CMA Laws and Ethics – Directors

Question 1. No. of directors

Answer:

Every public company shall have at least 3 directors every private company shall have at least 2 directors and every one-person company shall have at least 1 director under Section 149.

Question 2. Legal position of director

Answer:

Directors are trustees for the company i.e. the directors are persons selected to manage the affairs of the company for the benefit of the shareholders.

Question 3. Maximum Number of Directors

Answer:

The maximum number of directors is 15, which can be increased by passing a special Resolution.

Question 4. Woman director

Answer:

Certain prescribed class or classes of companies is required to have at least one woman director. This is a mandatory provision.

Read and Learn More CMA Laws and Ethics Paper

Question 5. Resident of director

Answer:

Every company including one person company shall have at least one director who stays in India for not less than 182 days in the previous calendar year.

Question 6. Number of directorships

Answer:

The maximum limit on the total number of directorships has been fixed at 20 companies including a limit of 10 for public companies.

Question 7. Removed of director

Answer:

A director may be removed from the office by giving a special notice.

Question 8. Managerial remuneration

Answer:

The overall limit on managerial remuneration shall not exceed 11% of the net profits.

Question 9. More than one such director

Answer:

If there is more than one such director, remuneration shall not exceed 10% of the net profits of the company.

Question 10. Independent director

Answer:

An independent director of a company means a director other than a managing director a whole-time director or a nominee director.

Question 11.Independent director

Answer:

An independent director can be selected from a data bank containing names, addresses, and qualifications of persons who are eligible and willing to act as independent directors.

Question 12. Independent No. of director

Answer:

Every listed company shall have one-third independent directors.

Question 13. Section 149(8)

Answer:

Section 149(8) provides that the company and independent directors shall abide by the provisions specified in Schedule IV.

Question 14. Term of independent director

Answer:

An independent director shall hold office for a term of up to 5 consecutive years on the Board of a company.

Question 15. Resignation or removal of an independent director

Answer:

The resignation or removal of an independent director will be in the manner as is provided in Sections 168 & 169 of the act.

Question 16. Composition of the Board of Directors

Answer:

50% of the Board is to be independent if the Chairman is a promoter, otherwise 1 / 3rd of the Board is to be independently prescribed under Clause 49 of the Listing Agreement.

Note: Regulation .17(1) of the SEBI (LODR) Regulation 2015. SEBI has notified a new regulation named SEBI (Listing Obligations and Disclosure Requirements) Regulation, 2015 on 2nd September 2015. A time period of 90 days has been given for implementing the Regulations. However, two provisions of the regulations, which are facilitating in nature, are applicable with immediate effect. Other provisions of this new regulation have come into effect from 1st Dec. 2015.

The new regulation aims to consolidate and streamline the provisions of existing Listing Agreements for different segments of the capital market. However, for the sake of students’ help, we have provided the questions and answers under this chapter as per the old listing Agreement as well as the new regulation about the listing agreement.

Question 17. Nomination Committee

Answer:

The Nomination Committee shall lay down the evaluation criteria for the performance evaluation of independent directors.

Question 18. Director

Answer:

The director can participate in the Board Meeting through video conferencing or another audio-visual mode as may be prescribed.

Question 19. Notice of Board Meeting

Answer:

Notice of not less than seven days in writing is required to call a board meeting and notice of meeting to all directors shall be given, whether he is in India or outside India by hand delivery by post, or by electronic means.

Question 20. The participation of the director at the Board Meeting through video

Answer:

conferencing or by other electronic means shall be counted for Quorum.

Question 21. Audit Committee

Answer:

Every Listed Company and such other company as may be prescribed shall form an Audit Committee comprised of a minimum of 3 directors with a majority of the Independent Directors and the majority of members of the committee shall be persons with the ability to read and understand financial statements.

Question 22. Nomination and Remuneration Committee

Answer:

Every listed company and prescribed class or classes of companies shall constitute the Nomination and Remuneration Committee consisting of three or more non-executive directors out of which not less than one-half shall be independent directors.

Question 23. Inter-corporate investments

Answer:

Intercorporate investments are not to be made through more than 2 layers of investment companies.

Question 24. Meeting of Board

Answer:

In addition to the first meeting to be held within thirty days of the date! of incorporation, there shall be a minimum of four Board Meetings every! year and not more one hundred and twenty days shall intervene! between two consecutive Board Meetings.

In the case of One Person Company (OPC), a small company, and dormant company, at least one Board Meeting should be conducted in each half of the calendar year and the gap between two meetings should not be less than Ninety days.

Question 25.Matters not to be dealt with in a Meeting through Video Conferencing or other Audio Visual Means

Answer:

- The approval of the annual financial statements;

- The approval of the Board’s report;

- The approval of the prospectus;

- The Audit Committee Meetings for consideration of accounts; and

- The approval of the matter relating to amalgamation, merger, demerger, acquisition, and takeover.

Question 6.The quorum for Board Meeting

Answer:

One-third of the total strength or two directors, whichever is higher, shall be the quorum for a meeting.

- To determine the quorum, the participation by a director through Video Conferencing or other audio-visual means shall also be counted.

- If at any time the number of interested directors exceeds or is equal to two-thirds of the total strength of the Board of Directors, the number of directors who are not interested and present at the meeting, being not less than two shall be the quorum during such time.

Question 27.Audit Committee

Answer:

The requirement of the constitution of the Audit Committee has been limited to:

- Every listed Public Companies; or

- The following class of companies

- All public companies with a paid-up capital of $ 10 crores or more;

- All public companies having a turnover of $ 100 crores or more;

- all public companies, having in aggregate, outstanding loans or borrowings or debentures or deposits exceeding 50 crores or more.

Question 28.Corporate Social Responsibility Committee

Answer:

The Section applies to the following classes of companies during any financial year:

- Companies having a Net Worth of $ 500 crores or more;

- Companies having a turnover of $ 1,000 crores or more;

- Companies having a Net Profit of $ 5 crores or more.

Amendment made by Companies (Amendment) Act, 2017 Revised Section 135(1): “Every company having a net worth of rupees five hundred crores or more, or turnover of rupees one thousand crores or more, or a net profit of rupees five crores or more during the immediately preceding financial year shall constitute a Corporate Social Responsibility Committee of the Board consisting of three or more directors, out of which at least one director shall be independent.

- Provided that where a company is not required to appoint an independent director under sub-section (4) of Section 149, it shall have in its Corporate Social Responsibility Committee two or more directors.”

- Revised Section 135(3)(a): “(a) formulate and recommend to the Board, a Corporate Social Responsibility Policy which shall indicate the activities to be undertaken by the company in areas or subject, specified in Schedule VII.”

- Revised Explanation to Section 135(5): “For This purpose this section “net profit” shall not include such sums as may be prescribed, and shall be calculated by the provisions of Section 198.”

Question 29. Prohibitions and Restrictions Regarding Political Contributions

Answer:

- The non-government company or the company that has been in existence for less than three financial years may contribute any amount directly or indirectly to any political party.

- Further, the limit of contribution to political parties is 7.5% of the average net profits during the three immediately preceding financial years.

Note: Section 154 of the Finance Act, 2017 amends Section 182 of the Companies Act, 2013. As per the amendment, the limit on the maximum amount that can be contributed by a company to a political party has been removed.

Question 30. Key Managerial Personnel

Answer:

- Under Section 2(51) a Key Managerial Personnel is defined as the Chief Executive Officer or Managing Director or the manager, a Company Secretary or the time director, and the Chief Financial Officer in) relation to a company.

Amendment made by Companies (Amendment) Act, 2017 Revised Section 2(51):-

“Key managerial personnel” in a company, means

- The Chief Executive Officer the managing director or the| manager

- The Company Secretary

- The whole-time Director

- The Chief Financial Officer

- Such other officers, not more than one level below the directors) who is in whole-time employment, designated as key) managerial personnel by the Board; and

- Such other officer as may be prescribed”

- Every listed Company has a paid-up share capital of 10 crore or) more and is compulsorily required to have key managerial personnel.

- The whole time key managerial personnel is to be appointed by the Board) and shall not hold office in more than one company however he is) permitted to hold such other office with the permission of the Board of the) company.

Question 31. Penalty for not Appointing Mandatory

Answer:

Every director or key managerial personnel who is in default shall be liable to a penalty that may extend to $ 50,000 and a further fine which may) be extended to $ 1,000 for every day during which the default continues.

As per the Companies (Amendment) Act,

2019 Section 203 of the Companies Act, 2013 makes provisions for mandatory) appointment of certain Key Managerial personnel like MD or CEO,) Company Secretary and CFO.

- If any company makes any default in complying with the provisions of section 203, such company shall be liable to a penalty of five lakh rupees) and every director and key managerial personnel of the company who is in)

- Default shall be liable to a penalty of fifty thousand rupees and where the default is a continuing one, with a further penalty of one thousand rupees! for each day after the first during which such default continues but not exceeding five lakh rupees – Section 203(5) of the Companies Act, 2013) amended vide the Companies (Amendment) Act, 2019.

- In section 203 of the principal Act, for sub-section (5), the following sub-section shall be substituted, namely :

- “(5) If any company makes any default in complying with the provisions oil this section, such company shall be liable to a penalty of five lakh rupees, and every director and key managerial personnel of the company who is in default shall” be liable to a penalty of fifty thousand rupees and where the default is a continuing one, with a further penalty of one thousand rupees for each day after the first during which such default continues but not exceeding five lakh rupees.”

Question 32. Section 203

Answer:

The Company Secretary has been covered under the same section of KMP therefore Section 203.

Rule 8A Appointment of Company Secretaries in companies not) covered under rule 8 A company other than a company covered under rule 8 which has a paid-up share capital of $ 5 crore or use shall have) a whole of the company secretaries.

Question 33. Managerial Personnel

Answer:

- Overall managerial remuneration Section 197 of the Companies Act, 2013 prescribed the maximum) ceiling for payment of managerial remuneration by a public company to) its managing director whole-time director and manager which shall not) exceed 11 % of the net profit of the company in that financial year) computed by Section 198 except that the remuneration) of the directors shall not be deducted from the gross profits.

- Remuneration to Managing Director Or whole-time Director Or Manager: The remuneration payable to any one managing director or whole-time) director or manager shall not exceed 5% of the net profits of the) company and if there is more than one such director remuneration) shall not exceed 10% of the net profits to all such directors.

- Remuneration to other directors: Except with the approval of the company in general meeting, the remuneration payable to directors who are neither managing directors nor whole-time directors shall not exceed,

- 1% of the net profits of the company, if there is a managing or whole-time director or manager;

- 3% of the net profits in any other case.

- Remuneration by a company having no profit or inadequate profit: If, in any financial year, a company has no profits or its profits are inadequate, the company shall not pay to its directors, including managing or full-time directors or managers, any remuneration exclusive of any fees payable to directors except by the provisions of Schedule V and if it is not able to comply with Schedule V, with the previous approval of the Central Government.

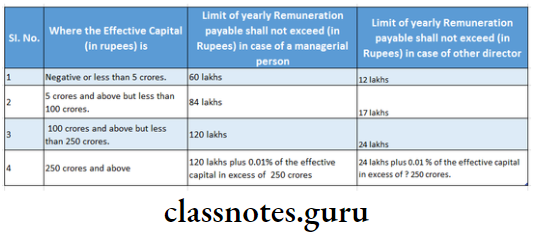

- Managerial Remuneration under Schedule V (Part II):

- Section 1: Remuneration by Companies Having Profits A company having profits in a financial year may pay remuneration to its managerial persons or persons or other directors or directors by Section 197.

- Section 2: Where in any financial year during the currency of tenure of a managerial person, or another director a company has no profits or its profits are inadequate it may without Central Government approval, pay remuneration to the managerial person not exceeding the limits under (A) and (B) given below:

Provided that the above limits shall be doubled if the resolution passed by the shareholders is special.

Explanation-

- It is hereby clarified that for a period less than one year, the limits shall be pro-rated.

- In the case of a managerial person or another director who is functioning in a professional capacity, no approval of the Central Government is required.

- if such a managerial person or other director does not have any interest in the capital of the company or its holding company or any of its subsidiaries directly or indirectly or through any other statutory structures and does not have any direct or indirect interest related to the directors or promoters of the company.

- Its holding company or any of its subsidiaries at any time during the last two years before or on or after the date of appointment and possesses graduate level qualification with expertise and specialized knowledge in the field in which the company operates:

- Provided that any employee of a company holding shares of the company not exceeding 0.5% of its paid-up share capital under any scheme formulated for allotment of shares to such employees including Employees Stock Option Plan or by way of qualification shall be deemed to be a person not having any interest in the capital of the company

Amendment made by Companies (Amendment) Act, 2017 Revised First Proviso to Section 197(1)-

“Provided that the company in general meeting may, with the approval of the Central Government, authorize the payment of remuneration exceeding eleven percent, of the net profits of the company, subject to the provisions of Schedule V:”

Revised Second Proviso to Section 197(1)- “Provided further that, except with the approval of the company in general meeting by a special resolution,

- The remuneration payable to any one managing director; or whole-time director or manager shall not exceed five percent, of the net profits of the company, and if there is more than one such director remuneration shall not exceed ten percent, of the net profits to all such directors and manager taken together.

- The remuneration payable to directors who are neither managing directors nor whole-time directors shall not exceed,

- one percent, of the net profits of the company, if there is a managing or whole-time director or manager;

- three percent, of the net profits in any other case.

Third Proviso to Section 197(1)-“Provided also that, where the company has defaulted in payment of dues to any bank or public financial institution or non-convertible debenture holders or any other secured creditor, the prior approval of the bank or public financial institution concerned or the non -non-convertible debenture holders or other secured creditor, as the case may be, shall be obtained by the company before obtaining the approval in the general meeting.”

Question 34. Secretarial audit

Answer:

The Central Government through rules has prescribed such other classes of companies as under-

- Every public company having a paid-up share capital of fifty crore rupees or more; or

- Every public company having a turnover of two hundred fifty crore rupees or more

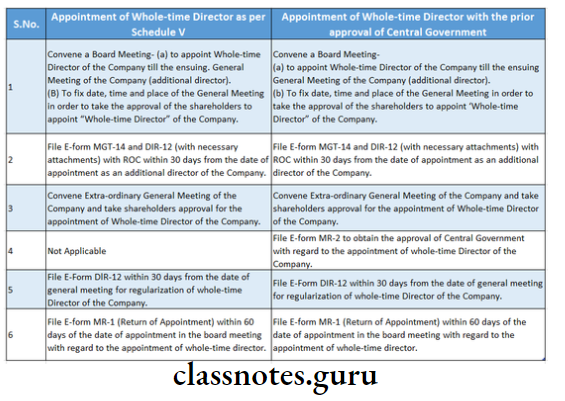

Steps for the Appointment of Whole-time Director

Directors Short Notes Question And Answers

Question 1. Write a short note of the following term Director Identification Number (DIN)

Answer:

- Every individual, who is to be appointed as director of a company shall make an application electronically in Form No. DIR-3 to the Central Government for allotment of DIN along with the prescribed fees.

- The applicant can download the said from the website of the Ministry of Corporate Affairs (‘MCA’ for short) duly filled in all respects along with a photograph and signed digitally.

- The form shall be verified by a Chartered Accountant in practice a Company Secretary in practice or a Cost Accountant in practice.

- On application, the system shall generate an application number. The Central Government shall process the application and decide on the approval or rejection and communicate the same to the applicant along with the DIN allotted in case of approval by way of a letter by post electronically or in any other mode within 30 days from the receipt of such application.

- If any defect is found in the application the central Government shall give intimation of such defect or incompletion to the applicant by placing it pp its website and by email to the applicant to rectify such defects within 15 days from the date of intimation.

- If the same has not been rectified the Government shall reject the application directing to file a fresh application.

- In case of rejection or invalidation of the application, the fee so paid with the application shall neither be refunded nor adjusted with any other application.

- The DIN allotted to a director before the commencement of this Act shall be deemed to be the DIN allotted under the present Act.

- The DIN allotted shall be valid up to the lifetime of the Director.

- The said number shall not be allotted to any other person. Similarly, a person shall be allotted only one DIN.

- The director, on allotment of DIN, is to intimate the company in Form No. DIR-3B within 30 days from the intimation, given to him.

- Amendment made by Companies (Amendment) Act, 2017 Proviso to Section 153- Provided that the Central Government may prescribe any identification number which shall be treated as Director Identification Number for this Act and in case any individual holds or acquires such identification number, the requirement of this section shall not apply or apply in such manner as may be prescribed.

- Section 159 provides that if any individual or director of a company, contravenes any of the provisions of Section 152 (dealing with the appointment of directors), Section 155 (dealing with prohibition to obtain more than one DIN), and Section 156 (Director to intimate DIN), such individual or director shall be liable to a penalty which may extend to fifty thousand rupees and where the default is a continuing one, with a further penalty which may extend to five hundred rupees for each day after the first during which such default continues.

Penalty if the company does not inform DIN to RoC within 15 days

As per the Companies (Amendment) Act, 2019 Section 157(1) of the Companies Act, 2013 imposes an obligation on every company to intimate DIN to RoC within 15 days of receipt of information from the director.

If any company fails to furnish the Director Identification Number under section 157(1), such company shall be liable to a penalty of twenty-five thousand rupees and in case of continuing failure, with further penalty of one hundred rupees for each day after the first during which such failure continues, subject to a maximum of one lakh rupees, and every Officer of the company who is in default shall be liable to a penalty of not less than twenty-five thousand rupees and in case of continuing failure, with further penalty of one hundred rupees for each day after the first during which such failure continues, subject to a maximum of one lakh rupees section 157(2) of Companies Act, 2013 amended vide the Companies (Amendment) Act, 2019.

Penalty violation of provisions by the director relating to DIN: If any individual or director of a company makes any default in complying with any of the provisions of sections 152,155 and 156, such individual or director of the company shall be liable to a penalty which may extend to fifty thousand rupees and where the default is a continuing one, with a further penalty which may extend to five hundred rupees for each day after the first during which such default continues – section 159 of Companies Act, 2013 amended vide the Companies (Amendment) Act, 2019.

Amendment made by Companies (Amendment) Act, 2017

Proviso to Section 153- “Provided that the Central Government may prescribe any identification number which shall be treated as Director Identification Number for this Act and in case any individual holds or acquires such identification number, the requirement of this section shall not apply or apply in such manner as may be prescribed.”

Directors Descriptive Question And Answers

Question 1. A company was formed and commenced business but directors were not appointed. In such a case who will act as a director?

1. The board acts on the advice given by a person in his professional capacity, whether he shall be treated as director.

2. What are the conditions to be complied with to keep the minutes in the loose-leaf binders?

3. “Audit committee is only luxury to the company”. Do you agree?

Answer:

1. Director: The designation as director does not mean that he indeed is a director. A person who has control over the direction, conduct, or management of the business of the company is a director. Company’s Act, 2013 provides that only individuals can be directors hence a firm, company, association of persons, body of individuals, or company can not function as a director of a company.

Appointment of first directors: (Section 152 of Companies Act, 2013)

- Normally AOA contains the names of the first directors.

- If the AOA does not contain the first directors then those who sign the MOA shall decide the names of the first directors.

- If the first directors are not decided in this manner, the subscribers (signatories) to MOA will be deemed as the first directors of the company.

As per Section 35 of, Indian Companies Act, 2013 such persons shall not be deemed to be directors.

2. Minutes may be kept in loose-leaf binders: The modern practice is to type out or obtain computerized printing of the minutes in loose leaves and then keep them in a binder. The Department . of Company Affairs vide File No. 8-16(l)-61 PR has prescribed that, in certain cases, minutes may be kept in a loose-leaf binder provided the following conditions are fulfilled:

- The pages are serially numbered;

- The loose leaves are bound up at reasonable intervals, say not exceeding six months;

- There should be a proper locking device to ensure security and proper control to prevent irregular removal of the loose leaves.

3. The audit committee serves as a communication link among various departments and has to interact with management, the internal auditor, the statutory auditor, and the public.

- The Audit Committee provides independent and impartial reassurance to the board through its oversight, supervisory, and monitoring role.

The chief role of the audit committee is to ensure that the reporting and disclosure made in the financial statements of the company are correct, accurate, and proper. - The Audit Committee has a responsibility to ensure that the company’s financials do not contain any misrepresentation or misleading information.

There have been many failures in the field of corporate governance and this has given birth to the necessity of an audit committee in corporate governance the Audit Committee has become increasingly relevant in enhancing confidence in the integrity of an organization’s processes and procedures relating to internal control and financial reporting. - The Audit Committee has become one of the main pillars of corporate governance in checking and forestalling corporate misconduct.

The effectiveness of the Audit Committee determines to a large extent the integrity of a company’s financial statements. - So, it can be said that the given statement is not true. Audit committee is not a luxury to the company and it is an essential element of good corporate governance.

- The Audit Committee provides independent and impartial reassurance to the board through its oversight, supervisory, and monitoring role.

Question 2. Describe the provisions for disclosure of interest by directors u/s184 of the Companies Act, 2013.

Answer:

The Act provides for the disclosure by directors relating their concern or interest in any company or companies or body corporate (including shareholding interest), firms, or other association of individuals by giving a notice in writing in form MBP 1 (Rule 9(1)) at the first meeting of the board after being appointed as director and at the first meeting of the board of every financial year, in addition to this, any change required to be disclosed in next board meeting.

- Every director is required to disclose the nature of his concern or interest at the meeting of the board in which the contract or arrangement is discussed and he has not to participate in such meeting.

- The abovementioned interest may be direct or indirect and relate to some contract or arrangement or proposed contract or arrangement entered into or to be entered into with a body corporate in which such director or such director in association with another director holds more than two percent shareholding or is a promoter, manager, Chief Executive Officer of that body corporate or with a firm or other entity in which such director is a partner, owner or member as the case may be.

- It shall be the duty of the director to give notice of interest to cause it to be disclosed at the meeting held immediately after the date of the notice. (Rule 9(2))

- If a director is not concerned or interested at the time of the contract but, subsequently becomes concerned or interested is required to disclose his interest or concern at the first meeting of the board.

- All notices shall be kept at the registered office and such notices shall be preserved for eight years from the end of the financial year to which it relates and shall be kept in the custody of the company secretary of the company or any other person authorized by the Board for the purpose. (Rule 9(3)).

- If a contract or arrangement entered into by the company without disclosure of interest by the director or with participation by a director who is concerned or interested in any way, directly or indirectly, in the contract or arrangement, shall be voidable at the option of the company.

- The contravention of the provisions leads to punishment for a term which may extend to one year or with a fine which shall not be less than fifty thousand rupees but which may extend to one lakh rupees or both.

- Any contract or arrangement entered into or to be entered into between two companies, where any director of any company holds more than two percent of the paid-up capital in another company, the provisions of this section shall not apply.

Note:

Amendment made by Companies (Amendment) Act, 2020: In Section 184 of the Principal Act, in sub-section (4), for the words “punishable with imprisonment for a term which may extend to one year or with fine which may extend to one lakh rupees, or with both”, the words “liable to a penalty of one lakh rupees” shall be substituted.

Question 3. In a public company, the total number of Directors is 9, and 2 offices of the Directors have fallen vacant. Referring to the relevant provisions of the Companies Act, 2013:

- What would be the quorum for the Board Meeting?

- Can the articles of a company fix the quorum (higher or lower) for the Board Meeting?

Answer:

Where the total number of Directors is 9 and 2 offices of the Directors have fallen vacant, the number of Directors remaining is 7. Therefore, a quorum is to be calculated concerning 7.

- As per Section 174 of the Companies Act, 2013, the quorum shall be 1/3 of the total strength of the directors, and any fraction shall be rounded off to the next full figure. In the given case 1 Or 3rd is 2.33. Therefore, where the total strength is 7, the quorum shall be 3.

- The articles of the company may fix a quorum higher than 1 /13th of total strength but not lower than that. If it is fixed on the lower side, it will be void.

Question 4. What is the time limit within which the Board has to appoint an Independent Director and at which meeting the Independent Director is appointed under the Companies Act, 2013?

Answer:

Section 149(5) of the Companies Act, 2013 inter alia provides that companies existing before the commencement of this Act, which are falling within the ambit of Section 149(4), shall have to appoint Independent Directors within one year from the commencement of Companies Act, 2013 or rules made in this behalf, as may be applicable.

Further, as per Section 152(2) read with Schedule IV of the Companies Act, 2013, inter alia provides that, the appointment of the Independent Director shall be approved by the Company in its meeting of shareholders.

5. How many Independent Directors have to be appointed in a company under the Companies Act, 2013?

Answer:

Number of Independent Directors:

The following class or classes of companies shall have at least two directors as independent directors:

- The Public Companies having paid up share capital of ten crore rupees or more; or

- Public Companies having a turnover of one hundred crore rupees or more; or

- The Public Companies have, in the aggregate, outstanding loans, debentures, and deposits, exceeding fifty crore rupees.

Provided that in case a company covered under this rule is required to appoint a higher number of independent directors due to the composition of its audit committee, a higher number of independent directors shall apply to it.

- Provided further that any intermittent vacancy of an independent director shall be filled up by the Board at the earliest but not later than the immediate next Board meeting or three months from the date of such vacancy, whichever is later.

- Provided also that where a company ceases to fulfill any of three conditions ‘3’ d down in sub-rule (1) for three consecutive years, it shall not be required to comply with these provisions until it meets any of such corrections.

- Provided that a company belonging to any class of companies for which a higher number of independent directors has been specified in the law for the law being in force shall comply with the requirements specified in such law.

Question 6.

1. Describe the Procedure for the resignation of the Director.

Answer:

Resignation of a Director: Section 168 provides the procedure for the resignation of a director as detailed below:

- A director may resign from his office by giving a notice in writing to the company;

- He shall within 30 days from the date of resignation, forward to the Registrar a copy of his resignation along with the reasons for the resignation, in Form No. DIR – 11 along with the fee;

- A foreign director may authorize in writing a practicing Chartered Accountant or Cost Accountant or Company Secretary in practice or any other resident director of the company to sign Form No. DIR – 11 and file the same on his behalf intimating the reasons for the resignation;

- The Board shall on receipt of such notice take notice of the same;

- The company shall intimate the Registrar in Form No. DIR-12 within one month from the date of receipt of such notice;

- The said information is to be posted on the website of the company;

- The fact of the resignation shall be laid in the report of directors immediately following the general meeting by the company;

- The resignation of a director shall lake effect from the date on ‘which the notice is received by the company or the date, if any, specified by the director in the notice, whichever is later;

- The director who has resigned shall be liable even after his resignation for the offenses that occurred during his tenure;

- Where all directors of a company resign from their offices the promoter or, in his absence, the Central Government shall appoint the required number of directors, who shall hold the office till the directors are appointed by the company in a general meeting.

2. Describe the term ’independent director as per the Companies Act, 2013.

Answer:

Independent directors: Independent directors are defined under Section 149(6) of the Companies Act as directors other than managing directors whole-time directors or nominee directors:

- Who, in the opinion of the Board, is a person of integrity and possesses relevant expertise and experience;

- He shall not be a promoter of the company or its holding, subsidiary, or associate company;

- He shall not relate to the promoters or directors in the company, its holding, subsidiary, or associate company;

- He shall not have any pecuniary relationship with the company or its promoters or directors during the two immediately preceding financial years or the current financial year;

- His relatives shall not have any pecuniary relationship with the company or their promoters of directors amounting to 2% or more of its gross turnover or total income. 50 lakhs or such higher amount as may be prescribed, whichever is lower, during the two immediately preceding financial years or the current financial years;

- He or his relatives:

- Holds or has held the position of a key managerial personnel or is or has been an employee of the company or its holding, subsidiary, or associate company, in any of the three financial years immediately preceding the financial year;

- Is or has been an employee or proprietor or partner, in any of the three financial years immediately preceding the financial year in which he is proposed to be appointed, of:

- A firm of auditors or company secretaries in practice or cost auditors of the company: or % any legal or consulting firm that has or had

- Any transaction with the company, amounting to 10% or more of the gross turnover of such firm.

- Holds together with his relatives 2% or more of the total voting power of the company: or is a Chief Executive or Director of any nonprofit organization that receives 25% or more of its receipts from the company, any of its promoters, directors, or its holding, subsidiary, or associate company or that holds 2% or more of the total voting power of the company; or

- Who possess such other qualifications as may be prescribed.

Question 7.

1. What are the different duties of a director in a company as per the Companies Act, of 2013?

Answer:

Section 166 of the Act prescribes the duties of a director under the provisions of this Act as detailed below:

- A director of a company shall act by the articles of the company;

- A director of a company shall act in good faith to promote the objectives of the company for the benefit of its members as a whole and in the best interests of the company, its employees, the shareholders, the community, and the protection of the environment;

- A director of a company shall exercise his duties with due and reasonable care, skill, and diligence and shall exercise independent judgment;

- A director shall not be involved in a situation in which he may have a direct or indirect interest that conflicts, or possibly may conflict, with the interest of the company;

- A director of a company shall not achieve or attempt to achieve any undue gain or advantage either to himself or to his relatives, partners, or associates and if such director is found guilty of making any undue gain, he shall be liable to pay an amount equal to that gain to the company;

- A director of a company shall not assign his office and any assignment so made shall be void;

If a director of the company contravenes the provisions of Section 166 such director shall be punishable with a fine which shall not be less than one lakh rupees but which may extend to five lakh rupees.

2. Enumerate the provisions relating to Restrictions on the powers of the Board.

Answer:

The board can exercise the following powers only with the consent of the company by special resolution, namely –

- to sell, lease, or otherwise dispose of the whole or substantially the whole of the undertaking of the company or where the company owns more than one undertaking, of the whole or substantially the whole of any of such undertakings.

- to invest otherwise in trust securities the amount of compensation received by it as a result of any merger or amalgamation;

- to borrow money, where the money to be borrowed, together with the money already borrowed by the company will exceed the aggregate of its paid-up share capital and free reserves, apart from temporary loans obtained from the company’s bankers in the ordinary course of business;

- to remit, or give time for the repayment of, any debt due from a director.

- The special resolution relating to borrowing money exceeding paid-up capital and free reserves specifies the total amount up to which the money may be borrowed by the Board.

- The title of the buyer or the person who takes on lease any property, investment, or undertaking in good faith cannot be affected and also in case such sale or lease is covered in the ordinary business of such company.

- The resolution may also stipulate the conditions of such sale and lease, but this doesn’t authorize the company to reduce its capital except the provisions contained in this Act.

- The debt incurred by the company exceeding the paid-up capital and free reserves is not valid and effectual unless the lender proves that the loan was advanced in good faith and also has no knowledge that the limit imposed had been exceeded.

Question 8. Discuss the provisions of the Companies Act, 2013 regarding disqualifications for appointment of director.

Answer:

Section 164 of the Companies Act, 2013 details the disqualification of a person for the appointment as a Director. A person shall not be eligible for appointment as a Director of a company, if –

- He is of unsound mind and stands so declared by a competent court;

- He is an undischarged insolvent;

- He has applied to be adjudicated insolvent and his application is pending;

- He has been convicted by a Court of any offense,’ whether involving moral turpitude or otherwise and sentenced to imprisonment for not less than 6 months and 5 years has not elapsed from the date of expiry of the Sentence;

Provided that

- If a person has been convicted of any offense and sentenced in respect thereof to imprisonment for 7 years or more, he shall not be eligible to be appointed as a director in any company;

- An order disqualifying him for appointment as a director has been passed by the Tribunal and the Order is in force;

- He has not paid any calls in respect of any shares of the company held by

- Him, whether alone or jointly with others, and six months have elapsed from the last day fixed for the payment of the call;

- He has been convicted of the offence dealing with related party transactions under Section 188 at any time during the preceding five years; or

- He has not complied with sub-Section (3) of Section 152;

- He has not complied with the provision of Section 165(1). (As per Amendment Companies Act, 2019).

- A private company may by its articles provide for any disqualifications for appointment as a director in addition to the above disqualifications.

The disqualifications in (d), (e), and (f) shall not take effect:

- For 30 days from the date of conviction or order of disqualification;

- where an appeal or petition is preferred within 30 days against the conviction resulting in sentence or order, until expiry of 7 days from the date on which such appeal or petition is disposed of;

- where any further appeal or petition is preferred against the order or sentence within 7 days until such further appeal or petition is disposed of.

Note: Inserted a clause in section 164: Disqualifications from appointment of directors: A new clause (1) after clause (h) in section 164(1) is inserted, whereby a person shall be subject to disqualification if he accepts directorships exceeding the maximum number of directorships provided in Section 165.

Question 9. Directors are agents of the company.”- Discuss.

Answer:

- The company can act only through Directors, and so the relationship between the company and the Director is that of Principal and Agent. A contract entered into by a person as a Director of a company will be binding on the Company.

- However, Directors are not Agents or Members of the company.

Directors have personal liability. They would be personally liable under the following circumstances:

- The director acts in his name,

- Director enters into an agreement or contract which does not state clearly as to whether the Director signing in his capacity or in his representative capacity as an Agent of the Company.

Rights of the Company:

- Contract executed by the Director more than his authority, is binding on the Company.

- However, the Company may claim damages from the Director for breach of implied warranty of authority.

- When Directors act properly on behalf of the Company, they do not incur personal liability; they do not exceed their powers.

Question 10.

1. Discuss the powers of the Board of Directors of a company as per the Companies Act, 2013

Answer:

Section 179 of the Companies Act, 2013 provides that the powers of the board; all powers to do such acts and things for which the company is authorised is vested with the board of directors.

But the board can act or do the things for which powers are vested with them

and not with general meetings.

The following Section 179(3) read with Rule 8 of Companies (Management And Administration) Rules, 2014 powers of the Board of Directors shall be exercised only using resolutions passed at meetings of the Board, namely:

- To make calls on shareholders in respect of money unpaid on their shares

- To authorize the buy-back of securities under Section 68

- To issue securities, including debentures, whether in or outside India

- To borrow monies

- To invest the funds of the company

- To grant loans or give guarantee or provide security in respect of loans

- To approve financial statement and the Board’s report

- To diversify the business of the company

- To approve amalgamation, merger, or reconstruction

- To take over a company or acquire a controlling or substantial stake in another company

- To make political contributions

- To appoint or remove key managerial personnel (KMP)

- To appoint internal auditors and secretarial auditor

Important: The Board may, by a resolution passed at a meeting, delegate to any committee of directors, the managing director, the manager, or any other principal officer of the company or in the case of a branch office of the company, the principal officer of the branch office, the powers specified in (4) to (6) above on such conditions as it may specify.

- The banking company is not covered under the purview of this section. The company may impose restrictions and conditions on the powers of the Board.

- Although, unless specifically restricted under the Act or Article of Association, the Board has all the powers to manage the affairs of the company

2. Enumerate the provisions of the Companies Act, 2013 relating to women directors in a company.

Answer:

The second proviso to Section 149(1) of the Companies Act, 2013 read with Rule 3 of Companies (Appointment and Qualification of Directors) Rules, 2014 provides that the following classes of companies shall appoint at least one woman director

- Every listed company;

- Every other public company having

- Paid-up share capital of 100 crores or more or

- Turnover of 300 crores or more.

- For this purpose, the paid capital or turnover as on the last date of the latest audited financial statements shall be taken into account.

- A company incorporated under the Companies Act shall comply with such appointment of a woman director within six months from the date of its incorporation.

- Any intermittent vacancy of a woman director shall be filed up by the Board at the earliest but not later than the immediate next Board meeting or three months from the date of such vacancy whichever is later.

Question 11.

1. Describe the procedure for the resignation of a Director under the Companies Act, 2013.

Answer:

Resignation of Director:

Section 168 of the Companies Act 2013, provides the procedure for the resignation of a director as detailed below:

- A director may resign from his office by giving a notice in writing to the company

- He may within 30 days from the date of resignation, forward to the Registrar a copy of his resignation along with the reasons for the resignation, in Form No. DIR -11 along with the fee

- A foreign director may authorize in writing a practicing Chartered Accountant or Cost Accountant in practice Company Secretary in practice or any other resident director of the company to sign Form No. DIR -11 and file the same on his behalf intimating the reasons for the resignation

- The Board shall on receipt of such notice take notice of the same

- The company shall intimate the Registrar in Form No. DIR-12 within one month from the date of receipt of such notice

- The said information is to be posted on the website of the company

- The fact of the resignation shall be included in the report of directors laid in immediately following the general meeting by the company

- The resignation of a director shall take effect from the date on which the notice is received by the company or the date, if any, specified by the director in the notice, whichever is later

- The director who has resigned shall be liable even after his resignation for the offenses that occurred during his tenure.

- Where all directors of a company resign from their offices the promoter or, in his absence, the Central Government shall appoint the required number of directors, who shall hold the office till the directors are appointed by the company in a general meeting.

Note: Amendment made by Companies Amendment Act, 2017 in Section 168(1): Provided that a [director may also forward] a copy of his resignation along, with detailed reasons for the resignation to the Registrar within thirty days of resignation in such manner as may be prescribed.

2. Discuss the rules of appointment of directors elected by small shareholders in a company.

Answer:

Process of appointment of director elected by small shareholders:

- ‘Small shareholder’ means a shareholder holding shares of nominal value of not more than? 20,000 or such other sum as may be prescribed. A listed company may have one director elected by small shareholders.

- Rules 7 requires that a listed company, may upon notice of not less. than 1000 small shareholders or one-tenth of the total number of such shareholders, whichever is lower, have a small shareholders director elected by small shareholders.

- Such a director shall not be liable to retire by rotation. The tenure shall not exceed three consecutive years and on the expiry of the tenure such director shall not be eligible for reappointment. A disqualified person for the appointment of director shall not be eligible for such appointment. No person shall hold the position of small shareholder’s director in more, than two companies at the same time.

- A small shareholders’ director shall not, for 3 years from the date on which he ceases to hold office as a small shareholders’ director in a company, be appointed in or be associated with such company in any other capacity either directly or indirectly.

Directors Practical Question And Answers

Question 1. Mr. Lalit, a Director of XY Limited proceeding on a long foreign tour, appointed Mr. Mohan as an alternate director to act for him during his absence. The articles of the company provide for the appointment of alternate directors. Mr Lalit claims that he has a right to appoint an alternate director. State whether Mr. Lalit is correct based on legal provisions.

Answer:

Appointment of an alternate director can be done by the BOD and not by any individual director. Mr. Lalit is not correct based on legal provisions. Section 161 (2) of the Companies Act, 2013 provides that the Board of Directors of a company may, if authorized by its Articles or by resolution passed by the company in a general meeting, appoint an alternate director to act for a director during his absence for not less than 3 months from the State in which the meetings of the Board are ordinarily held. The alternate director can be appointed only by the Board of Directors and only in cases where the Board is authorized by Articles or by the company in general meetings.

Hence Mr. Lalit the director in question, is not competent to appoint an alternate director, and the appointment of Mr. Mohan as alternate director is not valid.

Question 2. Mr. Joseph is the director of a Public Limited Company. He was removed by the company before the expiry of his term, by passing an ordinary resolution in a general meeting. Is the company justified in its actions? Is Mr. Joseph entitled to claim compensation for the loss of his office?

Answer:

- Yes, the company is justified in this action;

- As per Section 169 of the Companies Act, 2013, a company has the power to remove a director by ordinary resolution before the expiration of his office. Mr. Joseph is not entitled to claim any compensation for the loss of his office. As per Section 202, a director is not entitled to any compensation for loss of office.

In the present case, Mr. Joseph is removed by passing an ordinary resolution, and such removal is valid being authorized under Section 169. There is no entitlement of a director to claim compensation for such removal given Section 202.

Only a managing director, a director holding the office of the manager, or a director in whole-time employment is entitled to compensation for IOCs of office [Section 202].

Question 3. Atul was appointed director of the company in its Annual General Meeting. He took over the office and started acting on behalf of the company as its director. Subsequently, it was found that the appointment of the director was not valid because in the meeting where he was appointed, certain members who had voted were not qualified to vote and certain members had voted twice by mistake. There were also certain mistakes in the counting of votes. As such, the appointment of the director was held to be invalid. Would the acts of Atul, done by him as director, be valid and binding upon the company?

Answer:

- According to Sec. 176 of the Companies Act, 2013, all acts of the director are valid even though his appointment is afterward discovered to be invalid, the reason for any defect in his appointment.

- This is to protect outsiders as well as members dealing with the company.

- In this case, the defects in the appointment of the director were found after his appointment. The director did not know about the defects until he had started acting as a director.

- The validity of the acts of the director cannot be questioned just based on irregularities subsequently discovered in the appointment of the director.

Question 4. AB Ltd. has advanced a loan of 12,00,000 to one of its directors in Contravention of the provision of Section 185 of the Companies Act, 2013. State the consequences of such contravention.

Answer:

Loans to Directors (Section 185 of Companies Act, 2013):

Amendment made by Companies (Amendment) Act, 2017. Section 185 of the principal Act, the following section shall be substituted, namely:—

- No company shall, directly or indirectly; advance any loan, including any loan represented by a book debt to, or give any guarantee or provide any security connection with any loan taken by

- Any director of the company, or of a company which is its holding company or any partner or relative of any such director, or

- Any firm in which any such director or relative is a partner.

- A company may advance any loan including any loan represented by a book debt, or give any guarantee or provide any security in connection with any loan taken by any person in whom any of the directors of the company is interested, subject to the condition that—

- A special resolution is passed by the company in the general meeting: Provided that the explanatory statement to the notice for the relevant general meeting shall disclose the full particulars of the loans given, or guarantee given or security provided, and the purpose for which the loan or guarantee or security is proposed to be utilized by the recipient of the loan or guarantee or security and any other relevant fact; and

- The loans are utilized by the borrowing company for its principal business activities.

- Explanation: For this sub-section, the expression “any person in whom any of the directors of the company is interested” means—

- Any private company of which any such director is a director or

member; any body corporate at a general meeting of which not less than twenty-five percent, of the total voting power, may be exercised or controlled by any such director, or by two or more such directors, together; or - Anybody corporate, the Board of directors, managing director or manager, whereof is accustomed to act by the directions or instructions of the Board, or of any director or directors, of the lending company.

- Nothing contained in sub-sections (1) and (2) shall apply to

- The giving of any loan to a managing or whole-time director

- As a part of the conditions of service extended by the company to all its employees; or

- Under any scheme approved by the members by a special resolution; or

- A company that in the ordinary course of its business provides loans or gives guarantees or securities for the due repayment of any loan and in respect of such loans an interest is charged at a rate not less than the rate of prevailing yield of one year, three-year, five-year, or ten year Government security closest to the tenor of the loan; or t

- Any loan made by a holding company to its wholly owned subsidiary company or any guarantee given or security provided by a holding company in respect of any loan made to its wholly owned subsidiary company; or

- Any guarantee given or security provided by a holding company in respect of a loan made by any bank or financial institution to its subsidiary company:

- Provided that the loans made under clauses (3) and (4) are utilized by the subsidiary company for its principal business activities.

- If any loan is advanced or a guarantee or security is given or provided

or utilized in contravention of the provisions of this section,-- The company shall be punishable with a fine which shall not be less than five lakh rupees but which may extend to twenty-five lakh rupees,

- Every officer of the company who is in default shall be punishable with imprisonment for a term which may extend to six months or with a fine which shall not be less than five lakh rupees but which may extend to twenty-five lakh rupees, and the director or the other person to whom any loan is advanced or guarantee or security is given or provided in connection with any loan taken by him or the other person shall be punishable with imprisonment which may extend to six months, or with a fine which shall not be less than five lakh rupees but which may extend to. twenty-five lakh rupees, or with both.”