Buy Back Of Securities And Reduction Of Share Capital

Buy-back of shares Under Companies Act, 2013

The repurchase of shares by a company in order to reduce the number of shares on the market. Companies will buy back shares either to increase the value of shares still available (reducing supply) or to eliminate any threats by shareholders who may be looking for a controlling stake.

Reduction of capital Under Companies Act, 2013

- Reduction of capital means reduction of issued, subscribed or paid-up share capital of the company. Various modes of reduction have been laid down in the Companies Act.

- Reduction of share capital is governed by the provisions of Section 66 of the Companies Act, 2013.

- Reduction of share capital is required to be done by special resolution.

- Reduction of share capital is to be confirmed by the Tribunal.

Buy Buyback of Shares Under Companies Act 2013

Surrender of shares Under Companies Act, 2013

Surrender of shares means surrender to the company on part of shareholder of shares voluntarily. It amount to reduction of capital.

Forfeiture of shares Under Companies Act, 2013

A company may if authorized by its articles, forfeit shares for non-payment of calls and the same will not require confirmation of the Tribunal and amounts to reduction of capital.

Diminution of capital Under Companies Act, 2013

Diminution of capital is the cancellation of the unsubscribed part of the issued capital. It can be effected by an ordinary resolution provided articles of the company authorize to do so. It does not need any confirmation of Tribunal.

Buy Back Of Securities Short Notes

Write a note on the following:

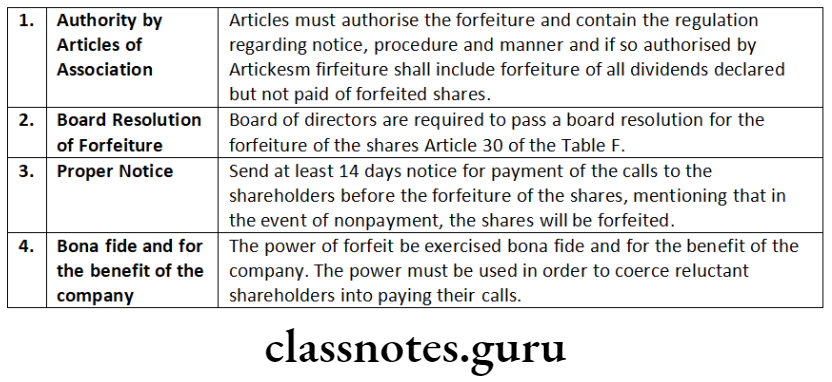

Conditions for valid forfeiture of shares

Answer:

Buy Back Of Securities Descriptive Questions

Answer the following citing the relevant provisions of law/case law, if any:

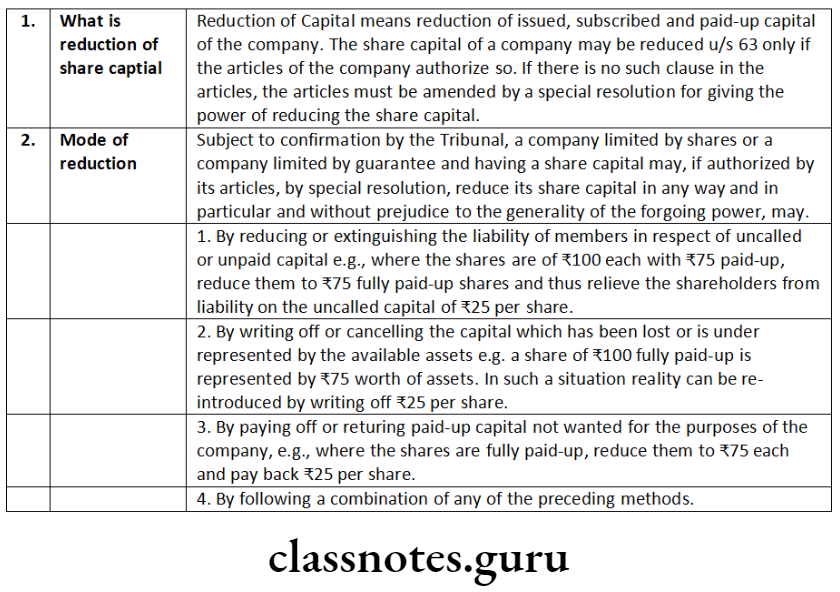

Explain the procedure for reduction of share capital.

Answer:

Reduction of Share Capital [Section 66]

- Subject to confirmation by the Tribunal on an application by the company, a company limited by shares or limited by guarantee and having a share capital may, by a special resolution, reduce the share capital in any manner and in particular, may:

- extinguish or reduce the liability on any of its shares in respect of the share capital not paid-up; or

- either with or without extinguishing or reducing liability on any of its shares,

- cancel any paid-up share capital which is lost or is unrepresented by available assets; or

- pay off any paid-up share capital which is in excess of the wants of the company, alter its memorandum by reducing the amount of its share capital and of its shares accordingly.

- The Tribunal shall give notice of every application made to it under sub-section (1) to the ‘Central Government, Registrar and to the Securities and Exchange Board, in the case of listed companies, and the creditors of the company and shall take into consideration the representations, if any, made to it by that Government, Registrar, the Securities and Exchange Board and the creditors within a period of three months from the date of receipt of the notice.

- The Tribunal may, if it is satisfied that the debt or claim of every creditor of the company has been discharged or determined or has been secured or his consent is obtained, make an order confirming the reduction of share capital on such terms and conditions as it deems fit. Provided that no application for reduction of share capital shall be sanctioned by the Tribunal unless the accounting treatment, proposed by the company for such reduction is in conformity with the accounting standards specified in Section 133 or any other provision of this Act and a certificate to that effect by the company’s auditor has been filed with the Tribunal.

- The order of confirmation of the reduction of share capital by the Tribunal under sub-Section (3) shall be published by the company in such manner as the Tribunal may direct.

- The company shall deliver a certified copy of the order of the Tribunal under subsection (3) and of a minute approved by the Tribunal showing:

- the amount of share capital;

- the number of shares into which it is to be divided;

- the amount of each share; and

- the amount, if any, at the date of registration deemed to be paid-up on each share, to the Registrar within thirty days of the receipt of the copy of the order, who shall register the same and issue a certificate to that effect.

- Nothing in this section shall apply to buy-back of its own securities by a company under Section 68.

- A member of the company, past or present, shall not be liable to any call or contribution in respect of any share held by him exceeding the amount of difference, if any, between the amount paid on the share, or reduced amount, if any, which is to be deemed to have been paid thereon, as the case may be, and the amount of the share as fixed by the order of reduction.

- Where the name of any creditor entitled to object to the reduction of share capital under this section is, by reason of his ignorance of the proceedings for reduction or of their nature and effect with respect to his debt or claim, not entered on the list of creditors, and after such reduction, the company is unable, within the meaning of sub-section (2) of Section 271, to pay the amount of his debt or claim:

- every person, who was a member of the company on the date of the registration of the order for reduction by the Registrar, shall be liable to contribute to the payment of that debt or claim, an amount not exceeding the amount which he would have been liable to contribute if the company had commenced winding up on the day immediately before the said date; and

- if the company is wound up, the Tribunal may, on the application of any such creditor and proof of his ignorance as aforesaid, if it thinks fit, settle a list of persons so liable to contribute, and make and enforce calls and orders on the contributories settled on the list, as if they were ordinary contributories in a winding up.

- Nothing in sub-section (8) shall affect the rights of the contributories among themselves.

- If any officer of the company:

- knowingly conceals the name of any creditor entitled to object to the reduction;

- knowingly misrepresents the nature or amount of the debt or claim of any creditor; or

- abets or is privy to any such concealment or misrepresentation as aforesaid, he shall be liable under Section 447.

Amendments as per Companies (Amendment) Act, 2017 Revised Section 447-

“Without prejudice to any liability including repayment of any debt under this Act or any other law for the time being in force, any person who is found to be guilty of fraud involving an amount of at least ten lakh rupees or one percent of the turnover of the company, whichever is lower, shall be punishable with imprisonment for a term which shall not be less than six months but which may extend to ten years and shall also be liable to fine which shall not be less than the amount involved in the fraud, but which may extend to three times the amount involved in the fraud.

Buyback Of Securities Procedure

Provided that where the fraud in question involves public interest, the term of imprisonment shall not be less than three years. Provided further that where the fraud involves an amount less than ten lakh rupees or one per cent of the turnover of the company, whichever is lower and does not involve public interest, any person guilty of such fraud shall be punishable with imprisonment for a term which may extend to five years or with fine which may extend to twenty lakh rupees or with both.”

- If a company fails to comply with the provisions of sub-section (4), it shall be punishable with fine which shall not be less than five lakh rupees but which may extend to twenty-five lakh rupees.

Note: Amendment made by Companies (Amendment) Act, 2020 Provides that the Section 66 of the principal Act, sub-section(11) shall be omitted. Space to write important points for revision

Comment on the following:

A company incorporated under the Companies Act, 2013 does not have the right to reduce its share capital on selective basis.

Answer:

Comment on the following:

Reduction of share capital and Diminution of share capital mean the same.

Answer:

According to Section 66(1) of the Companies Act, 2013 states that subject to approval by the Tribunal on an application by the company, a company limited by shares or limited by guarantee and having a share capital may, by passing a special resolution at general meeting reduce the share capital in any manner, and in, particular, may-

- extinguish or reduce the liability on any of its shares in respect of the share capital not paid-up; or

- either with or without extinguishing or reducing liability on any of its shares,-

- cancel any paid-up share capital which is lost or is unrepresented by available assets; or

- pay off any paid-up share capital which is in excess of the wants of the company,

alter its memorandum of association by reducing the amount of its share capital and of its shares accordingly.

As per Section 61(1)(e) of the Companies Act, 2013 provides that, a limited company having share capital, if authorised by its Articles of association may cancel shares, by passing an ordinary resolution at general meeting in that behalf, which have not been taken by any person, and diminish the amount of its share capital by the amount of the shares so cancelled.

Diminution needs no confirmation by the Tribunal. Further, Section 61(2) of the Companies Act, 2013 provides that the cancellation of shares under section 61(1) of the Companies Act, 2013 shall not be deemed to be reduction of share capital.

Hence, Reduction of Share Capital and Diminution of Share Capital is not the same.

Buyback Rules Under Companies Act

Buy Back Of Securities Practical Question

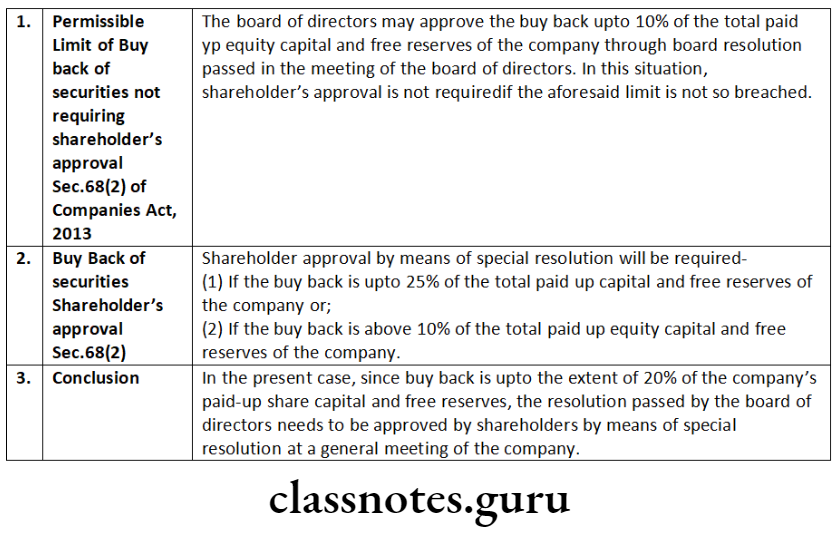

Board of Directors of Pious Ltd. gives you the following information extracted from the company’s financial statements as at 31st March, 2015:

Authorised equity share capital 10 crore

(1 crore shares of 10 each)

Paid-up equity share capital 5 crore

General reserve 5 crore

Debenture redemption reserve 2 crore

Board of Directors by a resolution passed at its meeting decides to go for buy-back of shares of the extent of 20% of the company’s paid-up share capital and free reserves. Examine the validity of the Board’s resolution with reference to the provisions of the Companies Act, 2013.

Answer:

Enkebee Ltd. wants to purchase its own 1,00,000 equity shares @ 10 each out of the following:

Unsecured loan 5 lakh

Balance of depreciation reserve for 3 lakh

Securities premium account 4 lakh.

Examine the legality of the above transactions for the buy-back of securities of the company under the provisions of the Companies Act, 2013.

Answer:

According to Section 68(1) of the Companies Act, 2013, a company may purchase its own shares or other specified securities out of the following:

- its free reserves; or

- the securities premium account; or

- the proceeds of any shares or other specified securities.

Hence, Enkebee Ltd. can purchase its own shares only out of the Securities Premium account and not out of unsecured loan or balance of depreciation reserve (not being free reserve).

Confident Ltd. has forfeited 50,000 equity shares of the company@10 each and same were re-issued. After the filing of the annual return, the Registrar of Companies (ROC) has issued show cause notice to the company for default of provisions of Section 39 of the Companies Act, 2013. Is the action of the ROC tenable under the provisions of the Companies Act, 2013? Discuss with relevant case law, if any.

Answer:

- Re-issue of forfeited shares does not require filing of return of allotment. In a similar case Sri Gopal Jalan & Co. v. Calcutta Stock Exchange Association Ltd., the Supreme Court held that the exchange was not liable to file any return of the forfeited shares under Section 75(1) of the Companies Act, 1956 [Corresponds to Section 39 of the Companies Act, 2013] when the same were re-issued.

- The Court observed that when a share is forfeited and re-issued, there is no allotment, in the sense of appropriation of shares out of the authorised and unappropriated capital and approved the observations of Harries C.J. in S.M. Nandy’s case that:

- “On such forfeiture all that happened was that the right of the particular shareholder disappeared but the shares considered as a unit of issued capital continued to exist and was kept in suspense until another shareholder was found for it”.

- Accordingly, in the present case Show cause notice issued by RoC to Confident Ltd. fo: default of provisions of Section 39 of the Companies Act, 2013 is not tenable.

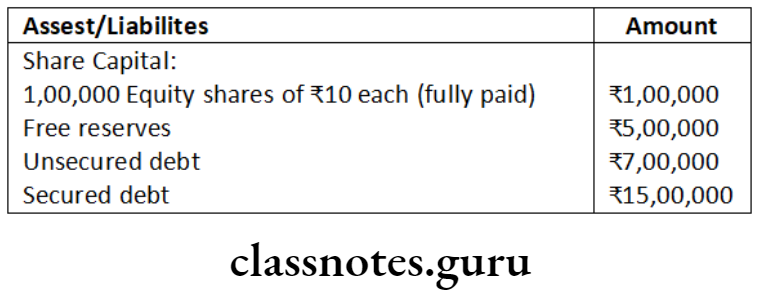

Premium Ltd. is considering buy-back of its shares without using any proceeds of shares or other specified securities. The balance sheet of Premium Ltd. shows the following status as on 31st March, 2018: Asset/Liabilities

Conditions For Buyback Of Shares In India

Determine the maximum quantum of buy-back of shares with the shareholders’ approval as on 1st April, 2018.

Answer:

The maximum quantum of buy-back that Premium Ltd. can make as on 1st April, 2018, in pursuance to Section 68 of Companies Act, 2013 is 25% of aggregate of paid-up capital and free reserves of the company. Further provided that the reference to twenty five per cent shall be construed with respect to its total paid-up equity capital in that financial year and the ratio of the aggregate of secured and unsecured debts owed by the company after buy-back should not be more than twice the paid-up capital and its free reserves.

Analysis of the Case Law:

Free Reserves – 5,00,000

Securities premium Account – Nil

Proceeds of other specified securities – Nil

Total Debt i.e. (7,00,000+ 15,00,000) -22,00,000

Sum of paid up Equity capital + free reserves – 15,00,000

Therefore, the maximum fund available for buy-back (in absence of securities premium account and proceeds of issue of any other specified securities) is 5,00,000.

Amount that must be maintained as sum total of free reserves and paid up equity capital is half of total debt i.e. half of 22,00,000 i.e. 11,00,000.

Buy back can be made upto 25% of Paid up capital and free reserves i.e. 10,00,000+ 5,00,000 i.e. 15,00,000 × 25% = 3,75,000. Further debt equity ratio is

Debt:

Secured and unsecured debt = 15,00,000+ 7,00,000 = 22,00,000

Capital after Buy Back:

Total Capital 10,00,000-3,75,000 = 6,25,000

Free reserve = 5,00,000-3,75,000 = 1,25,000

Total Capital + free reserve 6,25,000+ 1,25,000 = 7,50,000 Debt equity ratio = 22,00,000/7,50,000 = 2.93

The ratio being more than twice the paid-up capital and its free reserves the maximum quantum of 3,75,000 is not advisable.

As expressed above post buy-back debt equity ratio must not be more than 2. Accordingly, post buy-back total capital and free reserve must be half of debts i.e. (15,00,000+7,00,000)/2=11,00,000. The maximum buy-back of equity may be {(10,00,000+ 5,00,000) -11,00,000)/2 = 2,00,000.

Hence, in the above case, maximum possible buy-back is of ₹ 2,00,000 amounting to 20,000 equity shares of ₹ 10 each.

Buyback Of Shares Meaning And Process

Monika Ltd. wants to purchase its own 5,00,000 equity shares @ ₹10/- each out of the following:

₹ lakh

(a) Unsecured Loans 25

(b) Balance of Free Reserves 15

(c) Securities Premium Account 10

Examine the legality of the above transactions for the buy-back of securities of the company under the provisions of the Companies Act, 2013

Answer:

As per Section 68(1) of the Companies Act, 2013 a company may purchase its own shares or other specified securities (known as “buy-back”) out of:

- its free reserves; or

- the securities premium account; or

- the proceeds of the issue of any shares or other specified securities.

Although, no buy-back of any kind of shares or other specified securities shall be made out of the proceeds of an earlier issue of the same kind of shares or same kind of other specified securities.

Hence, in the above case Monika Ltd. can purchase its own 5,00,000 equity shares @10 each out of free reserves and from the securities premium account in accordance with the provisions of the Companies Act, 2013. But it cannot do buy-back from the amount of Unsecured Loan as it will be contravention of the provisions of Section 68 of the Companies Act, 2013.