Indian Partnership Act 1932

Question 1. Introduction

Answer:

- The law relating to partnership in India was first contained in the Indian Contract Act, of 1872.

- Later, on 1st October 1932 Indian Partnership Act, of 1932 came into force.

- This Act deals partly with the rights and duties of partners between themselves and partly with the legal relations between partners and third persons.

- It can be regarded as a branch of law relating to principal and agent.

Question 2.Partnership

Answer:

As per Sec. 4, “Partnership is the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all.”

Question 3. Essentials of Partnership

Answer:

- It must be a result of an agreement between two or more persons.

- It is voluntary.

- The agreement must be to share the profits of the business.

- Business must be carried on by all or any of them acting for all.

- All the above essentials must co-exist before any partnership comes into existence.

- The relation of partnership arises from contract and not from status.

- Agreement may be express or implied.

- As per Sec. 2 (b),

- “Business includes every trade, occupation, and profession.”

- Profit means the excess of return over advances.

- Sharing of profits includes the sharing of losses.

Read and Learn More CMA Laws and Ethics Paper

Question 4. True Test of Partnership

Answer:

- Mutual agency is the basic and most essential thing for partnership.

- The sharing of profit also involves the sharing of loss.

- Sharing of profits is not a conclusive test of the existence of a partnership.

- Every partner is a principal and agent for himself and others.

- An agency relationship is the most important test of partnership.

Question 5. Partnership deed

Answer:

- It constitutes the mutual rights and obligations of partners in a written form.

- It is also known as a partnership agreement, constitution of partnership articles of partnership, etc.

- It must be drafted and stamped as per the provisions of the Indian Stamp Act

Question 6. Types of Partners

Answer:

- Active Or Actual Ostensible Or Working Or Managing Partner:

- He is not only contributing capital but also taking an active part in the conduct of the firm’s business.

- He shares its profits and losses.

- As per Sec. 12 (a),

- Subject to the contract to the contrary, every partner is entitled to take part in the conduct of the business of the firm.”

- He has to give public notice of his retirement if he has to free himself from all liabilities.

- Sleeping Or Dormant Partner:

- He only contributes capital and shares profit or loss without taking an active part in the firm’s business.

- He has unlimited liability.

- He can retire from the firm without giving any public notice.

- He is entitled to access books and accounts of the firm, even though he performs no duty.

- Sub Partner:

- Me is the third person with whom a partner shares his profit.

- He has no rights or duties towards the firm.

- Nominal or Quasi Partner:

- He only lends his name and reputation for the firm’s benefit without sharing any profit or loss.

- He is known to outsiders as a partner but actually, he is not.

- He is liable to a third party for all his acts.

- He is required to give public notice of retirement.

- From a duration point of view partnership may be:

- Particular Partnership – i.e. for a particular purpose or a particular undertaking or single venture.

- Partnership at will – No fixed duration or period of partnership. It is dissolved by the partner by giving notice in writing.

- Partner in profits only:

- He gets a share in profits but does not share any losses of the firm. He has to bear all the liabilities to a third party.

- Partner by estoppel:

- He is not a partner of the firm but conducts himself in such a way that leads third parties to believe that he is a partner.

- He is liable for all the debts to such third party.

- Partner by holding out:

- He is declared by others as a partner of the firm but does not contradict it immediately and remains silent.

- He is liable to a third party who is entering into contracts with the firm on the belief that he is the partner.

- Holding out means ‘to represent’

- It is based on the doctrine of the Estoppel of Indian Evidence Act.

Question 7. Minor’s Position in Partnership

Answer:

- Minor is a person who has not completed 18 years of age, and thus cannot become a partner as he is not competent to contract.

- As per Sec. 30, He can, however, be admitted to the benefits of partnership with the mutual consent of all partners.’

- No partnership firm can be formed only with minors.

- A minor’s agreement is altogether void.

- If a minor has to be. admitted into the benefits of partnership, there must be at least 2 major partners.

Question 8. Rights of Minor

Answer:

- Sec. 30(2): Share profits of the firm.

- Sec. 30(2): Inspect and copy the book of accounts of the firm.

- Sec. 30(4): Can file a suit for accounts and his share in the firm but only when severing his connection with the firm.

- Sec. 30(5): On attaining majority, he may within 6 months either.

Question 9. Rights of Partners

Answer:

- To take part in management.

- To Express Opinion.

- To Inspect and take out copies of Books of Accounts.

- To Share Profits.

- To have an Interest in capital.

- To have an Interest in Advances.

- Right to be indemnified.

- To have a joint share in the partnership property.

- To enforce the proper use of property.

- Right of Retirement.

- To prevent the introduction of a new partner.

- Implied Authority.

- Right to Dissolve.

- Profits after retirement or death.

Question 10.Duties and Liabilities of Partner

Answer:

- To carry on the business of the firm to the Greatest Common Advantage.

- Being diligent and honest.

- Being just and faithful.

- To render accounts and information.

- To indemnify the firm.

- Not to make any secret profits.

- Not to hold and use the property of the firm.

- Not to start a business in competition with the firm.

- Not to receive any remuneration.

- Not to transfer his interest.

- To act within the scope of his authority.

- To share losses.

Question 11. Goodwill

Answer:

Goodwill is defined as the value of the reputation of a business house concerning profits expected in the future over and above normal profits.

- It is a partnership property.

- In case of dissolution of the firm, every partner has a right according to the deed in the absence of any agreement, to have a share in the goodwill on it being sold.

- It can be sold separately, or along with other properties of the firm.

Question 12. Effects of non-registration

Answer: The Indian Partnership Act does not make registration of partnerships compulsory nor does it impose any penalty.

1. However, non-registration gives rise to certain disabilities U/S 69:

- The firm or any person on its behalf cannot bring action against a third party for breach of contract unless the firm is registered and persons suing are shown in the register of firms.

- Neither the firm nor any partner can claim set off if any suit is brought by the third party against the firm.

- Partner of an unregistered firm cannot bring any action against the firm or any partner of such firm.

- An unregistered firm however can bring a suit for enforcing the right arising otherwise than out of contract.

2. Suits allowed by Act:

- Dissolution of a firm.

- Rendering accounts of a dissolved firm.

- Realization of property of a dissolved firm.

- Set off of values not exceeding $ 100.

- Proceeding arising incidentally of value not exceeding $ 100.

- The firm does not have a business place in territories to which the Indian Partnership extends.

- Realization of property of insolvent partner.

- Firms having business places in areas exempted from the Partnership Act.

Relevant Case Laws:

- Prithvi Singh Vs. Hasan Ali

- Kashav Lai Vs. Chunni Lai

Question 13. Dissolution of Partnership Firm (Sec. 39)

Answer:

It takes place when the relationship between all the partners of the firm is so broken to close the business of the firm.

As a result, the firm’s assets are sold and its liabilities are paid off.

Question 14. Modes of Dissolution of Partnership

Answer:

- Sec. 42 (a): By the expiry of the fixed term for which the partnership was formed.

- Sec. 42 (b): By the completion of the venture.

- Sec. 42 (c): By the death of a partner.

- Sec. 42 (d): By insolvency of a partner.

- Sec. 42 (e): By retirement of a partner.

Question 15. Modes of Dissolution of Firm

Answer:

- Sec. 40: Result of an agreement between all partners.

- Sec. 41 (a): By adjudication of all partners, or declaration of all partners as insolvent except one.

- Sec. 41 (b): By firm’s business becoming unlawful.

- Subject to agreement between parties, on the happening of certain contingent events.

- Sec. 43: In case of partnership at will, by a partner giving notice of the intention to dissolve the firm.

- The firm dissolves from the date mentioned in the notice. If no date is mentioned, then from the date of communication of the notice.

- See. 44: By Court Intervention in the case of:

- A partner becoming unsound mind.

- Permanent incapacity of partners to perform their duties.

- Misconduct of partners affecting the business.

- Willful or persistent breaches of agreement by a partner.

- Transfer or sale of the whole interest of a partner.

- The improbability of business being carried on except at a loss.

- Court being satisfied on other just and equitable grounds.

Question 16. Consequences of Dissolution

Answer:

- Continuing liability until public notice: Partners continue to be liable for any act done by them, done on behalf of the firm until public notice of dissolution is given.

- Sec. 46: Rights to enforce winding up:

- Partner or his representative have a right against others, on dissolution.

- Apply the firm’s property in payment of the firm’s debt. Distribute surplus amongst all partners.

Sec. 47: Continuing authority of partners:

The authority of partners continue

- So far as necessary to wind up the firm,

- To complete the pending transactions till the dissolution date.

Indian Partnership Act 1932 Distinguish Between Question And Answers

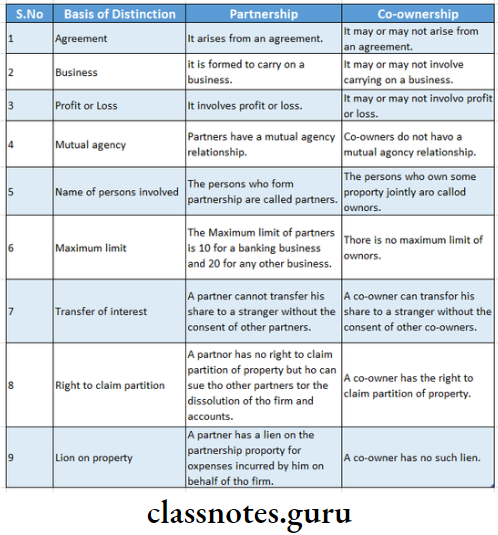

Question 1. Briefly explain the difference between Partnership and Co-ownership.

Answer:

Difference between Partnership and Co-ownership:

Indian Partnership Act 1932 Descriptive Question And Answers

Question 1. Who is a Partner by “Holding Out” or “Estoppels”?

Answer:

- If any person behaves and or poses or presents in such a way that others consider him to be a partner, he will be held liable to those persons who have been misled, suffered, or lent finance to the firm on the assumption that he is a partner.

- Such a person is known as a “Partner by Holding out or Estoppels.”

- He is not a true partner and he is not entitled to any share in the profit of the firm.

Question 2. What tests would apply to determining the existence of a partnership? Discuss.

Answer:

- As must be clear from the discussion of various elements of partnership, there is no single test of partnership.

- For example, in one case there may be a sharing of profits but may not be any business, in the other case there may be business but there may not be a sharing of profits,

- In yet another case there may be both business and sharing of profits but the relationship between persons sharing the proms may not be that of principal and agent.

- And in either case, therefore, there is no partnership.

- Thus, all the essential elements of a partnership must coexist to constitute a partnership.

- To emphasize this fact, Section 6 expressly provides that “in determining whether a group of persons is or is not a firm or whether a person is or is not a partner in a firm, regard shall be given to the real largeon between the parties, as shown by all relevant facts taken together.

- Thus, the existence of a partnership has to be determined by the real intention of the parties, which must be gathered from all the facts of the case and the surrounding circumstances.

Question 3. State your views on the following: A partner is not an agent of other partners in a partnership firm.

Answer:

Incorrect: The basis of the partnership is mutual agency, hence a partner is an agent of all other partners.

Question 4. What are the rights of outgoing partners?

Answer:

Rights of Outgoing Partners Section 36 provides that an outgoing partner may carry on a business competing with that of the firm. He may advertise such business, but, subject to contract to the contrary, he may not:

- use the firm name

- represent himself as carrying on the business of the firm; or

- solicit the custom of persons who were dealing with the firm before he ceased to be a partner.

Section 37 provides that in a case where a partner has died or ceased to be a partner, the surviving and continuing partners may carry on the business of the firm with the property of the firm without any final settlement of accounts between them and the outgoing partner or the estate of the deceased partner.

In the absence of a contract to the contrary, the outgoing partner of the representative of the deceased partner is entitled to the option:

- To such share of the profits made since he ceased to be a partner as may be attributable to the use of his share of the property of the firm; or

- To interest at 6% per annum on the amount of his share in the property of the firm.

- Where an option is given to surviving or continuing partners to purchase the interest of a deceased or outgoing partner and the same is duly exercised, the estate of the deceased partner or the outgoing partner is not entitled to any further or other share of profits.

- But if any partner, assuming to act in the exercise of the option, does not, in all material respects comply with the terms, he is liable to account under the provisions of this section.

Indian Partnership Act 1932 Practical Question And Answers

Question 1. A, B, and C were partners in a firm of drapers. The partnership deed authorized the expulsion of a partner when he was found guilty of a flagrant breach of duty. A was convicted of traveling without a ticket. On this ground, he was expelled by the other partners B and C. Is the expulsion justified?

Answer:

Yes, the expulsion is justified. In this case, the partnership deed authorized expulsion on the ground of flagrant breach of duty. Doing an act that brings a partner within the penalties of criminal law is a flagrant breach of duty. Also, the expulsion decision was taken by a majority of partners (Carmichel Vs. Evans (1904) 90 LT573).

Question 2. A, B, C are partners in a firm. As per terms of the partnership deed, A is entitled to 20% of the partnership property and profits. Retires from the firm and dies after 15 days. B and C continue the business of the firm without settling accounts. What are the rights of A’s legal representatives against the firm under the Indian Partnership Act, of 1932?

Answer:

Section 37 of the Indian Partnership Act, 1932 provides that where a partner dies or otherwise ceases to be a partner and there is no final settlement of account between the legal representatives of the deceased partner or the firms with the property of the firm, then in the absence of a contract to the contrary, the legal representatives of the deceased partner or the retired partner entitled to claim either.

- such shares of the profits earned after the death or retirement of the partner which is attributed to the use of his share in the property of the firm; or

- Interest at the rate of 6 percent per annum on the amount of his share in the property.

Based on the aforesaid provisions of Section 37 of the Indian Partnership Act, 1932 in the given problem, A’s representative, at his option, can claim:

- The 20% shares of profits (as per the partnership deed); or

- Interest at the rate of 6 percent per annum on the amount of A’s share in the property.

Question 3. Rohit and Anurag are partners in a firm. Did they borrow a sum of $ 10,000 from Parul? Later on, Rohit becomes insolvent but his assets are sufficient to pay back the loan. Parul compels Anurag for the payment of an entire loan. Referring to the provisions of the Indian Partnership Act, 1932, examine the validity of Parul’s claim and decide as to who may be held liable for the above loan.

Answer:

The present problem is concerned with the contractual liability of the Partners. As stated in Section 25 of the Indian Partnership Act, 1932, in partnership the liability of the partners is unlimited.

- The share of each partner in the partnership property along with his private property is liable for the discharge of partnership liabilities.

- The liability of the partners is not only unlimited but is also stated that a partner is both jointly and severally liable to third parties.

- However, every partner is liable jointly with other partners and also severally for the acts of the firm done while he is a partner.

- Based on the above provisions, Parul can compel Anurag for the payment of an entire loan. Anurag must pay the said loan and then he can recover the share of Rohit’s loan from his property.

Question 4. Arun, Varun, and Tarun started a Kirana business in Chennai on 1st January 2012 for five years. The business resulted in a loss of $ 20,000 in the first year, $ 25,000 in the second year, and $ 35,000 in the third year, Varun and Tarun wish to dissolve the firm while Arun wants to continue the business. Advise Varun and Tarun.

Answer:

- As per provisions of Sec. 44(f) of the Indian Partnership Act, 1932, Varun and Tarun are advised to make a petition to the Court for the dissolution of the firm on the ground that the firm cannot be carried on except at a loss.

- Since the firm was constituted for a fixed term of five years it cannot be dissolved without the consent of all the partners and as such Varun and Tarun cannot compel Arun to dissolve the firm.

Question 5. Akash, Ashish, and Anil were partners in a firm. By his willful neglect and misconduct, Anil caused serious loss to the business of the firm. After several warnings to Anil, Akash and Ashish passed a resolution expelling Anil from the firm. By another resolution, they admitted Abhishek as a partner in place of Anil. Anil objects to his expulsion as also to the admission of Abhishek. Is he justified in his objections?

Answer:

- A partner may be expelled from a firm by the majority of the partners only if,

- The power to expel has been conferred by contract between the partners, and

- Such a power has been exercised in good faith for the benefit of the firm.

- The partner who is being expelled must be given reasonable notice and opportunity to explain his position and to remove the cause of his expulsion.

- Yes, Anil is justified in his objections.

- In the absence of an express agreement authorizing expulsion, the expulsion of a partner is not proper and is without any legal effect.

[Section 33(1)] Anil’s objection to the admission of Abhishek is also justified as a new partner can be admitted only with the consent of all the partners.[Section 31 (1)]

Question 6. Mayur and Nupur purchased a taxi to ply it in partnership. They had done business for about a year when Mayur, without the consent of Nupur, disposed of the taxi. Nupur brought an action to recover his share in the sale proceeds. Mayur’s only defense was that the firm was not registered. Will Nupur succeed in her suit?

Answer:

- As per Section 69(3) of the Indian Partnership Act, the term set-off may be defined as the adjustment of debts by one party due to him from the other party who files a suit against him.

- It is another disability of the partners and of an unregistered firm that it cannot claim a set-off when a suit is filed against it.

- Yes, Nupur will succeed in her suit. As the business had been closed on the sale of the taxi, the suit in question is for claiming a share of the assets of ’ a dissolved firm.

- Section 69(3) especially protects the right of a partner of an unregistered firm to sue for the realization of the property of a dissolved firm.

Question 7. ABC & Co., a firm consisting of three partners A, Band C having one-third share each in the firm. According to A and B, the activities of C are not in the interest of the partnership, and thus want to expel C from the firm. Advise A and B whether they can do so quoting the relevant provisions of the Indian Partnership Act.

Answer:

Expulsion of a partner (Sec. 33):

- The expulsion of a partner is another event necessitating the reconstitution of a firm.

- A partner may be expelled from a firm if the following conditions are satisfied:

- expulsion should be as per the express provisions in the agreement;

- power of expulsion should be exercised by a majority of partners;

- expulsion should be in good faith.

- Only when all the above three conditions are satisfied a partner can be expelled from a firm.

- As stated above expulsion should be in good faith. The test of good faith may be:

- expulsion is in the interest of the firm

- expelled partner has been given notice

Question 8. X and Y were partners carrying on a banking business. X had committed adultery on several women in the city and his wife had left on this ground. Y applied to the court for dissolution of the firm on this ground. Will he succeed? )

Answer:

- As per Section 44(c) of the Indian Partnership Act, 1932 sometimes, a partner is guilty of misconduct. When the Court is satisfied that the misconduct adversely affects the partnership business the Court may allow the dissolution of the firm.

- Y will not succeed. In this case, though X is guilty of misconduct his misconduct does not have any adverse effect on their business as bankers [Snow Milform. (1868) 18 LT142].

- In the above case, the Court observed that how can it be said that a man’s money is less safe because one of the partners commits adultery?

- It was further observed that in those cases where the moral conduct of a partner would affect the firm business, it can be a ground for dissolution of the firm, an example where a medical man had entered into a partnership with another and it was found that his conduct was very immoral towards some of his patients, the firm can be dissolved on the ground of misconduct by the partner.