 88 containing all the relevant particulars of the shares so issued along with details of the shareholders.

Sebi Guidelines For Issue Of Securities

Question 3. Describe the Procedure for issue of shares on Preferential basis.

Answer:

Procedure for issue of shares on Preferential basis

- Check whether the issue is authorize by Articles. If not make necessary amendments to alter the articles of association, through special resolution passed at the shareholders’ meeting.

- Convene a Board Meeting to approve the notice of General Meeting and necessary special Resolution/s along with explanatory statements as required.

- It is to be noted that preferential issue of share are required to comply with Section 42 also which relates to private placement. However, in case of preferential offer to one or more existing members the aspects relating to letter offer as stated in Rule14(1) and proviso to Rule1 4(3) of Companies (Prospectus and Allotment of Securities) Rules, 2014 shall not apply.

- The company shall ensure that all the disclosures in the explanatory statement are annexed to the notice of the general meeting pursuant to Section102 of the Act.

- Convene General Meeting and pass necessary Special Resolution/s.

- Ensure to file Form MGT-14 with Registrar of Companies with in 30 days of passing the Resolution.

- the allotment of securities on a preferential basis made pursuant to the special resolution passed shall be completed with in a period of 12 months from the date of passing of the special resolution. If the allotment of securities is not completed within 12 months from the date of passing of the special resolution, another special resolution shall be passed for the company to complete such allotment thereafter.

- the price of the shares or other securities to be issued on a preferential basis, either for cash or for consideration other than cash, shall be determined on the basis of valuation report of a registered valuer; and when convertible securities are offered on a preferential basis with an option to apply for and get equity shares allotted, the price of the resultant shares pursuant to conversion shall be determined:

- either up front at the time when the offer of convertible securities is made on the basis of valuation report of the registered valuer given at the stage of such offer, or

- at the time, which shall not be earlier than thirty days to the date when the holder of convertible security becomes entitled to apply for shares, on the basis of valuation report of the registered valuer given not earlier than sixty days of the date when the holder of convertible security becomes entitled to apply for shares.

The company shall take a decision on the above clause (i) and (ii) at the time of offer of convertible security itself and make such disclosure in the explanatory statement to be annexed to the notice.

- Where shares or other securities are to be allotted for consideration other than cash, the valuation of such consideration shall be done by a registered valuer who shall submit a valuation report to the company giving justification for the valuation;

- Where the preferential offer of shares is made for a non-cash consideration, such non-cash consideration shall be treated in the following manner in the books of account of the company-

- Where the non-cash consideration takes the form of a depreciable or amortizable asset, it shall be carried to the balance sheet of the company in accordance with the accounting standards; or

- Where clause (i) is not applicable, it shall be expensed as provided in the accounting standards.

- Once the allotment is made, the company shall within 30 days of allotment, file with the Registrar a return of allotment in Form PAS.3, along with the fee as specified in Companies (Registration of Offices and Fees) Rules, 2014.

- Deliver the share certificates of allotted shares within a period of 2 months from the date of allotment.

- Intimate the details of allotment of shares to the Depository immediately on allotment of such shares

Question 4. Describe the procedure for issue of bonus shares.

Answer:

- Check whether the Article of Association authorizes issue of bonus share. If not, the name and the Articles of Association of the company by passing the Special Resolution.

- Check whether the Bonus issue results in increase of authorized capital. If so, make necessary alterations in the Memorandum/Articles of Association by passing special Resolution.

- In the case of listed entity, give prior intimation to the stock exchange at least two working days in advance of the date of Board Meeting excluding the date of intimation and the date of the meeting [Refer Regulation 29 of Listing Regulations]

- Hold the Board Meeting and get the following proposal to be approved by the Board:

- To recommend the bonus issue;

- To approve the resolution to be passed at a general meeting;

- To authorize the Bonus issue

- To approve requisite resolution for increase of the capital and consequential alteration of the Memorandum of Association/Articles of Association (if necessary)

- To enable the Articles to authorize the issue, if necessary.

- Ensure that bonus issue has been made out of free reserves built out of the genuine profits or securities premium or capital redemption reserve account.

- Ensure that reserves created by revaluation of assets are not capitalized.

- Ensure that the company has not defaulted in payment of interest or principal in respect of fixed deposits and or debt securities issued by it or in respect of the payment of statutory dues of the employees such as contribution to provident fund, gratuity, bonus etc.

- Ensure that the bonus issue is not made in lieu of dividend.

- The company which has once announced the decision of its Board recommending a bonus issue shall not subsequently withdraw the same.

- If there are any partly paid-up shares, ensure that these are made fully paid-up before the bonus issue is recommended by the Board of directors.

- Hold the general meeting and get the resolution/s for issue of bonus shares passed by the members.

- Once Special Resolution is passed file Form MGT-14 along with the fees with the Registrar with in 30 days of passing of the resolution along with the altered article of association.

- With in 30 days of allotment file with the registrar the Return of allotment in Form PAS-3 along with fee as specified in Companies (Registration of Offices and Fees), Rules 2014.

- All share certificates shall be delivered to the shareholders within two months from the date of allotment of bonus issue as required under section56(4). Incase of a Specified IFSC public and private company the share certificates shall be delivered within sixty days of allotment.

- Intimate the details of allotment of shares to the Depository immediately on allotment of such shares.

- In case of listed companies the conditions prescribed under SEBI (LODR), Regulation 2018 and SEBI (ICDR) Regulation 2009 are to be complied with.

Issue Of Securities Companies Act 2013

Question 5. Describe the Procedure for issue of Right Shares.

Answer:

Procedure for issue of Right Shares

- Check whether the rights issue results in increase of authorized capital.,

- If so call a board meeting to approve the notice of General meeting to pass necessary special resolutions at the general meeting to amend Memorandum/Articles of Association

- Convene the general Meeting and obtain shareholders’ approval through special Resolution.

- The offer should be made by notice, specifying the number of shares offered and limiting a time not being less than fifteen days and not exceeding thirty days from the date of the offer within which the offer, if not accepted, shall be deemed to have been declined. This notice shall be dispatched through Registered post or speed post or through electronic mode to all the existing shareholders at lest three days before the opening of the issue. However, in case of private companies in case 90% of members have given their consent in writing or in electronic mode, the lesser period than the specified period shall apply.

- Check the copy of form SH7, MGT14 filed with ROC.

- The shares declined by the existing shareholder can be disposed off by the company in manner which is not disadvantageous to the shareholders and the company.

- Once the allotment is made, the company shall within 30 days of allotment, file with the Registrar are turn of allotment in Form PAS.3, along with the fee as specified in Companies (Registration of Offices and Fees) Rules, 2014.

- Deliver the share certificates of allotted shares within a period of 2 months from the date of allotment.

- Intimate the details of allotment of shares to the Depository immediately on allotment of such shares

Types Of Securities In Company Law

Question 6. Describe the Procedure to issue and redemption of Preference Shares.

Answer:

Procedure to issue and redemption of Preference Shares

- For issue of preference shares the articles of the company should authorize for it, if not then amendment in the articles of the company is required. Also ensure that there is no subsisting defaults in redemption of preference shares earlier or in payment of dividend due on any preference shares.

- Ensure that the resolution for issuing preference shares contains all the relevant particulars as mentioned above

- Issue the notice of general meeting along with the explanatory statement, to provide the required details.

- In the case of listed entity, intimate the stock exchange at least two working days in advance of the date of board meeting (Refer Regulation 29 of Listing Regulations)

- Pass special resolution and file with the registrar Form MGT-14 along with the fee so specified in the Companies (Registration of Offices and Fees) Rules, 2014 within 30 days of passing the resolution

Note: in case of One Person Company for the purpose of passing of ordinary and special resolution in general meeting, any business which is required to be transacted at an annual general meeting or other general meeting of accompany by means of an ordinary or special resolution, it shall be sufficient if the resolution is communicated by the member to the company and entered in the minutes book and signed and dated by the member and such date shall be deemed to be the date of meeting for all purpose under this act. - Within 30 days of allotment file with the registrar the Return of allotment in Form PAS-3 along with fee as specified in companies (Registration of Offices and Fees), Rules 2014

- Update the register of members maintained under Section 88 after issue of preference shares

- The company may redeem the preference shares only on the terms on which they were issued or as varied after due approval of preference shareholders

- The preference shares may be redeemed as given below:

- At affixed time or happening of a particular event

- Any time at the company’s option

- Any time at the shareholders option

- The notice of redemption of preference shares shall be filed by the company with the Registrar in Form SH-7 along with altered MOA with the fee as specified in Companies (Registration of Offices and Fees), Rules, 2014 within 30 days of redemption of preference shares.

- Once the allotment is made, the company shall within 30 days of allotment, file with the Registrar are turn of allotment in Form PAS.3, along with the fee as specified in Companies (Registration of Offices and Fees) Rules, 2014.

- Deliver the share certificates of allotted shares within a period of 2 months from the date of allotment.

- Intimate the details of allotment of shares to the Depository immediately on allotment of such shares.