- Control And Co-Ordination In Living Organism Notes

- Continuity Of Life Notes

- Environment, Its Resources And Their Conservation Notes

- Evolution And Adaptation Notes

- Heredity And Common Genetic Diseases Notes

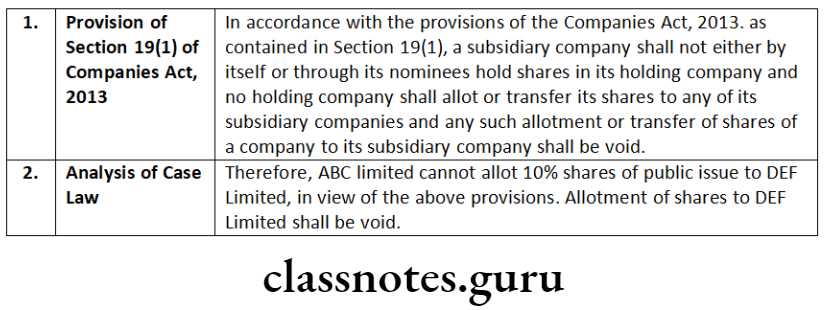

Transfer of securities Under Companies Act, 2013

As per Section 56(1) of the Companies Act, 2013, a company, whether public or private shall not register transfer of securities of the company unless a proper instrument of transfer duly stamped, dated and executed by or on behalf of the transferor and transferee has been delivered to the company along with the certificate relating to the securities or if no such certificate is in existence, along with the related letter of allotment of securities.

Depository system Under Companies Act, 2013

Depository system reduces the cost of issue and transfer of securities by eliminating stamp duty, it entitles the transferee to all the rights associated with the securities immediately on settlement of purchase transaction.

Transfer And Transmission Of Securities

Fungibility Under Companies Act, 2013

A good or asset’s interchangeability with other individual goods/assets of the same type. Assets possessing this property simplify the exchange/trade process, as interchangeability assumes that everyone values all goods of that class as the same.

Stamp duty Under Companies Act, 2013

The tax placed on legal documents usually in the transfer of assets or property. The transfer of documents in locations where this law exists, is only legally enforceable once they are stamped, which shows the amount of tax paid.

Transmission of Securities Under Companies Act, 2013

Lien on shares Under Companies Act, 2013

Lien on shares is the right to retain possession of a thing until a claim is satisfied. In the case of a company lien on a share means that the member would not be permitted to transfer his shares unless he pays his debt to the company.

Blank Transfer Under Companies Act, 2013

When a shareholder signs the transfer form without filling in the name of the transferee and the date of execution and hands it over with the share certificate to the transferee thereby enabling the transferee to deal with the shares, he is said to have made a transfer ‘in blank’ or a ‘blank transfer’.

Forged Transfer Under Companies Act, 2013

Dematerialisation of Shares Under Companies Act, 2013

Rematerialisation of Securities Under Companies Act, 2013

Rematerialisation is conversion of electronic securities into physical certificates of such securities. This can be done in the following manner:

Transmission Of Shares Companies Act 2013

Write a note on the following:

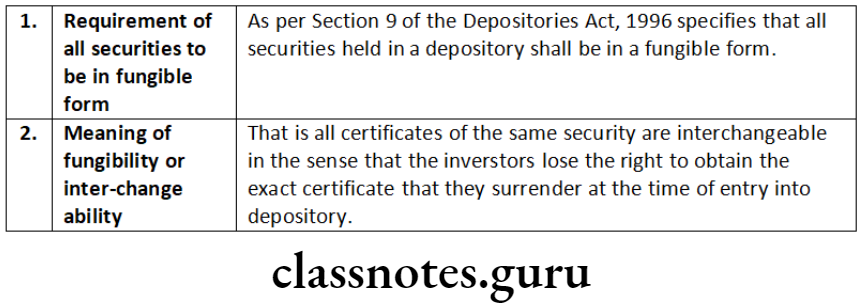

Fungibility

Answer:

Write a note on the following:

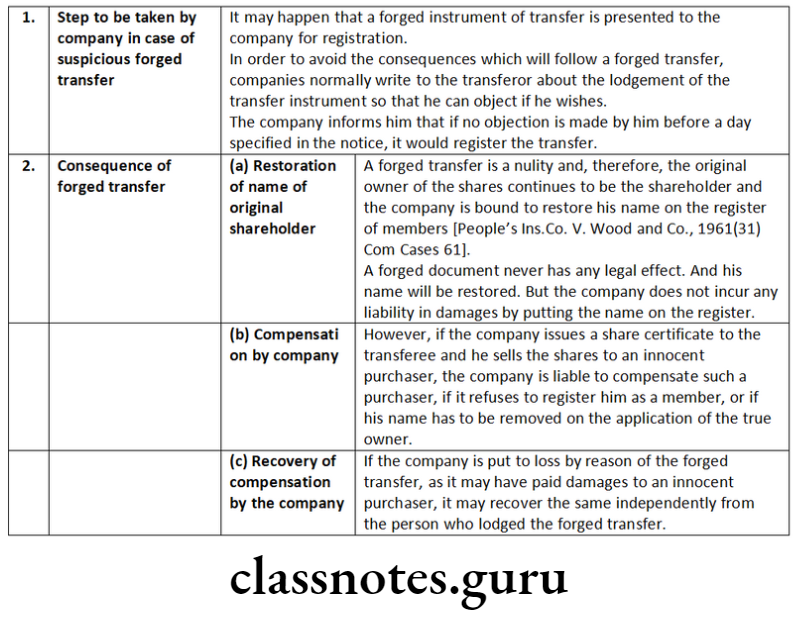

A forged transfer of shares is a nullity.

Answer:

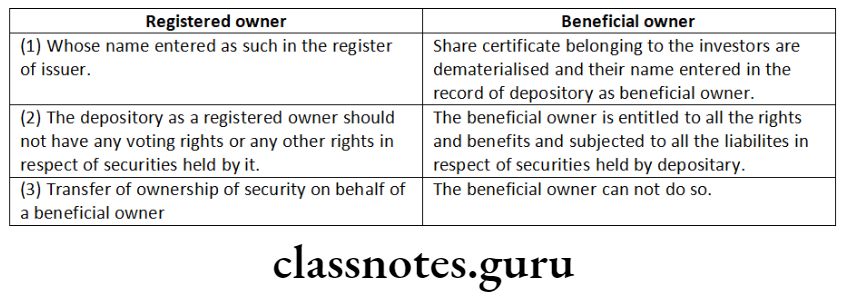

Distinguish between the following:

‘Beneficial owners under depository mode’ and ‘registered owners under depository mode’.

Answer:

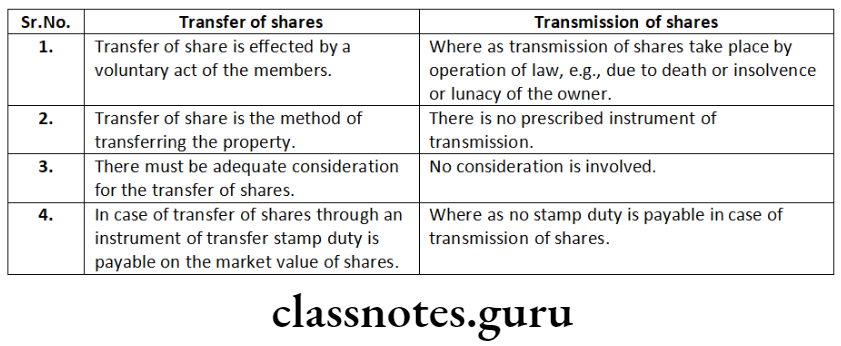

Distinguish Between the following:

‘Transfer’ and ‘transmission’ of shares.

Answer:

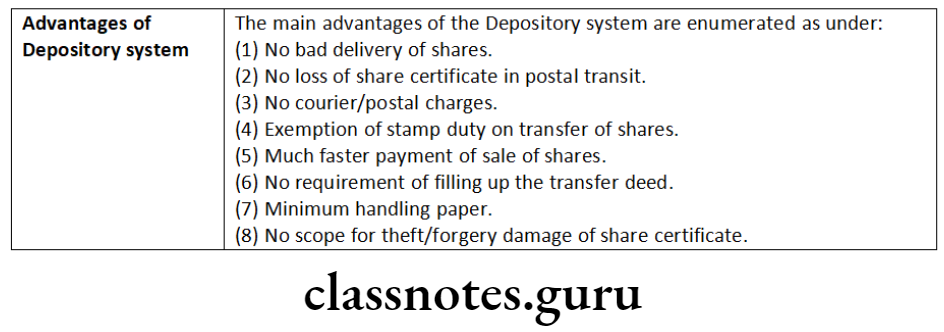

What are the benefits of the depository system of stock holding?

Answer:

Share Transfer Procedure India

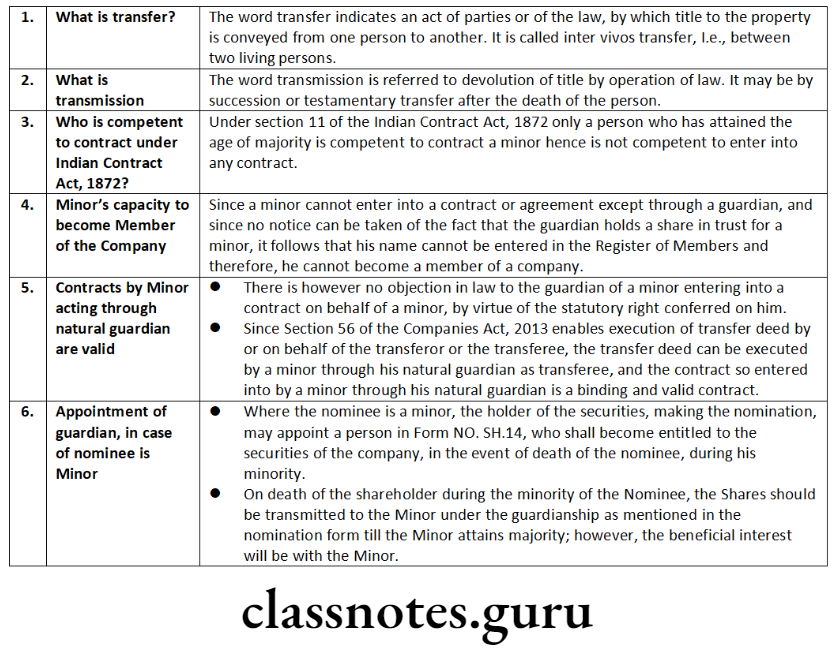

Examine the validity of transfer and transmission of shares in favour of a minor under the provisions of the Companies Act, 2013.

Answer:

Aniket has fraudulently sold his shares to two different transferees. Who will be entitled to the shares in priority?

Answer:

The Articles of Association of a company cannot impose a blanket ban prohibiting transfer of shares in favour of a minor. Such a restriction is unreasonable and not sustainable.

Answer:

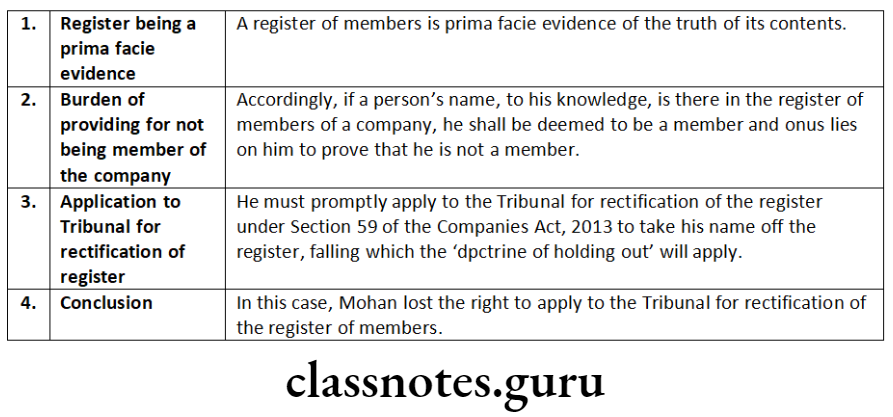

Mohan applied for 4,000 shares in a company but no allotment was made to him. Subsequently, 4,000 shares were transferred to him without his request and his name was entered in the register of members. Mohan stood by and allowed his name to remain in the register of members. Subsequently, the company went into liquidation and he was held liable as a contributory. Now, Mohan wants to apply to the Tribunal for rectification of the register of members. Can he do so? Explain.

Answer:

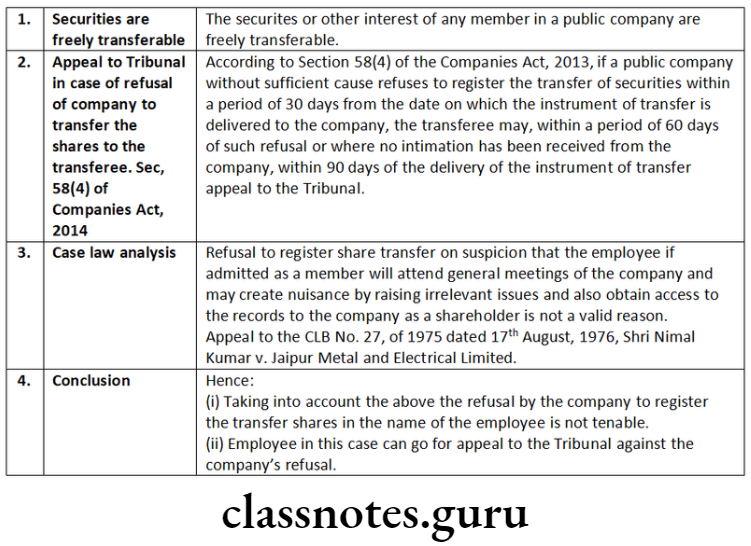

An employee of a company purchased certain shares of his company through a member of a stock exchange and lodged with the company an application for transfer of shares in his (employee’s) name. The company refused to execute the transfer on the suspicion that the employee, if admitted as a member of the company, will create nuisance in general meetings and seek access to the records of the company. Decide giving reasons –

Answer:

P Realtors Ltd., A Construction Ltd. and five other individuals have incorporated XYZ Builders Ltd. to construct a commercial complex. P Realtors Ltd. and A Construction Ltd. have executed an agreement according to which none of these companies can sell their shares in the new company before completion of construction of the commercial complex. Due to financial crunch, P Realtors decides to sell its shares in XYZ Builders Ltd. to PQR Builders Ltd. Can A Construction Ltd. restrain the transfer of shares before completion of construction of the commercial complex? (3 marks)

Answer:

With reference to the definition of a private company as provided under Section 2 (68) of the Companies Act, 2013, a private company is only authorised to exercise restriction by its Articles on the transfer of shares of the company held by its members.

In other words, in public companies the shares are freely transferable and no restrictions can be imposed on the members right regarding transfer of their shares.

In the above case the agreement between P Realtors Ltd. and A Construction Ltd restricting their rights to transfer their shares till completion of the project will be held subservient to the provision contained in the Companies Act, 2013, which provide for free transferability of shares.

Hence, A Construction Ltd. will not be able to restrain P Realtors from transferring their shares in XYZ Builders Ltd. to PQR Builders Ltd.

Santosh Kumar, an employee of a listed company purchased certain shares of his company through a member of a stock exchange and lodged with the company for transfer of shares in his (employee’s) name. The company refused to execute the transfer on the suspicion that the employee, if admitted as a member of the company, will create nuisance in general meetings and seek access to the records of the company. Decide giving reasons:

Answer:

The securities or other interest of any member in a public company are freely transferable (it means, no restriction on transfer of share from one person to another person). Refusal to register share transfer on suspicion that the employee if admitted as a member will attend general meetings of the company and may create nuisance by raising irrelevant issues and also get access to the records to the company as a shareholder is not a valid reason.

Therefore, as per Section 58 (4) of the Companies Act, 2013, if a public company without sufficient cause refuses to register the transfer of securities within a period of 30 days from the date on which the instrument of transfer is delivered to the company, the transferee may, within period of 60 days of such refusal or where no intimation has been received from the company, within 90 days of the delivery of the instrument of transfer, can appeal to the Tribunal.

Therefore, taking into account the above:

Question 1. Write short notes on Rematerialisation of securities.

Answer:

Rematerialisation is conversion of electronic securities into physical certificates of such securities. This can be done in the following manner:

Difference Between Transfer And Transmission

Question 2. Write short notes on Dematerialisation of securities.

Answer:

Dematerialisation of securities means holding of securities in electronic form in lieu of physical certificates. Dematerialisation is comparable to keeping your money in a bank account. In demat form, physical share certificates are replaced by electronic book entries; purchase of shares are reflected as credits in demat account and sales are reflected as debits.

The risk associated with physical share certificates such as loss, replacement, theft, damage, etc. are overcome in the share certificates held in Dematerialisation form which are totally risk free.

Question 3. Enumerate the steps for transfer of dematerialised shares.

Answer:

Section 7 of the Depositories Act, 1996 lays down that every depository shall, on receipt of intimation from a participant, register the transfer of shares in the name of the transferee and where the beneficial owner or a transferee of any shares seeks to have custody of such shares, the depository shall inform the issuer accordingly.

The transfer deed and all other provisions stipulated in Section 56 of the Companies Act, 2013 shall not apply to the transfers affected within the depository mode.

No stamp duty is levied on transfer of securities held in demat form. Any number of securities can be transferred/ delivered with one delivery instruction. Therefore, the paperwork and signing of multiple transfer forms is done away with.

The procedure for sale of shares held in demat form is as under:

The broker shall make payment to the investor in physical form. The procedure for purchases of securities held in demat form is as under:

Question 4. Enumerate the steps for hypothecation of dematerialised shares.

Answer:

A beneficial owner may, with the prior approval of the depository, pledge or hypothecate his shares held in a depository. Upon receipt of intimation from the beneficial owner about the pledge or hypothecation of his shares, the depository shall accordingly make entries in its records.

Such an entry in the records of a depository shall be evidence of a pledge or hypothecation [Section 12]. Both the pledger and pledgee must have a depository account. The procedure for pledge or hypothecation of shares held in demat form is as under:

Sebi Rules For Transfer Of Shares

Question 5. How does investor avail the services of depositary.

Answer:

Transfer And Transmission Of Securities

Question 6. Describes the process of the company to be followed by on refusal to register the transfer of securities.

Answer:

Section 58 of the Companies Act, 2013, deals with process of the company to be followed by on refusal to register the transfer of securities.

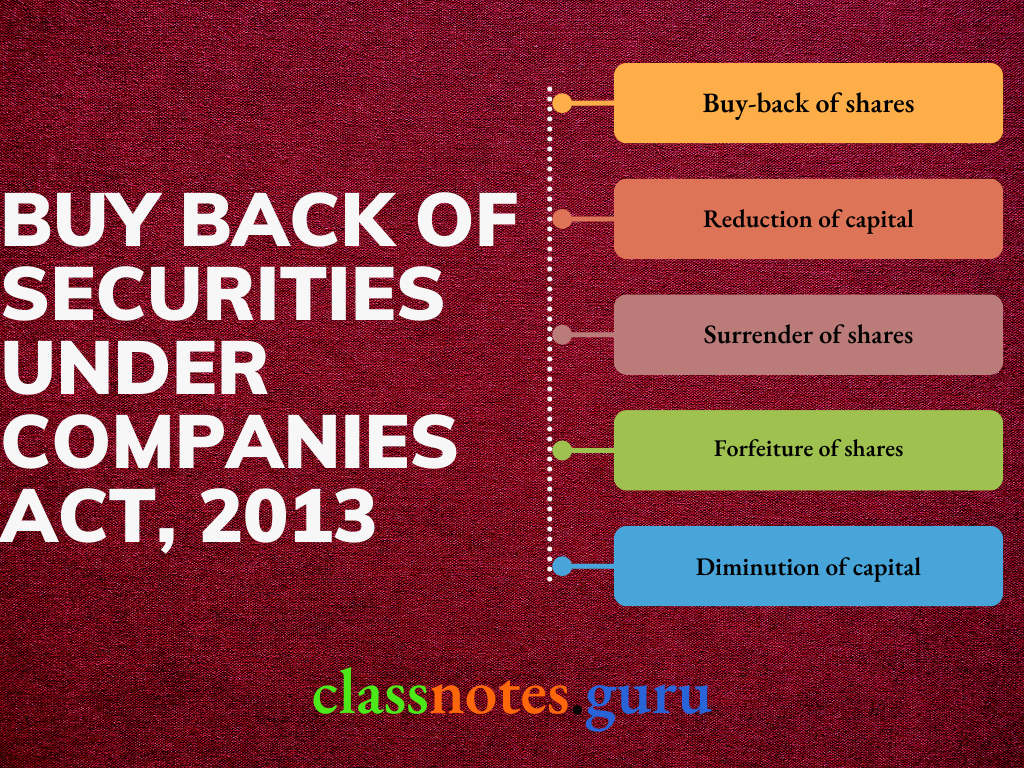

Buy-back of shares Under Companies Act, 2013

The repurchase of shares by a company in order to reduce the number of shares on the market. Companies will buy back shares either to increase the value of shares still available (reducing supply) or to eliminate any threats by shareholders who may be looking for a controlling stake.

Reduction of capital Under Companies Act, 2013

Buy Buyback of Shares Under Companies Act 2013

Surrender of shares Under Companies Act, 2013

Surrender of shares means surrender to the company on part of shareholder of shares voluntarily. It amount to reduction of capital.

Forfeiture of shares Under Companies Act, 2013

A company may if authorized by its articles, forfeit shares for non-payment of calls and the same will not require confirmation of the Tribunal and amounts to reduction of capital.

Diminution of capital Under Companies Act, 2013

Diminution of capital is the cancellation of the unsubscribed part of the issued capital. It can be effected by an ordinary resolution provided articles of the company authorize to do so. It does not need any confirmation of Tribunal.

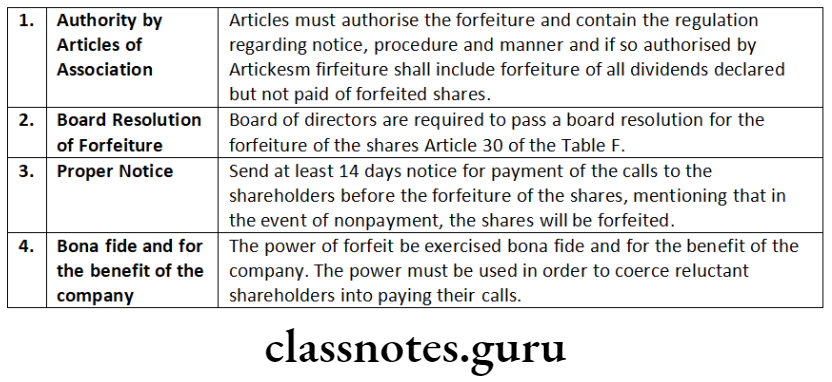

Write a note on the following:

Conditions for valid forfeiture of shares

Answer:

Answer the following citing the relevant provisions of law/case law, if any:

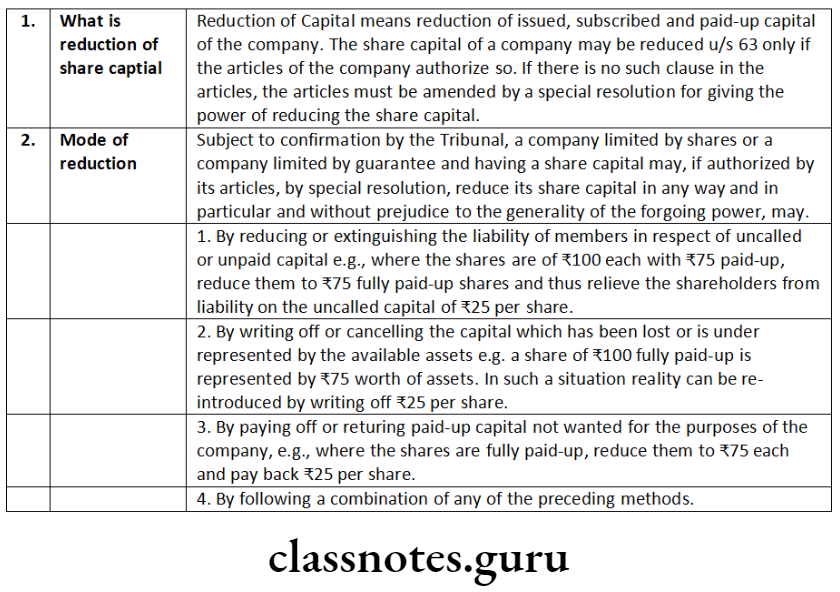

Explain the procedure for reduction of share capital.

Answer:

Reduction of Share Capital [Section 66]

Amendments as per Companies (Amendment) Act, 2017 Revised Section 447-

“Without prejudice to any liability including repayment of any debt under this Act or any other law for the time being in force, any person who is found to be guilty of fraud involving an amount of at least ten lakh rupees or one percent of the turnover of the company, whichever is lower, shall be punishable with imprisonment for a term which shall not be less than six months but which may extend to ten years and shall also be liable to fine which shall not be less than the amount involved in the fraud, but which may extend to three times the amount involved in the fraud.

Buyback Of Securities Procedure

Provided that where the fraud in question involves public interest, the term of imprisonment shall not be less than three years. Provided further that where the fraud involves an amount less than ten lakh rupees or one per cent of the turnover of the company, whichever is lower and does not involve public interest, any person guilty of such fraud shall be punishable with imprisonment for a term which may extend to five years or with fine which may extend to twenty lakh rupees or with both.”

Note: Amendment made by Companies (Amendment) Act, 2020 Provides that the Section 66 of the principal Act, sub-section(11) shall be omitted. Space to write important points for revision

Comment on the following:

A company incorporated under the Companies Act, 2013 does not have the right to reduce its share capital on selective basis.

Answer:

Comment on the following:

Reduction of share capital and Diminution of share capital mean the same.

Answer:

According to Section 66(1) of the Companies Act, 2013 states that subject to approval by the Tribunal on an application by the company, a company limited by shares or limited by guarantee and having a share capital may, by passing a special resolution at general meeting reduce the share capital in any manner, and in, particular, may-

alter its memorandum of association by reducing the amount of its share capital and of its shares accordingly.

As per Section 61(1)(e) of the Companies Act, 2013 provides that, a limited company having share capital, if authorised by its Articles of association may cancel shares, by passing an ordinary resolution at general meeting in that behalf, which have not been taken by any person, and diminish the amount of its share capital by the amount of the shares so cancelled.

Diminution needs no confirmation by the Tribunal. Further, Section 61(2) of the Companies Act, 2013 provides that the cancellation of shares under section 61(1) of the Companies Act, 2013 shall not be deemed to be reduction of share capital.

Hence, Reduction of Share Capital and Diminution of Share Capital is not the same.

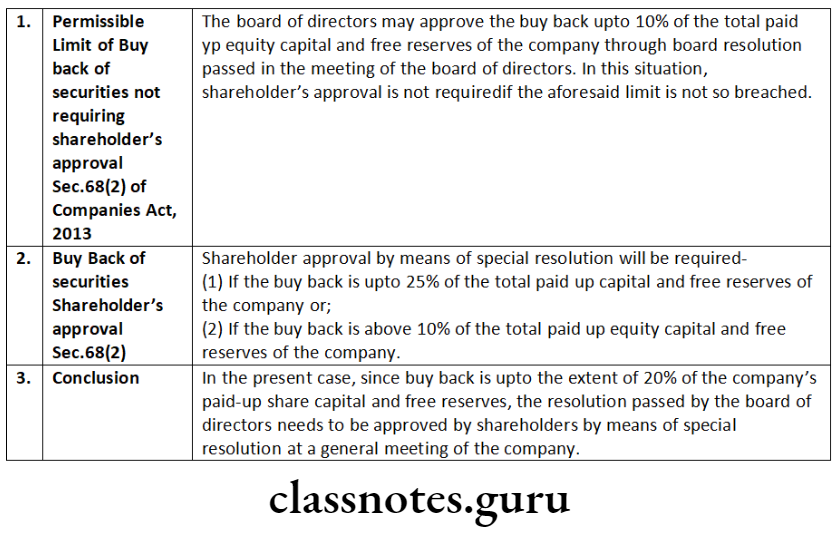

Buyback Rules Under Companies Act

Board of Directors of Pious Ltd. gives you the following information extracted from the company’s financial statements as at 31st March, 2015:

Authorised equity share capital 10 crore

(1 crore shares of 10 each)

Paid-up equity share capital 5 crore

General reserve 5 crore

Debenture redemption reserve 2 crore

Board of Directors by a resolution passed at its meeting decides to go for buy-back of shares of the extent of 20% of the company’s paid-up share capital and free reserves. Examine the validity of the Board’s resolution with reference to the provisions of the Companies Act, 2013.

Answer:

Enkebee Ltd. wants to purchase its own 1,00,000 equity shares @ 10 each out of the following:

Unsecured loan 5 lakh

Balance of depreciation reserve for 3 lakh

Securities premium account 4 lakh.

Examine the legality of the above transactions for the buy-back of securities of the company under the provisions of the Companies Act, 2013.

Answer:

According to Section 68(1) of the Companies Act, 2013, a company may purchase its own shares or other specified securities out of the following:

Hence, Enkebee Ltd. can purchase its own shares only out of the Securities Premium account and not out of unsecured loan or balance of depreciation reserve (not being free reserve).

Confident Ltd. has forfeited 50,000 equity shares of the company@10 each and same were re-issued. After the filing of the annual return, the Registrar of Companies (ROC) has issued show cause notice to the company for default of provisions of Section 39 of the Companies Act, 2013. Is the action of the ROC tenable under the provisions of the Companies Act, 2013? Discuss with relevant case law, if any.

Answer:

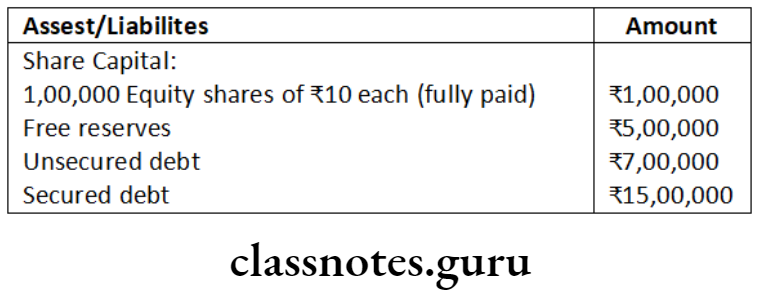

Premium Ltd. is considering buy-back of its shares without using any proceeds of shares or other specified securities. The balance sheet of Premium Ltd. shows the following status as on 31st March, 2018: Asset/Liabilities

Conditions For Buyback Of Shares In India

Determine the maximum quantum of buy-back of shares with the shareholders’ approval as on 1st April, 2018.

Answer:

The maximum quantum of buy-back that Premium Ltd. can make as on 1st April, 2018, in pursuance to Section 68 of Companies Act, 2013 is 25% of aggregate of paid-up capital and free reserves of the company. Further provided that the reference to twenty five per cent shall be construed with respect to its total paid-up equity capital in that financial year and the ratio of the aggregate of secured and unsecured debts owed by the company after buy-back should not be more than twice the paid-up capital and its free reserves.

Analysis of the Case Law:

Free Reserves – 5,00,000

Securities premium Account – Nil

Proceeds of other specified securities – Nil

Total Debt i.e. (7,00,000+ 15,00,000) -22,00,000

Sum of paid up Equity capital + free reserves – 15,00,000

Therefore, the maximum fund available for buy-back (in absence of securities premium account and proceeds of issue of any other specified securities) is 5,00,000.

Amount that must be maintained as sum total of free reserves and paid up equity capital is half of total debt i.e. half of 22,00,000 i.e. 11,00,000.

Buy back can be made upto 25% of Paid up capital and free reserves i.e. 10,00,000+ 5,00,000 i.e. 15,00,000 × 25% = 3,75,000. Further debt equity ratio is

Debt:

Secured and unsecured debt = 15,00,000+ 7,00,000 = 22,00,000

Capital after Buy Back:

Total Capital 10,00,000-3,75,000 = 6,25,000

Free reserve = 5,00,000-3,75,000 = 1,25,000

Total Capital + free reserve 6,25,000+ 1,25,000 = 7,50,000 Debt equity ratio = 22,00,000/7,50,000 = 2.93

The ratio being more than twice the paid-up capital and its free reserves the maximum quantum of 3,75,000 is not advisable.

As expressed above post buy-back debt equity ratio must not be more than 2. Accordingly, post buy-back total capital and free reserve must be half of debts i.e. (15,00,000+7,00,000)/2=11,00,000. The maximum buy-back of equity may be {(10,00,000+ 5,00,000) -11,00,000)/2 = 2,00,000.

Hence, in the above case, maximum possible buy-back is of ₹ 2,00,000 amounting to 20,000 equity shares of ₹ 10 each.

Buyback Of Shares Meaning And Process

Monika Ltd. wants to purchase its own 5,00,000 equity shares @ ₹10/- each out of the following:

₹ lakh

(a) Unsecured Loans 25

(b) Balance of Free Reserves 15

(c) Securities Premium Account 10

Examine the legality of the above transactions for the buy-back of securities of the company under the provisions of the Companies Act, 2013

Answer:

As per Section 68(1) of the Companies Act, 2013 a company may purchase its own shares or other specified securities (known as “buy-back”) out of:

Although, no buy-back of any kind of shares or other specified securities shall be made out of the proceeds of an earlier issue of the same kind of shares or same kind of other specified securities.

Hence, in the above case Monika Ltd. can purchase its own 5,00,000 equity shares @10 each out of free reserves and from the securities premium account in accordance with the provisions of the Companies Act, 2013. But it cannot do buy-back from the amount of Unsecured Loan as it will be contravention of the provisions of Section 68 of the Companies Act, 2013.

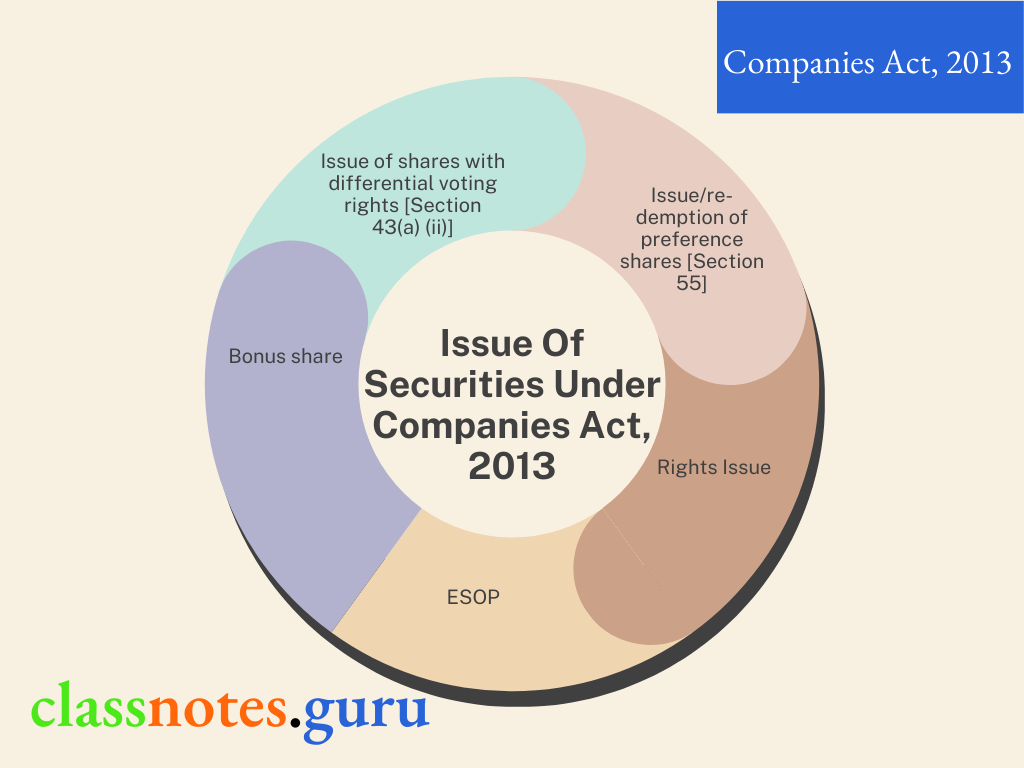

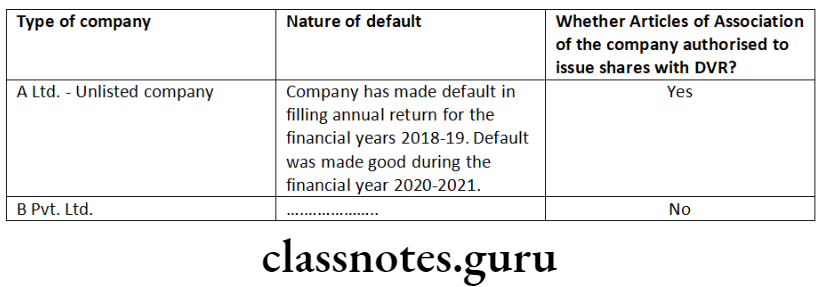

Issue of shares with differential voting rights [Section 43(a) (ii)]

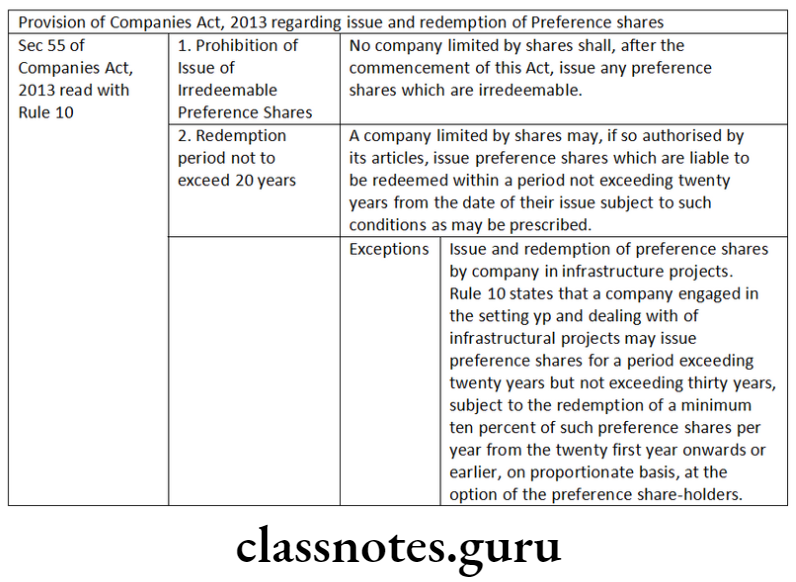

Issue/re-demption of preference shares [Section 55]

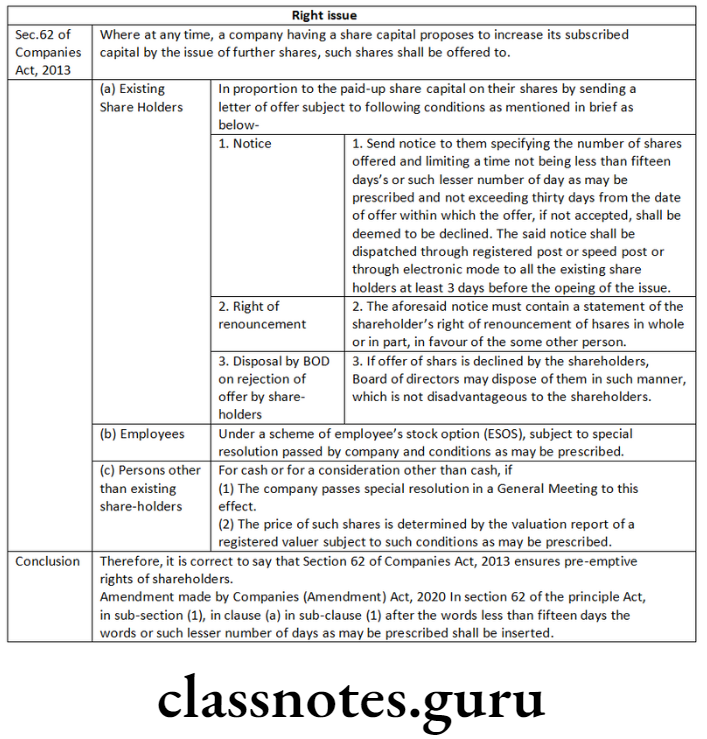

Rights Issue

Rights issue is an issue of capital to be offered to the existing shareholders of the company through a letter of offer.

ESOP

Preferential Issue Rule 13 of the Companies (Share Capital and Debentures) Rules, 2014

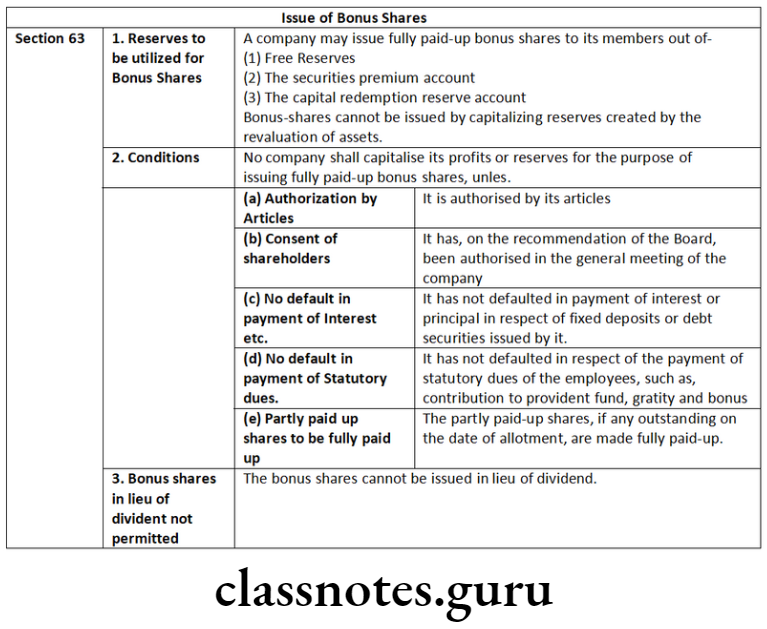

Bonus share

When a company is prosperous and accumulates large distributable profits, it converts these accumulated profits into capital and divides the capital among the existing members in proportion to their entitlements. Members do not have to pay any amount for such shares. A company may, if its Articles provide, capitalize its profits by issuing fully-paid bonus shares.

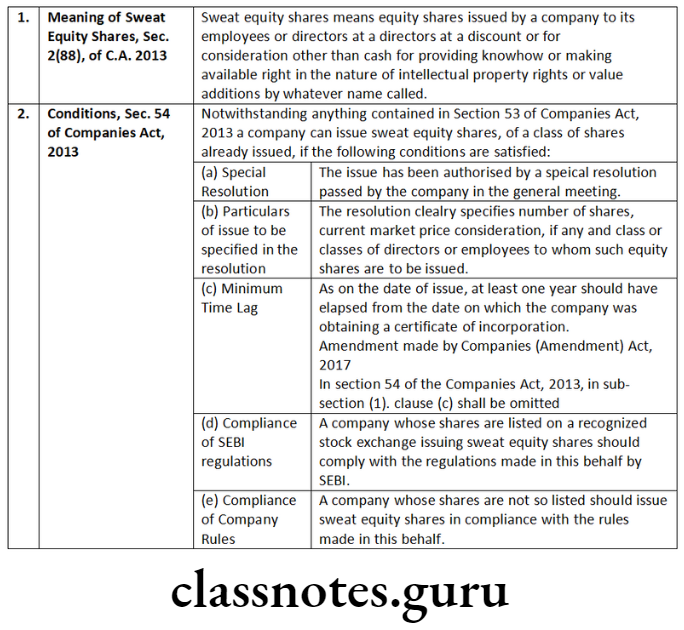

Sweat equity shares

Means equity shares issued by a company to its employees or directors at a discount or for consideration, other than cash for providing know-how or making available rights in the nature of intellectual property rights or value additions, by whatever name called.

Companies (Share Capital and Debentures) Second Amendment Rules, 2018

For the purpose of rules relating to issuance of Sweat equity shares the definition of Employee has been modified through this amendment. Current definition is as under:

“Employee” means-

Issue Of Securities Companies Act 2013

Write a note on the following:

Issue of sweat equity shares.

Answer:

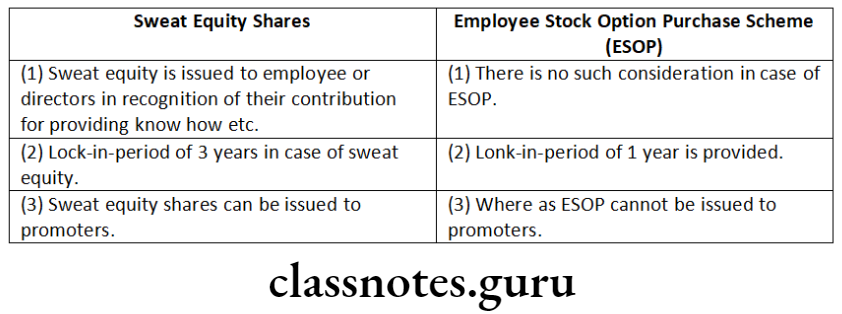

Distinguish between the following:

‘ESOP’ and ‘sweat equity shares’.

Answer:

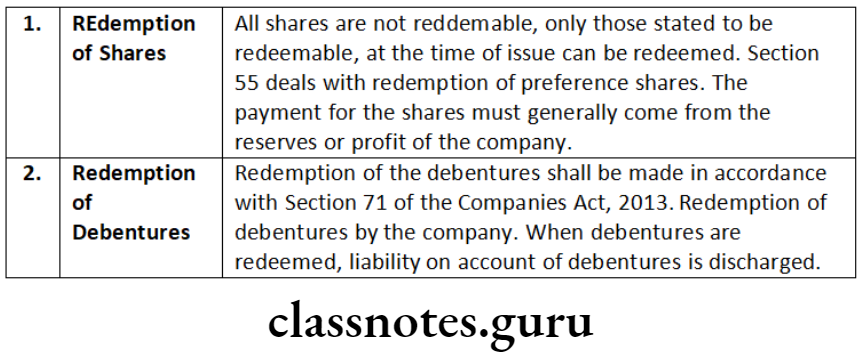

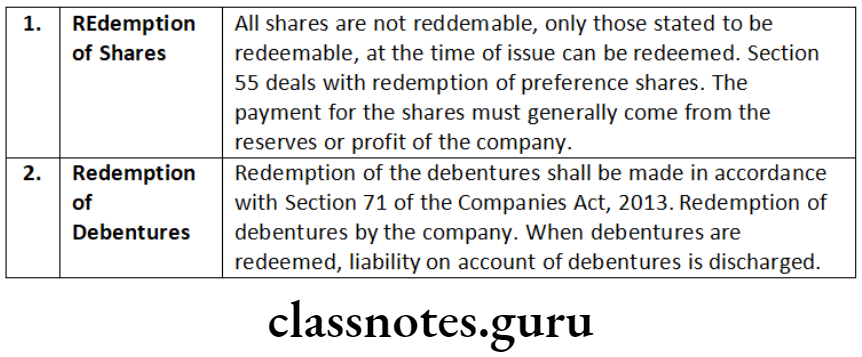

Distinguish between the following:

Redemption of shares and Redemption of debentures.

Answer:

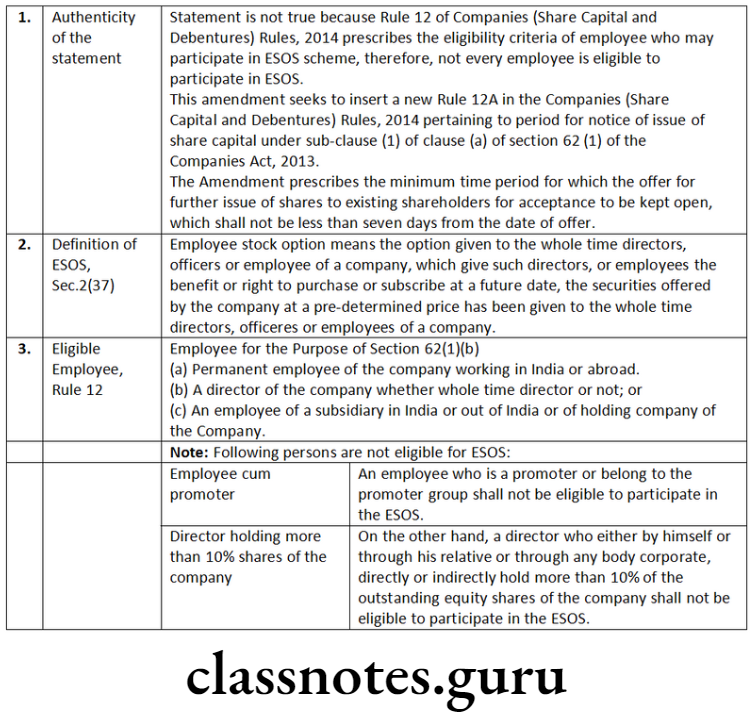

Comment on the following:

Every employee of a company shall be eligible to participate in Employee Stock Option Scheme (ESOS).

Answer:

Whether equity shares already issued can be converted into redeemable preference shares? Discuss.

Answer:

Section 62 of Companies Act, 2013 ensures pre- emptive rights of shareholders. Discuss.

Answer:

Comment on the following:

In no circumstances a company can issue redeemable preference shares with a redemption period beyond 20 years.

Answer:

Referring to the provisions of the Companies Act, 2013, state the conditions required to be fulfilled before a company can issue bonus shares to shareholders of the company.

Answer:

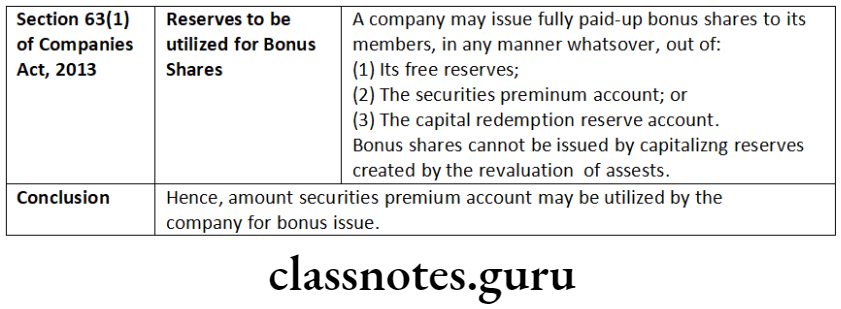

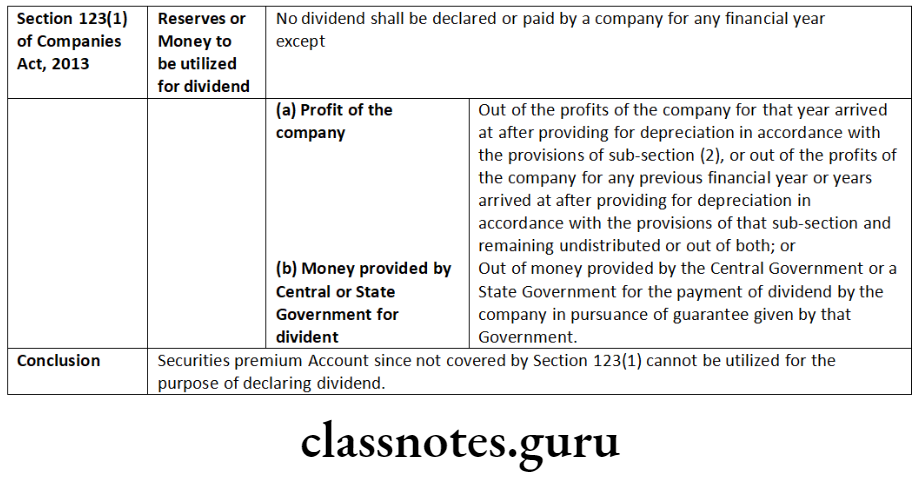

In view of the provisions of the Companies Act, 2013 relating to ‘securities premium’, state whether the amount lying in securities premium account of a company can be used:

For issuance of bonus shares; and

For payment of dividend declared by the company at its general meeting.

Answer:

Companies Act 2013 Securities Issue Process

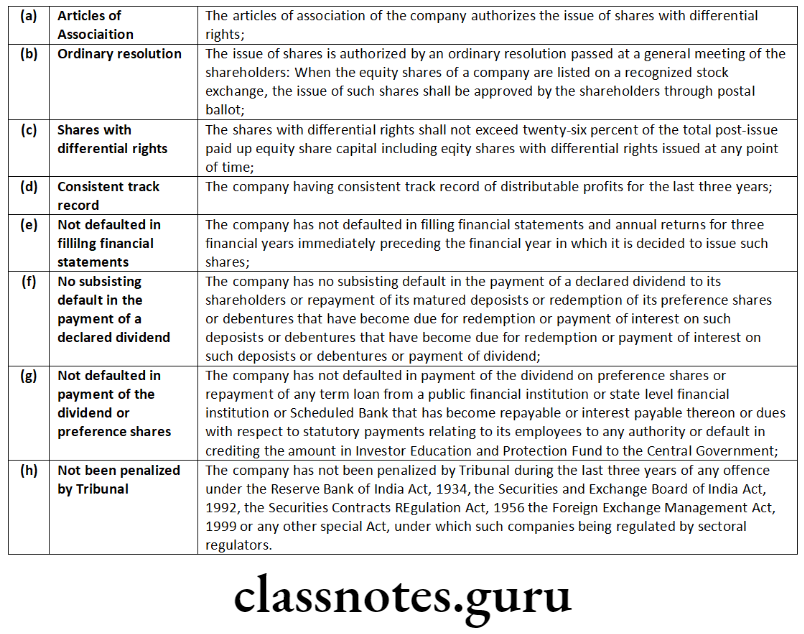

Board of directors of Progressive Ltd. decides to issue equity shares of the company with differential voting rights. Examining the provisions of the Companies Act, 2013, state the conditions to be complied with by the company in this regard.

Answer:

Section 43 enables companies to issue a variety of equity shares with differential rights etc. Rule 4 of Companies (Share Capital and Debentures) Rules, 2014 states the following conditions regarding shares with differential voting rights.

As a Practicing Company Secretary, advise your client company regarding the matters relating to issue of shares with differential rights, to be included in the Board of Directors Report.

Answer:

Pursuant to Rule (4) sub-rule (4) of the Companies (Share Capital and Debentures) Rules, 2014, the Board of Directors shall inter alia, disclosure in the Board Report for the financial year in which the issue of equity shares with differential Rights was completed, the following details, namely:

The Board of Directors of the company are accordingly advised to make disclosures in their report-Director’s Responsibility Statement. – Space to write important points for revision-

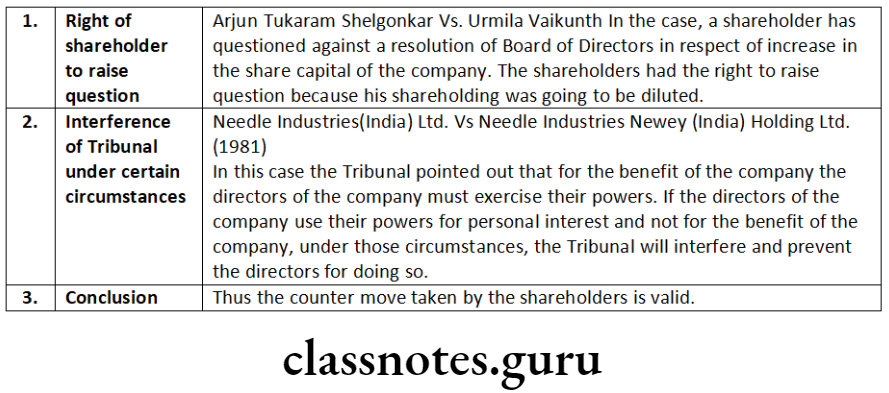

The Board of directors of Nav Avtar Ltd. passed a resolution for issue of rights shares. However, certain shareholders of the company raised an objection as to whether the company needed additional capital. Discuss the validity of the counter-move taken by the shareholders and resolution passed by the Board.

The Board of directors of Aakash Ltd., a listed company, at its meeting held on 1st April, 2011 announced a proposal for issue of bonus shares to all equity shareholders of the company at 1:1 ratio. On 1st May, 2011, the directors at another meeting passed a resolution to reverse the proposal of bonus issue announced on 1st April, 2011. Discuss the validity of the proposal and the reversal.

Answer:

During the financial year 2016-17, the Board of Directors of CARE Automation Services Limited has issued shares to employees under Employees Stock Option Scheme. Ms. Excellent has recently joined the Board of the company and asks you, the Secretary of the company, as to what details are to be disclosed in the Board’s Report for the year ending 31st March, 2017 in this regard. Advise her.

Answer:

Pursuant to Rule 12(9) of the Companies (Share Capital and Debentures)

Rules, 2014 the Board shall disclose following details of ESUP→

ABC Ltd. holds 75% equity share capital of DEF Ltd. and controls composition of Board of Directors of DEF Ltd. ABC Ltd. goes for public issue for raising further share capital. Board of Directors of ABC Ltd. allót 10% of the issue to DEF Ltd. Referring to the provisions of the Companies Act, 2013 examine the validity of Board’s decision to allot 10% – of issue to DEF Ltd. DEF Ltd. holds certain number of shares as a legal representative of a deceased member of ABC Ltd. and has a right to vote at a general meeting of ABC Ltd. in respect of such shareholdering, will this right be affected by issue of 10% to DEF Ltd. by ABC Ltd.?

Answer:

Note

Further, in the following circumstances, where a subsidiary can hold the shares of its holding company:

The subsidiary company, however, as referred above shall have a right to vote at a meeting of the holding company only in respect of the shares held by it as a legal representative or as a trustee.

Private Placement Vs Public Issue

Green Commercial Ltd., an unlisted company, has made a preferential offer of shares for consideration other than cash. A question has been raised by the accounts department as to the valuation of consideration at allotment and the manner of treatment of non-cash consideration in books of account. As a practising company secretary advise the company with reference to the provisions of the Companies Act, 2013.

Answer:

Under Section 62 read with Rule 13(2) of the Companies (Share Capital and Debentures) Rules 2014, where shares or other securities are to be allotted for consideration other than cash, the valuation of such consideration shall be done by a registered valuer who shall submit a valuation report to the company for justification of valuation.

Where the preferential offer of shares is made for a non-cash consideration, such non-cash consideration shall be treated in the following manner in the books of account of the company-

The Practicing Company Secretary (PCS) can advised the Green Commercial Ltd. accordingly.

The share capital of Raney Ltd. is 30 crore. ‘Russel’ is appointed as the managing director of the company, the company wants to compensate him by issue of shares for supplying technical know-how without any cost. In this context, answer the following:

Answer:

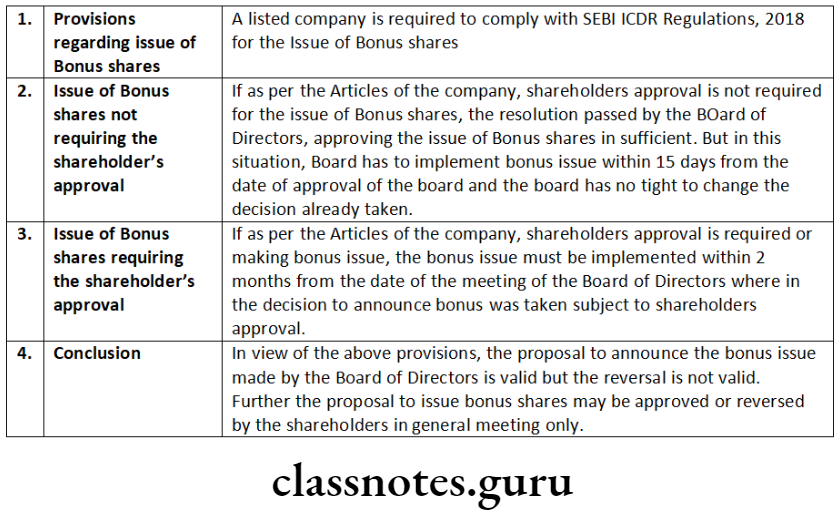

The Board of Directors of Aakash Ltd., a listed company, in its meeting held on 1st April, 2021 announced a proposal for issue of bonus shares to all equity shareholders of the company in the ratio of 1: 1. On 1st May 2021, the directors at another meeting passed a resolution to reverse the proposal of bonus issue announced on 1st April, 2021. Discuss the validity of the resolutions.

Answer.

A listed company is need to comply with the requirements of the Companies Act, 2013, rules made thereunder and SEBI (ICDR) Regulations, 2018 for issue of bonus shares.

As per section 63(2) of the Companies Act, 2013, no company shall capitalise its profits or reserves for the purpose of issuing fully paid-up bonus shares, unless it has, on the recommendation of the Board of Director been authorised in the general meeting of the company.

Further, as per Rule 14 of the Companies (Share capital and Debentures) Rules, 2014, a company which has once announced the decision of its Board recommending a bonus issue, shall not subsequently withdraw the same.

Also, the SEBI (ICDR) Regulations, 2018 provides that a bonus issue, once announced, shall not be withdrawn.

In view of the above case, the BOD of Aakash Limited once announced the issue of bonus share on 1st April 2021 to all equity shareholders of the company in the ratio of 1:1 cannot subsequently reverse the proposal of such issue in another board meeting. Therefore, the first board resolution proposing the bonus share is valid but second board resolution for reversal ‘is not valid.

Which of the following companies is eligible to issue shares with Differential Voting Rights (DVRs) during the financial year 2022-23?

Question 1. Write short note on preferential offer.

Answer:

The expression ‘Preferential Offer’ means an issue of shares or other securities, by a company to any select person or group of persons on a preferential basis and does not include shares or other securities offered through a public issue, rights issue, employee stock option scheme, employee stock purchase scheme or an issue of sweat equity shares or bonus shares or depository receipts issued in a country outside India or foreign securities.

Question 2. Describe the Procedure for Issue of Equity Shares with Differential Voting Rights.

Answer:

Procedure for Issue of Equity Shares with Differential Voting Rights

Sebi Guidelines For Issue Of Securities

Question 3. Describe the Procedure for issue of shares on Preferential basis.

Answer:

Procedure for issue of shares on Preferential basis

Question 4. Describe the procedure for issue of bonus shares.

Answer:

Issue Of Securities Companies Act 2013

Question 5. Describe the Procedure for issue of Right Shares.

Answer:

Procedure for issue of Right Shares

Types Of Securities In Company Law

Question 6. Describe the Procedure to issue and redemption of Preference Shares.

Answer:

Procedure to issue and redemption of Preference Shares

Question 1. Sialolith.

(or)

Clinical features and Investigations of submandibular sialolithiasis.

Answer:

Sialolith

Sialolith Etiology:

Sialolith Composition:

Salivary Glands Diagnosis:

Sialolith Occurrence:

Salivary Glands Clinical Presentation:

Read And Learn More: Oral Medicine Question and Answers

Sialolith Complications:

Differential Diagnosis Of Sialolithiasis:

Sialolith Treatment:

Question 2. Mumps.

Answer:

Mumps

Mumps Presentation:

Mumps Complications:

Mumps Diagnosis:

Mumps Treatment:

Question 3. Pleomorphic adenoma of the palate.

Answer:

Pleomorphic Adenoma Of The Palate

Pleomorphic Adenoma Of The Palate Presentation:

Pleomorphic Adenoma Differential Diagnosis:

Pleomorphic Adenoma Of The Palate Treatment:

Question 4. Xerostomia

Answer:

Xerostomia

Xerostomia refers to a subjective sensation of a dry mouth, but not always, associated with salivary hypofunction

Xerostomia Etiology:

1. Developmental:

2. Water/ Metabolic Loss:

3. Latrogenic:

4. Radiation Therapy Of The Head And Neck:

5. Xerostomia Local factors:

Xerostomia Clinical Features:

Xerostomia Treatment:

Question 5. Sialometaplasia.

Answer:

Sialometaplasia Description:

Sialometaplasia Etiology:

Sialometaplasia Presentation:

Sialometaplasia Diagnosis:

Sialometaplasia Treatment:

Question 1. Causes of Sialorrhea.

Answer:

Causes of Sialorrhea

Question 2. Sialosis.

Answer:

Sialosis Presentation:

Sialosis Treatment:

Question 3. Why is sialolith common in the submandibular gland?

Answer:

Question 4. Mucocele.

Answer:

Mucocele Description:

Mucocele Types:

1. Extravasation:

2. Retention:

Mucocele Clinical Presentation:

Mucocele Treatment:

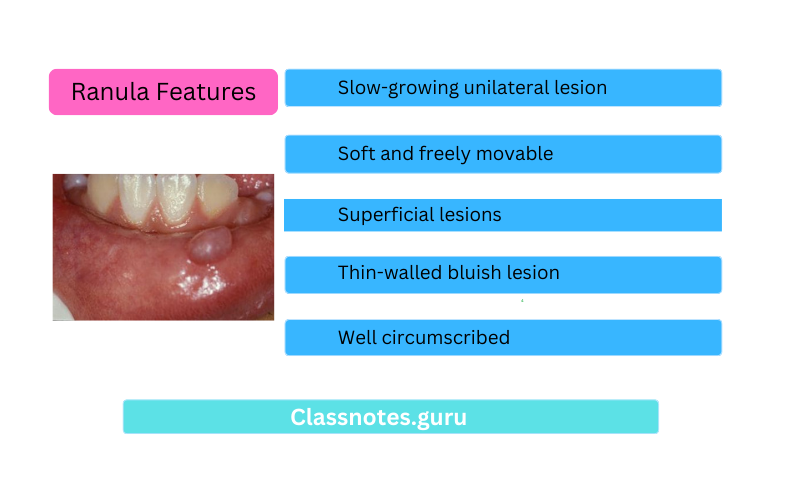

Question 5. Ranula

Answer:

Ranula

Ranula Site:

Ranula Cause:

Ranula Features:

Ranula Types:

Ranula Treatment:

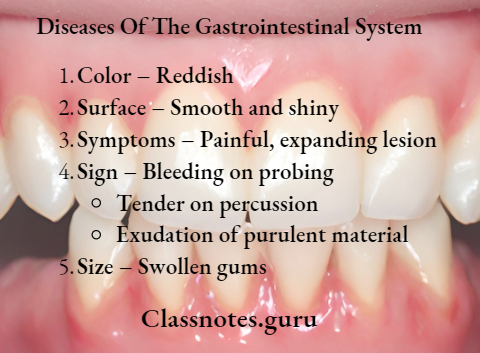

Question 1. Gingival

Answer:

Gingival Causes:

Gingival Features

Read And Learn More: General Medicine Question and Answers

Question 2. Glossitis.

Answer:

Glossitis

Glossitis is an inflammation of the tongue that causes is to enlarge and change in color.

Glossitis Types:

Glossitis Causes:

Glossitis Clinical Features:

Glossitis Treatment:

Glossitis Complications:

gastrointestinal diseases short essays

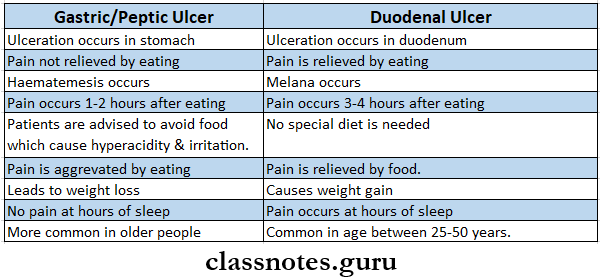

Question 3. Difference between gastric/peptic ulcer and duodenal ulcer.

Answer:

Difference Between Gastric/Peptic Ulcer And Duodenal Ulcer

Question 4. Plummer-Vinson syndrome.

Answer:

Plummer-Vinson Syndrome

It is characterized by dysphagia, iron deficiency anemia, dystrophy of nails, and glossitis.

Plummer-Vinson Syndrome Clinical Features:

Plummer-Vinson Syndrome Diagnosis:

Plummer-Vinson Syndrome Treatment:

Question 5. Acute gastritis.

Answer:

Acute Gastritis

Gastritis refers to inflammation of the stomach.

Acute Gastritis:

Acute gastritis is usually erosive and hemorrhagic.

Acute Gastritis Causes:

Acute Gastritis Clinical Features:

Acute Gastritis Treatment:

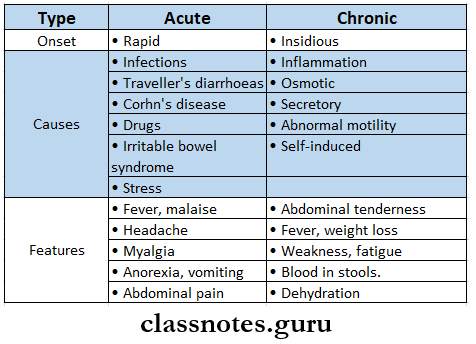

Question 6. Diarrhea.

Answer:

Diarrhea

It refers to frequent loose stools i.e., more than 3 loose stools in a day.

Diarrhea Types:

Diarrhea Causes:

Diarrhea Clinical Features:

Diarrhea Treatment:

Digestive System Diseases Short Answer Questions

Question 7. Constipation.

Answer:

Constipation

Constipation refers to bowel movements that are infrequent or hard to pass.

Constipation Causes:

Constipation Clinical Feature:

Constipation Treatment:

Constipation Prevention:

Constipation Complication:

Question 8. Oesophageal varices.

Answer:

Oesophageal Varices

Oesophageal varices are extremely dilated submucosal veins in the lower third of the esophagus.

Oesophageal Varices Causes:

Oesophageal Varices Symptoms:

short note on gastrointestinal diseases

Question 9. Hypersplenism.

Answer:

Hypersplenism

Hypersplenism is a clinical condition in which the spleen removes excessive quantities of erythrocytes, granulocytes, and platelets from circulation.

Hypersplenism Clinical Features:

Hypersplenism Diagnosis:

Hypersplenism Treatment:

Question 1. Causes of gum bleeding

Answer:

Causes Of Gum Bleeding

Question 2. Stomatitis.

Answer:

Stomatitis

Stomatitis is the inflammation of the mouth.

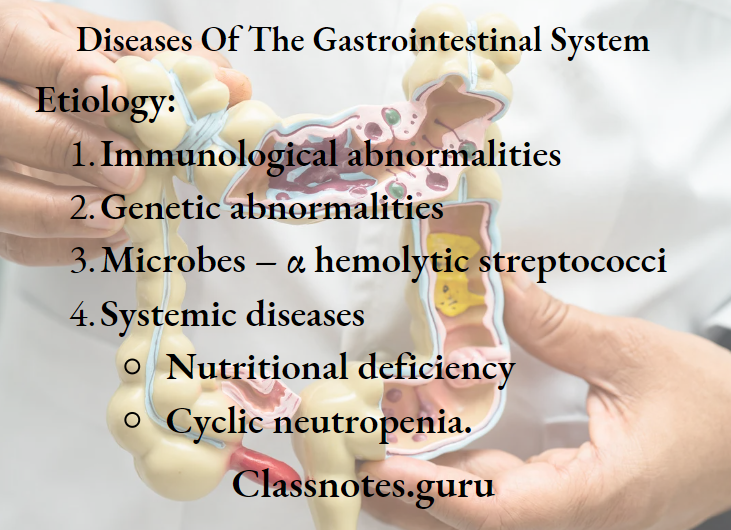

Etiology:

Read And Learn More: General Medicine Question and Answers

Stomatitis Treatment:

Gastrointestinal diseases short Q&A

Question 3. Melaena.

Answer:

Melaena

Melaena Causes:

Melaena Diagnosis:

Question 4. Melaena.

Answer:

Melaena

Dietary fiber can be defined as these parts of food that are not digested by human enzymes.

High Fibre Diet Significance:

Question 5. Ulcerative colitis.

Answer:

Ulcerative Colitis

Ulcerative colitis is an inflammatory disease affecting mainly the large intestine.

Ulcerative Colitis Causes:

Ulcerative Colitis Clinical Features:

Ulcerative Colitis Treatment:

Gastrointestinal system disorders short questions and answers

Question 6. Intestinal nematodes.

Answer:

Intestinal Nematodes

Question 7. H2 antagonists.

Answer:

H2 Antagonists

H2 antagonists competitively inhibit the action of histamine on H2 receptors.

H2 Antagonists Use:

Question 8. Leukoplakia.

Answer:

Leukoplakia Definition:

It is a whitish patch or plaque that cannot be characterized clinically or pathologically, as any other disease and which is not associated with any other physical or chemical causative agent except the use of tobacco.

Leukoplakia Clinical Features:

Question 9. Oral ulcers.

Answer:

Oral ulcers

Oral ulcers are a common disease characterized by the development of painful, recurrent, solitary ulceration of the oral mucosa.

Etiology:

Oral Ulcers Types:

Oral ulcer Treatment:

Common GI diseases viva questions

Question 10. Complications of peptic ulcers.

Answer:

Complications Of Peptic Ulcers are

Question 11. Barium swallow.

Answer:

Barium Swallow

Barium swallow is used to study the gastrointestinal tract

Barium Swallow Us Visualizelise a break in the gut mucosa.

Question 12. Gastritis.

Answer:

Gastritis

It refers to inflammation of the stomach

Gastritis Types:

Gastritis Causes:

Digestive system diseases questions with answers

Question 13. Diarrhea.

Answer:

Diarrhea

Diarrhea refers to frequent loose stools i.e., more than 3 loose stools in a day.

Question 14. Amoebiasis.

Answer:

Amoebiasis

A disease caused by entamoeba histolytica is called amoebiasis.

Amoebiasis Types:

Amoebiasis Clinical Features:

Amoebiasis Management:

Question 15. Causes of upper gastrointestinal bleeding.

Answer:

Causes Of Upper Gastrointestinal Bleeding

Digestive system diseases questions with answers

Question 16. Lactose intolerance.

Answer:

Lactose Intolerance

Lactose intolerance occurs due to a deficiency of the enzyme lactase.

Lactose Intolerance Types:

Lactose Intolerance Clinical Features:

VIVA Voce