Transfer And Transmission Of Securities

Transfer of securities Under Companies Act, 2013

As per Section 56(1) of the Companies Act, 2013, a company, whether public or private shall not register transfer of securities of the company unless a proper instrument of transfer duly stamped, dated and executed by or on behalf of the transferor and transferee has been delivered to the company along with the certificate relating to the securities or if no such certificate is in existence, along with the related letter of allotment of securities.

- Transfer takes place by a voluntary act of the transferor.

- An instrument of transfer is required in case of transfer.

- Transfer is a normal course of transferring property.

- Transfer of securities is generally made for some consideration.

- Stamp duty is payable on transfer of securities by a holder of securities.

Depository system Under Companies Act, 2013

Depository system reduces the cost of issue and transfer of securities by eliminating stamp duty, it entitles the transferee to all the rights associated with the securities immediately on settlement of purchase transaction.

Transfer And Transmission Of Securities

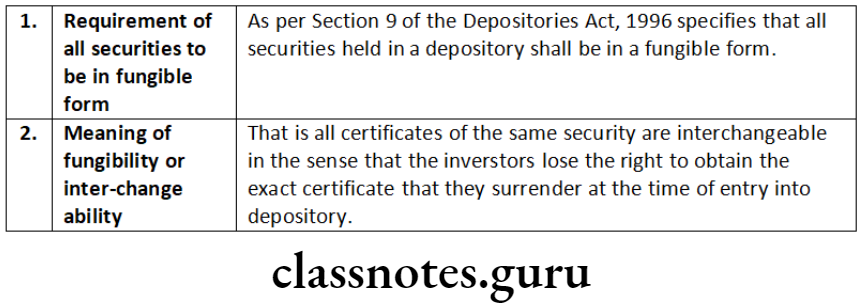

Fungibility Under Companies Act, 2013

A good or asset’s interchangeability with other individual goods/assets of the same type. Assets possessing this property simplify the exchange/trade process, as interchangeability assumes that everyone values all goods of that class as the same.

Stamp duty Under Companies Act, 2013

The tax placed on legal documents usually in the transfer of assets or property. The transfer of documents in locations where this law exists, is only legally enforceable once they are stamped, which shows the amount of tax paid.

Transmission of Securities Under Companies Act, 2013

- Transmission of Securities refers to those cases where a person acquires an interest in securities by operation of any provision of law, such as by right of inheritance or succession or by reason of the insolvency or lunacy of the holder of securities or by purchase in a Court-sale.

- Transmission is the result of the operation of law.

- No instrument of transfer is required in case of transmission.

- Transmission takes place on death or insolvency of a holder of securities.

- Transmission of securities is generally made without any consideration.

- No stamp duty is payable on transmission of securities.

Lien on shares Under Companies Act, 2013

Lien on shares is the right to retain possession of a thing until a claim is satisfied. In the case of a company lien on a share means that the member would not be permitted to transfer his shares unless he pays his debt to the company.

Blank Transfer Under Companies Act, 2013

When a shareholder signs the transfer form without filling in the name of the transferee and the date of execution and hands it over with the share certificate to the transferee thereby enabling the transferee to deal with the shares, he is said to have made a transfer ‘in blank’ or a ‘blank transfer’.

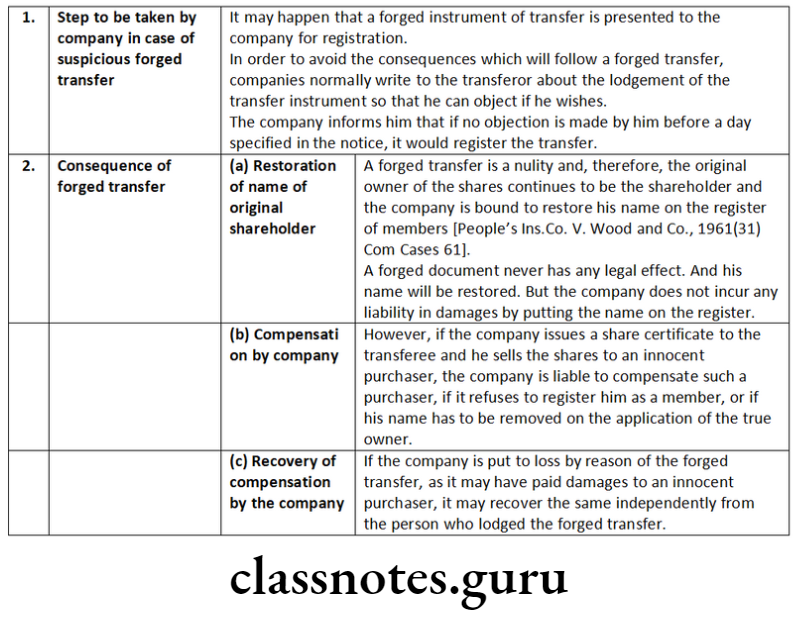

Forged Transfer Under Companies Act, 2013

- A forged transfer is a nullity and therefore, the original owner of the shares continues to be the shareholder and the company is bound to restore his name on the register of members [People’s Ins. Co. v. Wood and Co., 1961 (31) Com Cases 61].

- A forged document never has any legal effect. It can never move ownership from one person to another, however, genuine it may appear.

Dematerialisation of Shares Under Companies Act, 2013

- Dematerialisation of securities means holding of securities in electronic form in lieu of physical certificates. Dematerialisation is comparable to keeping your money in a bank account.

- In demat form, physical share certificates are replaced by electronic book entries; purchase of shares are reflected as credits in demat account and sales are reflected as debits.

- The risk associated with physical share certificates such as loss, replacement, theft, damage, etc. are overcome in the share certificates held in Dematerialisation form which are totally risk free.

Rematerialisation of Securities Under Companies Act, 2013

Rematerialisation is conversion of electronic securities into physical certificates of such securities. This can be done in the following manner:

- Beneficial owner sends request to DP.

- DP intimates Depository (NSDL or CDSL) of such request electronically.

- Depository confirms rematerialisation request to the company’s Share Transfer Agents.

- Share Transfer Agent updates accounts, prints certificates and confirms the Depository.

- Depository updates accounts and downloads the details to the DP.

- Share Transfer Agent dispatches certificates to holder thereof.

- The DP also sends intimation about rematerialisation to its client.

Transmission Of Shares Companies Act 2013

Transfer And Transmission Of Securities Short Notes

Write a note on the following:

Fungibility

Answer:

Write a note on the following:

A forged transfer of shares is a nullity.

Answer:

Transfer And Transmission Of Securities Distinguish Between

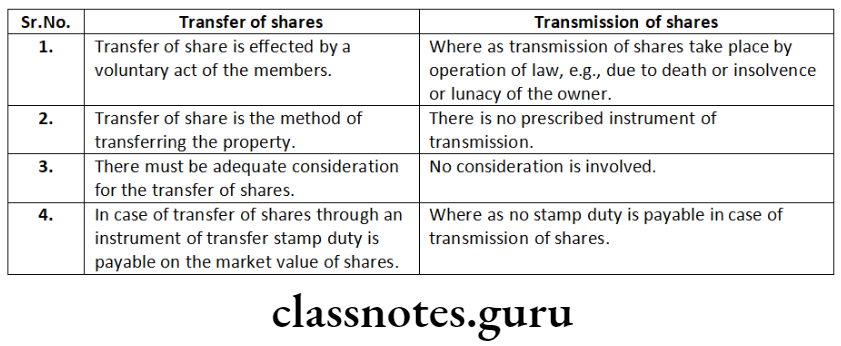

Distinguish between the following:

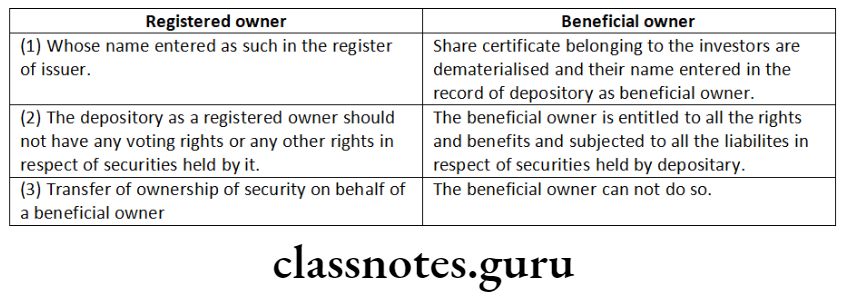

‘Beneficial owners under depository mode’ and ‘registered owners under depository mode’.

Answer:

Distinguish Between the following:

‘Transfer’ and ‘transmission’ of shares.

Answer:

Transfer And Transmission Of Securities Descriptive Questions

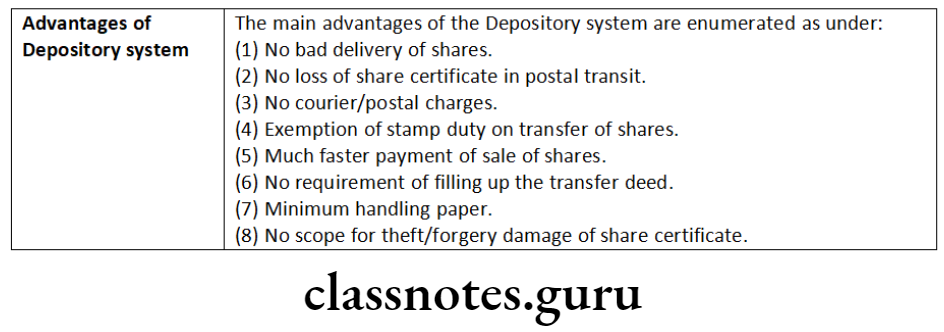

What are the benefits of the depository system of stock holding?

Answer:

Share Transfer Procedure India

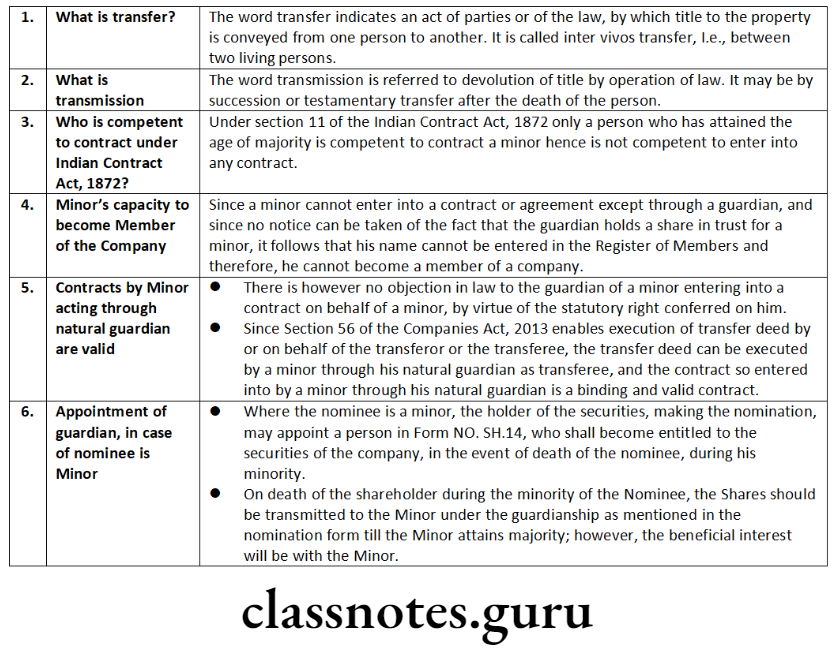

Examine the validity of transfer and transmission of shares in favour of a minor under the provisions of the Companies Act, 2013.

Answer:

Aniket has fraudulently sold his shares to two different transferees. Who will be entitled to the shares in priority?

Answer:

- Referring to Society General De Paris v. Jonet Walker and other (1886) it was held that where a shareholder has fraudulently sold his shares to two different transferees, the first purchaser will, on the ground of time alone, be entitled to the shares in priority to the second.

- Applying the case here, the first purchaser will be entitled to the shares in priority.

The Articles of Association of a company cannot impose a blanket ban prohibiting transfer of shares in favour of a minor. Such a restriction is unreasonable and not sustainable.

Answer:

- The Articles of Association of a company cannot impose a blanket ban prohibiting transfer of shares in favor of a minor, as such a restriction is unreasonable and not sustainable. Section 44 of the Companies Act, 2013 provides that shares in a company are movable property and are transferable in the manner provided by the Articles.

- The expression “in the manner provided by the articles of association the company” can only be interpreted to mean the procedure to be opted for transfer and impose restrictions, which are meaningful and reasonable.. In case, the restriction imposed on transfer to a minor is accepted, it would mean that the shares of a deceased member can never be inherited by the legal heir who might be a minor.

- This would lead to a highly unjust situation and cannot be accepted as tenable.

- Accordingly, if the shares can be transmitted in favour of a minor, there is no reason why the shares which are fully paid -up and in respect of which no financial liability devolves on the minor are to be held as not transferable merely because of the ban imposed in the Articles of Association [Saroj v. Britannia Industries Ltd., Appeal No.5/80 decided 14.12.81 by CLB).

Transfer And Transmission Of Securities Practical Questions

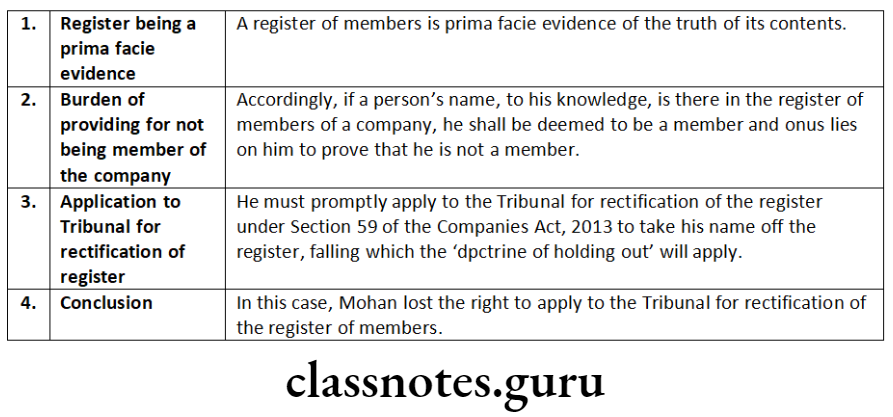

Mohan applied for 4,000 shares in a company but no allotment was made to him. Subsequently, 4,000 shares were transferred to him without his request and his name was entered in the register of members. Mohan stood by and allowed his name to remain in the register of members. Subsequently, the company went into liquidation and he was held liable as a contributory. Now, Mohan wants to apply to the Tribunal for rectification of the register of members. Can he do so? Explain.

Answer:

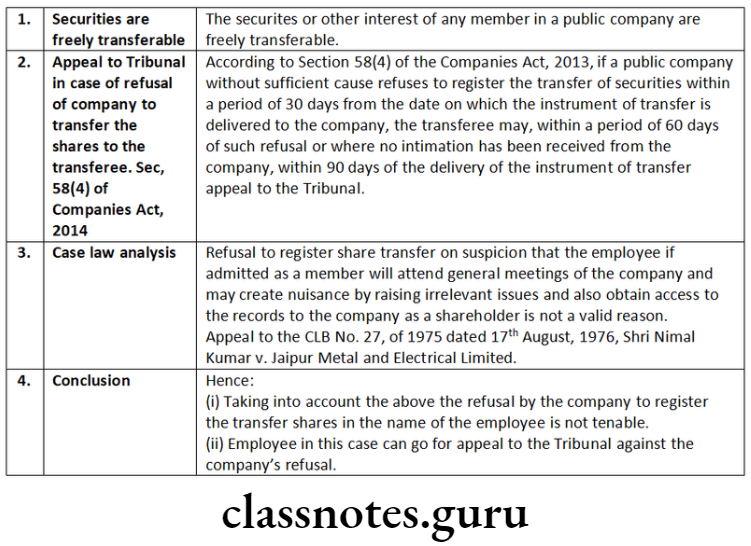

An employee of a company purchased certain shares of his company through a member of a stock exchange and lodged with the company an application for transfer of shares in his (employee’s) name. The company refused to execute the transfer on the suspicion that the employee, if admitted as a member of the company, will create nuisance in general meetings and seek access to the records of the company. Decide giving reasons –

- Whether the company’s contention shall be tenable; and

- What is the remedy available to the employee in the given case?

Answer:

P Realtors Ltd., A Construction Ltd. and five other individuals have incorporated XYZ Builders Ltd. to construct a commercial complex. P Realtors Ltd. and A Construction Ltd. have executed an agreement according to which none of these companies can sell their shares in the new company before completion of construction of the commercial complex. Due to financial crunch, P Realtors decides to sell its shares in XYZ Builders Ltd. to PQR Builders Ltd. Can A Construction Ltd. restrain the transfer of shares before completion of construction of the commercial complex? (3 marks)

Answer:

With reference to the definition of a private company as provided under Section 2 (68) of the Companies Act, 2013, a private company is only authorised to exercise restriction by its Articles on the transfer of shares of the company held by its members.

In other words, in public companies the shares are freely transferable and no restrictions can be imposed on the members right regarding transfer of their shares.

In the above case the agreement between P Realtors Ltd. and A Construction Ltd restricting their rights to transfer their shares till completion of the project will be held subservient to the provision contained in the Companies Act, 2013, which provide for free transferability of shares.

Hence, A Construction Ltd. will not be able to restrain P Realtors from transferring their shares in XYZ Builders Ltd. to PQR Builders Ltd.

Santosh Kumar, an employee of a listed company purchased certain shares of his company through a member of a stock exchange and lodged with the company for transfer of shares in his (employee’s) name. The company refused to execute the transfer on the suspicion that the employee, if admitted as a member of the company, will create nuisance in general meetings and seek access to the records of the company. Decide giving reasons:

- Whether the company’s contention shall be tenable; and

- What is the remedy available to the employee in the given case?

Answer:

The securities or other interest of any member in a public company are freely transferable (it means, no restriction on transfer of share from one person to another person). Refusal to register share transfer on suspicion that the employee if admitted as a member will attend general meetings of the company and may create nuisance by raising irrelevant issues and also get access to the records to the company as a shareholder is not a valid reason.

Therefore, as per Section 58 (4) of the Companies Act, 2013, if a public company without sufficient cause refuses to register the transfer of securities within a period of 30 days from the date on which the instrument of transfer is delivered to the company, the transferee may, within period of 60 days of such refusal or where no intimation has been received from the company, within 90 days of the delivery of the instrument of transfer, can appeal to the Tribunal.

Therefore, taking into account the above:

- The refusal by the company to register the transfer shares in the name of the employee is not tenable.

- Employee in this case can go for appeal to the Tribunal against the company’s refusal.

Transfer And Transmission Of Securities Short Notes

Question 1. Write short notes on Rematerialisation of securities.

Answer:

Rematerialisation is conversion of electronic securities into physical certificates of such securities. This can be done in the following manner:

- Beneficial owner sends request to DP.

- DP intimates Depository (NSDL or CDSL) of such request electronically.

- Depository confirms rematerialisation request to the company’s Share Transfer Agents.

- Share Transfer Agent updates accounts, prints certificates and confirms the Depository.

- Depository updates accounts and downloads the details to the DP.

- Share Transfer Agent dispatches certificates to holder thereof.

- The DP also sends intimation about rematerialisation to its client.

Difference Between Transfer And Transmission

Question 2. Write short notes on Dematerialisation of securities.

Answer:

Dematerialisation of securities means holding of securities in electronic form in lieu of physical certificates. Dematerialisation is comparable to keeping your money in a bank account. In demat form, physical share certificates are replaced by electronic book entries; purchase of shares are reflected as credits in demat account and sales are reflected as debits.

The risk associated with physical share certificates such as loss, replacement, theft, damage, etc. are overcome in the share certificates held in Dematerialisation form which are totally risk free.

Transfer And Transmission Of Securities Descriptive Questions

Question 3. Enumerate the steps for transfer of dematerialised shares.

Answer:

Section 7 of the Depositories Act, 1996 lays down that every depository shall, on receipt of intimation from a participant, register the transfer of shares in the name of the transferee and where the beneficial owner or a transferee of any shares seeks to have custody of such shares, the depository shall inform the issuer accordingly.

The transfer deed and all other provisions stipulated in Section 56 of the Companies Act, 2013 shall not apply to the transfers affected within the depository mode.

No stamp duty is levied on transfer of securities held in demat form. Any number of securities can be transferred/ delivered with one delivery instruction. Therefore, the paperwork and signing of multiple transfer forms is done away with.

The procedure for sale of shares held in demat form is as under:

- Sale shall be made through a broker who is a member of National Stock Exchange;

- Shareholder, i.e., the beneficial owner (BO) will give delivery instruction through Delivery Instruction Slip (DIS) to depository participant (DP) to debit his account and credit the broker’s account. Such instruction should reach the DP’s office at least 24 hours before the pay-in, failing which, DP will accept the instruction only at the BO’s risk;

- The broker shall give instructions to his DP for delivery to clearing corporation of the concerned stock;

- exchange and receive payment from clearing corporation.

The broker shall make payment to the investor in physical form. The procedure for purchases of securities held in demat form is as under:

- broker will receive the securitias in his account on the payout day;

- broker will give instruction to is depository participant to debit his account and credit beneficial o vner’s account;

- BO will give ‘Receipt Instruction’ to DP for receiving credit by filling appropriate form. However, BO can give standing instruction for credit to his account that will obviate the need of giving Receipt Instruction every time.

Question 4. Enumerate the steps for hypothecation of dematerialised shares.

Answer:

A beneficial owner may, with the prior approval of the depository, pledge or hypothecate his shares held in a depository. Upon receipt of intimation from the beneficial owner about the pledge or hypothecation of his shares, the depository shall accordingly make entries in its records.

Such an entry in the records of a depository shall be evidence of a pledge or hypothecation [Section 12]. Both the pledger and pledgee must have a depository account. The procedure for pledge or hypothecation of shares held in demat form is as under:

- Investor shall submit the details of shares to be pledged to the DP in the prescribed format.

- DP shall verify the records and on being satisfied that the shares are available for pledge, make a note in the records and forward the application to the Depository for approval.

- Depository shall obtain confirmation from pledgee and record the pledge within 15 days of application.

- Depository shall send intimation to the DP of both the pledger and pledgee who will inform the pledger and pledgee respectively.

- The pledgee may invoke the pledge in accordance with the terms of pledge and on such invocation the name of pledgee is entered in the Register of Beneficial Owners by the Depository.

- During the period the pledge is in force, the DP shall not give effect to transfer of any security without the concurrence of the pledgee.

- On closure of the loan, the pledger shall request the DP to close the pledge. The pledgee, on getting payment, shall make a request for closure of pledge to his DP.

- For making hypothecation of shares held in demat form the above procedure is to be followed. However, before registering the hypothecatee as a beneficial owner, the Depository should obtain the consent from the hypothecator.

Sebi Rules For Transfer Of Shares

Question 5. How does investor avail the services of depositary.

Answer:

- In the case of existing securities:

- An investor before availing the services of a depository, shall enter into an agreement with the depository through a participant and then shall surrender security certificates to the issuer. The issuer on receipt of security certificate shall cancel them and substitute in its records the name of the depository as the registered owner in respect of that security and inform the depository accordingly. The depository shall thereafter enter the name of the investor in its records as beneficial owner.

- In the case of fresh issue:

- At the time of initial offer the investor would indicate his choice in the application form. If the investor opts to hold a security in the depository mode, the issuer shall intimate the concerned depository about the details of allotment of a security made in the favour of investors and records the depository as registered owner of the securities.

- On receipt of such information, the depository shall enter in its records the names of allottees as the beneficial owners. In such case a prior agreement by the investor with the depository as well as an agreement between the issuer company and depository may be necessary.

- In the case of exit from the depository:

- If a beneficial owner or a transferee of a security desires to take away a security from depository, he shall inform the depository of his intention. The depository in turn shall make appropriate entries in its records and inform the issuer. The issuer shall make arrangements for the issue of certificate of securities to the investor within 30 days of the receipt of intimation from the depository.

- In the case of transfer within the depository:

- The depository shall record all transfers of securities made among the beneficial owners on receipt of suitable intimation to the effect that a genuine purchase transaction has been settled.

- In the case of pledge:

- Before creation of any pledge or hypothecation in respect of a security, the beneficial owner is required to obtain prior approval of the depository and on creation of pledge or hypothecation; the beneficial owner shall give intimation of such pledge or hypothecation to the depository. The depository shall make appropriate entries in its records which will be admissible as evidence.

Transfer And Transmission Of Securities

Question 6. Describes the process of the company to be followed by on refusal to register the transfer of securities.

Answer:

Section 58 of the Companies Act, 2013, deals with process of the company to be followed by on refusal to register the transfer of securities.

- If a private company limited by shares refuses (whether in pursuance of any power of the company under its articles or otherwise), to register the transfer of, or the transmission of the right to any securities or interest of a member in the company, then the company shall send notice of the refusal to the transferor and the transferee or to the person giving intimation of such transmission, within a period of thirty days from the date on which the instrument of transfer, or the intimation of such transmission, was delivered to the company. Notice shall contain the reasons for refusal to register the transfer or transmission.

- The transferee may appeal to the Tribunal against the refusal within a period of thirty days from the date of receipt of the notice or in case no notice has been sent by the company, within a period of sixty days from the date on which the instrument of transfer or the intimation of transmission, was delivered to the company.[Section 58(3)]

- If a public company without sufficient cause refuses to register the transfer of securities within a period of thirty days from the date on which the instrument of transfer or the intimation of transmission, is delivered to the company, the transferee may, within a period of sixty days of such refusal or where no intimation has been received from the company, within ninety days of the delivery of the instrument of transfer or intimation of transmission, appeal to the Tribunal. .[Section 58(4)]

- The Tribunal, while dealing with an appeal may, after hearing the parties, either dismiss the appeal, or by order-

- direct that the transfer or transmission shall be registered by the company and the company shall comply with such order within a period of ten days of the receipt of the order; or

- direct rectification of the register and also direct the company to pay damages, if any, sustained by any party aggrieved.[Section 58(5)]

- If a person contravenes the order of the Tribunal he shall be punishable with imprisonment for a term not less than one year but may extend to three years and with fine not less than one lakh rupees which may extend to five lakh rupees.[Section 58(6)]