Company Types Promotion Formation And Related Procedures

Question 1. Company

Answer:

- A company is an association of both natural and artificial persons incorporated under the existing law of a country.

A company has a separate legal entity from the persons constituting it.

Question 2. Characteristics of a Company

Answer:

The main characteristics of a company are corporate personality, limited liability, perpetual succession, separate property, transferability of shares, common seal, capacity to sue and be sued, contractual rights, limitation of action, separate management, termination of existence, etc.

Question 3. Compared to other types of business associations

Answer:

As compared to other types of business associations, an incorporated company has the advantage of corporate personality, limited liability, perpetual succession, transferable shares, separate property, capacity to sue, flexibility, and autonomy. ‘

Read and Learn More CMA Laws and Ethics Paper

Question 4. Disadvantages and inconveniences in incorporation

Answer:

There are, however, certain disadvantages and inconveniences in incorporation. Some disadvantages are formalities and expenses, corporate disclosures, separation of control from ownership, greater social responsibility, greater tax burden in certain cases, and cumbersome winding-up procedure.

Question 5. The doctrine of the lifting or piercing of the corporate veil

Answer:

- The separate personality of a company is a statutory privilege and it must be used for legitimate business purposes only.

- Where a fraudulent and dishonest use is made of the legal entity, the individuals concerned will not be allowed to take shelter behind the corporate personality.

- The Tribunal will break through the corporate shell and apply the principle Or doctrine of “lifting of or piercing the corporate veil”.

Question 6.LLP

Answer:

- It is an alternative corporate business form that gives the benefits of the limited liability of a company and the flexibility of a partnership.

- LLP can continue its existence irrespective of changes in partners.

- It is capable of entering into contracts and holding property in its name.

- LLP is a separate legal entity and is liable to the full extent of its assets.

- Still, the liability of the partners is limited to their agreed contribution to the LLP.

Question 7.Corporation

Answer: An organization formed under state law to carry on a business enterprise in such a manner as to make the enterprise distinct from its owners. ”

Question 8. Illegal association

Answer:

- As per Section 464 of the Companies Act, no association or partnership consisting of more than such number of persons as may be prescribed shall be formed to carry on any business that has for its object the acquisition of gain by the association or partnership or by the individual members thereof, unless it is registered as a company under this Act or is formed under any other law for the time being in force.

- The number of persons which may be prescribed under this section shall not exceed 100. Rule 10 of Companies (Miscellaneous) Rules, 2014 prescribes 50 persons in this regard.

Question 9. Types of Company

Answer:

From the point of view of incorporation, companies can be classified as chartered companies, statutory companies, and registered companies.

- Companies can be categorized as unlimited companies, companies limited by guarantee, and companies limited by shares.

- Companies can also be classified as public companies, private companies, one-person companies, small companies, associations not for profit having a license under Section 8 of the Act, Government Companies, Foreign Companies, Holding Companies, Subsidiary Companies, Associate Companies, Investment Companies, and Producer Companies.

Question 10.Private Company

Answer:

A private company has been defined under Section 2(68) of the Companies Act, 2013 as a company that has a minimum paid-up capital of $ 1,00,000 or such higher paid-up capital as prescribed and by its articles restricts the right to transfer its shares, limits the number of its members to two hundred and prohibits any invitation to the public to subscribe for any securities of the company.

Amendment Made by Companies (Amendment) Act, 2015 Provides that in clause (68), the words “of one lakhs rupees or higher paid-up share capital” shall be omitted.

Question 11.One Person Company

Answer: One Person Company” means a company that has only one person as a member.

Question 12.“Small Company”

Answer:

“Small company” means a company, other than a public company

- paid-up share capital which does not exceed $ 50,00,000 or such higher amount as may be prescribed which shall not be more than $ 5 crores; or

- turnover of which as per its last profit and loss account does not exceed $ 2 crore or such higher amount as may be prescribed which shall not be more than $ 20 crores.

Amendment made by Companies (Amendment) Act, 2017:

Revised Section 2(85)

“Small Company means a company, other than a public company,

- paid-up share capital of which does not exceed fifty lakh rupees or such higher amount as may be prescribed which shall not be more than ten crore rupees; and

- turnover of which as per profit and loss account for the immediately preceding financial year does not exceed two crore rupees or such higher amount as may be prescribed which shall not be more than one hundred crore rupees.”

Question 13. Public Company

Answer:

A public company is a company that is not a private company and has a minimum paid-up share capital of $ 5 lakh or such higher paid-up capital, as may be prescribed.

Amendment Made by Companies (Amendment) Act, 2015: Provides that in clause (68), the words “of $ 5 lakhs or higher paid-up share capital” shall be omitted.

Question 14.Limited Company

Answer: A limited company is a company limited by shares or by guarantee. An unlimited company is a company not having any limit on the liability of its members.

Question 15.Foreign Company

Answer:

Foreign Company means any company or body corporate incorporated outside India which has a place of business in India whether by itself or through an agent, physically or through electronic mode; and (b) conducts any business activity in India in any other manner.

Question 16.Investment Company

Answer: An Investment Company is a company whose principal business is the acquisition of shares, debentures, or other securities.

Question 17.Association not-for-profit

Answer:

Section 8(1) permits the registration, under a license granted by the Central Government, of associations not for profit with limited liability without being required to use the word “Limited” or the words “Private Limited” after their names.

The Central Government may grant such a license if:

- it is intended to form a company for promoting commerce, art, science, sports, education, research, social welfare, religion, charity protection of the environment, or any such other object, and the company prohibits payment of any dividend to its members but intends to apply its profits or other income in promotion of its objects

- A company in which not less than 51 % of the paid-up share capital is held by the Central Government, or by any State Government or Governments or partly by the Central Government and partly by one or more State Governments and includes a company that is a subsidiary company of such a Government Company.

Question 19.Holding Company

Answer:

As per Section 2 (46), a holding company, about one or more other companies, means a company of which such companies are subsidiary companies. Amendment made by Companies (Amendment) Act, 2017 Explanation to Section 2(46) “Explanation For this clause, the expression “company” includes any body corporate;”

Question 20.Subsidiary Company

Answer:

Section 2 (87) provides that a subsidiary company or subsidiary, about any other company (that is to say the holding company), means a company in which the holding company

- Controls the composition of the Board of Directors

- Exercises or controls more than one-half of the total share capital either on its own or together with one or more of its subsidiary companies.

Question 21.Control

Answer:

It shall include the right to appoint a majority of the directors or to control the management or policy decisions exercisable by a person or persons acting individually or in concert, directly or indirectly, including by their shareholding or management rights or shareholders agreements or voting agreements or in any other manner.

Question 22.Dormant Companies

Answer:

As per Section 455 (1) where a company is formed and registered under this Act for a future project or to hold an asset or intellectual property and has no significant accounting transaction, such a company or an inactive company may make an application to the Registrar in such manner as may be prescribed for obtaining the status of a dormant company.

Question 23.Associate Company

Answer:

As per Section 2(6), “Associate Company”, about another company, means a company in which that other company has a significant influence, but which is not a subsidiary company of the company having such influence and includes a joint venture company.

Amendment made by Companies (Amendment) Act, 2017:

Revised Explanation to Section 2(6)– “Explanation For this clause

- the expression “significant influence” means control of at least twenty percent, of total voting power, or control of or participation in business decisions under an agreement;

- the expression “joint venture” means a joint arrangement whereby the parties that have joint control of the arrangement have rights to the net assets of the arrangement.”

Question 24.Position of OPC in India under the Companies Act, 2013

Answer:

- As per Section 2(62) of the Companies Act, 2013, “One Person Company” means a company that has only one person as a member.

- Section 3(1 )(c) lays down that a company may be formed for any lawful purpose by one person, where the company to be formed is to be a person Company, that is to say, a private company.

- In other words, a personal company is a kind of private company. A One-person company shall have a minimum of one director. Therefore, a one-person company will be registered as a private company with one member and one director.

Question 25. Promoters 25 Promoters

Answer:

Promoters 25 Promoters are the persons who conceive the idea of forming a company and take the necessary steps to incorporate it by registration, provide it with share and loan capital, and acquire the business or property which it is to manage [Section 2(69)].

Question 26. Promoters

Answer: 26A promoter is neither an agent of nor a trustee for the company. But they occupy a fiduciary position in the company.

Question 27. promoters

Answer: Disclosure by promoters to the company should be through the medium of the Board of Directors.

Question 28. Promoters

Answer: A promoter has no legal right to claim promotional expenses for his services unless there is a valid contract.

Question 29. Liabilities of promoter

Answer:

- Incorporation of company by furnishing false information

- Civil Liability for misstatements in prospectus

- Punishment for fraudulently inducing persons to invest money

- Contravention of provisions relating to private placement

- Failure to cooperate with the Company Liquidator during winding up

- Criminal Liability for misstatement in the prospectus.

Question 30. Rights of promoters

Answer:

- Right to receive preliminary expenses;

- Right, to recover the proportionate amount from the Co-promoters.

Question 31. Procedure for Incorporation of a Company

Answer:

- Application for Availability of Name of Company;

- Preparation of Memorandum and Articles of Association;

- Filing of Documents with Registrar of Companies;

- Declaration from the professional;

- Declaration from the subscribers to the Memorandum;

- Furnishing verification of Registered Office

- Filing of particulars of Subscribers

- Filing particulars of first directors along with their consent to act as directors

- Power of Attorney: Execution of power of attorney on a non-judicial stamp paper of a value prescribed in state stamp laws.

- Issue of Certificate of Incorporation by Register.

Question 32. Steps to be taken by a promoter

Answer:

The first few steps to be taken by a promoter in incorporating a company are to apply for the availability of the name of the company, prepare the memorandum and articles of association, and get them vetted, printed, stamped, and signed. The promoter should then execute a power of attorney and fill in additional documents as required under section 7. He should then file a statutory declaration and pay the registration fees.

Question 33.Civil as well a3 criminal liability

Answer:

Civil as well as criminal liability may be imposed on a promoter for any misleading Statement in the prospectus if loss or damage has been -stored by a person who has subscribed for any securities of the company on the faith of the prospectus.

34. Conclusive Evidence

Answer:

The Certificate of Incorporation is conclusive evidence that everything is in order as regards registration and that the company has come into existence from the earliest moment of the day of incorporation stated therein.

35. Memorandum of Association

Answer:

- A Memorandum of Association is a document that sets out the constitution of the company and it is the foundation on which the structure of the company stands.

- It defines as well as confines the powers of the company, if the company enters into a contract or engages in any trade or business that is beyond the powers conferred on it by the memorandum, such a contractor the act will be ultra vires the company and hence void.

- However, the Companies Act 2013 shall override the provisions in the memorandum of a company if the latter contains anything contrary to the provisions of the Act.

36. Clauses

Answer:

Memorandum of Association consists of :

- Name Clause

- Situation Clause

- Object Clause

- Liability Clause

- Capital Clause

- Subscription Clause

37. Articles

Answer:

Articles means the articles of association of a company as originally framed or a.s shared from time to time in pursuance of any previous company law or of this Act It also includes the regulations contained in Tables F to J in Schedule I Of the Act, in so far as they apply to the company.

Question 38.Scope and powers of the company

Answer:

The memorandum lays down the scope and powers of the company and the articles govern how the objects of the company are to be carried out and can be framed and altered by the members.

Question 39. Alter its articles of association

Answer:

A company has a statutory right to Alter its articles of association. However, the power to alter is subject to the provisions of the Act and the conditions contained in the memorandum. Any alteration so made shall be as valid as if originally contained in the articles.

Question 40.Registration of MOA Or AOA

Answer:

The memorandum and articles, when registered, bind the company and its members to the same extent as if they have been signed by the company and by each member to observe and be bound by all the provisions of the memorandum and of the articles.

Question 41.Alteration of memorandum

Answer:

- Name Change:

- Pass Special Resolution

- Approval of Central Government

- To delete the word “private” approval from the Central Government is not required in case of conversion of a private company to a public company.

- Change in Registered Office:

- Change within local limits: Pass Board Resolution and Special Resolution Notice of change to the registrar in INC 22 within 15 days of such change

- Change of State: Approval of Central Govt. In INC 23 the Approval should be registered with Registrar for Incorporation Certificate

- Change in jurisdiction of Registrar: Get confirmation by the Regional Director Communication of confirmation by the Regional Director to the company within 30 days.

- Change in Liability:

- Needs a Special Resolution to be passed.

- file the same with the Registrar in form MGT 14.

- Change in Capital:

- alteration of the capital clause to be authorized by the Articles of Association [Section 61]; Ordinary Resolution

- If by division or consolidation in capital, the voting percentage gets| affected then a confirmation from the Tribunal is mandatory.

- Notify the alterations made and a copy of the Resolutions passed shall| be filed with the Registrar within 30 days.

- The Registrar shall record the notice and make the alterations required.

Question 42.The doctrine of constructive notice

Answer:

As per the doctrine of constructive notice, every person dealing with the company is deemed to have a “constructive notice” of the contents of its memorandum and articles.

- Outsiders dealing with incorporated bodies are bound to take notice of limits imposed on the corporation by the memorandum or other documents of the constitution.

- Nevertheless, they are entitled to assume that the directors or other persons exercising authority on behalf of the company are doing so by the internal

- Regulations as set out in the Memorandum And Articles of Association.

Question 43.The doctrine of indoor management

Answer:

- While the doctrine of constructive notice seeks to protect the company against outsiders, the doctrine of indoor management operates to protect outsiders against the company.

- While persons contracting with a company are presumed to know the provisions of the contents of the memorandum and articles, they are entitled to assume that the provisions of the articles have been observed by the officers of the company.

- However, there are certain exceptions to the doctrine of indoor management.

Question 44.The doctrine of ultra vires

Answer:

In the case of a company whatever is not stated in the memorandum as the objects or powers is prohibited by the doctrine of ultra vires (The word ‘ultra’ means beyond and the word ‘vires’ means powers).

Question 45. Share capital

Answer:

The share capital of a company can be classified as:

- nominal, authorized, or registered capital;

- issued and subscribed capital;

- called up and uncalled capital;

Question 46.Share

Answer: A share is defined as a share in the share capital of a company, including stock except where a distinction between stock and shares is expressed or implied.

Question 47.Two classes of shares

Answer: The Companies Act, 2013 permits a company limited by shares to issue! two classes of shares, namely equity share capital and preference share capital.

Question 48.Preference share

Answer: A preference share or preference share capital is that part of share capital that carries a preferential right concerning both dividends and capital.

Question 49.Types of preference shares

Answer: Preference shares may be of various types, namely participating and non-participating, cumulative and non-cumulative shares, and redeemable and! irredeemable preference shares.

Question 50. Equity share capital

Answer: Equity share capital means all share capital which is not preference share! [capital

Question 51. Sweat equity shares

Answer:

This means equity shares issued by a company to its employees or directors at a discount or for consideration, other than cash for providing know-how on making available rights like intellectual property rights or value additions, by whatever name called.

- Issue of sweat equity shares to be authorized by special resolution at a general meeting.

- The apodal resolution authorizing sweat equity shares is not valid if the allotment is made after 12 months of passing the resolution, i.o the validity of a special resolution is 12 months.

- The price of sweat equity shares Is to be determined by a registered valuer.

- The company shall maintain a Register of Sweat Equity Shares in Form No. SH 3

- The issue of sweat equity shares to employees and directors at a discount under Section 54 is outside the scope of Section 53,

Question 52. Rights issue

Answer:

The rights issue is an issue of capital to be offered to the existing shareholders of the company through a letter of offer.

- Listed companies to inform concerned stock exchanges

- Company to give notice to equity shareholder giving him 15-30 days to decide

- The company can issue shares to other than the existing shareholder for cash or other than cash if a special resolution is obtained

- Price to be determined by the registered valuer’s report

- The provisions of Section 62 apply to all types of companies.

Question 53. Bonus share

Answer:

- When a company is prosperous and accumulates large distributable profits, it converts these accumulated profits into capital and divides the capital among the existing members in proportion to their entitlements.

- Members do not have to pay any amount for such shares. A company may, if its Articles provide, capitalize its profits by issuing fully-paid bonus shares

- Authorized by articles

- Authorized on the recommendation of the board in general meeting

- No default in payment of interest or principle in respect of debt securities and fixed deposits and respect of payment to employees

- Partly paid-up shares are to be made fully paid up on allotment

- Listed companies to follow SEBI regulations

- Once announced by the board about the bonus issue no company should withdraw the same.

Question 54. Issuo of sharos at premium [Section 52]

Answer:

- Share premium to be transferred to share premium account.

- Utilization of the share premium account should be as prescribed in Section 52.

Question 55. Issue of shares at discount [Section 53]

Answer:

- Issue of shares at discount is prohibited except by issue of sweat equity shares.

- Any share issued by the company at a discount shall be void.

Question 56. Issue of shares with differential voting rights [Section 43(a) (if)]

Answer:

- Articles to authorize the issue

- Ordinary resolution to be passed and if shares are listed then approval through postal ballot.

- not to exceed 26% of the total post-issue paid equity capital including shares with differential voting rights at any point in time

- The company has not been penalized under specified legislature in the last 3 years

- No default in filing financial statements in the last 3 years.

- No default in payment of dividends.

Question 57. Issue Or redemption of preference shares [Section 55]

Answer:

- Issue to be authorised by special resolution

- Explanatory statement to be annexed to the notice of general meeting containing the relevant material facts

- No company shall issue irredeemable preference shares or redeemable preference shares with a redemption period beyond 20 years.

- Infrastructural companies may issue preference shares for a period exceeding 20 years but not exceeding 30 years

Question 58. ESOP

Answer:

- Pass special resolution

- Disclosures to be made in the explanatory statement

- Free pricing in conformity with accounting policies

- Separate resolution to be obtained for granting options to employees of holding/subsidiaries

- Minimum 1-year period between grant of options and vesting of option

- The company is free to set a lock-in period

- Option granted shall not be transferable, pledged, hypothecated, mortgaged in any manner

- Disclosures to be made in the board report

- Register to be maintained in form shelf – 6

- Listed companies, to comply with SEBI guidelines

Question 59.Preferential issue Rule 13 of the companies (share capital and debentures) rules, 2014

Answer:

- Pass special resolution

- The listed company shall follow SEBI regulations

- The issue to be authorized by the articles

- Securities to be made fully paid up on allotment

- Disclosures to be made in the explanatory statement to be annexed to the notice of the general meeting

- Allotment to get completed within 12 months if not completed a fresh resolution is required

- Price determination by the registered valuer’s report

Question 60.Prospectus

Answer:

- The prospectus has been defined as any document described or issued as a prospectus and includes a red herring prospectus referred to in Section 32 a shelf prospectus referred to in Section 31 or any notice, circular, or advertisement.

- other document inviting offers from the public for the subscription or purchase of any securities of a body corporate.

- A company is an association of both natural and artificial persons incorporated under the existing law of a country. A company has a separate legal entity from the persons constituting it.

Question 61. Ingredients of a prospectus

Answer:

One of the ingredients of a prospectus is to make an invitation to the public to subscribe for securities of a body corporate which is construed as including a reference to any section of the public, whether selected as members or debenture holders of the company or as clients of the person issuing the prospectus. However, there are exceptions to it.

Question 62. Shelf prospectus

Answer:

A shelf prospectus means a prospectus in respect of which the securities or class of securities included therein are issued for subscription in one or more issues over a certain period without the issue of a further prospectus (Section 31).

Question 63. Red herring prospectus

Answer: Red herring prospectus means a prospectus that does not include complete particulars of the quantum or price of the securities included therein.

Question 64. Content of prospectus

Answer: Companies Act and SEBI guidelines provide for contents and disclosures required in a prospectus.

Question 65. Abridged prospectus

Answer:

- A bridged prospectus is usually a shorter form of the Prospectus and possesses all the significant features of a Prospectus.

- This accompanies the application form for public issues.

Question 66. Private placement

Answer:

“Private placement” means any offer of securities or invitation to subscribe securities to a select group of persons by a company (other than by way of public offer) through the issue of a private placement offer letter and which satisfies the conditions specified in Section 42.

- Offer Letter to be in Form No. PAS-4

- The offer shall not be made to more than 200 persons excluding QIBs and the employees of the company in a financial year under the scheme of ESOS only the person addressed in the application can apply

- Before passing a special resolution at a general meeting.

- All monies payable on subscription shall not be paid by cash.

If unable to allot within 60 days then repay the money in 15 days from the end of those 60 days and the money shall be refunded with interest 12%p.a. - Offer only to be made to those whose names are recorded by the company

- The record shall be kept in Form No. PAS-5

A copy of the record is to be filed with the registrar along with PAS-4 and with SEBI and the stock exchange within 30 days.

Amendment made by Companies (Amendment) Act, 2017:

- The Private Placement process is simplified by doing away with separate offer letter details to be kept by the company and reducing the number of filings to the Registrar.

- To ensure that investor gets adequate information about the company that is making private placement, the disclosures made under the Explanatory Statement referred to in Rule 13(2)(d) of Companies (Share Capital and Debenture) Rules, 2014, embodied in the Private Placement Application Form.

- There would be ease in the private placement offer-related documentation to enable quick access to funds.

- A change in the definition of private placement is proposed to cover all securities offers and invitations other than right.

- There is condensed format of private placement offer letter and application form likely to be introduced

- The Companies would be allowed to make offers of multiple security instruments simultaneously.

- Restriction on utilization of subscription money before making actual allotment and additionally, before filing the allotment return to the registrar. Since the contract is concluding on allotment and return filing is just post-conclusion compliance, there may be difficulty in compliance.

- The penalty provisions for raising capital are proposed to be rationalized by linking it to the amount involved in the issue (twice the amount involved or 2 crores whichever is lower).

- The period for filing a return of the allotment is proposed to be reduced to 15 days.

Question 67.Buy-back of shares

Answer:

The repurchase of shares by a company to reduce the number of shares on the market. Companies will buy back shares either to increase the value of shares still available (reducing supply) or to eliminate any threats by shareholders who may be looking for a controlling stake.

Question 68.Reduction of capital

Answer:

- Reduction of capital means a reduction of issued, subscribed, or paid-up share capital of the company. Various modes of reduction have been laid down in the Companies Act.

- The reduction of share capital is governed by the provisions of Section 66 of the Companies Act, 2013.

- Reduction of share capital is required to be done by special resolution.

- The reduction of share capital is to be confirmed by the Tribunal.

Question 69.Surrender of shares

Answer: Surrender of shares means surrender to the company on the part of a shareholder of shares voluntarily. It amounts to a reduction of capital.

Question 70.Forfeiture of shares

Answer: A company may if authorized by its articles, forfeit shares for non-payment of calls and the same will not require confirmation of the Tribunal and amounts to a reduction of capital.

Question 71.Diminution of capital

Answer:

Diminution of capital is the cancellation of the unsubscribed part of the issued capital. It can be effected by an ordinary resolution provided articles of the company authorize to do so. It does not need any confirmation from the Tribunal.

Question 72.Debenture

Answer: A debenture is a document given by a company under its seal as evidence of a debt to the holder usually arising out of a loan and most commonly secured by a charge.

Amendment made by Companies (Amendment) Act, 2017

In Section 2 in clause (30), the following proviso shall be inserted, namely: “Provided that-

- The instruments referred to in all-D of the Reserve Bank of India Act, 1934

- such other instrument, as may be prescribed by the Central Government in consultation with Reserve Bank of India, issued by a company, shall not be treated as debenture.”

Question 73.Kinds of debentures

Answer: Debentures may be of different kinds, viz. redeemable debentures, registered and bearer debentures, secured and unsecured or naked debentures, and convertible debentures.

Question 74.Debenture stock

Answer: A debenture stock is a borrowed capital consolidated into one mass for the sake of convenience.

Question 75.Debenture Redemption Reserve

Answer:

Section 71(4) of the Act requires every company to create a debenture redemption reserve account to which an adequate amount shall be credited out of its profits available for payment of dividends until such debentures are redeemed and shall utilize the same exclusively for the redemption of a particular set or series of debentures only.

Question 76.Appointment of Debenture Trustees

Answer:

- Section 71(5) read with Rule 18(2) of aforesaid rules, provides that a company before making an issue of a prospectus or an offer or inviting the public or members to more than 500 persons, shall appoint one or more debenture trustees.

- The names of the debenture trustees shall be stated in the letter of offer inviting subscription for debentures and also in all the subsequent notices or other communications sent to the debenture holders. Before the appointment of a debenture trustee or trustee, written consent shall be obtained from such a debenture trustee.

Question 77.Duties of Debenture Trustees

Answer:

Section 71(6) read with Rule 18(3) of aforesaid rules provides that a debenture trustee shall take steps to protect the interests of the debenture holders and redress their grievances.

It shall be the duty of every debenture trustee to:

- satisfy himself that the letter of offer does not contain any matter which is inconsistent with the terms of the issue of debentures or with the trust deed;

- satisfy himself that the covenants in the trust deed are not prejudicial to the interest of the debenture holders

- call for periodical status or performance reports from the company

- Inform the debenture holders immediately of any breach of the terms of the issue of debentures or covenants of the trust deed

- Ensure the implementation of the conditions regarding the creation of security for the debentures, if any, and debenture redemption reserve

Question 78.Debenture trust deed

Answer: A debenture trust deed is a document created by the company, whereby debenture trustees are appointed to protect the interest of Debenture holders before they are offered for public subscription.

Question 79.Company

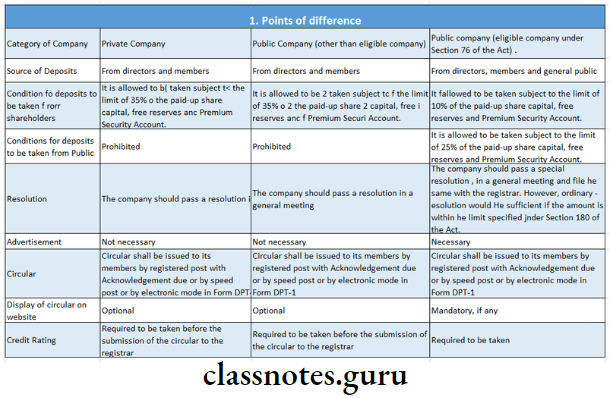

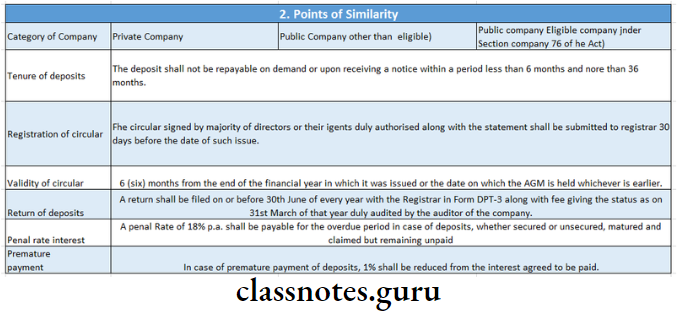

Answer: The company may accept deposits from its members by passing a resolution in a general meeting and subject to conditions as may be prescribed in the Rules including Credit rating, Deposit insurance, etc.

Question 80.Eligible company

Answer:

Eligible company public companies may accept deposits, if it has a net worth of not less than $ 100 crore or a turnover of not less than ? 500 crores and which has obtained the prior consent of the company in a general meeting using a special resolution and also filed the said resolution with the Registrar of Companies and where applicable, with the Reserve Bank of India before making any invitation to the Public for acceptance of Deposits:

Question 81.Deposit trustees

Answer:

No company under sub-section (2) of section 73 or any eligible company shall issue a circular or advertisement inviting secured deposits unless the company has appointed one or more deposit trustees to create security for the deposits.

Question 82.Deposit insurance

Answer:

Amendment made by Companies (Amendment) Act, 2017: A contract providing for deposit insurance at least thirty days before the issue of circular or advertisement.

In Section 73 of the principal Act, in sub-Section (2), clause (d) shall be omitted;

Question 83.Foreign investment

Answer:

Repatriation Capital flows from a foreign country to the country of origin. This usually refers to returning returns on foreign investment in the case of a corporation or transferring foreign earnings home in the case of an individual.

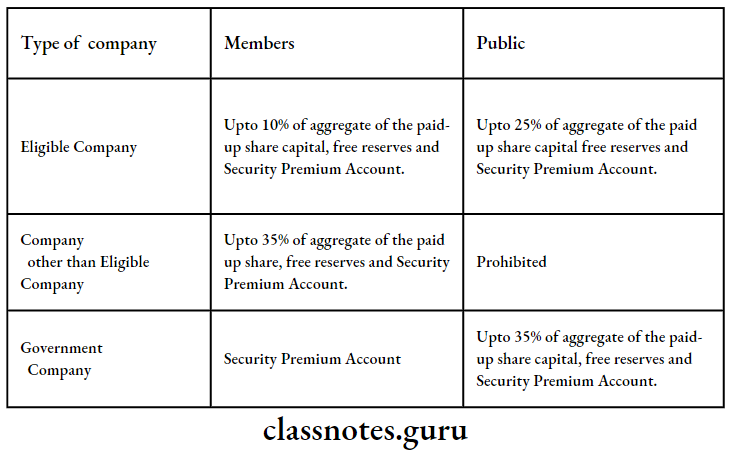

Question 84. Quantum of deposits

Answer:

Question 85. The procedure for acceptance of the deposit

Answer:

Amendment Made by Companies (Amendment) Act, 2015 Punishment for Contraction of Section 73 or 76 “Section 76A. Where a company accepts or invites or allows or causes any other person to accept or invite on its behalf any deposit in contravention of the manner or the conditions prescribed under Section 73 or Section 76 or rules made thereunder or if a company fails to repay the deposit or part thereof or any interest due thereon within the time specified under Section 73 or 76 or rules made thereunder or such further time as may be allowed by the Tribunal under Section 73:

- the company shall, in addition to the payment of the amount of deposit or part thereof and the interest due, be punishable with a fine which shall not be less than $ 1 crore but which may extend to $ 10 crores; and

- every officer of the company who is in default shall be punishable with imprisonment which may extend to seven years or with a fine which shall not be less than $ 25 lakhs but which may extend to $ 2 crores, or with both.

Provided that if it is proved that the officer of the company who is in default, has contravened such provisions knowingly or wilfully to deceive the company or its shareholders or depositors or creditors or tax authorities, he shall be liable for action under Section 447.”

Question 86. Charge

Answer:

A charge is a security given for securing loans or debentures by way of a mortgage on the assets of the company. As mentioned earlier, the power of the company to borrow includes the power to give security.

- A charge may be created either through the act of parties or by operation of law.

- A charge created by operation of law does not require registration. But a charge created by an act of parties requires registration.

- The charge may be in perpetuity.

- A charge only gives a right to receive payment out of a particular property.

- A charge is good against subsequent transferees with notice.

- In case of charge, no personal liability is created. But where a charge is the result of a contract, there may be a personal remedy.

- There is no such transfer of interest in the case of a charge.

Question 87. Two Kinds of Charges

Answer:

There are two kinds of charges, fixed or specific charges and floating charges.

Question 88. Fixed Charge

Answer:

- A charge is called fixed or specific when it is created to cover assets that are ascertained and definite or are capable of being ascertained and defined, at the time of creating the charge Example, land, building, plant, and machinery.

- A fixed charge, therefore, is a security in terms of certain specific property, and the company gives up its right to dispose of that property until the charge is satisfied.

Question 89.Floating Charge

Answer:

- A floating charge, as a type of security, is peculiar to companies as borrowers.

- A floating charge is not attached to any definite property but covers the property of a fluctuating type Example, stock-in-trade, and is thus necessarily equitable.

- A floating charge is a charge on a class of assets present and future which in the ordinary course of business changes from time to time and leaves the company free to deal with the property as it sees fit until the holders of charge take steps to enforce their security.

Question 90.Crystallization of Floating Charge

Answer:

- A floating charge attaches to the company’s property generally and remains dormant till it crystallizes or becomes fixed.

- The company has a right to carry on its business with the help of assets over which a floating charge has been created till the happening of some event which determines this right.

A floating charge crystallizes and the security becomes fixed in the following cases:

- when the company goes into liquidation

- When the company ceases to carry on its business;

- When the creditors or the debenture holders take steps to enforce their security

- For example by appointing a receiver to take possession of the property charged

- on the happening of the event specified in the deed

Question 91.Mortgage

Answer:

- A mortgage is the transfer of an interest in a specific immovable property to secure the payment of money advanced in or to be advanced by way of a loan, existing or future debt, or the performance of an agreement that may give rise to a pecuniary liability.

- A mortgage is created by the act of the parties.

- A mortgage requires registration under the Transfer of Property Act, of 1882.

- A mortgage is for a fixed term.

- A mortgage is a transfer of an interest in a specific immovable property.

- A mortgage is good against subsequent transferees.

- A simple mortgage carries personal liability unless excluded by an express contract.

- A mortgage is a transfer of an interest in a specific immovable property.

Question 92.Registration of Charges- Section 77(1)

Answer:

Any charge created

- within or outside India,

- on its property or assets or any of its undertakings,

- whether tangible or otherwise, and situated in or outside India Shall be registered.

- Particulars of charges that are being filed with Registrar of Companies I are to be signed by the company creating the charge and the charge holder in Form No. CHG-1 (for other than Debentures) or Form CHG-9 (for debentures) as the case may be.

- The Charge has to be registered within 30 days of its creation.

As per Companies (Amendment), Act, 2019

The time limit for filing charges created on or after 2.11.2018 reduced The charge should be filed within 30 days from its creation. In case of charges created on or after 2.11.2018, RoC can allow an extension of up to 30 days (total of 60 days from the date of creation of charge, on payment of

- Prescribed additional loos. RoC can allow further extension of 60 days on alternate payment of such ad valorem fees as may be prescribed – first and second proviso to Section 77(1) of the Companies Act, 2013 amended vide ho Companies (Amendment) Act, 2019.

- Thoro has no provision to grant a further extension for the registration of charges. Section 87 of the Companies Act, 2013 has been amended w.e.f. 2.11.2018 to provide that the Central Government cannot order rectification of the register of charges in such cases.

- Provision In respect of charges created before 2.11.2018 Registrar can allow’ filing of particulars of such registration within 300 days of such creation, on payment of additional fee as prescribed.

- Ho can grant further extension of up to 6 months on payment of additional fees as may be proscribed – first and second proviso to Section 77(1) of the Companies Act, 2013 amended vide the Companies (Amendment) Act, 2019.

- Registrar can condone delay up to 300 days on being satisfied that the company had sufficient cause for not filing particulars and instrument of charge within 30 days, on payment of an additional fee – Rule 4 of Companies (Registration of Charges) Rules, 2014.

- If the charge is not filed within 300 days of creation, a further extension could be granted by the Central Government under section 87 of the Companies Act, 2013 – second proviso to Section 77(1) of the Companies Act, 2013 as existing up to 2.11.2018 [powers delegated to Regional Director]. Now, such an extension cannot be granted.

- Punishment for not filing charges or giving false Information Amendment made by Companies (Amendment) Act, 2020 “(1) If any company is in default in complying with any of the provisions of this Chapter, the company shall be liable to a penalty of five lakh rupees and every officer of the company who is in default shall be liable to a penalty of fifty thousand rupees.”.

Question 93.Satisfaction of Charges.

Answer:

- According to Section 82 read with the rules, the company shall give intimation to the Registrar of the payment or satisfaction in full of any charge within thirty days from the date of such payment or satisfaction in Form No. CHG-4 along with the fee.

- The Registrar may, on an application by the company or the charge holder, allow such intimation of payment or satisfaction to be made within a period of three hundred days of such payment or satisfaction on payment of such additional fees as may be prescribed.

Question 94.Notice of Charge

Answer:

- According to Section 80, where any charge on any property or assets of a company or any of its undertakings is registered under Section 77, any person acquiring such property, assets, undertakings, or part thereof or any share or interest therein shall be deemed to have notice of the charge from the date of such registration.

- The section clarifies that if any person acquires a property, assets, or undertaking for which a charge is already registered, it would be deemed that he has complete knowledge of the charge from the date the charge is registered.

Question 95.Consequences of Non- Non-registration of Charge

Answer: According to Section 77 of the Companies Act, 2013, all types of charges created by a company are to be registered

96. Particulars of Charges

Answer:

The following particulars in respect of each charge are required to be filed with the Registrar:

- date and description of the instrument creating charge

- the total amount secured by the charge

- date of the resolution authorising the creation of the charge; (in case of issue of secured debentures only)

- general description of the property charged

- list of the terms and conditions of the loan and

- name and address of the charge holder.

Question 97. Central Government can Order Rectification of the Register of Charges Only When Delay was in Respect of Filing of Satisfaction of Charge or Mistake Made in Filing Charges

Answer:

The Central Government can order the rectification of the register on any of the following grounds:

The Central Government is satisfied that the:

- the omission to give intimation to the Registrar of the payment or satisfaction of a charge, within the time required under this Chapter, or

- the omission or misstatement of any particulars concerning any such change or modification or concerning any memorandum of satisfaction or other entry made in pursuance of section 82 or 83, was accidental or due to inadvertence or some other sufficient cause or it is not of a nature to prejudice the position of creditors or shareholders of the company.

- it may, on the application of the company or any person interested and on such terms and conditions as the Central Government deems just and expedient, direct that the time for the giving of intimation of payment or satisfaction shall be extended or, as the case may require, that the omission or misstatement shall be rectified Section 87 of Companies Act, 2013 amended vide the Companies (Amendment) Act, 2019.

- Central Government cannot order rectification of the register of charges if there was a delay in filing of the original charge itself, beyond the specified period or extended period as allowable under section 77 of the Companies Act, 2013.

- Application for rectification can be made by the company or any person interested. Thus, the secured creditor (Bank or FI) can make an application if the charge or its modification was not filed in time, as the secured creditor is certainly interested in registration/modification of the charge.

- Powers to order rectification of the register of charges have been delegated to the Regional Director vide Notification F No. 1-6-2014 – CL. V dated 21.5.2014.

Question 98.Annual general meeting

Answer:

An annual general meeting is required to be held every year by every company whether public or private, limited by shares or by guarantee, with or without share capital or unlimited company.

- The annual general meeting should be held once every year.

- The first annual general meeting of the company should be held within 9 months from the closing of the first financial year.

- Subsequent annual general meetings of the company should be held within 6 months from the closing of the financial year.

- The gap between the two annual general meetings should not exceed 15 months.

Question 99.Extra-Ordinary General Meeting

Answer:

All general meetings other than annual general meetings are called extra-ordinary general meetings (EGM). According to SS-2 items of business other than ordinary business may be considered at an EGM or using a postal ballot, if thought fit by the Board. This means that all the transactions dealt with in an EGM shall be special business.

- By the Board Suo Motu

- By Board on the requisition of members

- By requisitionists

- By Tribunal

Question 100.Class meetings

Answer: Class meetings are those meetings which are held by holders of a particular class of shares Example. preference shares.

Question 101.Motion

Answer: A motion becomes a resolution only after the requisite majority of members have adopted it.

Question 102.Methods voting

Answer: Various methods that may be adopted for taking votes on a motion properly placed before a meeting are by show of hands, by poll, by postal ballot, and by electronic voting.

Question 103.Kinds of resolutions

Answer:

- There are four kinds of resolutions under the Act

- Ordinary Resolution

- Special Resolution

- A resolution requiring special notice

- Board Resolution.

Question 104.Notice of Meeting

Answer:

A general meeting of a company may be called by giving not less than 21 clear days’ notice either in writing or through electronic mode.

- Notice through electronic mode shall be given in such manner as may be prescribed.

- In the case of Section 8 company, 14 days’ clear notice is required instead of 21 days.

- ‘Clear days’ means days exclusive of the day of the notice of service and of the day on which the meeting is held.

Question 105.Contents of Notice

Answer:

- Place of meeting

- Day of meeting

- Time of meeting

- Agenda

- Proxy clause with reasonable prominence

Question 106. Notice through Electronic Mode Rule 18 of Companies (Management and Administration) Rules, 2014

Answer:

A company may give notice through electronic mode. Electronic mode’ means any communication sent by a company through its authorized and secured computer program:

- The e-mail shall be addressed to the person entitled to receive such e-mail as per the records of the company.

- E-mail shall state the name of the company, a notice of the type of meeting, and the date on which the meeting is scheduled.

- If notice is sent in the form of an e-mail attachment, such attachment shall be in the Portable Document Format (PDF).

- There shall be no difference in the text of the physical version of the notice and the electronic version except concerning the mode of dispatch of the notice.

- If a member entitled to receive notice fails to provide or update the relevant e-mail address to the company, the company shall not be in default for not delivering notice via e-mail.

The company may send e-mails through the in-house facility or authorize any third-party agency to provide a bulk e-mail facility.

Question 107.Persons entitled to receive Notice

Answer:

In terms of Section 101 (3), a notice of every meeting of the company must be given to:

- every member of the company, legal representative of any deceased member, or the assignee of an insolvent member;

- the auditor or auditors of the company; and

- every director of the company.

A private company, which is not, a subsidiary of a public company may prescribe, by its Articles, persons to whom the notice should be given.

Question 108.Quorum

Answer:

In the case of a public company, the quorum shall depend on the number of members as on the date of the meeting:

- If members are not more than 1000- the quorum shall be 5.

- If members are more than 1000 but less than 5000- the quorum shall be 15.

- If members are more than 5000- the quorum shall be 30

- In the case of the private company, 2 members personally present shall be the quorum of the meeting.

Question 109. Adjourned Meetings

Answer:

- Notice of an adjourned meeting- Where the meeting stands Adjourned to the same day in the next week at the same time and place or to such other day, not being a National Holiday, or at such other time and place as the Board may determine there the company shall give at least 3 days notice to the members either individually or by publishing an advertisement in 2 newspapers (one in English and one in vernacular language).

- No quorum in an adjourned meeting- If at the adjourned meeting also, a quorum is not present within half an hour from the time appointed for holding the meeting, the members present, being not less than two in number, will constitute the quorum.

- If a Meeting is adjourned sine die or for thirty days or more, a Notice of the adjourned Meeting shall be given by the provisions contained herein above relating to Notice.

Question 110.Chairman of Meetings

Answer:

- Unless the articles of the company are otherwise provided, the members personally present at the meeting shall elect one of themselves to be the Chairman thereof on a show of hands.

- If a poll is demanded on the election of the Chairman, it shall be taken forthwith by the provisions of this Act and the Chairman elected on a show of hands shall continue to be the Chairman of the meeting until some other person is elected as Chairman as a result of the poll, and such other person shall be the Chairman for the rest of the meeting.

Question 111.Proxies

Answer:

- A person who is appointed by a member to attend and vote at a meeting in the absence of the member at the meeting is termed a proxy.

- Thus proxy is an agent of the member appointing him.

- The term ‘proxy’ is also used to refer to the instrument by which a person is appointed as a proxy. Section 105 of the Companies Act, 2013 provides that a member, who is entitled to attend to vote, can appoint another person as a proxy to attend and vote at the meeting on his behalf.

Question 112. Demand for Poll

Answer:

Before or on the declaration of the result of the voting on any resolution on show of hands, a poll may be ordered to be taken by the Chairman of the meeting on his motion, and shall be ordered to be taken by him on a demand made in that behalf by the following person(s):

- In the case of a company having a share capital: by the members present in person or by proxy, where allowed, and having not less than one-tenth of the total voting power or holding shares on which an aggregate sum of not less than $ 5,00,000/- or such higher amount as may be prescribed, has been paid-up and

- In the case of any other company by any member or members present in person or by proxy, where allowed, and having not less than one-tenth of the total voting power.

- The Chairman shall get the validity of the demand verified.

The demand for a poll may be withdrawn at any time by the persons who made the demand.

Question 113. Postal Ballot

Answer:

- As per Section 2(65) “postal ballot” means voting by post or through any electronic mode.

- The following items of business shall be transacted only using voting through a postal ballot:

- Alteration of the objects clause of the memorandum

- Alteration of articles of association

- Change in place of registered office outside the local limits of any city, town, or village

- Change in objects for which a company has raised money from the public through a prospectus

- Issue of shares with differential rights as to voting or dividend

- Variation in the rights attached to a class of shares or debentures

- Buy-back of shares by a company

- Election of a director

- Sale of the whole or substantially the whole of an undertaking of a company.

Amendment made by Companies (Amendment) Act, 2017

Any item of business required to be transacted using a postal ballot (as stated above), may be transacted at a general meeting by a company that is required to provide the facility to members to vote by electronic means under Section 108, in the manner provided in that section.

Question 114.Circulation of Members’ Resolution

Answer:

As per Section 111, a company shall, on the requisition in writing of a certain number of members, give notice to members of any proposed resolution intended to be moved in the meeting or circulate any statement concerning matters referred to in the proposed resolution. The company shall be bound to give notice of resolution only if the requisition is deposited not less than six weeks before the meeting. In case of other requisitions not less than 2 weeks before the meeting.

Question 115.Minutes

Answer:

Section 118 provides that every company shall prepare, sign, and keep minutes of proceedings of every general meeting, including the meeting called by the requisitionists and all proceedings of the meeting of any class of shareholders or creditors or Board of Directors or committee of the Board and also resolution passed by postal ballot within thirty days of the conclusion of every such meeting concerned.

Company Types Promotion Formation And Related Procedures Short Note Question And Answers

Question 1. Write a short note on the following Revocation of the license

Answer:

Revocation of Licence

Section 8(6) provides that the Central Government, by order, revoke the license granted to the company registered under this section:

- if the company contravenes any of the requirements of this section; or

- any of the conditions subject to which a license is issued; or

- he affairs of the company are conducted fraudulently or in a manner violative of the objects of the company.

- The Central Government shall direct the company to convert its status and change its name to add the words ‘limited’ or ‘private limited’ to its name. No such order will be passed without allowing the company to be heard.

- A copy of such order shall be given to the Registrar.

- The Registrar shall, without prejudice to any action taken, on application, in the prescribed form register the company accordingly.

Question 2. Write short notes on out of the following terms Alteration of Share Capital

Answer:

Alteration of Share Capital:

A Limited Company having a Share Capital may, if so authorized by its articles, alter its memorandum by passing an ordinary resolution in its general meeting to:

- increase its authorized share capital by such amount as it thinks expedient;

- consolidate and divide all or any of its share capital into shares of a larger amount than its existing shares;

- convert all or any of its fully paid-up shares into stock, and reconvert that stock into fully paid-up shares of any denomination.

- sub-divide its shares, or any of them, into shares of smaller amount than is fixed by the memorandum, so, however, that in the sub-division the proportion between the amount paid and the amount, if any, unpaid on each reduced share shall be the same as it was in the case of the share from which the reduced share is derived.

- cancel shares which, at the date of the passing of the resolution on that behalf, have not been taken or agreed to be taken by any person, and diminish the amount of its share capital by the amount of the shares so canceled.

- All the above alterations do not require confirmation by the Tribunal except that alteration relating to consolidation and division which results in changes in the voting percentage of shareholders shall not take effect unless it is approved by the Tribunal on an application made in the prescribed manner

- These alterations are, however, required to be notified and a copy of the resolution should be filed with the Registrar within 30 days of the passing of the resolution along with an altered memorandum. [Section 64(1)]

- The Registrar shall record the notice and make any alteration that may be necessary in the company’s memorandum articles or both.

- The cancellation of shares under section 61(1) of the Act shall not be deemed to be a reduction of share capital. Section 64 (1) provides that a notice is required to be given to the Registrar for alteration of share capital.

Question 3. Write short notes on Small Companies

Answer:

Section 2(85) of the Companies Act, 2013 defines ‘small company’ as a company, other than a public company

- paid-up share capital that does not exceed $ 50 lakh or such higher amount as may be prescribed which shall not be more than $ 10 crore; and

- turnover which is as per its last profit and loss account does not exceed $ 2 crores or such higher amount as may be prescribed which shall not be more than $ 100 crores.

This definition shall not apply to the following companies –

- A holding company or subsidiary company

- A company registered under Section 8 or

- A company or a body corporate governed by any special Act.

Question 4. Write short notes on the Red herring prospectus

Answer:

Red herring prospectus:

The Explanation to Section 32 defines the term red herring prospectus’ as a prospectus that does not include complete particulars of the quantum or price of the securities included therein Section 32 provides that a company proposing to make an offer of securities may issue a red herring prospectus before the issue of a prospectus.

- The same shall be filed with the Registrar at least three days before the opening of the subscription list and the offer. It shall carry the same obligations as apply to a prospectus and any variation between the red herring prospectus and a prospectus shall be highlighted as variations in the prospectus.

- At the time of closing of the offer, the prospectus stating the total capital raised, whether by way of debt or share capital, and the closing price of the securities and any other details as are not included in the red herring prospectus shall be filed with the Registrar and the SEBI.

Question 5. Write Short Notes on the Revocation of license under Section 8(6) of the Companies Act.

Answer:

Revocation of License (Section 8(6) of Companies Act, 2013): Provides that the Central Government may, by order, revoke the license granted to the company registered under this section –

- If the company contravenes any of the requirements of this section or

- Any of the conditions subject to which a license is issued or

- The affairs of the company are conducted fraudulently or in a manner violative of the objects of the company or prejudicial to the public interest.

- The Central Government shall direct the company to convert its status and change its name to add the words “Limited” or “Private Limited” to its name.

- No such order will be passed without allowing the company to be heard. A copy of such order shall be given to the Registrar.

- The Registrar shall, without prejudice to any action taken, on application, in the proscribed form, register the company accordingly.

Company Types Promotion Formation And Related Procedures Descriptive Questions And Answers

1. A chemical manufacturing company distributed 7 twenty lakhs to scientific institutions for the furtherance of scientific education and research. Referring to the provisions of The Companies Act, 2013, decide whether the said distribution of money was ‘ultra vires’ the company.

Answer:

The doctrine of Ultra Vires :

- Ultra means beyond and Viresmeansn powers. Ultra Viros moans beyond power. Any action of the company is Ultra Viroo if such action is not authorized in the MOA.

- The MOA defines and confines the powers of the company and the company can operate only within the scope of the authority given to it by its MOA and the Company’s Act, 2013.

- Any action beyond the scope of MOA or Company’s Act, 2013 is Ultra Viros of the company.

- It is also dear that the company can not ratify such action or make such action valid, even if every member assents to it.

- Whatever was ultra vires the company will remain ultra vires.

- Any action that is ultra vires but intra vires to the company can be ratified by the company.

- If any act is ultra vires to the directors the body of shareholders can ratify it.

- The term ultra viros means beyond powers.

- More, in the given case, a chemical manufacturing company distributed 20 lakhs to scientific institutions for furtherance (moans continuance, persistence, maintenance) of scientific education and research.

- It is not ultra vires since it is conducive to the continued growth of the company as a chemical manufacturer.

- A similar view was found in the case of Evans V. Brunner Mond And Company, (1921) Ch 359.

- Hero, a company was incorporated to carry on the business of manufacturing chemicals.

- The objects clause in the memorandum of the company authorized the company to do all such business and things as may be incidental or conducive to the attainment of the above objects or any of thorn by a resolution the directors were were authorized to distribute $ 1,00,000 out of surplus reserve account to such universities in the U.K. as they might select for the furtherance of scientific research and education.

- The resolution was challenged on the ground that it was beyond the objects clause of the memorandum and therefore it war, ultra vires the power of the company.

- The directors proved that the company had great difficulty in finding trained men and the purpose of the resolution was to encourage scientific training of more men to enable the company to recruit staff and continue Our progress.

- The Tribunal held that the expenditure authorized by the resolution was necessary for the continued progress of the company as a chemical manufacturer and thus the resolution was incidental or conducive to the attainment of the main object of the company and consequently it was not ultra vires.

- “Acts incidental or ancillary’’ are those acts, which have a reasonable proximate connection with the objects stated in the objects clause of the memorandum.

Question 2. Explain provisions of the Companies Act, 2013 regarding documents containing otter of securities for sale to be deemed prospectus.

Answer:

Document Containing offer of Securities for Sale to be Deemed Prospectus:

Section 25(1) of the Companies Act, 2013 states that when a company agrees to allot any securities of the company with a view to all or any of those securities being offered for sale to the public:

- Any document by which the otter for sale to the public is made shall, for all purposes, be deemed to be a prospectus issued by the company; and

- All enactments and rules of law as to the contents of the prospectus and as to liability in respect of misstatements, in and omissions from, prospectus, or otherwise relating to the prospectus, shall apply with the modifications specified in sub-section (3) and (4) and shall have effect accordingly, as if the securities had been offered to the public for subscription and as if persons accepting the offer in respect of any securities were subscribers for those securities, but without prejudice to the liability, if any, of the persons by whom the offer is made in respect of misstatements contained in the document or otherwise in respect thereof.

Section 25(2) states that unless the contrary is proved, it shall be evidence that an allotment of, or an agreement to allot, securities was made with a view to the securities being offered for sale to the public if it is shown:

- that an offer of the securities or any of them for sale to the public was made within six months after the allotment or agreement to allot; or

- that at the date when the offer was made, the whole consideration was to be received by the company in respect of the securities that had not been received by it.

As per Section 25(3); Section 26 as applied by this section shall have effect as if:

- It required a prospectus to state in addition to the matters required by that section to be stated in a prospectus:

- The net amount of the consideration received or to be received by the company in respect of the securities to which the offer relates; and

- The time and place at which the contract where under the said securities have been or are to be allotted may be inspected;

- The persons making the offer were persons named in a prospectus as directors of a company.

Question 3. A company wants to buy back its shares in the current financial year. State the defaults which make the company ineligible to buy back its shares as outlined in the Companies Act, 2013.

Answer:

Prohibition for Buy-Back in Certain Circumstances [Section 70]

- No company shall directly or indirectly purchase its shares or other specified securities:

- Through any subsidiary company including its own subsidiary companies

- Through any investment company or group of investment companies or

- If a default is made by the company, in the repayment of deposits accepted either before or after the commencement of this Act, interest payment thereon, redemption of debentures or preference shares or payment of dividend to any shareholder, or repayment of any term loan or interest payable thereon to any financial institution or banking company.

- Provided that the buy-back is not prohibited if the default is remedied and three years have lapsed after such default ceased to subsist.

- No company shall, directly or indirectly, purchase its shares or other specified securities in case such company has not complied with the provisions of Sections 92,123,127 and 129.

Question 4. Can a non-profit organization be registered as a company under the Companies Act, 2013? If so, what procedure does it have to adopt? ABC Limited decided to buy back shares. Advise the Company’s Board of Directors about the sources of which the . company can buy back its shares. Define the term ‘Small Company’ as contained in the Companies Act, 2013.

Answer:

Registration of a non-profit organization or company :

- Where it is proved to the satisfaction of the Central Government that a person or an association of persons proposed to be registered under this Act as a limited company:

- Has in its objects the promotion of commerce, art, science, sports, education, research, social welfare, religion, charity, protection of the environment, or any such other object;

- Intends to apply its profits, if any, or other income in promoting its objects; and

- Intends to prohibit the payment of any dividend to its members, the Central Government may, by license issued in such manner as may be prescribed, and on such conditions as it deems fit, allow that person or association of persons to be registered as a limited company under this section without the addition to its name of the word “Limited”, or as the case may be, the words “Private Limited”, and thereupon the Registrar shall, on application, in the prescribed form, register such person or association of persons as a company under this section.

- The company registered under this section shall enjoy all the privileges and be subject to all the obligations of limited companies.

- A firm may be a member of the company registered under this section.

- A company registered under this section shall not alter the provisions of its memorandum or articles except with the previous approval of the Central Government.

- A company registered under this section may convert itself into a company of any other kind only after complying with such conditions as may be prescribed.

- Where it is proved to the satisfaction of the Central Government that a limited company registered under this Act or any previous company law has been formed with any of the objects specified in clause (a) of sub-section (1) and with the restrictions and prohibitions as mentioned respectively in clauses (b) and (c) of that sub-section, it may, by license, allow the company to be 5.

- Registered under this section subject to such conditions as the Central Government deems fit and to change its name by omitting the word “Limited”, or as the case may be the words “Private Limited” from its name and thereupon the Registrar shall, on application, in the prescribed form, register such company under this section and all the provisions of this section shall apply to that company.

- The Central Government may, by order, revoke the license granted to a company registered under this section if the company contravenes any of the requirements of this section or any of the conditions subject to which a license is issued or the affairs of the company are conducted fraudulently or in a manner violative of the objects of the company or prejudicial to the public interest, and without prejudice to any other action against the company under this Act, direct the company to convert its status and change its name to add the word “Limited” or the words.

- “Private Limited”, as the case may be, to its name and thereupon the registrar shall, without prejudice to any action that may be taken under sub-section (7), on application, in the prescribed form, register the company accordingly.

- Provided that no such order shall be made unless the company is given a reasonable opportunity to be heard. Provided further that a copy of every such order shall be given to the registrar.

- Where a license is revoked under sub-section (6), the Central Government may, by order, if it is satisfied that it is essential in the public interest, direct that the company be wound up under this Act or amalgamated with another company registered under this section. Provided that no such order shall be made unless the company is given a reasonable opportunity to be heard.

- Where a license is revoked under sub-section (6) and where the Central Government is satisfied that it is essential in the public interest that the company registered under this section should be amalgamated with another company registered under this section and having similar objects, then, notwithstanding anything to the contrary contained in this Act, the Central Government may, by order, provide for such amalgamation to form a single company with such constitution, properties, powers, rights, interest, authorities and privileges and with such liabilities, duties, and obligations as may be specified in the order.

- If on the winding up or dissolution of a company registered under this section, there remains, after the satisfaction of its debts and liabilities, any asset, they may be transferred to another company registered under this section and having similar objects, subject to such conditions as the Tribunal may impose, or may be sold and proceeds thereof credited to the Rehabilitation and Insolvency Fund formed under Section 269.

- A company registered under this section shall amalgamate only with another company registered under this section and having similar objects.

Sources:

According to Section 68(1) of the Companies Act, 2013, a company may purchase its shares or other specified securities (hereinafter referred to as “buy-back”) out of:

- its free reserves

- the securities premium account

- the proceeds of any shares or other specified securities.

However, no buy-back of any kind of shares or other specified securities can be made out of the proceeds of an earlier issue of the same kind of shares or the same kind of other specified securities.

Thus, the company must have at the time of buy-back, sufficient balance in any one or more of these accounts to accommodate the total value of the buy-back.

- “Small company” means a company, other than a public company,

- paid-up share capital of which does not exceed fifty lakh rupees or such higher amount as may be prescribed which shall not be more than five crore rupees; or

- turnover of which as per its last profit and loss account does not exceed two crore rupees or such higher amount as may be prescribed which shall not be more than twenty crore rupees.

- Amendment made by Companies (Amendment) Act, 2017: Revised Section 2(85)-

- “Small Company means a company, other than a public company,

- Paid-up share capital of which does not exceed fifty lakh rupees or such higher amount as may be prescribed which shall not be more than ten crore rupees; and

- Turnover of which as per profit and loss account for the immediately preceding financial year does not exceed two crore rupees or such higher amount as may be, prescribed which shall not be more than one hundred crore rupees.”

Question 5. Explain the Red Herring Prospectus under the Companies Act, 2013. State the procedure for shifting a registered office of the company from one state to another state under the provisions of the Companies Act, 2013.

Answer:

Red Herring Prospectus [Section 32 of the Companies Act, 2013]:

- A company proposing to make an offer of securities may issue a red herring prospectus before the issue of a prospectus.

- A company proposing to issue a red herring prospectus under sub-section (1) shall file it with the Registrar at least three days before the opening of the subscription list and the offer.

- A red herring prospectus shall carry the same obligations as apply to a prospectus and any variation between the red herring prospectus and a prospectus shall be highlighted as variations in the prospectus.

- Upon the closing of the offer of securities under this section, the prospectus stating therein the total capital raised, whether by way of debt or share capital and the closing price of the securities and any other details as are not included in the red herring prospectus shall be filed with the Registrar and the Securities and Exchange Board.