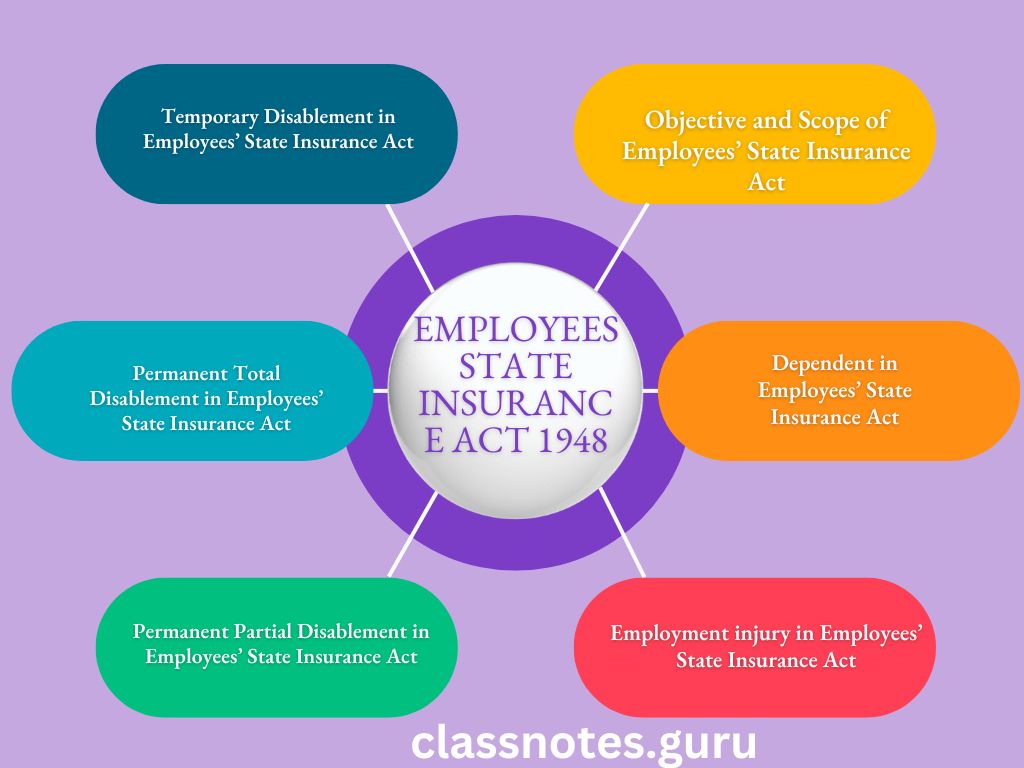

Employees State Insurance Act 1948

Question 1. Objective and Scope of Employees’ State Insurance Act

Answer:

- An act to provide benefits to employees of the organized sector.

- This applies to the whole of India including Jammu and Kashmir.

- The objective of the act is to protect the interest of workers in contingencies such as sickness, disability, maternity, or death due to employment injury.

- Amended in 2010 by the ESI (Amendment) Act, 2010 to increase the purview of the Act.

- Applies to employees receiving wages monthly up to 21,000 per month.

Question 2.Dependent in Employees’ State Insurance Act

Answer:

“Dependant” means any of the following relatives of a deceased insured person, namely

- a widow, a legitimate or adopted son who has not attained the age of twenty-five years, or an unmarried legitimate or adopted daughter.

[(a) a widowed mother]. - if wholly dependent on the earnings of the insured person at the time of his death, a legitimate or adopted son or daughter who has attained the age of twenty-five years and is infirm;

- if wholly or in part dependent on the earnings of the insured person at the time of his death

- parent other than a widowed mother,

- a minor illegitimate son, an unmarried illegitimate daughter, or a daughter legitimate or adopted or illegitimate if married and a minor or if widowed and a minor,

- A minor brother an unmarried sister or a widowed sister if a minor,

- A widowed daughter-in-law,

- A minor child of a pre-deceased son,

- A minor child of a pre-deceased daughter where no parent of the child is alive, or

- A paternal grand-parent if no parent of the insured person is alive,

Read and Learn More CMA Laws and Ethics Paper

Question 3. Employment injury in Employees’ State Insurance Act

Answer:

- Employment injury means an injury caused to an employee arising out of and in the course of his employment being an insurable employee.

- whether the accident occurs within or outside the territorial limits of India.

- Employment injury need not be confined to the employer’s premises only.

- It extends to time and place(theory of notional extension).

- It is not limited to injury or wound but has broader coverage.

- There needs to be some nexus (means relation) between the employment and the accident.

Includes:

- Injury by knocking the belt of pulley though caused by ignorance of employee himself

- Injury caused by a person who was beaten at the job though there was a threat pre-announced due to a call for strike

Excludes: Accident while on the way to the office

Question 4. Types of disablement in Employees’ State Insurance Act

Answer:

Temporary Disablement in Employees’ State Insurance Act : A condition resulting from an employment injury that requires medical treatment and results in the employee being temporarily incapable.

Permanent Partial Disablement in Employees’ State Insurance Act

- It means such disablement of a permanent nature, as reduced the earning capacity of an employee in every employment which he was capable of undertaking at the time of the accident resulting in the disablement.

- Provided that every injury specified in Part II of the Second Schedule to the Act shall be deemed to result in permanent partial disablement.

Permanent Total Disablement in Employees’ State Insurance Act

- It means such disablement of a permanent nature as incapacitates an employee for all work which he was capable of performing at the time of the accident resulting in such disablement.

- Provided that permanent total disablement shall be deemed to result from every injury specified in Part -1 of the Second Schedule to the Act or from any combination of injuries specified in Part- 2 thereof, where the aggregate percentage of loss of earning capacity, as specified in the said Part – 2 against those injuries, amount to 100% or more.

Employees’ State Insurance Act Noteworthy Points:

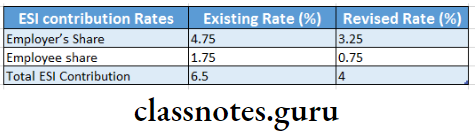

- The rate of contribution towards the Employees’ State Insurance Fund is 3.25% and 0.75% of employee’s wages by the employers and employees respectively.

- According to the ESI Act, 1948 wages include any remuneration paid at intervals not exceeding two months.

- Factory or establishment to which the Employees’ State Insurance Act,1948 applies has to be registered within 15 days.

- The judge of the Employees Insurance Court (ElC)should be either a Judicial Officer or a Legal practitioner for at least 5 years.

Question 5. Changes in Employees State Insurance Act, 1948

Answer:

- Employees must be registered online on the date of appointment; the online system shall allow a maximum of 10 days to register the new employee.

- The employee will have to collect their Biometric ESI permanent card from the nearest Branch Office.

- Contribution against an employee must be deposited within the due date. One shall not be able to deposit a contribution online after 42 days from the end date of the contribution period.

- Exemption from payment of employee’s contribution

- The average daily wages during a wage period for exemption from payment of employee’s contribution under section 42 shall be up to and inclusive of rupees one hundred seventy-six only.

Contribution has been reduced:

Employees State Insurance Act 1948 Short Note Question And Answers

Question 1. Write a note on the following Purposes for which ESI funds may be expended under the Employees’ State Insurance Act, 1948.

Answer:

- Various purposes for which ESI funds may be expended under the Employees State Insurance Act, of 1948. are as follows:-

- Payment of benefits to the insured person or their families.

- Payment about any contract entered for implementing the provisions of the Act.

- Payment of salaries to the employees of Employee State Insurance Corporation.

- Payment of fees to members of the standing committee

2. Write a short note on the following term Dependent in Employees’ State Insurance Act

Answer:

“Dependant” means any of the following relatives of a deceased insured person, namely,

- A widow, a legitimate or adopted son who has not attained the age of twenty-five years, or an unmarried legitimate or adopted daughter.

- A widowed mother].

- If wholly dependent on the earnings of the insured person at the time of his death, a legitimate or adopted son or daughter who has attained the age of twenty-five years and is infirm;

- If wholly or in part dependent on the earnings of the insured person at the time of his death,

- A parent other than a widowed mother,

- A minor illegitimate son, an unmarried illegitimate daughter, or a (b)daughter legitimate or adopted or illegitimate if married and a minor or if widowed and a minor,

- A minor brother an unmarried sister or a widowed sister if a minor,

- A widowed daughter-in-law,

- A minor child of a pre-deceased son,

- A minor child of a pre-deceased daughter where no parent of the child is alive, or

- A paternal grandparent if no parent of the insured person is alive.

Employees State Insurance Act 1948 Distinguish Between Question And Answers

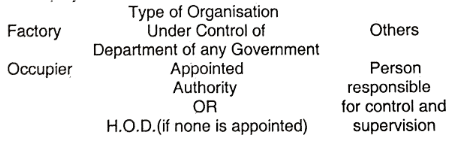

Question 1. Distinguish between the following ‘Principal employer’ and ‘immediate employer ‘1 under the Employees’ State Insurance Act, 1948.

Answer:

According to Section 2(17) of the Employees’ State Insurance Act, 1948 principal employer means:

‘Immediate employer’ means a person, about employees employed by or through him, who has undertaken the execution on the premises of a factory or an establishment to which this Act applies or under the supervision of the principal employer or his agent, of the whole or any part of any work which is ordinarily part of the work of the factory on the establishment of the principal employer.

Employees’State Insurance Act 1948 Descriptive Question And Answers

Question 1. What are the different purposes for which employees’ state insurance funds may be utilized by the central government?

Answer:

- Purposes for which the fund may be expended Section 28 of the Act provides the Central Government may utilize the State Insurance Fund only for the following purposes:

- payment of benefits and provision of medical treatment and attendance to insured persons and, where the medical benefit is extended to their families, the provision of such medical benefit to their families by the provisions of this Act and defraying the charges and costs in connection therewith;

- payment of fees and allowances to members of the corporation, the Standing Committee and the Medical Benefit Council, the Regional Boards, Local Committees, and Regional and Local Medical Benefit Councils;

- payment of salaries, leave and joining time allowances, traveling and compensatory allowances, gratuities, and compassionate allowances, pensions, contributions to provident or another benefit fund of officers and

- servants of the corporation and meeting the expenditure in respect of offices and other services set up to give effect to the provisions of this Act;

- establishment and maintenance of hospitals, dispensaries, and other institutions and the provision of medical and other ancillary services for the benefit of insured persons and, where the medical benefit is extended to their families;

- payment of contributions to any State Government, local authority, or any private body or individual, towards the cost of medical treatment and attendance provided to insured persons and, where the medical benefit is extended to their families, including the cost of any building and equipment, by any agreement entered into by the Corporation; ‘.

- defraying the cost (including all expenses) of auditing the accounts of the Corporation and of the valuation of its assets and liabilities;

- defraying the cost (including all expenses) of the Employees’ insurance Courts set up under this Act;

- payment of any sums under any contract entered into for this Act by the Corporation or the Standing Committee or by any officer duly authorized by the Corporation or the Standing Committee on that behalf;

- payment of any sums under any doctor, order, or award of any Court or tribunal against the corporation or any of Its officers or servants for any net done In the execution of his duty or under a compromise or settlement of any suit or other legal proceedings or claim Instllulod or made against the corporation;

- defraying the cost and other charges of instituting or defending any civil or criminal proceedings arising out of any action taken under this Act;

- defraying oxpondlturo, within the limits proscribed, on measures for the Improvement of the health, will of Insured persons and lor tho rehabilitation and ro-employment of Insured person who has boon disabled or Injured; and

- such other purposes as may be authorized by the corporation with the previous approval of the Control Government.

Question 2. Mention the benefits that are entitled to the insured persons under the Employees’ State Insurance Act, 1948. (6 marks)

Answer:

- Section 46 of the Employees State Insurance Act, 1948 states that the insured persons and their dependents shall be entitled to the following benefits,

- Annual payments to any insured person in case of his sickness

- Annual payments to an insured woman in case of confinement miscarriage or sickness arising out of the pregnancy, confinement, premature birth of a child, or miscarriage

- Annual payments to an insured person suffering from a disablement as a result of an employment injury sustained as an employee

- Annual payments to such dependents of an insured person who dies as a result of an employment injury sustained as an employee

- Medical treatment for and attendance of insured persons

- Payment to the eldest surviving member of the family of an insured person, who has died, towards the expenditure on the funeral of the deceased insured person; if the injured person at the time of his death does not have a family, the funeral payment will be paid to the person who incurs the expenditure.

- The amount of such payment shall not exceed such amount as may be proscribed by the Central Government.

- The claim for such payments shall be made within 3 months of the death of the Insured person or within such an extended period as the Corporation allows on this behalf.

Question 3. Mention any seven purposes for which the ESI fund may be expended.

Answer:

- Section 28 of the Employees State Insurance Act, 1948 provides the Central.

- Government may utilize the State Insurance Fund only for the following purposes:

- payment of benefits: and provision of medical treatment and attendance to insured persons and, where the medical benefit is extended to their families, the provision of such medical benefit to their families by the provisions of this Act and defraying the charges and costs in connection therewith

- payment of fees: and allowances to members of the Corporation, the Standing Committee and the Medical Benefit Council, the Regional Boards, Local Committees, and Regional and Local Medical Benefit Councils

- payment of salaries: leave and joining time allowances, traveling and compensatory allowances, gratuities, and compassionate allowances, pensions, contributions to provident or another benefit fund of officers and servants of the Corporation, and meeting the expenditure in respect of offices and other services set up to give effect to the provisions of this Act

- establishment and maintenance of hospitals, dispensaries, and other institutions and the provision of medical and other ancillary services for the benefit of insured persons and, where the medical benefit is extended to their families

- payment of contributions: to any State Government, local authority, or any private body or individual, towards the cost of medical treatment and attendance provided to insured persons and, where the medical benefit is extended to their families, including the cost of any building and equipment, by any agreement entered into by the Corporation

- defraying the cost: of auditing the accounts of the Corporation and of the valuation of its assets and liabilities;

- payment of any sums: under any contract entered into for this Act by the Corporation or the Standing Committee or by any officer duly authorized by the Corporation or the Standing Committee on that behalf

- payment of sums under any decree, order, or: award of any Court or Tribuna against the Corporation or any of its officers or servants for any act done in the execution of his duty or under a compromise or settlement of any suit or other legal proceeding or claim instituted or made against the Corporation

- defraying expenditure: within the limits prescribed, on measures for the improvement of the health, and welfare of insured persons and forth© rehabilitation and re-employment of insured persons who have been disabled or injured.

Employees State Insurance Act 1948 Practical Question And Answers

Question 1. Attempt the following stating relevant legal provisions and decided case law, if any: Visual Electronics Ltd. sells household consumer durables such as TVs, washing machines, electric stoves, etc., of various manufacturers in its sales outlet. While delivering these items to the homes of the customers, it deputes its employees to install and explain the salient features of these items. It pays its employees an additional amount of defray for the actual traveling expenses. The Employees’ State Insurance Corporation demanded contribution to this additional payment including traveling expenses under the head “wages’. Is the demand of the Employees’ State Insurance Corporation justified?

Answer:

- In the above case, the employer is not liable to contribute to the traveling allowance.

- Traveling allowance does not form part of wages as defined under Section 2 (22) of the ESI Act as held in “S. Ganeshan wasThe Regional Director, ESI Corporation.’

- The demand of Employee’s State Insurance Corporation is not justified.

Question 2. Attempt the following stating relevant legal provisions and decided case law, if any: Lecktronics Ltd. is an establishment covered under the Employees’ State Insurance Act, 1948. The salesmen of the company were paid a commission of 10 % of the sales done by them every month. The ESI Inspector asked the employer to deposit contributions (the sum of money payable to the ESI Corporation by the principal employer in respect of an employee) in respect of the commission paid. Is he justified? Give reasons.

Answer:

- According to the ESI Act, 1948 wages include any remuneration paid at, intervals not exceeding two months.

- The employee receives incentives or commissions in addition to wages.

- As the commission is paid every month, the ESI Inspector can ask the employer to deposit contributions.