Negotiable Instruments Act 1881

Question 1. Negotiable Instruments

Answer:

- It is an “instrument which is transferable, by delivery, like cash and can also be sued upon by the person holding for the time being.

- As per Section 13(1) of the Act, “A negotiable instrument means a promissory note, bills of exchange, or cheque payable either to order or to bearer.”

Question 2. Conditions of Negotiability

Answer:

- It should be freely transferable.

- The defective title of the transferor affects the title of the person taking it for value and in good faith.

- The transferee can sue upon the instrument in his name.

Question 3. Negotiability Involves two Elements

Answer:

- Transferability free from equities.

- Transferability by delivery or endorsement.

Read and Learn More CMA Laws and Ethics Paper

Question 4. Effects of Negotiability

Answer:

The general principle of law says:

- “Nemo Dat Quad Non-Habet” therefore no one can pass a better title than he has.

- A negotiable instrument is an exception to the above rule.

- Thus, a bonafide transferee of the negotiable instrument without notice of any defect of title acquires a better title than that of the transferor.

Question 5. Characteristics

Answer:

- The holder is presumed to be the owner of the property contained therein.

- It is a written document.

- It should be signed.

- Payable to bearer or order.

- It is unconditional.

- It may be transferred by endorsement and delivery.

- The transferee obtains a good title.

These are freely transferable but can be transferred only till maturity and in the case of a cheque till it becomes stale (Therefore Three months from the date of issue)

Question 6. Classification

Answer:

- Bearer

- Order

- Inland

- Foreign

- Demand

- Time

- Ambiguous

- Inchoate or Incomplete.

Question 7. Promissory Note

Answer:

- As per Sec. 4 of the Act, A promissory note is, “an instrument in writing containing an unconditional undertaking signed by the maker to pay a certain sum of money only to or to the order of a certain person, or to the bearer of the instrument”.

Parties:

- A maker is the person making or executing it.

- Payee person to whom the note is payable.

- Holder person to whom it is endorsed.

- Endorser.

- Endorsee.

Question 8. Essentials of Promissory Note

Answer:

- It must be in writing.

- The promise to pay must be unconditional.

- The amount promised must be certain and a definite sum of money.

- The instrument must be signed by the maker.

- The person to whom the promise is made must be definite.

- It must contain an express promise or a clear undertaking to pay.

- Payment must be in the legal money of the country.

- It must be properly stamped as per the provisions of the Indian Stamp Act.

- The name of the place, member and date on which it is made must be contained in it.

- Should contain the sum payable which is certain and must not be capable of contingent additions or deletions.

Question 9. Bill of Exchange

Answer:

- As per Sec. 5 of the Act, A Bill of Exchange is, “an instrument in writing containing an unconditional order signed by a maker.

- Directing a certain person to pay a certain sum of money only to or to the order of a certain person or to the bearer of an instrument.”

Parties:

- Drawer: The party who draws a bill.

- Drawee: The party on whom such bill is drawn.

- Acceptor: The drawee of the bill who has signified his assent to the drawer’s order.

- Payee: The party to whom or to whose order, the amount of bill is payable.

- Endorser: The party who endorses the bill.

- Endorsee: The party to whom it is endorsed.

- Holder: Person entitled in his name to the possession of the bill and to receive or recover the amount due thereon from the parties.

- Drawee in Case of a Need: When in the bill, the person whose name is entered, in addition to the drawee, is to be resorted to in case of need.

- Acceptor for Honour: A person who offers better security for safeguarding the honour of the drawer or any endorser, accepts the bill.

Question 10. Essentials of Bill of Exchange

Answer:

- It must be in writing.

- There must be an order to pay.

- The order must be unconditional.

- The drawee must sign the instrument.

- The drawer, drawee and payee must be specified in the instrument.

- The sum must be certain.

- The medium of payment must be money and money only.

Question 11. Types of Bills

Answer:

- Inland bills: Bills drawn in India for any person.

- Foreign bills: Bills which are not inland. Foreign Bill is drawn in sets of three copies.

- Trade bills: Bills issued for trade settlements

- Accommodation bills: Also known as kite bills, these are used for mutual help.

- An accommodation bill is a bill which is drawn, accepted or endorsed without any consideration.

Question 12. Cheque

Answer:

- As per Sec. 6 of the Act, “Cheque is a special type of bill of exchange which is always –

- Drawn upon a specified bank and

- Payable on demand.

It also includes an electronic image of truncated cheque or cheque in an electronic form.”

- “A Cheque in the Electronic form” means a cheque which contains the exact mirror image of a paper cheque and is generated, written and signed in a secure system ensuring the minimum safety, and standards with the use of digital signatures and asymmetric cryptosystem.

- “A Truncated Cheque” means a cheque which is truncated during the clearing cycle, either by the clearing house or by the bank, preventing the further physical movement of the cheque.

- “Clearing House” refers to the clearing house managed or recognised by RBI.

- It is a kind of bill of exchange, thus must satisfy all requirements of a bill.

Note: No bill of exchange or hundi except a cheque can be made payable to the bearer on demand.

Parties: All are the same as that of B or E, except drawee who is a banker.

Question 13. Essentials of Cheque

Answer:

- It is always paid on demand.

- It is drawn on a specified banker.

- It does not require acceptance.

- It may be payable to the drawer himself or the bearer on demand.

- It is usually valid for 3 months.

- It can be drawn on a bank where the drawer has an account.

- No stamp is required.

- The banker is only liable to the drawer.

Question 14. Banker

Answer:

- The person doing the banking work.

- As per Sec. 5(b) of the Banking Regulation Act, 1949.

Banking refers to, “Accepting for lending or investment, of deposits of money from the public, repayable on demand or otherwise and withdrawable by cheque, draft or otherwise.”

Question 15. Customer

Answer: A person who has an account with them or who utilises the bank services

Question 16. Rights and Obligations of Banker

Answer:

- Honour customer’s cheques.

- Collect cheques and drafts on the customer’s behalf.

- Keep proper records of transactions with customers.

- Not to disclose customer’s account status with anyone, etc.

- Give reasonable notice to the customer before closing his account.

- Right, to claim incidental charges as per the rules of the bank.

Question 17. Liabilities of Banker

Answer:

- Liable to the customer to the extent of the amount of the account opened.

- Liable to honour customer’s cheques to the extent of the amount in his account.

- Liable to compensate the drawer for any loss or damage suffered if he fails to honour cheques without justification.

- Liable to maintain proper and accurate accounts of credits and debits.

- Liable to honour cheque presented in due course.

Question 18. Cases when the Banker must refuse Payment

Answer:

- Banker receives notice of customer’s insolvency or lunacy.

- When the customer countermands payment.

- If a legal order from the Court attaching or otherwise dealing with money in the banker’s hand is served on the banker.

- Banker receives notice of customer’s death.

- The customer gives notice to the banker to close the account.

- ” Customer gives notice of assignment of his credit balance.

Question 19. Cases when the Banker may refuse Payment

Answer:

- The cheque is undated.

- It is stale and, therefore not presented for payment within a reasonable period. (3 months)

- It is inchoate or not free from reasonable doubt.

- It is post-dated and presented before its ostensible period.

- If the customer’s funds in the banker’s hand are not properly applicable to the payment of the cheque drawn by the former. ,

- Where the cheque is presented at a branch other than the one where the customer has the account.

- It is not duly presented.

- It is mutilated.

- It is irregular or materially altered.

- The customer’s signature does not agree with his specimen signatures:

Question 20. Crossing of Cheque

Answer:

The cheque is either open or crossed.

Open Cheque: This can be presented by the payee to the paying banker and is paid over the counter.

Crossed Cheque: It is not paid over the counter but has to be collected through a banker.

- When two parallel lines are drawn on the upper left corner of the cheque, it is known as the crossing of the cheque.

- It is a direction to the paying banker that the cheque should be paid only to a banker or a specified banker.

- It is done as a measure of safety.

Question 21. Modes of Crossing

Answer:

- General Crossing:

- When two parallel lines are drawn nothing is specified in between them.

- The amount will be directly credited to the account of the payee.

- Payees cannot get money over the counter.

- It prevents the money from going into the wrong hands.

- Restrictive Crossing:

- When the words ‘A/c Payee’ are specified within the crossing. The cheque cannot be further negotiated.

- The collecting banker will be guilty of negligence if he credits the proceeds to an account other than that of the A/c payee. It does not affect the paying banker.

- Special Crossing:

- When the name of a particular bank is specified between the crossed lines.

- Amount can be collected only by the bank whose name is specified.

- Not – Negotiable Crossing:

- When the words ‘not – -negotiable’ are specified between the crossed lines.

- It enhances safety as it ensures protection from any misappropriation. ,

- As per Sec. 130,

- “A person taking a cheque crossed generally or specially bearing in either case, with the words ‘not – negotiable’ shall not have and shall not be capable of giving, a better title to the cheque than that which the person from whom he took it had.”

- It does not mean non – non-transferable.

- It protects the drawer or holder of a cheque who wants to transfer it against dishonesty or actual miscarriage in the course of transmission.

Question 22. Holder (Sec. 8)

Answer:

- A person must be named in the instrument.

- It implies a ‘dejure’ holder in law and not a ‘defactor’ holder.

- It alters the party’s liabilities.

- It renders the instrument

Question 23. Holder in Due Course (HDC) (Sec. 9)

Answer:

It means any person who obtains the instrument-

- Before maturity.

- For some consideration.

- In good faith.

Question 24. Privileges of HDC

Answer:

- An inchoate instrument, if properly stamped, is valid, if it subsequently comes into the hands of HDC.

- In the case of an inchoate instrument, HDC has a right to recover that much amount which is sufficiently covered by the stamp.

- The acceptor of a bill of exchange cannot plead against an HDC that the bill is drawn in a fictitious name.

- The person liable for an instrument cannot plead against HDC that the instrument has been lost or was obtained using fraud or unlawful means.

- No one can deny the original validity of the instrument.

- No one can deny against a HDC, the capacity of the payee to endorse.

- HDC can recover from all prior parties.

- No effect of conditional delivery.

Question 25. Bank Draft

Answer:

It is an order drawn by an office of a bank upon another office of the same bank.

It is different from a cheque in the following 3 ways:

- It cannot be easily counter-manned.

- It cannot be made payable to the bearer.

- It can be drawn only by one branch of the bank upon another branch.

Question 26. Material Alteration (Sec. 87)

Answer:

- Any alteration made in the instrument which causes it to speak a different language from what it originally intended or which changes the legal identity of the instrument in its terms or relation or parties thereto is a material alteration.

- It renders the instrument void.

- Persons taking the altered instrument after its alteration have no right to complain.

- However, as per Sec. 88, an acceptor or endorser remains bound by his acceptance or endorsement.

- Example Sum payable, interest rate, date of payment etc.

- The following cases do not result in material alteration:

- Alteration made with the consent of parties before issue.

- Crossing of the cheque.

- Adding words “on demand”.

- Correction of any mistake.

- Carrying out common intention of parties. ,

Question 27. Liability of Endorser (Sec. 35)

Answer:

- By accepting and delivering it before maturity, he undertakes the responsibility that on the presentment it shall be accepted and paid.

- If it is dishonour by the drawee, acceptor or maker, he will identify the holder or subsequent endorser who is compelled to pay, provided due notice of dishonour is received by him.

- However, he may make his liability conditional.

Question 28. Negotiation (Sec. 14)

Answer:

When a negotiable instrument is transferred to a person, to make the person the holder of the instrument, the instrument is said to be negotiated. It may be by

- Mere Delivery.

- Endorsement and Delivery.

Question 29. Assignment

Answer: It is a mode of transferring the instrument which requires a written document. Under this, the instrument is transferred like goods, by deed that is under a contract.

Question 30. Endorsement (Sec. 15)

Answer:

- It refers to “signing one’s name on the negotiable instrument to transfer it to another person.”

- if there is no space on the instrument, it may be made on a slip of paper attached to it known as “Allonge.”

- An endorser is the person to whom the instrument is endorsed.

- Endorsement therefore means writing something on the back of an instrument to transfer the rights, title and interest to some other person.

Question 31. Kinds of Endorsement

Answer:

- Blank or General

- Special or Full

- Restrictive

- Partial.

- Conditional or Qualified.

Question 32. Hundis

Answer:

- It is an instrument drawn in an oriental language i.e. local language.

- Known as a native bill of exchange.

- They were also called ‘Teep’

Question 33. Types of Hundis

Answer:

- Shah Jog Hundi

- Jokhmi Hundi

- Jawabee Hundi

- Nam Jog Hundi

- Darshani Hundi

- Miadi Hundi

- Dhani Jog Hundi

Negotiable Instruments Act 1881 Short Note Question And Answers

Question 1. Write Short Notes on Endorsement under Negotiable Instruments Act, 1881

Answer:

Endorsement:

Section 15 of the Negotiable Instrument Act states that when the maker or holder of a negotiable instrument signs the same, otherwise than as such maker, for negation on the back or face thereof or a slip of paper annexed thereto, or so signs for. the same purpose a stamped paper intended to be completed as a negotiable instrument he is said to endorse the same and is called the ‘endorsed.

- Hence, endorsement (endorsement) means writing of a person’s name (other than the maker) on the face or back of an instrument or on a slip of paper attached thereto for negotiation.

- The person signing the instrument is known as the endorser and the person in whose favour it is endorsed is known as the endorsee.

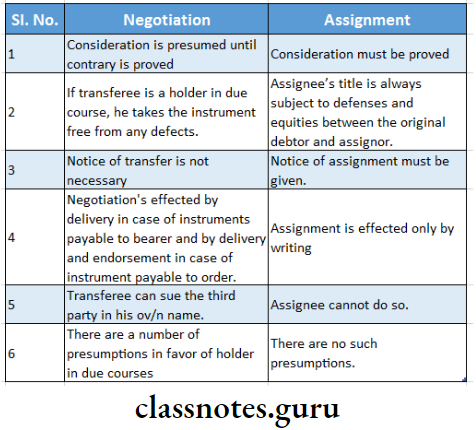

Question 2. How would you differentiate between negotiation and assignment?

Answer:

Differences Between Negotiation and Assignment are as under:

Negotiable Instruments Act 1881 Descriptive Question And Answers

Question 1. Comment on the following based on legal provisions: There are in total two parties to a promissory Note.

Answer:

The Statement Is False: There are five Parties to a promissory note viz.

- The Marker: The person who makes the Note promising to pay the amount stated therein.

- The payee: The person to whom the amount of the ‘note’ is payable

- The Holder: i.e. either the original payee or other persons in whose favour the ‘note’ has been endorsed.

- The endorser: The person who endorses the Note in favour of another person.

- The endorsee: The person in whose favour the “Note” is negotiated by endorsement.

Question 2. What is ‘Noting Comment on the following based on legal provisions: There are in total two parties to a Promissory Note.

Answer:

“Noting” means recording the fact of dishonour by Notary Public upon the instrument.“Noting” must contain the following :

- The fact of dishonour.

- Date of. dishonour.

- Reasons if any, assigned for dishonor.

- If the Instrument is not expressly dishonoured, reasons why the holder thinks so.

- Notary Charges.

Question 3. What will be the fate of a “Holder” of the negotiable instrument if he fails to give notice of dishonour to prior parties?

Answer:

If the Holder does not give notice of dishonour of the bill, instrument or cheque (except when the notice of dishonour is excused,) all the parties liable thereon are discharged of their liability.)

Question 4. State the circumstances under which the drawer of a cheque will be liable for an offence relating to dishonour of the cheque under the Negotiable Instrument Act, of 1881. Examine, whether there is an offence under the Negotiable Instrument Act,1881, if a Drawer not to a cheque after having issued the informs the drawee not to present the cheque as well as informs the bank to stop the payment.

Answer:

On dishonour of a cheque, the drawer is punishable with imprisonment for a term not exceeding two years or with a fine not exceeding twice the amount of a cheque or with both of the following conditions fulfilled:

- if the cheque is returned by the bank unpaid due to insufficiency of funds in the account of drawer.

- If the cheque was drawn to discharge a legally enforceable debt or other liability in whole or part of it.

- If the cheque has been presented to the bank within three months from the date on which it is drawn or within the period of its validity, whichever is earlier.

- If the payee or the holder in due course of the cheque has given a written notice demanding payment within 30 days from the drawer on receipt of information of dishonour of cheque from the bank.

- If the drawer has failed to make payment within 15 days of the receipt of the said notice. (Section 135) .

- If the payee or a holder in due course has made a complaint within one month of the cause of action arising under Section 138 (Section 142)

Case Laws: The Supreme Court held in Modi Cements Ltd. Vs. Kuchil Kumar Nandi held that once a cheque is issued by the drawer, a presumption

- under Section 139 follows (the cheque has been issued for the discharge of any debt or other liability) and merely because the drawer issued a notice thereafter to the drawee as to the bank for stoppage of payment, it will not preclude an action under Section 138.

- Hence, the drawer of the cheque will be liable for the offence under Section 138 for the dishonour of the cheque.

Question 5. A Bill of exchange dated 1st February 2014 payable two months after the date was presented to the maker for payment 10 days after maturity. What is the date of maturity? Explain concerning the relevant provisions of the Negotiable Instruments Act, 1881 whether the endorser and the maker will be discharged by reasons of such delay.

Answer:

- The due date of maturity is 4th April (3rd day after two months) Promissory notes, bills of exchange and cheques must be presented for payment at the due date of maturity to the maker, acceptor or drawee thereof respectively, by or on behalf of the holder.

- In default of such presentment, the other parties to the instrument (therefore parties other than the parties primarily liable) are not liable thereon to such holder.

- If authorized by agreement or usage, a presentation through the post office using a registered letter is sufficient (Section 64).

- So, the Endorser is discharged due to delayed presentment for payment, and the primary party (Maker of the instrument) continues to be liable.

Question 6. ‘A partial endorsement does not operate as a negotiation of the instrument’. Explain.

Answer:

- Section 56 provides that a negotiable instrument cannot be endorsed for a part of the amount appearing to be due on the instrument.

- In other words, a partial endorsement which transfers the right to receive only a part payment of the amount due on the instrument is invalid.

- Moreover, it would also interfere with the free circulation of negotiable instruments.

- It may be noted that an endorsement which purports to transfer the instrument to two or more endorsees separately and not jointly is also treated as a partial endorsement and hence would be invalid.

- Thus, where A holds a bill of $ 2,000 and endorses it in favour of B for $ 1,000 and in favour of C for the remaining $ 1,000, the endorsement is partial and invalid.

- Section 56, however further provides that where an instrument has been paid in part, a note to that effect may be endorsed on the instrument and it may then be negotiated for the balance. Thus, if in the above illustration, the acceptor has already paid $ 1,000 to A, the holder of the bill, A can then make an endorsement saying “Pay B or order $ 1,000 being the unpaid residue of the bill”. Such an endorsement would be valid.

Question 7. Amrut draws a cheque payable to ‘self or order1. Before he could encash the cheque, one of his creditors, Bihari approached him for payment. Amrut endorses the same cheque in Bihari’s favour. The. banker refuses payment to Bihari on account of insufficiency of funds in the account. Can Amrut be made liable to penalties for the dishonour of cheques due to insufficiency of funds in the account under Section 138?

Answer:

- Section 138 of the Negotiable Instrument Act, of 1881, creates statutory offence in the matter of dishonour of cheques on the ground of insufficiency of funds in the account maintained by a person with the banker.

- Section 138 of the Act can be said to be falling either in the acts which are not a criminal offence in a real sense but are acts in the public interest are prohibited under the penalty or those where although the proceeding may be in criminal form, they are only a summary mode of enforcing a civil right.

- Normally in criminal law existence of guilty intent is an essential ingredient of a crime.

- However, the Legislature can always create an offence of absolute liability or strict liability where ‘mens reel is not at all necessary.

- No, Amrut cannot be made liable to penalties for dishonour of cheques due to insufficiency of funds in the account since the cheque was not originally drawn payable to another person.

- A cheque drawn payable to self and later endorsed in favour of another person does not seem to fall within the purview of the provisions of Section 138 which lay down that the cheque should have been drawn for payment to another person.

Question 8. “A cheque is a specie of a bill of exchange with two additional qualifications.” Explain.

Answer:

- According to Sec. 6 of the Negotiable Instrument Act, “A cheque is a bill of exchange drawn on a specified banker and not expressed to be payable otherwise than on demand.”

- A cheque is a bill of exchange with the following two distinctive features which are additional qualifications viz:

- A cheque is always on a specified banker.

- A cheque is always payable on demand.

- Thus, a cheque is a bill of exchange drawn on a bank payable on demand. All cheques are bills of exchange, but all bills of exchange are not cheques. A cheque must have all the essential requisites of a bill of exchange.

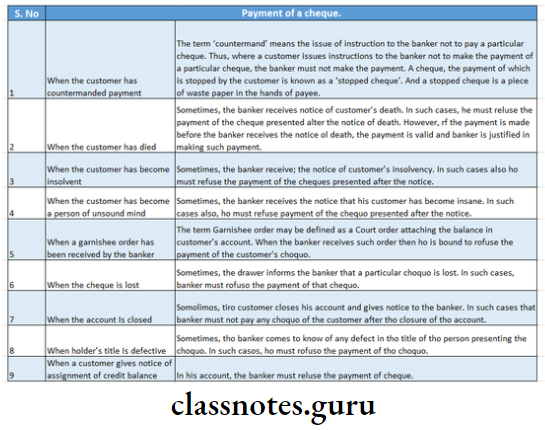

Question 9. State the circumstances under which a banker is bound to refuse the payment of a cheque.

Answer:

Circumstances when the banker must refuse the payment:

Following are the circumstances in which the banker is bound to refuse the payment of a cheque:

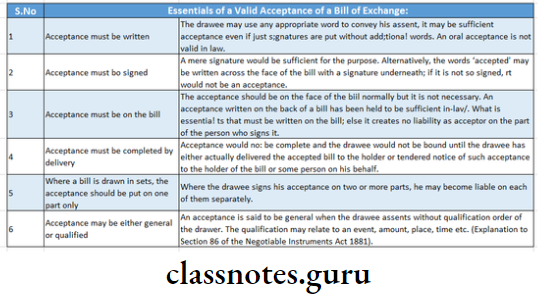

Question 10. What are the essential elements of a valid acceptance of a Bill of Exchange? An acceptor accepts a ‘Bill of Exchange’ but writes on it ’Accepted but payment will be made when goods delivered to me is sold. Decide the validity.

Answer:

Essentials of a Valid Acceptance of a Bill of Exchange:

The essentials of a valid acceptance are as follows:

Question 11. Anil draws a bill of exchange payable to himself on Sushil, who accepts the bill without consideration just to accommodate Anil. Anil transfers the bill to Ajay for good consideration. State the rights of Anil and Ajay. Would your answer be different if Anil transferred the bill to Ajay after maturity?

Answer: .

Section 43 of the Negotiable Instrument Act, of 1881 states the following:

- Liability of parties if there is no consideration – A negotiable instrument made, drawn, accepted, endorsed or transferred without consideration, or for a consideration which fails, creates no obligation of payment between the parties to the transaction.

- Rights. of the holder for consideration – but if any such party has transferred the instrument to a holder for consideration, such holder, and every subsequent holder deriving title from him, may recover the amount due on such instrument from the transferor for consideration or any prior party thereto.

- No right of accommodating party to recover from accommodating party – No party for whose accommodation a negotiable instrument has been made, drawn, accepted, endorsed can, if he has paid the amount thereof, recover thereon such amount from any person who became a party to such instrument for his accommodation.

- In the given case, Anil is not entitled to sue Sushil, since there is no consideration between Anil and Sushil and hence there is no obligation to pay.

- Again Ajay is entitled to sue Anil and Sushil since Ajay is a holder for consideration. Ajay is entitled to sue the transferor for consideration and every other party before him.

- According to Section 59, in the case of accommodation bills, a defect in the title of the transferor does not affect the title of the holder acquiring after maturity. Hence, even if Ajay has acquired the bill for. consideration after maturity, he is entitled to sue.

Question 12. Rahul draws a cheque payable to ‘sell or order’. Before he could encash the cheque, one of his creditors, Samrat approaches him for payment. Rahul endorses the same cheque in Samrat’s favour. The banker refuses payment to Samrat on account of insufficiency of funds in the account. Can Rahul be made liable to penalties for dishonour of cheques due to insufficiency of funds in the account under section 138 of the Negotiable Instruments Act, 1881?

Answer: .

- Section 138 of the Negotiable Instrument Act, of 1881, creates statutory offence in the matter of dishonour of cheques on the ground of insufficiency of funds in the account maintained by a person with the banker.

- Section 138 of the Act can be said to be falling either in the acts which are not a criminal offence in a real sense but are acts which in public interest are prohibited under the penalty or those where although the proceeding may be in criminal form, they are only a summary mode of enforcing a civil right.

- Normally in criminal law existence of guilty intent is an essential ingredient of a crime.

- Although, the Legislature can always create an offence of absolute liability or strict v/here ‘mens rea’ is not at all necessary.

- No, Rahul cannot be made liable to penalties for dishonour of cheques due to insufficiency of funds in the account since the cheque was not originally drawn payable to another person.

- A cheque drawn payable to self and later endorsed in favour of another person does not seem to fall within the purview of the provisions of Section 133 which lay down that the cheque should have been drawn for payment to another person.

Negotiable Instruments Act 1881 Practical Question And Answers

Question 1. ‘Anil’ drav/s a bill on ‘Susheel’ for INR 10,000 payable to his order. ‘Susheel’ accepts the bill but subsequently dishonours it by non-payment. ‘Anil’ sues ‘Susheel’ on the bill. ‘Susheel’ proves that it was accepted for value as INR 8,000 and as an accommodation to ‘Anil’ for INR 2,000. How much can ‘Anil’ recover from ‘Susheel’? Decide in the light of the provisions of the Negotiable Instruments Act, of 1881.

Answer:

- According to the provisions of Section 44 of the Negotiable Instruments Act, of 1881, when there is a partial absence or failure of money

- consideration for which a person signed a bill of exchange, the same rules applicable for total absence or failure of consideration will apply.

- Thus, the parties standing in immediate relation to each other cannot recover more than the actual consideration. Accordingly, Anil can recover only INR 8000.

Question 2. ‘A’ issues an open ‘bearer’ cheque for $ 10,000 in favour of ‘B’ who strikes out the word ‘bearer’ and puts a crossing across the cheque. The cheque is thereafter negotiated to ‘C’ and ‘D’. When it is finally presented by D’s banker, it is returned with remarks ‘payment countermanded’ by the drawer. In response to this legal notice from ‘D’, A pleads that the cheque was altered after it had been issued and therefore he is not bound to pay the cheque. Referring to the provisions of the Negotiable Instruments Act, of 1881, discuss whether A’s argument is valid or not.

Answer:

- Effects of striking off the word bearer. It amounts to a material alteration.

- However, such material alteration is authorized by the Act.

- Therefore, the cheque is not discharged; it remains valid.

- Effects of crossing the cheque. It amounts to a material alteration.

- However, such material alteration is authorized by the Act.

- Therefore, the cheque is not discharged; it remains valid. A’s argument is not valid.

- Since the reason for the dishonour of the cheque is not ‘material alteration ‘but ‘payment countermanded by drawer1.

- Therefore, A is liable for the payment of the cheque and he shall also be liable for dishonour of the cheque by the provisions of Section 138.

Question 3. On a Bill of Exchange for Rupees one lakh, X’s acceptance of the Bill is forged. ‘A’ takes the Bill from the customer for value and in good faith before the bill becomes payable. State with reasons whether ‘A’ can be considered as a “Holder in due course” and whether he can receive the amount of the Bill from ‘X’.

Answer:

- According to Section 9 of the Negotiable Instruments Act, 1881 “holder in due course” means any person who for consideration becomes the possessor of a promissory note, bill of exchange or cheque if payable to bearer or the payee or endorsee thereof, if payable to order, before the amount in it became payable and without having sufficient cause to believe that any defect existed in the title of the person from whom he derived his title.

- As ‘A’ in this case, prima facie became a possessor of the bill for value and in good faith before the bill became payable, he can be considered as a holder in due course.

- But where a signature on the Negotiable Instruments is forged the instrument is not at all an instrument in itself.

- The holder of a forged instrument cannot enforce payment thereon. In

the event of the holder being able to obtain payment despite forgery, he cannot retain the money. - The true owner may sue on tort (tort means a wrongful act, misdeed, or offence)the person who had received it.

- The principle is universal; by reason that even a holder in due course is not exempt from it.

- ‘ A holder in due course is protected when there is a defect in the title.

- But he derives no title when there is an entire absence of title as in the case of forgery. Hence, “A” cannot receive the amount on the bill.

Question 4. Mr. Punit obtains fraudulently from Rohan a crossed cheque “Not Negotiable”. He transfers the cheque to Sunit, who gets the cheque encashed from ABC Bank Limited which is not the drawee bank.

Or

Rohan on coming to know about the fraudulent act of Mr. Punit sues ABC Bank for the recovery of the money. Examine concerning the relevant provisions of the Negotiable Instruments Act, of 1881, whether Rohan will succeed in his claim. Would your answer be still the same in case Mr Punit does not transfer the cheque and gets the cheque encashed from ABC Bank himself?

Answer:

- According to Section 130 of the Negotiable Instruments Act 1881, a person taking a cheque crossed generally or especially bearing, in either case, the words, not negotiable shall not have or shall not be able to give a better title to the cheque than the title the person from whom he had.

- In consequence, if the title of the transferor is defective, the title of the transferee would be vitiated by the defect.

- Thus, based on the above provisions, it can be concluded that if the holder has a good title, he can still transfer it with a good title but if the transferor has a defective title, the transferee is affected by such defects and he cannot claim the right of a holder in due course by proving that he purchased the instrument in good faith and for value.

- As Mr. Punit in the given case had obtained the cheque fraudulently, he had no title to it and could not give to the bank any title to the cheque or money and the bank would be liable for the amount of the cheque for encashment. (Great Western Railway Co. Ltd. Vs. London and County Banking Co.)

- The answer in the second case would not change and shall remain the same for the reasons given above. Thus, Rohan in both cases shall succeed in his claim from ABC Bank.

Question 5. Amit signs, as a maker, a blank stamped paper and gives it to Sumit and authorizes him to fill it as a note for $ 500, to secure an advance which Namit is to make to Sumit. Sumit fraudulently fills it up as a note for $ 2,000, payable to Namit who has in good faith advanced. 2,000. Decide, with reasons, whether Namit is entitled to recover the amount, and if so, up to what extent.

Answer:

- A duly signed blank-stamped instrument is called an inchoate instrument. According to Section 20 of the Negotiable Instruments Act, an inchoate instrument is an incomplete Instrument in some respect.

- When a person signs and delivers blank or incomplete stamped paper to another, such other is authorized to complete it for any amount not exceeding the amount covered by the stamp.

- The person so signing is liable upon such instrument, to any holder in due course for any amount.

- But any other person can’t claim more than the amount intended by the drawer of the instrument.

- Thus, for Namit’s claim to be valid and enforceable, two things are important:

- That Namit is a holder in due course, i.e., there should be valid consideration and he would have obtained it in good faith and before maturity.

- The amount filled in $ 2,000 is covered by the stamp amount. In the Negotiable Instruments Act, every holder is deemed to be a holder in due i course. Thus, the other party has to establish that Namit is not a holder in due course.

Question 6. Parag issues an open ‘bearer1 cheque for? 10,000 in favour of Qadir who strikes out the word ‘bearer1 and crosses the cheque. The cheque is thereafter negotiated to Raman and Suman. When it is finally presented by Suman’s banker, it is returned with remarks ‘payment countermanded’ by the drawer. In response to a legal notice from Suman, Parag pleads that the cheque was altered after it had been issued and therefore he is not bound to pay the cheque. Referring to the provisions of the Negotiable Instruments Act, of 1881, decide, whether Parag’s argument is valid or not.

Answer:

- The cheque bears two alterations when it is presented to the paying banker. One, the word ‘born has been struck off and two, the cheque has been crossed.

- Although both the alterations amount to material alterations such alterations are authorized by the Act.

- So, it can be said that both of these alterations do not amount to material alteration under the provisions of the Act and hence the liability of any including the drawer is not at all affected.

- Parag is liable to pay the amount of the cheque to the holder.

Question 7. A cheque payable to the bearer is crossed generally and is marked ‘not negotiable’. The cheque is lost and comes into the possession of Baldev, who takes it in good faith and for value. Baldev deposits the cheque into his account and his banker collects the same. Discuss the liability of collecting bankers and paying bankers. Can Baldev be compelled to refund the money to the true owner of the cheque?

Answer:

- Neither the collecting banker nor the paying banker incurs any liability to anyone because of special protection granted to the bankers under the Act.

- Yes, the true owner can compel Baldev to refund the money because the cheque bears a ‘not negotiable’ crossing as a result of which the transferee cannot get a better title than that of the transferor.

Question 8. A draws a bill on B. B accepts the bill without any consideration. The bill is transferred to C without consideration. C transferred it to D for value, Decide – 1. Whether D can sue the prior parties of the bill, 2. Whether the prior parties other than D have any right of action? Give your answer about the Provisions of Negotiable Instruments Act, of 1881.

Answer:

Section 43 of the Negotiable Instruments Act, of 1881 provides that an instrument made, drawn, accepted, endorsed or transferred without consideration, or for a consideration which fails, creates no obligation of payment between the parties to the transaction. But if any such party has transferred the instrument with or without endorsement to a holder for consideration, such holder, and every subsequent holder deriving title from him, may recover the amount due on such instrument from the transferor for consideration or any prior party thereto.

- In the problem, as asked in the question, A has drawn a bill on B and B accepted the bill without consideration and transferred it to C without consideration. Later on in the next transfer by C to D is for value.

- According to provisions of the aforesaid Section 43, the bill ultimately has been transferred to D with consideration. Therefore, D can sue any of the parties A, B or C, as D arrived at a good title on it being taken into consideration.

As regards to the second part of the. the problem, the prior parties before D, A, B and C have no right of action intense because the first part of Section 43 laid down that a negotiable instrument, made, drawn, accepted, indorsed or transferred without consideration, or for a consideration which fails, creates no obligation of payment between the parties to the transaction before the parties who receive it on consideration.

Question 9. X, by inducing Y, obtains a Bill of Exchange from him fraudulently in his (X) favour. Later, he enters into a commercial deal and endorses the bill to Z towards consideration to him (Z) for the deal. Z takes the Bill as a holder in due course. Z subsequently endorses the bill to X for value, as consideration to X for some other deal. On maturity, the bill is dishonoured. X sues Y for recovery of money. Concerning the provisions of the Negotiable Instruments Act, decide whether X will succeed in the case.

Answer:

Section 58 of the Negotiable Instruments Act provides that when an instrument is obtained by fraud, offence or for unlawful consideration, the possessor or endorsee cannot receive the amount of the instrument. Hence, normally X would not be entitled to sue Y as X has obtained the instrument through fraud.

- However, as per section 53, a holder who derives title from the holder in due course has all rights of a holder in due course.

- Since X derives his title from Z (who is a holder in due course), X has all the rights of Z.

- The second part of section 58 also makes it clear that even if a negotiable instrument is obtained using an offence or fraud or for unlawful consideration, the possessor or endorsee is entitled to receive the amount from the maker, if he is a holder in due course or claims through a person who was a holder in due course.

- Hence, X can sue Y as he is deriving his right from Z, who is holder in due course. Hence, X will succeed.

Question 10. Ajay draws a bill on Anoop. Anoop accepts the bill without any consideration. The bill is transferred to Udit without consideration. Udit transferred it to Vicky for value.

Decide –

- Vicky can sue the prior parties of the bill?

- Whether the prior parties other than Vicky have any right of action?

Answer:

Section 43 of the Negotiable Instrument Act, of 1881, Provides that an instrument made, drawn, accepted, indorsed or transferred without consideration, or for a consideration which fails, creates no obligation of payment between the parties to the transaction.

- But if any such party has transferred the instrument with or without endorsement to a holder for consideration, such holder, and every subsequent holder deriving title from him, may recover the amount due on such instrument from the transferor for consideration or any prior party thereto.

- In the given case, as asked in the question, Ajay has drawn a bill on Anoop and Anoop accepted the bill without consideration and transferred it to Udit without consideration. Later on in the next transfer by Udit to Vicky is for value. According to provisions of the aforesaid Section 43, the bill ultimately has been transferred to Vicky with consideration.

- Hence, Vicky can use any of the parties i.e. Ajay, Anoop or Udit, as Vicky arrived at a good title on it being taken into consideration.

- As regards the second part of the problem, the prior parties before Vicky therefore Ajay, Anoop and Udit have no right of action inter se because the first part of Section 43 has laid down that a negotiable instrument, made, drawn, and accepted, indorsed transferred without consideration, or for a consideration which fails, creates no obligation of payment between the parties to the transaction before the parties who receive it on consideration.

Question 11. Mr. S. K drew a cheque in favour of Mr. P. K who was * seventeen years old. Mr. P. K settled his rental due by endorsing the cheque in favour of Mrs. R. K the owner of the house in which he stayed. The cheque was dishonoured when Mrs. R. K presented it for payment on the grounds of inadequacy of funds. Advice to Mrs. R. K. on how she can proceed to collect her dues.

Answer:

- Section 26 of the Negotiable Instrument Act 1881, states that every person capable of contracting may bind himself and be bound by the making, drawing, acceptance, endorsement, delivery and negotiation of a promissory note, bill of exchange or cheque.

- But, A minor may draw, endorse, deliver and negotiate such instrument to bind all parties except himself.

- As per the facts given in the question, Mr S.K. drew a cheque in favour of Mr P.K. a minor. Mr. P. K endorses the same in favour of Mrs. R. K. to settle his rental dues.

- The cheque was dishonoured when Mrs. R. K. presented it to the bank on the grounds of inadequacy of funds.

- In the above. It’ Mr‘ P’ K’ being 3 minors may draw- endorse, deliver and negotiate the instrument to bind all parties except himself Hence Mr P K is not liable.

- Mrs. R. K can thus, proceed against Mr. S. K to collect the”