Indemnity And Guarantee

1. Contracts of Indemnity

Answer:

- As per Sec. 124, A contract by which one party promises to save the other from loss caused to him by the conduct of the promisor himself or the conduct of any person is called a contract of indemnity.

- Contracts of Indemnity are part of a general class of contingent contacts and,

thus are conditional. - Parties of Indemnity Contract

- Indemnifier – The person who promises to make good the loss.

- Indemnified or Indemnity Holder – The person whose loss is to be made good.

- It does not include events or accidents, which do not depend upon the conduct of any person.

Example Contract of insurance etc. (except life insurance)

- Modes

- Expressed

- Implied

2. Essential Elements of Contracts of Indemnity

Answer:

- All essential elements of a valid contract must be present.

- A loss should be incurred or a loss has become certain.

- Its purpose is to protect the indemnity holder against any loss.

- It must specify that the indemnity holder is protected from loss caused due to;

- The action of the promisor himself

- Action of any other person

- Any act, event, or accident that is not in the control of the parties.

Read and Learn More CMA Laws and Ethics Paper

3. Rights of Indemnity Holder (Sec. 125)

Answer:

- Right to recover damages

- Right to recover costs

- Right to recover sums paid

4. Contracts of Guarantee (Sec. 126) ‘

Answer:

- It is a contract to perform the promise or discharge the liability incurred by a third person in case of his default.

- Parties to the contract

- Surety- The person who gives the guarantee.

- Principle Debtor- The person in respect of whose default the guarantee is given.

- Creditbr – The person to whom the guarantee is given.

5. Essential Elements of Contracts of Guarantee

Answer:

Must have all the essentials of a valid contract

Exceptions:

Consideration received by the principal debtor is a sufficient consideration to the surety for giving the guarantee.

- The principal debtor is primarily liable

- Debt must be legally enforceable

- Debt must be a time-barred debt

- Liability of surety is secondary and conditional

- The Creditor should disclose all the facts which are likely to affect the surety liability

- The contract may be either oral or written

6. Nature and exploit of Suroty’a Liability (Soc. 120)

Answer:

- Liability of surety In same as that of the principal debtor.

- Whoro n dolor cannot be held liable on account of any defect In the document, The liability of the surety also Ceases.

- Surety liability is continuous oven If the principal debtor has not been or omitted to be used. Thus, the surety’s liability lo separate from the guarantor.

7. Kinds of Guarantee

Answer:

- Specific Guarantee

- It In glvon for a olngto dobt

- It comes to an end when the doubt guarantor no boon paid,

- Continuing Gunrnntoo (Sec. 129),

- It extends to the series of transactions.

- Surety’n liability extends to nil tho transactions contemplated until the guarantee is provoked.

8. Rovocntlon of Continuing guarantee

Answer:

- It may be revoked at any time by the surety as to the future transactions by giving notice to creditors (Soc. 130)

- Upon the death of surety, It Is provoked for all future transactions in the absence of a contract to the contrary. (Soc. 131)

9. Rights of Suroty

Answer:

- Against the principal debtor

- Right of Indomnlty (Sec. 145): Suroty lo entitled to recover from the principal debtor all payments properly made.

- Right of Subrogation (Sec. 140): It means the substitution of one person for another. On payment of a doubt, the surety shall be entitled to all the rights to which the creditor can claim against the principal debtor.

- Against the creditor

- Right to claim securities (Sec. 141): Suroty Is entitled to the benefit of ivory security, which the creditor has against the tho principal debtor, whether surety knows of it or not. If the creditor loses or parts with security without the surety’s consent, the surety Is discharged to the extent of the security’s value.

- Right to sign off: Suroty can ask the creditor to set off or adjust any claim that the doctor has against the creditor.

- Right to share reduction: If the principal debtor becomes insolvent, the surety may claim a proportionate reduction In his liability.

- Against Co – Sureties.

- Right to contribution (Sec. 146): All the co-sureties contribute equally except in the following cases:

- Co-sureties may fix limits on their respective liabilities.

- The contract may provide co-sureties to contribute in some other proportion.’

10. Right to share the benefit of securities

Answer:

Discharge of a surety:

- Sec. 130: By giving notice to the creditor for future transactions in case of continuing guarantee.

- Sec. 131: In the absence of any contract to the contrary, continuing guarantee Is provoked on the death of surety.

- Sec. 133: Whoro there Is any variance in the term of the contract between the principal debtor and creditor without surety’s consent) it would discharge tho surety in respect of all the transactions taking place after ouch variance.

- Sec. 134: Tho surety is discharged, if the principal debtor is discharged by

- a contract

- any act or

- any omission, the result of which l3 tho discharge of principal debtor.

- Sec. 135: If the creditor makes an arrangement with the principal debtor for composition, for giving time, or for not suing him without surety’s consent.

- Sec. 139: If the creditor does any act or omission, thereby impairing sureties eventual remedy.

- Sec. 141: If the creditor loses or parts with security without the surety’s consent, the surety is discharged to the extent of the security’s value

Indemnity And Guarantee Descriptive Question And Answers

1. In the event of the principal debtor being a minor, the creditor can not recover his money, from the surety-offer your views.

Answer:

- The statement is true. As the liability of the minor is nil, the liability of the surety of the minor would also be nil.

- There are contrary judgments about this matter. Some decisions of some courts say that the surety is liable to pay the creditor if the principal debtor who is a minor, fails to pay.

- Some judgments state that as the liability of a minor is nil, the surety can not be forced to pay if the minor debtor fails to pay.

2. Comment on the following based on legal provisions: A surety is discharged from his liability where there is a failure of Consideration between the Creditor and the Principal Debtor in a Contract of Guarantee.

Answer:

- According to the Indian Contract Act, of 1872, consideration is an essential element of any contract.

- If there is no consideration there is no contract.

- In the present case, there is a failure of consideration between the creditor and the principal debtor

- Hence the surety has no responsibility towards such a contract because it is no contract at all. In such a case, the surety is discharged.

3. In a contract of Guarantee, A surety is discharged from his liability where there is a failure of consideration between the creditor and the principal debtors. Comment.

Answer:

- According to the provisions of the Indian Contract Act, of 1872, the presence of a lawful consideration is an essential element for a valid contract.

- Therefore, where in a contract of guarantee, there is a failure of consideration between the creditor and the Principal Debtor, the surety is discharged.

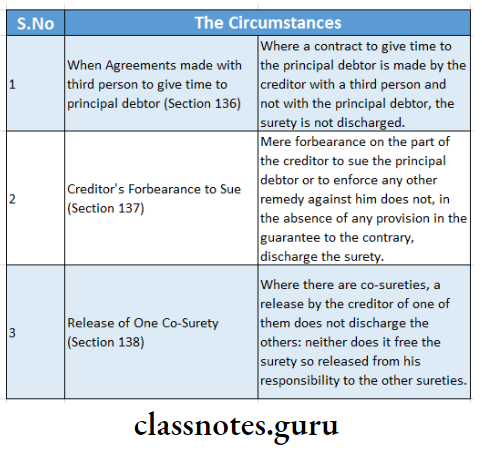

4. State the circumstances in which surety is not discharged.

Answer:

As per provisions of the Indian Contract Act, 1872 Surety is not discharged in the following circumstances

Indemnity And Guarantee Practical Question And Answers

1. Mr. A, Mr. B, And Mr. C are Sureties to Mr. D for the sum of INR 6000 lent to Mr E. Mr E failed to repay on the due date. Mr A one of the sureties, disagreed to Pay. Advise whether ‘A’ is right.

Answer :

All sureties are equally responsible for the debt. As the debt was INR 6000, and there are three sureties each surety will be responsible for one-third of the amount therefore INR 2000. Any surety cannot escape from this responsibility.

2. Mr. Mitra guarantees payment to Mr. Basu to the extent of INR 50,000 for a time-to-time supply of paper by Mr. Basu to Mr. Chandan. Basu supplies paper to Chandan more than the value of INR 50,000 and Mr. Chandan pays. Later on Mr. Basu, at the request of Chandan, supplies paper valued at INR 60,000. This time Chandan fails to pay. What action Basu can take against Mitra?

Answer:

In this case, the guarantee given by Mr. Mitra is a continuing guarantee (Sec.129), and accordingly, Mr. Mitra being the guarantor of INR 50,000, is liable to Mr. Basu to the extent of INR 50,000 only. Mr. Basu can recover the balance amount from Chandan.

3. ‘A’ contracts with ‘B1 for a fixed price to construct a house for ‘B’ within the stipulated time. ‘B’ would supply the necessary material to be used in the construction. ‘C’ guarantees A’s performance of the contract. ‘B’ does not supply the material as per the agreement. Is ‘C’ discharged from his liability?

Answer:

- In this case, C is surety for A’s performance. The performance of A depends on the supply of material by B. B does not supply the required material which makes A unable to perform his part of the contract.

- According to Section 134 of the Indian Contract Act, of 1872, the surety is discharged by any contract between the creditor and the principal debtor, by which the principal debtor is released or by any act or omission of the creditor, the legal consequence of which is the discharge of the principal debtor.

- In the given case, B omits to supply the necessary material.

- Hence, C is discharged from his liability.