Share Capital, Issue And Allotment Of Securities

Share capital in Companies Act, 2013

Share capital of a company can be classified as:

- nominal, authorized or registered capital;

- issued and subscribed capital;

- called up and uncalled capital.

Nominal, Authorised or Registered Capital in Companies Act, 2013

Such capital as is authorised by the memorandum of a company to be the maximum amount of share capital of the company.

Issued Capital in Companies Act, 2013

Such capital as the company issues from time to time for subscription. It is that part of the authorised or nominal capital which the company issues for the time being for public subscription and allotment. This is computed at the face or nominal value.

Subscribed Capital in Companies Act, 2013

Such part of the capital which is for the time being subscribed by the members of a company. It is that portion of the issued capital at face value which has been subscribed for or taken up by the subscribers of shares in the company. It is clear that the entire issued capital may or may not be subscribed.

Allotment Of Shares Under Companies Act 2013

Called-up Capital in Companies Act, 2013

Such part of the capital, which has been called for payment. It is that portion of the subscribed capital which has been called up or demanded on the shares by the company.

Paid-up Share Capital in Companies Act, 2013

Such aggregate amount of money credited as paid-up as is equivalent to the amount received as paid-up in respect of shares issued and also includes any amount credited as paid-up in respect of shares of the company, but does not include any other amount received in respect of such shares, by whatever name called.

Equity and Preference Share Capital (Discussed later) in Companies Act, 2013

“Equity Share Capital”, with reference to any company limited by shares, means all share capital which is not preference share capital; “preference share capital”, with reference to any company limited by shares, means that part of the issued share capital of the company which carries or would carry a preferential right with respect to-

- payment of dividend, either as a fixed amount or an amount calculated at a fixed rate, which may either be free of or subject to income-tax; and

- repayment, in the case of a winding up or repayment of capital, of the amount of the share capital paid-up or deemed to have been paid-up, whether or not, there is a preferential right to the payment of any fixed premium or premium on any fixed scale, specified in the memorandum or articles of the company;

Share in Companies Act, 2013

A share is defined as a share in the share capital of a company, including stock except where a distinction between stock and shares is expressed or implied.

Two classes of shares in Companies Act, 2013

The Companies Act, 2013 permits a company limited by shares to issue two classes of shares, namely equity share capital and preference share capital.

Preference share in Companies Act, 2013

A preference share or preference share capital is that part of share capital which carries a preferential right with respect to both dividend and capital.

Types of preference shares in Companies Act, 2013

Preference shares may be of various types, namely participating and non-participating, cumulative and non-cumulative shares, redeemable and irredeemable preference shares.

Equity share capital in Companies Act, 2013

Equity share capital means all share capital which is not preference share capital.

Prospectus in Companies Act, 2013

Prospectus has been defined as any document described or issued as a prospectus and includes a red-herring prospectus referred to in Section 32 or shelf prospectus referred to in Section 31 or any notice, circular, advertisement or other document inviting offers from the public for the subscription or purchase of any securities of a body corporate.

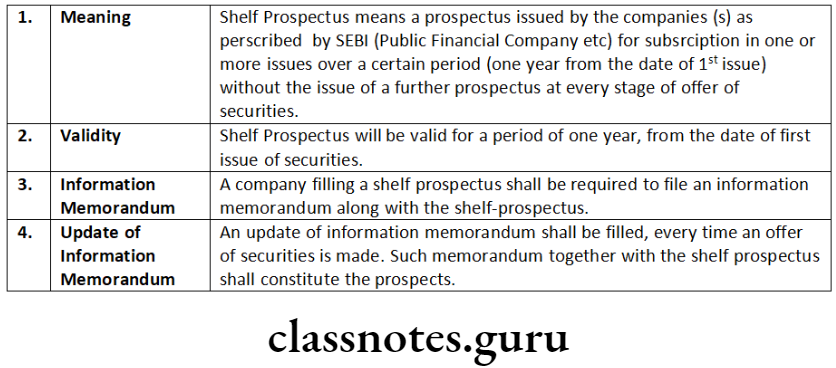

Shelf prospectus in Companies Act, 2013

Shelf prospectus means a prospectus in respect of which the securities or class of securities included therein are issued for subscription in one or more issues over a certain period without the issue of a further prospectus (Section 31).

Red-herring prospectus in Companies Act, 2013

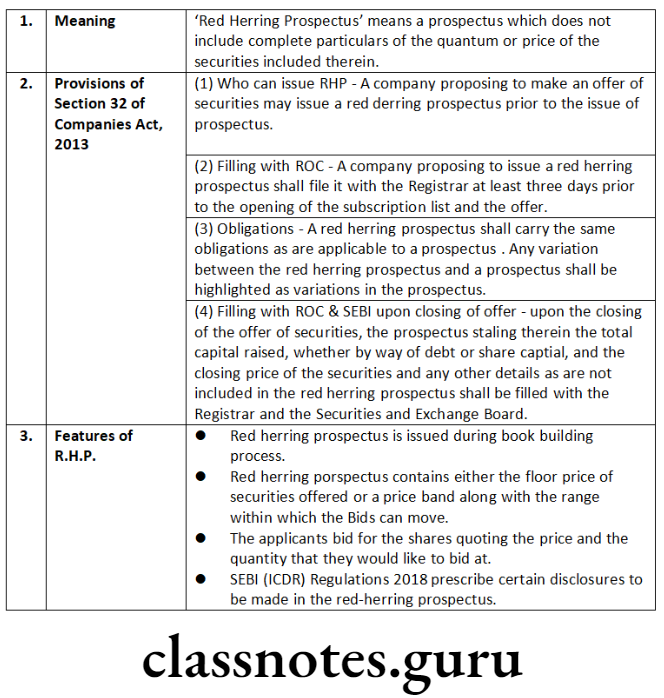

What is Red Herrring Prospectus of Company ?

The expression ‘red herring prospectus’ means a prospectus which does not include complete particulars of the quantum or price of the securities included therein.

- A company proposing to make an offer of securities may issue a red herring prospectus prior to the issue of a prospectus.

- A company proposing to issue a red herring prospectus shall file it with the Registrar at least 3 days prior to the opening of the subscription list and the offer.

- Upon the closing of the offer of securities, the prospectus shall be filed with the Registrar and SEBI.

- Any variation between the red herring prospectus and a prospectus shall be highlighted as variations in the prospectus.

- The prospectus shall state-

- the total capital raised, whether by way of debt or share capital;

- the closing price of the securities; and

- any other details as were not included in the red herring prospectus.

A red herring prospectus shall carry the same obligations as are applicable to a prospectus.

Procedure For Allotment Of Shares

What is Abridged prospectus in Companies Act, 2013?

- ‘Abridged prospectus’ means a memorandum containing such salient features of a prospectus as may be specified by SEBI by making regulations in this behalf [Section 2(1)].

- No form of application for the purchase of any of the securities of a company shall be issued unless such form is accompanied by an abridged prospectus.

- A copy of the prospectus shall, on a request being made by any person before the closing of the subscription list and the offer, be furnished to him.

- Where an application form is issued in connection with a bona fide invitation to a person to enter into an underwriting agreement with respect to such securities.

- Where an application form is issued in relation to securities which are not offered to the public.

The company shall be liable to a penalty of 50,00,000 for each default.

Offer for Sale in Companies Act, 2013

Public Offer includes or an offer for sale (OFS) of securities to the public by an existing shareholder, through issue of a prospectus.

- Under Section 25 of the Act where a company allots or agrees to allot any securities of the company with a view to all or any of those securities being offered for sale to the public, any document by which the offer for sale to the public is made shall, for all purposes, be deemed to be a prospectus issued by the company. In simple terms any document by which the offer or sale of shares or debentures to public is made shall for all purposes be treated as prospectus.

- The document “Offer for sale” is an invitation to the general public to purchase the shares of a company through an intermediary, such as an issuing house or a merchant bank.

- A company may allot or agree to allot any shares or debentures to an “Issue house” without there being any intention on the part of the company to make shares or debentures available directly to the public through issue of prospectus.

- The issue house in turn makes an “Offer for sale” to the public.

Private placement in Companies Act, 2013

“Private placement” means any offer of securities or invitation to subscribe securities to a select group of persons by a company (other than by way of public offer) through issue of a private placement offer letter and which satisfies the conditions specified in Section 42.

- Offer Letter to be in Form No. PAS-4.

- The offer shall not be made to more than 200 persons excluding QIBS and the employees of the company in a financial year under the scheme of ESOS only the person addressed in the application can apply.

- All monies payable on subscription shall not be paid by cash, but by DD or Cheque.

- If unable to allot within 60 days then repay the money in 15 days from the end of those 60 days and money shall be refunded with interest @12%p.a.

- Offer only to be made to those whose names are recorded by the company.

- The record shall be kept in Form No. PAS-5.

- A copy of record to be filed with registrar along with PAS-4 and with SEBI and the stock exchange within 30 days.

Amendment made by Companies (Amendment) Act, 2017

The Private Placement process is simplified by doing away with separate offer letter details to be kept by company and reducing number of filings to Registrar. In order to ensure that investor gets adequate information about the company which is making private placement, the disclosures made under Explanatory Statement referred to in Rule 13(2)(d) of Companies (Share Capital and Debenture) Rules, 2014, embodied in the Private Placement Application Form.

There would be ease in the private placement offer related documentation to enable quick access to funds.

Change in definition of private placement is proposed to cover all securities offer and invitations other than right.

There is condensed format of private placement offer letter and application form likely to be introduced

The Companies would be allowed to make offer of multiple security instruments simultaneously.

Restriction on utilization of subscription money before making actual allotment and additionally before filing the allotment return to the registrar. Since contract is concluding on allotment and return filing is just a post conclusion compliance, there may be difficulty in compliance.

The penalty provisions for raising of capital are pro-posed to be rationalized by linking it to the amount involved in the issue (twice the amount involved or 2 crores whichever is lower).

Period for filing return of return of allotment is pro-posed to be reduced to 15 days.

Companies (Prospectus and Allotment of Securities) Second Amendment Rules, 2018

- For the purposes of sub-section (2) and sub-section (3) of Section 42, a company shall not make an offer or invitation to subscribe to securities through private placement unless the proposal has been previously approved by the shareholders of the company, by a special resolution for each of the offers or invitations: Provided that in the explanatory statement annexed to the notice for shareholders’ approval, the following disclosure shall be made:-

- particulars of the offer including date of passing of Board resolution;

- kinds of securities offered and the price at which security is being offered;

- basis or justification for the price (including premium, if any) at which the offer or invitation is being made;

- name and address of valuer who performed valuation;

- amount which the company intends to raise by way of such securities;

- material terms of raising such securities, proposed time schedule, purposes or objects of offer, contribution being made by the promoters or directors either as part of the offer or separately in furtherance of objects; principle terms of assets charged as securities:

- Provided further that this sub-rule shall not apply in case of offer or invitation for non-convertible debentures, where the proposed amount to be raised through such offer or invitation does not exceed the limit as specified in clause (c) of sub-section (1) of Section 180 and in such cases relevant Board resolution under clause (c) of sub-section (3) of Section 179 would be adequate:

- Provided also that in case of offer or invitation for non-convertible debentures, where the proposed amount to be raised through such offer or invitation exceeds the limit as specified in clause (c) of sub-section (1) of Section 180, it shall be sufficient if the company passes a previous special resolution only once in a year for all the offers or invitations for such debentures during the year.

- For the purpose of sub-section (2) of Section 42, an offer or invitation to subscribe securities under private placement shall not be made to persons more than two hundred in the aggregate in a financial year: Provided that any offer or invitation made to qualified institutional buyers, or to employees of the company under a scheme of employees stock option as per provisions of clause (b) of sub-section (1) of Section 62 shall not be considered while calculating the limit of two hundred persons. Explanation.- For the purposes of this sub-rule, it is hereby clarified that the restrictions aforesaid would be reckoned individually for each kind of security that is equity share, preference share or debenture.

- A private placement offer cum application letter shall be in the form of an application in Form PAS-4 serially numbered and addressed specifically to the person to whom the offer is made and shall be sent to him, either in writing or in electronic mode, within thirty days of recording the name of such person pursuant to sub-section (3) of Section 42: Provided that no person other than the person so addressed in the private placement offer.cum application letter shall be allowed to apply through such application form and any application not conforming to this condition shall be treated as invalid.

- The company shall maintain a complete record of private placement offers in Form PAS-5.

Types Of Share Allotment

- The payment to be made for subscription to securities shall be made from the bank account of the person subscribing to such securities and the company shall keep the record of the bank account from where such payment for subscription has been received: Provided that monies payable on subscription to securities to be hold by joint holders shall be paid from the bank account of the person whose name appears first in the application: Provided further that the provisions of this sub-rule shall not apply in case of issue of shares for consideration other than cash.

- A return of allotment of securities under section 42 shall be filed with the Registrar within fifteen days of allotment in Form PAS-3 and with the fee as provided in the Companies (Registration Offices and Fees) Rules, 2014 along with a complete list of all the allottees containing- (i) the full name, address, Permanent Account Number and E-mail ID of such security holder; (ii) the class of security held; (iii) the date of allotment of security; (iv) the number of securities held, nominal value and amount paid on such securities; and particulars of consideration received if the securities were issued for consideration other than cash.

- The provisions of sub-rule (2) shall not be applicable to (a) non-banking financial companies which are registered with the Reserve Bank of India under the Reserve Bank of India Act, 1934 (2 of 1934); and (b) housing finance companies which are registered with the National Housing Bank under the National Housing Bank Act, 1987 (53 of 1987), if they are complying with regulations made by the Reserve Bank of India or the National Housing Bank in respect of offer or invitation to be issued on private placement basis: Provided that such companies shall comply with sub-rule (2) in case the Reserve Bank of India or the National Housing Bank have not specified similar regulations.

- A company shall issue private placement offer cum application letter only after the relevant special resolution or Board resolution has been filed in the Registry: Provided that private companies shall file with the Registry copy of the Board resolution or special resolution with respect to approval under clause (c) of sub-section (3) of Section 179.

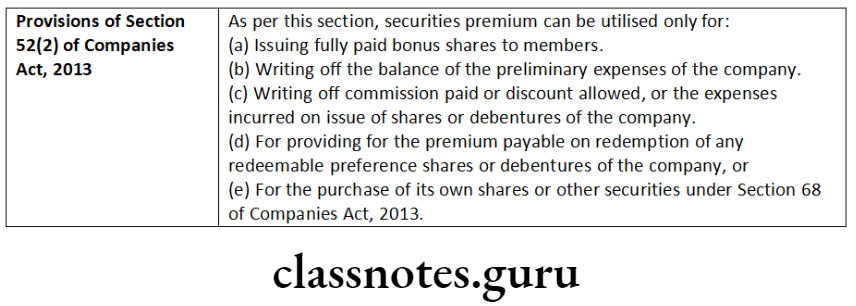

Issue of shares at premium [Section 52]

- Share premium to be transferred to share premium account.

- Utilisation of share premium account should be as prescribed in Section 52.

Issue of shares at discount [Section 53]

- Issue of shares at discount is prohibited except by issue of sweat equity shares.

Any share issued by the company at a discount shall be void.

Amendment made by Companies (Amendment) Act, 2017 in sub-section (2), for the words “discounted price”, the word “discount” shall be substituted;

“Allotment” of securities in Companies Act, 2013

“Allotment” of securities means the act of appropriation by the Board of Directors of the company out of the previously un-appropriated capital of a company of a certain number of securities to persons who have made applications for securities.

Share certificate in Companies Act, 2013

A share certificate is a certificate issued to the members by the company under its common seal specifying the number of shares held by him and the amount paid on each share.

- Pass board resolution.

- Certificate shall be issued in Form No. SH-1 and shall specify the name of person in whose favour the certificate is issued.

- Common Seal (if any).

- A certificate issued by the company is prima facie evidence of the title of the member to the shares specified therein.

- Every share certificate shall be issued under the common seal, (if any) of the company or in case company does not have a common seal, certificate be duly issued under signature of two directors or one director and a company secretary if company has appointed a company secretary.

Return of allotment in Companies Act, 2013

After allotment of securities, a return of allotment in the Form PAS-3 is required to be filed with Registrar of Companies within 30 days of allotment of securities.

Call

A call is a demand by the company upon its shareholders to pay the whole or part of the balance still due on each class of shares allotted, made at any time during the life of the company.

- Board of Directors to make call(s) on shares.

- Call(s) to be made bonafide in the interest of the company.

- Call(s) must be made on uniform basis.

- Notice of call(s).

- Time limitations for receiving the call money.

Split certificate

A split certificate means a separate certificate claimed by a shareholder for a portion of his holding.

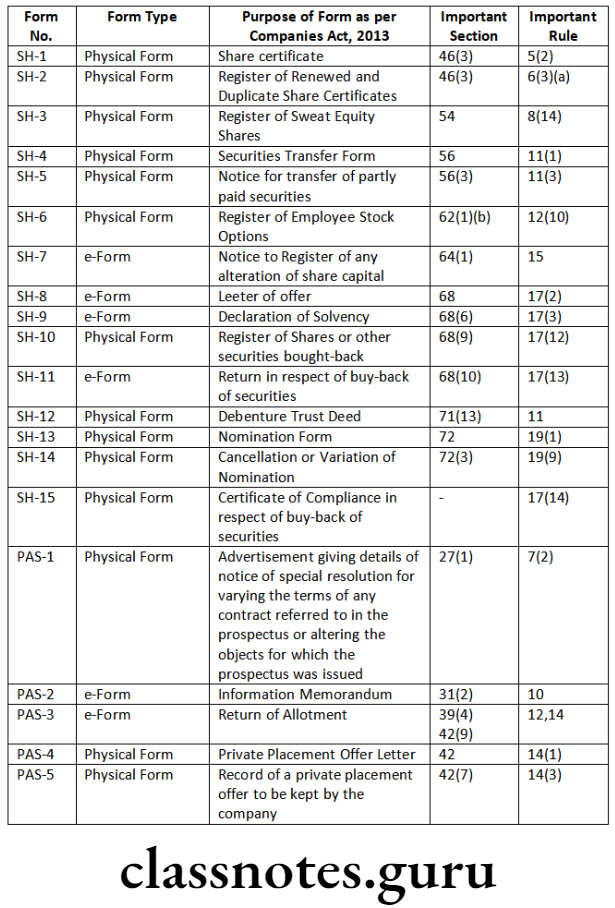

List Of Important Forms

Share Allotment Process In India

Allotment Of Shares Short Notes

Question 1. Write a note on the following:

Red-herring prospectus.

Answer:

Allotment Of Shares Under Companies Act, 2013 Distinguish Between

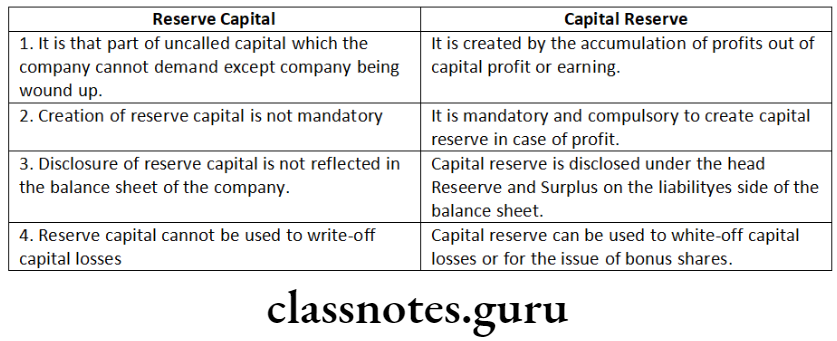

Question 1. Distinguish between the following:

‘Capital reserve’ and ‘reserve capital’.

Answer:

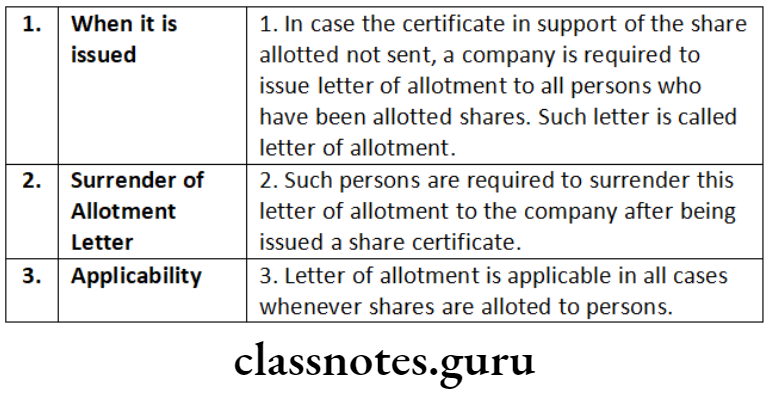

Question 2. Distinguish between the following:

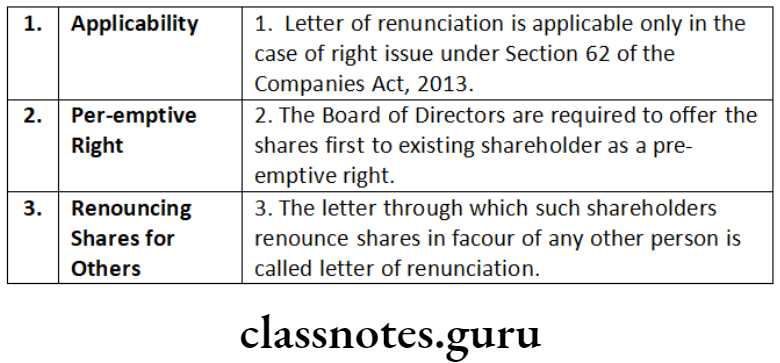

‘Letter of allotment’ and ‘letter of renunciation’.

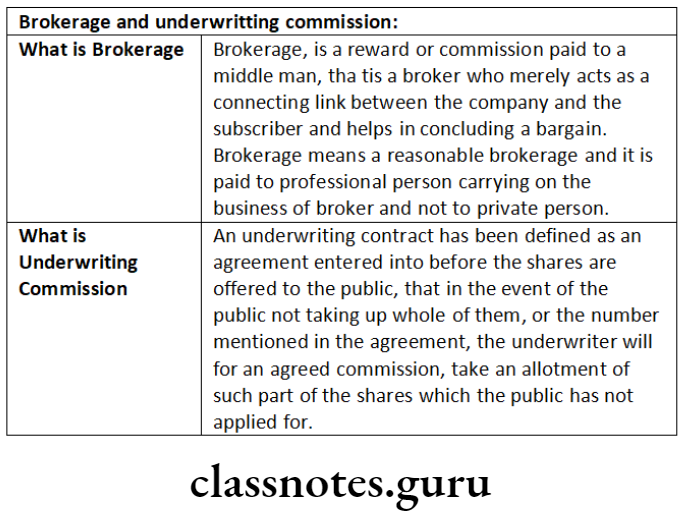

‘Brokerage’ and ‘underwriting commission’.

‘Reserve capital’ and ‘capital reserve’.

Answer:

Letter Of Allotment

Letter of Reunciation

Brokage and underwriting commission:

Question 3. Distinguish between the following:

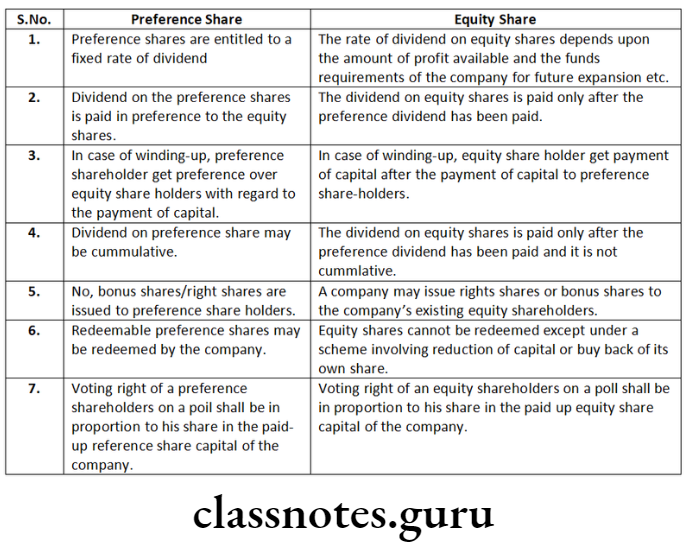

‘Preference shares’ and ‘equity shares’.

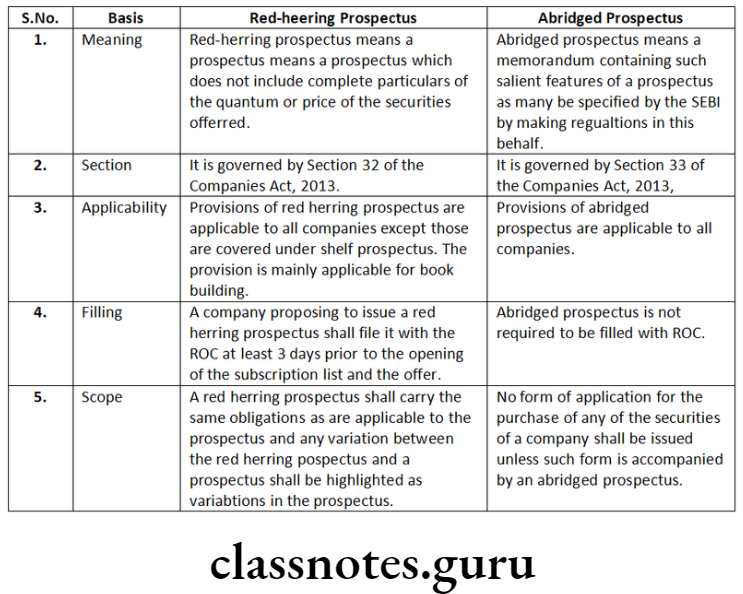

‘Red-herring prospectus’ and ‘abridged prospectus’.

Answer:

Following are the main points of distinction between Red-herring Prospectus & Abridged Prospectus:

Companies Act 2013 Share Allotment Rules

Allotment Of Shares Descriptive Questions

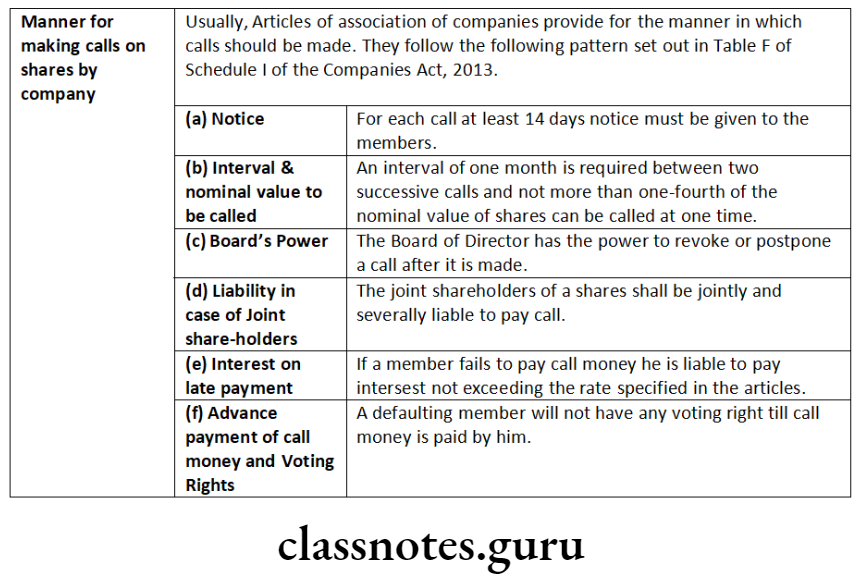

Question 1. Explain the manner in which calls on shares should be made by a company.

Answer:

Question 2. Explain the following:

Securities premium shall be utilised for certain specific purposes only.

Answer:

Question 3. Comment on the following:

Public companies can issue ‘shelf prospectus’.

Answer.

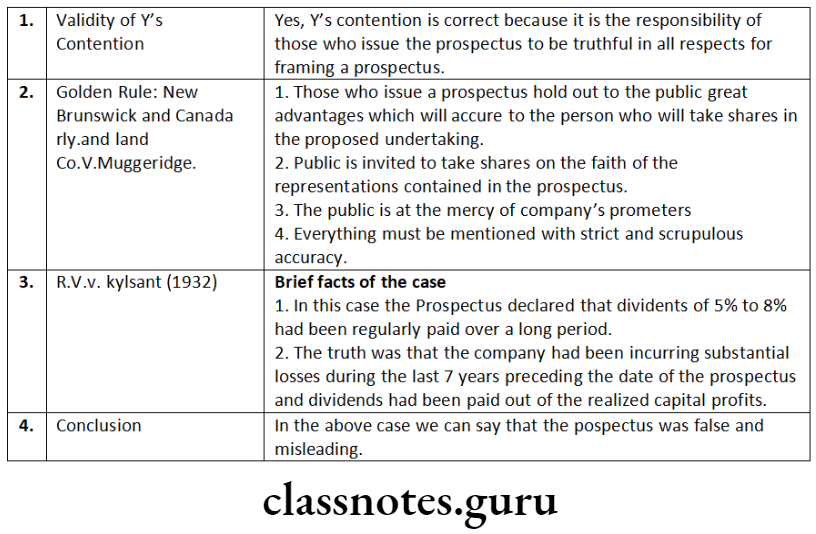

Question 4. Answer the following citing the relevant provisions of law/case law, if any:

A company has issued a prospectus to the public stating that the company has paid dividend regularly and the prospectus is silent relating to the sources of profits, i.e., whether trading profits or capital profits. The fact is that the company has incurred losses for all the last 5 years, but the dividend is paid out of realised capital profits (i.e., secret reserves). Y, a shareholder, claimed that the prospectus is false. Whether Y’s contention is correct? Discuss.

Answer:

Allotment Of Shares Under Companies Act 2013

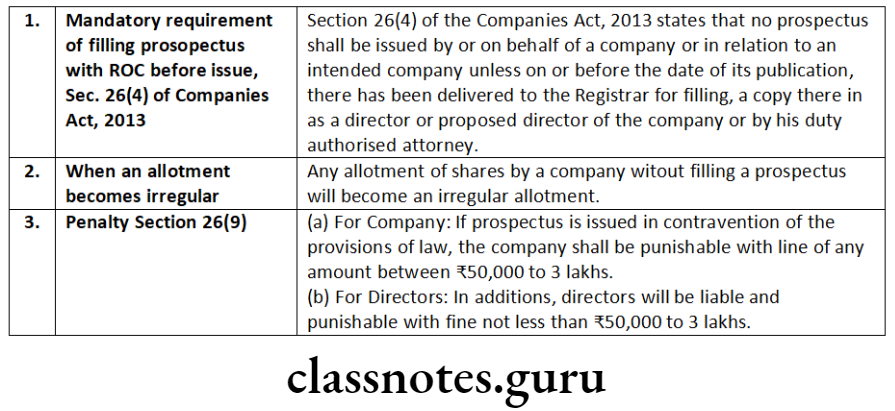

Question 5. Shortcut Ltd. has allotted shares to investors of the company without filing prospectus with the Registrar of Companies, Mumbai. Explain the remedies available to the investors in this regard.

Answer:

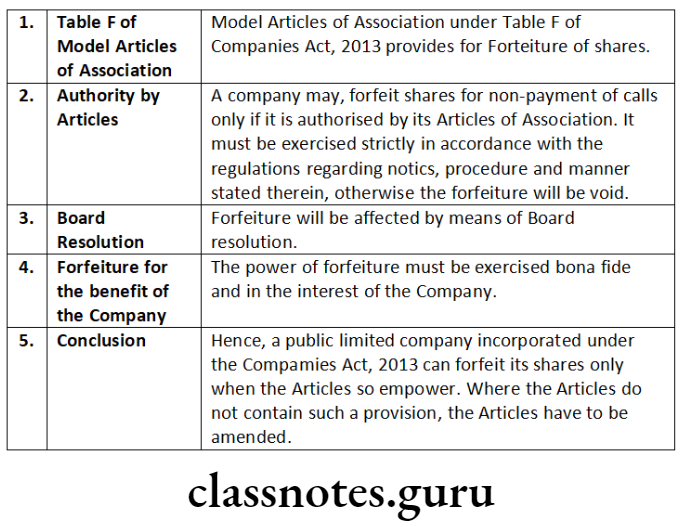

Question 6. Comment on the following:

A public limited company incorporated under the Companies Act, 2013 may amend its articles of association so as to confer upon it power to forfeit the shares of those members who have defaulted in the payment of calls made by the company.

Answer:

Question 7. “If a company does not receive minimum subscription, it should refund money received from applicants within such time as may be prescribed”. Explain the above statement with suitable comments.

Answer:

According to Section 39 of the Companies Act, 2013 allotment of any securities of a company offered to the public for subscription shall be made only when the amount stated in the prospectus as the minimum amount has been subscribed and the sums payable on application for the amount so stated have been paid to and received by the company by cheque or other

The amount payable on application on every security shall not be less than five per cent of the nominal amount of the security or such other percentage or amount, as may be specified by the Securities and Exchange Board of India (SEBI) by making regulations in this behalf.

Refund of money:

In cases where the stated minimum amount has not been subscribed and the sum payable on application is not received within a period of thirty days from the date of issue of the prospectus, or such other period as may be specified by SEBI, the amount received as above shall be returned.

The application money shall be repaid within a period of fifteen days from the closure of the issue and if any such money is not so repaid within such period, the directors of the company who are officers in default shall jointly and severally be liable to repay that money with interest at the rate of fifteen percent per annum. The application money to be refunded shall be credited only to the bank account from which the subscription was remitted.

Question 8. State the time limit within which certificate of securities as provided in Companies Act, 2013 to be issued in case of :

Any allotment of shares.

Any allotment of debentures.

What is the punishment in case of default committed in the above cases?

Answer:

Under Section 56(4) of the Companies Act, 2013, every company, unless prohibited by any provision of law or any order of any Court Tribunal or other authority must deliver the certificates of all securities allotted, transferred or transmitted.

- Within a period of two months from the date of incorporation, in the case of subscribers to the Memorandum and within a period of two months from the date of allotment in the case of any allotment of any of its shares;.

- Within a period of six months from the date of allotment in the case of any allotment of debenture

However, as per the proviso to sub Section 4 of Section 56. where the securities are dealt with in a depository, the company shall intimate the details of allotment of securities to depository immediately on allotment of such securities.

Where any default is made in complying with the above provisions, Section 56(6) states the company shall be punishable with fine which shall not be less than 25,000 but which may extend to ₹ 5 Lakh and every officer of the company who is in default shall be punishable with fine which shall not be less than 10,000 but which may extend to * 1,00,000.

Amendment made by Companies (Amendment) Act, 2020

“(6) Where any default is made in complying with the provisions of sub-sections (1) to (5), the company, and every officer of the company who is in default shall be liable to a penalty of fifty thousand rupees.

Allotment Of Shares Under Companies Act 2013

Question 9. Comment on the following:

Certain members of a company are allowed to offer for sale their shareholding in the company to the public, such offer document is deemed to be a prospectus issued by the company.

Answer:

- As per Section 28 of the Companies Act, 2013 permits certain members of a company, in consultation with Board of directors, to offer the whole or a part of their holdings of shares to the public. The document by which the offer of sale to the public is made shall, for all purposes, be deemed to be a prospectus issued by the company.

- Since public offer is not same as offer for sale. However many provisions relating to issue of prospectus does apply to such an offer, yet many provisions including requirement of minimum subscription does not apply to the same.

- All laws and rules made under this agreement as to the contents of the prospectus and as to liability in respect of misstatements in and omission from prospectus or otherwise relating to prospectus shall apply as if this offer document is a prospectus issued by the company.

- The section states that the members, whether individuals or bodies corporate or both, whose shares are proposed to be offered to the public, shall collectively authorize the company, whose share were offered for sale to the public, to take all actions in respect of offer of sale for and on their behalf and they shall reimburse the company all expenses incurred by it on this matter.

- Rule 8 of The Companies (Prospectus and Allotment of Securities) Rules, 2014 in this context state that the provisions of “Prospectus and Allotment of Securities” and rules made there under shall be applicable to an offer of sale referred to in Section 28 of Companies Act, 2013 except for the following, namely:-

- the provisions relating to minimum subscription;

- the provisions for minimum application value;

- the provisions requiring any statement to be made by the Board of directors in respect of the utilization of money; and

- any other provision or information which cannot be compiled or gathered by the offer or, with detailed justifications for not being able to comply with such provisions.

- Another rules provide that such offer document or prospectus issued under the section shall disclose the name of the entity bearing the cost of making the offer for sale along with reasons.

Comment on the following:

Amount lying in the securities premium account belongs to the shareholders and can be used freely for their benefit.

Answer:

According to Section 52(2) of the Companies Act, 2013, the securities premium can be utilised only:

- towards the issue of unissued shares of the company to the members of the company as fully paid bonus shares;

- in writing off the preliminary expenses of the company;

- in writing off the expenses of, or the commission paid or discount allowed on, any issue of shares or debentures of the company;

- in providing for the premium payable on the redemption of any redeemable preference shares or of any debentures of the company; or

- for the purchase of its own shares or other securities under Section 68 of the Companies Act, 2013.

Hence, the amount available in the securities premium is restrictive in nature and can only be used for specified purposes.

Question 10. Santosh, CEO of the company, has advised the Board of directors of an unlisted company that in order to market the public issue and generate interest and awareness amongst the public a prospectus can be issued without giving details of number of shares and the issue price. Examine the correctness of the advice in light of the provisions of the Companies Act, 2013.

Answer:

Section 32 of the Companies Act, 2013, Red herring Prospectus means “a prospectus which does not include complete particulars of the quantum or price of the securities included therein.” In other words, a Red herring Prospectus is a prospectus, which does not include details of either price or number of securities being offered, or the amount of issue.

As per section 32(1) of the Companies Act, 2013, a company proposing to make an offer of securities may issue a Red herring Prospectus prior to the issue of a prospectus. Such company proposing to issue a Red herring Prospectus shall file it with the Registrar of Companies at least 3 days prior to the opening of the subscription list and the offer. Hence, the advice given by CEO Santosh is correct. Space to write important points for revision

Question 11. Provide a specimen of board resolution for preparation of annual report in abridged form for mailing to the members. Assume facts and figures for the purposes of mentioning in the resolution.

Answer:

The Board Resolution for preparation of Annual Report in abridged form “RESOLVED THAT pursuant to the provisions of second proviso of Section

136(1) of the Companies Act, 2013 and Rule 10 of the Companies (Accounts) Rules 2014, the Annual Report comprising of the Balance Sheet, Profit and Loss Account and other relevant documents to be attached to the financial statements in abridged form for the financial year ended 31st March… also, to be prepared, finalised and audited in the prescribed Form No. AOC-3 for sending to the members of the company.”

“RESOLVED FURTHER THAT the draft audited financial statement containing salient features of financial statements for the year ended 31st March, prepared in the prescribed Form No. AOC-3 as submitted to the meeting, be and are hereby approved and the same be authenticated by the directors of the company as required under Section 136 of the Companies Act, 2013 and be sent to the statutory auditors of the company for their report thereon and thereafter be sent to the members of the company for adoption at the ensuing annual general meeting of the company.”

Allotment Of Shares Practical Questions

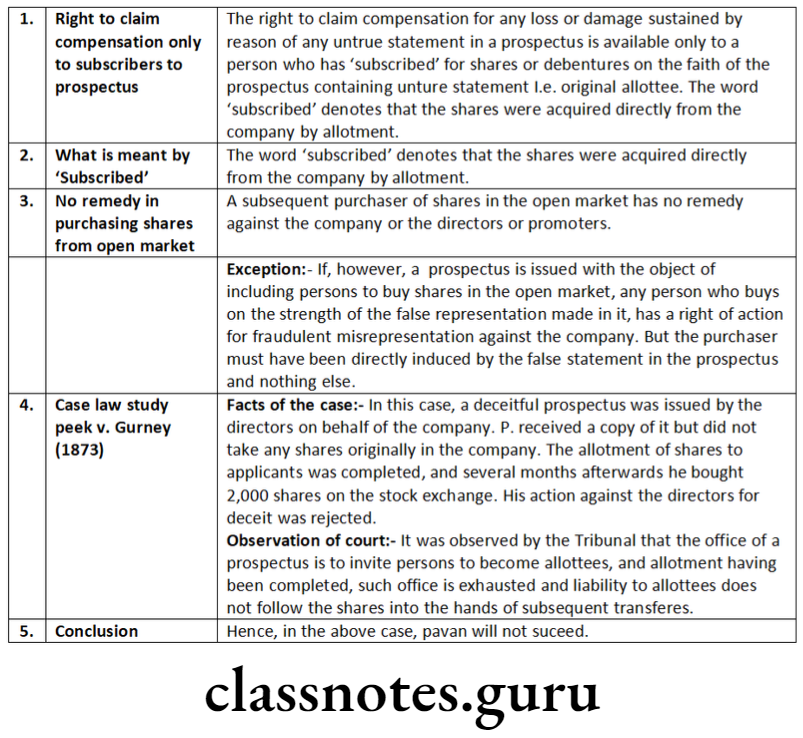

Question 1. Answer the following citing the relevant provisions of law/case law, if any:

A deceitful prospectus was issued by the directors on behalf of the company. Pavan received a copy of it, but did not take any shares in the company. The allotment of shares to applicants was completed. Several months later, Pavan bought 2,000 shares of that company from the stock market. He proceeded with a suit against the directors for issuing deceitful prospectus. Will he succeed?

Answer:

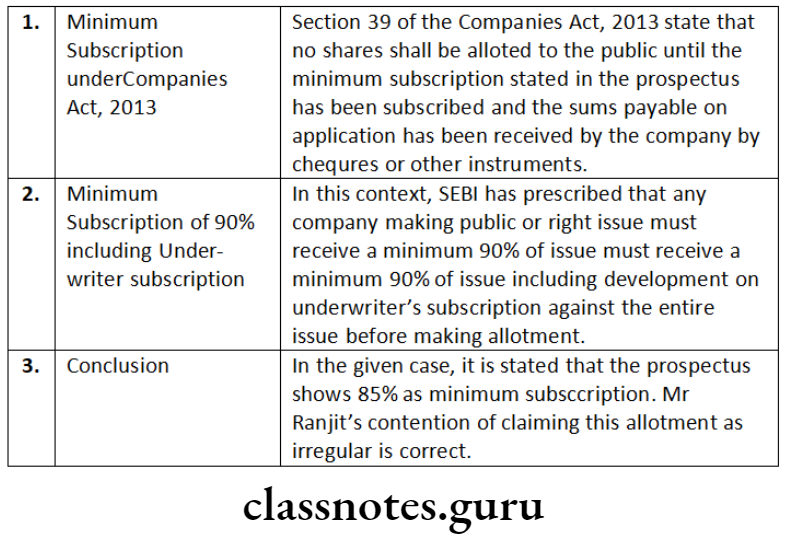

Question 2. On receipt of 85% of the minimum subscription stated in the prospectus, Little Stars Ltd. allotted 200 shares to Ranjit and the money was deposited in a scheduled bank. Later on, it was revealed that 40% of the amount withdrawn was for acquisition of fixed assets for the company. Ranjit, knowing these facts, refused to accept the allotment contending that the allotment was irregular under the provisions of the Companies Act, 2013. As an expert on company law advise Ranjit.

Answer:

Procedure For Allotment Of Shares

Question 3. KBC Ltd. filed Form PAS-3 with the Registrar of Companies (ROC). Mumbai as required under the Companies Act, 2013 with late fees as it was not filed within the due date. The ROC on examining the e-form, found it necessary to call for further information. He gave a notice to the company directing it to furnish the required information within the prescribed time. The company furnished only a part of the required information. Discuss the consequences of the action in such circumstances under the provisions of the Companies Act, 2013.

Answer:

Rule 10(2) of the Companies (the Registration offices and Fees) Rules, 2014 provides that, where the Registrar on examining any application or e-form or document finds it necessary to call for further information or finds such application or e-form or document to be defective or incomplete in any respect, he shall give intimation of such information called for or defect or incompleteness, by e-mail on the last intimated e-mail address of the person or the company, which has filed such application or e-form or document, directing him or it to furnish such information or to rectify such defects or incompleteness or to re-submit such application or e-Form or document within the prescribed time.

Rule 10(4) of the Companies (the Registration offices and Fees) Rules, 2014 provides that, in case where such further information called for has not been provided or has been furnished partially or defects or incompleteness has not been rectified or has been rectified partially or has not been rectified as required within the stipulated period, the Registrar shall either reject or treat the application or e-form or document, as the case may be, as invalid in the electronic record, and shall inform the person or the company.

Accordingly, where any document is recorded as invalid by the Registrar, the document may be rectified by the person or company by only fresh filing along with payment of fee and additional fee, as applicable at the time of fresh filing, without prejudice to any other liability under the Companies Act.